btj 35.indd - Baltic Press

btj 35.indd - Baltic Press

btj 35.indd - Baltic Press

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ContentsEWTC Newsletter ................................................................................................... 5Green light for East-West transportBTJ calendar of partnership events ............................................................................................ 6What’s new ......... 8Just one question .......................................................................................................................... 12Transporting oil – a growing opportunity ........................................................................... 14Perspectives for the <strong>Baltic</strong> regionReporting, learning, being flexible ......................................................................................... 17Safety in BSRTo implement or not to implement ........................................................................................ 18Ship source marine pollution law in BSRReport: China-EU trade outlook ........................................................................ 21The future of bilateral relationsHow to do business with ChinaTrans<strong>Baltic</strong> Newsletter ....................................................................................... 26<strong>Baltic</strong> Ports Organization Newsletter ............................................................... 30Two openings, three dimensions ............................................................................................ 32DNV starts up 3D virtual training centerFocus: Shortsea Shipping on the <strong>Baltic</strong> ............................................................ 33More than hype?Two options for Finland .............................................................................................................. 36Debate on new IMO regulations continuesSystem planning: a new view ................................................................................................... 38IT solutions in portsHow to speed up freight traffic between Russia and Finland ....................................... 40New study by VTTRecovery in Russia approaching? ............................................................................................ 42Oversized goods and inland water transportLearn logistics . 44Educational undertakings of K+NTransport miscellany .................................................................................................................... 45Who’s who ........ 463/2010 | <strong>Baltic</strong> Transport Journal | 3

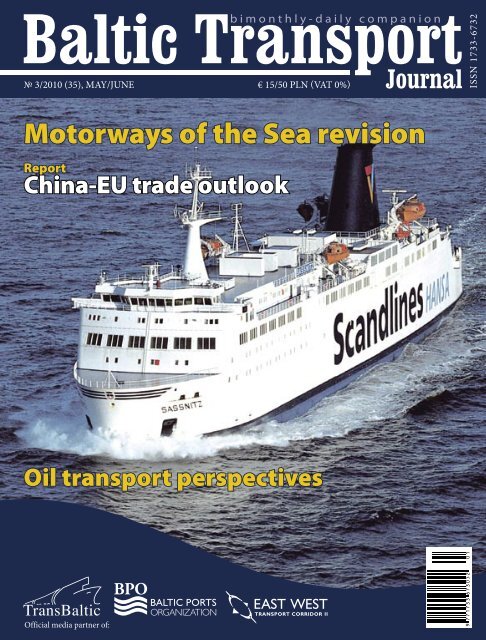

Editorial <strong>Baltic</strong> TransportJournalPresident of the BoardBOGDAN OŁDAKOWSKIoffice@baltictransportjournal.comPublishing DirectorPIOTR TRUSIEWICZpiotr@baltictransportjournal.comEditorial TeamMARTYNA BILDZIUKIEWICZmartyna@baltictransportjournal.comALISON NISSENalison@baltictransportjournal.comPIOTR TRUSIEWICZpiotr@baltictransportjournal.comContributing writers andupdate correspondents:KRZYSZTOF SZYMICHOWSKI, PROSHANTO MUKHERJEE,ABHINAYAN BASU BAL, KATARZYNA KUREK, YAN WEI,WILLY DE DECKER, MAREK BŁUŚ, JOHN LUND,ANTTI PERMALA, MARISA LUTTER, PIOTR STAREŃCZAK,ULLA TAPANINEN, JUHA KALLI, TAPIO KARVONEN,AGNIESZKA PAWŁOWSKAEnglish Language EditorsALISON NISSENDesign and DTPMEDONArt Director&Graphic DesignerDANUTA SAWICKAPublisherBALTIC PRESS SP. Z O.O.Address: 8 Pułaskiego Street81-368 Gdynia, Polandoffice@baltictransportjournal.comtel. +48 58 627 23 94, tel. +48 58 627 23 95fax +48 58 621 69 66www.baltictransportjournal.comMarketing & Sales(advertising, tradefairs, conferences)PIOTR TRUSIEWICZpiotr@baltictransportjournal.comANNA PASZEKanna@baltictransportjournal.comSubscriptionssubscriptions@baltictransportjournal.comPrintMEDONAddress: Medon sp. j.ul. Kartuska 245, 80-125 Gdańsk, Polande-mail: medon@medon.gda.plwww.medon.gda.plCirculation: 2,500Cover photo:Scandlines(FS Sassnitz on the Trelleborg-Sassnitz MoS)Subscriptions can be orderedin Kolporter offices in Poland.For more information call 0801-205-555 or visitwww.kolporter-spolka-akcyjna.com.pl/prenumerata.aspDear Readers,All those who were advertising Expo 2010 in Shanghai as the biggest in history– taking into account nearly all possible aspects – were right. The biggest exhibition area inone of the biggest (demographically as well as in terms of economic potential) countries makesa huge impression. Under such circumstances, it would be impossible not to mention China in this issueof BTJ, especially when we think of the country’s ties with the <strong>Baltic</strong> Sea region and the interest the Asianpower evokes in our area. For all those who are interested in doing business in China I recommend thearticle by Yan Wei, full of practical hints what (not) to do while working with the Chinese. Also, don’tmiss the analysis prepared by Cosco R&D, which gives us a full picture of China-EU trade relations.We also take you to another part of the globe – to Russia, whose economic recovery, as Marisa Lutterclaims, may already be underway thanks to the developing branch of oversized goods transportationas well as inland waterway transport. As we are in Russia, we also take a thorough look at the oilbusiness there and investments involved – I cordially recommend the expert article written by KrzysztofSzymichowski.The <strong>Baltic</strong> TLF industry is still in a hot discussion over new IMO regulations, regarding sulphurcontent in marine fuels. We’ve been writing about this issue since January and don’t omit the difficulttopic now. Ulla Tapaninen, with her colleagues from the Centre for Maritime Studies in Turku, givesus an in-depth analysis of the consequences Finland needs to take into account when implementing theregulations. Speaking of the latter – it’s worth seeing how many rules and regulations the <strong>Baltic</strong> Seaneeds to obey, especially when it comes to marine pollution; you can see a detailed list with experts’comments in the article by Proshanto K. Mukherjee and Abhinayan Basu Bal.As always, we are open to your comments, views and ideas. The more we discuss various issuesaround BSR, the better for our region.Martyna BildziukiewiczEditorCompany indexAckermans & van Haaren 45; Aeroflot Russian Airlines 13; Ahlers Group 34; air<strong>Baltic</strong> 12, 13; Airbus 13, 44; AKG Logistics42, 43; Alpcot Agro 10; Alpcot Capital Management 10; Alstom 45; AnsaldoBreda 11; Älvsborg Ro/Ro Terminal 20;Åland Posten 45; <strong>Baltic</strong> Oil Terminals 10; <strong>Baltic</strong> Ports Organization (BPO) 30; Banverket 20; Birka Line 45; Blue1 12;Citroën 11; Civil Aviation Administration (Denmark) 13; Confederation of Finnish Industries 36; Copenhagen Airports13; COSCO R&D 23; Credit Suisse 13; Damco 10; Danish Ports 46; DASH7 Alliance 10; DB Schenker 10; DEME Group 45;Det Norske Veritas Poland 32; DFDS 28; DFDS Lisco 26, 28; DNV Academy 32; DSB 11; European Bank of Research andDevelopment (EBRD) 12; European Commission 26, 27, 28, 29, 30, 33, 34; European Shortsea Network 33; Fast Lines34; Femern Bælt A/S 46; FESCO Transportation Group 10; Finnair Oy 12, 13; Finnish Customs 39, 40; Finnish Ministryof Transport and Communications 37, 40; Finnish Oil and Gas Federation 36; Finnish Transport Agency 31; Finnsteve39; Flensburg University of Applied Sciences 46; Forkor Shipyard 45; Frankfurt Airport 13; Germanwings 12; GothenburgCar Terminal 20; Gothenburg Municipality 20; Green Cargo 11; Group H. Essers 34; Grupa LOTOS 16; Gunvor8; Hansgrohe 9; HELCOM 17, 18; Helsinki Airport 13; International Air Transport Association (IATA) 17; InternationalCivil Aviation Organization (ICAO) 13, 17; International Energy Agency 15; International Maritime Organization (IMO)18, 19, 36, 37; International Monetary Fund (IMF) 23; Italscania 46; Katoen Natie 34; Kaunas International Airport 13;Kemi Bulk Terminal 31; KGHM Metraco 8; Kuehne Foundation 44; Kuehne + Nagel 10, 44; Kühne Logistics University44; Latvian Airlines 12; Latvian Railways (LDz) 11; Lever GmbH 46; LicTech 41; Lufthansa 13; Lufthansa Systems AG 46;Lufthansa Systems Infratec GmbH 46; Lufthansa Systems Network GmbH 46; Lufthansa Technik 44; Maersk 8, 10; MagemarPoland 45; MegaFon 13; Marine Environment Protection Committee (MEPC) 36; Mitsubishi 11; Mitsui & Co. 10;Multi-Link Terminals 39; Mussalo Harbour 41; Naftoport 14; National Aeronautics and Space Administration (NASA) 17;Noord Natie 34; Nordic Ferry Services 9; OOO Revival Express 10; Organization of the Petroleum Exporting Countries(OPEC) 14, 15; ORLEN Lietuva 14; Peugeot 11; PKN ORLEN 16; Polish Airways LOT 12; Port of Baltiysk 10; Port of Butinge14; Port of Esbjerg 5; Port of Fredericia 5; Port of Gdynia 45; Port of Gothenburg 20, 31; Port of Helsinki 39, 41; Port ofIl’yitchovsk 5; Port of Kaliningrad 5; Port of Karlshamn 5, 28, 29; Port of Karlskrona 5, 26; Port of Kemi 30; Port of Kiel 8;Port of Klaipėda 5, 8, 15, 26, 28, 29; Port of Lübeck 31; Port of Odessa 5, 16; Port of Primorsk 14, 15; Port of Riga 8; Portof Sassnitz 26; Port of Tallinn 8, 15, 30; Port of Trelleborg 26; Port of Ust-Luga 8, 14; Port of Ventspils 8, 14, 15; PulkovoAirport 12; RAF 17; Railport Scandinavia 20; Rhenus Group 10; Riga International Airport 12; Russian Customs 10, 41;RzD Russian Railways 11; Scandinavian Tank Storage 20; Scandlines Group 8, 26; Scania 46; Scania Schweiz AG 46; Sea-Invest 34; Sheremetyevo International Airport 13; Shortsea Promotion Centre Flanders 33, 34; Siemens AG 46, Silja Line45; Skandia Container Terminal 20; Skytrax 13; Statens Järnvägar 45; Stena Line 9, 26; Steveco 39; Sund & Bælt HoldingA/S 46; Szczecin Seaport 8, 45; Tabaknatie 34; Tallinn Airport 12; Tor Harbour 20; Trans<strong>Baltic</strong> 5, 26, 28, 30; TransLumi Line31; Transneft 14; Trinity House 45; United Nations (UN) 37; Visy Oy 39; Vnesheconombank 12; VTT Technical ResearchCentre of Finland 40; Vuosaari Harbour 39, 41; Wallenius Wilhelmsen Logistics 8; Wizz Air 13; World Bank 14..4 | <strong>Baltic</strong> Transport Journal | 3/2010

<strong>Baltic</strong> Transportb ibm i mo no tn ht lhy l-yd -ad ial y i l y c oc mo mp ap na ino ino nJournalPhoto: Port Hamburg AuthorityChina-EU trade outlookThe future of bilateral relations .................................................................................. 22How to do business with China .................................................................................. 24

What’s new?Aviationair<strong>Baltic</strong> will independently attract financialresources to build a new terminalfor handling its own as well as transitpassengers. Implementation of the planwill not require funding from RIGA InternationalAirport, state budget allocationsor government guarantees. Accordingto the plan, the new passengerterminal with appropriate infrastructureand a capacity of 5.2 mln passengers is tobe built by 2013. Investments requiredfor the construction of the terminal areestimated at approximately EUR 92 mln.The EBRD has committed to lend EUR100 mln to finance the building of anew terminal at St. Petersburg’s PulkovoAirport as part of a EUR 716 mlnlong-term debt package being put togetherby five international financialinstitutions and Russia’s Bank for Developmentand Foreign Economic AffairsVnesheconombank (VEB) to fundthis landmark Public-Private-Partnershipproject. Pulkovo’s existing facilitieshave reached their capacity limit anddo not allow for further traffic growth.Once completed, the project aims todouble traffic numbers at Pulkovo. Thenew terminal serving both domesticand international passengers is due tobe finished in 2013.Passenger turnover at Riga Airportcontinues to grow. In the 1st quarter of2010 there were 914.4 thous. passengerarrivals and departures from the airport,an increase of 21% if compared to the1st quarter of last year. In the 1st quarterof 2010, 609.3 thous. passengers usingLatvian Airlines saw an increase of28.3% when compared to the 1 st quarterof 2009. The largest 1st quarter passengerturnover at the airport was with Germanairports – 122.5 thous. passengers,followed by Great Britain with 116.8thous. passengers.After a two-year break Polish AirwaysLOT have resumed flight service fromWarsaw to Tallinn. The trip, lastingabout one hour and forty-five minutes,will be served by Embraer 145 and 170aircraft. The connection to Tallinn isone of many new routes which will extendthe LOT network over the comingmonths. They will also include connectionsto Bratislava and Kaliningrad.Just one questionChaos in European airportsWhat if another volcano erupts?With the recent flight disruptions, caused by ashes from the Eyjafjallajökull volcanoin Iceland, we have asked industry leaders, what can be done in the future tominimise passenger inconvenience and airline costs when dealing with potentialnatural disasters such as occurred in April.Erik SakkovMember of the Management BoardTallinn AirportDecisions of the authorities must be based on actual facts, on a scientificand measureable basis, not on emotions or fears. To minimisepassenger inconvenience, airlines and airports must have a clearstrategy and action plan to handle force majeure situations in thefuture. Volcanoes will not accept our bills, perhaps it makes sense tocreate a special fund to cover the costs related to similar disruptions.Maria MroueCommunications DirectorFinnair Oyj Corporate CommunicationsA common ground would help everyone to put every effort into solvingthe situation. Insurance companies, for example, state that they do notcover anything in these situations. We at Finnair have all our resourceshelping our customers, as it should be. Yet there are demands that airlinesshould cover various expenses in addition to refunding tickets.Andreas EngelManager International Public RelationsGermanwingsFirst of all better coordination between airlines, national governments,air traffic services and EU authorities. That also means faster decisions tominimise passenger inconvenience and airline costs. Hopefully not onlythe airline industry has learned from underestimating the potential ofsuch events. We need to look forward, everyone within the EU, in order tomodel and price the risks as well as we can to deal with mother nature.Tom ChristidesVP Communications and Public AffairsBlue1We’ll have to accept the fact that traffic disruptions on a very large scale,like in April, always will cause passenger inconvenience to some extent.Our experience is that on-time and accurate passenger communication,through all kinds of channels, e.g. mass media, the web, Facebook andtext messaging, is a major factor in relieving passenger inconvenience.Of course, the passengers involved need to be taken care of, but clearrules have to apply in a situation like this, it cannot differ from country tocountry or airline to airline. And it must not cover only aviation, but theentire transport sector.12 | <strong>Baltic</strong> Transport Journal | 3/2010

FocusShortsea Shipping on the <strong>Baltic</strong>Photo: Keith FoleyMore than hype?In the mid-1990s the European Commission launched the term “shortsea shipping” (SSS), being thetransport of cargo and passengers, using the coastal waters throughout Europe, including the MediterraneanSea (North Africa), the Black Sea and the <strong>Baltic</strong> Sea. This meant a much wider geographicalspectrum than the previous “coastal navigation”.Also, the limitation of“small” vessels was abandoned.In certain countriessea-river vessels delivercargo directly to the customer’spremises on riversand canals. The European Commission’s aim isthat shortsea shipping contributes to solving thecongestion problem on European roads.Promoting Shortsea ShippingAfter setting up contact points in the administration(Focal Points), the Commissionwas stimulating the establishment of shortseapromotion centres. The first one was set up inthe Netherlands (1997), followed by Flanders/Belgium one year later. The promotion centresare the natural contact office for marketplayers. In 2000, the European Shortsea Networkwas launched, an informal network of 21shortsea promotion centres spread across Europe.This network connects 21 local networksand offers a lot of expertise to the market.During the promotion of shortsea shippingthe focus is on giving adequate information totarget groups: shippers, forwarders, logisticscompanies, roadhauliers, etc. As the promotioncentres are neutral and non-commercialentities, they use mainly “best practices” toapproach the market players and use the extensivenetwork to answer the raised questions.The <strong>Baltic</strong> region is one of the main targetareas for SSS: the <strong>Baltic</strong> Sea and the number ofwell equipped ports allow to set up frequent,reliable shortsea liner services. For certaincountries like Estonia, Lithuania and Latviaa solution has to be found for an imbalancebetween the import and export cargo flow: atriangle service can offer possibilities. Differenttypes of ships are available for a variety ofcargo goods with the greatest focus on ro-rovessels. Local winter circumstances are met bycontinued on page 343/2010 | <strong>Baltic</strong> Transport Journal | 33

FocusPhoto: Stena Lineice-classed vessels, guaranteeing the shippersthat their cargo is in good hands.Belgian maritime companies have beeninvesting for some years already in the <strong>Baltic</strong>region: Ahlers Group (St. Petersburg), GroupH. Essers (near Copenhagen), Katoen Natie(Trollhättan/Sweden), Tabaknatie (Gdynia),Noord Natie (Ventspils), Fast Lines (Szczecin),Sea-Invest (Gdańsk), and more.SSS in the crisisIn recent years, a lot of shipowners havestrengthened their services in and into the<strong>Baltic</strong> Sea by increasing capacity and frequency.The economic crisis that started inthe last months of 2008 hit shortsea shippingactivities due to decreasing cargo volumes.Although all countries were faced with smallercargo flows, especially the traffic betweenFlanders and Finland as well as Flanders andRussia dropped dramatically.In the first quarter 2010 there have beensome signs of slight recovery in the <strong>Baltic</strong> regionas far as cargo flows are concerned, alsofrom the Russian market. This leads to somereshuffling within shortsea services, even withsome extra capacity or sailing. Analysing theshortsea statistics of the last three years, Polandhas survived the crisis quite well.Motorways of the SeaTrucking prices have always been lowfor transport by truck in the <strong>Baltic</strong> region,especially the three <strong>Baltic</strong> states and Poland,and western Europe. After the entry of thesecountries into the EU, prices went up a bit.But it was still difficult to set up shortseaservices between this area and western Europedue to the prices and the imbalance ofcargo flows. For ro-ro services, the ownersfaced difficulties in obtaining (long-term)commitments from trucking companies.The crisis has decreased the prices again,however, it has caused a growth in localmarkets, EU regulations on drive/rest, GermanMaut, shortage of drivers… all in all, itmight open up some opportunities for newshortsea services. It is extremely importantto look for synergy with road transport toset up Motorways of the Sea.The European Commission has set upco-financing programs for the establishmentof these Motorways of the Sea: existingor new maritime services which arepart of a door-to-door logistics chain andwhich are bundling cargo flows into viable,regular, frequent and high quality shortseaconnections. A <strong>Baltic</strong> Motorways of the SeaTaskforce is working on projects out of themarket to submit to the EC-Motorways ofthe Sea subsidy program.Still a lot to doShortsea shipping has certainly played asustainable role in intermodal transport chainsbetween the <strong>Baltic</strong> region and western Europe.The environmental image will be further developedin the forthcoming years, supportedby already ongoing projects like shore supplyof power in certain ports. This transport modehas proved to be more than hype: without SSS,the road would be fully congested. But there isstill a huge potential to work on, just to namethe more than 23 mln small and medium-sizedenterprises in the EU. One of the tasks of thepromotion centres is to focus on the SMEswith adequate information and convince themwith best practices to include SSS as a sustainablepart of their transport and supply chain. Willy De DeckerShortsea Promotion Centre FlandersFor more information, please visit:www.shortsea.be“De Lloyd” – Antwerp, <strong>Baltic</strong> Special,April 23 th 2010, www.shortsea.info34 | <strong>Baltic</strong> Transport Journal | 3/2010 3/2009

East West Transport Corridor IIEWTC newsletterGreen light for East-West transportinterlinked hubs and more environmentallyfriendlytransport solutions.Keeping up the momentumAs the first EWTC project turned out to be a success, a new editionwas started in September 2009. The follow-up initiative of EWTC IIaims at highlighting the development of a Green Corridor Conceptas a best practise case in the European TEN-T context.Being an integrated part of theNorthern Transport Axis andrunning from Vilnius in Lithuaniavia South-East Sweden toEsbjerg in Denmark, the East-West Transport Corridor servescross-border and transit transport across theregion, taking cargo further to Russia, the FarEast and to the Black Sea areas. The EWTCcan become an important player in the marketfor Russian freight export and imports via theII and IX Pan-European Corridors linked tothe Ports of Kaliningrad and Klaipėda. It alsohopes that development of the Trans-SiberianRailway line shall allow it in the long run tobecome an alternative to sea transport of allgoods from the Far East to Europe. While thesea route from China to Europe is approximately20,000 km, the Trans-Siberian line tothe southern <strong>Baltic</strong> Sea is only about 11,000 km.When compared to shipping, the train route isshorter and faster, and offers more flexibility intiming and volume as regards the transportedgoods. With increased capacity in the transportroutes between Lithuania and Sweden,Klaipėda and Blekinge (Karlshamn/Karlskrona)can be developed into important gatewaysfor trade between Scandinavia and the BlackSea, and beyond. The goods can be carried onfurther to Ukraine, Belarus and the Caucasus,via the Il’yitchovsk and Odessa ports. The railcarswith containers can even be delivered toGeorgia, Armenia and Turkey. Hence, a part ofthe project is dedicated to developing the ports,including the most western Port of Esbjerg andFredericia (both in Denmark), Swedish Helsingborg,Karlshamn and Karlskrona, LithuanianKlaipėda and Russian Kaliningrad.Creating a common visionThe first edition of the project was held inyears 2006-2007 as a cooperative venture between42 partners and aimed to strengthentransport development by infrastructure improvements,new business solutions, logisticsand co-operation between researchers. Partnersin the EWTC project, with Region Blekinge beingthe lead one, included local, regional andnational authorities, universities, harbours andprivate stakeholders from Denmark, Lithuania,Russia and Sweden. Co-financed by the projectpartners as well as the <strong>Baltic</strong> Sea Region Programme2007-2013, EWTC was the first stepon the way toward a more sustainable transportsystem in the region. Aside from a new strategyand a concrete Action Plan for further improvementsof the corridor, the project resultedin the partners starting a common vision forthe year 2030, where EWTC stands out as anefficient and green corridor on the map of theTrans-European Network, meeting market demandsfor growing freight to/from Scandinaviaand Lithuania with close co-operation betweenWith EWTC II, the co-operation was renewedin March 2009, when the partnershipapplied for EU grants of EUR 7.5 mln from theInterreg IV <strong>Baltic</strong> Sea region programme, withRegion Blekinge again taking the role as leadpartner. This time, it has been joined by around70 partners from Sweden, Denmark, Lithuania,Germany, Russia, Belarus, Italy and China, includingseveral partners from the private sector,and is supported by both the Swedish andLithuanian governments. The project serves asa testing ground not only for the green corridorconcept, but also for innovations, new technology,business models and improved managementsystems that may advance the presentsustainable transport solutions. Linking Minsk,Vilnius, Klaipėda/Kaliningrad with Denmarkvia southern Sweden and with Germany viaSassnitz, the project will facilitate developmentof hubs as growth centres. For better results indeveloping the green corridor criteria, EWTCII will cooperate with the ongoing Trans<strong>Baltic</strong>and SCANDRIA projects.Stimulating sustainable growthThe main goal of the EWTC II is to securesustainability for transport solutions withinthe corridor by means of creating a networkof stakeholders and making use of the alreadyexisting Corridor Organisation and Structure.EWTC II is supposed to act as a referencemanual concerning green corridors that willpropose more eco-friendly alternatives and explainbasic steps required to develop a greencorridor concept in line with the EU transportpolicies. The manual will also describe optionsfor the certification of green transport systems.As a way to reduce costs and environmentalimpact, the project will also suggestan innovative IT-based information brokersystem, in correspondence with the EU’s ambitionsfor e-freight. New business conceptsfor railway transport, improved infrastructureand transport service in ports and terminalsare among the expected outcomes as well. For more information on this project,please visit www.ewtc2.eu.Agnieszka Pawłowska3/2010 | <strong>Baltic</strong> Transport Journal | 5

European Commission’s perspective on Motorways of the SeaTowards an integrated transport system in the <strong>Baltic</strong> Sea RegionReviewing the White PaperPhoto: JLoganEven though the <strong>Baltic</strong> Sea lies within the scope of EU’s highest priority, six attempts to formthe Motorways of the Sea here have been declined. Today, just before the revision of the WhitePaper and ahead of the biggest MoS budget in history, Trans<strong>Baltic</strong> puts the MoS issue on theagenda, giving you some hints how the EC sees the MoS today and in future.So far, there are only threeMotorways of the Sea operatingon the <strong>Baltic</strong>, all linkingSweden with the continent.The two existing inner-<strong>Baltic</strong>MoS, Karlskrona-Gdyniaand Trelleborg-Sassnitz, are located on theNorth-South axis, with the first one beingoperated by Stena Line and the latter byScandlines. The only West-East route betweenKarlshamn and Klaipėda is operatedby DFDS Lisco.Until now, intermodality has been the keyprinciple of the MoS concept, with involvementof two ports from two countries, a maritimeoperator and hinterland transport companiesadding to the project’s value. The EUeven likes to see broader consortia of partners,with terminal operators, logistics companiesand ship brokers expected to take partin the project. A strong focus is usually givento investments in infrastructure, in order toovercome or prevent bottlenecks.Picture of todayAs Marc Vanderhaegen, the principal administratorof the EC’s Motorways of the SeasProgramme puts it, the main goal of the MoSis to reduce road congestion and improve accessibilityof the regions, involving correctzoom on the TEN-T priority network. Theperfect candidate to receive funding shouldbe a viable business in itself, focused predominantlyon freight traffic and deliveringregular, frequent and high-quality servicesthat allow a concentration of freight flowsinto door-to-door logistics chains. There is aneed for commitment that the services will bemaintained after the project period.Generally speaking, the EC is open tosupport all project users in their infrastructureinvestments and purchase of the necessaryequipment. From the ports/terminalsperspective, these can be high water protectiondevices (like dikes, breakwaters or locks);lights, buoys and beacons; ramps and jetties;as well as operational facilities for loadingunits, for drivers, offshore electricity, wastehandling, and terminal handling equipment.However, the EC is eager to go further andco-fund both land and sea access to the port,including links to the TEN-T or national landtransport networks in the hinterland, as wellas waterways/canals which shorten the searoutes. The applicants should not forget aboutthe hinterland part of the project. A simpleport to port link is certainly not enough toreceive final approval.An important factor for the evaluators isthe efficiency of MoS services based on modalshift calculations until 2025 along with the reductionof the external costs to society. Applicantshave to go through the tedious processof calculating costs 15 years ahead and itneeds to be done well in a coherent manner.Luckily, the calculation can be done using theexisting Marco Polo calculator. Meanwhile,integration of IT systems or application of asingle window concept becomes increasingly26 | <strong>Baltic</strong> Transport Journal | 3/2010

Towards an integrated transport system in the <strong>Baltic</strong> Sea Regionimportant. It is welcome when the projectaims at implementing electronic logisticsmanagement systems, improves safety andsecurity, and/or simplifies administrationand customs procedures. Shipping can alsoreceive co-funding for vessels and vesselequipment.The total TEN-T budget dedicated toMotorways of the Sea has significantly beenrising each year, from EUR 20 mln for 2008,up to 85 mln for 2010, and as much as 100mln for 2011. However, this is not going tolast forever, and the amounts designated foryears 2012-13 are just EUR 50 mln and 25mln. The TEN-T MoS co-financing in 2010allows 20% funding for infrastructure worksand facilities (implementation projects), 30%for crossborder sections, 50% for pilot actionsand studies, and finally 30% for the start-upaid. Combining rates within the same projectis possible, but you cannot cumulate the receivedsupport with other EU co-financinginstruments for the same actions.Revisions and changesPaweł Stelmaszczyk, head of logistics, comodality,inland waterways, MoS & Marco Polounit at the European Commission DirectorateGeneral for Energy and Transport, commentsthat the Motorways of the Sea remain at thetop of the EC agenda, being an integral part ofthe future integrated European transport system,and thus also lies at the heart of the WhitePaper. This means that as the WP is now beingreviewed and its new version is most likely tobe adopted by the end of the year, the Commissionis also going through major issuesrelevant to MoS. This also includes the futureof the Marco Polo programme, which – as Stelmaszczykadmits – has not been an astoundingsuccess. It is only last year that MP attractedenough fundable projects, so that all fundswere allocated, and, for the first time ever, therewas a reserve list. This year, however, the ECis expecting the same situation. The Commissionis now analyzing the success factors andwonders if it is due to successful marketing,increasing awareness, or rather changes thatwere introduced last year (lowered thresholdsand doubled funding) which made the applicationprocess easier, that caused raised intereston the market. For sure there might still be toolittle knowledge about the application processand the general mood of too strict bureaucracy.The Commission also holds the positionthat there is a need to refocus the funding prioritiesfor MoS, and puts forward several importantquestions that currently assist revisionof the TEN-T, Marco Polo and MoS policies.The question is whether the modal shift shouldremain the key objective and if the MoS shouldfollow/link the core TEN-T network. Then, ifwe should continue the bottom-up approachand if the top-down path is only really a definition,or maybe we should look at top-downplus bottom-up at the same time.There is another challenge of how toovercome funding fragmentation, and thequestion of whether we should stick to oneapplication for each MoS project, or one singlefund for all the actions – infrastructure,equipment, studies, services, pilot actions,etc. The EC, in its future White Paper, is likelyto propose establishment and managementof the so-called European Transport InfrastructurePlan and now investigates how itwill relate to the cohesion funds and regionaldevelopment policies. The so-called “newEU Member States” (like Poland, Lithuania,Latvia and Estonia) which are beneficiariesof cohesion and regional development funding,are afraid that this future transport fundwill take away money from the cohesion andregional development policies.Another thing is if we really need a specialregime for state aid (there have beenmore and more complaints about this), and ifwe can benefit more from EIB involvement.Therefore, the EC is now going through moreinnovative financing mechanisms talking tocommercial banks in different countries, inorder to find a way to provide direct fundingor co-funding through the EIB for MoS.Hopefully, these concerns will make MoSmore market-driven, and application criteriaclearer. “It’s very unique that all threeMoS Policy Review– next steps:• TEN-T, Marco Polo, MoS policyevaluation and impact assessment:ongoing• Saragossa Conference (8-9 June 2010)• MoS Conference (September 2010)• Marco Polo Stakeholder Conference(tba)• New Transport Policy White Paper(end of 2010)• Commission proposal on TEN-TGuidelines (Spring 2011)• Commission document on Motorwaysof the Sea (tba)• Commission proposal on Marco Polo(mid-2011)policies are being revised at the same time.It gives us a chance to synchronise thesepolicies and funding instruments,” commentsStelmaszczyk, meanwhile encouragingbusiness representatives to come upwith innovative ideas. Also, to make things5/2009 | <strong>Baltic</strong> Transport Journal | 3easier and to save potential applicants fromfalling into the hands of some consultantsthat “specialise” in getting EU funds, theEC has brought together two agencies andcreated the MoS One Stop Help Desk, availableat www. mos-helpdesk.eu. Piotr Trusiewicz3/2010 | <strong>Baltic</strong> Transport Journal | 27

Towards an integrated transport system in the <strong>Baltic</strong> Sea RegionHow the Karlshamn-Klaipėda Motorway of the Sea was formedBetter to be well preparedPhoto: Port of KlaipėdaFollowing a case study of the Karlshamn-Klaipėda connection, Trans<strong>Baltic</strong> investigates what iscrucial to establish a successful MoS master plan.In spring 2008, the Ports of Karlshamnand Klaipėda jointly submittedan application for MoS, set toenhance capacity of unitised goodsin the corridor. The project got theEuropean Commission’s approvalin 2009 and will last until the end of 2013,with its major goal to raise the intermodalshare of cargo transported in this corridorto 56% in 2015, and ultimately 71% in 2025(last year the result amounted to just 18%).Currently, the line is served by two vesselsand offers six departures weekly. Eventhough DFDS is not among the project’simplementing bodies, the company has alsocontributed to capacity growth implementingthe new M/v Lisco Optima vessel to theroute last year.The total cost of the project is EUR 26mln, out of which 20% is financed by theEuropean Union. It involves numerous portinfrastructure and rail investments – mostlyon the Swedish side. Apparently however,the significant imparity in funds allocation(EUR 24 mln going to Sweden and only twomillion to Lithuania) has not been a problematicissue for the Commission.Karlshamn taking the leadFor many years forest products, petroleumand bulk cargo was the basis for thePort of Karlshamn’s operations. The portopened its first ro-pax connection (the oneby DFDS Lisco) in 2001 and its utilizationsteadily grew by 15-20% each year until itreached the level of 50,000 freight units in2008 (plus private cars and passengers). Today,the volumes are down because of marketconditions, but Karlshamn is proud tofeature regular links to Lithuania, Germanyand Russia, anyway.Karlshamn applied to the MoS project onthe basis of its development plan from 1997with spatial expansion and reconstructionworks not only planned within the port itself,but also in the surrounding area aswell as located further on in the hinterland.Apart from the new entrance to the ro-roterminal and new handling equipment (anew crane with higher container capacity,upgrading existing ramps, purchasing a newreachstacker, etc.), the application includedincreasing the efficiency and capacity fortrains together with the renovation andelectrification of the port rail track. Thisshould allow block trains to connect theport directly with the Nordic Triangle byBlekinge coastal railway incorporated andstandardised with the national rail system.As Anders Wiberg, Manager of Strategic Developmentin the Port of Karlshamn reveals,integration with hinterland investments wasimportant because there had been practicallyno transit traffic in south-eastern Swedenbefore; therefore, the expected freightincrease could have a significant effect onroads. But – as the Port of Karlshamn is locatedoutside of the city, the traffic increaseshould not influence the living standard inthe area. It is again one of the crucial thingsin the project. Today, the rail shunting yardis still located within the municipality, so theport authorities intend to build a completelynew facility together with a combined terminaland logistics centre in place of the oldstone quarry located close to the port area.All this should double Karlshamn’s containerhandling capacity to 40,000 units peryear and allow the terminal to manage heavycargo and high shaft weight. Its location willalso improve the goods flow inside the port28 | <strong>Baltic</strong> Transport Journal | 3/2010

Towards an integrated transport system in the <strong>Baltic</strong> Sea Regionarea and the goods access to the quay. Thenew combi-terminal will have a surface areaof 30,000 m² and will be built in connectionto the shunting yard. The intermodal facilitywill be accessible by road and rail and alsoconnected to the ferry terminal. Meanwhilethe project includes a new railway connection,the “missing link” between Karlshamnand Olofström – Sydostlänken. By 2020,Sydostlänken should transport 75,000 units,according to a feasibility study made on behalfof Blekinge Region.Authorities in the Port of Klaipėda appliedfor building a new hydraulic ramp andbuying a dredging pump, but the latter appearedas not eligible in the EC’s final decision.Meanwhile, there are no funded activitiesfor the line operator involved.Success factorsAccording to the EC’s external experts’evaluation, the Klaipėda-Karlshamn MoSproject is well integrated in the overallTEN-T network and is aimed at improvingcompetitiveness of sea transportation contraroads, meanwhile trying to build an intermodalconnection with rail. All these leadto an increase in traffic volumes, which isexpected to bring strong social and environmentalbenefits to the regional economy,releasing economic values significantlylarger than the investments costs. The newlink improves cohesion and accessibilitybetween the two regions and further equalizethe east-west gap of BSR. What is more,realization of the project has not been perceivedas very complex. “Before applying tothe MoS project we were previously involvedin numerous other regional initiatives, likethe <strong>Baltic</strong> Gateway or East West TransportCorridor,” explains Wiberg. “We madevarious feasibility studies, but most of allwe have learned to know each other wellwith our partners on the Eastern side of the<strong>Baltic</strong>, because it really helps to have goodfriends in such activities,” he says.Drawbacks and doubtsArturas Drungilas, Marketing and AdministrationDirector at Klaipėda StateSeaport Authority finds the reason for sucha minor Lithuanian role in the project inother, more favourable financing possibilitiesavailable to the new EU Member States(south-eastern part of the <strong>Baltic</strong>). For example,the Port of Klaipėda is now startingto build a new ro/pax terminal with twogeneral cargo warehouses (4,000 m 2 and7,000 m 2 ) which should be ready by 2012,and even though it would nicely suit theMoS concept, its construction is financedfrom EU cohesion funds.Another problem stems from the longapplication process to the final decision thatdistracts companies from seeking funds inthe first place. Indeed, it took Karlshamn-Klaipėda almost one year to receive the fundingdecision from the Commission. Also, theshortsea network on the <strong>Baltic</strong> is so densethat it is hardly possible to add any new connectionwithout distracting the competition.BTJ’s ro-ro/ferry market review fromOctober last year (see BTJ 5/2009) showed124 vessels sailing in the <strong>Baltic</strong> Sea by 17 operators.Just from Klaipėda alone, there are6 ro-ro lines that altogether call at 25 portsin 18 countries. “You can find a similar networkfrom all major <strong>Baltic</strong> ro-ro ports and itis hard to find a shipping line partner fittingthe project,” he continues. His general feelingabout the MoS procedures is that theyapply too many constraints on the projectpartners and give insufficient support, notonly concerning the relatively small percentageof investment payback. “We would mostlikely not have this MoS if it was not thanksto the Swedish efforts,” he admits, beingrather reluctant about his company potentiallysigning another MoS project under thecurrently applying conditions.Karlshamn’s Strategic Development Manageralso has his doubts in the administrationprocedures that require a lot of resources, andare not at all, or at least poorly funded in theproject. For example, “once you receive a positivedecision, you need to prepare a StrategicAction Plan and describe everything onceagain, in even more detail,” he stresses. Thenevery year the beneficiaries are asked to reportwhat was completed (or not) accordingto the time schedule, what costs they have incurred,what communications activities havebeen undertaken, etc.5/2009 | <strong>Baltic</strong> Transport Journal | 3“You must know exactly what you wantto do, and you should be well prepared, asthere are many assessment questions in theapplication process, and the project simplyneeds to be mature,” both Wiberg andDrungilas agree. Also, all activities need tobe in line with the EU’s environmental strategyso environmental impact assessmentsare a particularly important thing to do beforeyou apply.Piotr TrusiewiczPhoto: DFDS LISCO3/2010 | <strong>Baltic</strong> Transport Journal | 29

BPO consultson MoS conceptBPO & Trans<strong>Baltic</strong> joint seminar in Sopot (PL),11 th May 2010<strong>Baltic</strong> Ports Conference<strong>Baltic</strong>-Asian Transit & Port sectorin changeand BPO General Assembly 20109-10 th September 2010Tallink Spa & Conference Hotel, Tallinn, EstoniaPhoto: BPOIn November 2009, the European Commission announced the call forproposals concerning Motorways of the Sea and secured EUR 310mln for such projects. In the previous call, there were 3 <strong>Baltic</strong> projects(out of 9 delivered at the national level) accepted by the EC for financing.These projects included: <strong>Baltic</strong>-Link MoS (Gdynia-Karlskrona,High Quality Rail and Intermodal Nordic Corridor Königslinie Trelleborg-Sassnitz, and the Klaipėda-Karlshamn link).The MoS policy in the <strong>Baltic</strong> has not been successful enough in pastyears. A few barriers were mentioned during the seminar, including toobureaucratic procedures, unclear criteria (e.g. proof of modal shift). Representativesfrom the successful projects underlined two main success factors,namely a strong partnership and very well prepared documentation.“There is a clear unbalanced picture of MoS projects between the <strong>Baltic</strong>region and other regions in Europe. BPO wishes to make sure that themoney spent on <strong>Baltic</strong> ports is evenly spread throughout the EU. We needto know where the problem is and we are glad that the EC is highly interestedin our consultation work,” said Bogdan Ołdakowski, Secretary Generalof BPO.BPO will soon present a report on barriers and challenges of the MoSpolicy, which will be presented to the European Commission. It well fitswith the revision of the EC TEN-T and MoS policy, which should be finalisedby Autumn 2010.The seminar was organised by BPO within the Trans<strong>Baltic</strong> project.Trans<strong>Baltic</strong>, as one of few transnational projects so far, has been granteda strategic status by the authorities of the <strong>Baltic</strong> Sea Region Programme2007-2013. In this way the decision-makers have acknowledged the role ofTrans<strong>Baltic</strong> in fostering sustainable development of the region, the project’swide geographical coverage, deep focus on implementation and strong politicalbackup at the national level. Trans<strong>Baltic</strong> is led by Region Skåne andlasts from 1 June 2009 to 31 December 2012. You can read more about thisproject in Trans<strong>Baltic</strong>’s newsletter in this issue of BTJ.Presentations from the seminar can be found on the BPO website:www.bpoports.com.BPO and Port of Tallinn are pleased to inviterepresentatives of seaports, terminals, shippinglines and research institutions to join the <strong>Baltic</strong>Ports Conference on 9-10 th September in Tallinnthis year. The main theme of the meeting willbe <strong>Baltic</strong>-Asian transit and its developmentpotential. The current economic situation ofports, as well as how they will face changes andchallenges after the economic crisis, will becovered. Please do not miss this opportunity tojoin the interesting debate and book the datein your calendars now.Photo: www.visitestonia.com30 | <strong>Baltic</strong> Transport Journal | 3/2010

Port of KemiMines will keep us developingInterview with Port Director Reijo Viitala and Project Manager Hannu Tikkala, Port of KemiPhoto: ˝Port of Kemi How does the Port of Kemi take advantageof its location?Port of Kemi is the northernmost universal portin the European Union. It accepts all cargo, regardlessof ownerships, origin or type. The locationis an advantage for cargo owners, becausethe cheapest transport mode – sea transport – ismaximally available via the port.Also significant is the port’s connection to themining industry in Lapland. It has made significantexploration investments within thelast years, which have given positive results.Several mines were launched and more arecoming. Mining activity comprises not onlyexporting, but also importing of various equipment,chemicals, etc., for mines. Port of Kemiserves all these mines since our location is thenearest to mines in the High North – that is inthe most northern areas of Norway, Sweden,Finland and north-western Russia. Speakingof Russia, we’re in a pole position consideringcargo transportation to Murmansk region; wecan serve transit deliveries from ContinentalEurope to Murmansk within 5 days. What is the specialization of the port? Inwhich directions does it want to develop?At the moment Port of Kemi is specialized inexport and import of forest industry productsfrom and to northern Finland as well as Swedenand Norway.The main destinations of our cargo are thePorts of Lübeck and Gothenburg, bothachieving 3 ship calls per week, regular andscheduled lines. TransLumi Line vessels areloaded with exceptionally large SECU containers.However, the multifunctional vesselscan transport standard containers, projectcargo, etc., to inter alia Swedish Gällivare andKittilä goldmine in Lapland.All in all, the Port of Kemi targets on diversificationby building infrastructure for themining industry of the High North. Bulk cargotransportation is expanding and will magnifythe port’s cargo volumes in tonnes. Port of Kemi is the 13 th Finnish port interms of throughput/capacity. Is the portdoing anything to acquire a higher position?In summer 2009, we launched the work of anEnvironmental Impact Assessment (EIA) andgeneral spatial planning until the year 2025.According to the plan, new land areas of theport will be exploited and the cargo volumewill rise from its existing 2.5 mln tonnes peryear to at least up to 7 mln tonnes by 2015.The main customer for the new bulk harbourwill be the mining company Northland Resourcesthat has iron ore deposits in the Pajala-Kolari area in Lapland. Their so-called Kaunisvaaraproject will yield up and transport viaPort of Kemi annually around 5 tonnes of ironconcentrate.The port is also ready to welcome productsfrom other mines in Lapland. Kevitsa andSokli mines are expected to become customersof Port of Kemi. How will the project of Pajala-Kolari ironconcentrate affect the Port of Kemi?Kemi Bulk Terminal company will be responsiblefor terminal operations of iron orehandling in the port. The company will buildterminal and warehousing buildings as wellas conveyors and loading systems. Investmentcosts are around EUR 90 mln.At the first stage, Port of Kemi will build onenew berth, dredge the pool basin (1.5 mln m 3 )and build necessary road and railway connectionsin the port area. Costs are estimated to beEUR 40 mln. Furthermore, Finnish TransportAgency will be responsible for deepening thesea fairway from its authorised existing 10 mdepth to 12 m. Are there other logistics undertakings takingplace in the port area?At the moment we have sufficient industrialsites next to the port area. This so-calledSarana industrial area will soon be primarilybooked by large scale industry and by SMEsof logistics, maintenance and other servicesthat follow close to their main clients. Forinstance, Kemi Bulk Terminal company hasreserved a site for 500 m warehouse and onekilometre conveyor line.Moreover, an undertaking worth EUR 1 bln isunder study – a bioenergy plant, which wouldrequire road transportation of 2 mln tonnes ofraw material and pipeline investments to deliverthe final products. The 10 km long pipelinescould increase the cargo volume in Portof Kemi by more than 0.5 mln tonnes/year.Terminal investments in the port area wouldalso be substantial.Finland’s largest windmill park of 35 MW islocated at the sea area of the port. Therefore,realization of extension proposals would meanmore project cargo and additional activity inthe Port of Kemi.Photo: ˝Port of KemiMartyna BildziukiewiczBALTIC PORTS ORGANIZATION • Secretariat Office – Actia Forum Ltd.ul. Pułaskiego 8, 81-368 Gdynia, POLAND, ph.: +48 58 627 24 67, fax: +48 58 627 24 27e-mail: bpo.office@actiaforum.pl, bpo.sg@actiaforum.pl, http://www.bpoports.com3/2010 | <strong>Baltic</strong> Transport Journal | 31

BTJ calendar of partnership events 2010BTJ 3/2010 (May-June edition)Issue distributed at:12 th <strong>Baltic</strong> Development ForumSummit 20101-2 June 2010, LT/Vilniuswww.bdforum.orgEuropean Supply Chainand Logistics Summit 20107-9 June 2010, CZ/Praguewww.scleurope.comPosidonia 2010 Expo7-11 June 2010, GR/Athenswww.posidonia-events.comTOC Europe 2010 Expo & Conf.8-10 June 2010, ES/Valenciawww.tocevents-europe.comSoNorA V Consortium Meeting16-17 June 2010, Erfurt/DEwww.sonoraproject.euSpecial Report on: Chinese cargo flowsFocus on: Short sea shipping on the <strong>Baltic</strong>The 12 th <strong>Baltic</strong> Development Forum Summit 2010 will be held in Vilnius under the title EuropeanChallenges – Regional Solutions, An Agenda for Jobs, Investments and Sustainable Growth. TheSummit is held in association with the government of Lithuania and the <strong>Baltic</strong> Sea States Summit.Many high level speakers are expected. Decision-makers representing business, politics, academiaand media in the <strong>Baltic</strong> Sea Region are invited to attend.The European Supply Chain and Logistics Summit (SCL Europe 2010) will reveal how you can adaptyour supply chain to meet the requirements of the economic rebound and drive renewed growth.Topics include: transforming your supply chain infrastructure to maximise customer service and drivedown costs, minimising volatility with a demand-driven supply chain, and driving social values todeliver business value.Posidonia International Exhibition first took place in 1969 and has been organized every two yearsever since. Last year’s Posidonia had over 1,700 exhibiting companies and was attended by morethan 17,000 visitors from 86 countries. A must-see event for everyone involved in any branch ofactivity related to shipping.This year’s conference, held in Valencia under the theme “New Decade, New World”, will focus onunderstanding the pattern of recovery, the new economic, financial and regulatory climate, andhow these and other significant factors will impact the business of container shipping, ports andterminals in the post-crisis world.Partners of the SoNorA project led by Veneto Region (IT) meet again for the 5 th time to present theirlatest progress and achievements and to discuss the next steps of the parntership aiming to helpregions develop South-North accessibility between the Adriatic and <strong>Baltic</strong> Seas.Trans-Port & Energy Seminar 201017 June 2010, PL/Gdańskwww.actiaconferences.comDuring the period of economic slowdown, which we are all experiencing these days, the Gdańskseminar aims at determining viable forecasts for future energy resources supply, predicted levels ofdemand as well as the potential infrastructural needs within the scope of transport, port infrastructure,storage and handling.SuperGreen Workshop28 June 2010, FI/Helsinkiwww.supergreenproject.euWeighing Containers29 June 2010, UK/ Londonwww.dunelmpr.co.ukEuropean Shortsea Congress29-30 June 2010, IE/Dublinwww.shortseacongress.comSuperGreen aims to assist the Commission with defining the ‘Green Corridor’ concept and promotes thedevelopment of European freight logistics in an environmentally friendly manner. The workshop covers KeyPerformance Indicators, eFreight, selection of the most favourable set of corridors and a discussion amongrepresentatives of key stakeholders.The conference will address the subject of misdeclared container weights. Most people in the maritimeindustry believe that container weights should be verified before loading on board a vessel but thereseems to be no enthusiasm for setting up procedures for weighing containers in ports and terminals. Theconference will also look at the risks involved in carrying containers whose weights are at best impreciseand at worst simply unknown.The 3 rd European Shortsea Congress will be held in Dublin Castle. It is the most important gathering for theShortsea sector in 2010 and comprises a two-day conference catering for bulk and unitised interests, a preconferencereception, a gala dinner at Trinity College and a tour of the port. Conference sessions include theidentification of future opportunities for various bulk and unitised sectors, insights from a number of highprofileshortsea customers, adding value to shortsea-sea supply chains, help and hindrance from Brusselsand a range of other hot shortsea topics.BTJ 4/2010 (July-Aug edition)Issue distributed at:Annual <strong>Baltic</strong> PortsConference 20109-10 September, EE/Tallinnwww.bpoports.comCoastlink’s Annual Conference201014-15 September 2010, BE/Antwerpwww.coastlink.co.ukInnoTrans 201021-24 September, DE/Berlinwww.innotrans.comAirports Conference 201029-30 September 2010, PL/Warsawwww.actiaconferences.comSpecial Report on: <strong>Baltic</strong> maritime rankingFocus on: Aviation marketThe Annual <strong>Baltic</strong> Ports Conference is the most important event for its members and delegates fromall parts of the industry, offering a platform for networking and face-to-face communication. In 2010the duties of a co-organizer and the conference host are to be taken over by the Port of Tallinn.Attention will be directed towards Benelux ports and the various shortsea and feeder activitiesthat serve them. Serious issues for ports and shortsea operators alike, rail and barge operators andinland terminal operators will be discussed. Other topics to be discussed include the changing routepatterns taking place in northern Europe, including the growth of Rotterdam as a hub for the <strong>Baltic</strong>,a trend which has impacted the northern German ports of Hamburg and Bremerhaven.The event has become established as an international industry showplace focusing on railwaytechnology, and a platform for buyers and sellers of modern passenger and cargo freight solutions.A full range of rail vehicles is presented on the Messe Berlin tracks located outside the exhibitionhalls. The conference also features displays on Railway Infrastructure, Interiors, Public Transport andTunnel Construction as well as an associated InnoTrans Convention including a special DialogueForum.This is the 6 th edition of this well-known international aviation conference for various air transportbusinesses in the CEE market. Delegates from various European countries will deal with the challengesof passenger/cargo traffic in the region’s airports. The most important representatives of the aviationmarket are involved in organizing the conference. The high level of the conference and its niceatmosphere offer a unique opportunity to share experiences, discuss and exchange opinions as wellas get to know each other.6 | <strong>Baltic</strong> Transport Journal | 3/2010

BTJ calendar of partnership events 2010BTJ 5/2010 (Sept-Oct edition)Issue distributed at:Port Finance InternationalLondon19-20 October 2010, UK/Londonwww.portfinanceinternational.comTLS Congress 201017-18 November 2010, PL/Warsawwww.tls-congress.com<strong>Baltic</strong> Ro-Ro & FerryConference 2010tba, tbawww.actiaconferences.comSpecial Report on: Breakbulk, project & heavyliftsFocus on: <strong>Baltic</strong> ShipyardsThe second annual edition of Port Finance International London will once again bring togetherleading experts and senior executives involved in the development and financing of the world’sports, who will be provided with an opportunity to discuss the many challenges and opportunitiesof this dynamic market. This year the regional emphasis will be on port activities in the Middle Eastand Brazil as well as looking at their role in the ever-changing global market.The TLS Congress for Central and Eastern Europe, this time held in Warsaw, is once again inviting youto network with Europe’s leading companies as well as to discuss the latest strategies, initiatives anddevelopments with regard to transportation, logistics and supply chain in the EU.The 5 th edition of the event concentrating on ro-ro, ro-pax and con-ro traffic on the <strong>Baltic</strong> Sea, givinga thorough insight into shipping, port and hinterland matters as well as current trends in vesselstechnology and the sector’s role in the regional logistics network.BTJ 6/2010 (Nov-Dec edition)Issue distributed at:Intermodal Europe 2010Expo & Conf.30 Nov-2 Dec 2010, NL/Amsterdamwww.intermodal-events.comAirFreight 20101-2 December, PL/Warsawwww.actiaconferences.comSpecial Report on: Modern logisticsFocus on: CEE RailwaysAfter a one-year break, Intermodal, the world’s leading container event, will be back in 2010 at afamiliar venue, the Amsterdam RAI. Showcasing all elements of the container and intermodalindustries, the conference represents a nice opportunity to network and source new technologiesand services for the improvement of your business operations.A conference wholly dedicated to the problems of today’s air cargo development and its futureprospects and threats, with special focus on the Polish and Central European markets. The event’sagenda will include a discussion on cargo airports in the region, cargo safety and protection, thecurrent state of air forwarding markets as well as a debate and analysis of specific policy measures.Dates and places of the events are subject to be changed by the organizing parties.3/2010 | <strong>Baltic</strong> Transport Journal | 7