FORM 1 - Tax Administration Jamaica

FORM 1 - Tax Administration Jamaica

FORM 1 - Tax Administration Jamaica

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

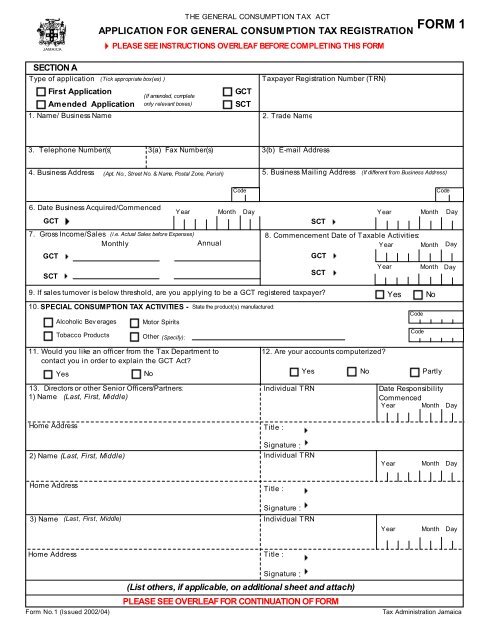

JAMAICATHE GENERAL CONSUMPTION TAX ACTAPPLICATION FOR GENERAL CONSUM PTION TAX REGISTRATIONPLEASE SEE INSTRUCTIONS OVERLEAF BEFORE COMPLETING THIS <strong>FORM</strong><strong>FORM</strong> 1SECTION AType of application (Tick appropriate box(es) )First ApplicationAmended Application1. Name/ Business Name(If amended, completeonly relevant boxes)GCTSCT<strong>Tax</strong>payer Registration Number (TRN)2. Trade Name3. Telephone Number(s)3(a) Fax Number(s)3(b) E-mail Address4. Business Address (Apt. No., Street No. & Name, Postal Zone, Parish) 5. Business Mailing Address (If different from Business Address)Code6. Date Business Acquired/CommencedYear Month DayGCT7. Gross Income/Sales (i.e. Actual Sales before Expenses)MonthlyAnnualGCTSCTCodeYear Month DaySCT8. Commencement Date of <strong>Tax</strong>able Activities:Year Month DayGCTSCTYear Month Day9. If sales turnover is below threshold, are you applying to be a GCT registered taxpayer?10. SPECIAL CONSUMPTION TAX ACTIVITIES - State the product(s) manufactured:Alcoholic Bev eragesTobacco ProductsMotor SpiritsOther (Specify):11. Would you like an officer from the <strong>Tax</strong> Department to12. Are your accounts computerized?contact you in order to explain the GCT Act?Yes No YesNoYesNoCodeCodePartly13. Directors or other Senior Officers/Partners:1) Name (Last, First, Middle)Individual TRN Date ResponsibilityCommencedYear Month DayHome Address Title :Signature :2) Name (Last, First, Middle) Individual TRNYearMonthDayHome AddressTitle :Signature :3) Name(Last, First, Middle)Individual TRNYear Month DayHome AddressTitle :Form No.1 (Issued 2002/04)Signature :(List others, if applicable, on additional sheet and attach)PLEASE SEE OVERLEAF FOR CONTINUATION OF <strong>FORM</strong><strong>Tax</strong> <strong>Administration</strong> <strong>Jamaica</strong>

SECTION B14. GCT <strong>Tax</strong>able Activities:Primary:Secondary:CodeCode15. If you have more than one place of business, state the number of GCT certificates required in boxand attach a list detailing the name and address of eachSECTION C16. I declare that the information given in this form is to the best of my knowledge and belief a true and correct statement.NameSignatureTitle(State whether Proprietor, Partner, Director, Manager,Secretary, Office-holder in Club, Association, etc.)Documentation Process Date InitialReceiv edChecked and CodedFurther Inf o. RequestedApprov ed/Ref usedEnteredGCTFOR OFFICIAL USE ONLYSCTGCTReceiv ingOf f ice:Date:Ty peSCTDateRemarks:Registration Status/ ReasonPeriod LengthBasis CodeEffective DateProcessing Of f icer's NameAgencyCode:(Of f icialStamp)Processing Of f icer's SignatureINSTRUCTIONSPLEASE TYPE OR PRINT THE REQUIRED IN<strong>FORM</strong>ATION. DO NOT USE A PENCIL. USE BLUE OR BLACK INK PEN ONLY. ALLDOLLAR VALUE AMOUNTS SHOULD BE ROUNDED TO THE NEAREST WHOLE NUMBER. ALL SECTIONS MUST BE COMPLETED.TICK ( ) APPROPRIATE BOX WHERE REQUIRED.SECTION A"Tick appropriate box" - (To be completed by All applicants)Indicate the ty pe of application and if applicantion is the f irst or amended/changed. If application is amended/changed, complete ONLYboxes f or which inf ormation is being corrected.BOXES 1 AND 2 - BUSINESS NAME AND TRADE NAMESole Proprietors : enter y our f irst, middle and last name in Box 1 and trade name in Box 2.Partnerships :enter the legal name of the partnership as it appears in the agreement in Box 1 and trade name in Box 2.Companies / Corporations : enter the company 's/ corporation's name as shown in the company 's/ corporation's charter.Trust : enter the name of the trust in Box 1 and the f irst, middle, and last name of the grantor in Box 2.BOX 4 - BUSINESS ADDRESSEnter the address where the taxable activ ity is being carried on.BOX 7 - GROSS INCOME/ SALESEnter gross sales/ income f or the month in which y ou are apply ing f or registration plus the immediate elev en prev ious months.For new businesses, enter projected/ expected gross monthly / annual sales.SECTION BBOX 14 - GCT <strong>Tax</strong>able activ ities:Primary : Enter description of MAIN business activ ity carried on.Secondary : Enter description of any other business activ ity carried on.PLEASE RETURN COMPLETED <strong>FORM</strong> TO THE NEAREST COLLECTORATE (TAX OFFICE)