Annual report to members 2009 - QSuper - Queensland Government

Annual report to members 2009 - QSuper - Queensland Government

Annual report to members 2009 - QSuper - Queensland Government

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

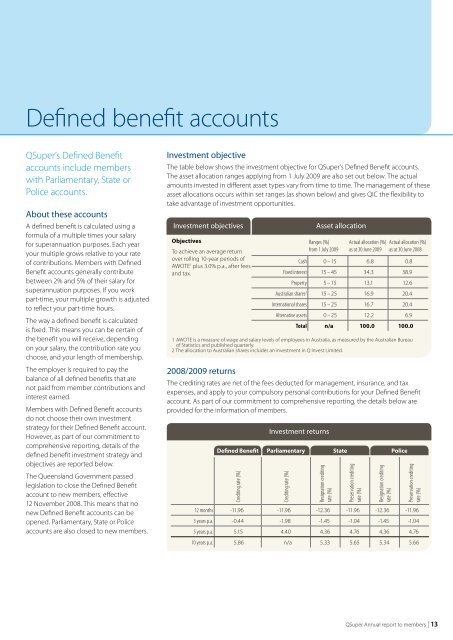

Defined benefit accounts<strong>QSuper</strong>’s Defined Benefitaccounts include <strong>members</strong>with Parliamentary, State orPolice accounts.About these accountsA defined benefit is calculated using aformula of a multiple times your salaryfor superannuation purposes. Each yearyour multiple grows relative <strong>to</strong> your rateof contributions. Members with DefinedBenefit accounts generally contributebetween 2% and 5% of their salary forsuperannuation purposes. If you workpart‐time, your multiple growth is adjusted<strong>to</strong> reflect your part-time hours.The way a defined benefit is calculatedis fixed. This means you can be certain ofthe benefit you will receive, dependingon your salary, the contribution rate youchoose, and your length of <strong>members</strong>hip.The employer is required <strong>to</strong> pay thebalance of all defined benefits that arenot paid from member contributions andinterest earned.Members with Defined Benefit accountsdo not choose their own investmentstrategy for their Defined Benefit account.However, as part of our commitment <strong>to</strong>comprehensive <strong>report</strong>ing, details of thedefined benefit investment strategy andobjectives are <strong>report</strong>ed below.The <strong>Queensland</strong> <strong>Government</strong> passedlegislation <strong>to</strong> close the Defined Benefitaccount <strong>to</strong> new <strong>members</strong>, effective12 November 2008. This means that nonew Defined Benefit accounts can beopened. Parliamentary, State or Policeaccounts are also closed <strong>to</strong> new <strong>members</strong>.Investment objectiveThe table below shows the investment objective for <strong>QSuper</strong>’s Defined Benefit accounts.The asset allocation ranges applying from 1 July <strong>2009</strong> are also set out below. The actualamounts invested in different asset types vary from time <strong>to</strong> time. The management of theseasset allocations occurs within set ranges (as shown below) and gives QIC the flexibility <strong>to</strong>take advantage of investment opportunities.Investment objectivesObjectivesTo achieve an average returnover rolling 10-year periods ofAWOTE 1 plus 3.0% p.a., after feesand tax.Asset allocationRanges (%)from 1 July <strong>2009</strong>Actual allocation (%)as at 30 June <strong>2009</strong>Actual allocation (%)as at 30 June 2008Cash 0 – 15 6.8 0.8Fixed interest 15 – 45 34.3 38.9Property 5 – 15 13.1 12.6Australian shares 2 15 – 25 16.9 20.4International shares 15 – 25 16.7 20.4Alternative assets 0 – 25 12.2 6.9Total n/a 100.0 100.01 AWOTE is a measure of wage and salary levels of employees in Australia, as measured by the Australian Bureauof Statistics and published quarterly.2 The allocation <strong>to</strong> Australian shares includes an investment in Q Invest Limited.2008/<strong>2009</strong> returnsThe crediting rates are net of the fees deducted for management, insurance, and taxexpenses, and apply <strong>to</strong> your compulsory personal contributions for your Defined Benefitaccount. As part of our commitment <strong>to</strong> comprehensive <strong>report</strong>ing, the details below areprovided for the information of <strong>members</strong>.Investment returnsDefined Benefit Parliamentary State PoliceCrediting rate (%)Crediting rate (%)Resignation creditingrate (%)Preservation creditingrate (%)Resignation creditingrate (%)Preservation creditingrate (%)12 months -11.96 -11.96 -12.36 -11.96 -12.36 -11.963 years p.a. -0.44 -1.98 -1.45 -1.04 -1.45 -1.045 years p.a. 5.15 4.40 4.36 4.76 4.36 4.7610 years p.a. 5.86 n/a 5.33 5.65 5.34 5.66<strong>QSuper</strong> <strong>Annual</strong> <strong>report</strong> <strong>to</strong> <strong>members</strong> | 13

![[PDF] Making a Binding Death Benefit Nomination - QSuper](https://img.yumpu.com/51120548/1/184x260/pdf-making-a-binding-death-benefit-nomination-qsuper.jpg?quality=85)

![[PDF] Employee rewards and benefits - QSuper](https://img.yumpu.com/50770119/1/184x260/pdf-employee-rewards-and-benefits-qsuper.jpg?quality=85)

![[PDF] Providing Proof of Identity factsheet - QSuper](https://img.yumpu.com/48792920/1/184x260/pdf-providing-proof-of-identity-factsheet-qsuper.jpg?quality=85)

![[PDF] Information Collection form - QSuper](https://img.yumpu.com/48024629/1/184x260/pdf-information-collection-form-qsuper.jpg?quality=85)

![[PDF] Defined Benefit Account Disability Claim - QSuper - Queensland](https://img.yumpu.com/43464395/1/184x260/pdf-defined-benefit-account-disability-claim-qsuper-queensland.jpg?quality=85)

![[PDF] Allocated pension notes booklet v1.indd - QSuper](https://img.yumpu.com/42513025/1/184x260/pdf-allocated-pension-notes-booklet-v1indd-qsuper.jpg?quality=85)

![[PDF] Investment Choice Guide - QSuper - Queensland Government](https://img.yumpu.com/42079288/1/184x260/pdf-investment-choice-guide-qsuper-queensland-government.jpg?quality=85)