3. Credit Decision-making:The Credit Risk Area acts as a check and balance in the credit decision-making in all of the committees in which it participates. Italso defines the delegated powers granted to the commercial areas, being able to act above the commercial areas if the risk standardsare exceeded in a particular instance.There are mainly two types of committees and they are separated by their operating manner: 1) File circulation and 2) Meeting. In thefirst case, which operates for smaller amounts, the file circulates through the different levels of authority going from one to anotheruntil it arrives at the required level. In the second case, for greater amounts, a meeting is held in which the commercial executivepresents the loan transactions to the members of the committee for their approval. Likewise the meeting credit committees aredivided depending on the amount.Within these credit committees the most important one is the Board of Directors Credit Committee, which involves the participationof two directors, the President of the <strong>Security</strong> Group, the Bank’s General Manager and Risk Division Manager, and in which the mostimportant loans are analyzed, evaluating close to 80% of the operations and 20% of customers.4. Credit Management:Basically this is the stage where Credit Management Chiefs take action. They ensure correct processing of the classification of ourcustomers by the commercial executives and that closing of provisions each month occurs without errors and represents the realityof the Bank’s portfolio.In addition, in this part of the process work is performed with the commercial areas to keep the number of operations with exceptionsand overdue amounts as low as possible. Furthermore, strict control is exercised over appraisals of assets given to the Bank ascollateral.5. Collection:This is the stage at which the specialist Normalization area performs problem loan collections, acting in pre-court collections andcourt collections.6. Control:At this stage of the process, in which the Credit Risk Control area participates, the Bank seeks to maintain a global vision of how theaforementioned stages of the credit process are operating. Its participation encompasses from reviewing and auditing current creditpolicies to performing the analysis and committee areas, as well as corrects credit management.C.2 Description by Area:People Credit Risk Assistant Management:The Personal Credit Risk Assistant Management participates in the first three stages of the credit process in the people bankingsegment. Its main tasks include active participation in the definition of the target market as well as in commercial campaigns,definition of the credit risk policies of that segment, design, maintenance and calibration of the different scoring models, participationin the different levels of approval of operations and definition of delegated authority for the commercial areas, among others.Corporate Credit Analysis Management:This area, which is the most numerous of the Risk Division, is in charge of participating in the two first stages of the process,strongly focusing on the second, which corresponds to analysis and evaluation of customers. Its main function is the preparationof different types of financial analysis of customers depending on their size, complexity and amount, adapting to the needs ofthe commercial area in respect to depth and speed of response and maintaining the Bank’s market competitiveness. Togetherwith the above, it is also the area responsible for sector reports, analysis of optimum portfolio and country risk study.

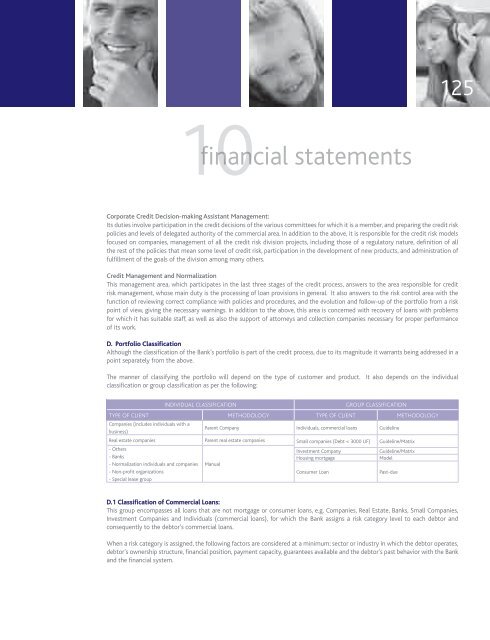

10 financial statements125P A G ECorporate Credit Decision-making Assistant Management:Its duties involve participation in the credit decisions of the various committees for which it is a member, and preparing the credit riskpolicies and levels of delegated authority of the commercial area. In addition to the above, it is responsible for the credit risk modelsfocused on companies, management of all the credit risk division projects, including those of a regulatory nature, definition of allthe rest of the policies that mean some level of credit risk, participation in the development of new products, and administration offulfillment of the goals of the division among many others.Credit Management and NormalizationThis management area, which participates in the last three stages of the credit process, answers to the area responsible for creditrisk management, whose main duty is the processing of loan provisions in general. It also answers to the risk control area with thefunction of reviewing correct compliance with policies and procedures, and the evolution and follow-up of the portfolio from a riskpoint of view, giving the necessary warnings. In addition to the above, this area is concerned with recovery of loans with problemsfor which it has suitable staff, as well as also the support of attorneys and collection companies necessary for proper performanceof its work.D. Portfolio ClassificationAlthough the classification of the Bank’s portfolio is part of the credit process, due to its magnitude it warrants being addressed in apoint separately from the above.The manner of classifying the portfolio will depend on the type of customer and product. It also depends on the individualclassification or group classification as per the following:Individual ClassificationGroup ClassificationType of client Methodology Type of client MethodologyCompanies (includes individuals with abusiness)Parent Company Individuals, commercial loans GuidelineReal estate companies Parent real estate companies Small companies (Debt < 3000 UF) Guideline/Matrix- OthersInvestment CompanyGuideline/Matrix- BanksHousing mortgageModel- Normalization individuals and companies- Non-profit organizations- Special lease groupManualConsumer LoanPast-dueD.1 Classification of Commercial Loans:This group encompasses all loans that are not mortgage or consumer loans, e.g. Companies, Real Estate, Banks, Small Companies,Investment Companies and Individuals (commercial loans), for which the Bank assigns a risk category level to each debtor andconsequently to the debtor’s commercial loans.When a risk category is assigned, the following factors are considered at a minimum: sector or industry in which the debtor operates,debtor’s ownership structure, financial position, payment capacity, guarantees available and the debtor’s past behavior with the Bankand the financial system.