BTJ 5/2011 - Baltic Press

BTJ 5/2011 - Baltic Press

BTJ 5/2011 - Baltic Press

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NETWORKINGINTELLIGENTLYWe can manage the biggest ones. Not only by usingstate-of-the-art handling technology but also at a speedand with an efficiency that are unique in Europe. To thisend Hamburger Hafen und Logistik AG invests systematicallyin future technologies. This ensures that Hamburg willremain the most important hub between Asia and Europe.www.hhla.deGROWING TOGETHER.

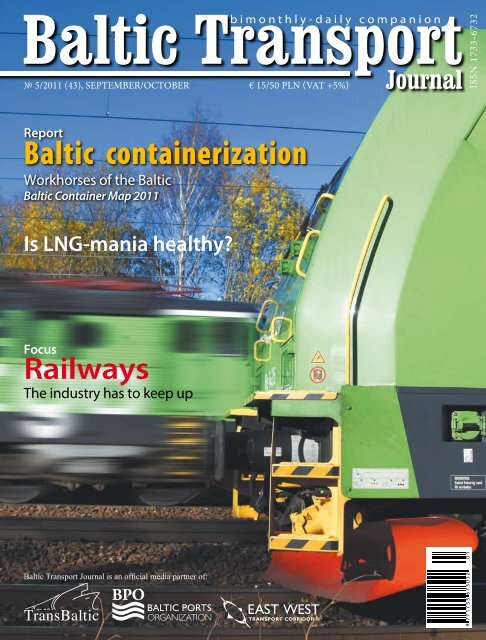

Contents3Regular columns3 Editorial6 <strong>BTJ</strong> calendar of partnership events8 Market SMS Extended10 What’s new?12 On the roads:Simplicity of daily cut-offs54 WISTA: Steering a course throughchange55 Tall ships bid farewell to the summer56 Collector’s corner57 Transport miscellany58 Who’s who14Maritime14 Under pressure16 Is LNG-mania healthy?18 We will monitor the shipping sectorInterview with Siim Kallas,VP of the European Commission20 Incentives to act21 Ships’ sewage discharge: banned36NewslettersTrans<strong>Baltic</strong>36 Getting connected38 Inland waterway transport in theBSR – Time to take action<strong>Baltic</strong> Ports Organization40 Face to face with challengesEWTC II42 Business opportunities inrailway transport of the EWTC– Integrated rail transport | <strong>Baltic</strong> Transport Journal | 5/<strong>2011</strong>

Contents25Report<strong>Baltic</strong> containerization25 Workhorses of the <strong>Baltic</strong>33 Fierce competition34 Kiel Canal – Strategic shortcut orbottleneck?43FocusRailways43 The industry has to keep up47 On track for the futureInterview with Johannes Ludewig,CER Executive Director50 Finding optimum52Logistics52 The importance of sustainability –Benefiting the supply chain all alongthe wayI n t h i s i s s u eIt is very difficult to quantify the exact risk of modal backshift, nevertheless,we will continue to monitor possible impacts on the shipping sector, to ensureadequate policy response in case of distortions in the logistic chain.Siim Kallas, Vice-President of the European CommissionRead more in the interview devoted to IMO’s SOx regulations, entitled: We will monitor the shipping sector, p. 18-19and receive 2 posters with BALTIC RORO/FERRY and CONTAINER mapsFOR FREE* BALTIC RORO/FERRY map is a free supplement to <strong>BTJ</strong> May- June 3/<strong>2011</strong>* BALTIC CONTAINER map is a free supplement to <strong>BTJ</strong> Sept.-Oct. 5/<strong>2011</strong>of 6 upcoming <strong>BTJ</strong> issuesof 6 upcoming <strong>BTJ</strong> issuesGo to(+5% VAT, postage costs included)www.baltictransportjournal.comand click:5/<strong>2011</strong> | <strong>Baltic</strong> Transport Journal |

<strong>BTJ</strong> calendar of events<strong>BTJ</strong> 5/<strong>2011</strong> (Sept.-Oct. edition) Special: <strong>Baltic</strong> Container Map <strong>2011</strong> |Report: <strong>Baltic</strong> containerization | Focus: RailwaysIssue distributed at:European Transport Conference <strong>2011</strong>, 10-12 October, UK/Glasgow, www.aetransport.orgThe European Transport Conference is the annual event for transport planning professionals organized by the Association for EuropeanTransport. ETC is a forum for transport practitioners to come together and debate on policy issues, research findings and best practice acrosstheir sector. Besides the professional discussion sessions the conference’s structure also gives an opportunity for informal meetings.TRAKO International Railway Fair, 12-14 October <strong>2011</strong>, PL/Gdańsk, www.mtgsa.com.pl/title,lang,2.htmlThe most important rail meeting in Poland and one of the largest in CE Europe, giving the opportunity to promote agglomeration rail transport,freight forwarding and logistics, present the latest technology and hold business meetings. The exhibition is organized in partnership withPolish National Railways (PKP) together with a number of seminars, conferences and presentations.28 th International Port & Terminal Technology Conference <strong>2011</strong>, 19-20 October <strong>2011</strong>, DE/Hamburg,www.millenniumconferences.comAn impressive technical and well-structured programme of industry experts and market leaders will explore the latest developments,issues, trends and technology affecting ports and terminals around the globe. The conference will provide delegates an invaluable learningopportunity as well as an excellent platform for discussion, debate and networking.International Supply Chain Conference <strong>2011</strong>, 19-21 October, DE/Berlin, www.bvl.de/isccFor the 28 th time the ISCC will bring together experts from the industry, trade and service sector as well as scientists from over 40 countries.This year participants will share their knowledge and experiences in the supply chain under the keynote: “flexible – secure – sustainable” andtopics will include risk management in supply chains, brands and marketing in logistics, agility-focused strategies and supplier integrationin global markets. The meeting is a perfect occasion to exchange ideas on up-to-date supply chain resolutions.<strong>Baltic</strong> Development Forum Summit <strong>2011</strong>, 24-27 October <strong>2011</strong>, PL/Gdańsk, www.bdforum.orgFor the first time Poland will host the annual BDF Summit. <strong>Baltic</strong> Development Forum will work closely together with the Polish governmentduring its EU-presidency and the European Commission in an effort to demonstrate how to combine top-down political guidance withbottom-up enthusiasm and entrepreneurship.Europort Rotterdam <strong>2011</strong>, 8-11 November <strong>2011</strong>, NL/Rotterdam, www.europort.nlA bi-annual event gathering over 30,000 professionals from all segments of the shipbuilding/shiprepair industry, giving an overview of thelatest technologies in the maritime industry. Construction of vessels, dredging, fishery, inland navigation, mega yachts, naval specials, offshore,sea shipping, workboats, and much more is waiting for you at the four-day exhibition and its assisting conferences.Port Finance International London, 09-10 November <strong>2011</strong>, UK/London, www.portfinanceinternational.comPort Finance International will be organized for the 3 rd time in London. The event attracts professionals involved in port development and port finance.Some of the key topics to be covered at this year’s conference include: global trends in port finance and development, market overview, financingchallenges for ports, port financing, safe harbours in a financial storm, etc. This conference will provide all those who attend with the chance to hearfrom industry experts, learn about development plans, debate, identify risks, meet potential business partners and reconnect with industry friends.Port Development UK, 28-29 November <strong>2011</strong>, UK/London, www.port-development.comPort Infrastructure Development UK is the first meeting focusing specifically on the challenges and opportunities surrounding UK portinfrastructure development. Given the increased demand for offshore renewable energy, now is the time to focus on marrying the needsof ports with the requirements of the renewable energy industry. The topics will include, inter alia, ports secure investment, developmentopportunities as well as the requirements of green energy.Marine Propulsion Strategies, 7-8 December <strong>2011</strong>, DE/Hamburg, www.propulsionstrategies.comMarine Propulsion Strategies will bring together representatives from across the global shipping industry. The aim of the conference is to learnabout technological innovations and projections for investment, in order to make critical strategic business decisions to develop a long-termand enduring marine propulsion strategy. During the two-day event approaches to drive operational efficiency, meet environmental targetsand understand viable next generation propulsion options will be explored.<strong>BTJ</strong> 6/<strong>2011</strong> (Nov.-Dec. edition)Issue distributed at:Report: Bulk transport | Focus: Road trafficRail Revenue and Customer Management <strong>2011</strong>, 7-9 November, NL/Amsterdam, www.terrapinn.com/<strong>2011</strong>/rail-revenueThe conference gathers high speed, non-high speed and metro rail operators from all over Europe. The main theme of the event ismaximizing revenue opportunities from increased customer engagement. During the three days Europe’s leading rail operators will presentcase studies, take part in panel discussions, brainstorm sessions and debates. The main topics include increasing revenue by creatingcustomer-centric rail solutions, using customer analytics and taking advantage of new ticketing platforms. Maximizing ancillary revenue andthe growing rail market share are also key issues to be discussed.Smart Stations & Terminals World <strong>2011</strong>, 8-10 November <strong>2011</strong>, NL/Amsterdam, www.terrapinn.com/<strong>2011</strong>/rail-stationsThe conference is dedicated to station and terminal owners and operators to discuss new revenue and development strategies, meetwith investors, property developers, operators, infrastructure managers, designers and technology solution providers in order to deliverSmart Terminals of the future. The event will be divided into three sections: “Rail Terminal owners and operators come to Rail Stations &Terminals World and learn”, “World class solution providers attend” and “The Rail Stations & Terminals World focus.”7 th International Airports Conference <strong>2011</strong>, 16-17 November, PL/Warsaw, www.actiaconferences.comThis two-day conference is split into three sessions with diverse lectures, discussion panels and a think-tank on the first day. The openingday is going to be dedicated to “Airports and their surroundings”. The day will end with a special event, the Awionetka Gala <strong>2011</strong>, whichincludes the 3 rd aviation business meeting, the <strong>Baltic</strong> Ballroom, and awards presentation. The second day will feature “Non-aviationrevenues” and “Air cargo” sessions.TRANSLOG Connect Congress <strong>2011</strong>, 22-23 November <strong>2011</strong>, HU/Budapest, www.translogconnect.euThe event is going to offer the possibility for solution providers (limited to 100 delegates) to present their products and services directly to around500 decision makers of target clients throughout Central and Eastern Europe. During two days, service providers will meet with the leading directorsthrough a number of pre-arranged one-to-one business meetings. Several weeks before the Congress, participants will receive individualizedpasswords to access the website, where they can select key presentations, pre-schedule one-to-one meetings and confirm their presence atadditional networking activities, an option which will greatly help them to create their own itinerary prior to the Congress taking place.Intermodal Europe <strong>2011</strong>, 29 Nov.-1 Dec. <strong>2011</strong>, DE/Hamburg, www.intermodal-events.comAfter a 3-year break the Intermodal Europe exhibition and conference will again be hosted in Hamburg. The world’s leading event for allassociated with the container and intermodal industries dates back to 1976 (at first named CTC – the Container Technology Conference).Intermodal Europe is organised by IIR Exhibition, a part of the Informa Group. The conference will host the <strong>Baltic</strong> Transport Journal session. | <strong>Baltic</strong> Transport Journal | 5/<strong>2011</strong>

<strong>BTJ</strong> calendar of events– continuedIssue distributed at:3 rd Annual Tanker Economics, 5-6 December <strong>2011</strong>, UK/London, www.platts.com/ConferenceDetail/<strong>2011</strong>/pc163/indexThe event represents an opportunity to discover what strategies are being adopted by the shipping industry and other organizations to dealwith challenges faced by the liquid tanker industry. The conference will focus on the assessment of today’s tankers market and the supply anddemand situation, bunker fuels and their alternatives along with a discussion on how to minimize the risk of piracy.4 th International Ports & the Environment Seminar, 8 December <strong>2011</strong>, NL/Amsterdam, www.millenniumconferences.comScheduled to take place in Amsterdam in December <strong>2011</strong>, the one day seminar will deliver a varied, in-depth and informative programme,ensuring delegates an invaluable learning opportunity and platform for discussion, debate and networking. MCI Media Ltd is committed todelivering an event of the highest calibre, not only in-depth and informative, but also stimulating and enjoyable.<strong>BTJ</strong> 2012 partnershipsIssue distributed at:Transport Week 2012, 6-8 March 2012, PL/Gdańsk, http://www.actiaconferences.com/transport-week-2012.htmlActia Conferences invite you to the 2 nd edition of International Transport Week 2012 which will be held in the Polish <strong>Baltic</strong> Philharmonic inGdańsk. The event is a discussion platform for representatives from the maritime, railway and intermodal sectors. Transport Week 2012 will beaccompanied by conferences, exhibition areas, discussion panels, seminars and topped with an evening gala dinner.TransRussia 2012, 24-27 April 2012, RU/Moscow, www.transrussia.ruBeing focused primarily on cargo transportation services, the TransRussia Exhibition & Conference demonstrates a full range of industrysolutions – from transport and forwarding services to software and equipment for cargo handling. The exhibition attracts leading professionalsfrom Russia, the CIS and the <strong>Baltic</strong> Sea countries, among others. The event will discuss the most important issues in the development of theRussian transport system and new information systems, which are developed for interaction between different modes of transport.RORO 2012, 22-24 May 2012, SE/Gothenburg, www.roroex.comThe only dedicated exhibition to the roll on-roll off industry is returning to Gothenburg. The meeting will gather professionals from over 50countries, who will analyze the newest threats and opportunities accompanying the ro-ro industry, i.e. the upcoming regulations such as theEmission Control Areas (ECA) and Marpol Annex VI.Posidonia 2012, 4-8 June 2012, GR/Athens, www.posidonia-events.comIn 2012 Posidonia relocates to the Metropolitan Expo Centre situated within the Athens International Airport complex. It is expected to attract morethan 1,800 exhibiting companies from over 80 countries, highlighting the position of Greek shipping and its commitment to renewing and upgradingits fleet. The exhibition will host conferences and shipping association gatherings, chaired by industry leaders, debating and shaping the challengesfacing the industry. Apart from business meetings, the event will also hold the Posidonia Cup yacht race and the Posidonia Shipsoccer Tournament.Transfairlog, 12-14 June 2012, DE/Hamburg, www.transfairlog.com/enThe event will concentrate on optimization of local and global international freight transport and logistics. At the Trade Fair Centre Hamburgdecision-makers, experts and companies from the logistics and transport industries will participate in the showcase of products, services andsolutions for day-to-day operations of present and future logistics.5/<strong>2011</strong> | <strong>Baltic</strong> Transport Journal |

Market SMS extendedLatvian ports:45.76 mln tn handled in Latvian ports (+11.5% yoy)Port of Tallinn:24.84 mln tonnes handled during I-VIII <strong>2011</strong> (+2.6% yoy)Photo: Port of LiepajaFrom January to August Port of Riga handled 22.56 mln tn of goods(+14.7% yoy). Cargo turnover at Port of Ventspils totalled 18.97 mlntn (+9.2%), while at Port of Liepāja amounted to 3.18 mln tn (+16.7%).The largest ports in Latvia handled 21.52 mln tn of bulk cargo, 16 mlntn of liquid and 8.22 mln tn of general cargo.Tallinn port’svolumesRussian ports on the <strong>Baltic</strong>: 122.7 mln tn handled in I-VIII <strong>2011</strong> (+5.2% yoy)From January to August Russia’s ports located within the <strong>Baltic</strong> Sea saw a 5.2% year-on-year increase in theircargo turnover (122.7 mln tn). The overall output of dry bulk grew by 15.2% to 47.1 mln tn, whereas the handlingof liquid cargo fell down by 0.1% and totalled 75.6 mln tn. Stevedoring companies operating in Port of St. Petersburghandled 39.5 mln tn (+6.5%). Terminal operators at Port of Ust-Luga handled 13.6 mln tn (+80%). Cargotraffic at Port of Vysotsk decreased by 6.3%; at Port of Primorsk by 3.2% and at Kaliningrad’s port by 1.3%.I-VIII <strong>2011</strong> I-VIII <strong>2011</strong>/ I-VIII 2010Liquid cargo 18.19 mln tn +7.9%Ro-ro cargo 2.45 mln tn +7.8%Bulk cargo 2.65 mln tn -31.1%Total 24.84 mln tn +2.6%Port Vysotsky LLC: 2.2 mln tn of coal handled during I-VIII <strong>2011</strong> (+50% yoy)Container turnover at the port went up by 26.7% to 127,504 TEU.Port of Aalborg:6,800 containers via X-<strong>Press</strong> Feeders in I-VIII <strong>2011</strong>Since August 19 th , 2010, Port of Aalborg has handled 8,500 containerunits on X-<strong>Press</strong>’ weekly route among Rotterdam-Aalborg-Gothenburg,of which 6,800 was handled in this year alone. From January to Augustthe average output was 206 units per X-press call (+129% yoy). Theport’s aim is to have two feeder calls per week.Port of Rostock:12 mln tonnes handled inH1 <strong>2011</strong> (+/-0% yoy)Last year the Port Vysotsky LLC, a stevedoring company operating in Port of Vysotsk, handled 2.3 mln tn of coal(-21% yoy), but given this year’s quite optimistic results, the company is planning to handle 4.5 mln tn by the endof <strong>2011</strong>. Thanks to the overhaul of berths and the completion of a dredging project, conducted in 2008-2010,bulkers over 40,000 DWT can call at the port which was deepened from 9.3 m to 11.9 m. Additionally, the approachchannel was widened by 50 m. Since September the bulk carrier Sam Dragon (46,931 DWT) has kept itstitle as the largest vessel which ever visited Vysotsk. It loaded 44,500 tn of coal for Immingham in the UK.New passenger cars in the EU:8.9 mln new cars registered during I-VIII <strong>2011</strong> (-1.3% yoy)In August new car registration in theEU increased by 7.7% year-on-year(753,709), all of the biggest EU marketsPhoto: European Commissionmarked a rise – Germany (+18.3%),UK (+7.3%), Spain (+5.9%), France(+3.1%) and Italy (+1.5%). However,from January toAugust new carregistrations fellby 1.3% and totalled8,888,793.Only Germany(+11.2%) andFrance (+0.4%)w i t n e s s e dgrowth, while theUK (-6.1%), Italy(-12%) and Spain(-22.2%) have fallenbehind comparedto last year.Tallink:6.4 mln passengers carriedduring I-VIII <strong>2011</strong>(+5.87% yoy)During the time period January-August<strong>2011</strong> the companyachieved growth on every oneof its pax routes. The Finland-Sweden link totalled 2,257,365pax (+0.48%). Traffic on the routebetween Estonia and Finlandamounted 2,903,019 pax (+8.51%).The Estonia-Sweden connectionreached 671,083 pax (+6.48%).The Latvia-Sweden link totalled515,435 pax (+14.85%). The Finland-Germanyroute, althoughit’s the company’s smallest link,marked the biggest increase by22.63% to a total of 47,044 pax.Photo: Port of RostockThe Seaport Rostock handled 11.1mln tn of the abovementionedresult, while the remaining 900thou. tn were handled by otherRostock port facilities, such as thechemical Port of Yara and the fishingport. Seaport of Rostock handled6.6 mln tn of wheeled cargoand ro-ro traffic, achieving a 6%year-on-year rise. Other generalcargoes increased by 28% to 248thou. tn. Turnover of liquid goodstotalled 1.4 mln tonnes (-22.2%),while the throughput of dry bulkcargo stayed at the same level asin the previous year, amountingto 2.9 mln tn (+/-0%). The seaportalso handled 166,848 escortedtrucks (+7%), 57,435 unescortedtrailers (+17%) along with 38,304load units (+11%). | <strong>Baltic</strong> Transport Journal | 5/<strong>2011</strong>

What’s new?Gothenburg’s Skandia Container Terminal taken over by APMPhoto: Port of GothenburgOver the next five years APM Terminals, global containerterminal operator and a part of the AP Möller-MaerskGroup, will invest USD 115 mln in container terminal atPort of Gothenburg, for which it has won a 25-year concessionagreement with the port’s Authority. The Skandiaterminal was the third terminal (apart from the ro-ro andcar terminals) in the port to be transferred to a privatecompany. APM Terminals’ bid won over 13 others. Theoperator will invest in three Super post-Panamax cranesfor loading and unloading container vessels; expansionof the rail terminal and 10 new straddle carriers, amongothers. Moreover, the deal is to highly benefit the City ofGothenburg, which faces major investments related tothe infrastructure as well as continual port development.The Estonian competition authorities have agreed to DFDS’ takeover of the ro-pax route betweenPaldiski (Estonia) and Kapellskär (Sweden) from <strong>Baltic</strong> Scandinavian Lines AS (BSL). DFDS and BSL willestablish a joint agency operation with an ownership share of 67% for DFDS and 33% for BSL. Accordingto DFDS, the route’s annual turnover is approx. EUR 13.7 mln.New Inspection Regime – lesser controls, better resultsThe Paris MOU New Inspection Regime (NIR), a system used by state control authorities to evaluate a vessel’srisk profile and their management companies’ performance, has been functioning since the beginningof <strong>2011</strong> and according to the figures, it has already proven useful. From January to July 27 Paris MOU NIRcountries performed 10,971 inspections (-22.6% year-on-year), showing that indeed lesser inspections areneeded to do the same job. In the same time period the detention rate increased from 3.6% in 2010 to 3.7%in <strong>2011</strong>, indicating that the new system options, such as company performance, are helping to investigatetroublesome vessels. Additionally, NIR discovered a new problem – in 2010 no ships were banned for multipledetentions (“refuse of access” or “banning” provisions), while this year 11 cases have been recorded hitherto.Rail is getting stronger in PolandDB Schenker and Vestas, a companyspecializing in the wind turbinesmarket, have opened a logistics facilityspecially designed for heavy-dutywind turbines components nearLeipzig. The new facility has 5,000m 2 of space, which means that now15,000 m 2 is at DB Schenker’s disposalfor planning, managing and monitoringthe complex spare parts, componentand tool logistics for Vestas.Breaking the Finnish rail bottleneckPhoto: VestasHamburg Hafen und Logistik (HHLA) and Polzug Intermodal haveopened a new hub container terminal in Gądki near Poznań in Poland. Inthe start-up phase the hub enables daily shuttling of three to five shuttletrains between North European ports and Poznań. The new facility of a150,000 TEU annual handling capacity has four tracks of at least 610 m inlength, capable of serving an entire block train without shunting. Thanksto this Kombiverkehr has launched a shuttle train between Duisburg andPolzug’s hub. The service will run three times a week offering one of thegreatest capacities in combined transport in Europe (up to 1,800 tn). Onthe other hand PCC Intermodal has completed the first phase of constructingits new inland container hub in Kutno, Poland. At present theterminal offers 45 thou. m 2 of operating area, a 9 thou. m 2 railway site withtwo 700 m siding tracks and an annual handling capacity of 100 thou. TEU.The terminal is operated by three reachstackers with capacities of about 45tn. Ultimately, in the last stage of development, more than 200 thou. TEUcapacity will be available. Based on the Kutno investment, PCC wants to extendits existing connections from Rotterdam, Hamburg and Bremerhavenfurther on to Moscow, and establish permanent connections from Gdyniaand Gdańsk to Sopron (Hungary), Koper (Slovenia) and Trieste (Italy).Competition is rising in Ust-LugaGulftainer Group, a company from the Emirate of Sharjah inthe United Arab Emirates, has signed an agreement with Port ofUst-Luga during the Investment Forum in Sochi, Russia. The deal,worth EUR 203 mln, is aimed at developing the multifunctional terminalYug-2, most notably, its container activities.The European Union has selectedtwo Finnish rail projects for co-fundingunder 2010 TEN-T calls. At present thesingle track railway Seinäjoki-Oulu hasinsufficient capacity, which is causingbottlenecks on the north-south axisfor the whole of Finland’s rail network.The investment will focus on increasingthe section’s effectiveness in axle loads and operation speeds. The total costof the project is EUR 45.4 mln of which 10% is contributed by the EU. The secondventure, regarding Kokkola-Ylivieska, a part of the Seinäjoki-Oulu line, is goingto receive funds for conducting a study on the feasibility of a Public-PrivatePartnership procurement model for this section. The project is going to costEUR 2.44 mln, of which the EU co-financing amounts to EUR 1.22 mln.Photo: DB SchenkerBecoming biggerKlaipėdos Smeltė, a stevedoring company operating in Port ofKlaipėda, has invested in three STS and seven RTG cranes, which will bedelivered by Konecranes. Since its start in 2006 Klaipėdos Smeltė hasbeen consistently developing; the company wants to become a 1 mlnTEU transhipment hub. The ordered STS cranes are Post Panamax sizewith an outreach of 51 m, a lifting capacity of 65 tn and a lifting height of42 m. The 16-wheel RTGs have a lifting capacity of 40 tn. They can stackone over six boxes high and six plus truck lane wide. STS and RTG cranesare equipped with remote access technology, enabling immediate diagnosticsand maintenance services via Konecranes TRUVIEW® software.10 | <strong>Baltic</strong> Transport Journal | 5/<strong>2011</strong>

On the roadsSimplicity of daily cut-offsMy favourite Albert Einsteinquote, apart from “Any foolcan make things bigger, morecomplex, and more violent. Ittakes a touch of genius – and a lot of courage– to move in the opposite direction,” is“Make everything as simple as possible, butnot simpler.”Seven centuries before Einstein, Williamof Ockham created “Ockham’s razor” – theidea stating that in trying tounderstand something, gettingunnecessary informationout of the way is the fastestway to the truth. I wouldn’tbe myself, if I didn’t addsomebody from the jazz sideof life: Charles Mingus alsosupported “making the complicatedsimple, awesomelysimple”, what he considereda true creativity.The world we meet everymorning is more and morecomplex – we cannot justlet things flow and see whatcomes up. Facts and figuresstrike us every minute inreal time; no one waits forone’s proper answer; thechance to get a contractpresents itself twice: the firstand last time. Informationhas gained power over theworld and modern treasurehunters are relentlesslyseeking every snatch of insidestories to reach the top.One of the most vital andvisible examples of such behaviouris the specializationmaking everyday maritimetransport and seaport routinesa countless sequence of questions, answers,offers and unit prices leading to thelonged-for destination. Conclusions mustbe made almost at the moment of enquiryand decision-makers must remember: someis not a number, soon is not a an interval oftime. Otherwise you may hopelessly call toHouston, Texas, USA.Can anyone specify the limits of this, Idare to say, crazy, unbalanced and very oftenabsurd rally? Is there any logical or straightforwardanswer? I can think of one dailyproposal, following the latest global examplecoming from Denmark through London.The answer is… simplifying. Yes, inmy opinion simplifying can make us more12 | <strong>Baltic</strong> Transport Journal | 5/<strong>2011</strong>productive. Doing less than more. Getrid of all the inessential stuff on your todolist. Get rid of all the clutter on yourdesk and computer. Focus on one task ata time. No one can do everything that hasto be done – it is not possible. You cannotread everything, write everything, listento everyone or meet everybody. Time isrunning consecutively, always in only onedirection, and – the biggest drama for allThe art of choice is becoming the most preciousadvantage, also in the transport industry.workaholics – it cannot be saved; everysecond is valid and may be utilized in onesecond only. That’s why the art of choiceis becoming the most precious advantage,also in the transport industry. Even whenthe best and only strategy remains “trialvs. error”, execution of inevitable activities.The art of choice and the willpowerto change goes hand in hand leading to asuccessful finish line – the port of expecteddestination.Let’s go global, as simplicity is alsothe core message of the new A.P. Møller-Mærsk plan of reinventing and redefiningits Far East-Europe connection. The conceptis called “Daily Maersk”. Even thoughthis column is not created for in-depthcoverage and analysis of such a story, I willenumerate the most important facts andfigures,, as they were presented by Maersk’sCEO Eivind Kolding on September 12 th ,<strong>2011</strong>, at Millbank Tower in London.The project will consist of 70 vessels,including the Emma Maersk series, fourports in Asia: Shanghai, Ningbo, Yantianand Tanjung Pelepas and three ports inEurope: Felixstowe, Rotterdamand Bremerhaven.The service will start on24 th October, <strong>2011</strong>, andthe first call in Europe isplanned for 19 th of November,<strong>2011</strong>. The main issue isthe offer of the “conveyorbelt approach” – cargo canbe shipped immediately afterproduction without theneed for storage, with cutoffsperformed every day.The transit time parameteris going to be replaced bytransportation time value;Maersk will pay penaltiesin case the agreed valuesare neglected. Koldingemphasized its simplicity,beneficial to all presentand future customers, andthe absolute reliability ofthe service, presenting thistransparent shipping modelas the most unique solutionof the 21 st century.There is one fact whichis undisputable – we maywitness another originalservice pattern in oceanshipping, which most probablywill change a lot. Whatwill the competition do? What impact willnew sailing schedules have on inventorypolicy and warehousing business in logisticsand distribution services? Will shippers savemillions on their supply chains? Will storageproviders lose the same amount?We are living in interesting times,and more and more often, crisis means achance rather than a loss. Simplifying hasa bright future too, no doubt. So, let’s allmake something, even relatively small, ona daily basis in our office, with an eye focusedon the big game which starts thismonth on the world’s sea routes. Krzysztof Urbaś

MaritimeThe shipping sector within the SECAUnder pressureThe <strong>Baltic</strong> shipping sector is trying to foresee the consequences of theIMO’s 2008 decision to establish new regulations regarding sulphur contentin marine fuels and prepare for them. Increased fuel expenses, logisticscosts and the need for large investments into low-emission technologyand infrastructure – this outcome is unquestionable. But is that all?TIhe Emission Control Area (ECA),constituting only the <strong>Baltic</strong> Sea,North Sea and the English Channel,is an area covering about 0.3% ofthe world’s water surface. These regions aredeclared as SECAs, unlike the Black Sea, theMediterranean and the East Atlantic.“The global sulphur and nitrogen dioxideregulations of the Marpol Annex VI wasa success for the IMO, but the even morestringent regional sulphur rules of the SulphurEmission Control Area was a decisiontaken in darkness since no impact assessmentwas conducted prior to the decision.The SECA regulation will lead to trade-offeffects and enormous negative competivenessimplications, which should make allpoliticians shiver” – begins an article entitled“Lower sulphur levels in shipping -not sustainable” by Karolina Boholm, advisorto the Industrial Policy Departmentof Swedish Forest Industries Federation.And it won’t be far off to state that almostthe whole shipping industry which operateswithin the SECA nods its head to thisstatement, if not shivers in the face of whatthe future might bring.The consequences of the new IMO rulesfor short short sea shipping are fairly obvious,as various reports conducted by theMember States, organizations and institutesindicate that reducing the sulphur content inmaritime fuel to 0.1% in less than four yearswill lead to a modal backshift, forcing freightonto roads, which, in turn, will increasegreenhouse gas emissions. As the SwedishMaritime Administration has shown, roadtransport might increase by 6% within Sweden,corresponding to more than 300,000tonnes of CO 2. Maritime UK, an organizationof shipping, ports and maritime businessservices sectors in the United Kingdom,has recently warned that the 2015 SECAregulations may increase bunker fuel costsby 87%, creating considerable financial, logistical,societal and environmental impacts.What’s more, they will force dramatic costincreases onto the already highly vulnerableand competitive sector of short sea shippingwithin the <strong>Baltic</strong> and North Seas, leaving globalshipping, not really competing with othermodes of transport, unaffected for the nextfifteen years. Industry might also face anotherproblem – a diesel shortfall, resulting inincreased imports and a further price boostas well as additional costs in hydro-treatingheavy fuel oil to meet the requirements andadditional carbon emissions.The backgroundOn July 15 th , <strong>2011</strong>, the European Commissionadopted a new legislative proposal,bringing the EU’s regulation on marine fuelsulphur content in line with IMO’s requirementsset out under the Convention for thePrevention of Marine Pollution from Ships(MARPOL 73/78). According to Annex VIof the convention, Regulations for the Preventionof Air Pollution from Ships, before2008 it was allowed to use maritime fuelscontaining up to 4.5% of sulphur in all seaareas, excluding SOx Emission Control Areas,where the sulphur content was restrictedto 1.5%. A reduction in sulphur oxide (SOx)emissions from ships, with the global sulphurcap initially reduced to 3.5%, effectivefrom 1 January 2012; then progressively to0.5 %, effective from 1 January 2020, subjectto a feasibility review, to be completedno later than 2018. The limits applicable inSECAs were reduced to 1.0%, beginning on1 July 2010, being further reduced to 0.1 %,effective from 1 January 2015. However, asstated in the European Commission’s communication,the entry into force of the ‘global’provision may be delayed until 2025subject to a review on the availability of thenecessary fuels.As a result of MARPOL Annex VI, SO 2emissions from shipping are to decrease bymore than 90% in SECAs and by more than75% in other sea areas bordering the EU. Theemissions of the particulate matter (PM2.5)are predicted to be lowered by more than60% and 75%, respectively. According tothe European Commission, EUR 15-34 blnper annum in 2020 is to be saved due to improvedhealth and a reduced mortality ratewithin the EU, while EUR 2.6-11 bln will bespent on implementing the revision.As recognized by the Commission, compliancewith the new rules poses a number ofchallenges for, inter alia, shipping, which is tobe monitored and in case of distortions in thelogistics chain or a significant modal backshiftfrom sea to land transport, the adequatepolicy response is promised. Among the solutionsthe operators can choose, the use ofexhaust gas cleaning systems or alternativefuels such as LNG were named, provided theydeliver the same emission reduction benefitscompared to low-sulphur marine fuels. TheEuropean Commission expects boosting innovationin green technologies (which is inline with the EU 2020 strategy).The revised IMO measures were designedfor a wonderful purpose and expectedto benefit greatly the atmosphericenvironment and human health, particularlythat of people living in port cities andcoastal communities. The problem, however,is that time is limited. First of all: to getready for the appropriate solutions – to developthem, by exploiting technologies, andthen to implement them on a broader scale.If this is lacking, what’s left are increasedcosts and fines, a modal backshift from thesea to roads and an extreme limitation ofthe environmental benefits. The whole shippingsector looks to the IMO and EuropeanCommission in search of a reaction to themore and more obvious problem.Tab. 1. Annex VI: adoption, entry into force & date of taking effect of the Emission Control AreasSpecial Areas Adopted Date of entry into force In effect from<strong>Baltic</strong> Sea (SOx) 26 Sept 1997 19 May 2005 19 May 2006North Sea (SOx) 22 July 2005 22 Nov 2006 22 Nov 2007North American (SOx and NOx) 26 March 2010 1 August <strong>2011</strong> 1 August 201214 | <strong>Baltic</strong> Transport Journal | 5/<strong>2011</strong>

MaritimeLiquefied Natural Gas as a ship fuelIs LNG-mania healthy?The campaign for LNG-fuelled engines in many respects reminds of historical campaigns for other innovationsin shipping – for nuclear ships, gas turbine, air cushion vehicles or mechanical sails. In all cases lots ofwords were used with minor practical effect. And the whole mass of words has common features – some factsare left unsaid and others are underlined without compatibility, probably for propaganda purposes.In the article “Greener shipping in the<strong>Baltic</strong> – The best solution is LNG” (<strong>BTJ</strong>4/<strong>2011</strong>) we find information that the BSR“constitutes over 11% of the global shippingtrade volume.” Even if this figure weretrue it is not relevant to the subject of environmentalissues and misleads outsiders, whomight think that this number also representsthe <strong>Baltic</strong>’s share in global shipping emissions.If we were to look for the adequate proportionsin transport statistics, only one set ofdata seems to be proper – a transport work,because in order to cause emissions, the volumehas to be moved. And the BSR generatesonly 0.9% (9 per mile) of the global shippingtransport work! Consequently, the first questionis born: why is the whole world so interestedin such a small amount of emissions andenacts special laws for the <strong>Baltic</strong> Sea?through the engines unburned – from 32 to154 kg (!) per tonne of LNG (3.2-15.4%), dependingon the engine class, load factor, etc.It means that probably all Norwegian LNGfuelledships are less “green” than ships withinstalled selective catalytic reduction (SCR)on traditional Diesel engines.Looking at the GWP factor alone, theNOx mixture is much worse than CH 4, butthings change when we look at them from atime perspective – from 1750 till the end ofthe 20 th century the methane content in theatmosphere grew by 150% (from 700 to 1,750ppb) and NOx by 17% only (270-315 ppb).This means that the increase in CH 4duringthe industrial era was twice as bad for today’sclimate as the historical rise of NOx.Summing up, today LNG engines existthanks to a legal loophole, which ignoredtheir methane emissions. The emission factorfor methane slip should be established ona level close to one per cent (1% of unburnedCH 4balances the drop in CO 2emission intotal GWP of exhaust gas thanks to the useof methane), but according to MARINTEKmost modern gas engines have a methaneslip of around 2.5%. The question is: how safeand viable is an investment in gas engines ifa regime for methane emission will be establishedin the near future, say in 5-10 years?Question of methane slipsThree greenhouse gases are the worst forthe climate – carbon dioxide (CO 2) with aGlobal Warming Potential (GWP) factor ofone, methane (CH 4) with a GWP between 21-25 and a mixture of nitrogen oxides (NOx)with a GWP of about 300. Today regulationsonly limit the emissions of CO 2and NOx andare silent in the case of methane.In 2010 the Norwegian Marine TechnologyResearch Institute (MARINTEK) measuredexhaust gases from gas-driven vessels inNorwegian domestic shipping*. As it turnedout a significant amount of methane passedPhoto: DISC BV16 | <strong>Baltic</strong> Transport Journal | 5/<strong>2011</strong>

Question of competing technologiesLNG has strong competitors – the aforementionedSCR is the most popular in Norway.54 ships equipped with Diesel engineshad such installations at the end of 2010– 35 serving the offshore industry, 17 fishingvessels and three – cargo. Actual measuresshow that SCR diminishes NOx emissionsby 83%. Additionally, 52 ships passed anengine rebuilding procedure called ‘optimization’,which reduces NOx emission by37%. Most interesting is a combination ofthe SCR and ‘optimization’ which was thecase for only four Norwegian vessels. Sadly,MARINTEK didn’t publish data on emissionfrom such a hybrid solution.Twenty Norwegian ships with LNG enginesagainst over 100 with competitive technologiesshow the market’s choice (in all casessupported by the state). Among LNG-drivenships there are only inland ferries, CoastGuard vessels and one PSV – ships with freecapacity in hulls. The number of engine-‘optimized’ships includes two passenger ships, fivecargo, 15 offshore and 24 fishing vessels.The advantage of an improved Diesel enginecould be predicted on a historical andeconomic basis. This engine since its very beginning(the first ocean-going Diesel drivenship, the Danish Selandia, set sail in 1912)was competing with the steam engine, steamand gas turbine and always won thanks toslow but continual improvements. Developmentdoesn’t stop and “green” Diesel will becheaper in total installation and operationcosts than the LNG engine. Another factor isthat fitting LNG tanks into a modern cargovessel with a highly rationalized hull and deckcapacity seems to be a step back towards theera of steam, because the engine space has tobe enlarged at the cost of cargo holds. Let usremind that the removal of boilers and transferof bunker stores to corners of the hull wasthe first and largest rationalization in a mechanically-drivenvessel. Costly pioneeringDiesel engines were self-financed by earningson better utilization of hull capacity. Now thesituation is being reversed as LNG enthusiastscall for taxpayers’ money for improvementswhich will diminish a shipowner’s income.Question of solidarityIn light of MARINTEK’s research the LNGengine has only one real advantage over Diesel– its methane exhaust doesn’t include solidand soluble particles. Of course, they will be lefteven in the best MDO and HFO, which meetfuture MARPOL requirements. But, accordingto MARINTEK’s deep evaluation, particulatesmatter has a complex nature. CleanerMaritimefuels could lose their grade – the report says:“There will probably not be enough low sulphurcrude oil available to meet the demands,and the average quality of heavy fuel oil mightsuffer. This might lead to higher emissions ofparticles, originating from the combustionprocess.” Black carbon particles act in the atmospherelike greenhouse gases – making theworld warmer. But sulphur added to a blackcarbon particle works like a ballast tank – it absorbswater from the air and forces the particleto land quickly. In its conclusion MARINTEKstates: “The effect on the climate when reducingsulphur seems to be mostly negative since theblack carbon lifetime increases due to a longerlife time in the atmosphere.”World shipping utilizes the waste madeby oil refineries, it can’t stop doing this.But the solidarity in this work has beenbroken because of the idea that we canrun away to an LNG heaven from the effectsof marine liquid fuels combustion.MARINTEK has said that such an escapeis impossible. An LNG heaven does not existyet and there is only one atmosphere. Marek Błuś* Jørgen B. Nielsen, Dag Stenersen, Report. Emission factorsfor NH 4, NOx, particulates and black carbon for domesticshipping in Norway, revision 1, MARINTEK, 23.11.2010.A crossroads for markets –A road map for the futureAsk for exhibitorinformation now!www.transfairlog.comFIRST TRADE FAIR FOR INTERNATIONALTRANSPORT AND LOGISTICS MANAGEMENT12 - 14 June 2012Trade Fair Centre Hamburg, GermanyOrganiser:EUROEXPO Messe- und Kongress-GmbHTel.: +49 89 32391-241Fax: +49 89 32391-246E-mail: transfairlog@euroexpo.deInternet: www.transfairlog.com5/<strong>2011</strong> | <strong>Baltic</strong> Transport Journal | 17

MaritimeWe will monitor the shipping sectorInterview with Siim Kallas,Vice-President of the European Commission Climate and environment challenges areamong the crucial problems the transportsector is nowadays confronted with.What are the most crucial EU measuresdesigned to improve the environmentalcondition of the European seas?Preserving the environment is indeed a keypillar in the development of a sustainable maritimetransport. The environmental protectionof the sea is a broad concept, which covers bothprevention of pollution and response to pollution.As regards pollution prevention, let memention a few examples, such as reducing thecontent of sulphur in marine fuels – we havejust proposed to amend Directive 1999/32/ECregarding this matter, to reduce the sulphuremitted from maritime transport in sensitiveareas, such as the <strong>Baltic</strong> Sea. We have also inplace legislation which enhances the availabilityand use of reception facilities in ports to handleship-generated waste and cargo residues, andwe are currently reviewing it. Moreover, theIMO decided that all oil tankers built from 1996onwards should have a double hull. The EU negotiateda faster phase-out and secured internationalacceptance for its position at IMO. Regulation417/2002/EC set a timetable for phasingout single-hull oil tankers worldwide and theintroduction of double-hull tankers. These offerbetter protection for the environment in theevent of an accident. As regards our initiativesin terms of response to pollution, together withthe European Maritime Safety Agency we havedeveloped the CleanSeaNet service, which providesnear-real-time satellite information on oilspills. EMSA can also mobilise ships, at the requestof Member States, to help clean the sea incase of an oil-spill. As regards the sulphur content of fuels,and the <strong>Baltic</strong> Sea in particular, whatare the European measures designedat maintaining the competitiveness ofshort sea shipping, also in the area ofcapital investments in the fields of infrastructureand technology?The Commission is aware of the short termpotential economic impact the stricter limitsfor ships’ emissions might have and has beenlooking into possible solutions to limit theadverse impacts on the industry, in particularfor short sea shipping operators and users.18 | <strong>Baltic</strong> Transport Journal | 5/<strong>2011</strong>We have proposed a set of accompanyingmeasures to supportthe sector to meet the mandatorytargets and limit the cost of compliance.The TEN-T Programmewill continue to support projectsaddressing environmental issues,such as implementation projects,studies, and pilot actions introducingnew technologies, innovativeinfrastructure, and facilitiessupporting the deployment ofLNG. In addition, Marco Polo II Programmewill support projects aiming at the implementationand use of innovative technologies oroperational practices that significantly reduceair emissions from ships, such as the use of lowsulphur fuels, alternative fuels like LNG, abatementtechnologies (scrubbers), or vessels usingshore side electricity. Also, investments targetingresearch, development, and innovation toreduce emissions from ships and to promoteenergy efficiency could be financed throughthe European Investment Bank (EIB) dedicatedlending programmes. For the medium andlonger-term our approach aims at encouragingthe use of clean ship technology and alternativefuels, the development of adequate green infrastructure,and the use of funding instrumentsthat could support this – in close dialogue awith all relevant Stakeholders.Making use of the additional technology-basedcompliance provided by the revised Annex VIof MARPOL, and subsequently by the reviseddirective, requires capital investments by theprivate as well public sector. Such investmentsmay need to be incentivised notably when awider set of sustainable shipping objectivesgoing beyond compliance with Marpol AnnexVI are being pursued. Therefore, the use ofpublic funds (both those managed by MemberStates and those resulting from EU funding)could also be envisaged to support measuressuch as retro-fitting air pollution control devicesor marine engines on vessels ahead of theentry into force of the new standards, or developingonshore infrastructure for the treatmentof residues or marine-LNG refuelling stations.Any such support must comply with existingEU Guidelines on State aid for environmentalprotection and the EU Guidelines on NationalRegional Aid for 2007-2013 respectively. As Isaid, the Commission actively supports LNGinfrastructure. What steps will be taken in the casemodal backshift from sea to land-basedtransport occurs?The Commission’s impact assessment findsthat it is very difficult to quantify the exactrisk of modal backshift, as this depends on theroutes and trades affected. However, I wouldlike to recall that the fuel used by road transport(diesel) is still more expensive than marine fuel,and there are additional charges for road transport(Eurovignette) which aim to internalisethe environmental externalities of transportinggoods by trucks. Nevertheless, with the help ofthe industry, we will continue to monitor possibleimpacts on the shipping sector, especiallythe short sea shipping, to ensure adequate policyresponse in case of distortions in the logisticschain or in case of significant modal backshiftfrom sea to land based transport. The IMO regulations established the sulphurcontent of fuels used in all seas on thelevel of 0.5% as of 2020. However, theirentry into force may be delayed to 2025, incase the necessary fuels are not available.Do you think postponing these regulationsin the <strong>Baltic</strong> Sea region is also possible?This flexibility in the IMO decision is indeednot applicable to the so-called Emission ControlAreas, such as the <strong>Baltic</strong> Sea. These areasmust respect a stricter fuel standard whichcomes into force at an earlier date (2015). Forthe ECAs, the IMO has not foreseen any revisionmechanism, so I do not see how the standardsapplicable there could be changed, withoutre-opening a delicate compromise at the levelof the IMO. As the Commission proposal releasedlast July aims to align existing EU ruleswith the new IMO provisions, it does not divertfrom the international provision.

Maritimeships to the sea, since the ferry and cruise industriesare delivering 356 tonnes of nitrogenand 119 of phosphorus annually (HELCOM’sdata). The regulations were approved by theInternational Maritime Organization (IMO)in MARPOL Annex IV. The idea is that dumpingsewage into the sea is going to be prohibited,unless passenger ships (both ferries andcruise vessels) will have an approved sewagetreatment plant capable of reducing nutrientsor that ships will deliver sewage to port recipientfacilities (PRF). Ports have time until 2015at latest to construct or upgrade their sewageservices, while new and existing vessels willhave to cope with the new laws by 2016 and2018, respectively. The estimated decrease innutrients coming from ships is 63%.PRF will have to be “adequate”, meaningthat sewage discharge infrastructure or servicesshould meet the needs of the vessel and do notcause a ship’s delay. The adequacy of the PRFdepends on pax traffic inside the port as well ason the size and type of the vessel. Ports handlingonly ferry traffic can effectively fulfil the rulesusing only tank trucks or tankers. In oppositionto that, ports also visited by cruise ships needto construct an infrastructure for direct sewagedischarge to a municipal waste system. Asfor now only two out of the six biggest <strong>Baltic</strong>pax ports – Helsinki and Stockholm – have theTallink has made significant investments for cleaning the sewage waterson board through our new vessels, but this investment is useless as wehave already had to follow the principle discharging sewage waters toport reception facilities for years. The cleanliness of the waters and theend result for the environment is the same in both cases. To make theregulation work efficiently, the rule should be applied to all ships operatingin the <strong>Baltic</strong>. We see several potential problems arising with the implementationof these regulations, like the present insufficient capacityof port reception facilities as well as financing of investments needed toimprove that. It is pointless to make new rules which are not implementable due to real conditionsand not implemented by all stakeholders.Tanel Hinno, Head of Technical and Safety Management, Tallink GruppWWF was pleased with the decision by the International Maritime Organisationto ban the discharge of sewage from ferries and passenger shipsin the <strong>Baltic</strong> Sea – something WWF has been working to secure for manyyears. In reality, however, this ban cannot come into effect since many <strong>Baltic</strong>Ports are ill-equipped to receive this ship waste.The <strong>Baltic</strong> Sea region is an attractive and fast-growing destination for touristsrepresenting roughly three million cruise passengers visiting the region eachyear. Today most of the sewage produced by them is directly discharged intothe <strong>Baltic</strong> which contributes to the problem of eutrophication and thereforenegatively affects the very environment which attracts these visitors. Given the financial benefitsthe cruise industry, cities and ports receive from the ever-increasing pax ship traffic, they must showgreater responsibility and leadership by making the necessary upgrades to pax vessels as well asport waste management capacity to avoid ships dumping directly out at sea. Only when this is donewill the cruise industry and ports demonstrate their commitment to protect the sensitive marineenvironment of the <strong>Baltic</strong> Sea and enable the IMO ban to come into effect. It is simply not enoughfor the industry to passively wait for laws to make dumping illegal.Mattias Rust, WWFThe fastest routeto EuropeThe port of Antwerp is accessible to the largest container vessels sailingthe world seas. 14.000 TEU vessels with a draft up to 16 metres are regularlycalling the port. Ranking second on the list of European container ports,Antwerp handles more than 8 million TEU of containerized freight per year andhas plenty reserve handling capacity. Performing the highest terminal productivityin Europe, it guarantees a seamless service and a smooth flow of goodsfrom and into Europe. Thanks to the strategic 80 kilometre inland position,every European destination is just around the corner and easy to reach by rail,barge and road. The nearby areas of our port are strategic locations to installcentral European Distribution Centres. With 550 ha of covered storage space,the port offers a unique range of storage and value added services.www.portofantwerp.com22 | <strong>Baltic</strong> Transport Journal | 5/<strong>2011</strong>

MaritimePort of Tallinn Harbours, especially Tallinn Old City Harbour and MuugaHarbour, are some of the busiest ports in the region. In our developmentplans we are taking into consideration the newest technologies and scientificknowledge for energy efficiency and environmental protection inorder to achieve sustainable development. The Sustainable DevelopmentPlans of Utilities of Port of Tallinn Harbours is dedicated to the fulfilmentof the HELCOM <strong>Baltic</strong> Sea Action Plans’ goals, especially to the fulfilmentof Chapter 3: “Towards a <strong>Baltic</strong> Sea with environmentally friendly maritimeactivities”. In addition to that EU directives and international suggestions forwater and wastewater (minimizing the effect on the environment also through new technology,construction of port reception facilities, etc.) are taken into account. At present Port of Tallinn ismaking preparation works to modernise port reception facilities for passenger and cruise vesselsin the Old City Harbour.Ellen Kaasik, Head of the Quality and Environmental Management Department at Port of Tallinnproper PRF. Tallinn, St. Petersburg, Rostock it, but the port authorities aren’t sure thatand Copenhagen have fallen behind, and currentlythe initiative will have the anticipated effect.are at the stage of constructing such fa-Also, ship owners might not be so fond ofcilities or have them only at one pax quay, like the new regulations, since onboard sewageSt. Petersburg. It should be noticed that Danishtreatment plants will mean the cost ofports – Helsingør, Rødby, Frederikshavn, Gedserbuying one, installing and fixing it; the new– are the best prepared for the upcoming equipment will take up valuable space with-standards, all of them having direct discharge in the ship. Not without meaning there willto a sewer system. Other ports, such as Gdynia, also be the added weight, which will accountGothenburg, Riga, Świnoujście, Trelleborg, for more fuel consumption. In addition,Turku and Ystad have room for improvement. ship operators will have to pay waste treatmentcompanies for taking care of the sewage.The sceptical point of viewBoth ports and ship owners will bow toFirst of all, ports will have to pay for the the necessity, but it’s rather hard to imagine<strong>BTJ</strong>.Container:184 x 118 / 4C .03.1 1:28 Seite 1additional infrastructure and for mending that they will behave like a Good Samaritan.Most likely they will make the ultimate consumerto bear costs. The proposed solution,the so-called ‘no special fee’ system, wherethe cost of reception, handling and disposalof ship-generated wastes, originating fromnormal operation of the ship, is includedin the harbour fee or otherwise charged tothe ship irrespective of whether wastes aredelivered or not, is in fact a cloaked charge.At present, not every <strong>Baltic</strong> pax port has implementedthe ‘no special fee’ system. Butit’s not only the problem of ports, but alsocities owning them. It is the cities who getmost of the revenues from pax traffic – hotelnights, shopping, restaurants, etc. – thusthey have a role to play in solving the sewageissue, tooIt remains unclear whether the regulationswill help or not. But if the upcominglaws are combined with other actions,most notably with establishing the TotalDaily Maximum Load (TMDL) for nutrients,indicating the highest amountof pollutants that can enter a body ofwater without exceeding the thresholdabove which negative impacts will occur,there may be a possibility that the <strong>Baltic</strong>Sea will once again be safe and sound. Przemysław Myszka5/<strong>2011</strong> | <strong>Baltic</strong> Transport Journal | 23

Report<strong>Baltic</strong> containerizationA guideto the <strong>Baltic</strong> Sea Container Map <strong>2011</strong>Photo: MaerskWorkhorsesof the <strong>Baltic</strong><strong>BTJ</strong>’s 2006 report lists 124 ships feedering in the <strong>Baltic</strong> with a total nominal capacity of 83,500 TEU. Now, five yearson, the census shows 160 feeders and 157,000 TEU – almost twice the amount in the main term of productivity.Five years ago, in our first report on container shipping in the<strong>Baltic</strong> Sea, we compared this business to “a bunch of parsleytied to the Kiel Canal”. Its roots are ingrained in a few hubs onthe North Sea, while stems and leaves reach the northernmostports of the Gulf of Bothnia. Although some ocean and transatlanticcontainer services have started to call in Gdańsk and St. Petersburg sincethe beginning of 2010, this general picture has not changed. Against allodds, feeder shipping now has stronger roots and richer greens.Our first report, published at the end of 2006 (<strong>BTJ</strong> 6/2006),lists 124 ships feedering in the <strong>Baltic</strong> with a total nominal capacityof 83,500 TEU. Five years later the census shows 160 feeders and157,000 TEU – nearly twice the amount. But to precisely comparepast and present we should diminish the newest numbers, becauseour first ranking didn’t include Norway, the UK, Iceland and theFaeroe Islands’ short sea services (minus 14 ships and about 12,300TEU). Nevertheless, the growth in capacity is enormous – almost80%, but in terms of the number of ships it is only 20%. The differencebetween the latter numbers informs that a ship’s averagecapacity has grown significantly – from 675 to 981 TEU (+45%).In 2006 operators had 13 vessels which could carry nominally over1,200 TEU, now they have 43 such ships (to be exact, 41 serve theBSR and two are employed on an Icelandic service).Large and small operatorsToday 24 operators are involved in the container business and thisnumber is larger than in 2006, even though some names have disappearedfrom the list in the meantime. For example, in 2007 <strong>Baltic</strong> ContainerLines merged with IMCL, which was later acquired by Unifeeder (2009).Also in 2007 Kuršių Linija merged with Containerships while SaimaaLines ceased its shipping activities. In fact, almost all companies listed in2006, except overseas operators like MSC or OOCL, were transformedduring the period in focus: they changed ownership without changingtheir names (i.e. Containerships, Unifeeder) or have a new owner anda new brand (i.e. ESF Euroservices since 2006 has been FESCO-ESF).The <strong>Baltic</strong> has seen ‘veteran’ operators grow and expand geographically;Team Lines has opened a service to the Iberian Peninsula, Unifeeder – to5/<strong>2011</strong> | <strong>Baltic</strong> Transport Journal | 25

Reportthe UK, and vessels of Containerships ply in a detached network betweenMediterranean ports (it has acquired the Turkish operator Contaz Line).Among the successful new entrants are Green Feeder, Merilinja, SeaConnect and SCA Transforest. Some initiatives are short-lived, includinge.g. a two-ship service to St. Petersburg started and closed in 2007 byNYK Line. Even an innovative feeder service from Lübeck to St. Petersburg– Combispeed – ceased operations in 2009.Container business in the <strong>Baltic</strong> and its surrounding waters is a mixtureof feedering and short sea shipping. Some operators declare themselveson one side but in fact most carry containers both in overseas andintra-Europe traffic. Consequently, there is no reason to omit two wellestablishedIcelandic companies – Eimskip and Samskip. They are mentionedfor first time in our report and ranking because their ships call atports in the Kattegat. Among the 18 common carriers only three companies(Green Feeder, Team Lines and X-<strong>Press</strong> Feeders), haven’t declaredshort sea services although they also carry 45’ containers – the typicalintra-Europe box. Twelve companies declare door-to-door services andoperate their own or leased containers. Two operators: Containershipsand Unifeeder, have fleets in the range of 15,000 units each.global carriers, then CMA CGM, Maersk Line, MSC and OOCL witha share of 30% (now we have added two ships on one service of the K-Line). The rest, also 30%, is left for medium and small operators usuallyserving one loop like Hacklin or one destination like FESCO-ESF (previouslyESF Euroservices). Things haven’t changed very much althoughthe share of global carriers has grown to about 36% at the expense ofUnifeeder and Team Lines (now 36%) and local operators with a shareof 28%. It is worth noting, the share of the latter group was smaller(25%) at the beginning of 2010. This recovery probably underlines theimportance of the local market and cluster relations in it.Tab. 2. Operator’s capacity [TEU]Tab. 1. <strong>Baltic</strong> container [feeder] operators 2010OperatorNumberof shipsTotalcapacity(TEU)Ship’saverage(TEU)Total GT1 Unifeeder* 41 41,211 1005 423,7292 MSC 16 23,340 1,459 313,5183 Maersk/Seago Line 15 19,500 1,300 205,0004 Team Lines** 17 17,621 1,037 187,9055 FESCO-ESF 7 10,164 1,452 110,4946 Containerships*** 9 7,882 877 81,8427 OOCL 6 5,488 915 63,2488 Delta Shipping 4 3,806 952 41,132Lines9 CMA CGM 5 3,750 750 40,76710 Transatlantic 8 3,646 456 34,40511 X-<strong>Press</strong> Feeders**** 5 3,500 700 35,00012 Eimskip 3 3,479 1,160 34,38413 MacAndrews 4 2,414 604 23,00714 Sea Connect 3 2,107 702 19,21015 Swan Container 2 1,876 978 22,919Line16 Samskip 2 1,816 908 17,66017 Tschudi Lines 3 1,716 572 15,44418 K-Line 2 1,410 705 12,38219 Merilinja 2 1,358 679 11,41920 Green Feeder 2 1,016 508 7,99821 Hacklin Seatrans 2 894 447 7,82422 SCA Transforest 1 809 809 7,72023 Mann Lines 1 658 658 5,056160 157,013 981 1,732,063Remarks:1*including four ships serving the UK2* excluding three ships in the Iberian services3* excluding four ships in the Mediterranean4*capacity and GT estimatedSince the very beginning of our report we have divided operatorsinto three groups and measure their relations of total capacities. The firstgroup consists of the two largest independent common operators havingwide networks to all shores of the BSR – Unifeeder and Team Lines.In 2006 Team Lines was the second in the chart, so both companies heldabout 40% of the total feedering capacity. The second group includedRemarks:* second half of the year** first half of the yearLarge and minor shipsAttention-grabbing is the average and maximum size of ships. Theaverage capacity of feeders has grown continuously and independentlyof the market situation, even during the crisis. Interestingly, theprocess has slowed down recently – in the beginning of 2010 the averagewas 960 TEU, now, after 18 months, it is only 21 units more. Onthe other hand, against many predictions pointing to the number of3,000 TEU as optimum for the <strong>Baltic</strong> (at least for the main routes tothe Gulf of Finland), capacity of the largest ships entering the markethasn’t grown. So it seems that in the near future a “baltimax feeder”will not exceed a capacity of 2,000 TEU. Although the general growingtrend is obvious, since 2007 all new huge deliveries remain in therange of 1,600 – 1,800 TEU. The leader among modern vessels is nowMaersk Vallvik built in China in <strong>2011</strong>, with a 1,800 TEU nominal capacityand a gross tonnage (GT) of 20,927. She is employed in the loop:Rotterdam – Kaliningrad – Kotka. Only one company, MSC, operatesships over 2,000 TEU, but these are former ocean liners retired to therole of feeders. Today, in terms of nominal capacity the largest is MSCDymphna (2,900 TEU) built in 1989 and in terms of gross tonnage– MSC Carina (GT 42,640) from 1986. Both ships sail in the service:Antwerp – Bremerhaven – Gdynia – Klaipėda. MSC Carina is probablythe biggest feedering container ship ever in the <strong>Baltic</strong> and the firstone crossing the threshold of GT 40,000. Let us remind – in terms ofcapacity the record is still held by MSC Nora (3,016 TEU) which wasserving the same route in 2010. MSC traditionally leads the ranking interms of ship average, but in this census its figure is lower than in 2010– decreasing from 1,583 to 1,459 TEU.On the other hand, the average of Team Lines and Unifeeder’sship capacity has crossed the limit of 1,000 TEU for the first time.Notable is a split between operators with a growing and stable average– since 2006 Team Lines’ fleet has grown 64%. Both FESCO-ESFand Unifeeder’s fleet have grown by 54%. On the contrary, Containershipsincreased its ships’ average by only 7% and OOCL by 4.5%.Now six <strong>Baltic</strong> feeder operators have ships exceeding 1,200 TEU intheir fleets; MSC has 12, Maersk Line – eight; Unifeeder, Team Lines andFESCO-ESF each have seven such vessels. Only the latter has a whole26 | <strong>Baltic</strong> Transport Journal | 5/<strong>2011</strong>

Reportfleet of this size. It seems interesting that in the western part of the area infocus only one operator – Eimskip – has two ships over 1,200 TEU.Obviously, the market still needs smaller vessels and until nowthe ship average hasn’t passed the limit of 1,000 TEU. Six <strong>Baltic</strong>feeders have a capacity less than 500 TEU (10 such vessels existedat the beginning of 2010) and six are in the range 508-510 TEU.Time confirms our prediction that at least two classes of “handy”vessels will remain the most popular – one, between 800 and 900TEU (now 36 units) and the second, around 1,400 TEU (19 units).13 ships have already reached the top range for modern ships – acapacity between 1,600 and 1,800 TEU.Tab. 3. Minor <strong>Baltic</strong> container ports served by feeder operatorsCountry PortTurnover[thou.TEU]Served by:1 SE Södertälje 38 Containerships, MSC2 SE Norrköping 37MSC, Team Lines,Transatlantic3 FI Oulu 31 Merilinja, Transatlantic4 SE Halmstad 27 CMA CGM, Unifeeder5 SE Stockholm 26SCA Transforest, TeamLines, Unifeeder6 SE Åhus 24Team Lines,Transatlantic7 FI Pori 22 Hacklin8 SE Västerås 21 Transatlantic9 SE Umeå 18 SCA Transforest10 FI Tornio 14 Transatlantic11 FI Turku 14 Team Lines12 FI Kokkola 12 Merilinja13 SE Oxelösund 11 Transatlantic14 SE Sundsvall 9 SCA Transforest15 SE Varberg 8 Samskip16 FI Kemi 7 TransatlanticTotal 319Remarks:1. This table supplements Table 14. ‘Top 20 container ports 2010’ published in the <strong>BTJ</strong>4/<strong>2011</strong>, pg. 44.2. The actual sum for Finnish ports is 101 thou. TEU; in the table decreased to 100 thou.due to roundings.3. Figures for Swedish ports include flats and cassettes.Tab. 4. Ships’ average capacity [TEU]Remarks:* second half of the year** first half of the yearWide and limited networksFeeder and short sea <strong>Baltic</strong> operators currently serve 105 independentlines of which 79 simply join North Sea hubs and portswith the BSR. Two feeder connections are intra-<strong>Baltic</strong> – from DCTin Gdańsk to ports in the Gulf of Finland. Services within the limitsof the <strong>BTJ</strong> map and attached tables include 11 loops to Norway ofwhich four call at Danish and/or Swedish ports. Harbours in the <strong>Baltic</strong>Straits have three connections to Spain, three to Iceland/FaeroeIslands and one – separately – to the UK/Ireland, to Morocco and tothe Mediterranean (ships serving the two latter are not included inthe data presented in Table 1). Additionally, our tables – printed inthis issue and on the CD – list three overseas services which enter <strong>Baltic</strong>ports directly. Four listed services don’t call at <strong>Baltic</strong> or Norwegianports but we add them as integral parts of wider operators’ networks.Summing up – 97 container services call at ports in the BSR. The largestnetwork belongs to Unifeeder – 29 services, including 22 to theBSR, four to Norway and three to the UK. Team Lines follows with13 services, MSC has 10 and Seago Line – nine.Such a rich network serves 36 ports (51 terminals) in the <strong>Baltic</strong>– they are connected to five North Sea hubs (29 terminals) and 28other destinations in Western Europe. Shortly, the first pair of figureswill grow to 37 and 52 because the container terminal in Ust-Luga will start operations this November. Other changes are in thepipeline because Maersk Line is reconstructing its services Europe– Far East and its whole European feeder network. The new “total”service Daily Maersk will probably absorb some AE loops whichcould also affect the longest AE 10 from China to Gdańsk. The newMøller-Maersk company Seago Line, dedicated to feeder and shortsea services in Europe, will probably strengthen Maersk’s servicesin the <strong>Baltic</strong> – we would like to note a first sign of this new policy:in September <strong>2011</strong> a new loop started from Bremerhaven to Riga,Klaipėda and back via Aarhus and Scandinavia Feeder to Aarhusand Gothenburg. Competition will again be on the rise and newtakeovers and/or merges on the feeder market can be expected.FiguresContainer turnover in <strong>Baltic</strong> ports grew from 6.4 mln TEU in2006 to 7.4 mln TEU in 2010 – and in <strong>2011</strong> a growth of over 20%is expected. In the ‘Top 20 container ports’ table (<strong>BTJ</strong> 4/<strong>2011</strong>) wewould like to note one important <strong>Baltic</strong> liner port not listed in thisreport because it is not connected to the feeder network. This isLübeck (15 th position) which handled 126 thou. TEU in 2010. Justbelow the bottom line of the table is Hanko (21 st position), also aro-ro port without feeder connections but having a turnover of 50thou. TEU. Some other ports and terminals outside the feeder networkshow minor turnovers, for example Naantali: 11 thou., Raahe:5 thou., Liepāja: 1.8 thou. TEU. This means that some containertraffic is served by other branches of shipping. The pair, Lübeckand Hanko, handles containers served by ro-ro and con-ro vesselslike Trafexpress vessels operated by Transfennica. Helsinki is alsoan important destination in this combined network. Another Germanport – Sassnitz – tranships containers between trucks and widegauge rail cars delivered by ferries from Russia. Such turnover inro-ro and universal terminals could be estimated on the level of 300thou. TEU and is mostly intra-<strong>Baltic</strong>.Additionally, about 100 thou. TEU of intra-<strong>Baltic</strong> traffic is carriedby container ships and multipurpose vessels. Summing up theyear 2010 – 7.2 mln TEU travelled to and from the <strong>Baltic</strong> in containerships, of which feeders carried about 6.8 mln TEU. Basing onthe incomplete statistics of hub ports, one could estimate that about5.2 mln TEU was transshipped to and from ocean vessels and therest, about 1.6 mln, travelled as short sea cargo.According to the latest Annual Report of Unifeeder, revealingfigures for 2010, its vessels carried 1,748,823 TEU of which215,066 TEU was served by its short sea department. The utilisationratio on the vessels’ capacity was 91.3% – four points morethan in 2009. Calculating Unifeeder’s data we can roughly say that5/<strong>2011</strong> | <strong>Baltic</strong> Transport Journal | 27

ReportMap 1. Ro-ro & con-ro lines serving container traffic on the <strong>Baltic</strong> Seaone quarter of <strong>Baltic</strong> feeder capacity carried one quarter of thecargo which crossed the Skaw and Kiel Canal. All data show thatin 2010 an average Unifeeder vessel made 35 round voyages carrying50,000 TEU and made 200 calls at ports. These figures seemto be valid also for vessels of other operators – so, the whole <strong>Baltic</strong>container fleet made at least 5,200 round trips (about 100 perweek) and 30,000 calls at ports (about 580 per week).Following these data one could say that feedering containershipsare the real workhorses of the <strong>Baltic</strong> Sea.Marek BłuśSee the full <strong>Baltic</strong> Sea container network in the tables on pgs. 29-32,also graphically depicted in the attached map poster and CD.28 | <strong>Baltic</strong> Transport Journal | 5/<strong>2011</strong>