1. Hymer GB 04-05 Textf. engl.

1. Hymer GB 04-05 Textf. engl.

1. Hymer GB 04-05 Textf. engl.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

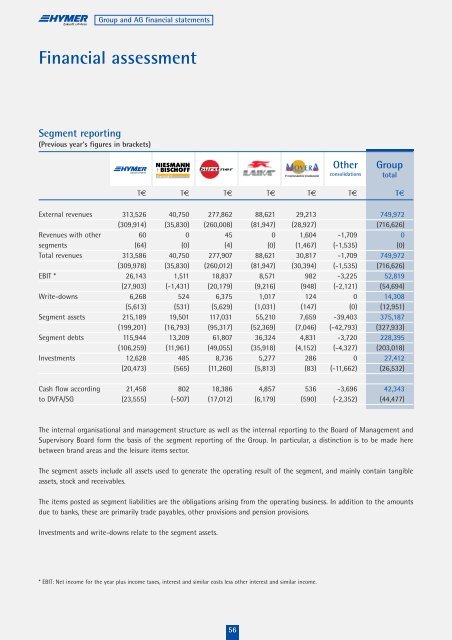

Financial assessment<br />

Segment reporting<br />

(Previous year's figures in brackets)<br />

Group and AG financial statements<br />

T€ T€ T€ T€ T€ T€ T€<br />

56<br />

Other<br />

consolidations<br />

Group<br />

total<br />

External revenues 313,526 40,750 277,862 88,621 29,213 749,972<br />

(309,914) (35,830) (260,008) (81,947) (28,927) (716,626)<br />

Revenues with other 60 0 45 0 1,6<strong>04</strong> -1,709 0<br />

segments (64) (0) (4) (0) (1,467) (-1,535) (0)<br />

Total revenues 313,586 40,750 277,907 88,621 30,817 -1,709 749,972<br />

(309,978) (35,830) (260,012) (81,947) (30,394) (-1,535) (716,626)<br />

EBIT * 26,143 1,511 18,837 8,571 982 -3,225 52,819<br />

(27,903) (-1,431) (20,179) (9,216) (948) (-2,121) (54,694)<br />

Write-downs 6,268 524 6,375 1,017 124 0 14,308<br />

(5,613) (531) (5,629) (1,031) (147) (0) (12,951)<br />

Segment assets 215,189 19,501 117,031 55,210 7,659 -39,403 375,187<br />

(199,201) (16,793) (95,317) (52,369) (7,<strong>04</strong>6) (-42,793) (327,933)<br />

Segment debts 115,944 13,209 61,807 36,324 4,831 -3,720 228,395<br />

(106,259) (11,961) (49,<strong>05</strong>5) (35,918) (4,152) (-4,327) (203,018)<br />

Investments 12,628 485 8,736 5,277 286 0 27,412<br />

(20,473) (565) (11,260) (5,813) (83) (-11,662) (26,532)<br />

Cash flow according 21,458 802 18,386 4,857 536 -3,696 42,343<br />

to DVFA/SG (23,555) (-507) (17,012) (6,179) (590) (-2,352) (44,477)<br />

The internal organisational and management structure as well as the internal reporting to the Board of Management and<br />

Supervisory Board form the basis of the segment reporting of the Group. In particular, a distinction is to be made here<br />

between brand areas and the leisure items sector.<br />

The segment assets include all assets used to generate the operating result of the segment, and mainly contain tangible<br />

assets, stock and receivables.<br />

The items posted as segment liabilities are the obligations arising from the operating business. In addition to the amounts<br />

due to banks, these are primarily trade payables, other provisions and pension provisions.<br />

Investments and write-downs relate to the segment assets.<br />

* EBIT: Net income for the year plus income taxes, interest and similar costs less other interest and similar income.