Pace plc Annual Report and Accounts 2012 - Financial Statements

Pace plc Annual Report and Accounts 2012 - Financial Statements

Pace plc Annual Report and Accounts 2012 - Financial Statements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

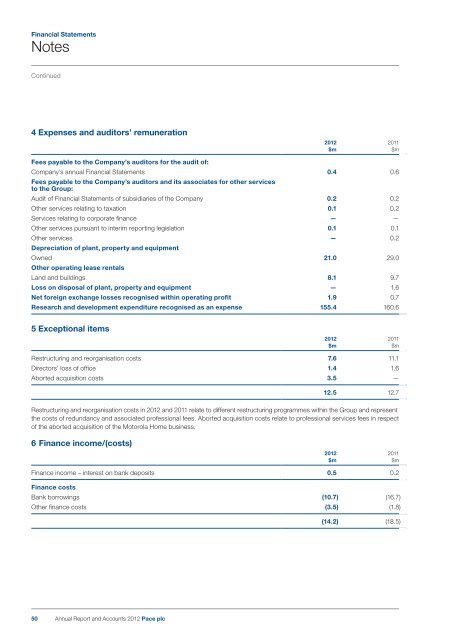

<strong>Financial</strong> <strong>Statements</strong>NotesContinued4 Expenses <strong>and</strong> auditors’ remuneration<strong>2012</strong> 2011$m $mFees payable to the Company’s auditors for the audit of:Company’s annual <strong>Financial</strong> <strong>Statements</strong> 0.4 0.6Fees payable to the Company’s auditors <strong>and</strong> its associates for other servicesto the Group:Audit of <strong>Financial</strong> <strong>Statements</strong> of subsidiaries of the Company 0.2 0.2Other services relating to taxation 0.1 0.2Services relating to corporate finance — —Other services pursuant to interim reporting legislation 0.1 0.1Other services — 0.2Depreciation of plant, property <strong>and</strong> equipmentOwned 21.0 29.0Other operating lease rentalsL<strong>and</strong> <strong>and</strong> buildings 8.1 9.7Loss on disposal of plant, property <strong>and</strong> equipment — 1.6Net foreign exchange losses recognised within operating profit 1.9 0.7Research <strong>and</strong> development expenditure recognised as an expense 155.4 160.65 Exceptional items<strong>2012</strong> 2011$m $mRestructuring <strong>and</strong> reorganisation costs 7.6 11.1Directors’ loss of office 1.4 1.6Aborted acquisition costs 3.5 —12.5 12.7Restructuring <strong>and</strong> reorganisation costs in <strong>2012</strong> <strong>and</strong> 2011 relate to different restructuring programmes within the Group <strong>and</strong> representthe costs of redundancy <strong>and</strong> associated professional fees. Aborted acquisition costs relate to professional services fees in respectof the aborted acquisition of the Motorola Home business.6 Finance income/(costs)<strong>2012</strong> 2011$m $mFinance income – interest on bank deposits 0.5 0.2Finance costsBank borrowings (10.7) (16.7)Other finance costs (3.5) (1.8)(14.2) (18.5)50<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong> <strong>Pace</strong> <strong>plc</strong>