The Tourist (Duty-Free) Shopping System Act - Jamaica Tourist Board

The Tourist (Duty-Free) Shopping System Act - Jamaica Tourist Board

The Tourist (Duty-Free) Shopping System Act - Jamaica Tourist Board

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

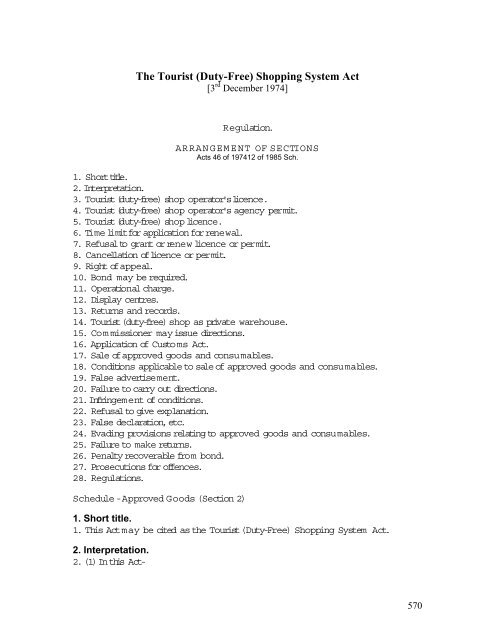

<strong>The</strong> <strong>Tourist</strong> (<strong>Duty</strong>-<strong>Free</strong>) <strong>Shopping</strong> <strong>System</strong> <strong>Act</strong>[3 rd December 1974]Regulation.ARRANGEMENT OF SECTIONS<strong>Act</strong>s 46 of 197412 of 1985 Sch.1. Shorttitle.2. Interpretation.3. <strong>Tourist</strong>(duty-free) shop operator'slicence.4. <strong>Tourist</strong>(duty-free) shop operator's agency permit.5. <strong>Tourist</strong>(duty-free) shop licence.6. Time limitfor application for renewal.7. Refusalto grant or renew licence or permit.8. Cancellation oflicence or permit.9. Right of appeal.10. Bond may be required.11. Operational charge.12. Display centres.13. Returns and records.14. <strong>Tourist</strong>(duty-free) shop as private warehouse.15. Com missioner may issue directions.16. Application of Custo ms <strong>Act</strong>.17. Sale ofapproved goods and consu mables.18. Conditions applicable to sale of approved goods and consu mables.19. False advertisement.20. Failure to carry out directions.21. Infringement of conditions.22. Refusal to give explanation.23. False declaration, etc.24. Evading provisions relating to approved goods and consu mables.25. Failure to make returns.26. Penalty recoverable from bond.27. Prosecutions for offences.28. Regulations.Schedule -Approved G oods (Section 2)1. Short title.1. This <strong>Act</strong>may be cited as the <strong>Tourist</strong> (<strong>Duty</strong>-<strong>Free</strong>) <strong>Shopping</strong> <strong>System</strong> <strong>Act</strong>.2. Interpretation.2. (1)In this <strong>Act</strong>-570

"approved goods" means any class or description of goods specified in theSchedule as approved goods;"Co m missioner" means the Com missioner of Customs and Excise;"consumables" means-(a) any spirits, wine or fermented, distiled or spirituous liquor; and(b) any cigars cigarettes ortobacco, specified in the Schedule as consumables;"diplomats" means persons entitled to immunities or privileges under section 10of the Diplom atic Immunities and Privileges <strong>Act</strong>;"licensed tourist (duty-free) shop" means any pre mises, or area in any pre mises,in relation to which a licence issued under the provisions of section 5isin force;"Minister"means the Minister responsible for finance;"tourist(duty-free) shopping system" means the system permitted by this <strong>Act</strong>forthe sale of goods for exportfree of customs or excise duty or of retailsales tax;"visitor" means a person who is in Ja maica-(a) on a visitor's visa; or(b)intransit,from a place outside <strong>Jamaica</strong> to so me other place outside <strong>Jamaica</strong>;or(c) on a visitprimarily for recreational purposes, so, however,thatin any case, oron any occasion, where that person's status as a visitor is being considered forthe purposes ofthis <strong>Act</strong>, a person shallnotbe deemed to be a visitorif-(i)on that occasion his stay in Jam aica exceeds six months; or(ii)during his stay, he works or performs any functions in <strong>Jamaica</strong> for payment orreward.(2) Minister may,from time to time, by order a mend the Schedule.3. <strong>Tourist</strong> (duty-free) shop operator's licence.3. (1) <strong>The</strong> Co m missioner may, on application made in the prescribed manner andon paymentof the prescribed fee, grant to any person who desires to operate onhis own account a licensed tourist(duty-free) shop a licence (hereinafter referredto as a "tourist(duty-free) shop operator'slicence") so to do.(2) Any licence granted under this section may be granted on such terms andsubjectto such conditions as may be prescribed or as the Co m missioner may inany case stipulate.571

(3) Any licence granted under this section shall,unless Previously cancelledunder this <strong>Act</strong>, continue in force from the date ofissue untilthe next succeeding31st day of March and may be renewed from year to year, so, however,that alicence issued or renewed during the month of March in any year shall,unlesscancelled as aforesaid, continue in force untilthe 31st day of March ofthe nextsucceeding year.4. <strong>Tourist</strong> (duty-free) shop operator's agency permit.4. (1) <strong>The</strong> Co m missioner may, on application made in the prescribed manner andon paymentof the prescribed fee issue to any person who (not being the holderof, or an applicant for,a tourist(duty-free) shop operator'slicence) is forthe timebeing accredited in writing by the holder of, or an applicant for, a tourist (dutyfree)shop operator s licence as an agentfor the purposes ofthe tourist (dutyfree)shopping system, a permit(hereinafter referred to as a "tourist(duty-free)shop operator's agency permit")to operate a tourist(duty-free) shop as agent forthe tourist(duty-free) shop operator by whom he is accredited.(2) Every person accrediting an agent forthe purposes ofsubsection (1) shallkeep a registerin the prescribed form showing every person who is forthe timebeing accredited forthis purpose, and shallnot grant any such accreditationwithout making the appropriate entry in this register, and ifany personcontravenes the require ments ofthis sub-section he shall,in respect of eachcontravention, incur a penalty of one hundred dollars.(3) Any permitissued under this section may be issued subject to such terms andconditions as may be prescribed or as the Co m missioner may in any casestipulate.(4) Any permitissued under this section sha lunless previously cancelled underthis <strong>Act</strong>,continue in force from the date ofissue untilthe next succeeding 31stday of March, and may be renewed from year to year,so, how-ever,that anypermitissued or renewed during the month of March in any year shall,unlesscancelled as aforesaid, continue in force untilthe 31st day of March ofthe nextsucceeding year.5. <strong>Tourist</strong> (duty-free) shop licence.5. (1) <strong>The</strong> Co m missioner may, on application made in the prescribed manner andon paymentof the prescribed fee, grant to any person who is -(a)the holder of, or an applicant for,a tourist(duty-free) shop operator'slicense,or(b)the holder of, or an applicant for,a tourist(duty-free) shop operator's agencypermit,a licence (hereinafter referred to as a "tourist(duty-free) shop license")in relationto any premises specified in the application, authorizing the use of such premisesor any area in such pre mises as a licensed tourist (duty-free) shop where572

approved goods or consu m ables m ay be sold under the tourist(duty-free)shopping system.(2) Any licence granted under this section may be granted subject to such term sand conditions as may be prescribed or as the Co m missioner may in any casestipulate.(3) Any licence granted under this section shall,unless previously cancelledunder this <strong>Act</strong>, continue in force from the date ofissue untilthe next succeeding31st day of March, and may be renewed from year to year, so, how-ever,thatany licence issued or renewed during the month of March in any year shall,unless cancelled as aforesaid, continue in force untilthe 31st day of March of thenext succeeding year.6. Time limit for application for renewal.6. Every application for the renewal of a licence or a permit under this <strong>Act</strong> shall,unless the C o m missioner otherwise per mits, be delivered to the Co m missionernot later than twenty-one days before the expiry ofthatlicence or permit, as thecase may be.7. Refusal to grant or renew licence or permit.7. (1) Subjectto the right of appeal conferred by section 9 ofthis <strong>Act</strong>,theCo m missioner may,in his discretion, refuse to grant, or to renew, any licence orpermit under this <strong>Act</strong>,and shallso refuse ifhe is not satisfied thatthe applicantis, or satisfactory evidence is produced that the applicantis not, a fitand properperson to be the holder of a licence or permit, or where itappears that theapplicant -(a) not being a body corporate,is under eighteen years of age; or(b)is notresidentin Jam aica, or was not so residentthroughoutthe six monthsimmediately preceding the date of application; or(c) being a body corporate is notincorporated in <strong>Jamaica</strong>; or(d) has within the immediately preceding twelve months been refused the grantor renewal of a tourist(duty-free) shop operator'slicence or a tourist (duty-free)shop operator's agency permit;or(e) has been the holder of a tourist(duty-free) shop operator'slicence or a tourist(duty-free) shop operator's agency permit which has been cancelled within theimmediately preceding twelve months; or(f) has been found to be knowingly concerned with evading or attem pting toevade the provisions ofthis <strong>Act</strong>or ofthe Customs <strong>Act</strong> relating to the importationor exportation of any goods.573

(2) Where the Co m missioner refuses an application forthe grant or renewal of alicence or a permit,he shallscan refund to the applicant any fee paid in respectof such application.8. Cancellation of licence or permit.8. <strong>The</strong> Com missioner shallcancel a licence or a per mit Cancel under this <strong>Act</strong> if-(a)the holder ofthe licence or the permitis convicted of any offence involvingfraud or dishonesty; or(b)the holder ofthe licence or the permitis found to be knowingly concerned withevading orattempting to evade the provisions ofthis <strong>Act</strong> or of the C ustoms <strong>Act</strong>relating to the importation or exportation of any goods,in connection with thetourist(duty-free) shopping system; or(c) after due consideration and determination in the prescribed manner of anyapplication m ade in the prescribed form-(i)by any person; or(ii)by any organization or association recognized by the Co m missioner asrepresenting operators oftourist(duty-free) shops, requesting that the licence orpermit be cancelled, he is satisfied thatthe holder is no longer a fitand properperson to hold such licence or permit.9. Right of appeal.9. (1)In any case where the Co m missioner cancels a licence under paragraph(c) of section 8, or refuses to grant or to renew any licence or permit under this<strong>Act</strong>,the holder of or the applicant as the case may be for,the licence or permitmay, atany time within sixty days afterthe Co m missioner's decision has beenco m municated to him, and on payment of such fee as m ay be prescribed, appealin the prescribed manner to the Minister.(2) On any such appealthe Minister may-(a) confirm the cancellation or refusal; or(b) on paym ent by the appellant ofthe prescribed fee, restore, grant or renew thepermit orlicence, as the case may be,and the decision ofthe Minister on any such appeal shallbe final.10. Bond may be required.10. <strong>The</strong> Com missioner may require any applicant, as a condition precedent tothe grant of a licence under this <strong>Act</strong>,to furnish a bond -(a)in such su m; and(b) with such nu mber of sureties approved by the Co m missioner,574

as the Commissioner may from time to time specifyin each case, conditioned ondue payment of allduties and the due observance ofthe provisions ofthis <strong>Act</strong>and of any regulations made thereunder.11. Operational charge.11. (1) <strong>The</strong> Minister may,from time to time, by notice published in the Gazette,declare an operational charge to be paid in respect of every tourist(duty-free)shop.(2) <strong>The</strong> operational charge shallbe a percentage ofthe sum received as sellingprice of approved goods sold in a licensed tourist (duty-free) shop.(3) Every holder of a tourist (duty-free) shop licence sha lpay to theCo m missioner in respect of every month during which he operates a licensedtourist(duty-free) shop, notlater than fourteen days after the end of the month,the a mount due as operational charge in respect of every licensed tourist(dutyfree)shop operated by him.(4)In this section "selling price" includes the value as assessed by theC o m missioner of things exchanged or other consideration accepted by theoperator of a licensed tourist (duty-free) shop or his agentas the price or onaccount of the price of approved goods or consumables purchased or deliveredfrom a tourist (duty-free) shop.(5) Every notice under this section shallbe subjectto affirmative resolution oftheHouse of Representatives.12. Display centres.12. (1) Any holder of a tourist(duty-free) shop licence may apply to theCo m missioner to register centres where approved goods and consu mables maybe displayed, subjectto the prescribed conditions, for purposes other than sale.(2) Any person who se ls approved goods or consu mables from a display centreor fails to co mply with any prescribed conditions applicable to display centresshallbe guilty of an offence and shallincur a penalty of one thousand dollars.13. Returns and records.13. (1) Every holder of a tourist(duty-free) shop licence shall-(a) make such returns atsuch times; and(b) keep such records in such form,as may be prescribed or as may be required by the Com missioner.(2) <strong>The</strong> Com missioner may vary the time form aking any returns,ifhe thinks fit.14. <strong>Tourist</strong> (duty-free) shop as private warehouse.575

14. (1) Everylicensed tourist(duty-free) shop shallbe deemed to be a privatewarehouse forthe purposes ofthe Customs <strong>Act</strong> and the Excise <strong>Duty</strong> <strong>Act</strong>.(2) <strong>The</strong> Com missioner may per mit any approved goods or any consu mableswhich, butfor the provisions ofthis <strong>Act</strong>, would be liable to customs duty, exciseduty, consum ption duty or retailsales tax,to be removed from any warehouse,orcustoms area, or private excise ware-house or factory licensed under the Excise<strong>Duty</strong> <strong>Act</strong> with out paym ent of such duties ortax and deposited in a licensedtourist(duty-free) shop, subjectto the prescribed conditions, for purposes ofexport under the tourist (duty-free) shopping syste m.(3) No provisions ofthis section shallconfer on any approved goods orconsu mables any exem ption from custo ms exa mination either prior to depositin,or after delivery from, a licensed tourist (duty-free) shop.15. Commissioner may issue directions.15. (1) <strong>The</strong> Com missioner may issue any directions he considers necessary forthe better regulation and controlissue ofthe operations of a licensed tourist(duty-free) shop.(2) <strong>The</strong> Com missioner may require a written explanation from any person incharge of a licensed tourist (duty-free) shop, or his servant e mployed in suchshop, or his agent,in order to enquire into any matter affecting the ad ministrationand control ofsuch shop.16. Application of Customs <strong>Act</strong>.16. <strong>The</strong> provisions of PartIV ofthe Customs <strong>Act</strong> shallapply mutatis mutandis tothe warehousing of goods under the provisions ofthis <strong>Act</strong>.17. Sale of approved goods and consumables.17. Subject to the provisions ofthis <strong>Act</strong> and of any regulations made thereunder,any approved goods or consumables warehoused in a licensed tourist(duty-free)shop may be sold free of any customs, excise or consu mption duties, or of anyretailsales tax to which such goods would, but forthe provisions ofthis <strong>Act</strong>, beliable.18. Conditions applicable to sale of approved goods and consumables.18. <strong>The</strong> sale of any approved goods or consu mables warehoused in a tourist(duty-free) shop shallbe subjectto the following conditions, thatis to say-(a) approved goods and consu mables shallbe sold only for export;(b) approved goods shallbe sold only to visitors and diplomats;(c) subjectto any prescribed requirements in respect of packaging or otherwise,approved goods may be delivered to the visitor at the time ofpurchase; and576

(d) consu m ables shallnot be delivered to the purchaser untiland unlesssatisfactory proof is furnished to the vendor that the purchaser is, at or aboutthetime ofthe delivery ofthe consumables, departing from Ja maica.19. False advertisement.19. (1) Any person who, not being the holder of a tourist(duty-free) shopoperator'slicence or a tourist(duty-free) shop operator's agency permit underthis <strong>Act</strong>, with intentto deceive, displays any advertise m ent indicating in anymanner that-(a) any premises used by him is a licensed tourist (duty-free) shop; or(b) approved goods or consu mables may be obtained from him or through himunder the tourist (duty-free) shopping system; or(c) he is authorized to sellgoods free of custo ms duty, excise duty, consu mptionduty or retailsales tax, shallbe guilty of an offence and shallincur a penalty offour thousand dollars.(2)In this section "advertise ment" shallhave the meaning assigned toitinsection 2 of the Advertisements Regulation <strong>Act</strong>.20. Failure to carry out directions.20. Any person who, without reasonable excuse,fails to carry out any directiongiven in writing by the Co m missioner relating to the operation of a tourist (dutyfree)shop shallbe guilty of an offence and shallincur a penalty of one thousanddollars.21. Infringement of conditions.21. Any person who, without reasonable excuse,infringes any term or conditionsubjectto w hich his licence or permit was granted, sha lbe guilty of an offenceand shallincur a penalty of one thousand dollars.22. Refusal to give explanation.22. Any person who, when required by the Com missioner to give a writtenexplanation of any matterrelating to the operation of a place used as a privatewarehouse under this <strong>Act</strong>, withoutreasonable cause, refuses or fails to give asatisfactory written explanation, or to give any explanation, shallbe guilty of anoffence and shallincur a penalty of one thousand dollars.23. False declaration, etc.23. Any person who, in any matter relating to the tourist(duty-free) shoppingsystem or to the operation of any rationaltourist(duty-free) shop,with intent todeceive-(a) makes,or causes to be made, any false declaration, w hether oral or written;or577

(b) uses, or causes to be used, any false certificate; or(c) makes,or causes to be made, any alteration or falsification in any docu mentafterthat document has been officiallyissued, shallbe guilty of an offence andshallincur a penalty oftwo thousand dollars.24. Evading provisions relating to approved goods and consumables.24. Any person who, kno wingly and with intent to defraud the Government of<strong>Jamaica</strong> ofrevenue-(a) acquires possession of; or(b) carries, removes, deposits,conceals or harbours; or(c) deals in any manner, otherwise than in accordance with the provisions of this<strong>Act</strong> or of any regulations made thereunder,with any approved goods or anyconsu mables on which custo ms, excise, or consu mption duties or any retailsalestax due thereon has not been paid, shallbe guilty of an offence and shallincur apenalty for each such offence offive hundred dollars or treble the value of suchgoods, at the election of the Co m missioner,and, in addition, allsuch goods shallbe forfeited.25. Failure to make returns.25. Any person who without reasonable excuse fails or rebuses-(a)to make such returns at such times; or(b)to keep such records in such form; or(c)to embody in any return any such information, as may be prescribed or asmay be required by the Co m missioner shallbe guilty of an offence and shallincur a penalty offive hundred do lars.26. Penalty recoverable from bond.26. Without prejudice to any other form of recovery, any penaltyincurred underthe provisions ofthis <strong>Act</strong> may be recovered by the Co m missioner by theapplication, in whole or in part,of any bond furnished pursuant to section 10.27. Prosecutions for offences.27. (1) Any offences under this <strong>Act</strong> may be prosecuted, and any penaltyincurredunder, or forfeiture imposed by this <strong>Act</strong> may be sued for, prosecuted andrecovered sum marilyin a Resident Magistrate's Court,and any sum of moneypayable under this <strong>Act</strong> may be recovered and enforced in a su m m ary manner ina Resident Magistrate's Court on the complaint of any officer.(2)In this section "officer" has the meaning assigned to itby section 2 oftheCustoms <strong>Act</strong>.28. Regulations.578

28. (1) <strong>The</strong> Minister may make regulations generally for the better carrying out ofthe purposes and provisions ofthis <strong>Act</strong>, and in particular, but without prejudice tothe generality of the foregoing, may make regulations-(a) prescribing the form and manner in which applications shallbe m ade for anylicence or permit which may be granted underthis <strong>Act</strong>, and the forms of suchpermits orlicences;(b) prescribing any fees to be paid under this <strong>Act</strong>;(c) prescribing the nature of the notices, emblems or other instruments to bedisplayed in touristshops;(d) prescribing the method of packaging of approved goods and consumables;(e) prescribing any other matter or anything w hich may be, or is required to be,prescribed.(2) Notwithstanding anything contained in section 29 of the Interpretation <strong>Act</strong>,any regulations made under this <strong>Act</strong> may provide in respect of a breach of any ofthe provisions thereofthat the offender shallbe liable to a fine not exceeding onethousand dollars orto a term ofimprisonmentnot exceeding two years orto bothsuch fine and imprison ment.SCHEDULE (Section 2)Approved Goods1. Binoculars;2. Electric C alculators-3. Photographic ca meras with accessories;4. Chinaware —bone and porcelain;5. Clocks;6. Cosmetics;7. Cutlery— sterling silver and stainless steel;8. Crystalware;9. Earthenware;10. Figurines —bronze,ivory or quartz;11. Figurines —china or porcelain;579

12. Hi-ficom ponents;13. Jewellery and articles consisting of orincorporating pearls;14. Mechanicallighters for cigars, cigarettes and pipes;15. Perfumery;16. Pipes,cigar and cigarette holders;17. Projectors;18. Portable radios;19. Record changers or record players;20. Electric shavers;21. Sweaters and cardigans, pullovers or similar knitted outerwearof angora,mohair,cash mere or similar mixtures of wool;22. Silverware-sterling silverplate, Sheffield plated and antiquereproductions, Siamese, Portuguese and Indian sterling silver;23. Table linen — Madeira,Irish, embroidered,hand-painted, cut-work;24. Tape recorders;25. Telescopes;26. Toiletlotion or toilet waters;27. Watches.Consumables1. Cigarettes —locally m anufactured or imported in containers of notless than200 units each;2. Cigars — <strong>Jamaica</strong>n cigars in boxes of notless than 25;3. Tobacco;4. Spirits,liqueurs and wines (except miniatures)imported with minimu mcontents 11ounces per bottle;580

5. Spirits or liqueurs (miniatures)— w h ether assorted or not,locally manufacturedor imported,in sealed containers of notless than six bottles; each bottlecontaining not less than one ounce per bottle;6. Spirits,liqueurs orwines-locally manufactured with minimu m contents 11ounces per bottle.581