important terms and conditions of debit card - Abhyudaya Co ...

important terms and conditions of debit card - Abhyudaya Co ...

important terms and conditions of debit card - Abhyudaya Co ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

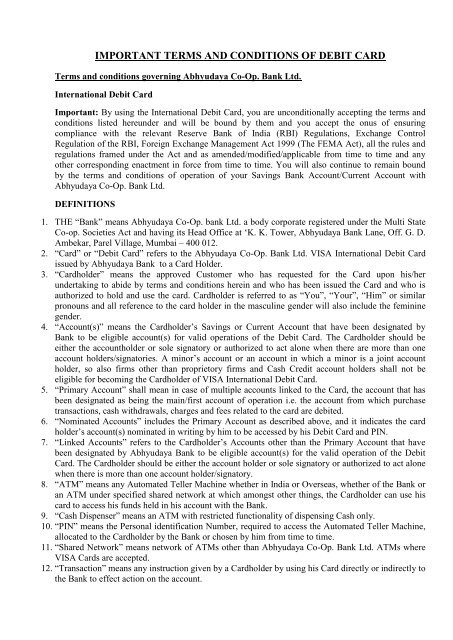

IMPORTANT TERMS AND CONDITIONS OF DEBIT CARDTerms <strong>and</strong> <strong>conditions</strong> governing <strong>Abhyudaya</strong> <strong>Co</strong>-Op. Bank Ltd.International Debit CardImportant: By using the International Debit Card, you are unconditionally accepting the <strong>terms</strong> <strong>and</strong><strong>conditions</strong> listed hereunder <strong>and</strong> will be bound by them <strong>and</strong> you accept the onus <strong>of</strong> ensuringcompliance with the relevant Reserve Bank <strong>of</strong> India (RBI) Regulations, Exchange <strong>Co</strong>ntrolRegulation <strong>of</strong> the RBI, Foreign Exchange Management Act 1999 (The FEMA Act), all the rules <strong>and</strong>regulations framed under the Act <strong>and</strong> as amended/modified/applicable from time to time <strong>and</strong> anyother corresponding enactment in force from time to time. You will also continue to remain boundby the <strong>terms</strong> <strong>and</strong> <strong>conditions</strong> <strong>of</strong> operation <strong>of</strong> your Savings Bank Account/Current Account with<strong>Abhyudaya</strong> <strong>Co</strong>-Op. Bank Ltd.DEFINITIONS1. THE “Bank” means <strong>Abhyudaya</strong> <strong>Co</strong>-Op. bank Ltd. a body corporate registered under the Multi State<strong>Co</strong>-op. Societies Act <strong>and</strong> having its Head Office at ‘K. K. Tower, <strong>Abhyudaya</strong> Bank Lane, Off. G. D.Ambekar, Parel Village, Mumbai – 400 012.2. “Card” or “Debit Card” refers to the <strong>Abhyudaya</strong> <strong>Co</strong>-Op. Bank Ltd. VISA International Debit Cardissued by <strong>Abhyudaya</strong> Bank to a Card Holder.3. “Cardholder” means the approved Customer who has requested for the Card upon his/herundertaking to abide by <strong>terms</strong> <strong>and</strong> <strong>conditions</strong> herein <strong>and</strong> who has been issued the Card <strong>and</strong> who isauthorized to hold <strong>and</strong> use the <strong>card</strong>. Cardholder is referred to as “You”, “Your”, “Him” or similarpronouns <strong>and</strong> all reference to the <strong>card</strong> holder in the masculine gender will also include the femininegender.4. “Account(s)” means the Cardholder’s Savings or Current Account that have been designated byBank to be eligible account(s) for valid operations <strong>of</strong> the Debit Card. The Cardholder should beeither the accountholder or sole signatory or authorized to act alone when there are more than oneaccount holders/signatories. A minor’s account or an account in which a minor is a joint accountholder, so also firms other than proprietory firms <strong>and</strong> Cash Credit account holders shall not beeligible for becoming the Cardholder <strong>of</strong> VISA International Debit Card.5. “Primary Account” shall mean in case <strong>of</strong> multiple accounts linked to the Card, the account that hasbeen designated as being the main/first account <strong>of</strong> operation i.e. the account from which purchasetransactions, cash withdrawals, charges <strong>and</strong> fees related to the <strong>card</strong> are <strong>debit</strong>ed.6. “Nominated Accounts” includes the Primary Account as described above, <strong>and</strong> it indicates the <strong>card</strong>holder’s account(s) nominated in writing by him to be accessed by his Debit Card <strong>and</strong> PIN.7. “Linked Accounts” refers to the Cardholder’s Accounts other than the Primary Account that havebeen designated by <strong>Abhyudaya</strong> Bank to be eligible account(s) for the valid operation <strong>of</strong> the DebitCard. The Cardholder should be either the account holder or sole signatory or authorized to act alonewhen there is more than one account holder/signatory.8. “ATM” means any Automated Teller Machine whether in India or Overseas, whether <strong>of</strong> the Bank oran ATM under specified shared network at which amongst other things, the Cardholder can use his<strong>card</strong> to access his funds held in his account with the Bank.9. “Cash Dispenser” means an ATM with restricted functionality <strong>of</strong> dispensing Cash only.10. “PIN” means the Personal identification Number, required to access the Automated Teller Machine,allocated to the Cardholder by the Bank or chosen by him from time to time.11. “Shared Network” means network <strong>of</strong> ATMs other than <strong>Abhyudaya</strong> <strong>Co</strong>-Op. Bank Ltd. ATMs whereVISA Cards are accepted.12. “Transaction” means any instruction given by a Cardholder by using his Card directly or indirectly tothe Bank to effect action on the account.

13. “International Transaction” means the transactions performed by the Cardholder through hisinternationally valid Debit Card, outside India, Nepal & Bhutan. The Card is NOT VALID fortransactions in Nepal & Bhutan.14. “Account Statement” means a periodic statement <strong>of</strong> account sent by Bank to a <strong>card</strong>holder or PassBook issued by the branch where the account is maintained setting out transactions carried out by the<strong>card</strong>holder(s) during the given period <strong>and</strong> the balance on that date. It may also include any otherinformation that Bank may deem fit to include.15. “Merchant” or Merchant Establishment” shall mean establishments wherever located whichaccept/honor the <strong>card</strong> <strong>and</strong> shall include amongst others airline organizations, railways, petrol pumps,shops, stores, restaurants etc. (advertised by the Bank from time to time). Delete16. “Electronic Data Capture (EDC)” refers to electronic Point- <strong>of</strong>-Sale swipe terminals whether in Indiaor Overseas, whether <strong>of</strong> the Bank , VISA Card or any other Bank on the network, those permit the<strong>debit</strong> <strong>of</strong> the account(s) for purchase transaction from the member establishments.17. “Valid Charges” means charges incurred by the Card Holder for purchase <strong>of</strong> goods or services on the<strong>card</strong> or any other charge as may be included by the Bank from time to time for the purpose <strong>of</strong> thisproduct.18. “Force majeure event” means any event such as fire, earthquake, flood, epidemic strike, lockout,labour controversy, industrial dispute, riot, civil disturbance, war, civil commotion, natural disasters,acts <strong>of</strong> God, failure or delay <strong>of</strong> any transportation agency, or any other furnisher <strong>of</strong> essential suppliesor other facilities, omissions <strong>and</strong> acts <strong>of</strong> public authorities preventing or delaying performance <strong>of</strong>obligation relating to acts <strong>of</strong> public authorities including changes in Law, or other regulatoryauthority, acts beyond the control <strong>of</strong> the Bank or for any other reasons which cannot reasonably beforecast or provided against <strong>and</strong> which cannot be predicted by person <strong>of</strong> ordinary prudence.19. “Law” includes all applicable statutes, enactments, acts or legislature or Parliament, ordinances,rules, bye-laws, regulations, judgments, notifications, guidelines, policies, directions, circulars,directives <strong>and</strong> orders <strong>of</strong> any Government, Statutory authority, Tribunal, Board, <strong>Co</strong>urt or RecognizedStock exchange, final <strong>and</strong> interim Decrees <strong>and</strong> Judgments.20. “Technical Problem” includes any problems <strong>and</strong> difficulties arising due to the power <strong>and</strong> electricityfailure, computer errors, programming errors, s<strong>of</strong>tware or hardware errors, computer breakdown,non-availability <strong>of</strong> Internet connections, communication problems between the Bank’s server <strong>and</strong>ATM network, shutting down <strong>of</strong> the Bank’s servers, non-availability <strong>of</strong> links, corruption <strong>of</strong> thecomputer s<strong>of</strong>tware, problems in ATM or any other service providers infrastructure <strong>and</strong>telecommunication network, problems in any other telecommunication network <strong>and</strong> any othertechnology related problems.21. “VISA” means a trademark owned by <strong>and</strong> normally associated with VISA International.22. “VISA ATM Network” means ATMs that honor the Debit Card <strong>and</strong> that display the VISA symbol.23. “NFS Network” means the network banks’ in National Financial Switch <strong>of</strong> National Paymentnetwork setup by NPCI.24. “Add-on Card” means a supplementary or additional <strong>card</strong> issued to the person specified by theAccount holder/s.<strong>Abhyudaya</strong> <strong>Co</strong>-Op. Bank Ltd. International Debit Card is issued on thefollowing <strong>terms</strong> <strong>and</strong> <strong>conditions</strong>1. ActivationThe <strong>card</strong> sent to you needs to be activated at Bank’s own ATM prior to its use at any other device.The Card can be activated through first utilization <strong>of</strong> the PIN for PIN change at any <strong>of</strong> the Bank’sATM.

2. Card Holder’s Obligationsi) The issue <strong>and</strong> use <strong>of</strong> the Card shall be subject to the rules <strong>and</strong> regulations in force from time to timeas issued by <strong>Abhyudaya</strong> <strong>Co</strong>-Op. Bank Ltd., Reserve Bank <strong>of</strong> India <strong>and</strong> under FEMA 1999.ii) The <strong>card</strong> shall be valid only for transaction options, as permitted by the Bank from time to time inIndia <strong>and</strong> abroad, ATMs <strong>of</strong> other banks, which are members <strong>of</strong> VISA network <strong>and</strong> Point-<strong>of</strong> Saleswipe terminals at Merchant Establishments.iii) The <strong>card</strong> is not transferable or assignable by the <strong>card</strong>holder under any circumstances.iv) The <strong>card</strong> is <strong>and</strong> will be the property <strong>of</strong> <strong>Abhyudaya</strong> <strong>Co</strong>-Op. Bank Ltd. at all times <strong>and</strong> shall bereturned to the Bank immediately upon Bank’s written request unconditionally. The Cardholder isrequested to ensure that the identity <strong>of</strong> the Bank’s Officer is established before h<strong>and</strong>ingover/returning the <strong>card</strong>.v) The Cardholder is required to sign the <strong>card</strong> immediately upon receipt. The <strong>card</strong>holder must notpermit any other person to use it <strong>and</strong> should safeguard the Card from misuse by retaining the Cardunder his personal control at all times.vi) The PIN issued to the Cardholder for use with the Card or any numbers chosen by the Cardholders asa PIN will be known only to the Cardholder <strong>and</strong> is for his personal use <strong>and</strong> is strictly confidential. Awritten record <strong>of</strong> the PIN should not be kept in any form, place or manner that may facilitate its useby a third party. The PIN should not be disclosed to any third party, either to staff <strong>of</strong> the Bank or tomerchant establishments, under any circumstances or by any means whether voluntarily orotherwise.vii) The Cardholder’s account will be <strong>debit</strong>ed immediately with the amount <strong>of</strong> any withdrawal, transfer,valid charges <strong>and</strong> other transactions effected by the use <strong>of</strong> Card. The <strong>card</strong>holder will maintainsufficient funds in the account to meet any such transactions.viii) The Cardholder shall maintain, at all times, such minimum balance in his account as the Bank maydecide from time to time, <strong>and</strong> the Bank may at its discretion, levy such penal or service charges asper Bank’s rules from time to time <strong>and</strong>/or withdraw the Card Facility, if at any time the amount <strong>of</strong>balance falls short <strong>of</strong> the required minimum as aforesaid, without giving any further notice to theCardholder <strong>and</strong>/or without incurring any liability <strong>of</strong> responsibility whatsoever by reason <strong>of</strong> suchwithdrawal.ix)The Cardholder should not use or attempt to use the Card without sufficient funds in the <strong>card</strong>account. In the event <strong>of</strong> payment/<strong>debit</strong> made in excess <strong>of</strong> the balance available in the Cardholder/s<strong>card</strong> account/s for any reason whatsoever, the Cardholder undertakes to repay such overdrawnamount together with interest @18% p.a. or as applicable from time to time <strong>and</strong> charges that may be<strong>debit</strong>ed by the Bank within 3 days <strong>of</strong> such overdrawn amount.x) The Bank shall have the right <strong>of</strong> set <strong>of</strong>f <strong>and</strong> lien irrespective <strong>of</strong> any other lien or charge, present aswell as future on the balances held in the Cardholder’s primary <strong>and</strong>/or secondary account/s or in anyother account whether in single name or joint names to the extent <strong>of</strong> all outst<strong>and</strong>ing dues,whatsoever, arising as a result <strong>of</strong> services extended to <strong>and</strong>/or used by the Cardholder.xi)xii)The Cardholder will be responsible for transactions effected by the use <strong>of</strong> the <strong>card</strong>, whetherauthorized by the Cardholder or not, <strong>and</strong> shall indemnify the Bank against any loss or damage causedby an unauthorized use <strong>of</strong> the Card or related PIN including any penal action arising therefrom onaccount <strong>of</strong> any violation <strong>of</strong> RBI guidelines or rules framed under the FEMA 1999 (as amended) orany other law being in force in India <strong>and</strong>/or any other country/state continent/territory whereverlocated in the world at the time, notwithst<strong>and</strong>ing the termination <strong>of</strong> this agreement.In case <strong>of</strong> joint account, where only one <strong>card</strong> is issued to a joint account holder, the other jointaccount holder/s shall expressly agree with <strong>and</strong> give consent on the application form for issue <strong>of</strong> the<strong>card</strong>. If more than one person signs or agrees to be bound by these <strong>terms</strong> <strong>and</strong> <strong>conditions</strong>, theobligation <strong>of</strong> such persons hereunder will be joint <strong>and</strong> several <strong>and</strong> as the context may require. Anynotice to any such person will be deemed as an effective notification to all such persons:-a) In case <strong>of</strong> joint account, with operational instructions anyone/either or survivor, each <strong>of</strong> the jointaccount holders will be entitled to a <strong>card</strong>, if so requested by all the joint account holders.

) In case <strong>of</strong> any <strong>of</strong> the joint account holder/s gives “STOP OPERATION” instructions, no operationswill be allowed on such Card account/s through the use <strong>of</strong> the Card. Any one or more joint accountholders only in respect <strong>of</strong> such <strong>card</strong> accounts in which he/she is a joint account holder can give the“Stop Payment” instructions.c) All the joint account holders shall jointly instruct the Bank to revoke “Stop Payment Instructions”. Insuch event fresh consent/m<strong>and</strong>ate for continuation <strong>of</strong> such <strong>card</strong> signed by all the joint accountholders would be necessary.xiii) The Cardholder is requested to note that the Card is valid upto the last day <strong>of</strong> the month/yearindicated on the Card. The renewed Card shall be sent by the Bank before the expiry <strong>of</strong> the Card atthe discretion <strong>of</strong> the Bank, upon evaluation <strong>of</strong> the conduct <strong>of</strong> the account. The Bank reserves the soleright <strong>of</strong> renewing your Card account on expiry. The Cardholder undertakes to destroy the expired<strong>debit</strong> <strong>card</strong> by cutting it into several pieces through the magnetic strip.xiv) The Cardholder is required to get passbook /account statement <strong>of</strong> his Card Account updated from thebranch where he is maintaining his Card Account at least once in a month.xv) The Cardholder will inform <strong>Abhyudaya</strong> Bank in writing within 15 days from the statement date <strong>of</strong>any irregularities or discrepancies that exist in the transaction details at an ATM/merchantestablishment on the statement <strong>of</strong> account provided by/available with the <strong>Abhyudaya</strong> Bank on thephysical location or on the website. Whenever <strong>and</strong> whereever practicable, the bank will attempt tosend details <strong>of</strong> the transaction through SMS to the <strong>card</strong>holders registered mobile phone number. If nosuch notice is received during this time, <strong>Abhyudaya</strong> Bank will assume the correctness <strong>of</strong> both thetransaction <strong>and</strong> the statement <strong>of</strong> account.3) FEATURES OF THE INTERNATIONAL DEBIT CARDi) ATM Facilities: The following facilities are available with <strong>Abhyudaya</strong> <strong>Co</strong>-Op. Bank ATMspertaining to the Card Account which shall be <strong>of</strong>fered at the sole discretion <strong>of</strong> the Bank in ATMssubject to change from time to time, without prior noticea) Withdrawal <strong>of</strong> cash by the Cardholder from his <strong>card</strong> account upto a stipulated number <strong>of</strong> occasions<strong>and</strong> limit during the cycle <strong>of</strong> 24 hours, as may be prescribed by the Bank from time to time.b) Enquiry about the balances in the <strong>card</strong> accountsc) Printing <strong>of</strong> Mini Statement <strong>of</strong> Accountd) Change <strong>of</strong> PINi) At <strong>Abhyudaya</strong> <strong>Co</strong>-op. Bank Ltd. Cash Dispensers <strong>and</strong> ATMs <strong>of</strong> other banks which are member <strong>of</strong>VISA/Plus network the following facilities shall be <strong>of</strong>fered, which are subject to change from time totime without any prior notice:-a) Withdrawal <strong>of</strong> cash by the Cardholder from his <strong>card</strong> account upto a stipulated number <strong>of</strong> occasions<strong>and</strong> limit during the cycle <strong>of</strong> 24 hours, as may be prescribed, by the Bank from time to time.b) Enquiry about the balances in the <strong>card</strong> accountsii) PIN is a secret four-digit code number referred to as ATM-PIN, which is assigned by the Bank to theCardholder. The Cardholder will be required to enter the PIN to avail ATM services using the <strong>card</strong>.Cardholder should ensure that the PIN mailed by the Bank is received in a sealed envelope withoutany tampering.iii) The Cardholder is advised to change the PIN immediately through the relevant menu option in BankATM <strong>and</strong> he is also advised to keep the PIN changing at frequent intervals. If the Cardholder forgetsthe PIN, he shall apply to the Bank for the re-generation <strong>of</strong> the PIN. The Bank shall send the newPIN directly to Cardholder’s registered address with the Bank. New PIN may be issued at the solediscretion <strong>of</strong> the Bank, upon request in writing <strong>and</strong> payment <strong>of</strong> the requisite fee.iv) The Bank may from time to time, at its discretion, tie up with various agencies to <strong>of</strong>fer variousfeatures on Debit Cards. All these features would be on best efforts basis only. The Bank does notguarantee or warrant the efficacy, efficiency <strong>and</strong> usefulness <strong>of</strong> any <strong>of</strong> the products or services <strong>of</strong>feredby any service providers/merchants/outlets/agencies. Dispute, if any, would have to be taken up withthe merchant/agency, etc directly, without involving the Bank.

4) ATM USAGEi) The Card is accepted at <strong>Abhyudaya</strong> <strong>Co</strong>-Op. Bank Ltd. NFS ATM network (RuPay) <strong>and</strong> at VISAATMs worldwide.ii) Cash Withdrawals <strong>and</strong> balance enquiry performed by the Cardholder at VISA ATMs in India will besubject to a fee <strong>and</strong> will be <strong>debit</strong>ed to the account at the time <strong>of</strong> such withdrawal <strong>and</strong>/or balanceenquiry transactions. Similar transactions performed by the Cardholder at VISA ATMs in countriesother than India will also be subject to fee, as per prevailing tariff <strong>of</strong> Charges. All transactions at nonBank <strong>of</strong> <strong>Abhyudaya</strong> Bank ATMs whether executed or failed are subjected to the charges asdetermined by the Bank from time to time.iii) For all cash withdrawals, cheque/cash deposits (wherever provided) at Bank’s ATM, anystatements/receipts issued by the ATM at the time <strong>of</strong> deposit or withdrawal shall be deemedconclusive, unless verified <strong>and</strong> intimated otherwise by the Bank. Any such verification shall bedeemed conclusive <strong>and</strong> verified amount will be binding on the Cardholder.iv) The Bank will not be liable for any failure, due to technical problems or Force Majeure events, toprovide any service or to perform any obligation there under.v) Bank will not be liable for any consequential damage arising from or related to loss/use <strong>of</strong> the Card<strong>and</strong>/or related PIN, howsoever caused.vi) The availability <strong>of</strong> ATM services in a country other than India is governed by the local regulations inforce in the said country. The Bank will not be liable if these services are withdrawn without noticethere<strong>of</strong>.5) MERCHANT ESTABLISHMENT USAGEi) The Card is accepted at all electronic Point-<strong>of</strong>-Sale terminals at merchant establishments in India <strong>and</strong>overseas which display the VISA Electron logo.ii) The Card will be accepted only at Merchant Establishments that have EDC swipe terminals. Anyusage <strong>of</strong> the Card other than electronic use will be deemed un-authorized <strong>and</strong> the Cardholder will besolely responsible for such transactions. Please note that PIN is not required for use <strong>of</strong> the Card atEDC machines at Merchant Establishments.iii) The Cardholder is required to sign the sales slip <strong>and</strong> retain a copy <strong>of</strong> the same whenever the Card isused at merchant establishments. Bank will not furnish copies <strong>of</strong> the sales slip. Any sales slip notpersonally signed by the Cardholder but which can be proven, as being authorized by him, will bedeemed to be his liability.iv) The Card is accepted at any <strong>of</strong> VISA Electron Card merchant outlets worldwide. Bank will notaccept any responsibility for any dealings the merchant may have with the Cardholder, including butnot limited to the supply <strong>of</strong> goods <strong>and</strong> services so availed or <strong>of</strong>fered. If the Cardholder has anycomplaint relating to any VISA Electron merchant establishment, he should resolve the matter withthe merchant establishment <strong>and</strong> failure to do so will not relieve him from any obligation to the Bank.v) Bank accepts no responsibility for any charges over <strong>and</strong> above the value/cost <strong>of</strong> transactions leviedby any merchant establishment <strong>and</strong> <strong>debit</strong>ed to Cardholder account alongwith the transaction amount.vi) A purchase <strong>and</strong> a subsequent credit for cancellation <strong>of</strong> goods/services are two separate transactions.The refund will only be credited into Cardholders Account (less cancellation charges) as <strong>and</strong> when itis received from the merchant. Unlike <strong>debit</strong> transactions, credit transactions are not given effectonline, hence if the credit is not posted in <strong>card</strong> account within 30- days from the day <strong>of</strong> refund, theCardholder will notify the Bank, alongwith a copy <strong>of</strong> the credit note from the merchant.vii) In case <strong>of</strong> <strong>card</strong> linked to multiple accounts, transaction at merchant establishments will be effectedonly on the primary account. In case there are insufficient funds in the said account, the Bank willnot honor the transactions even if the necessary funds are available cumulatively or severally in theother accounts linked to the Card.viii) The Card is not to be used at Hotels during check-in for “blocking the amount” as done for credit<strong>card</strong>s <strong>and</strong> also at other merchant establishments where advance payment is required even beforecompletion <strong>of</strong> the purchase transactions or services.

ix) The Card should not be used for any Mail order/Phone purchases <strong>and</strong> any such usages will beconsidered unauthorized <strong>and</strong> the Cardholder shall be solely responsible.x) The Card should not be utilized for payment <strong>of</strong> subscription to foreign magazines/periodicals <strong>and</strong>any such usage will also be considered as unauthorized.xi) The Cardholder agrees to use the Card upto an amount limited for a cycle <strong>of</strong> 24 hours, as may beprescribed by the Bank from time to time.6) INTERNATIONAL USAGEi) The Card is NOT VALID for transactions in Nepal & Bhutan.ii) The Cardholder is required to use the Card strictly in accordance with the Exchange <strong>Co</strong>ntrolRegulations <strong>of</strong> Reserve Bank <strong>of</strong> India. In the event <strong>of</strong> failure to comply with the same, theCardholder will be liable for action under Foreign Exchange Management Act 1999 (as amended)<strong>and</strong> may be debarred from holding the Card from the Bank either at the instance <strong>of</strong> the Bank or RBI.The Cardholder shall indemnify <strong>and</strong> hold Bank harmless from <strong>and</strong>/or against any/all consequencesarising from his not complying with Exchange <strong>Co</strong>ntrol Regulations <strong>of</strong> RBI.iii) The Bank shall be under no liability whatsoever <strong>and</strong> shall be deemed to be indemnified in respect <strong>of</strong>a loss or damage arising directly or indirectly out <strong>of</strong> the decline <strong>of</strong> a charge caused by the Cardholderhaving exceeded the foreign exchange entitlements as prescribed by RBI as issued from time to time.iv) The Card may be used, within the foreign exchange entitlements, as stipulated by RBI from time totime, by Cardholders going abroad for bonafide personal expenses, provided the total exchangedrawn during the trip abroad does not exceed the entitlement import <strong>of</strong> goods, so purchased abroad,into India would be governed by the baggage rules/EXIM policy or any other rules in force. Theentitlement <strong>of</strong> exchange should be ascertained by the Cardholder prior to the trip from the authorizeddealer branches <strong>of</strong> the Bank. The <strong>card</strong> cannot be used for effecting remittances for which the release<strong>of</strong> exchange is not permissible under the extant rules.v) Non-resident Indians can hold the internationally valid <strong>debit</strong> <strong>card</strong>, provided all dues arising out <strong>of</strong> itsuse in India/abroad are met out <strong>of</strong> a NRE account held with the Bank.vi) The Cardholder agrees that every transaction for withdrawal <strong>of</strong> foreign currency will attract a servicefee stipulated by the Bank. The service fee is liable to change without notice.vii) The exchange rate used for all foreign currency transactions will be decided by the Bank/VISA <strong>and</strong>will be binding on the Cardholder.7) FEESi) Bank’s Debit Card is currently <strong>of</strong>fered free <strong>of</strong> charge initially upto 31 st March, 2013 <strong>and</strong> will bereviewed subsequently to primary account holder <strong>and</strong> to ONE joint account holder. However, Bankreserves the right to levy actual fees at a later date without prior notice. Such fees if <strong>and</strong> when leviedwill be <strong>debit</strong>ed to Cardholder’s primary account on the Cardholder’s approval/renewal at Bank’sdiscretion. These fees are not refundable. Charges for other services will be <strong>debit</strong>ed at prevailingrates.ii) Transaction fees for cash withdrawals/balance enquiry wherever applicable, will be <strong>debit</strong>ed to theaccount at the time <strong>of</strong> posting the Cash withdrawal/balance enquiry.iii) All charges in foreign currency will be <strong>debit</strong>ed in the account in India Rupees.The charges for usage <strong>of</strong> the Debit Card may be revised/changed by the Bank from time to timewithout prior intimation to the individual Cardholder.8) LOST OR STOLEN CARDi. If the Card is lost or stolen, the Cardholder must report the loss to the Bank immediately for hotlisting the Card. Card holder can hotlist the <strong>card</strong> by sending SMS “HOTC” from his registeredmobile with the Bank to “5667717”. Card holder transacting internationally can avail this facilityonly if the registered mobile is equipped with International roaming facility. Though the loss or theftmay be reported by means <strong>of</strong> the 24 hours Customer Service, at his own expenses, the Cardholder

must confirm the same in writing to the Bank as soon as possible. A copy <strong>of</strong> the acknowledgedpolice complaint must accompany the said written confirmation.ii. If the Cardholder loses his <strong>card</strong> overseas, he may either follow the above procedure or may reportthe loss through the VISA Global Emergency Assistance (VGEA) help line. In case the Cardholderuses the VGEA services, then the charges for the usage <strong>of</strong> such services shall be borne by theCardholder.iii. After the loss/theft is reported to the Bank followed by written confirmation, the Cardholder isprotected from any financial liability arising from any purchase transaction done on his <strong>card</strong> from thetime <strong>card</strong> holder reports the loss to the Bank. It may please be noted that during the process <strong>of</strong>blocking the <strong>card</strong> NO SUCH COVERAGE will be available on the CASH withdrawals done throughATMs as such transactions are governed by PIN, which is confidential to Cardholder only.iv. The Cardholder agrees to indemnify the Bank fully against any liability (civil or criminal), loss,cost, expenses or damages that may arise due to loss or misuse <strong>of</strong> the Card in the event that it is lost<strong>and</strong> not reported to the Bank or lost <strong>and</strong> misused before it is reported to the Bank.v. The replacement <strong>card</strong> may be issued at the sole discretion <strong>of</strong> the Bank after receipt <strong>of</strong> written request<strong>and</strong> upon payment <strong>of</strong> requisite fees, provided the Cardholder has complied with the <strong>terms</strong> <strong>and</strong><strong>conditions</strong> in all respects.vi. If the lost/stolen <strong>card</strong> is subsequently recovered, the Cardholder shall not use the same <strong>and</strong> destroythe Card by cutting it into several pieces through the magnetic strip.9) DISCLOSURE OF INFORMATIONi. THE Cardholder shall provide any information, records or certificates relating to any matters that theBank deems necessary, as <strong>and</strong> when requested by Bank. The Cardholder will also authorize the Bankto verify the veracity <strong>of</strong> the information furnished by whatever means or from whichever sourcedeemed necessary. If the Cardholder declines to provide the information or provides incorrectinformation, the Bank at its sole discretion may refuse renewal <strong>of</strong> the <strong>card</strong> or cancel the <strong>card</strong>forthwith.ii. The Bank reserves the right to disclose, in strict confidence, to other institutes, such informationconcerning the Cardholder’s account as may be necessary or appropriate in connection to itsparticipation in any Electronic Fund Transfer Network.iii. The Bank also reserves the right to disclose customer information to any court <strong>of</strong> competentjurisdiction, quasi-judicial authorities, law enforcement agencies <strong>and</strong> any other wing <strong>of</strong> Central orState Government or as provided under law.iv. The Bank reserves the right to report to the RBI, expenditure undertaken by its Cardholders, inforeign currencies to ensure that the Basic Travel Quota/other permissible entitlements are notexceeded by the Cardholder(s) <strong>and</strong> that FEMA 1999 is not contravened.10) INSURANCEi) Insurance benefit is not provided on the <strong>card</strong> by the Bank. If however the <strong>card</strong>holder desires to haveInsurance benefit then the Bank would make available the Insurance at the cost to be borne solely bythe Cardholder.ii) Where Insurance is taken by the Cardholder, the Bank does not hold any warranty <strong>and</strong>/or makerepresentation about quality, delivery <strong>of</strong> the cover, claim processing <strong>and</strong> settlement <strong>of</strong> the claim bythe Insurance <strong>Co</strong>mpany, in any manner whatsoever.iii) The Insurance <strong>Co</strong>mpany may ask the Cardholder to submit additional documents <strong>and</strong>/or information,as per the requirement <strong>of</strong> the claim.iv) The Bank shall not be liable for any delayed settlement <strong>of</strong> the claim or for non sanction or lessersanction <strong>of</strong> Insurance claim. The Bank holds no responsibility whatsoever regarding Insurance on the<strong>card</strong>.

11) STATEMENT AND RECORDSi. The records <strong>of</strong> Card Transactions will be available on the account statement issued by the Bank<strong>and</strong>/or account passbook which is to be got updated by the customer. It will be obligatory on the part<strong>of</strong> the customer to get his passbook updated from the branch where he is maintaining Card account atleast once in a month. Any discrepancy in the statement or transactions must be reported by theCardholder to the Bank within 15 days from the statement date.ii. The Bank’s record <strong>of</strong> transactions processed by the use <strong>of</strong> the Card shall be conclusive <strong>and</strong> bindingfor all purposes.12) DISPUTESi. In case <strong>of</strong> purchase transactions, a sales slip with the signature <strong>of</strong> the Cardholder together with the<strong>card</strong> number noted thereon shall be conclusive evidence between the Bank <strong>and</strong> the Cardholder as tothe extent <strong>of</strong> the liability incurred by the Cardholder. The Bank shall not be required to ensure thatthe Cardholder has received the goods purchased/availed <strong>of</strong> the services to his satisfaction.ii. The Bank shall make bonafide <strong>and</strong> reasonable efforts to resolve an aggrieved Cardholder’sdisagreement with an applicable charge indicated in the account statement/passbook or as otherwisedetermined by the customer within 45 days <strong>of</strong> the receipt <strong>of</strong> notice <strong>of</strong> disagreement. If after sucheffort Bank determines that the charge is correct then it shall communicate the same to theCardholder.iii. The Bank accepts no responsibility for the refusal by any establishment to honor the Card whetherdue to technical reason or otherwise.iv. This agreement will be construed in accordance with <strong>and</strong> governed by the laws <strong>of</strong> India. All disputesare subject to the exclusive jurisdiction <strong>of</strong> the <strong>Co</strong>urts <strong>of</strong> Mumbai, India, irrespective <strong>of</strong> whether theapplication for issuance <strong>of</strong> <strong>card</strong> was submitted to any branch <strong>of</strong> the Bank, in India or even where anyother <strong>Co</strong>urt may have concurrent jurisdiction in the matter.v. The Cardholder shall be liable for all the costs associated with the collection <strong>of</strong> dues <strong>and</strong> legalexpenses.13) General1. You will promptly notify <strong>Abhyudaya</strong> Bank in writing <strong>of</strong> any change in your employment <strong>and</strong>/or<strong>of</strong>fice <strong>and</strong>/or residential address <strong>and</strong> telephone number.2. <strong>Abhyudaya</strong> Bank reserves the right to add, delete or modify any <strong>of</strong> the <strong>terms</strong> <strong>and</strong> <strong>conditions</strong>,policies, features <strong>and</strong> benefits which would be made available on the website <strong>of</strong> the Bankwww.abhyudayabank.co.in. Use <strong>of</strong> the <strong>card</strong> after update on the website constitutes your acceptanceto the revised <strong>terms</strong>.3. If a <strong>card</strong>holder, by using the <strong>card</strong>, draws an amount in excess <strong>of</strong> the <strong>card</strong> balance available oroverdraft limit permitted by <strong>Abhyudaya</strong> Bank, the <strong>card</strong>holder will pay <strong>Abhyudaya</strong> Bankunconditionally the entire amount overdrawn with interest <strong>and</strong> penalties, if any, at a rate <strong>of</strong> 18% p.aor such rate as the Bank may decide. However this should not be construed as an agreement, eitherexpressed or implied that <strong>Abhyudaya</strong> Bank is bound to grant any overdraft facility whatsoever.4. <strong>Abhyudaya</strong> Bank makes no representations about the quality <strong>of</strong> the goods <strong>and</strong> services <strong>of</strong>fered bythird parties providing benefits such as discounts to Cardholders. <strong>Abhyudaya</strong> Bank will not beresponsible if the service is in any way deficient or otherwise unsatisfactory.14) LIMITATION OF BANK’S LIABILITYi. The Bank shall not be liable to the Customer or to any third party, for any loss or damage suffereddue to the following reasons:-

a) Any action carried on by the Bank, based upon the instructions <strong>of</strong> the Customer by exercising duediligence <strong>and</strong> reasonable care.b) Any action carried on by the Bank in good faith based upon the instructions <strong>of</strong> the customer.c) Any unauthorized <strong>and</strong> illegal transactions occurring through the use <strong>of</strong> Bank Account(s), which canbe attributed to the fraudulent or negligent conduct <strong>of</strong> the customer.d) Intrusion or hacking into the computer system/network or communication network <strong>of</strong> the Bank.e) Failure to carry out any instructions <strong>of</strong> the Customer due to insufficiency <strong>of</strong> balance in theCustomer’s bank account(s).f) Failure <strong>of</strong> the customer to access the Bank account due to any Force Majeure Event or any TechnicalProblems or any other reason beyond the control <strong>of</strong> the Bank.g) Failure <strong>of</strong> the customer to inform the Bank when the Customer’s Bank account is being illegally usedby third parties for carrying out unauthorized <strong>and</strong> illegal transactions.h) Failure <strong>of</strong> the Customer to keep confidential <strong>and</strong> secure, PIN or any passwords, keywords or otheridentification marks given to the Customer for operating <strong>of</strong> the Bank account <strong>and</strong>/or <strong>card</strong>.i) Failure <strong>of</strong> the Customer to inform the Bank regarding any changes in the Customer’s Personalinformation or Account information or other material information.j) Violation <strong>of</strong> any foreign Lawk) Breach <strong>of</strong> any <strong>of</strong> the other <strong>terms</strong> <strong>and</strong> <strong>conditions</strong> stated herein by the customer. Under nocircumstances shall the Bank be liable for any damages, whatsoever whether such damages aredirect, indirect, incidental, consequential <strong>and</strong> irrespective <strong>of</strong> whether any claim is based on loss <strong>of</strong>revenue, investment, production, goodwill, pr<strong>of</strong>it, interruption <strong>of</strong> business or any other loss <strong>of</strong> anycharacter <strong>of</strong> whatsoever nature <strong>and</strong> whether sustained by the Customer or any other third party.15) Termination1. <strong>Abhyudaya</strong> Bank reserves the rights to cancel/withdraw the <strong>debit</strong> Card or any <strong>of</strong> the other services<strong>of</strong>fered at any time without prior notice <strong>and</strong> without assigning any reason.2. In the event that the <strong>card</strong>holder decides to terminate the use <strong>of</strong> the VISA Card, the Cardholder shallgive <strong>Abhyudaya</strong> Bank not less than 7 days prior notice in writing <strong>and</strong> forthwith return the Card <strong>and</strong>any additional <strong>card</strong>holder Cards (if not required) cut into several pieces through the magnetic strip, to<strong>Abhyudaya</strong> Bank. The Cardholder will be responsible for all the <strong>card</strong> facilities <strong>and</strong> related chargesincurred on the VISA Card after the Cardholder claims to have destroyed the Card, not withst<strong>and</strong>ingthe termination <strong>of</strong> the applicability <strong>of</strong> these <strong>terms</strong> <strong>and</strong> <strong>conditions</strong>. The Cardholder will be responsiblefor all the charges incurred on the VISA Card whether or not the same are a result <strong>of</strong>misuse/fraudulent use <strong>and</strong> whether or not the Bank has been intimated <strong>of</strong> the destruction <strong>of</strong> the Card.3. The VISA Card issued by the Bank is the property <strong>of</strong> <strong>Abhyudaya</strong> Bank <strong>and</strong> must be returned to anOfficer <strong>of</strong> <strong>Abhyudaya</strong> Bank immediately <strong>and</strong> unconditionally upon request. Please ensure that theidentity <strong>of</strong> the Bank Officer is established by you before h<strong>and</strong>ing over your <strong>card</strong>.4. <strong>Abhyudaya</strong> Bank shall be entitled to terminate the VISA Card facility with immediate effect bysending written notice to the Cardholder <strong>and</strong> the Card shall be returned to the Bank upon theoccurrence <strong>of</strong> any <strong>of</strong> the following events:i) Failure to comply with the <strong>terms</strong> <strong>and</strong> <strong>conditions</strong> herein set forth.ii) An event <strong>of</strong> default under an agreement or commitment (contingent or otherwise) entered into with<strong>Abhyudaya</strong> Bank.iii) The Cardholder becoming the subject <strong>of</strong> any bankruptcy, insolvency proceedings or proceedings <strong>of</strong> asimilar nature.iv) Demise <strong>of</strong> the Cardholder.5. If there is any change in the features <strong>of</strong> the Card <strong>and</strong> it is deemed necessary by the Bank to withdrawsuch <strong>card</strong>s then also the VISA Card should be returned to <strong>Abhyudaya</strong> Bank prior to the date uponwhich any changes are to take effect. In case <strong>of</strong> the Cardholder’s rejection <strong>of</strong> any <strong>of</strong> the proposedchanges to the features, charge or <strong>terms</strong> <strong>and</strong> <strong>conditions</strong> applicable to the Card, even then the VISA<strong>card</strong> should be returned to <strong>Abhyudaya</strong> Bank.

For Internet Merchant Transactions/Payment/Ticketing, the Bank has dual factorauthentication from Verified by VISA.Terms <strong>and</strong> <strong>Co</strong>nditions For Verified By Visa® Secure<strong>Co</strong>de “Provided By <strong>Abhyudaya</strong> Bank.Welcome to the <strong>Abhyudaya</strong> Bank Verified by VISA Secure<strong>Co</strong>de authentication service (“3DS”).Please read this Terms <strong>of</strong> Service Agreement carefully before using Verified by VISA Secure<strong>Co</strong>de.In this Agreement, “Issuer” refers to the financial institution that issued your Credit/Debit/TravelCurrency Card; “we”, “us”, <strong>and</strong> “our” refer to Issuer <strong>and</strong> its suppliers <strong>of</strong> <strong>card</strong> processing <strong>and</strong> webhostingservices; <strong>and</strong> “you”, “your”, or “yours” refers to the VISA <strong>card</strong>holder using Verified byVISA Secure<strong>Co</strong>de.This Terms <strong>of</strong> Service Agreement supplements <strong>and</strong> is incorporated in Issuer’s <strong>card</strong>holderagreement(s) with you (“Cardholder Agreement”).In addition to this Terms <strong>of</strong> Service Agreement, Verified by VISA Secure<strong>Co</strong>de also is subject to theCardholder Agreement governing the <strong>card</strong> transactions for which Verified by VISA Secure<strong>Co</strong>de isused.16. ACCEPTANCE OF TERMSa) Verified by VISA Secure<strong>Co</strong>de provides its service to you, subject to the following Terms <strong>of</strong>Service (“TOS”) <strong>and</strong> the Cardholder Agreement governing the <strong>card</strong> transactions for whichVerified by VISA Secure<strong>Co</strong>de is used. The TOS may be updated by us from time to timewithout notice to you. Use <strong>of</strong> the service constitutes your acceptance <strong>of</strong> the <strong>terms</strong>. In addition,when using Verified by VISA Secure<strong>Co</strong>de, you shall be subject to any guidelines or rulesapplicable to Verified by VISA Secure<strong>Co</strong>de that may be posted from time to time at the samewebsite.b) You agree that creation <strong>of</strong> a Verified by VISA Secure<strong>Co</strong>de account password, <strong>and</strong>/or use <strong>of</strong>Verified by VISA Secure<strong>Co</strong>de, will represent your acceptance <strong>of</strong> this TOS, <strong>and</strong> thatcontinued use <strong>of</strong> Verified by VISA Secure<strong>Co</strong>de after revisions to this TOS shall constituteyour agreement to such revised <strong>terms</strong> <strong>and</strong> any applicable posted guidelines or rules.c) Unless explicitly stated otherwise, any new features that augment, enhance or otherwisechange Verified by VISA Secure<strong>Co</strong>de shall be subject to this TOS.d) The Issuer reserves the right at any time <strong>and</strong> from time to time to modify or discontinue,temporarily or permanently, Verified by VISA Secure<strong>Co</strong>de (or any part there<strong>of</strong>) with orwithout notice.17. DESCRIPTION OF Verified by VISA Secure<strong>Co</strong>deVerified by VISA Secure<strong>Co</strong>de provides you with a way <strong>of</strong> increasing security in online <strong>and</strong>other transactions for which Verified by VISA Secure<strong>Co</strong>de is used, by reducing the chances<strong>of</strong> fraud for those transactions. Registering for Verified by VISA Secure<strong>Co</strong>de involvesproviding personal information to us, which is then used to confirm your identity inconnection with future online transactions or other transactions for which Verified by VISASecure<strong>Co</strong>de is used, as discussed in more detail in Section 20 below. Verified by VISASecure<strong>Co</strong>de also may be used for record keeping <strong>and</strong> reporting purposes, as well as to helpresolve any transaction disputes. Your Registration Data, as defined in Section 18 (ii), <strong>and</strong>other personal information is not shared with the merchant, as discussed in more detail inSection 21 below.18. YOUR REGISTRATION OBLIGATIONSYou agree to (i) provide true, accurate, current <strong>and</strong> complete information about yourself asprompted by Verified by VISA Secure<strong>Co</strong>de’s registration form (“Registration Data”) <strong>and</strong> (ii)maintain <strong>and</strong> promptly update the Registration Data to keep it true, accurate, current <strong>and</strong>

complete. If you provide any Registration Data that is untrue, inaccurate, not current orincomplete, or if we have reasonable grounds to suspect that your Registration Data is untrue,inaccurate, not current or incomplete, we have the right to suspend, terminate, or refuse yourcurrent or future use <strong>of</strong> Verified by VISA Secure<strong>Co</strong>de or your <strong>card</strong> account.19. REGISTRATIONa) In order to use Verified by VISA Secure<strong>Co</strong>de, you must provide certain information to usthat allows us to validate your identity <strong>and</strong> verify that you are the owner <strong>of</strong> or an authorizeduser <strong>of</strong> the specified Credit/Debit/Travel Currency Card(s). The information that you providemay be validated against information we already have on file that is associated with you, yourCredit/Debit/Travel Currency Card(s).b) If you are unable to provide adequate information for us to validate your identity, we have theright to not allow you to register for Verified by VISA Secure<strong>Co</strong>de. You warrant that theRegistration Data is correct <strong>and</strong> that you have the legal right to use all <strong>of</strong> theCredit/Debit/Travel Currency Cards that you register for Verified by VISA Secure<strong>Co</strong>de.c) If you do not successfully register for Verified by VISA Secure<strong>Co</strong>de, the merchant may notaccept your VISA Credit/Debit/Travel Currency Card (s) in payment for an e-commerce orother transaction subject to verified by VISA Secure<strong>Co</strong>de.d) In order to use Verified by VISA Secure<strong>Co</strong>de, you must have the ability to access the WorldWide Web <strong>and</strong> must pay any service fees associated with such access. In addition, you musthave the equipment necessary to make such a connection to the World Wide Web, includinga computer <strong>and</strong> modem or other access device.e) In the event you have a question regarding the Verified by VISA Secure<strong>Co</strong>de registrationprocess or a transaction using Verified by VISA Secure<strong>Co</strong>de, you should direct that questionto Issuer’s customer service department.20. AUTHENTICATIONa) During registration in Verified by VISA Secure<strong>Co</strong>de, you may be asked to select or may beprovided a password <strong>and</strong> hint-<strong>and</strong>-response question <strong>and</strong> answer. When engaging in an onlinetransaction or other transaction for which Verified by VISA Secure<strong>Co</strong>de is used, you may beasked for your Verified by VISA Secure<strong>Co</strong>de password or hint response before the merchantaccepts your VISA Card in payment for the transaction. If you are unable to provide yourVerified by VISA Secure<strong>Co</strong>de password or hint response, or if the authentication throughVerified by VISA Secure<strong>Co</strong>de otherwise fails, the merchant may not accept your VISACredit/Debit/Travel Currency Card in payment for that transaction.b) By registering in Verified by VISA Secure<strong>Co</strong>de, you assent to the use <strong>of</strong> Verified by VISASecure<strong>Co</strong>de to evidence your identity, including the authorization <strong>of</strong> transactions authorizedin advance to recur at substantially regular intervals.21. CARDHOLDER PASSWORD AND SECURITYYou are solely responsible for maintaining the confidentiality <strong>of</strong> your password, RegistrationData <strong>and</strong> other verification information established by you with Verified by VISASecure<strong>Co</strong>de, <strong>and</strong> all activities that occur using your password, Registration Data or otherverification information supplied to or established by you with Verified by VISASecure<strong>Co</strong>de. You agree not to transfer or sell your use <strong>of</strong>, or access to, Verified by VISASecure<strong>Co</strong>de to any third party. You agree to immediately notify us <strong>of</strong> any unauthorized use <strong>of</strong>your password or other verification information, or any other breach <strong>of</strong> security. Youacknowledge <strong>and</strong> agree that, except as otherwise provided by Applicable Law or in theCardholder Agreement, we shall not be liable for any loss or damage arising from yourfailure to comply with this TOS. It is our policy not to seek/send information such asinformation on user id <strong>and</strong> password <strong>of</strong> your internet banking facility through email. In caseyou receive any email from an address appearing to be sent by us, advising you <strong>of</strong> any

changes made in your personal information, account details or information on youruser id <strong>and</strong> password <strong>of</strong> your internet-banking facility, PLEASE DO NOT RESPOND.22. PRIVACY OF REGISTRATION DATAa) Verified by VISA Secure<strong>Co</strong>de stores your Registration Data. Your Registration Data will notbe shared with online retail merchants or merchants in other transactions for which Verifiedby VISA Secure<strong>Co</strong>de is used.b) You acknowledge <strong>and</strong> agree that Verified by VISA Secure<strong>Co</strong>de may keep your Registrationdata <strong>and</strong> also may disclose your Registration Data if required to do so by Applicable Law inthe good faith belief that such preservation or disclosure is permitted by Applicable Law, oras reasonably necessary to (i) comply with legal process or (ii) enforce this TOS.23. YOUR CONDUCTYou agree not to:a) Impersonate any person or entity using Verified by VISA Secure<strong>Co</strong>de;b) Upload, post, email or otherwise transmit any material that contains s<strong>of</strong>tware viruses or anyother computer code, files or programs designed to interrupt, destroy or limit the functionality<strong>of</strong> any computer s<strong>of</strong>tware or hardware or telecommunications equipment used by Verifed byVISA Secure<strong>Co</strong>de;c) Spam or flood the Verified by VISA Secure<strong>Co</strong>de Website or service;d) Modify, adapt, sub-license, translate, sell, reverse engineer, decompile or disassemble anyportion <strong>of</strong> the Verified by VISA Secure<strong>Co</strong>de Website or service <strong>of</strong> the s<strong>of</strong>tware used inconnection with verified by VISA Secure<strong>Co</strong>de;e) Remove any copyright, trademark, or other proprietary rights notices contained in Verified byVISA Secure<strong>Co</strong>de;f) “Frame” or “Mirror” any part <strong>of</strong> the Verified by VISA Secure<strong>Co</strong>de Website or servicewithout VISA’s prior written authorization;g) Use any robot, spider, site search/retrieval application, or other manual or automatic device orprocess to retrieve, index “data mine”, or in any way reproduce or circumvent thenavigational structure or presentation <strong>of</strong> the Verified by VISA Secure<strong>Co</strong>de Website orservice or its contents;h) Otherwise interfere with, or disrupt, Verified by VISA Secure<strong>Co</strong>de or servers or networksconnected to Verified by VISA Secure<strong>Co</strong>de, or violate this TOS or any requirements,procedures, policies or regulations <strong>of</strong> Verified by VISA Secure<strong>Co</strong>de or <strong>of</strong> any networksconnected to Verified by VISA Secure<strong>Co</strong>de; ori) Intentionally or unintentionally violate any applicable local, state, national or internationalstatute, regulation, regulatory guideline or judicial or administrative interpretation, or any ruleor requirement established by VISA (all <strong>of</strong> which shall constitute “Applicable Law”) inconnection with your use <strong>of</strong> Verified by VISA Secure<strong>Co</strong>de.24. LIABILITYa) Under no circumstances will we be liable for consequential, incidental, special or indirectlosses or other damages, such as any damage to your computer or telephone service resultingfrom your use <strong>of</strong> Verified by VISA Secure<strong>Co</strong>de.b) We assume no responsibility for <strong>and</strong> will not be liable for, any damages to, or any viruseswhich may affect, your computer equipment or other property on account <strong>of</strong> your access to,use <strong>of</strong>, or downloading from this web site.25. TERMINATIONa) If you want to end your ability to use Verified by VISA Secure<strong>Co</strong>de, you must call Issuer’scustomer service department so that your password <strong>and</strong> Registration Data with Verified byVISA Secure<strong>Co</strong>de can be deactivated. Any purchases you made using Verified by VISASecure<strong>Co</strong>de prior to deactivation will not be affected.

) We may temporarily or permanently deactivate your ability to use verified by VISASecure<strong>Co</strong>de <strong>and</strong> terminate your relationship with us at any time, with or without fault on yourpart. For your protection, we may automatically deactivate your ability to use Verified byVISA Secure<strong>Co</strong>de if it is not used at least one time during any six (6) month period. IF wedeactivate your ability to use Verified by VISA Secureode, we may without being bound todo so give you notice at the most on current e-mail address you have provided to us asreflected in our records.26. DEALINGS WITH MERCHANTSYour correspondence or business dealings with, or participation in promotions <strong>of</strong>, onlineretail or other merchants on or through Verified by VISA Secure<strong>Co</strong>de, including payment<strong>and</strong> delivery <strong>of</strong> related goods or services, <strong>and</strong> any other <strong>terms</strong>, <strong>conditions</strong>, warranties orrepresentations associated with such dealings, are solely between you <strong>and</strong> such merchant.You agree that, except as otherwise provided by Applicable Law or in our CardmemberAgreement with you, we will not be responsible or liable for any loss or damage <strong>of</strong> any sortincurred as the result <strong>of</strong> any such dealings. You underst<strong>and</strong> that use <strong>of</strong> Verified by VISASecure<strong>Co</strong>de does not, in any way, indicate that we recommend or endorse any merchant,regardless <strong>of</strong> whether the merchant participates in verified by VISA Secure<strong>Co</strong>de. It is madeclear that Verified by VISA Secure<strong>Co</strong>de does not verify the identity <strong>of</strong> the merchant or thequality <strong>of</strong> the merchant’s goods or services.27. DISCLAIMER OF WARRANTIESa) You expressly underst<strong>and</strong> <strong>and</strong> agree that any s<strong>of</strong>tware obtained through the use <strong>of</strong> Verifiedby VISA Secure<strong>Co</strong>de is downloaded <strong>and</strong> used at your own discretion <strong>and</strong> risk <strong>and</strong> that exceptas otherwise provided in this TOS Agreement, you will be solely responsible for any damageto your computer system or loss <strong>of</strong> data that results from the download or use <strong>of</strong> any suchs<strong>of</strong>tware or other materials through Verified by VISA Secure<strong>Co</strong>de.b) Except As Otherwise Required By Any Applicable State Law, We Make No RepresentationsOr Warranties About Verified By VISA Secure<strong>Co</strong>de Of Any Kind, Express Or Implied,Including Any Warranties As To Merchantability OR Fitness For A Particular Purpose.28. NOTICENotices to you regarding the Verified by VISA Secure<strong>Co</strong>de Terms <strong>of</strong> Service may be madeeither via email or regular mail to the address that you have provided to us in connection withany <strong>of</strong> your accounts with us, or your Credit/Debit/Travel Currency <strong>card</strong>s issued or otherwiseprovided by us.29. AGE AND RESPONSIBILITYYou represent that you are <strong>of</strong> sufficient legal age to use Verified by VISA Secure<strong>Co</strong>de <strong>and</strong> tocreate binding legal obligations for any liability you may incur as a result <strong>of</strong> the use <strong>of</strong>Verified by VISA Secure<strong>Co</strong>de. Except as otherwise provided by Applicable Law or in ourCardmember Agreement with you, you underst<strong>and</strong> that you are financially responsible for alluses <strong>of</strong> Verified by VISA Secure<strong>Co</strong>de by you <strong>and</strong> those authorized by you to use yourRegistration Data, your password or other verification information.