btj 35.indd - Baltic Transport Journal

btj 35.indd - Baltic Transport Journal

btj 35.indd - Baltic Transport Journal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Baltic</strong> <strong>Transport</strong> 1733-6732<br />

<strong>Journal</strong> ISSN<br />

№ 3/2010 (35), MAY/JUNE<br />

Official media partner of:<br />

b i m o n t h l y - d a i l y c o m p a n i o n<br />

€ 15/50 PLN (VAT 0%)<br />

Motorways of the Sea revision<br />

Report<br />

China-EU trade outlook<br />

Oil transport perspectives

EWTC Newsletter ................................................................................................... 5<br />

Green light for East-West transport<br />

BTJ calendar of partnership events ............................................................................................ 6<br />

What’s new .........� 8<br />

Just one question .......................................................................................................................... 12<br />

<strong>Transport</strong>ing oil – a growing opportunity ........................................................................... 14<br />

Perspectives for the <strong>Baltic</strong> region<br />

Reporting, learning, being flexible ......................................................................................... 17<br />

Safety in BSR<br />

To implement or not to implement ........................................................................................ 18<br />

Ship source marine pollution law in BSR<br />

Report: China-EU trade outlook ........................................................................ 21<br />

The future of bilateral relations<br />

How to do business with China<br />

Trans<strong>Baltic</strong> Newsletter ....................................................................................... 26<br />

<strong>Baltic</strong> Ports Organization Newsletter ............................................................... 30<br />

Two openings, three dimensions ............................................................................................ 32<br />

DNV starts up 3D virtual training center<br />

Focus: Shortsea Shipping on the <strong>Baltic</strong> ............................................................ 33<br />

More than hype?<br />

Two options for Finland .............................................................................................................. 36<br />

Debate on new IMO regulations continues<br />

System planning: a new view ................................................................................................... 38<br />

IT solutions in ports<br />

How to speed up freight traffic between Russia and Finland ....................................... 40<br />

New study by VTT<br />

Recovery in Russia approaching? ............................................................................................ 42<br />

Oversized goods and inland water transport<br />

Learn logistics .� 44<br />

Educational undertakings of K+N<br />

<strong>Transport</strong> miscellany .................................................................................................................... 45<br />

Who’s who ........� 46<br />

Contents<br />

3/2010 | <strong>Baltic</strong> <strong>Transport</strong> <strong>Journal</strong> | 3

Editorial<br />

� � � � � � � � � � � � � � � � � � � � � � � � �<br />

����������������<br />

�����������������������<br />

�������� ����� ������� ���<br />

���������������������<br />

�����������������������������<br />

������<br />

�����������������������<br />

��������������������������<br />

<strong>Baltic</strong> <strong>Transport</strong><br />

<strong>Journal</strong><br />

President of the Board<br />

BOGDAN OŁDAKOWSKI<br />

office@baltictransportjournal.com<br />

Publishing Director<br />

PIOTR TRUSIEWICZ<br />

piotr@baltictransportjournal.com<br />

Editorial Team<br />

MARTYNA BILDZIUKIEWICZ<br />

martyna@baltictransportjournal.com<br />

ALISON NISSEN<br />

alison@baltictransportjournal.com<br />

PIOTR TRUSIEWICZ<br />

piotr@baltictransportjournal.com<br />

Contributing writers and<br />

update correspondents:<br />

KRZYSZTOF SZYMICHOWSKI, PROSHANTO MUKHERJEE,<br />

ABHINAYAN BASU BAL, KATARZYNA KUREK, YAN WEI,<br />

WILLY DE DECKER, MAREK BŁUŚ, JOHN LUND,<br />

ANTTI PERMALA, MARISA LUTTER, PIOTR STAREŃCZAK,<br />

ULLA TAPANINEN, JUHA KALLI, TAPIO KARVONEN,<br />

AGNIESZKA PAWŁOWSKA<br />

English Language Editors<br />

ALISON NISSEN<br />

Design and DTP<br />

MEDON<br />

Art Director&Graphic Designer<br />

DANUTA SAWICKA<br />

Publisher<br />

BALTIC PRESS SP. Z O.O.<br />

Address: 8 Pułaskiego Street<br />

81-368 Gdynia, Poland<br />

office@baltictransportjournal.com<br />

tel. +48 58 627 23 94, tel. +48 58 627 23 95<br />

fax +48 58 621 69 66<br />

www.baltictransportjournal.com<br />

Marketing & Sales<br />

(advertising, tradefairs, conferences)<br />

PIOTR TRUSIEWICZ<br />

piotr@baltictransportjournal.com<br />

ANNA PASZEK<br />

anna@baltictransportjournal.com<br />

Subscriptions<br />

subscriptions@baltictransportjournal.com<br />

Print<br />

MEDON<br />

Address: Medon sp. j.<br />

ul. Kartuska 245, 80-125 Gdańsk, Poland<br />

e-mail: medon@medon.gda.pl<br />

www.medon.gda.pl<br />

Circulation: 2,500<br />

������� ���������������<br />

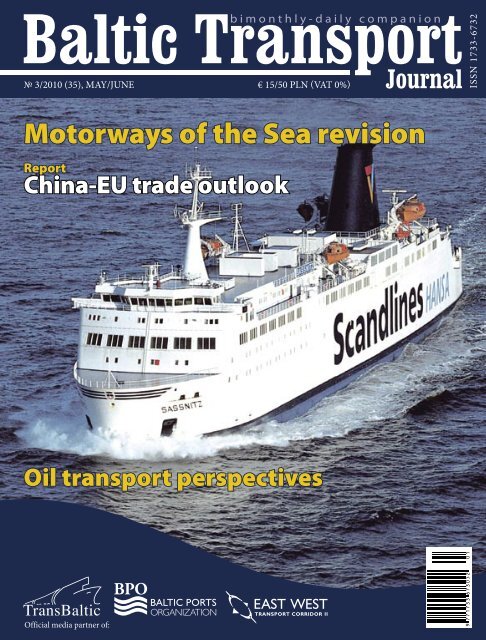

Cover photo:<br />

Scandlines<br />

(FS Sassnitz on the Trelleborg-Sassnitz MoS)<br />

Subscriptions can be ordered<br />

in Kolporter offices in Poland.<br />

For more information call 0801-205-555 or visit<br />

www.kolporter-spolka-akcyjna.com.pl/prenumerata.asp<br />

4 | <strong>Baltic</strong> <strong>Transport</strong> <strong>Journal</strong> | 3/2010<br />

Dear Readers,<br />

All those who were advertising Expo 2010 in Shanghai as the biggest in history<br />

– taking into account nearly all possible aspects – were right. The biggest exhibition area in<br />

one of the biggest (demographically as well as in terms of economic potential) countries makes<br />

a huge impression. Under such circumstances, it would be impossible not to mention China in this issue<br />

of BTJ, especially when we think of the country’s ties with the <strong>Baltic</strong> Sea region and the interest the Asian<br />

power evokes in our area. For all those who are interested in doing business in China I recommend the<br />

article by Yan Wei, full of practical hints what (not) to do while working with the Chinese. Also, don’t<br />

miss the analysis prepared by Cosco R&D, which gives us a full picture of China-EU trade relations.<br />

We also take you to another part of the globe – to Russia, whose economic recovery, as Marisa Lutter<br />

claims, may already be underway thanks to the developing branch of oversized goods transportation<br />

as well as inland waterway transport. As we are in Russia, we also take a thorough look at the oil<br />

business there and investments involved – I cordially recommend the expert article written by Krzysztof<br />

Szymichowski.<br />

The <strong>Baltic</strong> TLF industry is still in a hot discussion over new IMO regulations, regarding sulphur<br />

content in marine fuels. We’ve been writing about this issue since January and don’t omit the difficult<br />

topic now. Ulla Tapaninen, with her colleagues from the Centre for Maritime Studies in Turku, gives<br />

us an in-depth analysis of the consequences Finland needs to take into account when implementing the<br />

regulations. Speaking of the latter – it’s worth seeing how many rules and regulations the <strong>Baltic</strong> Sea<br />

needs to obey, especially when it comes to marine pollution; you can see a detailed list with experts’<br />

comments in the article by Proshanto K. Mukherjee and Abhinayan Basu Bal.<br />

As always, we are open to your comments, views and ideas. The more we discuss various issues<br />

around BSR, the better for our region.<br />

Martyna Bildziukiewicz<br />

Editor<br />

Company index<br />

Ackermans & van Haaren 45; Aeroflot Russian Airlines 13; Ahlers Group 34; air<strong>Baltic</strong> 12, 13; Airbus 13, 44; AKG Logistics<br />

42, 43; Alpcot Agro 10; Alpcot Capital Management 10; Alstom 45; AnsaldoBreda 11; Älvsborg Ro/Ro Terminal 20;<br />

Åland Posten 45; <strong>Baltic</strong> Oil Terminals 10; <strong>Baltic</strong> Ports Organization (BPO) 30; Banverket 20; Birka Line 45; Blue1 12;<br />

Citroën 11; Civil Aviation Administration (Denmark) 13; Confederation of Finnish Industries 36; Copenhagen Airports<br />

13; COSCO R&D 23; Credit Suisse 13; Damco 10; Danish Ports 46; DASH7 Alliance 10; DB Schenker 10; DEME Group 45;<br />

Det Norske Veritas Poland 32; DFDS 28; DFDS Lisco 26, 28; DNV Academy 32; DSB 11; European Bank of Research and<br />

Development (EBRD) 12; European Commission 26, 27, 28, 29, 30, 33, 34; European Shortsea Network 33; Fast Lines<br />

34; Femern Bælt A/S 46; FESCO <strong>Transport</strong>ation Group 10; Finnair Oy 12, 13; Finnish Customs 39, 40; Finnish Ministry<br />

of <strong>Transport</strong> and Communications 37, 40; Finnish Oil and Gas Federation 36; Finnish <strong>Transport</strong> Agency 31; Finnsteve<br />

39; Flensburg University of Applied Sciences 46; Forkor Shipyard 45; Frankfurt Airport 13; Germanwings 12; Gothenburg<br />

Car Terminal 20; Gothenburg Municipality 20; Green Cargo 11; Group H. Essers 34; Grupa LOTOS 16; Gunvor<br />

8; Hansgrohe 9; HELCOM 17, 18; Helsinki Airport 13; International Air <strong>Transport</strong> Association (IATA) 17; International<br />

Civil Aviation Organization (ICAO) 13, 17; International Energy Agency 15; International Maritime Organization (IMO)<br />

18, 19, 36, 37; International Monetary Fund (IMF) 23; Italscania 46; Katoen Natie 34; Kaunas International Airport 13;<br />

Kemi Bulk Terminal 31; KGHM Metraco 8; Kuehne Foundation 44; Kuehne + Nagel 10, 44; Kühne Logistics University<br />

44; Latvian Airlines 12; Latvian Railways (LDz) 11; Lever GmbH 46; LicTech 41; Lufthansa 13; Lufthansa Systems AG 46;<br />

Lufthansa Systems Infratec GmbH 46; Lufthansa Systems Network GmbH 46; Lufthansa Technik 44; Maersk 8, 10; Magemar<br />

Poland 45; MegaFon 13; Marine Environment Protection Committee (MEPC) 36; Mitsubishi 11; Mitsui & Co. 10;<br />

Multi-Link Terminals 39; Mussalo Harbour 41; Naftoport 14; National Aeronautics and Space Administration (NASA) 17;<br />

Noord Natie 34; Nordic Ferry Services 9; OOO Revival Express 10; Organization of the Petroleum Exporting Countries<br />

(OPEC) 14, 15; ORLEN Lietuva 14; Peugeot 11; PKN ORLEN 16; Polish Airways LOT 12; Port of Baltiysk 10; Port of Butinge<br />

14; Port of Esbjerg 5; Port of Fredericia 5; Port of Gdynia 45; Port of Gothenburg 20, 31; Port of Helsinki 39, 41; Port of<br />

Il’yitchovsk 5; Port of Kaliningrad 5; Port of Karlshamn 5, 28, 29; Port of Karlskrona 5, 26; Port of Kemi 30; Port of Kiel 8;<br />

Port of Klaipėda 5, 8, 15, 26, 28, 29; Port of Lübeck 31; Port of Odessa 5, 16; Port of Primorsk 14, 15; Port of Riga 8; Port<br />

of Sassnitz 26; Port of Tallinn 8, 15, 30; Port of Trelleborg 26; Port of Ust-Luga 8, 14; Port of Ventspils 8, 14, 15; Pulkovo<br />

Airport 12; RAF 17; Railport Scandinavia 20; Rhenus Group 10; Riga International Airport 12; Russian Customs 10, 41;<br />

RzD Russian Railways 11; Scandinavian Tank Storage 20; Scandlines Group 8, 26; Scania 46; Scania Schweiz AG 46; Sea-<br />

Invest 34; Sheremetyevo International Airport 13; Shortsea Promotion Centre Flanders 33, 34; Siemens AG 46, Silja Line<br />

45; Skandia Container Terminal 20; Skytrax 13; Statens Järnvägar 45; Stena Line 9, 26; Steveco 39; Sund & Bælt Holding<br />

A/S 46; Szczecin Seaport 8, 45; Tabaknatie 34; Tallinn Airport 12; Tor Harbour 20; Trans<strong>Baltic</strong> 5, 26, 28, 30; TransLumi Line<br />

31; Transneft 14; Trinity House 45; United Nations (UN) 37; Visy Oy 39; Vnesheconombank 12; VTT Technical Research<br />

Centre of Finland 40; Vuosaari Harbour 39, 41; Wallenius Wilhelmsen Logistics 8; Wizz Air 13; World Bank 14..

East West <strong>Transport</strong> Corridor II<br />

EWTC newsletter<br />

Green light for East-West transport<br />

As the first EWTC project turned out to be a success, a new edition<br />

was started in September 2009. The follow-up initiative of EWTC II<br />

aims at highlighting the development of a Green Corridor Concept<br />

as a best practise case in the European TEN-T context.<br />

Being an integrated part of the<br />

Northern <strong>Transport</strong> Axis and<br />

running from Vilnius in Lithuania<br />

via South-East Sweden to<br />

Esbjerg in Denmark, the East-<br />

West <strong>Transport</strong> Corridor serves<br />

cross-border and transit transport across the<br />

region, taking cargo further to Russia, the Far<br />

East and to the Black Sea areas. The EWTC<br />

can become an important player in the market<br />

for Russian freight export and imports via the<br />

II and IX Pan-European Corridors linked to<br />

the Ports of Kaliningrad and Klaipėda. It also<br />

hopes that development of the Trans-Siberian<br />

Railway line shall allow it in the long run to<br />

become an alternative to sea transport of all<br />

goods from the Far East to Europe. While the<br />

sea route from China to Europe is approximately<br />

20,000 km, the Trans-Siberian line to<br />

the southern <strong>Baltic</strong> Sea is only about 11,000 km.<br />

When compared to shipping, the train route is<br />

shorter and faster, and offers more flexibility in<br />

timing and volume as regards the transported<br />

goods. With increased capacity in the transport<br />

routes between Lithuania and Sweden,<br />

Klaipėda and Blekinge (Karlshamn/Karlskrona)<br />

can be developed into important gateways<br />

for trade between Scandinavia and the Black<br />

Sea, and beyond. The goods can be carried on<br />

further to Ukraine, Belarus and the Caucasus,<br />

via the Il’yitchovsk and Odessa ports. The railcars<br />

with containers can even be delivered to<br />

Georgia, Armenia and Turkey. Hence, a part of<br />

the project is dedicated to developing the ports,<br />

including the most western Port of Esbjerg and<br />

Fredericia (both in Denmark), Swedish Helsingborg,<br />

Karlshamn and Karlskrona, Lithuanian<br />

Klaipėda and Russian Kaliningrad.<br />

Creating a common vision<br />

The first edition of the project was held in<br />

years 2006-2007 as a cooperative venture between<br />

42 partners and aimed to strengthen<br />

transport development by infrastructure improvements,<br />

new business solutions, logistics<br />

and co-operation between researchers. Partners<br />

in the EWTC project, with Region Blekinge being<br />

the lead one, included local, regional and<br />

national authorities, universities, harbours and<br />

private stakeholders from Denmark, Lithuania,<br />

Russia and Sweden. Co-financed by the project<br />

partners as well as the <strong>Baltic</strong> Sea Region Programme<br />

2007-2013, EWTC was the first step<br />

on the way toward a more sustainable transport<br />

system in the region. Aside from a new strategy<br />

and a concrete Action Plan for further improvements<br />

of the corridor, the project resulted<br />

in the partners starting a common vision for<br />

the year 2030, where EWTC stands out as an<br />

efficient and green corridor on the map of the<br />

Trans-European Network, meeting market demands<br />

for growing freight to/from Scandinavia<br />

and Lithuania with close co-operation between<br />

interlinked hubs and more environmentallyfriendly<br />

transport solutions.<br />

Keeping up the momentum<br />

With EWTC II, the co-operation was renewed<br />

in March 2009, when the partnership<br />

applied for EU grants of EUR 7.5 mln from the<br />

Interreg IV <strong>Baltic</strong> Sea region programme, with<br />

Region Blekinge again taking the role as lead<br />

partner. This time, it has been joined by around<br />

70 partners from Sweden, Denmark, Lithuania,<br />

Germany, Russia, Belarus, Italy and China, including<br />

several partners from the private sector,<br />

and is supported by both the Swedish and<br />

Lithuanian governments. The project serves as<br />

a testing ground not only for the green corridor<br />

concept, but also for innovations, new technology,<br />

business models and improved management<br />

systems that may advance the present<br />

sustainable transport solutions. Linking Minsk,<br />

Vilnius, Klaipėda/Kaliningrad with Denmark<br />

via southern Sweden and with Germany via<br />

Sassnitz, the project will facilitate development<br />

of hubs as growth centres. For better results in<br />

developing the green corridor criteria, EWTC<br />

II will cooperate with the ongoing Trans<strong>Baltic</strong><br />

and SCANDRIA projects.<br />

Stimulating sustainable growth<br />

The main goal of the EWTC II is to secure<br />

sustainability for transport solutions within<br />

the corridor by means of creating a network<br />

of stakeholders and making use of the already<br />

existing Corridor Organisation and Structure.<br />

EWTC II is supposed to act as a reference<br />

manual concerning green corridors that will<br />

propose more eco-friendly alternatives and explain<br />

basic steps required to develop a green<br />

corridor concept in line with the EU transport<br />

policies. The manual will also describe options<br />

for the certification of green transport systems.<br />

As a way to reduce costs and environmental<br />

impact, the project will also suggest<br />

an innovative IT-based information broker<br />

system, in correspondence with the EU’s ambitions<br />

for e-freight. New business concepts<br />

for railway transport, improved infrastructure<br />

and transport service in ports and terminals<br />

are among the expected outcomes as well. �<br />

For more information on this project,<br />

please visit www.ewtc2.eu.<br />

Agnieszka Pawłowska<br />

3/2010 | <strong>Baltic</strong> <strong>Transport</strong> <strong>Journal</strong> | 5

BTJ calendar of partnership events 2010<br />

BTJ 3/2010 (May-June edition)<br />

Issue distributed at:<br />

12 th <strong>Baltic</strong> Development Forum<br />

Summit 2010<br />

1-2 June 2010, LT/Vilnius<br />

www.bdforum.org<br />

European Supply Chain<br />

and Logistics Summit 2010<br />

7-9 June 2010, CZ/Prague<br />

www.scleurope.com<br />

Posidonia 2010 Expo<br />

7-11 June 2010, GR/Athens<br />

www.posidonia-events.com<br />

TOC Europe 2010 Expo & Conf.<br />

8-10 June 2010, ES/Valencia<br />

www.tocevents-europe.com<br />

SoNorA V Consortium Meeting<br />

16-17 June 2010, Erfurt/DE<br />

www.sonoraproject.eu<br />

Trans-Port & Energy Seminar 2010<br />

17 June 2010, PL/Gdańsk<br />

www.actiaconferences.com<br />

SuperGreen Workshop<br />

28 June 2010, FI/Helsinki<br />

www.supergreenproject.eu<br />

Weighing Containers<br />

29 June 2010, UK/ London<br />

www.dunelmpr.co.uk<br />

European Shortsea Congress<br />

29-30 June 2010, IE/Dublin<br />

www.shortseacongress.com<br />

BTJ 4/2010 (July-Aug edition)<br />

Issue distributed at:<br />

Annual <strong>Baltic</strong> Ports<br />

Conference 2010<br />

9-10 September, EE/Tallinn<br />

www.bpoports.com<br />

Coastlink’s Annual Conference<br />

2010<br />

14-15 September 2010, BE/Antwerp<br />

www.coastlink.co.uk<br />

InnoTrans 2010<br />

21-24 September, DE/Berlin<br />

www.innotrans.com<br />

Airports Conference 2010<br />

29-30 September 2010, PL/Warsaw<br />

www.actiaconferences.com<br />

6 | <strong>Baltic</strong> <strong>Transport</strong> <strong>Journal</strong> | 3/2010<br />

Special Report on: Chinese cargo flows<br />

Focus on: Short sea shipping on the <strong>Baltic</strong><br />

The 12 th <strong>Baltic</strong> Development Forum Summit 2010 will be held in Vilnius under the title European<br />

Challenges – Regional Solutions, An Agenda for Jobs, Investments and Sustainable Growth. The<br />

Summit is held in association with the government of Lithuania and the <strong>Baltic</strong> Sea States Summit.<br />

Many high level speakers are expected. Decision-makers representing business, politics, academia<br />

and media in the <strong>Baltic</strong> Sea Region are invited to attend.<br />

The European Supply Chain and Logistics Summit (SCL Europe 2010) will reveal how you can adapt<br />

your supply chain to meet the requirements of the economic rebound and drive renewed growth.<br />

Topics include: transforming your supply chain infrastructure to maximise customer service and drive<br />

down costs, minimising volatility with a demand-driven supply chain, and driving social values to<br />

deliver business value.<br />

Posidonia International Exhibition first took place in 1969 and has been organized every two years<br />

ever since. Last year’s Posidonia had over 1,700 exhibiting companies and was attended by more<br />

than 17,000 visitors from 86 countries. A must-see event for everyone involved in any branch of<br />

activity related to shipping.<br />

This year’s conference, held in Valencia under the theme “New Decade, New World”, will focus on<br />

understanding the pattern of recovery, the new economic, financial and regulatory climate, and<br />

how these and other significant factors will impact the business of container shipping, ports and<br />

terminals in the post-crisis world.<br />

Partners of the SoNorA project led by Veneto Region (IT) meet again for the 5 th time to present their<br />

latest progress and achievements and to discuss the next steps of the parntership aiming to help<br />

regions develop South-North accessibility between the Adriatic and <strong>Baltic</strong> Seas.<br />

During the period of economic slowdown, which we are all experiencing these days, the Gdańsk<br />

seminar aims at determining viable forecasts for future energy resources supply, predicted levels of<br />

demand as well as the potential infrastructural needs within the scope of transport, port infrastructure,<br />

storage and handling.<br />

SuperGreen aims to assist the Commission with defining the ‘Green Corridor’ concept and promotes the<br />

development of European freight logistics in an environmentally friendly manner. The workshop covers Key<br />

Performance Indicators, eFreight, selection of the most favourable set of corridors and a discussion among<br />

representatives of key stakeholders.<br />

The conference will address the subject of misdeclared container weights. Most people in the maritime<br />

industry believe that container weights should be verified before loading on board a vessel but there<br />

seems to be no enthusiasm for setting up procedures for weighing containers in ports and terminals. The<br />

conference will also look at the risks involved in carrying containers whose weights are at best imprecise<br />

and at worst simply unknown.<br />

The 3 rd European Shortsea Congress will be held in Dublin Castle. It is the most important gathering for the<br />

Shortsea sector in 2010 and comprises a two-day conference catering for bulk and unitised interests, a preconference<br />

reception, a gala dinner at Trinity College and a tour of the port. Conference sessions include the<br />

identification of future opportunities for various bulk and unitised sectors, insights from a number of highprofile<br />

shortsea customers, adding value to shortsea-sea supply chains, help and hindrance from Brussels<br />

and a range of other hot shortsea topics.<br />

Special Report on: <strong>Baltic</strong> maritime ranking<br />

Focus on: Aviation market<br />

The Annual <strong>Baltic</strong> Ports Conference is the most important event for its members and delegates from<br />

all parts of the industry, offering a platform for networking and face-to-face communication. In 2010<br />

the duties of a co-organizer and the conference host are to be taken over by the Port of Tallinn.<br />

Attention will be directed towards Benelux ports and the various shortsea and feeder activities<br />

that serve them. Serious issues for ports and shortsea operators alike, rail and barge operators and<br />

inland terminal operators will be discussed. Other topics to be discussed include the changing route<br />

patterns taking place in northern Europe, including the growth of Rotterdam as a hub for the <strong>Baltic</strong>,<br />

a trend which has impacted the northern German ports of Hamburg and Bremerhaven.<br />

The event has become established as an international industry showplace focusing on railway<br />

technology, and a platform for buyers and sellers of modern passenger and cargo freight solutions.<br />

A full range of rail vehicles is presented on the Messe Berlin tracks located outside the exhibition<br />

halls. The conference also features displays on Railway Infrastructure, Interiors, Public <strong>Transport</strong> and<br />

Tunnel Construction as well as an associated InnoTrans Convention including a special Dialogue<br />

Forum.<br />

This is the 6 th edition of this well-known international aviation conference for various air transport<br />

businesses in the CEE market. Delegates from various European countries will deal with the challenges<br />

of passenger/cargo traffic in the region’s airports. The most important representatives of the aviation<br />

market are involved in organizing the conference. The high level of the conference and its nice<br />

atmosphere offer a unique opportunity to share experiences, discuss and exchange opinions as well<br />

as get to know each other.

BTJ 5/2010 (Sept-Oct edition)<br />

Issue distributed at:<br />

Port Finance International<br />

London<br />

19-20 October 2010, UK/London<br />

www.portfinanceinternational.com<br />

TLS Congress 2010<br />

17-18 November 2010, PL/Warsaw<br />

www.tls-congress.com<br />

<strong>Baltic</strong> Ro-Ro & Ferry<br />

Conference 2010<br />

tba, tba<br />

www.actiaconferences.com<br />

BTJ 6/2010 (Nov-Dec edition)<br />

Issue distributed at:<br />

Intermodal Europe 2010<br />

Expo & Conf.<br />

30 Nov-2 Dec 2010, NL/Amsterdam<br />

www.intermodal-events.com<br />

AirFreight 2010<br />

1-2 December, PL/Warsaw<br />

www.actiaconferences.com<br />

Dates and places of the events are subject to be changed by the organizing parties.<br />

BTJ calendar of partnership events 2010<br />

Special Report on: Breakbulk, project & heavylifts<br />

Focus on: <strong>Baltic</strong> Shipyards<br />

The second annual edition of Port Finance International London will once again bring together<br />

leading experts and senior executives involved in the development and financing of the world’s<br />

ports, who will be provided with an opportunity to discuss the many challenges and opportunities<br />

of this dynamic market. This year the regional emphasis will be on port activities in the Middle East<br />

and Brazil as well as looking at their role in the ever-changing global market.<br />

The TLS Congress for Central and Eastern Europe, this time held in Warsaw, is once again inviting you<br />

to network with Europe’s leading companies as well as to discuss the latest strategies, initiatives and<br />

developments with regard to transportation, logistics and supply chain in the EU.<br />

The 5 th edition of the event concentrating on ro-ro, ro-pax and con-ro traffic on the <strong>Baltic</strong> Sea, giving<br />

a thorough insight into shipping, port and hinterland matters as well as current trends in vessels<br />

technology and the sector’s role in the regional logistics network.<br />

Special Report on: Modern logistics<br />

Focus on: CEE Railways<br />

After a one-year break, Intermodal, the world’s leading container event, will be back in 2010 at a<br />

familiar venue, the Amsterdam RAI. Showcasing all elements of the container and intermodal<br />

industries, the conference represents a nice opportunity to network and source new technologies<br />

and services for the improvement of your business operations.<br />

A conference wholly dedicated to the problems of today’s air cargo development and its future<br />

prospects and threats, with special focus on the Polish and Central European markets. The event’s<br />

agenda will include a discussion on cargo airports in the region, cargo safety and protection, the<br />

current state of air forwarding markets as well as a debate and analysis of specific policy measures.<br />

3/2010 | <strong>Baltic</strong> <strong>Transport</strong> <strong>Journal</strong> | 7

What’s new?<br />

Maritime<br />

In the Szczecin Seaport, a sulphuric acid<br />

terminal is going to be built. In April a<br />

conditional lease contract was signed between<br />

the Seaports Authority and KGHM<br />

METRACO. The contract provides for a<br />

lease of 10,000 m 2 at Katowicki Peninsula<br />

in the port to establish a sulphuric acid<br />

storage and handling facility. Plans include<br />

building 3 tanks linked through pipelines<br />

with the shore and a vessel loading post.<br />

As requested by the investor, the Seaports<br />

Authority will modernise the berthing facility<br />

along the Katowickie Berth, extend<br />

the railway track to the site border, provide<br />

utilities and build a transformer station.<br />

The investment cost to be borne by the<br />

Seaports Authority is about EUR 1.8 mln.<br />

The Port of Kiel is back on track with a total<br />

of 1.27 mln tons of cargo handled in the<br />

first three months of this year – an increase<br />

of 13% over the same period of 2009. Kiel<br />

was also able to more than double its container<br />

handling. In the first quarter 5,040<br />

containers were dealt with, compared to<br />

2,342 in the corresponding period of last<br />

year. Bulk cargo handling also showed<br />

positive development in the first quarter.<br />

Increases in building materials imports, oil<br />

products and coal contributed in particular<br />

to an 18.13% increase over the same period<br />

of 2009.<br />

Scandlines Group further extends its ropax<br />

services to the <strong>Baltic</strong> states. As of April<br />

the company offers its customers an additional<br />

service from Travemünde to Liepāja.<br />

Scandlines will also continue between<br />

Travemünde and Ventspils thereby offering<br />

a high frequency product from the<br />

German port while providing greater coverage<br />

and alternatives in the <strong>Baltic</strong>.<br />

Oil trader Gunvor has postponed the<br />

launch of Russia’s largest oil product outlet<br />

in the <strong>Baltic</strong> Port of Ust-Luga from May<br />

to autumn. Construction of all the main<br />

terminal facilities, except for the border<br />

checkpoint and electrical substation, have<br />

been completed.<br />

The Port of Klaipėda outperformed the<br />

ports of Riga and Ventspils again – cargo<br />

handling results at Klaipėda port for the<br />

first quarter of this year were higher than<br />

those of Riga and Tallinn in terms of the<br />

share in total turnover of all ports. In the<br />

first quarter of 2010, the growth in cargo<br />

turnover at Klaipėda amounted to 15.9%.<br />

8 | <strong>Baltic</strong> <strong>Transport</strong> <strong>Journal</strong> | 3/2010<br />

The clean queen of the seas<br />

Photo: WWL<br />

It is the ship of the future – powered by the<br />

sun, wind and waves. The futuristic vessel has no<br />

conventional engines, uses no fossil fuels and releases<br />

no harmful emissions into the atmosphere<br />

or pollution into the sea. The E/S Orcelle, a concept<br />

ro-ro cargo ship designed by the Scandinavian<br />

shipping company, Wallenius Wilhelmsen<br />

Logistics (WWL), represents a new vision of<br />

the future of ocean transport by harnessing the<br />

power of the sun, wind and water and no emissions<br />

into the environment. The ship’s design<br />

incorporates a cargo deck area equivalent to 14<br />

football fields. It has the capacity to carry up to<br />

Maersk’s efforts are paying off<br />

Photo: Maersk<br />

Revenue for the period increased by<br />

20%, primarily as a result of higher oil prices<br />

and increasing freight rates and volumes in<br />

container activities. The result for the period<br />

was a profit of USD 639 mln, compared<br />

to a loss of USD 373 mln in the same period<br />

of 2009. During the first three months<br />

of 2010, the container shipping market was<br />

positively affected by higher volumes and<br />

better rates compared to the same period of<br />

2009. The growth in activity was partly related<br />

to general restocking in the USA and<br />

Europe. Considerable rate increases and reasonable<br />

volume coverage were achieved in<br />

10,000 cars in emission-free conditions across<br />

the world’s oceans. Three giant rigid sails covered<br />

in solar panels and 12 dolphin-like fins on the<br />

ship’s pentamaran hull will help drive it along at a<br />

cruising speed of 15 knots.<br />

According to Melanie Moore, WWL Global<br />

Head of Environment, “E/S Orcelle represents<br />

one of our visions of an environmental<br />

sustainable future for logistics. We are working<br />

hard to minimise our environmental footprint<br />

by working closely with our customers to reduce<br />

their carbon risk in the supply chain while<br />

creating real economic and brand value.” �<br />

connection with the contract negotiations<br />

on the Transpacific routes. The Group also<br />

achieved higher coverage of fluctuations<br />

in fuel prices by means of surcharges. Global<br />

cargo volumes for 2010 are expected to<br />

rise by minimum 5%, driven mainly by the<br />

strong development in demand in the first<br />

quarter. A 6-9% addition of tonnage is expected<br />

for the global container fleet. Volumes<br />

on the head haul routes between Asia<br />

and Europe increased by 16% in the first<br />

three months of 2010 compared to the same<br />

period of 2009, while volumes on the lowerpaying<br />

back haul routes increased by 15%. �

Stena Line launches the world’s largest<br />

superferries<br />

Photo: Stena Line<br />

The two largest superferries in the world<br />

will sail the North Sea between Harwich and<br />

Hook of Holland this year, following their<br />

launch by Stena Line this spring and autumn.<br />

Stena Line’s largest ever investment of<br />

over EUR 434.2 mln has been spent on building<br />

the two new vessels, with the Stena Hollandica<br />

launched in May 2010 and the Stena<br />

Britannica following in autumn 2010. They<br />

are the largest ferries of<br />

their type in the world in<br />

terms of combined passenger<br />

and freight capacity.<br />

Each will be capable<br />

of transporting 230 cars<br />

and 300 freight vehicles.<br />

The 538 cabins, finished<br />

in a light and fresh style,<br />

will be equipped with<br />

Dux beds and will have<br />

a modern en suite bathroom<br />

with Hansgrohe<br />

fittings. Eco-friendly<br />

features on the new superferries<br />

include catalytic converters, an<br />

improved hull design, highly efficient engines<br />

and better combustion rates, all helping<br />

to reduce environmental impact. The<br />

ferries have facilities to recycle glass, cardboard<br />

and food waste onboard, while solar<br />

film on all windows will exclude up to 82%<br />

of the sun’s radiant heat, reducing the energy<br />

used by the onboard cooling system. �<br />

Maritime<br />

What’s new?<br />

Nordic Ferry Services, Danish shipping<br />

company, is to be known as FÆR-<br />

GEN (“the ferry”) from 1 October 2010.<br />

The shipping company is also introducing<br />

a new design. By 2012 all the ships<br />

serving inner-Danish ferry connections<br />

are to have a new livery and a new logo.<br />

With the Danish name FÆRGEN, Nordic<br />

Ferry Services is also signalling a change<br />

of strategy. In the future the company<br />

will concentrate solely on operating its<br />

inner-Danish routes.<br />

Agreement has now been reached between<br />

the Norwegian and the Russian<br />

negotiating delegations on the bilateral<br />

maritime delimitation in the Barents<br />

Sea and the Arctic Ocean. The issue of<br />

maritime delimitation between Norway<br />

and the Russian Federation has been the<br />

object of extensive negotiations over the<br />

last 40 years. The recommended solution<br />

involves a maritime delimitation line<br />

that divides the overall disputed area of<br />

about 175,000 km 2 in two parts of approximately<br />

the same size.<br />

3/2010 | <strong>Baltic</strong> <strong>Transport</strong> <strong>Journal</strong> | 9

What’s new?<br />

Logistics<br />

DB Schenker has significantly increased<br />

the storage and handling capacity at its<br />

Lvovsky site, south of Moscow. The new logistics<br />

project, which the boost is connected<br />

with, comprises approximately 25,000 m 2 of<br />

warehousing capacity for contract logistics<br />

services and a cross-docking terminal with<br />

an area of 6,000 m 2 have now been extended<br />

with the addition of a new facility.<br />

In the logistics centre, which covers an area<br />

of around 5,400 m 2 , a packaging facility for<br />

parquet boards has been installed.<br />

Kuehne + Nagel has established a new<br />

office in northwestern Russia, in order to<br />

participate in important development<br />

projects of the oil and gas industry. The<br />

new office in Murmansk, at the Kola Gulf of<br />

the Barents Sea, will be important for the<br />

coming launch of the Shtokman gas condensate<br />

field exploration project, as well as<br />

serve the oil and gas-related industries in<br />

general. The location is well connected to<br />

all Russian regions and to Norway and Finland<br />

via St. Petersburg and Moscow.<br />

<strong>Baltic</strong> Oil Terminals has announced that<br />

it has entered into a non-binding memorandum<br />

of understanding with Alpcot<br />

Agro AB and its investment adviser Alpcot<br />

Capital Management to expand its<br />

operations at the Port of Baltiysk in Kaliningrad.<br />

Under the memorandum, Alpcot<br />

Capital will be responsible for securing<br />

the necessary financing to build the<br />

terminal, which will be located adjacent<br />

to <strong>Baltic</strong>’s existing Rosbunker terminal.<br />

Alpcot Capital will also seek additional<br />

partners to develop the terminal. <strong>Baltic</strong><br />

will provide its operational expertise, advice<br />

and support on all logistical aspects<br />

of the terminal’s development and will<br />

assume its day to day operation.<br />

FESCO <strong>Transport</strong>ation Group and Mitsui<br />

& Co. have announced signing an<br />

agreement to form a strategic business alliance,<br />

envisaging the establishment of a<br />

joint company focused on providing a full<br />

range of warehousing and distribution<br />

services in the domain of imports and distribution<br />

of Japanese products manufactured<br />

in Russia. The newly created company<br />

will be based in Moscow and engages<br />

in the complete spectrum of warehousing<br />

and logistics services to support the supply<br />

chain of leading Japanese manufacturers<br />

across the Russian territory.<br />

10 | <strong>Baltic</strong> <strong>Transport</strong> <strong>Journal</strong> | 3/2010<br />

Rhenus to construct bonded warehouse in<br />

the Smolensk region<br />

Photo: Rhenus Group<br />

Rhenus AG & Co. KG has signed a<br />

declaration of intent to complete the “Establishment<br />

of a Bonded Warehouse for<br />

Temporary Storage” investment project together<br />

with the governor of the Smolensk<br />

region on behalf of OOO Revival Express,<br />

a Russian subsidiary of the Rhenus Group.<br />

The idea of moving the customs offices to<br />

the border regions is designed to simplify<br />

customs clearance to the maximum degree.<br />

At the same time, overland transportation<br />

routes will be changed in order to relieve<br />

the major cities of traffic. Revival Express<br />

was one of the first logistics companies to<br />

follow suit and establish new branches to reflect<br />

the realignment of the Russian customs<br />

policy, which took place in the summer of<br />

2009. The company is now organizing regular<br />

customs clearance procedures near the<br />

borders. A start has also been made on test<br />

procedures in Smolensk, whereby customers<br />

can make remote declarations on the<br />

Damco joins Dash7 Alliance<br />

The DASH7 Alliance, a coalition of organizations<br />

promoting a standard for wireless<br />

sensor networks, has announced that Damco,<br />

the combined brand of A.P. Møller-Maersk<br />

logistics activities, has joined the Alliance. As<br />

a member of the DASH7 Alliance, the company<br />

will work with more than 40 companies<br />

around the world to advance development of<br />

the ISO 18000-7 (DASH7) standard. DASH7<br />

is a wireless sensor networking technology<br />

that evolved from radio-frequency identification<br />

and sensing technologies used in the<br />

defense industry. Because of its long range,<br />

ten-year battery life and its ability to penetrate<br />

water, concrete and other materials<br />

that can block other Radio Frequency (RF)<br />

signals, DASH7 is used extensively today by<br />

Internet without being physically present.<br />

Rhenus has already secured the land for its<br />

first bonded warehouse by means of a preliminary<br />

agreement. Construction work is<br />

due to start in the second half of this year<br />

after getting approval by the Federal Customs<br />

Service of the Russian Federation.<br />

The first stage involves building of a bonded<br />

warehouse for temporary storage. After<br />

this, there are plans to expand the logistics<br />

complex to an area measuring 30,000 m 2 ,<br />

25,000 m 2 of which will be used as a transfer<br />

warehouse. Rhenus is planning to handle<br />

all the normal commercial goods at its<br />

own facilities during the first half of 2011<br />

and will later provide intermediate storage<br />

for all types of items except hazardous<br />

goods. The bonded warehouse will match<br />

European standards and will, for instance,<br />

have its own access control system and<br />

video monitoring. The centre will also provide<br />

all kinds of customs services and space<br />

for groupage freight to be transshipped. �<br />

Photo: Rhenus Group<br />

the military for tracking ocean cargo shipments.<br />

To meet the needs of the commercial<br />

shipping and supply chain industries, the<br />

DASH7 Alliance recently formed the Container<br />

Sensing and Security Initiative (CSSI),<br />

to define the next generation of cargo container<br />

tracking and monitoring devices. The<br />

DASH7 Alliance was formed in 2009, the<br />

Alliance now has more than 40 participants.<br />

Manufacturers, systems integrators, developers,<br />

regulators, academia, and end-users<br />

all work together to promote the use of<br />

DASH7 technology in a wide array of industries<br />

and applications. Damco is a provider<br />

of freight forwarding<br />

and supply chain management<br />

services. �

DSB tests fixed coupled IC4 train sets<br />

Photo: DSB<br />

Danish national railway carrier, DSB, has<br />

carried out trial runs between Vojens and Tinglev<br />

with two fixed coupled IC4 train sets and<br />

expects that they will be approved for service<br />

with customers during Q3. At the end of 2009,<br />

AnsaldoBreda and DSB entered into a supple-<br />

ment agreement regarding upgrading of the<br />

train computer which will make it possible<br />

to couple up to five IC4 train sets. DSB now<br />

has 17 IC4 trains in Denmark, 14 individually<br />

built train sets in the preliminary version<br />

called NT++, which are used in its daily service,<br />

and three type approved train sets in the<br />

final version called MPTO. DSB has seen a significant<br />

fall in the number of technical faults<br />

in the present serial produced type approved<br />

train sets. The latest serial produced train<br />

set, which AnsaldoBreda sent from Italy, had<br />

183 faults compared with up to 1,800 faults<br />

in the first individually built. The three type<br />

approved IC4 trains are mainly used for trial<br />

runs needed for obtaining approval to operate<br />

with passengers in coupled train sets. Ansaldo-<br />

Breda is to deliver a total of 83 IC4 and 23 IC2<br />

train sets to DSB before the end of Q3, 2012. �<br />

Intermodal shuttles between Germany and<br />

Sweden<br />

Photo: Green Cargo<br />

Green Cargo has started its own intermodal<br />

shuttles in Europe, which gives freight carriers<br />

and hauliers new opportunities to save time,<br />

money and the environment. The new shuttles<br />

with trailers and containers run six nights a week<br />

on the routes Hannover – Malmö and Krefeld<br />

– Malmö. More and more carriers want to trans-<br />

port trailers and containers for long distances by<br />

train. Preconditions for the trains to be a viable<br />

option are short lead-times, high punctuality and<br />

appropriate wagons. Train companies must also<br />

have access to good terminals where the trailers<br />

and containers can be lifted on and off trains.<br />

To ensure quality and punctuality, the shuttles<br />

are run as direct trains without any locomotive<br />

changes. Before Green Cargo only ran an intermodal<br />

shuttle on the route Olofström-Malmö-<br />

Gent. The increase of two new shuttles is part of<br />

Green Cargo’s strategy for the future where the establishing<br />

of so-called Green Corridors are in line<br />

with both Sweden’s and the EU’s ambitions for the<br />

transport sector. The intermodal shuttles are filled<br />

with truck trailers, swap bodies and containers.<br />

The efficiency and environmental performance<br />

of trains along with the flexibility of trucks is<br />

the reason behind intermodal traffic growth. �<br />

Overland<br />

What’s new?<br />

Latvijas dzelzceļš (Latvian Railways) have<br />

launched a feasibility study on the electrification<br />

of Latvian railway lines. Within the<br />

study’s framework it is planned to assess<br />

economic justification of Latvian railway<br />

system’s electrification – costs and potential<br />

economic benefits. It will also be determined<br />

on which lines this process should be<br />

implemented and what technical solutions<br />

should be included – either to develop the<br />

existing 3.3 kV DC system or to convert systems<br />

according to the most progressive 25<br />

kV AC, which is widely used in Europe.<br />

Russian Railways (RzD) has invested approx.<br />

RUB 60 bln in development during the first<br />

four months of 2010. Of this amount, RzD has<br />

spent RUB 9.2 bln on purchasing and upgrading<br />

locomotives and RUB 3.2 bln on purchasing<br />

and upgrading motorised railcar rolling<br />

stock. Also being implemented rapidly are<br />

various projects, including the final phase of<br />

the railway infrastructure needed for the highspeed<br />

Sapsan trains between Moscow and<br />

Nizhny Novgorod; renovation of the bridges<br />

over the Obvodny Kanal (Bypass Canal), which<br />

is part of a joint project with St. Petersburg.<br />

The alliance of carmakers Peugeot, Citroën<br />

and Mitsubishi have officially launched<br />

production at its Kaluga region facility,<br />

which has an annual capacity of 125,000<br />

cars. The Peugeot 308s assembled there fit<br />

all the requirements for buyers to use the<br />

RUB 50,000 available from the government<br />

under its car recycling program. The plant<br />

will make mid-sized cars under the Peugeot,<br />

Citroën, and Mitsubishi brands, which<br />

will be sold on the Russian market. Total investment<br />

in the Peugeot Citroën-Mitsubishi<br />

project is about EUR 470 mln. The alliance<br />

plans to produce 25,000 vehicles this year.<br />

3/2010 | <strong>Baltic</strong> <strong>Transport</strong> <strong>Journal</strong> | 11

What’s new?<br />

Aviation<br />

air<strong>Baltic</strong> will independently attract financial<br />

resources to build a new terminal<br />

for handling its own as well as transit<br />

passengers. Implementation of the plan<br />

will not require funding from RIGA International<br />

Airport, state budget allocations<br />

or government guarantees. According<br />

to the plan, the new passenger<br />

terminal with appropriate infrastructure<br />

and a capacity of 5.2 mln passengers is to<br />

be built by 2013. Investments required<br />

for the construction of the terminal are<br />

estimated at approximately EUR 92 mln.<br />

The EBRD has committed to lend EUR<br />

100 mln to finance the building of a<br />

new terminal at St. Petersburg’s Pulkovo<br />

Airport as part of a EUR 716 mln<br />

long-term debt package being put together<br />

by five international financial<br />

institutions and Russia’s Bank for Development<br />

and Foreign Economic Affairs<br />

Vnesheconombank (VEB) to fund<br />

this landmark Public-Private-Partnership<br />

project. Pulkovo’s existing facilities<br />

have reached their capacity limit and<br />

do not allow for further traffic growth.<br />

Once completed, the project aims to<br />

double traffic numbers at Pulkovo. The<br />

new terminal serving both domestic<br />

and international passengers is due to<br />

be finished in 2013.<br />

Passenger turnover at Riga Airport<br />

continues to grow. In the 1st quarter of<br />

2010 there were 914.4 thous. passenger<br />

arrivals and departures from the airport,<br />

an increase of 21% if compared to the<br />

1st quarter of last year. In the 1st quarter<br />

of 2010, 609.3 thous. passengers using<br />

Latvian Airlines saw an increase of<br />

28.3% when compared to the 1 st quarter<br />

of 2009. The largest 1st quarter passenger<br />

turnover at the airport was with German<br />

airports – 122.5 thous. passengers,<br />

followed by Great Britain with 116.8<br />

thous. passengers.<br />

After a two-year break Polish Airways<br />

LOT have resumed flight service from<br />

Warsaw to Tallinn. The trip, lasting<br />

about one hour and forty-five minutes,<br />

will be served by Embraer 145 and 170<br />

aircraft. The connection to Tallinn is<br />

one of many new routes which will extend<br />

the LOT network over the coming<br />

months. They will also include connections<br />

to Bratislava and Kaliningrad.<br />

12 | <strong>Baltic</strong> <strong>Transport</strong> <strong>Journal</strong> | 3/2010<br />

Just one question<br />

Chaos in European airports<br />

What if another volcano erupts?<br />

With the recent flight disruptions, caused by ashes from the Eyjafjallajökull volcano<br />

in Iceland, we have asked industry leaders, what can be done in the future to<br />

minimise passenger inconvenience and airline costs when dealing with potential<br />

natural disasters such as occurred in April.<br />

Erik Sakkov<br />

Member of the Management Board<br />

Tallinn Airport<br />

Decisions of the authorities must be based on actual facts, on a scientific<br />

and measureable basis, not on emotions or fears. To minimise<br />

passenger inconvenience, airlines and airports must have a clear<br />

strategy and action plan to handle force majeure situations in the<br />

future. Volcanoes will not accept our bills, perhaps it makes sense to<br />

create a special fund to cover the costs related to similar disruptions.<br />

Maria Mroue<br />

Communications Director<br />

Finnair Oyj Corporate Communications<br />

A common ground would help everyone to put every effort into solving<br />

the situation. Insurance companies, for example, state that they do not<br />

cover anything in these situations. We at Finnair have all our resources<br />

helping our customers, as it should be. Yet there are demands that airlines<br />

should cover various expenses in addition to refunding tickets.<br />

Andreas Engel<br />

Manager International Public Relations<br />

Germanwings<br />

First of all better coordination between airlines, national governments,<br />

air traffic services and EU authorities. That also means faster decisions to<br />

minimise passenger inconvenience and airline costs. Hopefully not only<br />

the airline industry has learned from underestimating the potential of<br />

such events. We need to look forward, everyone within the EU, in order to<br />

model and price the risks as well as we can to deal with mother nature.<br />

Tom Christides<br />

VP Communications and Public Affairs<br />

Blue1<br />

We’ll have to accept the fact that traffic disruptions on a very large scale,<br />

like in April, always will cause passenger inconvenience to some extent.<br />

Our experience is that on-time and accurate passenger communication,<br />

through all kinds of channels, e.g. mass media, the web, Facebook and<br />

text messaging, is a major factor in relieving passenger inconvenience.<br />

Of course, the passengers involved need to be taken care of, but clear<br />

rules have to apply in a situation like this, it cannot differ from country to<br />

country or airline to airline. And it must not cover only aviation, but the<br />

entire transport sector.

Arijandas Sliupas<br />

General Manager<br />

Kaunas International Airport<br />

Clear guidelines should be set stating that in such situations the<br />

airlines can offer two options to their passengers – changing the<br />

flight dates under the same conditions whenever a seat is available<br />

on the same or an alternative route towards the final destination<br />

operated by the airline or costs of the purchased ticket refunded to<br />

the passenger without any obligations to the airlines to offer the<br />

passenger compensation for food or hotel.<br />

Michael Løve<br />

Chief Operating Officer<br />

Copenhagen Airports A/S<br />

We need a common EU approach to the regulation imposed on airlines<br />

and airports during natural disasters. The difference between<br />

the approach in each country during the current crisis creates insecurity<br />

among passengers and makes it nearly impossible for airlines<br />

and airports to plan operations. This causes chaos and adds cost to<br />

an already pressured industry.<br />

Thorbjørn Ancker<br />

Director of Communications<br />

Civil Aviation Administration – Denmark<br />

Coordinated actions should be made to ensure that regulations regarding<br />

passengers’ rights are applied in a consistent way and that efforts<br />

are being made to ensure that, if one mode of transport cannot<br />

deliver, other transport modes can quickly substitute in the interest<br />

of passengers. Aviation is by nature an international means of transportation<br />

and thus the questions of passenger inconvenience and<br />

airline costs when dealing with potential natural disasters must be<br />

addressed by the global aviation community, such as the European<br />

Union and the International Civil Aviation Organization.<br />

Janis Vanags<br />

Vice President Corporate Communications<br />

air<strong>Baltic</strong><br />

The situation could have been better managed, if there would be a single<br />

mechanism controlling European airspace. It again calls for introduction<br />

of the Single European Sky that would replace the national patchwork of<br />

airspace, and allow for swift and consistent decisions and allow airlines<br />

to take stranded passengers back home much earlier. One more issue<br />

concerns consumer protection authorities, always in the front line when<br />

it comes to criticizing airlines for not living up to EU regulations in connection<br />

with flight irregularities. It is high time for these people to take a<br />

closer look at all the cheaters among the airlines, airlines that simply do<br />

not take care of their stranded passengers, instead of having their attention<br />

steadily focused on airlines that do their job. In that sense we clearly<br />

see that some customer watchdogs sometimes apply double standards,<br />

and this should be remedied immediately so that next time thousands of<br />

passengers are not left behind and forced to sleep on airport benches.<br />

Aviation<br />

What’s new?<br />

JSC Aeroflot Russian Airlines, Russia’s biggest<br />

air carrier, and the first all-Russian mobile<br />

operator JSC MegaFon have agreed to install<br />

MegaFon’s base stations on Aeroflot’s aircraft.<br />

For the first time in Russia, Aeroflot and Mega-<br />

Fon will offer passengers the opportunity to<br />

use mobile phones and the Internet in flight.<br />

Air passengers have chosen Finnair as the<br />

Best Airline in Northern Europe in the 2010<br />

independent Skytrax survey. About 18<br />

mln passengers from some 100 different<br />

countries contributed to the Skytrax research,<br />

which was carried out between July<br />

2009 and April 2010. Skytrax is a recognised<br />

research survey company that evaluates<br />

commercial airlines and their services.<br />

JSC Sheremetyevo International Airport<br />

has successfully recruited the consortium of<br />

Credit Suisse-Troika Dialog as its investment<br />

consultant to complete work relating<br />

to consolidation of the airport’s property. Realization<br />

of this project will expedite the process<br />

of transforming Sheremetyevo International<br />

Airport into a major international hub.<br />

Wizz Air has become the largest airline in<br />

Poland. Wizz Air will continue to grow at a<br />

20% rate in 2010, however, the outlook has<br />

been reduced by 400 thous. to a more cautious<br />

target of 4.3 mln passengers in Poland<br />

this year. In 2009 the airline carried 7.8 mln<br />

passengers, 30% more than in 2008.<br />

The delivery of Lufthansa’s first Airbus A380<br />

marks the dawn of a new era in flying for the<br />

airline’s passengers. Lufthansa has configured<br />

its Airbus A380 with 526 seats. Numerous airports<br />

worldwide are currently upgrading their<br />

facilities in preparation for the A380’s arrival.<br />

At Frankfurt Airport, where the Lufthansa<br />

A380 fleet will be based, facilities are already in<br />

place for passengers to board and disembark<br />

from the aircraft on two levels.<br />

Phase 1 of Helsinki Airport’s redevelopment<br />

was completed in May. Spacious and bright<br />

new passenger areas in Terminal 2 have increased<br />

check-in and baggage handling capacity.<br />

Renovations began in August, 2009,<br />

with the objective of connecting the existing<br />

baggage conveyor systems to the state-ofthe-art<br />

baggage handling centre in the new<br />

extension. Thanks to the extra space and<br />

modern technology, Helsinki Airport can now<br />

process 13.5 mln bags in one year, which is<br />

43% more than the current facilities allowed.<br />

3/2010 | <strong>Baltic</strong> <strong>Transport</strong> <strong>Journal</strong> | 13

Maritime<br />

Perspectives for the <strong>Baltic</strong> region<br />

<strong>Transport</strong>ing oil – a growing opportunity<br />

Photo: Stena Bulk<br />

In the last ten years, Russia’s economic growth<br />

has mainly resulted from the increased export<br />

of energy fuels. Since the end of its economic<br />

crisis in 1998, there has been an increase in production<br />

and export due to higher prices of oil,<br />

privatisation of oil companies and investments.<br />

Nowadays, the Russian economy is still dependent<br />

upon the export of oil and gas.<br />

According to World Bank data, export of oil and gas<br />

amounts to more than 70% of the overall export revenues<br />

in Russia. In March 2010, Russian companies produced<br />

42.81 mln tonnes of oil, which is an all-time record of<br />

10.12 barrels per day and makes Russia the world leader<br />

in oil extraction. The previous record was set in December,<br />

the new one is 0.4% higher. Russia is now the only country in the<br />

world that extracts more than 10 mln barrels per day: at the end of 2009,<br />

its oil production level exceeded the one from the previous world leader<br />

in oil production – Saudi Arabia.<br />

In 2009, oil production in Russia went up 1% and amounted to 494.2<br />

mln tonnes. It is the highest number since the collapse of the Soviet Union,<br />

being mainly the result of OPEC’s decision to decrease extraction in<br />

order to stop the drop in prices. Despite OPEC’s request for similar action,<br />

Russia adopted a totally different approach. The Russian extraction<br />

was increased in order to make up for the drop in prices and increase<br />

revenues, by selling cheaper oil in the Urals.<br />

The record production results also from exploiting new reserves.<br />

Nevertheless, the growth in production will probably not continue for<br />

much longer, since the extraction in old, highly exploited reserves is decreasing<br />

and requires investments. This applies particularly to the fields<br />

in western Siberia, supplying Western and Central Europe.<br />

14 | <strong>Baltic</strong> <strong>Transport</strong> <strong>Journal</strong> | 3/2010<br />

Oil supporting investments<br />

In recent years, there has been a strong, unabashed impact of the<br />

Kremlin to develop the energy fuels sector. Oil prices, increasing since<br />

2002, have fostered the implementation of expensive projects on transmission<br />

and export. It is most clearly evident in the development of sea<br />

transshipment terminals and transmission pipelines.<br />

The Port of Primorsk, currently transshipping 75 mln tonnes of oil<br />

per annum, is constantly developing, and may soon increase its transshipment<br />

to 120 mln tonnes. The terminal has 4 transshipment piers<br />

and can handle ships with a capacity of 150,000 tonnes.<br />

An oil terminal in Ust-Luga and an oil pipeline, designed to deliver crude<br />

oil from the Druzhba system to the new Russian port, are currently under<br />

construction. Ust-Luga is to start transshipping in 2012 and its capacity in the<br />

first stage will be 30 mln tonnes per annum with the view to increasing it to 38<br />

mln tonnes per annum. It will handle ships with a capacity of 100,000 tonnes.<br />

An oil depot will also be built near the marine transshipment terminal. Completing<br />

this investment will give Russians a sea alternative to the existing pipeline<br />

transport in supplying Poland and Germany.<br />

Most of the oil exported from the reserves in western Siberia is transported<br />

through the system of pipelines belonging in Russia to Transneft. In<br />

previous years, oil was exported mainly through the Druzhba pipeline, the<br />

Black Sea and the <strong>Baltic</strong> Sea, with the use of ports in Latvia and Lithuania, and<br />

through Naftoport in Gdańsk linked to the Druzhba system of pipelines.<br />

The importance of railways<br />

Railways play an important part in the balance of trade. They supply ports<br />

and refineries not connected to the pipeline system as well as those without<br />

pipeline supply, like Ventspils in Latvia and Butinge in Lithuania. Lithuanian<br />

Butinge is used as an import oil terminal by the ORLEN Lietuva refinery in<br />

Mažeikių, Lithuania. Cutting off the supply through the pipeline resulted in<br />

ORLEN Lietuva receiving oil both by sea through its terminal in Butinge and

y rail. Ports with good standing are Estonian Tallinn, with the transit of Russian<br />

oil and oil products delivered by rail, and Lithuanian Klaipėda, where<br />

over 30% of transshipment is of petroleum origin.<br />

The ESPO pipeline, providing Russia with direct access to the Far<br />

Eastern market, is another crucial Russian infrastructure investment. It<br />

has been designed to diversify export of Russian oil and allow Russia to<br />

enter Asian and Pacific markets, where oil demand is constantly growing.<br />

ESPO allows Russia to choose the direction of export, providing independence<br />

and economic safety for the country, whose income depends on<br />

profits from oil and gas export. Russia is an active player in the European<br />

oil market, but used to have little to say in the Asia-Pacific region. ESPO<br />

should solve this problem. In the future, internationally distributed Russian<br />

oil is most likely going to be related mainly to ESPO.<br />

Connected with ESPO by railway, the oil terminal in Kozmino, Nakhodka<br />

located by the Pacific Ocean, is designed to annually handle<br />

around 500 tanker ships with a capacity from 80,000 to 150,000 tonnes<br />

each. It also has a branch going to China. Its construction began in May<br />

2009 and is to be finished this year.<br />

The growing acceptance of ESPO, which is now transporting nearly<br />

600,000 barrels per day, is a clear sign that the Russian strategy to increase<br />

its share in sales to Asian importers at the expense of Middle East<br />

suppliers, is a success.<br />

The <strong>Baltic</strong>’s role<br />

The <strong>Baltic</strong> Sea is one of the smallest seas in the world. It is difficult<br />

to navigate and its waters are filtered very slowly through the Danish<br />

Straits. Still, traffic in the <strong>Baltic</strong> Sea is one of the busiest in the world.<br />

Around 500-700 mln tonnes of various cargo is being transported<br />

through the sea each year. At every time of day and night, there are<br />

around 2,000 ships in our sea. The Danish Straits are, of course, the busiest.<br />

There are around 40 fuel terminals in the <strong>Baltic</strong> area.<br />

Crucial for today’s Russian oil transport, the <strong>Baltic</strong> ports transshipped<br />

around ¼ of the overall Russian oil export and a great deal of<br />

oil products to international markets.<br />

The amount of cargo is to double by 2017. In recent years, fuel transport<br />

tends to dominate in the general balance. Since 1995, oil transportation has<br />

doubled. In 2000 alone, around 80 mln tonnes of oil was transported, and<br />

by 2015 the number should increase to 150 mln tonnes. The main reason<br />

for such growth is the construction of new fuel terminals in Russia.<br />

During the first two months of 2010, Russian Primorsk transshipped<br />

as much cargo as last year, whereas Latvian Ventspils and Lithuanian<br />

Klaipėda recorded substantial slides.<br />

Changes in directions of oil transport according to Russia’s needs are to be<br />

expected, since Russia announced to take full control over oil export, together<br />

with oil transported by rail. This may painfully affect railway-supplied terminals,<br />

but cargo will still be reaching the seaways through Russian terminals.<br />

The relatively good situation of the <strong>Baltic</strong> ports may change due to<br />

Russia’s aspiration to direct its oil and oil products export to Russian<br />

ports only. Russia is implementing its strategy to become independent<br />

from the transit countries.<br />

The search for new markets and buyers is the second essential component<br />

of the new strategy.<br />

What will the future bring?<br />

In Europe, consumption of fuel in passenger cars is clearly decreasing,<br />

especially when the number of cars remains rather constant, which is<br />

mainly the result of increased education and ecological awareness of European<br />

citizens. The European demand for fuel will quite possibly never<br />

go back to its levels from previous years and the overproduction of European<br />

refineries will need to find buyers in remote locations. This means<br />

Maritime<br />

that the traffic of oil and oil products will not decrease in the <strong>Baltic</strong> area.<br />

A larger stream of oil is most likely be directed towards China and<br />

India, with their booming automobile markets and drastically growing<br />

fuel requirement.<br />

It may even increase traffic in the <strong>Baltic</strong> region if local refineries<br />

keep their oil production at the current level. All predictable factors<br />

point to the fact that the <strong>Baltic</strong> Sea will not cease to be a bustling seaway<br />

of oil and oil products transport.<br />

According to the International Energy Agency, this year’s oil demand will<br />

be the highest in history, amounting to 86.6 mln barrels per day. The increased<br />

demand will be met by oil generated outside OPEC, mainly in Russia.<br />

Numbers speak for themselves<br />

Over 110 mln tonnes of liquid bulk cargo was transshipped in the<br />

<strong>Baltic</strong> ports in 2007. The number is to reach 137 mln tonnes in 2015 and<br />

increase even more to 165 mln tonnes in 2030. As was previously mentioned,<br />

one of the main assumptions of the Russian transport strategy is<br />

to increase the share of its ports from 75% to 95%, to which end Russia<br />

is building new ports and upgrading its existing ones. Russia supports<br />

the strategy with its tariff policy and subsidizing transport by own ports,<br />

which encourages Russian exporters.<br />

The share of transport costs in total production costs in Russia is<br />

relatively high and equals up to 20% of the end value, which is three<br />

times as much as in countries with developed markets. The underdeveloped<br />

transport system is one of the reasons for such high costs. It is no<br />

wonder that Russia tries to make up for the backlogs and is developing<br />

its port and transmission infrastructure. If it is profitable, why not take<br />

over the transshipment and transmission of oil?<br />

The pipeline infrastructure would ensure a long-term co-dependency<br />

of suppliers and buyers, provide continuing economic cooperation, as well<br />

as almost irreversibly change the geopolitical system of the region. The development<br />

of marine oil transshipment terminals connected with the pipeline<br />

system would in turn enable flexible cooperation in the oil market and<br />

Picture 1. The <strong>Baltic</strong> countries and main oil ports – source: EIA.<br />

3/2010 | <strong>Baltic</strong> <strong>Transport</strong> <strong>Journal</strong> | 15

Maritime<br />

provide freedom of contracts. Such freedom, however, does not come without<br />

a price. The cost of pipeline transport is still lower than sea transport.<br />

Time will show if the trend continues.<br />

Making use of sea transport and expanding port infrastructure provides<br />

flexibility in acquiring oil and diversifying both buyers and suppliers.<br />

The market is being changed by infrastructure, which is an opportunity for<br />

the <strong>Baltic</strong> ports and oil terminals. When planning for development, issues<br />

of sustainable development should be taken into consideration, particularly<br />

the ecological danger connected with increasing traffic in the <strong>Baltic</strong> Sea. It<br />

concerns shipping, transshipping, the fleet condition, safety regulations, as<br />

well as organising emergency action services for ships and providing shelter<br />

for ships posing a direct threat to the <strong>Baltic</strong> Sea environment.<br />

CEE’s reaction<br />

The development of Russian oil transport by sea will drastically<br />

change the market situation for CEE countries. The market will have to<br />

become more flexible, partly due to the decreasing difference in prices<br />

of Russian and, for example, Brent oil. The importance of premium on<br />

oil imports from Russia, having repeatedly decreased in recent years, will<br />

further diminish. This new situation does not guarantee “saving” on the<br />

costly pipeline and storage infrastructure – quite the contrary. What is<br />