Annual report to members 2009 - QSuper - Queensland Government

Annual report to members 2009 - QSuper - Queensland Government

Annual report to members 2009 - QSuper - Queensland Government

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

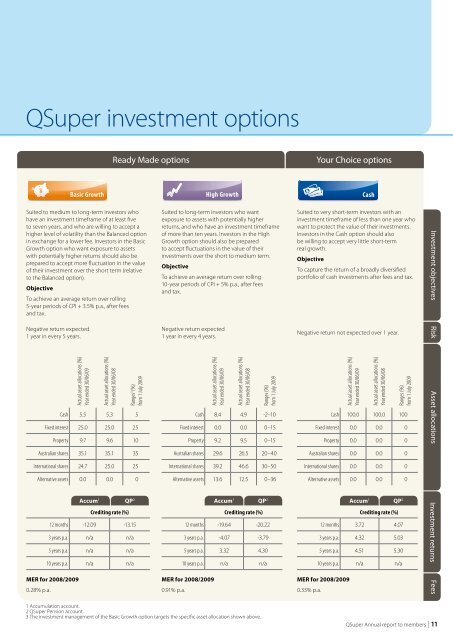

<strong>QSuper</strong> investment optionsReady Made optionsYour Choice optionsBasic Growth High Growth CashSuited <strong>to</strong> medium <strong>to</strong> long-term inves<strong>to</strong>rs whohave an investment timeframe of at least five<strong>to</strong> seven years, and who are willing <strong>to</strong> accept ahigher level of volatility than the Balanced optionin exchange for a lower fee. Inves<strong>to</strong>rs in the BasicGrowth option who want exposure <strong>to</strong> assetswith potentially higher returns should also beprepared <strong>to</strong> accept more fluctuation in the valueof their investment over the short term (relative<strong>to</strong> the Balanced option).ObjectiveTo achieve an average return over rolling5-year periods of CPI + 3.5% p.a., after feesand tax.Negative return expected1 year in every 5 years.Actual asset allocations (%)Year ended 30/06/09Actual asset allocations (%)Year ended 30/06/08Ranges 3 (%)from 1 July <strong>2009</strong>Cash 5.5 5.3 5Fixed interest 25.0 25.0 25Property 9.7 9.6 10Australian shares 35.1 35.1 35International shares 24.7 25.0 25Alternative assets 0.0 0.0 0Accum 1 QP 2Crediting rate (%)12 months -12.09 -13.153 years p.a. n/a n/a5 years p.a. n/a n/a10 years p.a. n/a n/aMER for 2008/<strong>2009</strong>0.28% p.a.Suited <strong>to</strong> long-term inves<strong>to</strong>rs who wantexposure <strong>to</strong> assets with potentially higherreturns, and who have an investment timeframeof more than ten years. Inves<strong>to</strong>rs in the HighGrowth option should also be prepared<strong>to</strong> accept fluctuations in the value of theirinvestments over the short <strong>to</strong> medium term.ObjectiveTo achieve an average return over rolling10-year periods of CPI + 5% p.a., after feesand tax.Negative return expected1 year in every 4 years.Actual asset allocations (%)Year ended 30/06/09Actual asset allocations (%)Year ended 30/06/08Ranges (%)from 1 July <strong>2009</strong>Cash 8.4 4.9 -2–10Fixed interest 0.0 0.0 0–15Property 9.2 9.5 0–15Australian shares 29.6 26.5 20–40International shares 39.2 46.6 30–50Alternative assets 13.6 12.5 0–36Accum 1 QP 2Crediting rate (%)12 months -19.64 -20.223 years p.a. -4.07 -3.795 years p.a. 3.32 4.3010 years p.a. n/a n/aMER for 2008/<strong>2009</strong>0.91% p.a.Suited <strong>to</strong> very short-term inves<strong>to</strong>rs with aninvestment timeframe of less than one year whowant <strong>to</strong> protect the value of their investments.Inves<strong>to</strong>rs in the Cash option should alsobe willing <strong>to</strong> accept very little short-termreal growth.ObjectiveTo capture the return of a broadly diversifiedportfolio of cash investments after fees and tax.Negative return not expected over 1 year.Actual asset allocations (%)Year ended 30/06/09Actual asset allocations (%)Year ended 30/06/08Ranges (%)from 1 July <strong>2009</strong>Cash 100.0 100.0 100Fixed interest 0.0 0.0 0Property 0.0 0.0 0Australian shares 0.0 0.0 0International shares 0.0 0.0 0Alternative assets 0.0 0.0 0Accum 1 QP 2Crediting rate (%)12 months 3.72 4.073 years p.a. 4.32 5.035 years p.a. 4.51 5.3010 years p.a. n/a n/aMER for 2008/<strong>2009</strong>0.33% p.a.Investment objectives RiskAsset allocations Investment returns Fees1 Accumulation account.2 <strong>QSuper</strong> Pension account.3 The investment management of the Basic Growth option targets the specific asset allocation shown above.<strong>QSuper</strong> <strong>Annual</strong> <strong>report</strong> <strong>to</strong> <strong>members</strong> | 11

![[PDF] Making a Binding Death Benefit Nomination - QSuper](https://img.yumpu.com/51120548/1/184x260/pdf-making-a-binding-death-benefit-nomination-qsuper.jpg?quality=85)

![[PDF] Employee rewards and benefits - QSuper](https://img.yumpu.com/50770119/1/184x260/pdf-employee-rewards-and-benefits-qsuper.jpg?quality=85)

![[PDF] Providing Proof of Identity factsheet - QSuper](https://img.yumpu.com/48792920/1/184x260/pdf-providing-proof-of-identity-factsheet-qsuper.jpg?quality=85)

![[PDF] Information Collection form - QSuper](https://img.yumpu.com/48024629/1/184x260/pdf-information-collection-form-qsuper.jpg?quality=85)

![[PDF] Defined Benefit Account Disability Claim - QSuper - Queensland](https://img.yumpu.com/43464395/1/184x260/pdf-defined-benefit-account-disability-claim-qsuper-queensland.jpg?quality=85)

![[PDF] Allocated pension notes booklet v1.indd - QSuper](https://img.yumpu.com/42513025/1/184x260/pdf-allocated-pension-notes-booklet-v1indd-qsuper.jpg?quality=85)

![[PDF] Investment Choice Guide - QSuper - Queensland Government](https://img.yumpu.com/42079288/1/184x260/pdf-investment-choice-guide-qsuper-queensland-government.jpg?quality=85)