P - Banco Security

P - Banco Security

P - Banco Security

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

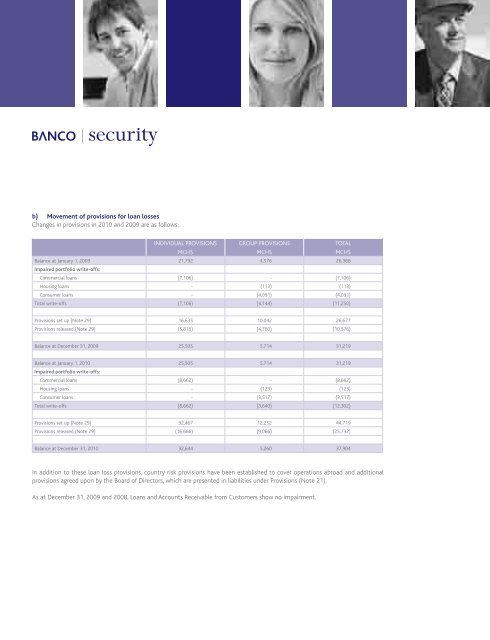

) Movement of provisions for loan lossesChanges in provisions in 2010 and 2009 are as follows:Individual provisions Group provisions TOTALMCh$ MCh$ MCh$Balance at January 1, 2009 21,792 4,576 26,368Impaired portfolio write-offs:Commercial loans (7,106) - (7,106)Housing loans - (113) (113)Consumer loans - (4,031) (4,031)Total write-offs (7,106) (4,144) (11,250)Provisions set up (Note 29) 16,635 10,042 26,677Provisions released (Note 29) (5,816) (4,760) (10,576)Balance at December 31, 2009 25,505 5,714 31,219Balance at January 1, 2010 25,505 5,714 31,219Impaired portfolio write-offs:Commercial loans (8,662) - (8,662)Housing loans - (123) (123)Consumer loans - (3,517) (3,517)Total write-offs (8,662) (3,640) (12,302)Provisions set up (Note 29) 32,467 12,252 44,719Provisions released (Note 29) (16,666) (9,066) (25,732)Balance at December 31, 2010 32,644 5,260 37,904In addition to these loan loss provisions, country risk provisions have been established to cover operations abroad and additionalprovisions agreed upon by the Board of Directors, which are presented in liabilities under Provisions (Note 21).As at December 31, 2009 and 2008, Loans and Accounts Receivable from Customers show no impairment.