Know more... - Abhyudaya Co-operative Bank Ltd.

Know more... - Abhyudaya Co-operative Bank Ltd.

Know more... - Abhyudaya Co-operative Bank Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

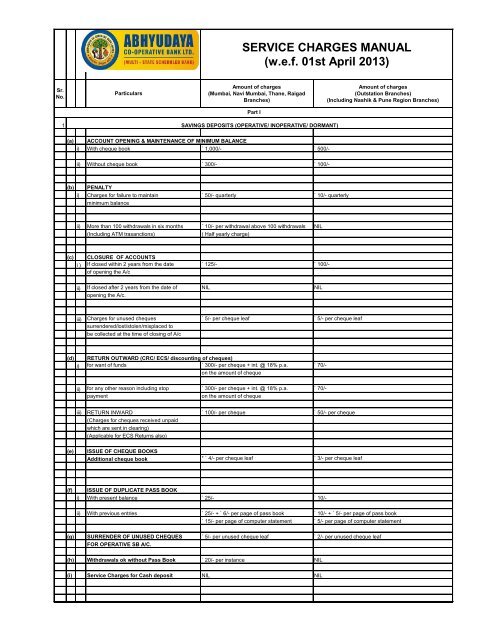

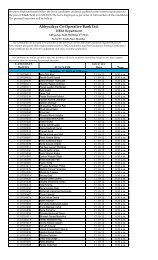

SERVICE CHARGES MANUAL(w.e.f. 01st April 2013)Sr.No.ParticularsAmount of charges(Mumbai, Navi Mumbai, Thane, RaigadBranches)Amount of charges(Outstation Branches)(Including Nashik & Pune Region Branches)Part I1SAVINGS DEPOSITS (OPERATIVE/ INOPERATIVE/ DORMANT)(a)ACCOUNT OPENING & MAINTENANCE OF MINIMUM BALANCEi) With cheque book ` 1,000/- ` 500/-ii) Without cheque book ` 300/- ` 100/-(b)PENALTYi) Charges for failure to maintain ` 50/- quarterly ` 10/- quarterlyminimum balanceii) More than 100 withdrawals in six months ` 10/- per withdrawal above 100 withdrawals NIL(Including ATM trasanctions)( Half yearly charge)(c)CLOSURE OF ACCOUNTSi ) If closed within 2 years from the date ` 125/- ` 100/-of opening the A/cii) If closed after 2 years from the date of NIL NILopening the A/c.iii) Charges for unused cheques ` 5/- per cheque leaf ` 5/- per cheque leafsurrendered/lost/stolen/misplaced tobe collected at the time of closing of A/c(d)RETURN OUTWARD (CRC/ ECS/ discounting of cheques)i) for want of funds ` 300/- per cheque + int. @ 18% p.a. ` 70/-on the amount of chequeii) for any other reason including stop ` 300/- per cheque + int. @ 18% p.a. ` 70/-paymenton the amount of chequeiii) RETURN INWARD ` 100/- per cheque ` 50/- per cheque(Charges for cheques received unpaidwhich are sent in clearing)(Applicable for ECS Returns also)(e)ISSUE OF CHEQUE BOOKSAdditional cheque book * ` 4/- per cheque leaf ` 3/- per cheque leaf(f)ISSUE OF DUPLICATE PASS BOOKi) With present balance ` 25/- ` 10/-ii) With previous entries ` 25/- + ` 6/- per page of pass book ` 10/- + ` 5/- per page of pass book` 15/- per page of computer statement ` 5/- per page of computer statement(g) SURRENDER OF UNUSED CHEQUES ` 5/- per unused cheque leaf ` 2/- per unused cheque leafFOR OPERATIVE SB A/C.(h) Withdrawals ok without Pass Book ` 20/- per instance NIL(i) Service Charges for Cash deposit NIL NIL

Sr.No.ParticularsAmount of charges(Mumbai, Navi Mumbai, Thane, RaigadBranches)Amount of charges(Outstation Branches)(Including Nashik & Pune Region Branches)Part I(a) Issue of Duplicate receipt (to be ` 25/- ` 25/-issued in the form of Certificate)(b) DDS accounts Please contact Branch Manager Please contact Branch ManagerClosure of account before maturity(c) Recurring Deposit * ` 1.50 for every ` 100/- per month * ` 1.50 for every ` 100/- per month(Penalty for delayed payment) (i.e. 15 paise per ` 10/-) (i.e. 15 paise per ` 10/-)(d) Service Charges for Cash deposits NIL NIL4LOANS & ADVANCES, CASH CREDIT, FLXLN & SOD A/CS(a)PROCESSING CHARGES FOR NEW APPLICATIONS (NON-REFUNDABLE) ONLY/ IN PRINCIPLE ACCEPTANCE& TAKE OVER PROPOSALS ( EXCEPT HOUSING LOANS)i) Upto ` 10 Lakh NIL NILii) Above ` 10 Lakh 0.10% of the amount applied* 0.10% of the amount applied*(Maximum ` 25,000/-) (Maximum ` 25,000/-)(b)SERVICE CHARGES FORi) Cash Credit, Bill Discounting & WCTL 1.3% for first sanctioned limit & subsequently 0.70% for first sanctioned limit & subsequently(Except OD against FDRs & FLXLN)on enhanced limit subject to max. ` 25.00 Lakh on enhanced limit subject to max. ` 25.00 Lakh(Per party in case of combined facilities) (Per party in case of combined facilities)ii) For all SOD IMP A/cs @ 1.30% on amount sanctioned @ 0.70% on amount sanctionediii) For Secured Overdraft (SOD) & Loans 0.70% of loan amount subject to 0.70% of loan amount subject toagainst collateral securities like NSCs/ minimum ` 100/- maximum ` 1000 minimum ` 100/- maximum ` 1000RBI Bonds/ LIP/ KVPiv)TERM LOAN (All Types)(Except loan against term deposit & FLXLN) 1.3% of sanctioned limit subject to 0.70% of sanctioned limit subject tomaximum ` 25.00 Lakh (Per party inmaximum ` 25.00 Lakh (Per party incase of combined facilities)case of combined facilities)v) Gold Loans & SODGLD @ 0.7% of loan amount subject to @ 0.7% of loan amount subject tominimum ` 100/- maximum ` 1000 minimum ` 100/- maximum ` 1000Maximum ` 500 - Udupi Region Branches onlyvi) Housing Loan 0.7% of sanctioned limit 0.7% of sanctioned limit(Refer Office Order No.302)(Refer Office Order No.302)vii) Short Term <strong>Co</strong>rporate Loan (STCL) 1.3% of sanctioned limit 0.7% of sanctioned limit(c)viii) Bill discounted under LC 0.1% of sanctioned limit subject to 0.1% of sanctioned limit subject tominimum of ` 250/- minimum of ` 250/-(to be collected at the time of discounting of bill)(to be collected at the time of discounting of bill)NOTICE TO DEFAULTERS* LOANSi) D-1 Notice ` 20/- ` 20/-ii) D-2 Notice ` 25/- ` 25/-iii) D-3 Notice ` 30/- ` 30/-iv) D-4 & Subsequent Notices ` 60/- if sent by Reg. A. D. otherwise ` 30/- ` 60/- if sent by Reg. A. D. otherwise ` 30/-v) Advocate Notice ` 350/- ` 350/-vi) Case file charges Actual Actualvii) Visit charges per visit to borrower/ ` 115/- per visit (Only if visit notice is served) ` 115/- per visit (Only if visit notice is served)sureties for recovery purpose3* CASH CREDIT ACCOUNTSi) D-22 Notice ` 30/- ` 30/-ii) D-23 Notice ` 35/- ` 35/-iii) Renewal reminder notice ` 35/- ` 35/-iv) Notice for non-operation in account ` 35/- ` 35/-for <strong>more</strong> than 3 monthsv) Advocate notice ` 460/- ` 460/-

Sr.No.ParticularsAmount of charges(Mumbai, Navi Mumbai, Thane, RaigadBranches)Amount of charges(Outstation Branches)(Including Nashik & Pune Region Branches)vi) Case file charges Actual Part IActualvii) Visit charges for recovery/ ` 115/- per visit (Only if visit notice is served) ` 115/- per visit (Only if visit notice is served)non-renewal/non-operationviii) Non display of <strong>Bank</strong>'s name board at ` 300/- ` 300/-place of business/office/factorypremises/on machinery/on vehicle(d)(e)STATUTORY NOTICEi) Issued u/s 13 (2) of SARFAESI Act ` 2,000/- ` 2,000/-ii) Reconveyance of Mortgaged Property ` 1,000/- + actual stamp duty ` 1,000/- + actual stamp dutyVEHICLE ETC.i) Issue of NOC to RTO ` 50/- ` 30/-ii) Issue of HPTR to RTO ` 50/- ` 30/-iii) Seizing chargesa) Two wheeler/three wheeler ` 1,000/- ` 600/-b) Light motor vehicle ` 1,200/- ` 750/-c) Heavy vehicle ` 3,000/- ` 2,000/-d) Excavators & cranes ` 10,000/- or actual outsourcing charges ` 5,000/- or actual outsourcing chargesas approved.as approved.(f) i) SEALING/ POSSESSION OF IMMOVABLEPROPERTIESa) Flat/Stall/Gala/Shop/Bunglow ` 2,000/- ` 2,000/-b) Factory Premises/Industrial Unit ` 5,000/- ` 5,000/-c) Possession of Flat/ Stall/ Gala/ Shop/Bunglow through <strong>Co</strong>urt` 2,000/- plus actual expenses incurred fortaking possession` 2,000/- plus actual expenses incurred for takingpossessionii)Possession of Factory Premises/ Indl. Unitthrough <strong>Co</strong>urta) Sanctioned amt. upto ` 5.00 Lakh ` 3,000/- plus actual expenses incurred fortaking possessionb) Sanctioned amt. above ` 5.00 Lakh to ` ` 5,000/- plus actual expenses incurred for50.00 Lakhtaking possessionc) Sanctioned amt. above ` 50.00 Lakh ` 10,000/- plus actual expenses incurred fortaking possession` 3,000/- plus actual expenses incurred for takingpossession` 5,000/- plus actual expenses incurred for takingpossession` 10,000/- plus actual expenses incurred for takingpossession(g) i) ASSIGNMENT OF NSC/KVP ` 50/- per certificate & actual travelling ` 25/- per certificate & actual travellingcharges not exceeding ` 200/- (bothcharges not exceeding ` 150/- (bothinclusive) + actual post office charges inclusive) + actual post office chargesii) ENCASHMENT OF NSC/IVP/KVP ETC. ` 100/- per certificate + actual travelling cost ` 30/- per certificate + actual travelling costnot exceeding ` 250/- (both inclusive) + not exceeding ` 150/- (both inclusive) +actual post office chargesactual post office charges(h) REASSIGNMENT OF NSC/IVP/KVP NIL NIL(i)ENCASHMENT OF PLEDGEDSHARE CERTIFICATESDEMAT Shares ` 60/-per transaction + actual brokerage ` 60/- per transaction + actual brokerage(j) ASSIGNMENT/REASSIGNMENT/ ` 30/- per policy plus actual postage ` 25/- per policy plus actual postageENCASHMENT OF LIP ETC.45BANK GUARANTEE (Fresh and renewals)(a)PARTLY SECURED BY ONLY OUR BANK'S TERM DEPOSITi) Less than 50% of <strong>Bank</strong> Guarantee amount 2.50% per annum + ` 125/- (inclusive of claimperiod)2.50% per annum + ` 125/- (inclusive of claim period)ii)50% or <strong>more</strong> but less than 100% of <strong>Bank</strong>Guarantee1.50% per annum + ` 125/- (inclusive of claimperiod)1.50% per annum + ` 125/- (inclusive of claim period)iii)FULLY SECURED BY ONLY OUR BANK'STERM DEPOSIT1% of BG amount subject to minimum ` 100/-& maximum ` 1,000/-1% of BG amount subject to minimum ` 100/- & maximum` 1,000/-

Sr.No.ParticularsAmount of charges(Mumbai, Navi Mumbai, Thane, RaigadBranches)Amount of charges(Outstation Branches)(Including Nashik & Pune Region Branches)(b)CHARGES FOR INVOKED BANKGUARANTEE` 500/- per <strong>Bank</strong> Guarantee Part I` 500/- per <strong>Bank</strong> Guarantee6SOLVENCY CERTIFICATES/CREDIT WORTHINESS CERTIFICATES/CERTIFICATEFOR GRANTING LOANS & ADV. (SUBJECT TO COMPLIANCE OF CONDITIONS)Upto ` 25.00 Lakh ` 200/- per ` 1.00 Lakh or part thereof ` 200/- per ` 1.00 Lakh or part thereofsubject to maximum ` 2,500/- subject to maximum ` 2,500/-Above ` 25.00 Lakh to ` 50.00 Lakh ` 5,000/- ` 5,000/-Above ` 50.00 Lakh to ` 1.00 Crore ` 10,000/- ` 10,000/-Above ` 1.00 Crore to ` 10.00 Crore ` 15,000/- ` 15,000/-Above ` 10.00 Crore to ` 25.00 Crore ` 20,000/- ` 20,000/-Above ` 25.00 Crore ` 25,000/- ` 25,000/-7ISSUE OF INLAND LETTER OF CREDITI (a) <strong>Co</strong>mmitment charges 20 paise per ` 100/- per quarter 20 paise per ` 100/- per quarteror part thereofor part thereofNote : to be collected at the time of opening of L/C(b) Usance Chargesi) For Sight L/C & upto 10 days sight 20 paise per ` 100/- 20 paise per ` 100/-ii) Over 10 Days & Upto 6 Months 20 paise per ` 100/- per month 20 paise per ` 100/- per monthor part thereofor part thereof(c) Postage etc. ` 50/- or actual postages whichever is higher ` 50/- or actual postages whichever is higherIIAmendment without extension of period orenhancement in the value of the L/cEnhancement in value or extension of period` 300/- ` 300/-Recalculate committement and usancecharges as per 1 (a) (b) above and differenceto be leviedRecalculate committement and usance charges as per 1(a) (b) above and difference to be leviedIIIAdvising letter of Credit` 500/- + postage ` 50/- or actual whichever ishigher` 500/- + postage ` 50/- or actual whichever is higherIVAdvising amendment to letter of creditReinstatement commission for Revolving L/C` 250/- + postage ` 50/- or actual whichever ishigher20 paise per ` 100/- per quarter or part thereof+ usance charges as per tenor of the bill` 250/- + postage ` 50/- or actual whichever is higher20 paise per ` 100/- per quarter or part thereof + usancecharges as per tenor of the billPostage etc. ` 50/- or actual postages whichever is higher ` 50/- or actual postages whichever is higherVRetirement of Documents 30 paise per ` 100/- or part thereof minimum 30 paise per ` 100/- or part thereof minimum` 250/- & maximum ` 10,000/- ` 250/- & maximum ` 10,000/-5VIInland LC Documents received with ` 500/- per set of discrepant documents to ` 500/- per set of discrepant documents todiscrepancies be deducted from the proceeds. be deducted from the proceeds.( Branches should intimate to the ( Branches should intimate to theNegotiating <strong>Bank</strong> about deduction of Negotiating <strong>Bank</strong> about deduction ofcharges at the time of issuing confirmation charges at the time of issuing confirmationVIIInland Letter of credit issued through other<strong>Bank</strong>'s lilke HDFC <strong>Bank</strong> / <strong>Bank</strong> of India/UBI,etc.Charges will be levied as per our chargesstructure above or as per rate of chargeslevied by that <strong>Bank</strong> whichever is higherCharges will be levied as per our charges structure aboveor as per rate of charges levied by that <strong>Bank</strong> whichever ishigher8CHEQUES & BILLS COLLECTION(a)COLLECTION OF OUTSTATION CHEQUES (IBC / OBC)i) Upto & Including ` 5000/- ` 25/- ` 25/-ii) Above ` 5000/- upto & including ` 10,000/- ` 50/- ` 50/-iii) Above ` 10,000/- upto & including ` 1,00,000/- ` 100/- Inclusive of service tax ` 100/- Inclusive of service tax

Sr.No.ParticularsAmount of charges(Mumbai, Navi Mumbai, Thane, RaigadBranches)Amount of charges(Outstation Branches)(Including Nashik & Pune Region Branches)iv) Above ` 1,00,000/- ` 165/- Part I` 165/-v) Charges for return unpaid outstation 50% charges as above 8 (a) + actual 50% charges as above 8 (a) + actualcheques postage & ` 5/-* postage & ` 5/-*(b) RTGS/NEFT INWARD/OUTWARD Please contact Branch Manager Please contact Branch ManagerCHARGES(c)COLLECTION OF OUTSTATION BILLSIBC/OBC/BD/SBDi) Upto ` 1,000/- ` 20/- ` 20/-ii) Above ` 1,000/- upto ` 5,000/- ` 35/- ` 35/-iii) Above ` 5,000/- upto ` 10,000/- ` 60/- ` 60/-iv) Above ` 10,000/- upto ` 1.00 Lakh ` 6/- per ` 1,000/- or part thereof ` 6/- per ` 1,000/- or part thereofv) Above ` 1.00 Lakh ` 5.50 per ` 1,000/- as part thereof subject ` 5.50 per ` 1,000/- as part thereof subjectto minimum ` 600/- maximum ` 2,000/- to minimum ` 600/- maximum ` 2,000/-vi) Charges for return unpaid outstation bills 50% charges as above 8 (c) subject to 50% charges as above 8 (c) subject tominimum ` 20/- minimum ` 20/-vii) Postage Actual Actualviii) Supply bill discounting Handling charges - ` 25/- per bill Handling charges - ` 25/- per bill(d) Bills Discounted UNDER L/C ` 1,000/- + Postage ` 1,000/- + Postage9 [I]PAY ORDERS ETC.(a)ISSUE OF PAY ORDERSi) Upto ` 500/- ` 10/- ` 10/-ii) Above ` 500/- upto ` 1,000/- ` 15/- ` 15/-iii) Above ` 1,000/- upto ` 5,000/- ` 25/- ` 25/-iv) Above ` 5,000/- upto ` 20,000/- ` 30/- ` 30/-v) Above ` 20,000/- upto ` 2.00 Lakh ` 1.00 per ` 1,000/- or part thereof ` 1.00 per ` 1,000/- or part thereofvi) Above ` 2.00 Lakh ` 0.50 per ` 1,000/- or part thereof ` 0.50 per ` 1,000/- or part thereofsubject to min. ` 200/- max of ` 1,000/- subject to min. ` 200/- max of ` 1,000/-(Charges for issuing pay orders of(Charges for issuing pay orders of` 2,00,001/- to ` 4,00,000/- will be` 2,00,001/- to ` 4,00,000/- will be` 200/-. Above ` 4.00 Lakh charges will ` 200/-. Above ` 4.00 Lakh charges willbe ` 200/- + ` 0.50 per ` 1,000/-) be ` 200/- + ` 0.50 per ` 1,000/-)(b) CONCESSIONAL RATE FOR STUDENTS 50% of above charges - 9 [I] (a) subject to 50% of above charges - 9 [I] (a) subject toEXAM FEES/PAYMENT TO COLLEGE/ minimum of ` 10/- minimum of ` 10/-UNIVERSITY, PENSIONERS & SENIORCITIZENS(c) i) Issue of Duplicate pay order *` 50/- *` 50/-ii) Revalidation of pay order within one *` 25/- *` 25/-year from date of issueiii) Stop payment of pay order ` 25/- ` 25/-6(d) Issue of pay order favouring our <strong>Bank</strong> Nil Nil[II] ISSUE OF ICICI BANK/HDFC BANK Same as pay order charges mentioned in Same as pay order charges mentioned incheques under cheque drawing 9 [I] (a) (full commission) to be retained by 9 [I] (a) (full commission) to be retained byarrangement our <strong>Bank</strong> for cancellation ` 25/- to be our <strong>Bank</strong> for cancellation ` 20/- to becollected as in case of pay orderscollected as in case of pay orders10SAFE DEPOSIT LOCKERS(a)OPENING OF LOCKERSi) Key Deposit i) Small locker size - ` 5,000/- i) Small locker size - ` 3,000/-(Includes charges for break open in cases of ii) Medium locker size - ` 10,000/- ii) Medium locker size - ` 4,000/-non-payment of rent) iii) Large locker size - ` 20,000/- iii) Large locker size - ` 5,000/-ii) Service Charges ` 300/- plus franking amount ` 50/- plus franking amount(b)RENT PER YEAR

Sr.No.ParticularsAmount of charges(Mumbai, Navi Mumbai, Thane, RaigadBranches)Amount of charges(Outstation Branches)(Including Nashik & Pune Region Branches)(1st April to 31st March)Part IType Dimension (cms)i) Small Size A 12.5x17.5x49.2 ` 1000/- ` 700/-11.4x16.5x49.2 N.A.B 15.9x21.0x49.2 ` 1200/- ` 800/-15.2x20.3x49.2N.A.ii) Medium Size 2A 12.5x35.2x49.2 ` 2000/- ` 1,400/-11.4x33.0x49.2N.A.2B 15.9x42.3x49.2 ` 2,400/- ` 1,600/-15.2x40.6x49.2N.A.30.5x20.3x49.2N.A.7.8x26.7x49.2N.A.iii) Large Size 4A 27.8x35.2x49.2 ` 4,000/- ` 2,800/-26.7x33.0x49.2N.A.17.8x53.3x49.2N.A.4B 32.1x42.3x49.2 ` 4,800/- ` 3,200/-30.5x40.6x49.2N.A.38.1x53.3x49.2 ` 6,000/-N.A.36.8x53.3x49.2N.A.(c) NUMBER OF ACCESS ALLOWED Every quarter 10 access free ` 25/- Every quarter 10 access free ` 25/-PER QUARTER per additional access over & above 10 per additional access over & above 10free access in the quarterfree access in the quarter(d)DELAY IN PAYMENT OF RENTSmall lockers - ` 25/- p.m. ` 25/- p.m.Medium lockers - ` 50/- p.m. ` 50/- p.m.Large lockers - ` 75/- p.m. ` 75/- p.m.(e) BREAK OPEN OF LOCKER IN CASE OF ` 500/- plus actual charges ` 500/- plus actual chargesLOSS OF KEY/NON PAYMENT OF RENT(f) SURRENDER OF LOCKER* *` 500/- to be adjusted from key deposit *` 100/- to be adjusted from key deposit(g)SAFE CUSTODY CHARGES1) Gold loan closed but pledged ornaments are ` 100/- p.m. ` 100/- p.m.not claimed within 1 month from date ofclosure (after sending the notice to theloanee regarding the charges)72) Sale of pledged gold ornaments by auctioni) Loans upto ` 5,000/- ` 150/- ` 150/-ii) Above ` 5,000/- upto ` 50,000/- ` 250/- + proportionate advertisement ` 250/- + proportionate advertisementcharges + Applicable Taxcharges + Applicable Taxiii) Above ` 50,000/- ` 300/- + proportionate advertisement ` 300/- + proportionate advertisementcharges + Applicable Taxcharges + Applicable Tax11DEMAT SERVICE TARIFF & CHARGES1) Account Opening Charges NIL NIL2) Transaction Charges NIL NILPurchase / Credit3) Transaction ChargesSales / Debit0.04% Subject to minimum of `. 21/- Pertransaction (ISIN)0.04% Subject to minimum of `. 21/- Per transaction(ISIN)

Sr.No.ParticularsAmount of charges(Mumbai, Navi Mumbai, Thane, RaigadBranches)Amount of charges(Outstation Branches)(Including Nashik & Pune Region Branches)4) Demat Charges `. 3/- per Certificate Part (Min. I `. 15/-) + `. 30/-<strong>Co</strong>urier Charges`. 3/- per Certificate (Min. `. 15/-) + `. 30/- <strong>Co</strong>urierCharges5) Remat Charges `. 25/- per Certificate + `. 30/- <strong>Co</strong>urier Chg. `. 25/- per Certificate + `. 30/- <strong>Co</strong>urier Chg.6) Account Maintenance Charges (Per annum) `. 300/- for Individuals `. 300/- for Individuals`. 900/- for Others `. 900/- for Others7) Pledge / Unpledge / Invocation `. 50/- per ISIN `. 50/- per ISIN8) Freeze Charge `. 50/- per ISIN `. 50/- per ISIN9) Custody Fees NIL NIL10) Statutory Charges at the time of AccountOpeningNIL (`. 100/- Franking Charges) + `.10Franking Service ChargeNIL (`. 100/- Franking Charges) + `.10 Franking ServiceCharge11) Failed Instruction Charges `. 25/- per ISIN `. 25/- per ISIN12) Account Maintenance Charges (Per annum) Nil for holding < `. 50,000/- Nil for holding < `. 50,000/-Holding from `. 50,001/- to `. 200,000/- AMC of Holding from `. 50,001/- to `. 200,000/- AMC of `. 100/-`. 100/-for Basic Services Demat Account (BSDA)Holding > `. 200,000/- Will be charge as Holding > `. 200,000/- Will be charge as applicable toapplicable to Normal Demat Account. Normal Demat Account.(6 above)(6 above)<strong>Co</strong>nditions:a) The above charges are exclusive of service tax & Cess which will be charged as per the applicable rates.b) Annual Account Maintenance and Demat Charges are payable upfront & are not refundable.c) All other charges are payable monthly.d) Same day execution instructions will be accepted on a best effort basis at the sole risk and responsibility of the client.The <strong>Bank</strong> will not be held responsible for non-execution of same day instructions. The <strong>Bank</strong> also reserves its rightsto charge an additional fee @ Rs.25/- per ISIN.e) Transaction / Holding cum Billing statements will be sent once in a month, provided there is a transaction, else once in a quarter. (Additionalstatement charges `. 15/- per page).f) For BSDA, <strong>Bank</strong> will provide two statements free of cost during the billing cycle. Additional physical statement will be charged `. 25/- perstatement.(*Note: The above charges are applicable to <strong>Bank</strong>’s staff members.)812GENERAL(a) ISSUE OF OUR BANK'S SHARE ` 10/- per certificate ` 10/- per certificateCERTIFICATE (DUPLICATE)(b) TRANSFER OF SHARE CERTIFICATE ` 10/- per certificate ` 10/- per certificate(c) Issue of any other certificate by <strong>Bank</strong> ` 25/- per certificate ` 25/- per certificatefor the purpose other than for our<strong>Bank</strong>'s purpose (including verificationof signature)(d) i) Income Tax certificate for interest on Nil NILterm deposit / savings A/c or BalanceCertificateii) Duplicate certificate as above ` 25/- per certificate ` 25/- per certificate(e) STOP PAYMENT INSTRUCTIONS ` 25/- per cheque per instruction ` 25/- per cheque maximum ` 500/-(All a/cs with cheque book facilities) (maximum ` 500/- )(f) FATE ENQUIRIES (at customers request )i) Savings a/c ` 25/- per enquiry ` 25/- per enquiryii) Current, CC, FLXLN & SOD A/cs only ` 100/- per enquiry ` 100/- per enquiry(g) SURRENDER/LOSS OF ATM CARD ` 100/- ` 100/-(h) ISSUE OF DUPLICATE ATM CARD ` 100/- ` 100/-(including loss of ATM card)(i) LOSS OF CHEQUE BOOK REQUISITION Savings A/c - ` 25/- per request Savings A/c - ` 25/- per request

Sr.No.ParticularsAmount of charges(Mumbai, Navi Mumbai, Thane, RaigadBranches)Amount of charges(Outstation Branches)(Including Nashik & Pune Region Branches)Part ISLIP CD/CC/FLXLN/SOD A/c - ` 50/- per request CD/CC/FLXLN/SOD A/c - ` 50/- per request(j) DOCUMENTS FRANKING CHARGES ` 10/- per document ` 10/- per documentNote : i) Charges applicable for <strong>Bank</strong>'s Documents also.ii) For Staff & Officers - No charges for Franking of Documents.(k)ENQUIRY RELATED TO OLD RECORDSMore than 12 months old record ` 115/- per instrument ` 115/- per instrument(l) Allowing operations in account through SB A/c. - ` 25/- SB A/c. - ` 25/-Power of Attorney CD/CC A/c. - ` 100/- CD/CC A/c. - ` 100/-On every changeOn every change(m) Service charges for issue of NIL NIL"Life Certificate" to Senior Citizens(n) Charges for recording ECS mandate ` 30/- ` 30/-Note : No additional charges for Signature verification.(o) <strong>Co</strong>llection of charges towards Please contact Branch Manager Please contact Branch ManagerCERSAI Registration(p) Charges for e-payment tax on ` 28/- per challan ` 28/- per challanbehalf of the customers(q)Speed Clearing Chargesi) Upto & including ` 1.00 Lakh NIL NILii) More than ` 1.00 Lakh ` 150/- per instrument ` 150/- per instrument*************************9Part II1 (a) PENAL CHARGES IN CC/ FLXLN/ IMPORTANT NOTE :SOD/ LATD TERM LOAN A/cs. Penal charges in CC/ term loan/ FLXLN/ Penal charges in CC/ term loan/ FLXLN/SOD/ LATD A/cs. As per ILA and other SOD/ LATD A/cs. As per ILA and otherrelevant circulars/ guidelines issued by relevant circulars/ guidelines issued by<strong>Bank</strong> from time to time.<strong>Bank</strong> from time to time.(b) CHEQUE DISCOUNTING & Rs.20/- per instrument + interest as per ILA Rs.20/- per instrument + interest as per ILACHEQUE PURCHASE(In case payment of salary cheques iseffected as per rules, no service charges tobe levied, also in case of discount of our<strong>Bank</strong>'s pay order no charges/ interestto be collected)(c)DRAWALS AGAINST CHEQUESPRESENTED IN CLEARINGi) Savings A/c (for drawals above Interest @ 18% p.a. Interest @ 18% p.a.` 5,000/- only)ii) Current, CC, FLXLN & SOD A/cs Interest @ 18% p.a. on uncleared Interest @ 18% p.a. on unclearedamountamount************************10

Sr.No.ParticularsAmount of charges(Mumbai, Navi Mumbai, Thane, RaigadBranches)Amount of charges(Outstation Branches)(Including Nashik & Pune Region Branches)PART Part IIII1 (a) GOLD APPRAISAL CHARGES ` 4/- per gm (gross) ` 4/- per gm (gross)(To be reimbursed to gold valuer) min ` 50/- min ` 50/-(b)SUPPLY OF APPLICATION FORMSi) Loan application with surety consent letterii) <strong>Bank</strong> guarantee application(including surety consent letter)iii) Solvency certificate application ` 25/- each ` 25/- eachiv) Cash credit/ LC application andtwo suretiesv) <strong>Co</strong>mposite loan/ CC/ <strong>Bank</strong> Guaranteeapplication for facility above ` 15.00 Lakh*************************11