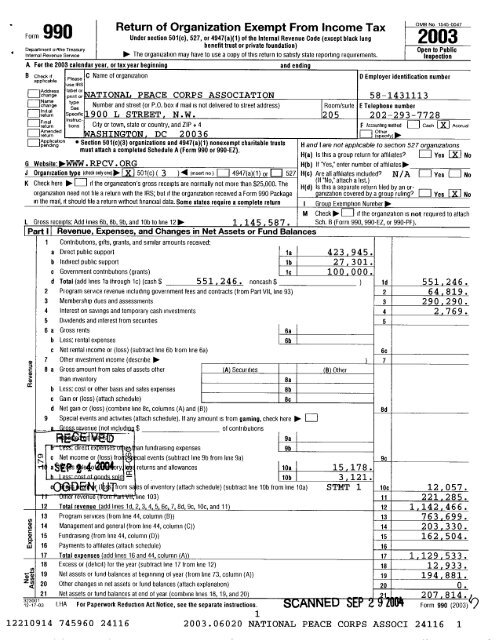

Return of Organization Exempt From Income Tax ... - Peace Corps Wiki

Return of Organization Exempt From Income Tax ... - Peace Corps Wiki

Return of Organization Exempt From Income Tax ... - Peace Corps Wiki

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Form 990(2003) NATIONAL PEACE CORPS ASSOCIATION 58-1431113 Page 3Part IV Balance SheetsNote: Where required, attached schedules and amounts within the description column (A) (B)should be for end-<strong>of</strong>-year amounts only. Beginning <strong>of</strong> year End <strong>of</strong> year45 Cash - non-interest-bearing 32 5 . 45 100 .46 Savings and temporary cash investments 317 , 172 . 46 182 , 912 .47 a Accounts receivable 47a 55 , 461 .b less: allowance for doubtful accounts 47b 5 , 546 . 64 , 604 . 47c 49 , 915 .48 a Pledges receivable 48ab Less : allowance for doubtful accounts 48b 10 , 302 . 48c49 Grants receivable 49 188 , 319 .50 Receivables from <strong>of</strong>ficers, directors, trustees,Nand key employees 50mN51 a Other notes and loans receivable 51ab Less : allowance for doubtful accounts 51b 51c52 Inventories for sale or use 5253 Prepaid expenses and deferred charges 6 , 783 . 53 26 , 420 .54 Investments - securities " 0 Cost ~ FMV 5455 a Investments - land, buildings, andequipment: basis55ab Less: accumulated depreciation 55b 55c56 Investments - other 5657 a Land, buildings, and equipment : basis 57a 93 , 673 .b less. accumulated depreciation STMT 6 57b 74 , 895 . 15 677 . 57c 18 , 778 .58 Other assets (describe " DEPOSITS ) 3 4 51 . 58 7 , 009 .59 Total assets add lines 45 throw h 58 must e q ual line 74 418 314 . 59 473 , 453 .60 Accounts payable and accrued expenses (8 170 . 60 90 , 924 .61 Grants payable 61N62 Deferred revenue 129 705 . 62 133 , 790 .°' 63 Loans from <strong>of</strong>ficers, directors, trustees, and key employees 6364 a <strong>Tax</strong>-exempt bond liabilities 64ab Mortgages and other notes payable65 Other liabilities (describe Do- REBATES DUE TO AFFILIATES ) 25 , 558 . 65 40 , 925 .64D66 Total liabilities add lines so throu g h 65 ) 223 , 433 . ss 265 , 639 .<strong>Organization</strong>s that follow SFAS 117, check here " LL and complete lines 67 through69 and lines 73 and 74 .67 unrestricted 6 6 , 882 . 67 2 a ss Temporarily restricted 127 , 999 . 6s 351 , 072 .m 69 Permanently restricted 69<strong>Organization</strong>s that do not follow SFAS 117, check here " 0 and complete lines70 through 74 .Y V°) 70 Capital stock, trust principal, or current funds 70v°', 71 Paid-in or capital surplus, or land, budding, and equipment fund 71NQ..72 Retained earnings, endowment, accumulated income, or other funds 72Z 73 Total net assets or fund balances (add lines 67 through 69 or lines 70 through 72 ;column (A) must equal line 19 ; column (B) must equal line 21) 19 4 , 8 81 . 73 2 07 , 814 .74 Total liabilities and net assets / fund balances (add lines 66 and 73) ~ 418,314 . 74 473,453 .Form 990 is available for public inspection and, for some people, serves as the primary or sole source <strong>of</strong> information about a particular organization . How the publicperceives an organization in such cases may be determined by the information presented on its return. Therefore, please make sure the return is complete and accurateand fully describes, in Part III, the organization's programs and accomplishments .32302112-77 03312210914 745960 24116 2003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1

_Form 990 2003 NATIONAL PEACE CORPSPart IV-A Reconciliation <strong>of</strong> Revenue per AuditedFinancial Statements with Revenue per<strong>Return</strong>a Total revenue, gains, and other support" per audited financial statements " a 1 , 15 3 762 .b Amounts included on line a but not online 12, Form 990.(1) Net unrealized gainson investments $(2) Donated servicesand use <strong>of</strong> facilities $ 8,175 .(3) Recoveries <strong>of</strong> prioryear grants $(4) Other (specify) :STMT 7 $ 3,121 .Add amounts on lines (1) through (4) " b 11 , 29 6 .c dine a minus line b " c 1 , 142 , 466 .d Amounts included on line 12, Form990 but not on line a:are iv'es ~ tteconcmation oT txpenses per AuarceaFinancial Statements with Expenses per<strong>Return</strong>a Total expenses and losses perbaudited financial statements t o 1 , 140 , EAmounts included on line a but not online 17, Form 990 :(1) Donated servicesand use <strong>of</strong> facilities $ 8,175 .(2) Prior year adjustmentsreported on line 20,Form 990 $(3) Losses reported online 20, Form 990 $(4) Other (specify) :STMT 8 $ 3,121 .Add amounts on lines (1) through (4) 11111". b 11 tc Mme a minus line b " c 1 12 9 5d Amounts included on line 17, Form990 but not on line a :4(1) Investment expensesnot included online 6b, Form 990 $(2) Other (specify) :(1) Investment expensesnot included online 6b, Form 990 $(2) Other (specify) :Add amounts on lines (1) and (2) 1 d 0 . Add amounts on lines (1) and (2) 1e Total revenue per line 12, Form 990e Total expenses per line 17, Form 990(line c plus line d) lo, I e 1 14 2 46 6 .(line c plus line d) 100,Part V List <strong>of</strong> Officers, Directors, Trustees, and Key E mployeeS (List each one even if not compensated .)(B) Title and average hours (C) Compensation (D) Contributionse ployee benef(A) Name and addressper week= toIf not paid, enter plans & deferm------------------------------------------------------------------SEE STATEMENT 9------------------------------------------------------------------,533 .Expenseount andallowance---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------I------------------------------------------------------------------II---------------------------------------------------------------------------------------------------75 Did any <strong>of</strong>ficer, director, trustee, or key employee receive aggregate compensation <strong>of</strong> more than $100,000 from your organization and all relatedorganizations, <strong>of</strong> which more than $10,000 was provided by the related organizations If "Yes," attach schedule . " 0 Yes Ef] No323031 12-17-03 Form 990 (2003)412210914 745960 24116 2003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1

Form 99o(2003) NATIONAL PEACE CORPS ASSOCIATION 58-1431113 PagesPart VI Other Information Yes No76 Did the organization engage m any activity not previously reported to the IRS If "Yes," attach a detailed description <strong>of</strong> each activity 76 X77 Were any changes made in the organizing or governing documents but not reported to the IRS 77 X" If "Yes," attach a conformed copy <strong>of</strong> the changes.78 a Did the organization have unrelated business gross income <strong>of</strong> $1,000 or more during the year covered by this returns 78a Xb If "Yes," has it fled a tax return on Form 990-T for this years 78b X79 Was there a liquidation, dissolution, termination, or substantial contraction during the years 79 XIf "Yes," attach a statement80 a Is the organization related (other than by association with a statewide or nationwide organization) through common membership,bgoverning bodies, trustees, <strong>of</strong>ficers, etc., to any other exempt or nonexempt organizations 80a XIf "Yes," enter the name <strong>of</strong> the organizationand check whether it is0 exempt or EJ nonexempt.81 a Enter direct or indirect political expenditures . See line 81 instructions 81a 0 .b Did the organization file Form 1120-POL for this years 81b X82 a Did the organization receive donated services or the use <strong>of</strong> materials, equipment, or facilities at no charge or at substantially less thanfair rental value 82a Xb If "Yes," you may indicate the value <strong>of</strong> these items here . Do not include this amount as revenue in Part I or as anexpense m Part II . (See instructions m Part III .) 82b 8 , 175 .83 a Did the organization comply with the public inspection requirements for returns and exemption applications 83a Xb Did the organization comply with the disclosure requirements relating to quid pro quo contnbutions9 83b X84 a Did the organization solicit any contributions or gifts that were not tax deductibles N/A 84ab If "Yes," did the organization include with every solicitation an express statement that such contributions or gifts were nottax deductible? N/A 84b85 501(c)(4), (5), or (6) organizations a Were substantially all dues nondeductible by members? N/A 85ab Did the organization make only in-house lobbying expenditures <strong>of</strong> $2,000 or less? N/A 85bIf "Yes" was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization received a waiver for proxy taxowed for the prior year .c Dues, assessments, and similar amounts from members 85c N / Ad Section 162(e) lobbying and political expenditures 85d N / Ae Aggregate nondeductible amount <strong>of</strong> section 6033(e)(1)(A) dues notices 85e N / Af <strong>Tax</strong>able amount <strong>of</strong> lobbying and political expenditures (line 85d less 85e) 85f N / Ag Does the organization elect to pay the section 6033(e) tax on the amount on line 85f9 N/A 85hIf section 6033(e)(1)(A) dues notices were sent, does the organization agree to add the amount on line 85f to its reasonable estimate <strong>of</strong> duesallocable to nondeductible lobbying and political expenditures for the following tax year? N/A 85h86 501(c)(7) organizations Enter : a Initiation fees and capital contributions included on line 12 86a N / Ab Gross receipts, included on line 12, for public use <strong>of</strong> club facilities 86b N / A87 501(c)(12) organizations. Enter: a Gross income from members or shareholders 87a N / Ab Gross income from other sources. (Do not net amounts due or paid to other sourcesagainst amounts due or received from them .) 87b N / A88 At any time during the year, did the organization own a 50% or greater interest in a taxable corporation or partnership,or an entity disregarded as separate from the organization under Regulations sections 301 .7701-2 and 301 .7701-3?If "Yes," complete Part IX 88 X89 a 501(c)(3) organizations Enter: Amount <strong>of</strong> tax imposed on the organization during the year under :section 49111 0 . ; section 49121 0 . ; section 4955 1 0 .b 501(c)(3) and 501(c)(4) organizations Did the organization engage in any section 4958 excess benefittransaction during the year or did it become aware <strong>of</strong> an excess benefit transaction from a prior yearIf "Yes," attach a statement explaining each transaction 89b Xc Enter : Amount <strong>of</strong> tax imposed on the organization managers or disqualified persons during the year undersections 4912, 4955, and 4958 . 0 .d Enter : Amount <strong>of</strong> tax on line 89c, above, reimbursed by the organization ~ 0 .90 a List the states with which a copy <strong>of</strong> this return is filed " DISTRICT OF COLUMBIAb Number <strong>of</strong> employees employed in the pay period that includes March 12, 2003 i 90b ~ 791 The books are in care <strong>of</strong> " THE ORGANIZATION Telephone no. " SEE PAGE 1located at " SEE PAGE 1 ZIP + 4 " SEE PAGE 192 Section 4947(a)(1) nonexempt charitable trusts filing Form 990 m lieu <strong>of</strong> Form 1041- Check here 0. E:Jand enter the amount <strong>of</strong> tax-exempt interest received or accrued during the tax year " 1 92 ~ N/Aiz3~i oa Form 990 (2003)512210914 745960 24116 2003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1

Form 9906Part VII Analysis <strong>of</strong> income-rroaucing Activities (See page 33 <strong>of</strong> the instructions .)Note : Enter gross amounts unless otherwise Unrelated business income Excluded by section aiz, sia, or sia(E)indicated (A) (B) R (D)Business ~Xclu- Related or exemptAmount Sion Amount93, Proaram service revenue: code code function incomea CONFERENCE AND AWARDS 07 25 , 032 .b PUBLICATIONS 39 , 787 .cdef Medicare/Medicaid paymentsp Fees and contracts from government agencies94 Membership dues and assessments 290 , 290 .95 Interest on savings and temporary cash investments 14 2 , 769 .96 Dividends and interest from securities97 Net rental income or (loss) from real estate:a debt-financed propertyb not debt-financed property98 Net rental income or (loss) from personal property99 Other investment income100 Gain or (loss) from sales <strong>of</strong> assetsother than inventory101 Net income or (loss) from special events102 Gross pr<strong>of</strong>it or (loss) from sales <strong>of</strong> inventory 12 , 057 .103 Other revenue:a ADVERTISING 541800 195 049 .b ROYALTIES 15 17 , 604 .c MISCELLANEOUS 8 , 632 .de104 Subtotal (add columns (8), (D), and (Q) 19 5 . 04 9 . 45,405 . i 350,766 .105 Total (add line 104, columns (B), (D), and (E)) 1 591 ,2 20 .Note . Line 105 plus fine 1d, Part l, should equal the amount on line 12, Part IPart VIII Relationship <strong>of</strong> Activities to the Accomplishment <strong>of</strong> <strong>Exempt</strong> Purposes (See page 34 <strong>of</strong> the instructions .)Line NoExplain how each activity for which income is reported in column (E) <strong>of</strong> Part VII contributed importantly to the accomplishment <strong>of</strong> the organization'sexempt purposes (other than by providing funds for such purposes) .-PURPOpage 34 <strong>of</strong> the instructions .Name, address, a6d'EIN <strong>of</strong> <strong>of</strong> I Nature <strong>of</strong> activities I Total income I E~ Part X I Information Regarding Transfers Associated with Personal Benefit Contracts (See page 34 <strong>of</strong> the instructions .)(a) Did the organization, during the year, receive any funds, directly or indirectly, to pay premiums on a personal benefit contracts 0 Yes [j] No(b) Did the organization, during the year, pay premiums, directly or indirectly, on a personal benefit contracts [] Yes [R] NoNote : !f "Yes" to ( b) , file Form 8870 and Form 0 ee instructions)Under pe alt _2111 erk ha e ed is return, including accompanying schedules and statements, and to the best <strong>of</strong> my knowledge and belief, it Is truePl ease correct, a ompete ~cl ation~ f ar r r tha fficer) is based on all inl matt n <strong>of</strong> which preparer has any knowledgeSign 7" 7" q/;U6"L r, wi, IA-Here SVtkrGf <strong>of</strong>f Iter I Da AeType or print name and title .I Check if Pr parer's SSN or PTINPreparer'sDate/Paidself-- employed looPreparer'sFirm's name (orAN, ROSENBERG FREEDMIum EiN to. 52-1392008Use Only y--self-employed),4550 MONTGOMERY AVE ., SUITE 650 NORTH31 223 - 16 address, Zip ~ 4 and17-03 1BETHESDA, MARYLAND 20814 -2930 Phone no . 11, ( 3 0 1 ) 951-9090Form 990 (2003)612210914 745960 24116 2003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1

SCHEDULE A(Form 990 or 990-EZ)<strong>Organization</strong> <strong>Exempt</strong> Under Section 501(c)(3)(Except Private Foundation) and Section 501(e), 501(f), 501(k),501(n), or Section 4947(a)(1) Nonexempt Charitable Trust" Department <strong>of</strong> the TreasurySupplementary Information-(See separate instructions .)Internal Revenue Service 1 MUST be completed by the above organizations and attached to their Form 990 or 990-EZName <strong>of</strong> the organizationOMB No 1545-00472003Employer identification numberCompensation <strong>of</strong> the Five Highest Paid Employees Other Than Officers, Directors, and Trustees(See page i <strong>of</strong> the instructions . List each one . If there are none, enter "None :")(a) Name and address <strong>of</strong> each employee paid(b) Title and average hours(demploy eubeneftper week devoted to (c) Compensationt'or's toPlans g de,~ed accountmore than $50,000DOSItI0I1 comoensa4on 3110VDAVID ARNOLDS DIRANNE BAKERCE PRESTotal number <strong>of</strong> other employees paidever $50,000 . 0Part 11 Compensation <strong>of</strong> the Five Highest Paid Independent Contractors for Pr<strong>of</strong>essional Services(See page 2 <strong>of</strong> the instructions. List each one (whether individuals or firms). If there are none, enter "None :')(a) Name and address <strong>of</strong> each independent contractor paid more than $50,000 (b) Type <strong>of</strong> service (c) CompensationNONE- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -Total number <strong>of</strong> others receiving over$50,000 for pr<strong>of</strong>essional services " Q323101/12-05-03 LHA For Paperwork Reduction Act Notice, see the Instructions for Form 990 and Form 990-EZ . Schedule A (form 990 or 990-EZ) 200312210914 745960 24116 2003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1

Schedule A (Form 990 or 990-EZ) 2003 NATT()NAT~ PFACF CORPS ASSnCTATTnN 58-1 431113 Page 2Part IH , Statements About Activities (see page 2 <strong>of</strong> the instructions .) - - IYes I No1 During the year, has the organization attempted to influence national, state, or local legislation, including any attempt to influencepublic opinion on a legislative matter or referendum? If "Yes," enter the total expenses paid or incurred in connection with thelobbying activities 1 $ $ (Must equal amounts on line 38, Part VI-A,or line i <strong>of</strong> Part VI-B.)<strong>Organization</strong>s that made an election under section 501(h) by fling Form 5768 must complete Part VI-A . Other organizations checking"Yes," must complete Part VI-B AND attach a statement giving a detailed description <strong>of</strong> the lobbying activities.2 During the year, has the organization, either directly or indirectly, engaged m any <strong>of</strong> the following acts with any substantial contributors,trustees, directors, <strong>of</strong>ficers, creators, key employees, or members <strong>of</strong> their families, or with any taxable organization with which any suchperson is affiliated as an <strong>of</strong>ficer, director, trustee, majority owner, or principal beneficiary (If the answer to any question is "Yes, "attach a detailed statement explaining the transactions)a Sale, exchange, or leasing <strong>of</strong> propertyb Lending <strong>of</strong> money or other extension <strong>of</strong> creditc Furnishing <strong>of</strong> goods, services, or facilities?d Payment <strong>of</strong> compensation (or payment or reimbursement <strong>of</strong> expenses if more than $1,000) SEE PART V 1 FORM 9 9 0e Transfer <strong>of</strong> any part <strong>of</strong> its income or assets3 a Do you make grants for scholarships, fellowships, student loans, etc . (If "Yes," attach an explanation <strong>of</strong> howyou determine that recipients qualify to receive payments )b Do you have a section 403(b) annuity plan for your employees4 Did you maintain any separate account for participating donors where donors have the right to provide advicefor Non-PrivateThe organization is not a private foundation because it is* (Please check only ONE applicable box.)5 0 A church, convention <strong>of</strong> churches, or association <strong>of</strong> churches. Section 170(b)(1)(A)(i).6 0 A school . Section 170(b)(1)(A)(u) . (Also complete Part V.)7 ~ A hospital or a cooperative hospital service organization . Section 170(b)(1)(A)(ni).8 ~ A Federal, state, or local government or governmental unit. Section 170(b)(1)(A)(v)(See pages 3 through 6 <strong>of</strong> the instructions .)9 0 A medical research organization operated m conjunction with a hospital. Section 170(b)(1)(A)(uQ . Enter the hospital's name, city,and state10 ~ An organization operated for the benefit <strong>of</strong> a college or university owned or operated by a governmental unit. Section 170(b)(1)(A)(iv).(Also complete the Support Schedule m Part IV-A .)11a ~ An organization that normally receives a substantial part <strong>of</strong> its support from a governmental unit or from the general public .Section 170(b)(1)(A)(w) . (Also complete the Support Schedule in Part IV-A.)11b ~ a community trust. Section 170(b)(1)(A)(vi). (Also complete the Support Schedule in Part IV-A .)12 ~ An organization that normally receives : (t) more than 33 1/3% <strong>of</strong> its support from contributions, membership fees, and grossreceipts from activities related to its charitable, etc ., functions - subject to certain exceptions, and (2) no more than 33 1/3% <strong>of</strong>its support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses acquiredby the organization after June 30, 1975 . See section 509(a)(2) . (Also complete the Support Schedule in Part IV-A.)13 0 An organization that is not controlled by any disqualified persons (other than foundation managers) and supports organizations described in :(1) lines 5 through 12 above ; or (2) section 501(c)(4), (5), or (6), it they meet the test <strong>of</strong> section 509(a)(2). (See section 509(a)(3) .)Provide the following information about the supported organizations . (See page 5 <strong>of</strong> the instructions .)(a) Name(s) <strong>of</strong> supported organization(s)(b) Line numberfrom above14 I I An organization organized and operated to test for public satetv. Section 509(a)(4). (See aaae 6 <strong>of</strong> the instruSchedule A (Form 990 or 990-EZ) 200332311112-OS-03O12210914 745960 24116 2003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1

Schedule A (Form 990 or 990-EZ) 2003 NATIONAL PEACE CORPS ASSOCIATION 58-1431113 Page 3Part IV-A Support Schedule (Complete only if you checked a box on line 10, 11, or 12 ) Use cash method <strong>of</strong> accounting.Note: You ma use the worksheet in the instructions /or converting from the accrual to the cash method <strong>of</strong> accountin .Calendar year (or fiscal yearbe g innin g in ) 110. (a) 2002 (b) 2001 (c) 2000 (d) 1999 (e) Total15 , Gifts, grants, and contributionsreceived. seDone28cludeunusua~571 519 . 659 809 . 605 644 . 619 528 . 2 , 456 , 500 .16 Membership tees received 283 , 026i . 282 , 454 . 240 , 808 . 251 , 026 . 1 , 057 , 314 .17 Gross receipts from admissions,merchandise sold or servicesperformed, or furnishing <strong>of</strong>facilities in any activity that isrelated to the organization'scharitable,etc .,purpose 485 448 . 18 , 936 . 65 , 782 . 14 , 878 . 585 044 .18 Gross income from interest,dividends, amounts received frompayments on securities loans (section512(a)(5)), rents, royalties, andunrelated business taxable income(less section 511 taxes) frombusinesses acquired by theorganization after ,rune 30, 1975 6 2 6 8 . 738 . 7 , 006 .19 Net income from unrelated business20activities not included in line 18<strong>Tax</strong> revenues levied for theorganization's benefit and eitherpaid to it or expended on its behalf21 The value <strong>of</strong> services or facilitiesfurnished to the organization by agovernmental unit without charge .Do not include the value <strong>of</strong> servicesor facilities generally furnished tothe public without charge22 Other income . Attach a schedule .Do not include gain or (loss) fromsale <strong>of</strong> capital assets23 Total <strong>of</strong>lines l5through 22 1 , 346 , 261 . 961 199 . 912 972 . 885 432 . 4 , 105 , 864 .24 Line 23minus line l7 860 813 . 942 263 . 847 190 . 870 554 . 3 , 520 , 820 .25 Enter t% <strong>of</strong> line 23 13 , 463 . 1 9 , 612 . 1 9 . 130 . 8 , 854 .26 <strong>Organization</strong>s described on lines 10 or 11 : a Enter 2% <strong>of</strong> amount m column (e), line 24 . 26a 70 , 416 .b Prepare a list for your records to show the name <strong>of</strong> and amount contributed by each person (other than a governmentalunit or publicly supported organization) whose total gifts for 1999 through 2002 exceeded the amount shown in line 26a.Do not file this list with your return Enter the total <strong>of</strong> all these excess amounts " 26b 116 , 570 .c Total support for section 509(a)(1) test : Enter line 24, column (e) " 26c 3 520 , 820 .d Add' Amounts from column (e) for lines: 18 7,006 . 1922 26b 116,570 . 00- 26a 123 , 576 .e Public support (line 26c minus line 26d total) " 26e 3 _39 7 , 244 .f Public support percentage (line 26e (numerator) divided by line 26c (denominator)) " 26f c) 6 . 4901 %27 <strong>Organization</strong>s described on line 12: a For amounts included in lines 15, 16, and 17 that were received from a "disqualified person," prepare a list for yourrecords to show the name <strong>of</strong>, and total amounts received in each year from, each "disqualified person." Do not file this list with your return Enter the sum <strong>of</strong>such amounts for each year:N/A(2002) (2001) (2000) (1999)b For any amount included in line 17 that was received from each person (other than "disqualified persons"), prepare a list for your records to show the name <strong>of</strong>,and amount received for each year, that was more than the larger <strong>of</strong> (1) the amount on line 25 for the year or (2) $5,000 . (Include in the list organizationsdescribed in lines 5 through 11, as well as individuals .) Do not file this list with your return After computing the difference between the amount received andthe larger amount described in (1) or (2), enter the sum <strong>of</strong> these differences (the excess amounts) for each year:d Add : Line 27a total and line 27b total 1 27d N/ Ae Public support (line 27c total minus line 27d total) 1 27e N/ Af Total support for section 509(a)(2) test. Enter amount on line 23, column (e) " 27f N/Ag Public support percentage (line 27e (numerator) divided by line 27f (denominator)) 1 27 N/ A %h Investment income percentage (line 18, column (e) (numerator) divided by line 27f (denominator)) 1 ~ 27h N/A28 Unusual Grants: For an organization described in line 10, 11, or 12 that received any unusual grants during 1999 through 2002, prepare a list for your recordsto show, for each year, the name <strong>of</strong> the contributor, the date and amount <strong>of</strong> the grant, and a brief description <strong>of</strong> the nature <strong>of</strong> the grant . Do not file this list withyour return Do not include these grants in line 15.323121 12-OS-03 NONE Schedule A (Form sso w 990-ez) zoos912210914 745960 24116 2003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1N/A(2002) (2001) (2000) (1999)c Add : Amounts from column (e) for lines: 15 1617 20 21 0- 1 27c ( N/A

Schedule A(Form990or990-EZ)2003 NATIONAL PEACE CORPS ASSOCIATION58-1431113 Page4Part V Private School Questionnaire (See page 7 <strong>of</strong> the instructions .) N/A(fo be completed ONLY by schools that checked the box on line 6 in Part 11n29 " Does the organization have a racially nondiscriminatory policy toward students by statement in its charter, bylaws, other governinginstrument, or m a resolution <strong>of</strong> its governing body 2930 Does the organization include a statement <strong>of</strong> its racially nondiscriminatory policy toward students in all its brochures, catalogues,and other written communications with the public dealing with student admissions, programs, and scholarships 3031 Has the organization publicized its racially nondiscriminatory policy through newspaper or broadcast media during the period <strong>of</strong>solicitation for students, or during the registration period if it has no solicitation program, in a way that makes the policy knownto all parts <strong>of</strong> the general community it serves 31If "Yes," please describe ; if "No," please explain . (If you need more space, attach a separate statement.)32 Does the organization maintain the following:abcdRecords indicating the racial composition <strong>of</strong> the student body, faculty, and administrative staffRecords documenting that scholarships and other financial assistance are awarded on a racially nondiscriminatory basisCopies <strong>of</strong> all catalogues, brochures, announcements, and other written communications to the public dealing with studentadmissions, programs, and scholarshipsCopies <strong>of</strong> all material used by the organization or on its behalf to solicit contributionsIf you answered "No" to any <strong>of</strong> the above, please explain . (If you need more space, attach a separate statement .)33 Does the organization discriminate by race in any way with respect to:a Students' rights or pnvdeges9b Admissions policiescEmployment <strong>of</strong> faculty or administrative staft9d Scholarships or other financial assistanceefEducational policiesUse <strong>of</strong> faalities9g Athletic programsh Other extracurricular actiwties9If you answered "Yes" to any <strong>of</strong> the above, please explain . (If you need more space, attach a separate statement.)34 a Does the organization receive any financial aid or assistance from a governmental agencyb Has the organization's right to such aid ever been revoked or suspendedIf you answered "Yes" to either 34a or b, please explain using an attached statement.35 Does the organization certify that it has complied with the applicable requirements <strong>of</strong> sections 4 01 through 4.05 <strong>of</strong> Rev . Proc . 75-50,1975-2 C .B . 587, covering racial nondiscnmination2 If "No," attach an explanationSchedule A (form 990 or 990-EZ) 200332313112-OS-031012210914 745960 24116 2003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1

American motor vehicles consume one-eighth <strong>of</strong>the world’s total oil production, and ubiquitous freeparking contributes to our automobile dependency. 23What can be done to improve this situation? Here arefour recommendations:1. ITE should state in the report for each parkingand trip generation rate that this raterefers only to suburban sites with ample freeparking but no public transit, pedestrianamenities, or TDM programs.2. ITE should show the regression equationand the R 2 for each parking and trip generationreport and state whether the coefficient<strong>of</strong> floor area (or other independent variable)in the equation is significantly different fromzero.3. ITE should report the parking and trip generationrates as ranges, not as precise pointestimates.4. Urban planners should recognize that even ifthe ITE data were accurate, using them toset parking requirements would dictate anautomobile-dependent urban form with freeparking everywhere.Both transportation engineers and urban plannersshould ponder this warning from Lewis Mumford:“The right to have access to every building inthe city by private motorcar, in an age when everyonepossesses such a vehicle, is actually the right todestroy the city.” (Mumford 1981)Parking and trip generation rates illustrate a familiarproblem with statistics used in transportationplanning, and placing unwarranted trust in the accuracy<strong>of</strong> these precise but uncertain data leads to badtransportation and land-use policies. Being roughlyright is better than being precisely wrong. We needless precision—and more truth—in transportationplanning.23 Transportation accounted for 66.4% <strong>of</strong> U.S. oil consumptionin 1996, and highway transportation accountedfor 78.3% <strong>of</strong> U.S. oil consumption for transportation.Therefore, highway transportation accounted for 52.0% <strong>of</strong>U.S. oil consumption (66.4% x 78.3%). The United Statesalso consumed 25.7% <strong>of</strong> the world's oil production in1996. Thus, U.S. highway transportation consumed 13.4%(slightly more than one-eighth) <strong>of</strong> the world's total oil production(52.0% x 25.7%). Highway transportation refersto travel by cars, trucks, motorcycles, and buses. See Davis(2000, tables 1.3, 2.10, and 2.7) for the data on energyconsumption for transportation in the United States.ACKNOWLEDGMENTSI am grateful to the University <strong>of</strong> California TransportationCenter for financial support. DouglasKolozsvari provided superb research assistance. Iam also grateful for excellent advice from JeffreyBrown, Leland Burns, Daniel Chatman, RandallCrane, Melanie Curry, T.H. Culhane, Simon Fraser,Daniel Hess, Mimi Holt, Hiro Iseki, JoshuaKirshner, Robin Liggett, Bravishwar Mallavarapu,Jeremy Nelson, Don Pickrell, Thomas Rice, MichaelSabel, Lisa Schweitzer, Charles Sciammas, PatriciaShoup, Charanjeet Singh, Alexander Smith, ManualSoto, Brian Taylor, Florian Urban, Melvin Webber,Richard Willson, and two anonymous reviewers.Earlier versions <strong>of</strong> this paper were presented at the2001 Annual Meeting <strong>of</strong> the TransportationResearch Board in Washington, DC, the 2001 WorldParking Symposium in St. Andrews, Scotland, andthe 2002 Annual Meeting <strong>of</strong> the Western RegionalScience Association in Monterey, California.REFERENCESDavis, S. 2000. Transportation Energy Data Book: Edition20, ORNL-6959. Oak Ridge, TN: Oak Ridge NationalLaboratory.Hoover, E. 1965. Motor Metropolis: Some Observations onUrban Transportation in America. Journal <strong>of</strong> Industrial Economics13(3):17–192.Institute <strong>of</strong> Transportation Engineers (ITE). 1987a. ParkingGeneration, 2nd edition. Washington, DC.______. 1987b. Trip Generation, 4th edition. Washington, DC.______.1991. Trip Generation, 5th edition. Washington, DC.______. 1997. Trip Generation, 6th edition. Washington, DC.______. 2001. Trip Generation Handbook: An ITE RecommendedPractice. Washington, DC.Meyer, M. and E. Miller. 2001. Urban Transportation Planning,2nd edition. New York, NY: McGraw Hill.Mumford, L. 1981. The Highway and the City. Westport, CT:Greenwood Press.Planning Advisory Service. 1991. Off-Street Parking Requirements:A National Review <strong>of</strong> Standards, Planning AdvisoryService Report Number 432. Chicago, IL: American PlanningAssociation.Author address: Department <strong>of</strong> Urban Planning, University<strong>of</strong> California, Los Angeles, CA 90095-1656. Email:shoup@ucla.edu.12 JOURNAL OF TRANSPORTATION AND STATISTICS V6/N1 2003

lD O OD d~p o Ol 00 l- 111c is Ol L- Co~ v Vl0 L~ UQoDCOa~ rC-5 dU)NUO01Ol~ o M O cM EN OD O EEU~d~ N C-Q o LO r-I lfl0coM l0 4 l4o l~ O Ol L-LPL R lo L-4ca n l0 M M M (Oco - C- c-I QlCcO NOUHo- U=WmM l~ dM~ v [- O Ol~n m l0 r1 00 l0R ~ lo M M M h ,-IL~ r-1 ON aNa-p0zkoEl)NWa0o)Ol0°'=CZ)QQO O Oa a aV2 V2W WH H Hpq piOa G+WE-1zw[-1 ~'.., Nz wa o0a t:) f4 4H H asa ,' :) H zZ3 Of 1-G~.~r H ON WOltDx w aw oaU W C~-ia H U) orx4 Nao w w w~-IN M00 0oz°;or~ o

NATIONAL PEACE CORPS ASSOCIATION58-1431113FORM 990INCOME AND COST OF GOODS SOLDINCLUDED ON PART I, LINE 10STATEMENT 1INCOME1 . GROSS RECEIPTS . . . . .2 . RETURNS AND ALLOWANCES . . . . . . . . . . .3 . LINE 1 LESS LINE 2 . . .4 . COST OF GOODS SOLD (LINE 13) . . . . . . . .5 . GROSS PROFIT (LINE 3 LESS LINE 4) . . . . .COST OF GOODS SOLD6 . INVENTORY AT BEGINNING OF YEAR . . . . . . .7 . MERCHANDISE PURCHASED . . . . . . . . . . .8 . COST OF LABOR . . . . .9 . MATERIALS AND SUPPLIES . . . . . . . . . . .10 . OTHER COSTS . . . . . .11 . ADD LINES 6 THROUGH 10 . . . . . . . . . . .12 . INVENTORY AT END OF YEAR . . . . . . . . . .13 . COST OF GOODS SOLD (LINE 11 LESS LINE 12) . .15,1783,1213,12115,17812,0573,1213,12116 STATEMENT S) 112210914 745960 24116 2003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1

NATIONAL PEACE CORPS ASSOCIATION 58-1431113FORM 990, OTHER EXPENSES STATEMENT 2(A) (B) (C) (D)PROGRAM MANAGEMENTDESCRIPTION TOTAL SERVICES AND GENERAL FUNDRAISINGBAD DEBT EXPENSE 12,674 . 12,674 .CONSULTANT FEES 124,088 . 89,313 . 17,938 . 16,837 .INSURANCE 5,713 . 1,801 . 3,462 . 450 .MEMBERSHIP DUES &WORKSHOP 34,504 . 4,417 . 870 . 24,217 .STAFF DEVELOPMENT 23 . 23 .TEMPORARY HELP 62,338 . 57,216 . 5,122 .MISCELLANEOUS 2,485 . 664 . 1,000 . 821 .LESS : IN-KINDSERVICES BOARD MEETING 1,706 . 1,706 .AWARDS 11,900 . 11,900 .WEBSITE 17,041 . 10,182 . 4,082 . 2,777 .COST OF MECHANDISE 0 .TOTAL TO FM 990, LN 43 264,297 . 193,167 . 20,906 . 50,224 .FORM 990 STATEMENT OF ORGANIZATION'S PRIMARY EXEMPT PURPOSE STATEMENT 3PART IIIEXPLANATIONPROMOTE WORLD PEACE AND UNDERSTANDING BETWEEN THE PEOPLE OF THE UNITEDSTATES AND THOSE OF OTHER COUNTRIES THROUGH EDUCATIONAL, CULTURAL AND SOCIALACTIVITIES .17 STATEMENT S) 2, 312210914 745960 24116 2003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1

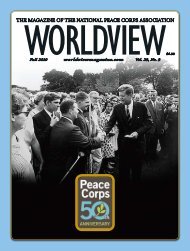

NATIONAL PEACE CORPS ASSOCIATION58-1431113FORM 99Q~STATEMENT OF PROGRAM SERVICE ACCOMPLISHMENTSSTATEMENT 4DESCRIPTION OF PROGRAM SERVICE ONEPUBLICATIONS : WORLDVIEW MAGAZINE IS A 16-YEAR-OLD QUARTERLYMAGAZINE OF NEWS AND COMMENTARY ABOUT THE PEACE CORPS WORLD,THE ONLY MAGAZINE DEDICATED TO BRINGING THE EVENTS AND PEOPLEOF THE LESS-DEVELOPED PLACES IN THIS WORLD TO U .S . READERS .IN EACH ISSUE, THE EDITORS PROVIDE RECENT NEWS SUMMARIES FROMMORE THAN 90 NATIONS, REVIEWS OF BOOKS WRITTEN BY OR ABOUTTHE DEVELOPING WORLD, NEW AND ORIGINAL FICTION BY DEVELOPING-WORLD WRITERS, AND REPORTING, ESSAYS, AND OPINIONS ABOUTEVENTS IN LATIN AMERICA, AFRICA, THE MIDDLE EAST, EASTERNEUROPE, ASIA, AND THE PACIFIC .GRANTSEXPENSESTO FORM 990, PART III, LINE A359,407 .FORM 990STATEMENT OF PROGRAM SERVICE ACCOMPLISHMENTSSTATEMENT 5DESCRIPTION OF PROGRAM SERVICE THREEEDUCATION/ SERVICE : NPCA'S GLOBAL EDUCATION PROGRAM FOCUSESON IMPROVING THE UNDERSTANDING AMONG AMERICANS OF THEIRBROADER ROLE AS PART OF A GLOBAL COMMUNITY . THIS INCLUDESTHE GLOBAL TEACHNET PROGRAM, PROVIDING PROFESSIONAL DEVELOP-MENT AND GLOBAL EDUCATION RESOURCES FOR K-12 EDUCATORS . THENPCA RECOGNIZES THE OUTSTANDING DOMESTIC AND AND/OR INTER-INTERNATIONAL SERVICE CARRIED OUT BY OUR INDIVIDUAL MEMBERSAND AFFILIATE GROUPS THROUGH AN ANNUAL AWARDS PROGRAM . THENPCA'S WEBSITE LINKS MEMBERS TO SERVICE OPPORTUNITIES (IN-CLUDING THOSE THROUGH THE EMERGENCY RESPONSE NETWORK) ANDTHROUGH FORMAL COLLABORATIONS WITH SERVICE ORGANIZATIONS .GRANTSEXPENSESTO FORM 990, PART III, LINE C196,381 .18 STATEMENT S) 4, 512210914 745960 24116 2003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1

NATIONAL PEACE CORPS ASSOCIATION58-1431113FORM 990DEPRECIATION OF ASSETS NOT HELD FOR INVESTMENTSTATEMENT 6DESCRIPTIONCOST OROTHER BASISACCUMULATEDDEPRECIATIONBOOK VALUECOMPUTER EQUIPMENTOFFICE FURNITURELEASEHOLD IMPROVEMENTS76,673 .13,106 .3,894 .61,233 .12,884 .778 .15,440 .222 .3,116 .TOTAL TO FORM 990, PART IV, LN 5793,673 .74,895 .18,778 .FORM 990 OTHER REVENUE NOT INCLUDED ON FORM 990STATEMENT 7DESCRIPTIONAMOUNTCOST OF GOODS SOLD 3,121 .TOTAL TO FORM 990, PART IV-A 3,121 .FORM 990 OTHER EXPENSES NOT INCLUDED ON FORM 990 STATEMENT 8DESCRIPTIONCOST OF GOODS SOLDTOTAL TO FORM 990, PART IV-BAMOUNT3,121 .3,121 .12210914 745960 2411619 STATEMENT S) 6, 7, 82003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1

NATIONAL PEACE CORPS ASSOCIATION58-1431113CORM 990PART V - LIST OF OFFICERS, DIRECTORS,TRUSTEES AND KEY EMPLOYEESSTATEMENT 9EMPLOYEETITLE AND COMPEN- BEN PLAN EXPENSENAME AND ADDRESS AVRG HRS/WK SATION CONTRIB ACCOUNTDANE SMITH PRESIDENT (UNTIL 8/03)ALL MAY BE REACHED C/O THE 40ORGANIZATION 40,900 . 2,044 . 0 .KEVIN QUIGLEY PRESIDENT (FROM 8/03)40 47,597 . 1,750 . 0 .KEN HILLCHAIR2 0 . 0 . 0 .STEPHANIE ARNOLDVICE CHAIR2 0 . 0 . 0 .CHRIS GLAUDELTREASURER2 0 . 0 . 0 .DEBORAH MOSTSECRETARY2 0 . 0 . 0 .BARRY S . ADAMSON BOARD MEMBER1 0 . 0 . 0 .FRANCES ALFORDBOARD MEMBER1 0 . 0 . 0 .BRUCE ANDERSONBOARD MEMBER1 0 . 0 . 0 .JOSH BUSBYBOARD MEMBER1 0 . 0 . 0 .20 STATEMENT S) 912210914 745960 24116 2003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1

NATIONAL PEACE CORPS ASSOCIATION 58-1431113LEO CECCHINIBOARD MEMBER1 0 . 0 . 0 .DON DAKINBOARD MEMBER1 0 . 0 . 0 .HELENE B . DUDLEY BOARD MEMBER1 0 . 0 . 0 .ROBERT A . FINDLAY BOARD MEMBER1 0 . 0 . 0 .CHARLES L . FRANKEL BOARD MEMBER1 0 . 0 . 0 .ARLENE GOLDBERGBOARD MEMBER1 0 . 0 . 0 .JAN GUIFARROBOARD MEMBER1 ~ 0 . 0 . 0 .CARRIE HESSLER-RADELETBOARD MEMBER1 0 . 0 . 0 .DAVE HIBBARDBOARD MEMBER1 0 . 0 . 0 .SANDRA LAUFFERBOARD MEMBER1 0 . 0 . 0 .MIKE MOOREBOARD MEMBER1 0 . 0 . 0 .PAT REILLYBOARD MEMBER1 0 . 0 . 0 .CAROL ROGERSBOARD MEMBER1 0 . 0 . 0 .21 STATEMENT S) 912210914 745960 24116 2003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1

NATIONAL PEACE CORPS ASSOCIATION 58-1431113JIM SOLOMONBOARD MEMBER1 0 . 0 . 0 .ROBERT C . TERRY BOARD MEMBER1 0 . 0 . 0 .DAVID WESSELBOARD MEMBER1 0 . 0 . 0 .JUDITH WHITNEYBOARD MEMBER1 0 . 0 . 0 .ANGENE H . WILSON BOARD MEMBER1 0 . 0 . 0 .SHERRY ZEMBOWERBOARD MEMBER1 0 . 0 . 0 .PETER JOHNSONHONORARY BOARD MEMBER1 0 . 0 . 0 .TOTALS INCLUDED ON FORM 990, PART V88,497 . 3,794 . 0 .22 STATEMENT S) 912210914 745960 24116 2003 .06020 NATIONAL PEACE CORPS ASSOCI 24116 1

Form 8868(12-2000) Page 20 If you are filing for an Additional (not automatic) 3-Month Extension, complete only Part II and check this box . . . _ ._Note : Only complete Part II if you have already been granted an automatic 3-month extension on a previously filed Form 8868 .0 Ifyou are filing for an Automatic 3-Month Extension, complete only Part I (on page 1).Part II Additional (not automatic) 3-Month Extension <strong>of</strong> Time - Must file Original and One Copy .Type orName <strong>of</strong> <strong>Exempt</strong> <strong>Organization</strong>Employer identification numberprint .NATIONAL PEACE CORPS ASSOCIATION 58-1431113File by theextended Number, street, and room or suite no . If a P .O . box, see instructions For IRS use onlydua date for1900 L STREET N . W .filing theNO . 205return see City, town or post <strong>of</strong>fice, state, and ZIP code. For a foreign address, see instructions .instructions WASHINGTON , DC 20036Check type <strong>of</strong> return to be filed (File a separate application for each return) :Form 990 [::] Form 990-EZ 0 Form 990-T (sec. 401(a) or 408(a) trust) E~:] Form 1041-A E] Form 5227 ~ Form 8870Form 990-BL E] Form 990-PF E] Form 990-T (trust other than above) F I Form 4720 E] Form 6069STOP : Do not complete Part II if you were not alrea dy gr anted an automatic 3-month extension on a previously filed Form 8868 ." If the organization does not have an <strong>of</strong>fice or place <strong>of</strong> business in the United States, check this box . . . . . . _ . . . * ED" .f this is fir a Group <strong>Return</strong>, ester the organization's four digit Group <strong>Exempt</strong>ion Number (GEN) If this is for the whole group, cheek thisbox loo- 0 . If it is for part <strong>of</strong> the group, check this box 1 0 and attach a list with the names and EINs <strong>of</strong> all members the extension is for .4 I request an additional 3-month extension <strong>of</strong> time until NOVEMBER 15, 2004 .For calendar year 2 0 0 3 , or other tax year beginning -^^d-°^~'6 If this tax year is for less than 12 months, check reason . 0 Indial return =1 Final return ~ Change in accounting penod7 State m detail why you need the extensionADDITIONAL TIME IS NEEDED FOR PREPARING A COMPLETE AND ACCURATE RETURNSa If this application is for Form 990-BL, 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less anynonrefundable credits See instructionsbIf this application is for Form 990-PF, 990-T, 4720, or 6069, enter any refundable credits and estimatedtax payments made. Include any prior year overpayment allowed as a credit and any amount paidpreviously with Form 8868 $c Balance Due . Subtract line 8b from line 8a Include your payment with this form, or, if required, deposit with FTDcoupon or, if required, by using EFTPS (Electronic Federal <strong>Tax</strong> Payment System) . See instructions $ N/ASignature and VerificationUnder penalties <strong>of</strong> perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best <strong>of</strong> my knowledge and belief,it is true, correct, an complete, and that I am ut or¢ed to prepare this form .Signature 1 ~3 `1J ~ Title 1 en-P A, Date 1Notice to Applicant - To Be Completed by the IRS~I We have approved this application . Please attach this form to the organization's return .We have not approved this application . However, we have granted a 10-day grace period from the later <strong>of</strong> the date shown below or the duedate <strong>of</strong> the organization's return (including any pnor extensions) . This grace period is considered to be a valid extension <strong>of</strong> time for electionsotherwise required to be made on a timely return . Please attach this form to the organization's return .0 We have not approved this application . After considering the reasons stated in item 7, we cannot r request for an extension <strong>of</strong> time t<strong>of</strong>ile . We are not granting the 10-day grace period O1y p~1~"~,~)~/~0 We cannot consider this application because ft was filed after the due date <strong>of</strong> the return for which an extension was request ~~u'DirectorOtherBY-W %N u~~lu~FAlternate Mailing Address - Enter the address if you want the copy <strong>of</strong> this application for an additional 3-month extensidifferent than the one entered above .Name'~~an addressType Number and street (include suite, room, or apt. no .) Or a P.O . box numberor print14550 MONTGOMERY AVE., SUITE 650 NORTfCity or town, province or state, and country (including postal or ZIP code)os3o oa I BETHESDA , MARYLAND 20814-2930Form 8868 (12-2000)2308470722 745960 24116 2003 .05040 NATIONAL PEACE CORPS ASSOCI 24116-1