Annual Travel Statistics 2011.pdf - Jamaica Tourist Board

Annual Travel Statistics 2011.pdf - Jamaica Tourist Board

Annual Travel Statistics 2011.pdf - Jamaica Tourist Board

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TABLE OF CONTENTSTABLE NO.PAGEDefinitionsivIntroductionv - viAn Overview of 2011vii - xxviSummary of Main Indicators 11 Visitor Arrivals to <strong>Jamaica</strong> 1997 - 2011 22 Total Stopover Arrivals by Month 2007 - 2011 33 Total Stopover Arrivals by Port of Arrival 2010 & 2011 44 Stopover Arrivals by Country and Month of Arrival 2011- U.S.A. Northeast and Mid-West 6 - 7- U.S.A. South and West 8 - 9- Canada and Europe 10 - 11- Latin America 12 - 13- Caribbean, Asia and Other Countries 14 - 155 Stopover Arrivals by Country of Residence and Year 2007 - 2011- U.S.A. Northeast and Mid-West 18- U.S.A. South and West 19- Canada and Europe 20- Latin America 21- Caribbean, Asia and Other Countries 226a Stopover Arrivals by Main Producing States 2011 & 2010 246b Stopover Arrivals by Main Producing Provinces 2011 & 2010 266c Stopover Arrivals by Main Producing European Countries 2011 & 2010 286d Stopover Arrivals by Main Producing Caribbean Countries 2011 & 2010 307 Age Distribution of Stopover Arrivals 2010 & 2011 328 Gender Distribution of Stopover Arrivals 2010 & 2011 338.1 Stopover Arrivals by Purpose of Visit 2008 - 2011 348.1a Main Purpose of Visit by Main Markets 2011 348.2 Stopover Arrivals by Intended Resort Area of Stay 2009 - 2011 358.2a Stopover Arrivals by Main Market and Intended Resort Area of Stay 2011 359 Average Length of Stay (Nights) by Month and Year (Foreign Nationals) 2006 - 2011 369a Average Length of Stay (Nights) by Country and Year (Foreign Nationals) 2006 - 2011 379.1 Average Length of Stay (Nights) by Month and Year Non-Resident <strong>Jamaica</strong>ns 2006 – 2011 38i

TABLE NO.PAGE9b Average Length of Stay (Nights) by Type of Accommodation 2011 3910 Stopover Arrivals by Scheduled and Charter Flights 2010 & 2011 40 - 42Cruise Shipping11 Cruise Passengers by Month and Year 2007 - 2011 4412 Cruise Passengers by Port of Call and Year 2008 - 2011 4512a Cruise Ship Calls by Major Ports of Call and Year 2008 - 2011 4612b Cruise Passenger Arrivals by Port and Cruise Line 2010 & 2011 47Hotel Utilization by Resort Region13 Hotels: Average Capacity Available, Room/Bed Nights Sold and % Occupancy 2007 - 2011 50Hotel Room/Bed Nights Sold and % Occupancy by Month and Year 2007 - 201114 & 14a - <strong>Jamaica</strong> 5215 & 15a - Montego Bay 5316 & 16a - Ocho Rios 5417 & 17a - Negril 5518 & 18a - Kingston 5619 & 19a - Port Antonio 5720 - 20a - Mandeville/Southcoast 58Hotel Room Nights Sold and % Occupancy by Room Size Category 2007 - 201121 & 21a - Under 100 Rooms 6022 & 22a - Over 100 Rooms 6123 & 23a Hotel Room Nights Sold & % Occupancy by CategoryAll-Inclusive vs Non All-Inclusive 2007 - 2011 6424 Hotel Rooms by Category All-Inclusive & Non All-Inclusive and Area 2011 6724a Hotel Rooms by Category Room Size and Area 2011 6825 <strong>Tourist</strong> Accommodations Inventory by Category and Area 2007 - 2011 69 - 7026 & 26a Visitor Accommodation by Years and Area 2008 - 2011 71 - 7227 Employment in Accommodation Sector 2007 - 2011 7328 <strong>Tourist</strong> <strong>Board</strong> Budget 1991/92 - 2011/12 7429 Estimated Foreign <strong>Travel</strong> receipts 1997 - 2011 7530 & 31 Distribution of Expenditure of Stopover & Cruise Passenger Visitors 2011 76 - 7732 Airlines Serving <strong>Jamaica</strong> by Gateways 2009 - 2011 78 – 81ii

FIGURE NO.LIST OF CHARTS AND GRAPHSPAGE1 Visitor Arrivals to <strong>Jamaica</strong> 1997 - 2011 22 Stopover Arrivals to <strong>Jamaica</strong> 2007 - 2011 33 Stopovers by Port of Arrival 2010 & 2011 44 Stopover Visitors by Market Share 2008 - 2011 54a Distribution of Stopovers from the U.S.A. Market Region 2008 - 2011 164b-4f Seasonality of Stopover Arrivals from the U.S.A. Market Regions - 3 Year Average 2009 - 2011 174g Average Growth Rate: 2007 - 2011 235 Top Ten Producing USA States 2011 256 Seasonality of Canadian Arrivals - 3 Year Average 2009 - 2011 266a Distribution of Stopovers from the Canadian Market Region 2008 - 2011 277 Seasonality of European Arrivals - 3 Year Average 2009 - 2011 287a Distribution of Stopovers from the European Market Region 2008 - 2011 298 Seasonality of Caribbean Arrivals - 3 Year Average 2009 - 2011 308a Distribution of Stopovers from Other Marketing Regions 2008 - 2011 319 Age Distribution of Stopover Arrivals and Main Markets 2010 & 2011 3210 - 10c Stopover Arrivals by Gender & Main Markets 2011 3310d Categories of Stopover Arrivals by Purpose of Visit to <strong>Jamaica</strong> 2011 3410e Stopover Arrivals by Intended Resort Area of Stay 2011 3511 % Distribution of Stopovers by Scheduled and Chartered Flights 2011 4212 Seasonality of Cruise Passenger Arrivals - 3 Year Average 2009 - 2011 4413 % Share of Cruise Passengers by Port of Arrival 2008 -2011 4513a Cruise Calls by Port of Arrival 2008 -2011 46Hotel Room Occupancy & Room Nights Sold:14 & 14a Hotel Room Occupancy & Room Nights Sold by Area 2010 & 2011 5115 & 15a Hotel Room Occupancy & Room Nights Sold by Season and Area 2011 5916 - 16c Seasonality of Hotel Room Occupancy by Category 2009 - 2011 6217 & 17a Hotel Room Occupancy & Room Nights by Category and Season 2011 6318 & 18a All-Inclusive & Non All-Inclusive Hotels 2007 - 2011 6518b & 18c Seasonality of Occupancy All-Inclusive and Non All-Inclusive Hotels 2009 - 2011 6619 & 19a Accommodation Categories 2011 67 - 6820 Employment in Accommodation Sector by Area 2011 7321 <strong>Tourist</strong> <strong>Board</strong> Budget Approved 2002/03 - 2011/12 7422 Estimated Foreign Exchange Earnings 2002 - 2011 7523 & 24 Distribution of Stopover & Cruise Passenger Visitor Expenditure 2011 76 - 77iii

D E F I N I T I O N SVISITORS : Any person visiting a country other than the one inwhich he/she normally resides, for not more than oneyear, and whose purpose of visit can be classified underone of the following headings:Leisure: recreation, holiday, health, study,religion, sport, visit family/friends;Business: conference, meeting and mission.There are two types of visitors: tourists and excursionists.TOURISTS : A visitor staying at least 24 hours in the country.STOPOVERS : The same as "tourists".NON-RESIDENT JAMAICANS : Any <strong>Jamaica</strong>n National whose usual residence is outsideof <strong>Jamaica</strong> and whose purpose of visit can be classifiedunder the headings previously mentioned above.EXCURSIONISTS : Any visitor staying less than 24 hours in the country.CRUISE PASSENGERS : A special type of excursionist travelling by cruise ships.ARMED FORCES : Personnel of the Naval Armed Forces of foreigncountries who take onshore leave in <strong>Jamaica</strong>.LENGTH OF STAY : The "length of stay" refers to the intended length ofstay as given by the visitors.iv

INTRODUCTIONThe statistics contained in this publication cover visitor arrivals, accommodation utilization, andvisitor expenditure.Tourism data from all the Embarkation/Disembarkation (E/D) Cards were entered in a computersystem located at the Corporate Head Office, <strong>Jamaica</strong> <strong>Tourist</strong> <strong>Board</strong>, Kingston. The data onstopovers, including demographics, were derived from this source.<strong>Jamaica</strong>n nationals resident abroad and who visited <strong>Jamaica</strong> are included in the visitor arrival figures.<strong>Jamaica</strong> has conformed with "Recommendations on Tourism <strong>Statistics</strong>" prepared by the WorldTourism Organization and adopted by the United Nations Statistical Commission (UNSC) in 1993.These recommendations state that nationals who reside abroad and who return as visitors shouldbe included in Tourism <strong>Statistics</strong>. The <strong>Jamaica</strong> <strong>Tourist</strong> <strong>Board</strong> has been publishing visitor arrivalfigures on Non-Resident <strong>Jamaica</strong>ns since 1989.Fly-cruise passengers i.e. Cruise Passengers flying into the island to meet the cruise ship are notincluded in tourist arrival figures, unless they spend at least one night in land-based accommodation.Data on cruise ship arrivals were obtained from the ships' manifests.Visitor accommodation figures such as hotel occupancy rates, room capacity, employment inaccommodation, were collected directly from the establishments. Estimates were made, using E/Dcard information, for some non-compliant properties.v

Information on visitor expenditure was obtained from an Exit survey conducted among departingvisitors at both international airports and at the cruise ship piers.The Research & Market Intelligence Unit of the Marketing Department is thankful for all theassistance and support given by the other tourism entities and their staff who provided the data and/ormaterial for this issue.Acknowledgments and appreciations are extended to the Data Entry staff and Research Assistants whoassisted with the data collection process.For further information, please contact:-Research & Market Intelligence UnitMarketing Department<strong>Jamaica</strong> <strong>Tourist</strong> <strong>Board</strong>64 Knutsford BoulevardKingston 5Phone: (876)-929-9200Fax: (876)-929-9375Please visit our Web sites at http://www.jtbonline.org or http://www.visitjamaica.comor e-mail alyn@visitjamaica.comvi

INTERNATIONALThe World Tourism Organization (UNWTO) reported that International touristarrivals grew to reach 980 million, representing an increase of 4.4% over 2010.In a year characterized by a stalled global economic recovery, major politicalchanges in the Middle East and North Africa and natural disasters in Japan,demand has been strong in both advanced and emerging economy destinations.This positive growth was recorded in all world regions except for the Middle Eastand North Africa. Europe and Asia & the Pacific both increased by 6.1%, theAmericas was up by 4.2%, Africa grew by 0.9% and the Middle East declined by8.4%.Overview 2011vii

CARIBBEANThe Caribbean Tourism Organization (CTO) reported that tourist arrivals to theregion remained afloat and resilient amidst turbulence in the marketplace andwelcomed an estimated 23.8 million arrivals in 2011. 1With the exception of May andOctober, which were downmarginally, the region recorded arise in arrivals every month in 2011.During the winter months (Januaryto April) arrivals were up 4.4% overthe previous winter. In the summerperiod a lower than expectedincrease of 3% was recorded.The Caribbean recorded modest performances from all major source markets in2011, the United States, increased by 1.7%, Europe remained flat recording a 0.6%increase, and Canada continuing to outpace all other markets, with arrivals up by6.8%.In terms of major markets, it is estimated that tourist arrivals to the Caribbean from themain visitor producing country, the United States of America, increased by 1.7%, Canadaincreased by 6.8% and Europe recording a flat 0.6% increase.The larger destinations, including Cuba, the Dominican Republic, Puerto Rico and theU.S. Virgin Islands, continued the historical trend of leading growth in the region. This1 Caribbean Tourism Performance 2011 CTO Media Conference; The State of Caribbean Tourism February 2012.Overview 2011viii

subgroup, which accounts for more than half of all arrivals to the region on an annualbasis, grew by 4.2%.The top three most visited islands in the region were: Dominica Republic, Cuba, and<strong>Jamaica</strong>, in descending order of importance.The Caribbean Cruise sector show a marginal increase of 0.3% in passenger arrivalsduring 2011 to reach 20.6 million. A subset of the cruise passenger arrivals in 2010 arecompared below with 2011 figures 2 .Table (I) showing a subset of the cruise passenger arrivals in 2011 compared to 2010.Table 4: Cruise Passenger Arrivals - 2011 & 2010Destination Period 2011 2010 % ch.Antigua & Barbuda Jan-Dec 606,485 557,635 8.8Aruba Jan-Dec 599,893 569,424 5.4Bahamas Jan-Dec 4,161,269 3,803,122 9.4Barbados Jan-Dec 619,054 664,747 -6.9Belize Jan-Dec 724,544 764,628 -5.2Bermuda Jan-Dec 415,958 347,931 19.6British Virgin Islands Jan-Nov 410,944 428,896 -4.2Cayman Islands Jan-Dec 1,401,495 1,597,838 -12.3Cozumel (Mexico) Jan-Dec 2,871,097 2,911,146 -1.4Curacao Jan-Dec 400,918 383,036 4.7Dominica Jan-Dec 341,503 517,979 -34.1Dominican Republic Jan-Nov 264,532 295,543 -10.5Grenada Jan-Dec 309,574 333,291 -7.1Haiti Jan-Aug 411,687 330,639 24.5<strong>Jamaica</strong> Jan-Dec 1,125,481 909,619 23.7Martinique Jan-Dec 41,142 74,634 -44.9Puerto Rico Jan-Nov 972,065 1,061,688 -8.4Saint Lucia Jan-Aug 414,660 458,486 9.6St. Maarten Jan-Dec 1,656,159 1,512,618 9.5St. Vincent & the Grenadines Jan-Dec 88,925 110,955 -19.9Trinidad & Tobago Jan-Dec 60,277 101,797 -40.8U S Virgin Islands Jan-Dec 2,008,991 1,858,946 8.1PN.B: Figures are subject to revision by reporting countries Preliminary figuresSOURCE - Data supplied by member countries and available as at July 10, 20122 Caribbean Tourism Performance 2011 CTO March 2012Overview 2011ix

In an effort to continue to monitor theextent of the recovery of tourist arrivalsfrom the impact of the global financialcrisis, figures from 2011 and 2008 werecompared. In every quarter, touristarrivals in 2011 outperformed those in2008, with growth rates of 14.3%, 8.2%,8.6% and 10.3%, for quarters 1 to 4, inthat order.The main factors that may be identified as having had an impact on <strong>Jamaica</strong>’s stopoverarrivals during 2011 were as follows:• Airlines decreased frequencies and routes during the latter part of the year alongwith increased surcharges and energy fees.• The occurrence of annual festivals.• On-island <strong>Travel</strong> Agents’ Familiarization tours.• The “Nothing Changes’ TV advertising campaign reassured consumers that<strong>Jamaica</strong> they know and love has not changed.• The inactive Hurricane season.• The continued impact of the global recession in the visitor generating countries.Despite the challenges, Destination <strong>Jamaica</strong> has endured and continues to offer a productof very high quality to its visitors, through its expansive and inclusive nature in 2011.The wide range of hotels, attractions and activities has allowed <strong>Jamaica</strong> to deliver onvisitor expectations and provide value for money.Overview 2011xi

MARKET PERFORMANCEUnited StatesThe U.S. economy grew by 1.7% in 2011 (that is, from the 2010 annual level to the 2011annual level), compared with an increase of 3.0% in 2010. 3 <strong>Travel</strong> by US citizens during2011 indicate that outbound travel from the USA increased by 3.0% over outbound travelduring the corresponding period in 2010. <strong>Travel</strong> to the Caribbean by US residentsincreased by 2.0% during this period also, reflecting a market share of 22% of the USAoutbound travel market. Of the 36 million total outbound travelers for 2011, 9 milliontraveled to Canada and Mexico. 4During the winter period (Jan. – Apr.), the United States market provided a total of2,029,715 tourist arrivals to the Caribbean, which was 11.1% greater than thecorresponding period in 2010 5 . This was 16.2% and 6.1% higher than the stopoverarrivals received in 2009 and 2008 respectively. With regard to <strong>Jamaica</strong>, during thewinter season, stopover arrivals in 2011were 1.5% lower than those in 2010and 7.7% more than in 2009. Incomparison to 2010, stopover arrivalsin the 2011 winter season from theNortheastern, Western, and Southernregions decreased by 4.3%, 5.2%, and1.0%, respectively. The Midwesternregion of the U.S was the only region3 Bureau of Economic Analysis, U.S Department of Commerce - News Release – March 29, 20124 U.S. Department of Commerce, ITA, Office of <strong>Travel</strong> & Tourism Industries “U.S. Citizen Air Traffic to OverseasRegions, Canada & Mexico 2011”5 U.S. Department of Commerce, ITA, Office of <strong>Travel</strong> & Tourism Industries “U.S. Citizen Air Traffic to OverseasRegions, Canada & Mexico 2010” AND Source: U.S. Department of Commerce, ITA, Office of <strong>Travel</strong> & TourismIndustries “U.S. Citizen Air Traffic to Overseas Regions, Canada & Mexico 2009”Overview 2011xii

to grow during this period by 4.8% with 104,338 visitors.For the summer period (May – December), the US market fell by 1.3% compared to 2010and rose 2.9% over 2009 stopoverarrivals. Summer arrivals in 2011 were804,715. In 2010, 815,623 stopoverarrivals came during summer and in2009, 781,999 stopover arrivals visited.During the summer season, arrivals fromthe Midwestern and Western regionsincreased by 3.6%, and 4.4%, while theNortheastern and Southern regionsdeclined by 4.2% and 1.6%, respectively.The Northeastern and Southern regions contributed 70.8% of the US stopover visitors to<strong>Jamaica</strong> during 2011. This represents 1.4 percentage points less than its contribution in2010. The Midwest region contributed 18.9% of the stopover arrivals and 10.3% of thestopover visitors came from the Western region. The USA marketing regions recordedmixed results in arrivals for 2011 over 2010. The Northeast and the South decreased by4.2% and 1.4%, while the Midwest and the Western regions grew by 4.1% and 1.9%.Overall, arrivals from the USA market declined 1.4% in 2011 with 1,225,565 over1,242,943 stopovers in 2010.Overview 2011xiii

CANADACanada’s economic activity expanded throughout 2011 with GDP at constant pricesgrowing by 2.5% 6 . Outbound trips reached an estimated 30.1 million in 2011 7 . Betweenthe years 2003 and 2011, arrivals from Canada to <strong>Jamaica</strong> have consistently grown yearon year by double digits; 10.9%, 10.6%, 31.4%, 24.1%, 23.9, 22.9% 12.0% and 16.5%respectively. Arrivals in 2011 totaled of 378,938 stopovers. This represents 53,747 moreCanadian visitors to <strong>Jamaica</strong> in 2011 than in 2010, a 16.5% increase.The Canadian market enjoyed a strong winter period, growing by 25.3%. A total of199,787 stopovers came from that market compared to 159,428 in winter 2010. All fourmonths of winter recorded increases:January (19.1%), February (20.5%),March (31.5%) and April (34.1%).This exceptional growth in the wintermonths continued into the summer butat a lower rate, an 8.1% increase wasrecorded for the May – Decemberperiod, with a total of 179,151stopovers arrived compared to the165,763 arrivals in summer 2010. The following months recorded double digitpercentage change in arrivals: June (21.2%), August (10.7%), September (23.4%) andOctober (21%).The main province of Ontario contributed 233,373 or 71.8% of stopover arrivals to theCanadian total, an increase of 14.4% over the 204,025 who came from that province in6 <strong>Statistics</strong> Canada, Industry Accounts Division (March 2012). Gross Domestic Product by Industry, Catalogue no.15-001-X, vol. 26, no37 Canadian Tourism Commission (December 2011). Tourism Snapshot: A focus on the markets that the CTC and itspartners are active in,(7), (12)Overview 2011xv

2010. Quebec, the second leading province (with 17.0% of the visitors), grew by 14.5%to reach 55,272 stopovers. The other two leading provinces Alberta and BritishColumbia produced 13.1% and 16.6% more visitors in 2011 compared to 2010respectively.Canada Visitor SummaryThe average length of stay for Foreign National Canadian visitors in 2011 equalledto the average of 9.0 nights for all visitors. (see page 37, Table 9a)In 2011 a total of 326,184 or 86.1% of Canadian visitors came to <strong>Jamaica</strong> forleisure, recreation and holiday, 26,104 or 6.9% came to visit friends & relatives,10,590 or 2.8% came on business, and 16,062 or 4.2% came for unstated purposes.(see page 34, Table 8.1a)The annual average growth rate for visitors from the Canada region over the pastfive years from 2007 to 2011 was 18.7%. (see page 23, Fig. 4g)In 2011 the age distribution shows 13.7% were aged under 18 years, 6.9% werebetween 18 – 24 years, 51.2% were between 25 – 49 years, 22.0% were between50 – 64 years and 6.2% were 65 and over. (see page 32, Table 7)The Gender mix of visitors from Canada, were 173,856 males (45.9%) and205,082 females (54.1%). The gender ratio of visitors from Canada is 118 femalesper 100 males. (see page 33, Table 8)January through March and December are the peak months for visitor arrivalsfrom Canada in 2010. This coincides with the cold winter climate experienced inCanada during this period (see pages 10, 11 and 26 Fig. 6)The most popular resort regions to which Canadian visitors stayed in 2011 wasOcho Rios with a total of 122,876 or 32.4% of Canadian visitors. 29.5% or111,624 Canadian visitors stayed in Montego Bay and another 21.8% or 82,538stayed in Negril. (see page 35, Table 8.2a)Overview 2011xvi

United Kingdom/EuropeThe number of visits abroad by UK residents has been more stable since mid-2010,following substantial declines in the previous 18 months. They grew by 0.8 per cent in2011 from 55.6 million in 2010 to 56.0 million. This growth occurred in relation to visitsto Europe (up 2.5%) while visit to North America and Other Countries fell. 8Stopover arrivals to <strong>Jamaica</strong> out of the European region recorded negative growth in2011. Arrivals from Europe declined by 6.7% in 2011, moving from 271,315 arrivals in2010 to 253,045 arrivals in 2011. The United Kingdom, Germany, Italy and theNetherlands are the most important visitor producing countries within this regionalmarket, in descending order of importance.United Kingdom Visitor SummaryThe United Kingdom, with 173,507 stopover arrivals, registered a decrease of5.9% over the 184,355 recorded in 2010. This is the lowest level of visitors fromthe UK since 2005 when 149,773 was recorded. The performance for winter wasup by 1.6% and the summer declined by 9.1%.The average length of stay for Foreign Nationals UK visitors in 2011 was 15.4nights, which is higher than the average of 9.0 nights for all visitors. (see page 37,Table 9a)In 2011 a total of 115,745 or 66.7% of UK visitors visited <strong>Jamaica</strong> for leisure,recreation and holiday, 32,252 or 18.6% visited friends & relatives, 11,957 or6.9% came on business, and 13,553 or 7.8% visited for unstated purposes. (seepage 34, Table 8.1a)The annual average growth rate for visitors from the United Kingdom over thepast five years from 2007 to 2011 was negative 1.7%. (see page 23)8 UK National <strong>Statistics</strong> – Overseas <strong>Travel</strong> and Tourism - Quarter 4 2012Overview 2011xvii

In 2011 the age distribution shows 15.4% were aged under 18 years, 8.3% werebetween 18 – 24 years, 50.2% were between 25 – 49 years, 18.0% were between50 – 64 years and 8.0% were 65 and over. (see page 32, Table 7)The Gender mix of visitors from UK, were 78,415 males (45.2%) and 95,092females (54.8%). The gender ratio of visitors from the United Kingdom is 121females per 100 males. (see page 33, Table 8)July, August and December were the peak months for visitor arrivals from UK in2011 with July being the only month with over 17,000 visitors. (see pages 10 and11, Table 4)Continental EuropeGermany continues to be the leading visitor producing country from Continental Europe.With a total of 19,939 stopover arrivals in 2011, the German market increased by 5.7%over the 18,857 recorded in 2010. However this is 1.4% below the 20,220 that wasrecorded in 2009 and 53.4% below the peak of 43,018 German visitors recorded in 1998.Italy, during the winter season posted negative growth of 24.1% with 4,950 stopoverarrivals compared to 6,521 in 2010. This negative trend was lessened during the summermonths recording a decrease of 6.0% with 6,750 stopover arrivals compared to 7,179 in2010. By the end of the year, Italy’s performance with a total of 11,700 stopover arrivals,was down 14.6% growth against the 13,700 stopovers in 2010.The Netherlands recorded growth in 2011 of 7.8% with 7,200 stopovers against the 6,677recorded in 2010.Overview 2011xviii

The performances of the following European countries albeit small numbers recordedmixed growth in 2011 compared to the corresponding period in 2010;Spain -32.2%;France 26.2%;Portugal -53.5%;Switzerland 10.4%;Belgium 0.9%.Austria -3.6%;Latin AmericaLatin America continues to be a market which holds much potential for <strong>Jamaica</strong>. Aftertwo years of negative growth, since 2009, stopover arrivals out of the Latin Americanmarket region reversed this trend in 2011 moving from 13,442 in 2010 to 16,589 in 2011.Of the top three visitor-producing countries in the South American sub-region, Ecuadorwith 2,979 increased by 101.1%; Argentina with 2,168 visitors increased by 21.9%; whileBrazil with 1,597 visitors declined by 5.1%;.From the Central American sub-region, Mexico with 2,124 and Panama with 1,217visitors both increased by 7.1%; and Costa Rica with 846 increased by 11.6%.CaribbeanArrivals from Caribbean territories to <strong>Jamaica</strong> increased by 13.6% with 66,216 visitors in2011 when compared to the 58,299 recorded in 2010.The Cayman Islands, with 18,035 stopovers, Trinidad and Tobago with 15,513, TheBahamas with 5,999 and Barbados with 5,422, continued to be the main providers ofvisitors to <strong>Jamaica</strong> from the Caribbean. These countries combined contributed 44,969stopovers or 67.9% of the total Caribbean arrivals.Overview 2011xix

CRUISE PASSENGERSAccording to the Florida-Caribbean Cruise Association (FCCA), an estimated 16 millionpassengers cruised the seas in 2011, up 6.7% from the 15 million passengers in 2010,with 11.2 million originating in North America. In 2011 the growth of the cruise industrycontinued with fourteen additional innovative, feature-rich ships, international ports ofcall and convenient departures from proximal embarkation cities. The guest capacities ofthese ships ranged from 162 to 3,652 passengers.The current cruise ship order book extending through 2015 includes 26 new builds, with45,600 berths at a value of nearly $12 billion. 9In 2011, the Caribbean continued to lead as the number one cruise destination,accounting for 39.8% of all itineraries in 2011, versus 43.1% in 2010. The passengernumbers for the Caribbean continues to be consistent and high, despite other rising cruisedestinations.<strong>Jamaica</strong> recorded over a million cruise passengers during 2011. This total of 1,125,481cruise passengers who visited our shores was a 23.7% increase over the 909,619 recordedfor the corresponding period in 2010. Seasonally, cruise arrivals recorded a largeincrease of 32.7% in the summer period (May to December) with 732,951 cruisepassengers, up from the 552,206 for 2010.With the exception of March, every month 2011, cruise passenger arrivals recordedincreases ranging from 9.7% in July to 72.7% in November.9 Source: Florida-Caribbean Cruise Association – Cruise Industry Overview 2012Overview 2011xxi

The main contributing factor to this resounding turn around in passenger arrivals was theopening of the new Falmouth pier in Trelawny. The port of Falmouth contributed456,442 cruise ship passengers or 40.6% or passengers to <strong>Jamaica</strong> from 110 cruise shipcalls.The port of Ocho Rios, which in the past provided the largest share of <strong>Jamaica</strong>’s cruisearrivals, accounted for 417,520 or 37.1% of the 1,125,481 who arrived at our shores in2011. The port of Montego Bay accounted for 250,491 passengers or 22.3%.The cruise ships carrying the most passengers to <strong>Jamaica</strong> in 2011 were Oasis of the Seas,of the Royal Caribbean Cruise Line and Conquest, of the Carnival Cruise Line. The Oasisof the Seas made 21 calls to the Port of Falmouth with 125,023 passengers. The CarnivalConquest made 35 cruise ship calls to Montego Bay, and provided 120,526 cruisepassengers.Average Length of StayIn 2011 the overall average intended length of stay for foreign nationals was 8.9 nights;this was slightly below the level of 9.0 nights recorded in 2010. Those foreigners whoused hotel accommodation had an average length of stay of 6.9 nights and those whostayed in non-hotel accommodation stayed 14.2 nights.American visitors, on the average, stayed 7.7 nights while Canadians stayed an averageof 9 nights. Visitors from the United Kingdom recorded an average length of stay of 15.4nights and those visitors from Continental Europe stayed 11.5 nights.Overview 2011xxii

Purpose of VisitOf the 1,951,752 stopover arrivals who visited the island during 2011, a total of1,519,363 or 77.8% were visiting for the purpose of leisure, recreation and holiday; 9.4%were visiting Friends and Relatives, 5.4% were on business, and the remaining 7.3%were on other purposes. (See page 34, Table 8.1)Hotel Room OccupancyThe average room capacity grew by 3.2% in 2011, moving from 18,759 rooms in 2010 to19,369 rooms in 2011. Total room nights sold of 4,275,303 increased by 3.1% in 2011compared to 4,145,603 room nights sold in 2010. Hotel room occupancy was at the samelevel as in 2010 at 60.5%. The number of stopovers that intended to stay in hotelaccommodations increased from 1,286,366 in 2010 to 1,314,135, an increase ofapproximately 2.2% in 2011.In the resort region of Montego Bay, theannual hotel room occupancy rate was63.2%, which was up by 3.2% from the61.2% recorded in 2010. The totalnumber of room nights sold increasedby 8.6% moving from 1,453,367 in2010 to 1,578,787 in 2011. The averageroom capacity grew by 5.3% in 2011,moving from 6,503 rooms in 2010 to 6,844 rooms in 2011. The number of stopoversthat intended to stay in hotel accommodations increased from 486,360 in 2010 to518,550, an increase of 6.6% in 2011.Overview 2011xxiii

The average hotel room occupancy rate for Ocho Rios was 63.9%, which was 2.1% lowerthan the 66.0% recorded in 2010. The total number of hotel room nights moved slightlyfrom 1, 223,340 in 2010 to 1,224,827 in 2011. The number of stopovers that intended tostay in hotel accommodations increased from 344,292 in 2010 to 353,067, an increase of2.5% in 2011.The resort area of Negril recorded an average hotel room occupancy rate of 58.5% incomparison to the rate of 61.7% in 2010. The number of hotel room nights sold in thisresort area decreased by 2.5%, recording 1,111,386 room nights sold compared 1,140,434sold in 2010. The average room capacity increased by 2.8% in 2011, moving from 5,061rooms in 2010 to 5,201 rooms in 2011. The number of stopovers that intended to stay inhotel accommodations decreased from 357,499 in 2010 to 345,152, a decline of 3.5% in2011.In the Mandeville/Southcoast resort area, average hotel room occupancy rate increased by17.8%, moving from 49.8% in 2010 to 58.7% in 2011. Room nights sold increased from100,030 in 2010 to 119,489 being sold in 2011.Kingston & St. Andrew achieved a hotel room occupancy level of 45.2%, which was3.4% more than the 41.8% recorded in 2010. The number of room nights sold inKingston & St. Andrew increased by 5.2%, moving from 224,899 in 2010 to 236,537 in2011.Hotel room occupancy for the resort area of Port Antonio was 14.1%, which was 4.1%more than the level of 10.0% recorded in 2010. The number of room nights sold in PortAntonio increased from 3,533 in 2010 to 4,277 in 2011.Overview 2011xxiv

Overall, the all-inclusive hotel roomoccupancy rate was 67.3%, compared to67.4% recorded in 2010. Non all-inclusiveroom occupancy rate moved from 33.6% in2010 to 38.6% in 2011.Hotel room occupancy rate varied with thesize of the hotel. Hotels with less than 50rooms, recorded a rate of 30.5%. Hotels with 50 – 100 rooms, achieved a rate of 37.0%.Hotels in the size range of 101 – 200 rooms recorded a 65.9%, and hotels with over 200rooms achieved a room occupancy rate of 67.7%.Visitor ExpenditureGross visitor expenditure in 2011 was estimated at approximately US$2.008 billion. Thisrepresents an increase of 0.4% against the estimated US$2.001 billion earned in 2010.Total expenditure of Foreign Nationals amounted to US$1.851 billion. Cruise passengerexpenditure totaled US$0.080 billion while US$0.076 billion was estimated as thecontribution of Non-Resident <strong>Jamaica</strong>ns.Foreign Nationals spent on the average US$115.74 per person per night while cruisepassengers spent an average of US$71.27 per person per night.Direct Employment in the Accommodation SectorThe number of persons employed directly in the accommodation sub-sector decreasedfrom 37,018 in 2010 to 34,921 in 2011, a decrease of 5.7%.Overview 2011xxv

The main resorts of Montego Bay, Ocho Rios and Negril accounted for 30,569 persons or87.5% of the total number of persons employed directly in the sub-sector. Montego Baywith 12,198 direct jobs represented 34.9% of those employed, Negril with 9,407 directjobs, accounted for 26.9%, and Ocho Rios with 8,964, was responsible for 25.7%.Kingston, Port Antonio and the South coast accounted for the remaining 12.4% ofemployment in the accommodation sector.The average number of employees per room in 2011 was estimated at 1.23.New Developments 2012AirliftJet Blue Airlines is scheduled to begin operations out of Ft. Lauderdale intoNorman Manley International Airport.American Airlines is expected to increase frequency out of Miami during thesummer months into Norman Manley International Airport.Sunwing Airlines is scheduled to begin weekly operations out of Nashville,Tennessee and Cincinnati, Ohio.Copa Airlines began operating scheduled service into Sangster’s InternationalAirport from Panama.AccommodationsRe-opening of two major hotel properties; Royal Decameron Caribbean formerlyBreezes Super Fun Beach Resort & Spa, with 225 rooms and Braco formerlyBraco Beach Resort & Spa with 232 rooms.The Grand Palladium is expected to increase the number of rooms offered by 600rooms.Overview 2011xxvi

1SUMMARY OF MAIN INDICATORS%Change2010 2011 2011/2010TOTAL STOPOVERS 1,921,678 1,951,752 1.6Foreign Nationals 1,768,810 1,800,280 1.8Non-Resident <strong>Jamaica</strong>ns 152,868 151,472 -0.9MARKET REGION 1,921,678 1,951,752 1.6From U.S.A. 1,242,943 1,225,565 -1.4Canada 325,191 378,938 16.5Europe 271,315 253,049 -6.7Caribbean 58,299 66,216 13.6Latin America 13,442 16,589 23.4Asia & Pacific 5,791 6,522 12.6Other Countries 4,697 4,873 3.7CRUISE SHIP PASSENGERS 909,619 1,125,481 23.7TOURIST ACCOMMODATION 28,448 28,304 -0.5Hotel Rooms * 20,823 20,665 -0.8All-Inclusive 15,534 15,349 -1.2Non All-Inclusive 5,289 5,316 0.5Other Rooms 7,625 7,639 0.2Guesthouses 3,152 3,042 -3.5Resort Villas & Cottages 3,781 3,874 2.5Apartments 692 723 4.5Hotel Room Nights Sold 4,145,603 4,275,303 3.1Average Hotel Room Nights Available 6,847,035 7,069,685 3.3Average Hotel Room Occupancy 60.5 60.5 -0.1All-Inclusive Hotels 67.4 67.3 -0.1Non All-Inclusive 33.6 38.6 14.9AVERAGE LENGTH OF STAYForeign Nationals 9.0 8.9 -1.1Non-Resident <strong>Jamaica</strong>ns 16.4 16.4 0.0VISITOR EXPENDITURE (US$ MILLION) 2,001 2,008 0.4Stopovers 1,922 1,928 0.3Cruise Passengers 79 80 1.4EMPLOYMENT IN ACCOMMODATION SECTOR 37,018 34,921 -5.7* Excluding 3,281 Closed Hotel RoomsR&MI/JTB 2011

2TABLE 1VISITOR ARRIVALS TO JAMAICA1997 - 2011CRUISE ARMEDSTOPOVERS PASSENGERS FORCES1997 1,192,194 711,699 6161998 1,225,287 673,690 2,2751999 1,248,397 764,341 2,5322000 1,322,690 907,611 1,4642001 1,276,516 840,337 1,0752002 1,266,366 865,419 8072003 1,350,285 1,132,596 8152004 1,414,786 1,099,773 2,7372005 1,478,663 1,135,843 1,4072006 1,678,905 1,336,994 9992007 1,700,785 1,179,504 1,2292008 1,767,271 1,092,263 1,0102009 1,831,097 922,349 8852010 1,921,678 909,619 2802011 1,951,752 1,125,481 1,1652,500VISITOR ARRIVALS TO JAMAICA1997 - 2011Stopovers2,000Thousands1,5001,0005000Cruise &Armed Forces1997 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 2011Fig. 1R&MI/JTB 2011

3TABLE 2TOTAL STOPOVER ARRIVALS BY MONTH: 2007 - 20112007 2008 2009 2010 2011January 129,756 142,861 148,886 161,094 174,144February 132,949 156,831 160,282 167,462 175,114March 164,547 184,267 175,929 201,378 204,046April 150,561 152,199 164,090 166,955 179,444Jan.-Apr. 577,813 636,158 649,187 696,889 732,748May 132,044 141,236 153,443 149,775 146,583June 156,450 161,958 168,561 164,205 166,545July 195,409 185,447 195,940 204,526 202,493August 136,660 142,467 152,573 159,408 155,133September 89,704 92,037 95,263 97,010 98,280October 108,205 106,104 108,820 114,699 112,536November 124,474 122,250 125,494 134,320 139,721December 180,026 179,614 181,816 200,846 197,713May - Dec. 1,122,972 1,131,113 1,181,910 1,224,789 1,219,004Jan. - Dec. 1,700,785 1,767,271 1,831,097 1,921,678 1,951,752% Inc./Dec. 1.3 3.9 3.6 4.9 1.6STOPOVER ARRIVALS TO JAMAICA2007 - 2011Stopovers in Thousands2,0001,8001,6001,4001,2001,00080060040020001,8311,922 1,9521,7671,7012007 2008 2009 2010 2011YEARSNon-Resident <strong>Jamaica</strong>ns Foreign NationalsFig. 2R&MI/JTB 2011

4TABLE 3TOTAL STOPOVER ARRIVALS BY PORT OF ARRIVALKINGSTONMONTEGO BAYTOTAL TOTAL % INC./DEC. TOTAL TOTAL % INC./DEC.2010 2011 2011/10 2010 2011 2011/10January 29,991 30,550 1.9% 131,103 143,594 9.5%February 29,941 31,300 4.5% 137,521 143,814 4.6%March 39,749 36,490 -8.2% 161,629 167,556 3.7%April 34,555 38,335 10.9% 132,400 141,109 6.6%Jan.-Apr. 134,236 136,675 1.8% 562,653 596,073 5.9%May 27,312 32,519 19.1% 122,463 114,064 -6.9%June 36,650 39,392 7.5% 127,555 127,153 -0.3%July 54,891 55,546 1.2% 149,635 146,947 -1.8%August 41,153 39,826 -3.2% 118,255 115,307 -2.5%September 26,200 25,493 -2.7% 70,810 72,787 2.8%October 30,251 27,271 -9.9% 84,448 85,265 1.0%November 29,398 30,495 3.7% 104,922 109,226 4.1%December 53,489 49,365 -7.7% 147,357 148,348 0.7%May - Dec. 299,344 299,907 0.2% 925,445 919,097 -0.7%Jan. - Dec. 433,580 436,582 0.7% 1,488,098 1,515,170 1.8%STOPOVERS IN THOUSANDS22020018016014012010080604020STOPOVERS BY PORT OF ARRIVAL2011MONTEGO BAYKINGSTONTOTAL STOPOVERS0Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov DecFig. 3R&MI/JTB 2011

5STOPOVER VISITORS BY MARKET SHARE2008 - 20112,0001,8001,767 1,8311,9221,952OTHER COUNTRIES1,600LATIN AMERICAStopovers in Thousands1,4001,2001,000800600400200CARIBBEANEUROPECANADAU.S.A-2008 2009 2010 2011Stopovers in Thousands%ChangeCountries 2008 %Share 2009 %Share 2010 %Share 2011 %Share 2011/10U.S.A. 1,150.9 65.1 1,172.8 64.1 1,242.9 64.7 1,225.6 62.8 -1.4Canada 236.2 13.4 290.3 15.9 325.2 16.9 378.9 19.4 16.5Europe 284.7 16.1 276.8 15.1 271.3 14.1 253.0 13.0 -6.7Caribbean 67.2 3.8 65.3 3.6 58.3 3.0 66.2 3.4 13.6Latin America 16.1 0.9 14.5 0.8 13.4 0.7 16.6 0.8 23.4Other Countries 12.1 0.7 11.3 0.6 10.5 0.5 11.4 0.6 8.6Total 1,767.3 100.0 1,831.1 100.0 1,921.7 100.0 1,951.8 100.0 1.6Fig. 4R&MI/JTB 2011

6TABLE 4STOPOVER ARRIVALS BY COUNTRY AND MONTH OF ARRIVALS (2011)U.S.A.NORTHEASTJanuary February March April May June JulyConnecticut 2,500 2,969 3,034 3,349 2,476 2,623 4,017Delaware 490 355 653 621 470 624 698Maine 485 502 695 712 346 233 185Maryland 3,234 2,897 3,782 4,429 3,704 5,272 6,095Massachusetts 3,357 4,048 4,020 3,821 2,946 2,552 2,866New Hampshire 465 711 657 905 432 253 292New Jersey 4,749 5,161 5,782 7,910 5,452 5,817 9,415New York 16,760 19,701 20,026 22,725 16,345 16,823 29,341Pennsylvania 5,765 5,640 7,026 6,430 6,898 7,712 8,300Rhode Island 333 499 439 444 393 287 295Vermont 256 429 399 391 155 97 88Virginia 2,098 1,828 2,834 3,078 2,841 2,983 3,622Washington D.C. 456 472 696 489 465 512 641West Virginia 193 190 286 309 388 429 443Total 41,141 45,402 50,329 55,613 43,311 46,217 66,298MIDWESTIllinois 4,934 4,760 6,196 4,015 4,451 4,862 4,578Indiana 1,423 1,659 2,078 1,713 1,708 1,808 1,773Iowa 1,767 2,383 1,797 655 674 689 714Kansas 731 509 861 473 734 839 801Kentucky 594 511 666 800 781 1,160 989Michigan 2,593 3,813 4,211 3,957 2,367 2,036 1,952Minnesota 3,210 4,056 4,471 1,649 945 786 753Missouri 1,595 1,543 1,927 1,394 2,017 2,428 2,492Nebraska 588 796 631 436 465 682 500North Dakota 561 697 361 235 116 122 61Ohio 1,875 2,142 3,059 2,140 2,414 3,227 2,766South Dakota 614 565 303 144 236 205 103Wisconsin 4,316 4,303 4,885 2,743 1,632 1,258 1,106Total 24,801 27,737 31,446 20,354 18,540 20,102 18,588R&MI/JTB 2011

TABLE 47STOPOVER ARRIVALS BY COUNTRY AND MONTH OF ARRIVALS (2011)U.S.A.NORTHEASTAugust September October November December YearConnecticut 3,162 1,434 1,676 2,084 3,578 32,902Delaware 470 278 450 600 504 6,213Maine 133 135 261 367 355 4,409Maryland 4,764 2,610 3,085 3,286 4,559 47,717Massachusetts 2,534 1,441 1,524 2,531 3,490 35,130New Hampshire 212 189 212 446 403 5,177New Jersey 8,540 3,004 3,667 6,050 5,885 71,432New York 24,085 11,349 12,593 15,004 23,328 228,080Pennsylvania 6,396 3,144 4,230 5,641 5,749 72,931Rhode Island 251 138 231 316 287 3,913Vermont 93 67 80 254 195 2,504Virginia 2,855 1,442 1,802 2,201 2,687 30,271Washington D.C. 605 346 396 459 727 6,264West Virginia 235 137 203 203 246 3,262Total 54,335 25,714 30,410 39,442 51,993 550,205MIDWESTIllinois 3,083 1,938 2,751 3,718 5,336 50,622Indiana 876 964 1,427 1,223 1,392 18,044Iowa 345 357 548 723 845 11,497Kansas 442 424 461 621 615 7,511Kentucky 555 488 721 441 635 8,341Michigan 1,636 1,132 1,433 1,980 2,765 29,875Minnesota 589 491 690 1,218 1,808 20,666Missouri 1,320 1,029 1,259 1,105 1,216 19,325Nebraska 365 310 387 480 462 6,102North Dakota 76 70 142 180 305 2,926Ohio 1,789 1,626 1,833 1,948 2,427 27,246South Dakota 78 77 88 132 225 2,770Wisconsin 1,016 562 1,095 1,337 1,944 26,197Total 12,170 9,468 12,835 15,106 19,975 231,122R&MI/JTB 2011

8TABLE 4STOPOVER ARRIVALS BY COUNTRY AND MONTH OF ARRIVALS (2011)January February March April May June JulySOUTHAlabama 324 293 829 545 1,106 1,256 1,185Arkansas 257 202 497 238 434 548 544Florida 11,315 11,244 17,473 15,571 14,145 20,037 22,974Georgia 2,610 2,801 4,532 4,994 5,208 7,899 8,104Louisiana 336 170 545 527 1,060 1,224 1,036Mississippi 212 141 448 214 480 593 476North Carolina 1,423 1,527 2,204 2,110 2,325 2,970 3,281Oklahoma 319 224 522 355 690 926 835South Carolina 609 634 877 1,076 1,167 1,515 1,494Tennessee 768 704 1,657 831 1,596 2,011 1,859Total 18,173 17,940 29,584 26,461 28,211 38,979 41,788WESTAlaska 71 73 69 43 39 55 54Arizona 381 308 633 523 751 884 884California 2,224 1,684 2,668 3,517 3,744 5,139 6,198Colorado 535 643 1,109 773 1,083 1,219 895Hawaii 21 24 35 16 33 31 26Idaho 112 77 133 59 63 127 87Montana 139 48 119 79 88 133 44Nevada 188 123 216 314 315 480 464New Mexico 93 73 118 122 226 214 209Oregon 186 164 274 239 239 286 262Texas 2,098 1,538 3,914 2,659 4,896 7,412 8,153Utah 215 225 216 205 230 281 162Washington 484 463 616 640 538 696 682Wyoming 57 83 117 113 109 83 61Total 6,804 5,526 10,237 9,302 12,354 17,040 18,181TOTAL U.S.A. 90,919 96,605 121,596 111,730 102,416 122,338 144,855R&MI/JTB 2011

TABLE 49STOPOVER ARRIVALS BY COUNTRY AND MONTH OF ARRIVALS (2011)August September October November December YearSOUTHAlabama 544 478 531 424 615 8,130Arkansas 307 220 279 185 301 4,012Florida 15,133 11,816 11,656 12,189 20,128 183,681Georgia 3,685 3,443 3,357 3,304 5,106 55,043Louisiana 468 406 557 609 532 7,470Mississippi 245 251 246 190 282 3,778North Carolina 1,970 1,456 1,666 1,559 2,082 24,573Oklahoma 497 418 383 354 415 5,938South Carolina 819 676 748 740 970 11,325Tennessee 880 853 1,201 809 985 14,154Total 24,548 20,017 20,624 20,363 31,416 318,104WESTAlaska 33 29 29 38 62 595Arizona 384 341 490 532 656 6,767California 4,438 2,298 2,287 3,421 4,190 41,808Colorado 586 472 633 697 971 9,616Hawaii 17 19 27 67 33 349Idaho 57 31 67 148 112 1,073Montana 34 29 52 46 112 923Nevada 312 186 278 242 335 3,453New Mexico 111 89 83 117 118 1,573Oregon 232 149 166 283 329 2,809Texas 4,083 2,495 2,767 3,027 3,899 46,941Utah 155 138 209 182 234 2,452Washington 582 377 449 581 739 6,847Wyoming 42 53 35 97 78 928Total 11,066 6,706 7,572 9,478 11,868 126,134TOTAL U.S.A. 102,119 61,905 71,441 84,389 115,252 1,225,565R&MI/JTB 2011

10TABLE 4STOPOVER ARRIVALS BY COUNTRY AND MONTH OF ARRIVALS (2011)January February March April May June JulyCANADAAlberta 4,834 4,808 4,840 3,453 1,091 686 924British Columbia 2,243 2,029 2,809 1,398 587 457 557Manitoba 2,407 2,179 2,081 735 154 130 181New Brunswick 655 849 2,171 1,992 200 86 47Newfoundland 167 278 439 849 494 251 120Nova Scotia 900 2,195 2,296 2,456 561 120 109Ontario 30,899 28,438 30,440 20,670 12,326 11,582 16,724P.E. Island 65 159 313 248 28 0 18Quebec 9,899 8,442 6,836 4,693 2,138 2,140 3,304Saskatchewan 3,335 3,338 1,560 1,101 124 81 106Other Canada 84 84 71 49 30 18 16Total 55,488 52,799 53,856 37,644 17,733 15,551 22,106EUROPENorthern EuropeU.K. 13,210 13,249 14,449 15,293 13,971 14,559 17,241Denmark 66 110 47 59 46 41 100Finland 51 36 46 30 39 25 28Ireland 335 210 178 210 222 234 236Norway 119 109 87 103 61 97 154Sweden 188 232 137 134 124 113 8213,969 13,946 14,944 15,829 14,463 15,069 17,841Southern EuropeGreece 38 15 19 16 15 21 16Italy 1,674 1,253 1,205 818 593 551 820Portugal 385 178 435 363 443 465 755Spain 169 135 174 159 141 1,385 1,3162,266 1,581 1,833 1,356 1,192 2,422 2,907Western EuropeAustria 319 317 225 198 127 104 222Belgium 356 363 507 607 364 453 509France 397 475 474 384 313 183 272Germany 1,794 1,706 2,099 1,884 1,311 1,422 1,226Luxemburg 22 11 28 22 15 5 13Netherlands 536 519 629 483 658 660 684Switzerland 276 310 266 291 253 128 3693,700 3,701 4,228 3,869 3,041 2,955 3,295Central/East EuropeCzechoslovakia 107 76 222 44 27 62 24Hungary 77 37 20 33 6 17 14Poland 201 166 209 91 57 77 127Russia 284 126 124 140 174 130 100Ukraine 80 26 25 43 33 19 42Other Europe 223 181 197 153 125 124 119972 612 797 504 422 429 426Total 20,907 19,840 21,802 21,558 19,118 20,875 24,469R&MI/JTB 2011

TABLE 411STOPOVER ARRIVALS BY COUNTRY AND MONTH OF ARRIVALS (2011)August September October November December YearCANADAAlberta 677 694 1,001 2,423 4,675 30,106British Columbia 458 587 510 1,456 2,205 15,296Manitoba 150 136 147 729 1,662 10,691New Brunswick 41 71 152 259 324 6,847Newfoundland 129 210 299 284 145 3,665Nova Scotia 82 95 275 290 354 9,733Ontario 14,165 8,504 10,779 17,150 31,696 233,373P.E. Island 8 16 25 31 36 947Quebec 2,739 1,794 2,650 4,263 6,374 55,272Saskatchewan 90 74 118 550 1,996 12,473Other Canada 11 26 12 43 91 535Total 18,550 12,207 15,968 27,478 49,558 378,938EUROPENorthern EuropeU.K. 15,420 12,708 14,086 13,736 15,585 173,507Denmark 20 30 33 35 61 648Finland 11 12 34 35 104 451Ireland 159 168 156 182 169 2,459Norway 54 37 53 64 116 1,054Sweden 43 49 106 143 256 1,60715,707 13,004 14,468 14,195 16,291 179,726Southern EuropeGreece 37 15 22 31 28 273Italy 1,634 359 608 894 1,291 11,700Portugal 1,326 269 27 20 20 4,686Spain 1,966 893 161 198 136 6,8334,963 1,536 818 1,143 1,475 23,492Western EuropeAustria 117 80 129 368 339 2,545Belgium 306 388 378 555 490 5,276France 358 158 250 262 1,222 4,748Germany 1,455 1,236 1,243 2,598 1,965 19,939Luxemburg 39 6 5 22 24 212Netherlands 580 690 516 615 630 7,200Switzerland 156 111 172 354 473 3,1593,011 2,669 2,693 4,774 5,143 43,079Central/East EuropeCzechoslovakia 10 34 42 80 44 772Hungary 4 13 14 17 34 286Poland 68 69 101 134 143 1,443Russia 124 149 155 233 237 1,976Ukraine 22 20 11 45 50 416Other Europe 78 92 124 244 195 1,855306 377 447 753 703 6,748Total 23,987 17,586 18,426 20,865 23,612 253,045R&MI/JTB 2011

12TABLE 4STOPOVER ARRIVALS BY COUNTRY AND MONTH OF ARRIVALS (2011)January February March April May June JulyLATIN AMERICACENTRAL AMERICAMexico 180 159 149 182 140 174 236Belize 48 25 52 31 34 36 147Costa Rica 81 99 50 56 80 60 77El Salvador 17 41 15 11 15 8 16Guatemala 57 67 35 42 55 32 62Honduras 25 41 14 16 38 12 9Nicaragua 16 6 4 35 11 4 3Panama 94 129 72 74 105 107 134Total 518 567 391 447 478 433 684SOUTH AMERICAArgentina 338 171 218 178 205 122 227Bolivia 17 4 8 1 4 6 8Brazil 156 79 161 122 148 88 193Chile 55 120 58 42 54 65 91Colombia 133 48 87 125 87 116 73Ecuador 24 13 14 16 18 16 321Paraguay 26 3 1 2 3 1 3Peru 33 16 31 65 46 15 103Uruguay 1 13 18 22 11 12 25Venezuela 71 37 109 44 76 54 69Other South America 0 2 0 6 3 1 4Total 854 506 705 623 655 496 1,117Total Latin America 1,372 1,073 1,096 1,070 1,133 929 1,801R&MI/JTB 2011

TABLE 413STOPOVER ARRIVALS BY COUNTRY AND MONTH OF ARRIVALS (2011)August September October November December YearLATIN AMERICACENTRAL AMERICAMexico 168 198 161 195 182 2,124Belize 46 52 39 51 51 612Costa Rica 47 73 83 67 73 846El Salvador 8 5 13 13 12 174Guatemala 23 29 30 31 38 501Honduras 6 12 13 8 9 203Nicaragua 1 7 7 6 2 102Panama 79 104 103 84 132 1,217Total 378 480 449 455 499 5,779SOUTH AMERICAArgentina 147 129 94 178 161 2,168Bolivia 3 1 1 2 1 56Brazil 121 123 115 125 166 1,597Chile 87 173 110 56 112 1,023Colombia 72 98 298 131 221 1,489Ecuador 1,957 26 167 285 122 2,979Paraguay 1 2 6 3 7 58Peru 27 27 36 46 40 485Uruguay 21 11 18 8 8 168Venezuela 60 91 55 43 50 759Other South America 4 0 1 5 2 28Total 2,500 681 901 882 890 10,810Total Latin America 2,878 1,161 1,350 1,337 1,389 16,589R&MI/JTB 2011

14TABLE 4STOPOVER ARRIVALS BY COUNTRY AND MONTH OF ARRIVALS (2011)January February March April May June JulyCARIBBEANAntigua 155 97 151 179 176 225 327Bahamas 378 326 368 805 418 539 781Barbados 347 300 353 448 443 516 676Bermuda 259 142 189 300 118 172 400British Virgin Is. 45 50 45 92 44 83 163Cayman Is. 1,292 1,176 1,253 1,914 1,423 1,633 2,051Dominica 28 18 31 34 38 31 68Grenada 48 40 42 54 62 44 54Guyana 178 124 158 157 203 201 422Montserrat 8 6 9 18 19 10 18St. Kitts/Nevis/Anguilla 69 44 65 110 60 57 109St. Lucia 90 55 80 76 99 91 109St. Vincent 39 36 94 35 49 43 80Turks & Caicos Is. 89 78 61 165 85 96 228Trinidad & Tobago 966 995 1,266 1,500 1,289 1,493 1,569Comm. Caribbean 3,991 3,487 4,165 5,887 4,526 5,234 7,055Aruba 35 31 26 28 24 34 75Cuba 75 72 37 42 67 30 75Curacao 73 42 45 108 62 58 165Dominican Republic 115 105 124 74 119 139 108Guadelope 10 5 7 34 10 3 220Haiti 38 24 25 40 25 39 30Puerto Rico 151 110 119 110 156 124 117St. Maarten 56 51 60 96 33 69 220Surinam 35 38 30 31 65 41 30All other Caribbean 46 27 48 78 32 30 96Other Caribbean 634 505 521 641 593 567 1,136TOTAL CARIBBEAN 4,625 3,992 4,686 6,528 5,119 5,801 8,191ASIAIndia 67 71 107 117 151 188 93Pakistan 0 1 0 1 2 11 2Japan 136 227 266 181 123 180 170China 104 118 171 136 145 133 141Taiwan 2 1 26 11 8 8 1Korea 47 31 28 30 46 28 45Philippines 18 31 25 22 64 12 31Singapore 11 4 16 6 10 15 7Other Asia 22 20 49 22 60 31 53Total Asia 407 504 688 526 609 606 543OTHER COUNTRIESAfrican Countries 85 69 81 97 171 138 116Israel 62 45 35 56 28 23 72Saudi Arabia 4 1 2 4 1 4 2Turkey 8 8 9 7 15 6 8Other Middle East 53 31 34 48 49 56 107Australia 187 127 148 150 155 195 193New Zealand 24 20 13 22 23 23 19All Other Ctries 3 0 0 4 13 0 11Total Other 426 301 322 388 455 445 528GRAND TOTAL 174,144 175,114 204,046 179,444 146,583 166,545 202,493R&MI/JTB 2011

TABLE 415STOPOVER ARRIVALS BY COUNTRY AND MONTH OF ARRIVALS (2011)August September October November December YearCARIBBEANAntigua 263 184 159 145 229 2,290Bahamas 601 347 337 351 748 5,999Barbados 531 310 424 458 616 5,422Bermuda 277 169 123 97 464 2,710British Virgin Is. 151 68 64 57 169 1,031Cayman Is. 1,634 1,233 1,306 1,173 1,947 18,035Dominica 58 25 13 49 25 418Grenada 40 34 26 42 41 527Guyana 257 157 155 200 164 2,376Montserrat 14 7 12 13 9 143St. Kitts/Nevis/Anguilla 120 53 67 66 93 913St. Lucia 84 116 99 70 86 1,055St. Vincent 105 52 48 54 41 676Turks & Caicos Is. 211 150 102 88 169 1,522Trinidad & Tobago 1,657 994 1,060 1,230 1,494 15,513Comm. Caribbean 6,003 3,899 3,995 4,093 6,295 58,630Aruba 36 40 26 23 31 409Cuba 64 39 27 69 49 646Curacao 49 53 102 67 69 893Dominican Republic 101 97 109 126 76 1,293Guadelope 10 5 9 4 5 322Haiti 40 26 27 61 17 392Puerto Rico 138 143 116 117 85 1,486St. Maarten 114 89 76 75 140 1,079Surinam 46 62 47 23 32 480All other Caribbean 64 31 43 36 55 586Other Caribbean 662 585 582 601 559 7,586TOTAL CARIBBEAN 6,665 4,484 4,577 4,694 6,854 66,216ASIAIndia 85 130 66 139 116 1,330Pakistan 0 2 3 10 0 32Japan 105 116 131 178 214 2,027China 163 179 111 144 158 1,703Taiwan 4 1 4 2 6 74Korea 70 49 30 34 39 477Philippines 24 29 18 25 24 323Singapore 11 4 1 5 11 101Other Asia 65 42 27 28 36 455Total Asia 527 552 391 565 604 6,522OTHER COUNTRIESAfrican Countries 83 82 78 74 126 1,200Israel 58 49 86 49 34 597Saudi Arabia 2 0 0 12 4 36Turkey 8 13 7 13 5 107Other Middle East 89 29 22 38 57 613Australia 147 198 166 178 196 2,040New Zealand 17 10 21 21 16 229All Other Ctries 3 4 3 8 6 55Total Other 407 385 383 393 444 4,877GRAND TOTAL 155,133 98,280 112,536 139,721 197,713 1,951,752R&MI/JTB 2011

16DISTRIBUTION OF STOPOVERSFROM THE U.S.A. MARKET REGION1,4001,2001,1511,1731,2431,126Stopovers in Thousands1,000800600400WESTMID-WESTSOUTHNORTHEAST200-2008 2009 2010 2011Fig. 4aStopovers in Thousands%ChangeU.S.A. Regions 2008 %Share 2009 %Share 2010 %Share 2011 %Share 2011/10Northeast 495.2 43.0 524.5 44.7 574.5 46.2 550.2 44.9 -4.2South 321.2 27.9 314.2 26.8 322.6 26.0 318.1 26.0 -1.4Mid-West 210.6 18.3 213.6 18.2 222.0 17.9 231.1 18.9 4.1West 123.9 10.8 120.6 10.3 123.8 10.0 126.1 10.3 1.9Total 1,150.9 100.0 1,172.8 100.0 1,242.9 100.0 1,225.6 100.0 -1.4R&MI/JTB 2011

17SEASONALITY OF STOPOVER ARRIVALSFROM THE U.S.A.NORTHEAST REGION U.S.A.MIDWEST REGION U.S.A.Percentage14.012.010.08.06.04.07.09.48.19.88.112.18.610.14.6 5.76.99.6Percentage16.014.012.010.08.06.04.010.211.99.313.68.29.17.95.35.66.38.62.02.04.00.0JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC0.0JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC3Yr. Avg. 2009 - 20113Yr. Avg. 2009 - 2011Fig. 4bFig. 4cSOUTH REGION U.S.A.WEST REGION U.S.A.Percentage14.012.010.08.06.04.05.6 5.98.78.812.19.18.013.26.16.66.19.8Percentage16.014.012.010.08.06.04.05.68.55.07.910.013.114.39.15.2 5.89.16.52.02.00.0JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC0.0JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC3Yr. Avg. 2009 - 20113Yr. Avg. 2009 - 2011Fig. 4dFig. 4eTOTAL U.S.A.Percentage14.012.010.08.06.04.02.07.17.99.9 9.28.610.111.98.64.95.96.69.40.0JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC3Yr. Avg. 2009 - 2011Fig. 4fR&MI/JTB 2011

18TABLE 5STOPOVER ARRIVALS BY COUNTRY OF RESIDENCE AND YEARU.S.A.NORTHEAST2007 2008 2009 2010 2011Connecticut 29,703 30,644 30,088 34,027 32,902Delaware 5,815 5,483 5,525 6,234 6,213Maine 3,103 3,138 3,707 4,483 4,409Maryland 46,659 45,179 44,019 47,932 47,717Massachusetts 28,684 29,853 34,823 36,910 35,130New Hampshire 4,592 4,620 5,251 5,843 5,177New Jersey 69,565 66,906 69,958 75,096 71,432New York 202,447 204,934 219,948 242,787 228,080Pennsylvania 59,385 63,284 68,475 74,656 72,931Rhode Island 3,530 3,269 3,899 3,999 3,913Vermont 1,925 1,867 1,880 2,409 2,504Virginia 26,419 27,377 27,422 30,392 30,271Washington D.C. 6,371 5,994 6,332 6,389 6,264West Virginia 2,368 2,695 3,149 3,391 3,262Total 490,566 495,243 524,476 574,548 550,205MIDWESTIllinois 49,875 51,455 49,571 50,873 50,622Indiana 15,135 15,005 14,652 16,615 18,044Iowa 8,561 9,658 10,749 10,696 11,497Kansas 5,687 5,834 6,525 6,882 7,511Kentucky 7,137 7,097 7,392 7,545 8,341Michigan 24,798 26,539 28,831 31,037 29,875Minnesota 18,556 19,052 18,393 20,168 20,666Missouri 19,141 16,735 19,104 18,088 19,325Nebraska 5,837 6,056 6,419 5,679 6,102North Dakota 2,269 2,346 2,389 2,385 2,926Ohio 21,259 23,251 24,175 24,834 27,246South Dakota 2,157 2,366 2,545 2,544 2,770Wisconsin 23,541 25,192 22,868 24,605 26,197Total 203,953 210,586 213,613 221,951 231,122R&MI/JTB 2011

19TABLE 5SOUTH (MIAMI)STOPOVER ARRIVALS BY COUNTRY OF RESIDENCE AND YEAR2007 2008 2009 2010 2011Alabama 7,705 8,153 8,043 8,035 8,130Arkansas 3,876 4,275 4,373 4,159 4,012Florida 188,125 186,704 182,281 185,742 183,681Georgia 53,466 55,605 51,733 56,093 55,043Louisiana 7,449 6,758 6,923 7,151 7,470Mississippi 3,417 3,573 3,765 3,962 3,778North Carolina 22,089 23,954 25,479 26,149 24,573Oklahoma 5,290 5,455 5,845 5,294 5,938South Carolina 9,936 11,699 11,470 11,469 11,325Tennessee 13,343 14,995 14,287 14,548 14,154Total 314,696 321,171 314,199 322,602 318,104WESTAlaska 399 533 470 529 595Arizona 6,650 6,995 6,419 7,811 6,767California 49,274 46,988 41,607 41,186 41,808Colorado 8,594 8,920 8,989 9,572 9,616Hawaii 330 351 316 327 349Idaho 1,122 1,274 1,089 1,096 1,073Montana 893 856 996 1,070 923Nevada 3,289 3,621 3,977 3,860 3,453New Mexico 1,506 1,485 1,541 1,550 1,573Oregon 2,867 3,001 2,692 2,884 2,809Texas 39,533 40,097 42,633 43,810 46,941Utah 2,091 2,540 2,747 2,597 2,452Washington 6,037 6,457 6,192 6,760 6,847Wyoming 732 824 888 790 928Total 123,317 123,942 120,556 123,842 126,134TOTAL U.S.A. 1,132,532 1,150,942 1,172,844 1,242,943 1,225,565R&MI/JTB 2011

20TABLE 5STOPOVER ARRIVALS BY COUNTRY OF RESIDENCE AND YEAR2007 2008 2009 2010 2011CANADAAlberta 14,762 19,139 25,623 26,614 30,106British Columbia 7,914 10,500 14,775 13,121 15,296Manitoba 4,122 5,281 6,593 7,601 10,691New Brunswick 2,076 2,997 3,603 4,676 6,847Newfoundland 820 1,555 2,246 3,000 3,665Nova Scotia 3,446 4,442 5,345 7,739 9,733Ontario 127,847 150,994 179,334 204,025 233,373P.E. Island 319 343 495 646 947Quebec 25,033 34,011 44,730 48,273 55,272Saskatchewan 4,008 6,566 7,101 9,055 12,473Northwest Terr. 303 365 462 441 535Total 190,650 236,193 290,307 325,191 378,938EUROPENorthern EuropeU.K. 185,657 188,436 184,512 184,355 173,507Denmark 1,076 851 794 772 648Finland 279 404 526 427 451Ireland 3,940 3,431 2,838 2,737 2,459Norway 831 1,061 958 915 1,054Sweden 1,359 1,803 1,597 1,619 1,607Southern EuropeGreece 187 390 291 249 273Italy 17,394 14,563 14,588 13,700 11,700Portugal 11,907 9,649 9,056 10,076 4,686Spain 17,882 15,510 12,768 10,082 6,833Western EuropeAustria 2,551 2,252 2,623 2,641 2,545Belgium 6,338 6,187 6,610 5,228 5,276France 3,587 3,916 3,779 3,762 4,748Germany 19,895 18,962 20,220 18,857 19,939Luxemburg 242 210 248 207 212Netherlands 7,804 7,541 7,023 6,677 7,200Switzerland 2,155 2,100 2,345 2,861 3,159Central/East EuropeCzechoslovakia 653 680 578 473 772Hungary 316 722 276 389 286Poland 903 1,326 1,294 1,299 1,443Russia 1,302 1,881 1,744 1,945 1,976Ukraine 287 432 444 427 416Other Europe 2,349 2,393 1,687 1,617 1,855Total 288,894 284,700 276,799 271,315 253,045R&MI/JTB 2011

21TABLE 5STOPOVER ARRIVALS BY COUNTRY OF RESIDENCE AND YEAR2007 2008 2009 2010 2011LATIN AMERICACENTRAL AMERICAMexico 2,301 3,602 2,187 1,984 2,124Belize 524 582 592 481 612Costa Rica 710 812 799 758 846El Salvador 213 299 177 142 174Guatemala 306 284 348 527 501Honduras 147 361 156 131 203Nicaragua 69 90 85 76 102Panama 1,160 1,181 1,284 1,136 1,217Total 5,430 7,211 5,628 5,235 5,779SOUTH AMERICAArgentina 1,164 1,762 1,695 1,779 2,168Bolivia 34 52 34 51 56Brazil 1,454 1,865 1,550 1,683 1,597Chile 529 812 893 741 1,023Colombia 1,878 1,045 1,001 1,110 1,489Ecuador 343 1,865 1,844 1,481 2,979Paraguay 29 17 30 22 58Peru 341 482 465 393 485Uruguay 82 148 190 139 168Venezuela 873 852 1,145 786 759Other South America 12 11 17 22 286,739 8,911 8,864 8,207 10,810Total Latin America 12,169 16,122 14,492 13,442 16,589R&MI/JTB 2011

22TABLE 5STOPOVER ARRIVALS BY COUNTRY OF RESIDENCE AND YEAR2007 2008 2009 2010 2011CARIBBEANAntigua 2,236 2,799 2,554 2,235 2,290Bahamas 5,586 4,378 5,031 4,884 5,999Barbados 5,383 6,107 5,027 4,469 5,422Bermuda 3,208 3,393 3,369 3,112 2,710British Virgin Is. 939 966 1,025 1,054 1,031Cayman Is. 19,685 20,287 23,384 18,409 18,035Dominica 398 584 543 387 418Grenada 796 1,010 640 450 527Guyana 2,160 2,295 2,079 1,827 2,376Montserrat 111 146 154 149 143St. Kitts/Nevis/Anguilla 864 1,068 1,103 950 913St. Lucia 1,492 1,712 1,308 990 1,055St. Vincent 632 841 595 445 676Turks & Caicos Is. 1,765 1,815 1,445 1,545 1,522Trinidad & Tobago 9,684 10,621 9,622 10,330 15,513Comm. Caribbean 54,939 58,022 57,879 51,236 58,630Other Caribbean 8,028 9,209 7,454 7,063 7,586TOTAL CARIBBEAN 62,967 67,231 65,333 58,299 66,216OTHER COUNTRIESIndia 1,525 904 1,232 1,127 1,330Pakistan 79 19 16 25 32Japan 3,049 2,846 2,511 1,950 2,027China 1,077 935 1,142 1,302 1,703Taiwan 54 118 69 76 74Korea 238 211 291 375 477Philippines 366 441 322 479 323Singapore 137 118 128 108 101Other Asia 520 411 457 349 455African Countries 1,449 1,213 1,237 1,169 1,200Israel 1,135 1,135 879 683 597Saudi Arabia 19 28 19 16 36Turkey 240 307 253 141 107Other Middle East 458 549 513 526 613Australia 2,729 2,439 1,903 1,869 2,040New Zealand 450 344 315 252 229All Other Ctries 48 65 35 41 55Total 13,573 12,083 11,322 10,488 11,399GRAND TOTAL 1,700,785 1,767,271 1,831,097 1,921,678 1,951,752R&MI/JTB 2011

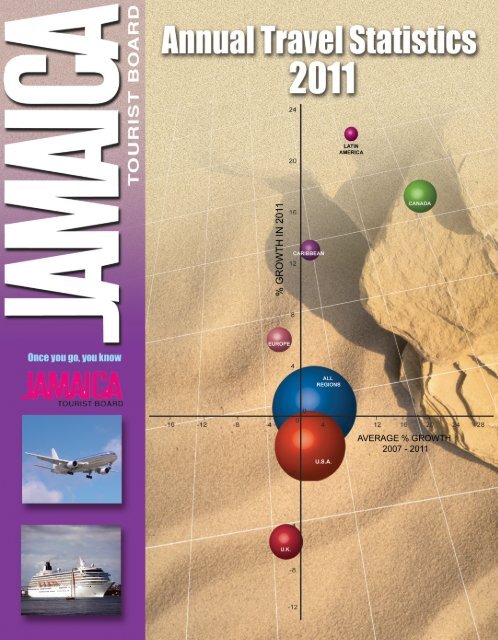

23Average Growth Rate : 2007 - 2011Total Stopovers3.4% per annumU.S.A.2.0% p.a.> North East 2.9% p.a.> Mid-West 3.2% p.a.> South 0.3% p.a.> West 0.6% p.a.Europe-3.3% p.a.> UK -1.7% p.a.CanadaCaribbeanLatin AmericaJapan18.7% p.a.1.3% p.a.8.1% p.a.-9.7% p.a.Total3.4Canada18.7Latin America8.1U.S.A.Caribbean1.32.0Germany0.1-1.7U. K.-2.0Netherlands-2.9Other-3.3Total Europe-6.3-9.4-9.7Continental EuropeItalyJapan-15.0 -10.0 -5.0 0.0 5.0 10.0 15.0 20.0 25.0Average Growth (%)Fig. 4g* Average growth rate: average of the years growth during the period under reviewR&MI/JTB 2011

24TABLE 6aTOTAL STOPOVER ARRIVALS BY MAIN PRODUCING STATESU.S.A.Ranking % of Ranking % of2011 2011 US Total 2010 2010 US TotalSTATESNew York 228,080 1 18.6 242,787 1 19.5Florida 183,681 2 15.0 185,742 2 14.9Pennsylvania 72,931 3 6.0 74,656 4 6.0New Jersey 71,432 4 5.8 75,096 3 6.0Georgia 55,043 5 4.5 56,093 5 4.5Illinois 50,622 6 4.1 50,873 6 4.1Maryland 47,717 7 3.9 47,932 7 3.9Texas 46,941 8 3.8 43,810 8 3.5California 41,808 9 3.4 41,186 9 3.3Massachusetts 35,130 10 2.9 36,910 10 3.0Connecticut 32,902 11 2.7 34,027 11 2.7Virginia 30,271 12 2.5 30,392 13 2.4Michigan 29,875 13 2.4 31,037 12 2.5Ohio 27,246 14 2.2 24,834 15 2.0Wisconsin 26,197 15 2.1 24,605 16 2.0North Carolina 24,573 16 2.0 26,149 14 2.1Minnesota 20,666 17 1.7 20,168 17 1.6Missouri 19,325 18 1.6 18,088 18 1.5Indiana 18,044 19 1.5 16,615 19 1.3Tennessee 14,154 20 1.2 14,548 20 1.2Iowa 11,497 21 0.9 10,696 22 0.9South Carolina 11,325 22 0.9 11,469 21 0.9Colorado 9,616 23 0.8 9,572 23 0.8Kentucky 8,341 24 0.7 7,545 26 0.6Alabama 8,130 25 0.7 8,035 24 0.6Kansas 7,511 26 0.6 6,882 28 0.6Louisiana 7,470 27 0.6 7,151 27 0.6Washington 6,847 28 0.6 6,760 29 0.5Arizona 6,767 29 0.6 7,811 25 0.6Washington D.C. 6,264 30 0.5 6,389 30 0.5Delaware 6,213 31 0.5 6,234 31 0.5Nebraska 6,102 32 0.5 5,679 33 0.5Oklahoma 5,938 33 0.5 5,294 34 0.4New Hampshire 5,177 34 0.4 5,843 32 0.5Maine 4,409 35 0.4 4,483 35 0.4Arkansas 4,012 36 0.3 4,159 36 0.3Rhode Island 3,913 37 0.3 3,999 37 0.3Mississippi 3,778 38 0.3 3,962 38 0.3Nevada 3,453 39 0.3 3,860 39 0.3West Virginia 3,262 40 0.3 3,391 40 0.3North Dakota 2,926 41 0.2 2,385 45 0.2Oregon 2,809 42 0.2 2,884 41 0.2South Dakota 2,770 43 0.2 2,544 43 0.2Vermont 2,504 44 0.2 2,409 44 0.2Other States 7,893 - 0.6 7,747 - 0.6TOTAL U.S.A. 1,225,565 100.0 1,242,943 100.0Note: States producing less than 2,500 in 2011 are included in the "Other" category.R&MI/JTB 2011

Stopover Arrivals by Top Ten States 20110 mi 200 400 600 800 1000 1200Copyright © 1988-2003 Microsoft Corp. and/or its suppliers. All rights reserved. http://www.microsoft.com/mappoint© Copyright 2002 by Geographic Data Technology, Inc. All rights reserved. © 2002 Navigation Technologies. All rights reserved. This data includes information taken with permission from Canadian authorities © 1991-2002 Government of Canada(<strong>Statistics</strong> Canada and/or Geomatics Canada), all rights reserved.

26TABLE 6bTOTAL STOPOVER ARRIVALS BY MAIN PRODUCING PROVINCESCANADAPROVINCESRanking % of Ranking % of2011 2011 CA Total 2010 2010 CA TotalOntario 233,373 1 61.6 204,025 1 62.7Quebec 55,272 2 14.6 48,273 2 14.8Alberta 30,106 3 7.9 26,614 3 8.2British Columbia 15,296 4 4.0 13,121 4 4.0Saskatchewan 12,473 5 3.3 9,055 5 2.8Manitoba 10,691 6 2.8 7,601 7 2.3Nova Scotia 9,733 7 2.6 7,739 6 2.4New Brunswick 6,847 8 1.8 4,676 8 1.4Newfoundland 3,665 9 1.0 3,000 9 0.9P.E. Island 947 10 0.2 646 10 0.2Northwest Terr. 535 11 0.1 441 11 0.1Total 378,938 100.0 325,191 100.0SEASONALITY OF CANADIANSTOPOVER ARRIVALS161414.313.713.513.612Percentage10869.26.27.4425.44.25.23.24.20JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC3Yr. Avg. 2009 - 2011Fig. 6R&MI/JTB 2011

27DISTRIBUTION OF STOPOVERSFROM THE CANADIAN MARKET REGION400350325.2378.9NORTHWEST TERR.NOVA SCOTIAMANITOBASASKATCHEWAN300290.3BRITISH COLUMBIAALBERTAStopovers in Thousands250200150236.2QUEBECONTARIO1005002008 2009 2010 2011Fig. 6a.Stopovers in Thousands%ChangeProvinces 2008 %Share 2009 %Share 2010 %Share 2011 %Share 2011/10Ontario 151.0 63.9 179.3 61.8 204.0 62.7 233.4 61.6 14.4Quebec 34.0 14.4 44.7 15.4 48.3 14.8 55.3 14.6 14.5Alberta 19.1 8.1 25.6 8.8 26.6 8.2 30.1 7.9 13.1British Columbia 10.5 4.4 14.8 5.1 13.1 4.0 15.3 4.0 16.6Saskatchewan 6.6 2.8 7.1 2.4 9.1 2.8 12.5 3.3 37.7Manitoba 5.3 2.2 6.6 2.3 7.6 2.3 10.7 2.8 40.7Nova Scotia 4.4 1.9 5.3 1.8 7.7 2.4 9.7 2.6 25.8Other Canada 5.3 2.2 6.8 2.3 8.8 2.7 12.0 3.2 36.9Total 236.2 100.0 290.3 100.0 325.2 100.0 378.9 100.0 16.5R&MI/JTB 2011

28TABLE 6cTOTAL STOPOVER ARRIVALS BY MAIN PRODUCING EUROPEAN COUNTRIESEUROPEEUROPERanking % of Ranking % of2011 2011 EUR Total 2010 2010 EUR TotalU.K. 173,507 1 68.6 184,355 1 67.9Germany 19,939 2 7.9 18,857 2 7.0Italy 11,700 3 4.6 13,700 3 5.0Netherlands 7,200 4 2.8 6,677 6 2.5Spain 6,833 5 2.7 10,082 4 3.7Belgium 5,276 6 2.1 5,228 7 1.9France 4,748 7 1.9 3,762 8 1.4Portugal 4,686 8 1.9 10,076 5 3.7Switzerland 3,159 9 1.0 2,861 9 1.1Austria 2,545 10 1.0 2,641 11 1.0Ireland 2,459 11 1.2 2,737 10 1.0Russia 1,976 12 0.8 1,945 12 0.7Sweden 1,607 13 0.6 1,619 13 0.6Poland 1,443 14 0.6 1,299 14 0.5Other Europe 5,967 2.4 5,476 2.0Total 253,045 100.0 271,315 100.0Note: Countries producing less than 1,050 in 2011 are included in the "Other" category.SEASONALITY OF EUROPEANSTOPOVER ARRIVALS12Percentage10868.17.78.67.48.08.59.8 9.67.4 7.48.39.3420JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC3Yr. Avg. 2009 - 2011Fig. 7R&MI/JTB 2011

29DISTRIBUTION OF STOPOVERSFROM THE EUROPEAN MARKET REGION300250284.7276.8 271.3253.1OTHER EUROPEFRANCEBELGIUMStopovers in Thousands200150100SPAINNETHERLANDSITALYGERMANYUNITED KINGDOM5002008 2009 2010 2011Fig. 7a.Stopovers in Thousands%ChangeCountries 2008 %Share 2009 %Share 2010 %Share 2011 %Share 2011/10United Kingdom 188.4 66.2 184.5 66.7 184.4 67.9 173.5 68.6 -5.9Germany 19.0 6.7 20.2 7.3 18.9 7.0 19.9 7.9 5.7Italy 14.6 5.1 14.6 5.3 13.7 5.0 11.7 4.6 -14.6Netherlands 7.5 2.6 7.0 2.5 6.7 2.5 7.2 2.8 7.8Spain 15.5 5.4 12.8 4.6 10.1 3.7 6.8 2.7 -32.2Belgium 6.2 2.2 6.6 2.4 5.2 1.9 5.3 2.1 0.9France 3.9 1.4 3.8 1.4 3.8 1.4 4.7 1.9 26.2Other Europe 29.6 10.4 27.3 9.9 28.7 10.6 23.8 9.4 -16.8Total 284.7 100.0 276.8 100.0 271.3 100.0 253.0 100.0 -6.7R&MI/JTB 2011

30TABLE 6dTOTAL STOPOVER ARRIVALS BY MAIN CARIBBEAN COUNTRIESCARIBBEANRanking % of Ranking % of2011 2011 Carib. Total 2010 2010 Carib. TotalCayman Is. 18,035 1 27.2 18,409 1 31.6Trinidad & Tobago 15,513 2 23.4 10,330 2 17.7Bahamas 5,999 3 9.1 4,884 3 8.4Barbados 5,422 4 8.2 4,469 4 7.7Bermuda 2,710 5 4.1 3,112 5 5.3Guyana 2,376 6 3.6 1,827 7 3.1Antigua 2,290 7 3.5 2,235 6 3.8Turks & Caicos Is. 1,522 8 2.3 1,545 8 2.7Puerto Rico 1,486 9 2.2 1,447 9 2.5Dominican Republic 1,293 10 1.6 1,038 11 1.8St. Maarten 1,079 11 1.3 941 14 1.6St. Lucia 1,055 12 2.0 990 12 1.7British Virgin Is. 1,031 13 1.6 1,054 10 1.8St. Kitts/Nevis/Anguilla 913 14 1.6 950 13 1.6Curacao 893 15 1.4 778 15 1.3St. Vincent 676 16 1.0 445 19 0.8Other Caribbean 3,923 5.9 3,845 6.6Total Caribbean 66,216 100.0 58,299 100.0Note: Countries producing less than 650 in 2011 are included in the "Other" category.SEASONALITY OF CARIBBEANSTOPOVER ARRIVALS141212.29.710.8109.18.5Percentage867.26.67.27.47.0 7.27.2420JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC3Yr. Avg. 2009 - 2011Fig. 8R&MI/JTB 2011

31DISTRIBUTION OF STOPOVERSFROM OTHER MARKETING REGIONSStopovers in Thousands1009080706050403095.4 94.291.182.3ALL OTHERSINDIACHINAJAPANAUSTRALIACENTRAL AMERICASOUTH AMERICACARIBBEAN201002008 2009 2010 2011Fig. 8aStopovers in Thousands%Change2008 %Share 2009 %Share 2010 %Share 2011 %Share 2011/10Caribbean 67.2 70.4 65.3 71.7 58.3 70.8 66.2 70.3 13.6South America 8.9 9.3 8.9 9.7 8.2 10.0 10.8 11.5 31.7Cenrtal America 7.2 7.6 5.6 6.2 5.2 6.4 5.8 6.1 10.4Australia 2.4 2.6 1.9 2.1 1.9 2.3 2.0 2.2 9.1Japan 2.8 3.0 2.5 2.8 2.0 2.4 2.0 2.2 3.9China 0.9 1.0 1.1 1.3 1.3 1.6 1.7 1.8 30.8India 0.9 0.9 1.2 1.4 1.1 1.4 1.3 1.4 18.0All Others 5.0 5.2 4.5 5.0 4.3 5.2 4.3 4.6 -0.3Total 95.4 100.0 91.1 100.0 82.3 100.0 94.2 100.0 14.5R&MI/JTB 2011

32TABLE 7AGE DISTRIBUTION OF STOPOVER ARRIVALS2010 2011No. %Share No. %Share U.S.A %Share Canada %Share UK %ShareUnder 18 226,211 11.6 223,585 11.5 139,354 11.4 51,974 13.7 22,711 13.1Between 18 and 24 148,845 7.6 147,073 7.5 100,184 8.2 26,078 6.9 14,400 8.3Between 25 and 34 413,154 21.2 414,614 21.2 261,336 21.3 70,981 18.7 31,134 17.9Between 35 and 49 586,846 30.1 587,503 30.1 361,104 29.5 122,977 32.5 56,102 32.3Between 50 and 64 425,007 21.8 448,082 23.0 285,901 23.3 83,311 22.0 34,227 19.7Over 64 121,615 6.2 130,895 6.7 77,686 6.3 23,617 6.2 14,933 8.6Total 1,921,678 100.0 1,951,752 100.0 1,225,565 100.0 378,938 100.0 173,507 100.0201135AGE DISTRIBUTIONOF STOPOVER ARRIVALS 20113232303029PERCENTAGE25201511111413212119182323222010887876695064 YrsFig. 9AGE RANGETOTAL U.S.A Canada UKR&MI/JTB 2011

3333TABLE 8GENDER DISTRIBUTION OF STOPOVER ARRIVALS2010 2011No. %Share No. %Share USA %Share Canada %Share UK %Share2011MALE 885,516 45.4 897,498 46.0 554,961 45.3 173,856 45.9 78,415 45.2FEMALE 1,036,162 53.1 1,054,254 54.0 670,604 54.7 205,082 54.1 95,092 54.8Total 1,921,678 100.0 1,951,752 100.0 1,225,565 100.0 378,938 100.0 173,507 100.0STOPOVER ARRIVALS BY GENDER & MAIN MARKETS 2011TOTAL STOPOVER ARRIVALSUSA ARRIVALS54.0%46.0%54.7%45.3%FEMALEMALEFEMALEMALEFig. 10Fig. 10aCANADIAN ARRIVALSUK ARRIVALS54.1%45.9%54.8%45.2%FEMALEMALEFEMALEMALEFig. 10bFig. 10cR&MI/JTB 2011

34TABLE 8.1STOPOVER ARRIVALS BY PURPOSE OF VISIT2008 2009 2010 2011No. %Share No. %Share No. %Share No. %ShareLeisure, Recreation and Holiday 1,328,887 75.2 1,403,812 76.7 1,482,979 77.2 1,519,363 77.8Visiting Friends & Relatives 183,182 10.4 186,265 10.2 193,117 10.0 183,501 9.4Business 109,334 6.2 101,310 5.5 102,743 5.3 105,839 5.4Other/not stated 145,868 8.3 139,710 7.6 142,839 7.4 143,049 7.3Total 1,767,271 100.0 1,831,097 100.0 1,921,678 100.0 1,951,752 100.0Leisure,Recreation &Holiday81.2%Foreign NationalsVisiting Friends& Relatives7.8%Leisure,Recreation &Holiday40.8%Non Resident <strong>Jamaica</strong>nsVisitingFriends &Relatives28.7%n = 1,800,280Other/Not stated5.6%Business5.4%n = 151,472Other/Notstated24.7%Business5.7%Fig. 10dTABLE 8.1aMAIN PURPOSE OF VISIT BY MAIN MARKETS 2011PURPOSE OF VISIT 2011 USA %Share Canada %Share UK %ShareLeisure, Recreation and Holiday 969,344 79.1 326,184 86.1 115,745 66.7Visiting Friends & Relatives 113,241 9.2 26,102 6.9 32,252 18.6Business 53,098 4.3 10,590 2.8 11,957 6.9Other/not stated 89,882 7.3 16,062 4.2 13,553 7.8Total 1,225,565 100.0 378,938 100.0 173,507 100.0R&MI/JTB 2011

35TABLE 8.2STOPOVER ARRIVALS BY INTENDED RESORT AREA OF STAYStopover Arrivals%ChangeArea 2009 %Share 2010 %Share 2011 %Share 2011/10Montego Bay 518,968 28.3% 581,220 30.2% 612,723 31.4% 5.4%Ocho Rios 422,630 23.1% 419,750 21.8% 427,776 21.9% 1.9%Negril 396,848 21.7% 413,356 21.5% 398,636 20.4% -3.6%Kingston 224,230 12.2% 221,779 11.5% 226,164 11.6% 2.0%Mdvle/S. Coast 106,592 5.8% 119,009 6.2% 120,847 6.2% 1.5%Port Antonio 17,594 1.0% 19,094 1.0% 18,979 1.0% -0.6%Other 144,235 7.9% 147,470 7.7% 146,627 7.5% -0.6%Total 1,831,097 100.0% 1,921,678 100.0% 1,951,752 100.0% 1.6%Montego BayOcho RiosNegrilKingstonStopover ArrivalsBy Intended Resort Area of Stay201111.6%21.9%20.4%31.4%Mdvle/S. CoastPort AntonioOther1.0%6.2%7.5%0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0%PercentageFig. 10eTABLE 8.2aSTOPOVER ARRIVALS BY MAIN MARKETS AND INTENDED RESORT AREA OFSTAY2011Area USA %Share Canada %Share UK %ShareMontego Bay 420,120 34.3% 111,624 29.5% 45,792 26.4%Ocho Rios 233,858 19.1% 122,876 32.4% 42,339 24.4%Negril 252,538 20.6% 82,538 21.8% 24,943 14.4%Kingston 134,203 11.0% 20,251 5.3% 20,232 11.7%Mdvle/S. Coast 80,311 6.6% 19,049 5.0% 14,855 8.6%Port Antonio 11,785 1.0% 1,962 0.5% 3,366 1.9%Other 92,750 7.6% 20,638 5.4% 21,980 12.7%Total 1,225,565 100.0% 378,938 100.0% 173,507 100.0%R&MI/JTB 2011

36TABLE 9AVERAGE LENGTH OF STAY (NIGHTS) BY MONTH AND YEARF O R E I G N N A T I O N A L A R R I V A L S2006 2007 2008 2009 2010 2011January 9.5 10.2 9.5 9.5 9.4 8.8February 9.0 9.2 8.5 8.4 8.3 8.2March 8.5 8.8 8.2 8.3 8.2 7.8April 8.6 8.4 8.1 8.3 7.8 8.0May 8.6 8.6 8.4 8.3 8.1 8.1June 10.2 10.0 9.7 9.6 9.5 9.3July 10.8 10.3 10.1 10.1 9.8 9.8August 10.3 9.7 9.3 9.2 9.2 9.2September 10.5 9.9 9.9 9.5 9.3 9.1October 9.9 9.2 8.8 8.9 8.7 8.7November 9.9 9.4 9.4 9.6 9.2 8.9December 11.5 11.1 11.1 10.9 10.4 10.4Jan. - Dec. 9.8 9.6 9.3 9.2 9.0 8.9* The Length of Stay is based on intended Length of StayR&MI/JTB 2011

37TABLE 9aAVERAGE LENGTH OF STAY (NIGHTS) BY COUNTRY AND YEARF O R E I G N N A T I O N A L A R R I V A L S2006 2007 2008 2009 2010 2011U.S.A. 8.3 8.0 7.8 7.9 7.7 7.7CANADA 11.8 10.8 10.2 9.6 9.3 9.0U.K. 17.2 16.5 16.0 16.0 15.7 15.4EUROPE 11.7 10.7 10.4 10.8 10.9 11.5LATIN AMERICA 8.6 8.9 8.0 8.3 8.9 8.2CARIBBEAN 9.3 9.5 8.7 8.9 9.3 8.1OTHER COUNTRIES 17.6 15.0 11.0 11.3 13.6 14.1TOTAL 9.8 9.6 9.3 9.2 9.0 8.9* The Length of Stay is based on intended Length of StayR&MI/JTB 2011

38TABLE 9.1AVERAGE LENGTH OF STAY (NIGHTS) BY MONTH AND YEARN O N-R E S I D E N T J A M A I C A N S2006 2007 2008 2009 2010 2011January 18.1 17.1 17.7 16.1 17.4 15.9February 16.6 15.0 16.1 14.2 14.4 13.9March 15.5 16.9 16.1 14.7 14.2 13.5April 14.5 14.2 15.6 14.3 13.5 13.7May 14.0 14.9 15.1 15.2 15.4 16.0June 16.5 19.6 19.6 18.1 18.3 17.9July 19.9 18.3 17.3 17.5 17.4 16.7August 16.7 15.1 15.3 14.4 15.0 15.0September 16.9 16.1 16.1 15.8 15.9 15.8October 16.9 17.0 14.9 15.7 15.1 16.8November 19.6 19.2 19.6 20.1 19.4 19.9December 19.5 19.6 18.7 19.1 18.5 19.4Jan. - Dec. 17.3 17.5 17.0 16.5 16.4 16.4* The Length of Stay is based on intended Length of StayR&MI/JTB 2011

39TABLE 9bAVERAGE LENGTH OF STAY (NIGHTS) BY TYPE OF ACCOMMODATION2011FOREIGN NATIONALS NON-RESIDENT JAMAICANSHOTELS NON-HOTEL HOTELS NON-HOTELJanuary 7.2 14.6 8.1 16.4February 7.1 12.2 7.7 14.2March 6.7 11.5 7.4 13.9April 6.7 11.9 7.8 14.1May 6.5 13.3 7.8 16.6June 6.7 15.8 8.7 18.5July 7.0 14.9 9.1 17.3August 7.0 14.1 8.8 15.5September 6.9 14.7 7.6 16.3October 6.9 14.0 8.7 17.3November 7.0 15.4 7.6 20.8December 7.3 16.1 9.9 19.7Jan. - Dec. 6.9 14.1 8.4 16.9FOREIGNNATIONALARRIVALSNON-RESIDENTJAMAICANARRIVALSAverage Lengthof Stay (Nights)Hotel 1,314,135 6.9 8,861 8.4Non-Hotel 84,274 9.2 1,520 11.8Private Homes 382,148 15.3 140,397 13.3Other 19,723 12.8 694 13.21,800,280 8.9 151,472 16.4Average Lengthof Stay (Nights)* The Length of Stay is based on intended Length of StayR&MI/JTB 2011

40TABLE 10STOPOVER ARRIVALS BY SCHEDULED & CHARTERED FLIGHTS20102011U.S.A.NORTHEASTSCHEDULED% change2010/09 CHARTERED% change2010/09 SCHEDULED% change2011/10 CHARTERED% change2011/10Connecticut 34,008 19 32,897 5Delaware 6,228 6 6,212 1Maine 4,288 195 4,406 3Maryland 47,891 41 47,705 12Massachusetts 36,879 31 35,122 8New Hampshire 5,832 11 5,173 4New Jersey 75,066 30 71,418 14New York 242,191 594 227,914 166Pennsylvania 74,614 43 72,909 22Rhode Island 3,997 3 3,913 0Vermont 2,401 8 2,503 1Virginia 30,357 35 30,256 15Washington D.C. 6,380 9 6,252 12West Virginia 3,389 2 3,258 4Total 573,521 9.8% 1,027 -56.5% 549,938 -4.1% 267 -74.0%MIDWESTIllinois 49,998 875 49,177 1,445Indiana 16,555 60 17,892 152Iowa 10,389 307 10,928 569Kansas 6,854 28 7,487 24Kentucky 7,513 31 8,311 30Michigan 30,895 143 27,968 1,907Minnesota 18,026 2,142 17,523 3,143Missouri 16,383 1,705 17,314 2,011Nebraska 5,659 20 6,093 9North Dakota 2,333 52 2,708 218Ohio 24,805 29 27,204 42South Dakota 2,463 81 2,684 86Wisconsin 22,755 1,850 25,299 898Total 214,628 11.5% 7,323 -65.3% 220,588 2.8% 10,534 43.8%SOUTH (MIAMI)Alabama 8,031 10 8,126 4Arkansas 4,149 4 3,997 15Florida 185,212 530 183,319 362Georgia 56,009 84 54,981 62Louisiana 7,151 0 7,462 8Mississippi 3,952 10 3,773 5North Carolina 26,118 31 24,551 22Oklahoma 5,286 8 5,924 14South Carolina 11,453 16 11,322 3Tennessee 14,525 23 14,138 16Total 321,886 2.7% 716 6.4% 317,593 -1.3% 511 -28.6%R&MI/JTB 2011

41TABLE 10STOPOVER ARRIVALS BY SCHEDULED & CHARTERED FLIGHTS20102011SCHEDULED% change2010/09 CHARTERED% change2010/09 SCHEDULED% change2011/10 CHARTERED% change2011/10WESTAlaska 529 0 595 0Arizona 7,806 5 6,761 6California 41,110 76 41,742 56Colorado 9,553 19 9,592 34Hawaii 327 0 348 1Idaho 1,096 0 1,073 0Montana 1,067 3 921 2Nevada 3,856 4 3,452 1New Mexico 1,548 2 1,568 5Oregon 2,865 19 2,805 4Texas 43,737 73 46,895 46Utah 2,593 4 2,451 1Washington 6,737 23 6,837 10Wyoming 788 2 928 0Total 123,612 2.9% 230 -47.1% 125,968 1.9% 166 -27.8%TOTAL U.S.A. 1,233,647 7.4% 9,296 -62.2% 1,214,087 -1.6% 11,478 23.5%CANADAAlberta 19,127 7,487 29,500 606British Columbia 11,067 2,054 14,856 440Manitoba 5,010 2,591 10,625 66New Brunswick 2,585 2,091 5,767 1,080Newfoundland 2,599 401 3,572 93Nova Scotia 3,385 4,354 7,614 2,119Ontario 128,070 75,956 205,871 27,502P.E. Island 224 422 760 187Quebec 19,545 28,728 48,938 6,334Saskatchewan 4,097 4,957 12,431 42Other Canada 340 101 525 10Total 196,049 63.1% 129,142 -24.1% 340,459 73.7% 38,479 -70.2%EUROPENorthern EuropeU.K. 116,654 67,701 113,311 60,196Denmark 740 32 626 22Finland 409 18 425 26Ireland 2,136 601 2,068 391Norway 881 34 1,017 37Sweden 1,565 54 1,569 38Southern EuropeGreece 245 4 267 6Italy 13,364 336 11,558 142Portugal 291 9,785 249 4,437Spain 1,830 8,252 1,685 5,148Western EuropeAustria 2,633 8 2,532 13Belgium 5,194 34 5,245 31France 3,638 124 3,911 837Germany 18,735 122 19,888 51Luxemburg 202 5 210 2Netherlands 6,598 79 7,060 140Switzerland 2,810 51 3,121 38Central/East EuropeCzechoslovakia 457 16 607 165Hungary 380 9 267 20Poland 1,176 123 1,373 70Russia 1,663 282 1,901 75Other Europe 5,669 688 6,356 604Total 183,392 11.4% 87,923 -21.6% 180,888 -1.4% 72,157 -17.9%R&MI/JTB 2011

42TABLE 10STOPOVER ARRIVALS BY SCHEDULED & CHARTERED FLIGHTS20102011SCHEDULED% change2010/09 CHARTERED% change2010/09 SCHEDULED% change2011/10 CHARTERED% change2011/10OTHER COUNTRIESMexico 1,968 16 2,108 16Central America 3,209 42 3,602 53South America 6,528 1,679 7,625 3,185Comm. Caribbean 49,515 1,721 57,887 743Other Caribbean 5,774 1,289 5,741 1,845African Countries 1,126 43 1,159 41India 1,078 49 1,207 123Australia & New Zealand 2,066 55 2,238 31Japan 1,944 6 2,020 7All Other Ctries 3,992 129 4,342 231Total 77,200 -11.9% 5,029 42.5% 87,929 13.9% 6,275 24.8%GRAND TOTAL 1,690,288 11.2% 231,390 -25.5% 1,823,363 7.9% 128,389 -44.5%% Distribution of Stopover Arrivalsby Scheduled & Charter Flights 2011NORTHEAST0.0%100.0%SOUTH0.2%99.8%Market RegionsMIDWESTWESTCANADA4.6%0.1%10.2%95.4%99.9%89.8%CHARTEREDEUROPE28.5%71.5%SCHEDULEDOTHER6.7%93.3%0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%PercentageFig. 11R&MI/JTB 2011

CRUISE PASSENGERS