Pace plc Annual Report and Accounts 2012 - Financial Statements

Pace plc Annual Report and Accounts 2012 - Financial Statements

Pace plc Annual Report and Accounts 2012 - Financial Statements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

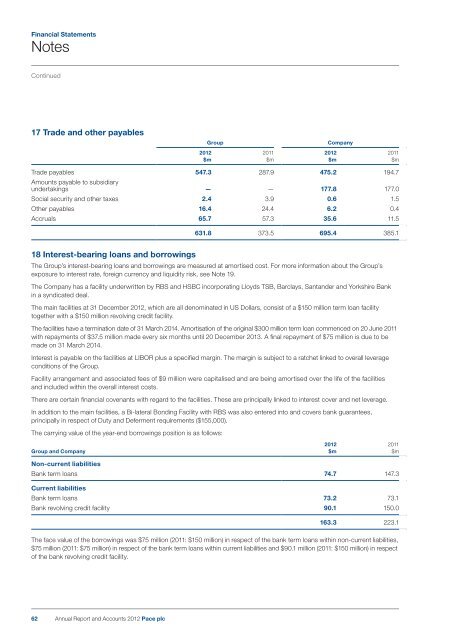

<strong>Financial</strong> <strong>Statements</strong>NotesContinued17 Trade <strong>and</strong> other payablesGroupCompany<strong>2012</strong> 2011 <strong>2012</strong> 2011$m $m $m $mTrade payables 547.3 287.9 475.2 194.7Amounts payable to subsidiaryundertakings — — 177.8 177.0Social security <strong>and</strong> other taxes 2.4 3.9 0.6 1.5Other payables 16.4 24.4 6.2 0.4Accruals 65.7 57.3 35.6 11.5631.8 373.5 695.4 385.118 Interest-bearing loans <strong>and</strong> borrowingsThe Group’s interest-bearing loans <strong>and</strong> borrowings are measured at amortised cost. For more information about the Group’sexposure to interest rate, foreign currency <strong>and</strong> liquidity risk, see Note 19.The Company has a facility underwritten by RBS <strong>and</strong> HSBC incorporating Lloyds TSB, Barclays, Sant<strong>and</strong>er <strong>and</strong> Yorkshire Bankin a syndicated deal.The main facilities at 31 December <strong>2012</strong>, which are all denominated in US Dollars, consist of a $150 million term loan facilitytogether with a $150 million revolving credit facility.The facilities have a termination date of 31 March 2014. Amortisation of the original $300 million term loan commenced on 20 June 2011with repayments of $37.5 million made every six months until 20 December 2013. A final repayment of $75 million is due to bemade on 31 March 2014.Interest is payable on the facilities at LIBOR plus a specified margin. The margin is subject to a ratchet linked to overall leverageconditions of the Group.Facility arrangement <strong>and</strong> associated fees of $9 million were capitalised <strong>and</strong> are being amortised over the life of the facilities<strong>and</strong> included within the overall interest costs.There are certain financial covenants with regard to the facilities. These are principally linked to interest cover <strong>and</strong> net leverage.In addition to the main facilities, a Bi-lateral Bonding Facility with RBS was also entered into <strong>and</strong> covers bank guarantees,principally in respect of Duty <strong>and</strong> Deferment requirements ($155,000).The carrying value of the year-end borrowings position is as follows:<strong>2012</strong> 2011Group <strong>and</strong> Company $m $mNon-current liabilitiesBank term loans 74.7 147.3Current liabilitiesBank term loans 73.2 73.1Bank revolving credit facility 90.1 150.0163.3 223.1The face value of the borrowings was $75 million (2011: $150 million) in respect of the bank term loans within non-current liabilities,$75 million (2011: $75 million) in respect of the bank term loans within current liabilities <strong>and</strong> $90.1 million (2011: $150 million) in respectof the bank revolving credit facility.62<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong> <strong>Pace</strong> <strong>plc</strong>