The Volvo Group Annual Report 2010

The Volvo Group Annual Report 2010

The Volvo Group Annual Report 2010

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Moving<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>...<strong>2010</strong>

A global group1 CEO comment4 Presence on all continents6 <strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s product offering8 Moving the world – New York10 Vision, mission and values11 Overall strategies12 Profitable growth13 Operational Excellence14 Product renewal16 Strength factors17 <strong>Volvo</strong> Financial goals18 World-class services20 Moving the world – London22 Market overviewBoard of Directors’ report24 Significant events26 Organisation28 Trucks32 Buses34 Construction Equipment36 <strong>Volvo</strong> Penta38 <strong>Volvo</strong> Aero40 <strong>Volvo</strong> Financial Services42 Moving the world – Australia44 Sustainable development50 Moving the world – Stockholm52 Financial strategy53 Risks and uncertainties56 <strong>The</strong> share58 Financial performance62 Financial position64 Cash-flow statementFinancial information66 Financial information <strong>2010</strong>67 Consolidated income statement andOther comprehensive income68 Consolidated balance sheet69 Changes in consolidatedShareholders’ equity70 Consolidated cash-flow statement71 Notes to consolidated financialstatements114 Parent Company AB <strong>Volvo</strong>126 Proposed remuneration policy127 Proposed disposition ofunappropriated earnings128 Audit <strong>Report</strong> for AB <strong>Volvo</strong>129 Eleven-year summaryCorporate Governance <strong>Report</strong>138 <strong>Group</strong> Management140 Board of Directors and Auditors142 Corporate Governance <strong>Report</strong>Fold-out Definitions<strong>Annual</strong> General Meeting... theWithout the products and services of the <strong>Volvo</strong> <strong>Group</strong> therecan be no modern society like we know it. Like lifeblood, our trucks, buses,engines, construction equipment and aircraft components are involved in many of thefunctions that most of us rely on every day.For instance, one in seven meals eaten in Europe reaches theconsumers thanks to trucks from the <strong>Volvo</strong> <strong>Group</strong> rolling on the roads of the continent.Buses are the most common type of public transportation in the world,helping many people to reach work, school, vacations, friends and family.And if all the <strong>Volvo</strong> buses in the world were to start at the same time, they would transportmore than 10 million people.Most of us want to be able to fly far away sometime, either at work or to explore a newpart of the world. In 2009, <strong>Volvo</strong> Aero delivered components for over 90% of all largecivilian aircraft engines.Every year, the population on earth produces billions of tons of garbage.In the US alone, the garbage removed by refuse trucks from the <strong>Volvo</strong> <strong>Group</strong> every weekcould form a line of full garbage cans that would reach the moon.<strong>The</strong>se are just a few examples. In this <strong>Annual</strong> <strong>Report</strong>, you can learn more about theimportance of the <strong>Volvo</strong> <strong>Group</strong> in every day life. How we are the lifeblood of modernsociety – Moving the world.This report contains ‘forward-looking statements’. Suchstatements reflect management’s current expectationswith respect to certain future events and potential financialperformance. Although the Company believes that theexpectations reflected in such forward looking statementsare reasonable, no assurance can be given thatsuch expectations will prove correct. Such statements aresubject to risk and uncertainties and such future eventsand financial performance could differ materially fromthose set out in the forward looking statements as a resultof, among other factors, (i) changes in economic, marketand competitive conditions, (ii) success of business andoperating initiatives, (iii) changes in the regulatory environmentand other government actions, (iv) fluctuations inexchange rates and (v) business risk management.This report does not imply that the company has undertakento revise these forward-looking statements, beyondwhat is required under the company’s registration contractwith OMX Nordic Exchange Stockholm if and whencircumstances arise that will lead to changes compared tothe date when these statements were provided.<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>'s formal financial reports are presentedon pages 24–127 in the printed version and hasbeen audited by the company's auditors.

<strong>Volvo</strong> <strong>Group</strong>Mo<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> is one of the world’s leading providers of commercialtransport solutions, providing such products as trucks, buses,construction equipment, engines and drive systems for boats andindustrial applications, as well as aircraft engine components. <strong>The</strong><strong>Volvo</strong> <strong>Group</strong> also offers financial solutions and an increasingshare of other services to its customers.<strong>The</strong> <strong>Group</strong> has about 90,000 employees, production facilitiesin 19 countries, and sales activities in some 180 countries.Net sales development over ten years, SEK bn+18% +43%North AmericaEuropeStrategy<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s strategy is based on customers’ requirementsand is focused on profitable growth, product renewal and operationalexcellence. More information. & 1 12000 <strong>2010</strong>40.7 47.92000 <strong>2010</strong>72.1 103.090.000Employees+458%South AmericaOrganization<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> has product-related business areas that focuson our customers while the supporting business units work tomake efficient use of <strong>Group</strong>-wide resources.More information. & 2 62000 <strong>2010</strong>5.2 29.0TrucksBusesConstructionEquipment <strong>Volvo</strong> Penta <strong>Volvo</strong> Aero<strong>Volvo</strong>FinancialServicessegments<strong>Volvo</strong> 3P<strong>Volvo</strong> PowertrainBusiness units<strong>Volvo</strong> Parts<strong>Volvo</strong> Logistics<strong>Volvo</strong> Business Services<strong>Volvo</strong> Information Technology<strong>Volvo</strong> <strong>Group</strong> Real Estate, <strong>Volvo</strong> Technology, <strong>Volvo</strong> Technology Transfer, <strong>Volvo</strong> <strong>Group</strong> NAP

ving theShare of <strong>Group</strong>’s net sales by geographyEurope, 39%+644%AsiaNorth America, 18%South America, 11%Asia, 25%Rest of the world, 7%2000 <strong>2010</strong>8.8 65.5+471%Rest of the world2000 <strong>2010</strong>3.4 19.4Customers<strong>Volvo</strong> <strong>Group</strong> customers are active in about 180 countries. <strong>Group</strong>sales of products and services are conducted through both whollyowned and independent dealers. <strong>The</strong> global service network handlescustomer demand for spare parts and other services.More information. & 1 8Employees<strong>The</strong> majority of the <strong>Group</strong>’s employees work in Sweden, France, theU.S. , Japan, China, Brazil and Belgium. More information. & 4 7Strong positions• <strong>The</strong> second largest Western manufacturer of trucks.• No. 4 in construction equipment.• One of the world’s largest manufacturers of heavy-dutydiesel engines.• Strong positions also in the other business areas.• Good market presence globally.Share of <strong>Group</strong>’s net salesTrucks 63%Buses 8%Construction Equipment 20%<strong>Volvo</strong> Penta 3%<strong>Volvo</strong> Aero 3%Customer Finance 3%

world<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s vision is to be valued asthe world’s leading provider of commercialtransport solutions.CEO commentRecovery, growthand strengthenedprofitabilityDuring <strong>2010</strong>, the<strong>Volvo</strong> <strong>Group</strong> grew ata good pace withincreased sales in all regions, improved profitabilityand good cash flow. After having reported asubstantial loss in 2009 when the global financialcrisis hit hard and we were forced into considerablerationalizations, it is pleasing to notethat recovery in growth and profitability has beenswift.<strong>The</strong> <strong>Group</strong>’s sales of SEK 265 billion during<strong>2010</strong> represented an increase of 21% comparedwith the preceding year. Demand for the <strong>Group</strong>’sproducts recovered strongly in essentially allmarkets. Demand continued to rise from alreadyhigh levels in emerging markets, while in ourmature markets, with the exception of Japan,there was a significant gain in momentum duringthe second half of the year.Significantly improved earningsOperating income improved to SEK 18 billion,compared with the loss of SEK 17 billion the precedingyear. <strong>The</strong> operating margin was 6.8%. <strong>The</strong>improvement in earnings is of course an effect ofus selling more products and services, but it isalso the result of focused work on rationalizingand streamlining all parts of the <strong>Group</strong>, as well asour tight grip on costs. <strong>The</strong> combination ofincreased profitability with our achievement ofgrowth without tying up any additional operatingcapital resulted in our Industrial Operations generatingan operational cash flow of SEK 19 billion.In spite of our debt increasing when we weregoing through the global financial crisis in 2009,we made the assessment that we could take itupon ourselves to reduce our debt by loweringcost levels and turning around the negative cashflow. Through hard work, we succeeded in whatwe set out to accomplish. Thanks to the improvedprofitability and strong cash flow, we once againstand financially strong, with a net debt in IndustrialOperations that at the close of the year wasdown to 37% of shareholders’ equity – in line withour objective.We have been fortunate to be able to welcomethe return of increasing numbers of our formercolleagues to the <strong>Volvo</strong> <strong>Group</strong> – colleagues whosadly had to leave us in conjunction with thefinancial crisis but who have now been offeredwork again in increasing numbers. It is also pleas-the volvogroup <strong>2010</strong>Net sales increased by 21% to SEK 264.7billionOperating income amounted to SEK 18.0billionOperating cash flow of SEK 19.0 billion inIndustrial OperationsNet debt in Industrial Operations reducedto 37.4% of shareholders’ equityProposed dividend of SEK 2.50 per shareNet sales, SEK bn06 07 08 09259 285 305 21810265Operating income, SEK bn0620.40722.20815.909(17.0)1018.0Key ratios 2009 <strong>2010</strong>Net sales <strong>Volvo</strong> <strong>Group</strong>, SEK M 218,361 264,749Operating income (loss) <strong>Volvo</strong> <strong>Group</strong>, SEK M (17,013) 18,000Operating income (loss) Industrial Operations, SEK M (16,333) 17,834Operating income (loss) Customer Finance, SEK M (680) 167Operating margin <strong>Volvo</strong> <strong>Group</strong>, % (7.8) 6.8Income (Loss) after financial items, SEK M (20,573) 15,514Income(Loss) for the period, SEK M (14,685) 11,212Diluted earnings per share, SEK (7.26) 5.36Dividend per share, SEK 0 2.50 1Return on shareholders' equity, % (19.7) 16.01 According to the Board’s proposal.1

a global group <strong>2010</strong>Continued CEO COMMENTing that we have been able to provision SEK 350M for profit sharing to our employees, sincereturn on shareholders’ equity for <strong>2010</strong> amountedto 16%. <strong>The</strong> past two years have required quickadaptations that we would never have managedwithout the extraordinary efforts undertaken byemployees throughout the <strong>Group</strong>.Based on the much improved profitability andthe significantly reduced debt level, the Boardproposes to resume dividends with a pay-out ofSEK 2.50 per share for the financial year of <strong>2010</strong>.Improvements within all business areas<strong>The</strong> improved demand was clearly visible in ourtruck operations, with order intake rising by 75%while deliveries increased by 41%. Order intakegradually increased from low levels in Europe andNorth America. In many emerging markets suchas Brazil and India, demand remained strong. Onthe other hand, the Japanese market weakenedduring the second half of the year. Net sales inthe truck operations increased 20% to SEK 167billion and the operating margin improved to6.0%. <strong>The</strong> positive trend in order intake led to agradual increase in the pace of manufacturingand delivery in most of our truck plants.<strong>The</strong> growth and profitability development ofConstruction Equipment was strong throughoutthe year with a gradual improvement in Europe andNorth America, and with a very good contributionfrom emerging markets, particularly China. Salesrose 51% to SEK 54 billion and the business arearecorded an operating income of slightly morethan SEK 6 billion. <strong>The</strong> full year operating marginwas 11.5% with a strong finish to the year. We haveincreased our market share in the important Chinesemarket and now rank as its third largestmanufacturer. We are moving our position forwardfurther with the launch of SDLG branded excavatorsfrom Lingong and a large number of <strong>Volvo</strong>products.Buses’ sales increased by 11% and the operatingmargin rose to 3.8%. <strong>The</strong> business area hada positive trend in profitability throughout theyear despite relatively low volumes in the importantmarkets of Europe and North America. <strong>The</strong>improved profitability is partly a result of increasedsales, but primarily the fruit of considerableefforts to raise internal efficiency and lowercosts.<strong>Volvo</strong> Penta turned around with a profit of SEK578 M and a margin of 6.6% despite continuedweak demand for marine engines. With one of theindustry’s broadest product ranges and a globalnetwork of service and distributors, <strong>Volvo</strong> Pentais strategically well-positioned to be an innovativepartner to important boat builders. <strong>The</strong> industrialengine business had a good development andthe aim is to further increase sales of industrialengines by breaking into new segments of themarket.<strong>Volvo</strong> Aero’s operating income rose to SEK286 M despite a loss of SEK 538 M related to thedivestment of the U.S.-based service business.Core operations developed strongly due toincreased volumes, resulting in improved capacityutilization, improved productivity and lower costs.<strong>Volvo</strong> Aero remains well-established with participationin many interesting engine programs thatwill be entering production in coming years.In our Customer Finance Operations profitabilitygradually improved as our customers’ businessactivity increased, which in turn led to a more stablefinancial situation for them. As a consequenceof the <strong>Volvo</strong> <strong>Group</strong>’s increased sales of new products,we also see that our credit portfolio is growingagain.Intensive year of newsWe take a long-term view of our business andwhat needs to be done to create value for ourcustomers and to create sustainable profitability.Accordingly, we maintained our relatively highinvestments in product development during both2009 and <strong>2010</strong>. We also continued to invest inour plants and sales channels. Combined, thismeans that we now stand well-prepared in termsof both products and capacity.As one of the world’s largest manufacturers ofcommercial vehicles, we have a responsibility toreduce the impact on the environment caused byour production as well as the usage of our products– it is a responsibility that we take mostse riously. Engines that use less fuel lower ourcustomers’ operating costs and strengthen theircompetitiveness while reducing environmentalimpact. At the beginning of the year, we introducedon a broad front in the USA, the newengines that meet the latest, extremely stringentrequirements on emission levels that are in factpractically zero for nitrogen oxides and particulates.Trucks fitted with the new engines havebeen well received by both old and new customersand we are capturing market share in NorthAmerica as a consequence. But the truck newsdoesn’t end there. In Europe, <strong>Volvo</strong> Truckslaunched the new construction truck <strong>Volvo</strong> FMXthat strengthens the offering within this importantsegment of the market. In Japan, UD Trucks,in conjunction with the introduction of new emissionregulations, launched a new heavy Quontruck equipped with <strong>Group</strong> engines.Through Eicher, we have a very strong positionin medium-duty trucks in India and a well-performingsales network. We are now further developingEicher to keep pace with the strong growthin the country and for export to other countries.We are developing a new generation of heavydutytrucks and investing in new assembly capacity.We are also building a new engine plant thatwill be the global base for the medium-dutyengine platform to be launched in increasingnumbers of the <strong>Group</strong>’s products in the comingyears.<strong>Volvo</strong> CE launched a number of new <strong>Volvo</strong>products during the year. Manufacturing was alsobegun in China of the new series of excavatorsunder the SDLG brand. In addition, <strong>Volvo</strong> CE’sengines received certification in accordance withthe new environmental rules that are beginning tobe introduced in Europe and North America in2011. During the year, <strong>Volvo</strong> Buses began massproduction of hybrid buses at its plant in Poland.This is but a small selection of news for a yearwhen the pace of renewal remained high for allbusiness areas.2

Positive development in the shortand long termThanks to hard work and the resolute executionof cost-cutting measures, the <strong>Volvo</strong> <strong>Group</strong> hastaken itself through the collapse of the globalfinancial system and emerged as a stronger companyat a time when the economic trend is onceagain pointing in the right direction. I can concludethat both our distributors and our suppliersare doing a great job, and that together we standprepared to meet the expected continuation ofthe rise in volumes that we saw during <strong>2010</strong>. Weare continuously working to trim the industrialsystem in order to improve productivity and capitalefficiency. We are also intensifying our activitieswithin product development in preparationfor several important product launches in thecoming years.Against the background of the <strong>Volvo</strong> <strong>Group</strong>’simproved profitability, good cash flow, reduceddebt and the improved market outlook, as well asthe investments we have made and continue tomake in our plants and in product development, Ilook upon the development of the <strong>Group</strong> withconfidence, both in the short- and the long-termperspective.Finally, I would like to say that it has been apleasure to work for the <strong>Volvo</strong> <strong>Group</strong> for thesepast 14 years and that I wish my successor everysuccess in leading the <strong>Volvo</strong> <strong>Group</strong> into thefuture.Leif JohanssonPresident and CEO

EN A global group koncern <strong>2010</strong> <strong>2010</strong>Presence on all continentsGlobal industrial structure andstrong market channelsBacked by competitive product programs, strong dealers and increasingly more completeofferings including total solutions with spare parts, workshops, service packages, financingand leasing, the <strong>Volvo</strong> <strong>Group</strong>’s companies have established leading positions on a globalmarket.<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> has an established and strongposition in Europe, North America, and SouthAmerica. Through the acquisitions of UD Trucksand Lingong and the cooperation within trucksand buses with India-based Eicher Motors theposition has been strengthened in many marketsin Asia. Through its acquisitions the <strong>Volvo</strong> <strong>Group</strong>has also established a global industrial structurewith manufacturing as well as sales and distributionchannels on all continents.TrucksProduction facilities North America South America<strong>Volvo</strong> New River Valley (US) Curitiba (BR)Renault TrucksUD TrucksMack Trucks Macungie (US) Las Tejerias (VE)Eicher*Buses St Claire, St Eustache (CA), Mexico City (MX), Plattsburgh (US) Curitiba (BR)Construction Equipment Shippensburg (US) Pederneiras (BR)<strong>Volvo</strong> PentaLexington (US)<strong>Volvo</strong> AeroNewington (US)<strong>Volvo</strong> Powertrain Hagerstown (US) Curitiba (BR)4

Share of <strong>Group</strong>’s net salesTrucks, 63%Buses, 8%Construction Equipment, 20%<strong>Volvo</strong> Penta, 3%<strong>Volvo</strong> Aero, 3%CustomerFinance, 3%Share of <strong>Group</strong>’s net sales by geographyEurope, 39%North America, 18%South America, 11%Asia, 25%Rest of the world, 7%Europe Asia Rest of worldGöteborg, Umeå (SE), Gent (BE), Kaluga (RU) Bangalore (IN) Durban (ZA), Brisbane (AU)Blainville, Bourg-en-Bresse, Limoges (FR), Kaluga (RU)Ageo (JP), Hangzhou* (CN)Pithampur* (IN)Brisbane (AU)Borås, Säffle, Uddevalla (SE), Wroclaw (PL) Bangalore (IN), Shanghai*, Xian* (CN) Durban (ZA)Arvika, Braås, Eskilstuna, Hallsberg (SE), Konz-Könen, Hameln (DE),Belley (FR), Wroclaw (PL)Göteborg, Vara (SE)Trollhättan, Linköping (SE), Kongsberg (NO)Köping, Skövde (SE), Vénissieux (FR)Changwon (KR), Shanghai, Linyi* (CN),Bangalore (IN)Shanghai (CN)Ageo, Kounosu, Hanyu (JP)* Ownership ≥ 50%5

A GLOBAL GROUP <strong>2010</strong><strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> ’s product offeringTrucksAll brands in the <strong>Volvo</strong> <strong>Group</strong>’s truck operations have a unique and distinctbrand-specific character that attracts customers in their market segments.<strong>The</strong> trucks are sold and marketed under the brands <strong>Volvo</strong>, Renault, UD,Mack and Eicher, which all offer customers a broad range of products andservices for efficient and economic transports.Long-haulRegional distributionCity distributionConstructionEicherMackTrucksUDTrucksRenaultTrucks<strong>Volvo</strong>TrucksBuses<strong>Volvo</strong> Buses’ product range includes complete buses and bus chassis forcity, intercity and coach traffic. <strong>The</strong> company has a total offering that, inaddition to buses, includes a global service network, efficient spare partshandling, service and repair contracts, financial services and traffic informationsystems.City buses Intercity buses Coaches ChassisMarine and industrial applications<strong>Volvo</strong> Penta manufactures engines and drive systems for marine applications,for both leisure and commercial craft, with an engine range of 10 to900 hp and has a global service network of approximately 4,000 dealers.<strong>Volvo</strong> Penta also supplies industrial engines ranging from 75 kW to 640 kWfor irrigation pumps, generator units and other industrial applications.Marine enginesIndustrial engines6

Construction equipment<strong>Volvo</strong> Construction Equipment develops, manufactures and markets equipmentfor construction and related industries. Its products are leaders inmany world markets, and include a comprehensive range of wheel loaders,hydraulic wheeled and crawler excavators, articulated haulers, road machineryand a wide range of compact equipment.Compact constructionequipmentHeavy construction equipmentRoad machineryWheel loadersCrawler excavatorsArticulated haulersMotor gradersBackhoe loadersWheeled excavatorsWheel loadersCompaction equipmentCrawler excavatorsCrawler excavators from LingongLingong wheel loadersPaversSkidsteer loadersAsphalt milling machinesAerospace industry<strong>Volvo</strong> Aero develops and manufactures advanced components for aircraftengines and space rockets with light weight in focus. More than 90% of allnew large commercial aircraft are equipped with engine components from<strong>Volvo</strong> Aero. <strong>The</strong> company is also responsible for the engines of the SwedishAir Force’s Gripen fighters. <strong>Volvo</strong> Aero also has an aftermarket businessthat comprises repair and maintenance of select aircraft engines aswell as stationary gas turbines.Engine components Engine overhaul SpaceFinancial servicesFinancial services, such as customer and dealer financing, and other services,such as insurance, contribute to create customer value. Providingattractive financing solutions is essential to retaining existing customersand attracting new ones.Customer and dealer financing7

A GLOBAL GROUP <strong>2010</strong>Moving the worldEvery dayMack Trucks collect garbage formillions around the U.S.Mack is one of the leading producers of heavy-duty trucks in North AmericaEver since the start, Mack Trucks has focused on power and reliability, which has contributed tomaking the company one of the strongest heavy-duty truck brands in the North American market.In the U.S., Mack is the leading producer of trucks in the construction, economic haul and refusesegments. In total, Mack has sales and service in more than 45 countries.8

<strong>The</strong> people on Earth produce more than 2,000 million tons of garbageevery year, and just a few days without refuse collection would becatastrophic for cities and suburban areas. In New York City alone, refusetrucks from the <strong>Volvo</strong> <strong>Group</strong> collect 11,000 tons of garbage each day.Every day, Mack trucks collect tons of refuse all over the U.S. <strong>The</strong>demands imposed on these trucks are rigorous. <strong>The</strong>y have to get throughin every situation and they must not break down. Should the garbagecollection stop, it wouldn’t take long for the cities and suburban areas tobecome inundated by waste.Mack refuse trucks collect 2 million tons of garbage every week in theU.S. Is the number hard to grasp? Try this: With the garbage that MackTrucks refuse trucks transport every week in the U.S., it would be possibleto build a column of filled garbage cans that reaches all the way to themoon.Mack has been leading the U.S. market for refuse collection for morethan 30 years. <strong>The</strong> company’s operations are most extensive on the eastcoast, with huge cities like New York, Boston and Philadelphia. In all,Mack has almost 50% of the refuse vehicle market in the U.S. and itssuccess is continuing.Customers range from private family-owned companies with just onerefuse truck to local authorities and large cities, such as New York City,operating around 2,500 Mack refuse trucks that haul more than 11,000tons of trash every day.Mack collaborates closely with customers to customise trucks thatmatch their specific requirements. In New York, for example, a number ofrefuse trucks are also able to help with snow clearance using a speciallydesigned plow.All Mack trucks are built at the plant in Macungie, Pennsylvania. <strong>The</strong>Mack TerraPro model is primarily used as a refuse truck. At the plant,the trucks are also adapted to match customer requirements. <strong>The</strong> nextstep in the development process involves alternative fuels. Both hybridsand natural gas driven vehicles are important, and many customers indifferent parts of the U.S. are interested in extending their fleets to includemore energy efficient and environmentally sound vehicles.9

EN A GLOBAL global GROUP koncern <strong>2010</strong> <strong>2010</strong>Vision, mission and valuesVision<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s vision is to be valued asthe world’s leading provider of commercialtransport solutions.MissionBy creating value for our customers, we create value for our shareholders.We use our expertise to create transport-related hard and soft products ofsuperior quality, safety and environmental care for demanding customers in selected segments.We work with energy, passion and respect for the individual.Values<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> views its corporate culture as a unique asset,since it is difficult for competitors to copy. By applying andstrengthening the expertise and culture we have built up over theyears, we can achieve our vision.Quality, safety and environmental care are the values that form the<strong>Volvo</strong> <strong>Group</strong>’s common base and are important components of ourcorporate culture. <strong>The</strong> values have a long tradition and permeate ourorganization, our products and our way of working. Our goal is tomaintain a leading position in these areas.QualityQuality is an expression of our goal tooffer reliable products and services. Inall aspects of our operations, from productdevelopment and production to deliveryand customer support, the focusshall be on customers’ needs and expectations.Our goal is to meet or exceedtheir expectations. With a customerfocus based on everyone’s commitmentand participation, our aim is to benumber one in customer satisfaction.This is based on a culture in which allemployees are responsive and aware ofwhat must be accomplished to be thebest business partner.SafetySafety pertains to how our products areused in society. We have had a leadingposition in issues regarding safety for along time; our goal is to maintain thisposition. A focus on safety is an integralpart of our product development work.Our employees are highly aware ofsafety issues, and the knowledge gainedfrom our internal crash investigations isapplied in product development. Ourgoal is to reduce the risk of accidentsand mitigate the consequences of anyaccidents that may occur as well as toimprove the personal safety and thework environment of the drivers of ourvehicles and equipment. Our long-termvision is zero accidents.Environmental careWe believe that it is self-evident that ourproducts and our operations shall havethe lowest possible adverse impact onthe environment. We are working tofurther improve energy efficiency and toreduce emissions in all aspects of ourbusiness, with particular focus on theuse of our products. Our goal is for the<strong>Volvo</strong> <strong>Group</strong> to be ranked as a leader inenvironmental care within our industry.To achieve this goal, we strive for a holisticview, continuous improvement, technicaldevelopment and efficient resourceutilization.10

Over all str ategies<strong>The</strong> majority of the <strong>Volvo</strong> <strong>Group</strong>’scustomers are involved in commercialtransport-related operations. <strong>The</strong>y placehigh demand on both products andservices.ProfitableGrowth<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s aim is to continue to grow withincreased focus on profitability. <strong>The</strong> goal is to grow by10% a year over a business cycle with a higher pace innew markets. Part of the growth may, over time, comefrom acquisitions and then mainly in growth marketsand in strategic product segments.<strong>The</strong> market is characterized by intense competitionwhere customer satisfaction is a key factoras it lays a foundation for future sales and futureprofitability. <strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s strategy is basedon customers’ requirements and is focused onprofitable growth, product renewal and internalefficiency.Customer requirements<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s products and services offerhigh performance characteristics, quality, safety,flexibility and a favorable total economy. Customersare offered solutions adapted to their operationsregardless of whether they involve a singleproduct or a complete solution.Products, services and complete solutions aredeveloped in close cooperation with customerswith the goal of contributing to improving thecustomers’ productivity and profitability, and thuscreating value for the customer. <strong>Volvo</strong> strives toincrease the penetration and proportion of salescoming from services and soft products, with anoffer consisting of financing, insurance, variousforms of service contracts and spare parts,superstructures and attachments.In the past few years, the <strong>Volvo</strong> <strong>Group</strong> hasintensified its relationships with key customers.<strong>The</strong> advantages are many. <strong>The</strong> <strong>Group</strong> can supportcustomers’ development in an even betterway than previously, and intensified relationshipsresult in increased penetration of both the productand the service range. <strong>The</strong> extended offeringcreates advantages for both the <strong>Volvo</strong> <strong>Group</strong> andits customers.ProductRenewalOperationalExcellence<strong>The</strong> ongoing renewal of the <strong>Group</strong>’s product range andcreation of new and better products and services is achallenge, but a matter of survival. Intense competition,new environmental standards and safety and qualityrequirements put significant demands on the entireproduct development process. <strong>The</strong> <strong>Group</strong> utilizes commonarchitecture and shared technology to create synergiesand reduce costs.<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> strives to optimize cost-efficiency andproductivity in all parts of its operations by reducingmanufacturing costs and sales and administrative costsand by speeding up product development and otherprocesses. <strong>The</strong> work also comprises competencedevelopment and organizational development.11

EN A GLOBAL global GROUP koncern <strong>2010</strong> <strong>2010</strong>Str ategYProfitable GrowthIn an industry characterized by economies of scale and which is undergoing consolidation,profitable growth is a necessary condition in order to continue to strengthen competitivenessand to develop as a close partner to customers with high demands. <strong>The</strong>re is particularlystrong growth potential in supplemental business relating to service and to services inwhich significant effort is invested to give the customer a more complete offering.Profitability is essential to ensure investments inthe development of new products and servicesand a favorable return to the shareholders. <strong>The</strong><strong>Group</strong>’s brands shall increase customer satisfactionby offering environmentally and cost-efficientproducts and services.Required scale achievedDuring the past ten years, the <strong>Volvo</strong> <strong>Group</strong> hasgrown on average 7.4% per year, both organicallyand through acquisitions. <strong>The</strong> acquisitions havebeen carried out in order to establish the <strong>Group</strong>in new markets and in new product segments, aswell as to achieve economies of scale throughsize. <strong>The</strong> average operating margin during theperiod has been 3.9%.Through its growth, the <strong>Group</strong> has achievedsufficient size in mature markets with satisfactorymarket shares. <strong>The</strong> size facilitates good economiesof scale in most product segments.Strong positions<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> has strong positions from whichfurther to develop:• No. 2 among Western manufacturers of heavydutytrucks• No. 4 in construction equipment• One of the world’s largest manufacturers ofheavy-duty diesel engines• Strong positions also in the other businessareas• Good market presence globally.Future directionWithin the strategic area Profitable Growth thefuture direction is:• Continued organic growth in mature markets.• Focus on increased sales of services and aftermarketproducts.• Products in market segments that open up possibilitiesto capture the rapid growth in Asia andother growth markets.• Realizing further synergies from acquired companies.• Increased cooperation with business partners.Net salesSEK bn4003002001000Net sales01 02 03 04 05 06 07 08 09 10<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s acquisitions and divestments2008 Joint venture with Eicher Motors of India within trucks and buses.2007 Acquisition of Igersoll Rand’s road development division.2007 Acquisition of Ingersoll Rand’s road development division.2006 Acquisition of Japanese Nissan Diesel (Now UD Trucks). Completed in 2007.2005 Sale of the service company Celero Support.2004 Acquisition of remaining 50% of the Canadian bus manufacturer Prévost.2004 Sale of axle-manufacturing operations to ArvinMeritor.2003 Acquisition of the truck and construction equipment dealers from Bilia.2001 Acquisition of the truck manufacturers Mack and Renault VI.1999 Sale of <strong>Volvo</strong> Cars to Ford.1998 Acquisition of the excavator operations of Samsung Heavy industries.12

Str ategYOperationalExcellenceOperational excellence is an important factor for securinga sustainable profitability for the <strong>Group</strong>. <strong>The</strong> work withoperational excellence includes lowering the manufacturingcosts and the cost of sales and administration as wellas making product development and other processes moreefficient.<strong>Volvo</strong> Production System (VPS) is an importanttool in the effort to increase operational excellence.It contains methods to make operationsmore efficient and reduce productivity losses.Competence development is a key part of VPS.Great effort is placed on developing employees innew, future technological competencies.Substantial cost savingsIn 2009 as well as <strong>2010</strong>, substantial measureswere implemented to lower the <strong>Group</strong>’s costs ona permanent basis. Short-term, they have beenfocused on quickly changing over the <strong>Group</strong> to anew, lower cost base while at the same timesecuring the <strong>Group</strong>’s long-term competitiveness.All parts of the <strong>Group</strong> have been subject to costsavings in a number of areas. <strong>The</strong> measures haveproduced results and substantially lowered thetotal costs for, among others, sales and adminstrationas well as for research and development.As the <strong>Group</strong> now grows again, it is of vital importancethat costs increase at a slower pacethrough increased efficiency and productivity andthus assist in raising profitability.Future directionWithin the strategic area of Operational Excellencethe future direction is:• Lowering the product cost.• Utilizing the global production capacity withregional support.• Productivity increase in the industrial system tostrengthen competitiveness.• Focus on closer and more long-term cooperationwith well-performing suppliers and takefurther advantage of large purchasing volumes.• Reduce administration by fully utilizing the businessunits.• Increase productivity in product development.• Increase flexibility to be able to rapidly adapt thecost structure to changes in demand.• Increase competency and diversity with strongemployee commitment.Improved profitability through cost controlIndustrial Operations8060+25%4020009Q4 10Q1 10Q2 10Q3 10Q4Net salesSelling, administrative, reserach and development expenses+3%13

EN A GLOBAL global GROUP koncern <strong>2010</strong> <strong>2010</strong>Str ategYProduct Renewal<strong>The</strong> development of new, innovative technology is key to the success of future productgenerations and to maintaining market-leading positions.Efforts are constantly under way within the <strong>Group</strong>to refine and improve the performance of productsand with swiftness strengthen current competitiveness.At the same time, research lookingfurther into the future is conducted to achievenew technical breakthroughs that will contributeto reduced environmental impact and meet futurerequirements.Cleaner enginesAfter implementing comprehensive productrenewal in recent years, the <strong>Volvo</strong> <strong>Group</strong> decidedto maintain relatively high investments in researchand development during 2009 and <strong>2010</strong>. This wasdone to secure a competitive range of productsand services in both the short and the long term.<strong>The</strong> pace of product renewal has been high, forexample in conjunction with the implementationof new emissions regulations in Europe, NorthAmerica and Japan. <strong>The</strong> <strong>Group</strong> also started serialproduction of hybrid buses and launched a largenumber of new construction machines, includingexcavators under the brand name SDLG in China.<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> has also developed its owncaptive <strong>Group</strong>-wide engine platform for mediumdutydiesel engines. <strong>The</strong> first models of the newmedium-duty engines started to be launched in<strong>2010</strong>.<strong>The</strong> <strong>Group</strong> has its most competitive productrange ever, but the customer offering will be furtherstrengthened in the next few years by focusingintensely on the development of future generationsof products and services that createvalue for customers.Focus on the driveline<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> is one of the world’s largestmanufacturers of heavy diesel engines for commercialuse. <strong>The</strong> <strong>Group</strong> has production andresearch and development facilities for drivelineson three continents. <strong>The</strong> products are sold tocustomers in some 180 markets worldwide.A large number of product launches<strong>Volvo</strong> TrucksIn April <strong>2010</strong>, <strong>Volvo</strong> Trucks launched thenew <strong>Volvo</strong> FMX truck, specially designedfor heavy construction duties. With thenew <strong>Volvo</strong> FMX and a strong serviceoffering for the construction industry,the company has strengthened its positionin this segment. During the year,<strong>Volvo</strong> Trucks also focused on the developmentof hybrid trucks and engines foralternative fuels.Renault TrucksRenault Trucks launched the Optitracksystem on Renault Premium Lander. <strong>The</strong>system is useful when driving on difficultterrain in quarries or worksites. With theaid of separate hydraulic motors integratedin the wheel hubs, the truck canautomatically be driven in all-wheeldrive. In addition Renault Trucks starteddelivery of an all-electric version ofRenault Maxity.UD TrucksIn April, UD Trucks launched versions ofits Quon heavy-duty truck with enginesbased on the <strong>Group</strong>’s common heavyengine platform that comply with newemission regulations introduced inJapan. In addition to environmentalperformance, the latest Quon lineuphas been developed to meet growingdemand for high levels of both fueleconomy and driving performance.Mack TrucksMack introduced its new mDRIVE automatedmanual transmission, based onwell-accepted <strong>Group</strong> architecture engineeredto work exclusively with MACKMP series engines and deliveringimproved fuel efficiency, driveability andsafety. A natural gas-powered version ofthe versatile MACK TerraPro Cabovermodel was brought to market for refuseand construction customers.14

Continued focus on product developmentResearch and development costs, SEK billion01 02 03 04 05 06 07 08 09 105.4 5.9 6.8 7.6 7.6 8.4 11.1 14.3 13.2 13.0<strong>The</strong> drivelines are designed so they can beadapted to a large number of applications in mostof the <strong>Group</strong>’s products. <strong>The</strong> diesel engines areused in trucks, buses and construction equipment,as well as in boats and industrial applications,such as generator units.<strong>The</strong> strongest driver of the development ofdrivelines is customer requirements and preferencesas well as new legislation with stricteremissions requirements. Products with reliability,sustainability, good drivability, favorable fueleconomy and high environmental parametershelp boost customers’ productivity and profitability.<strong>The</strong> environmental aspect is of great signifi-cance in all product development. Alternativedrivelines and fuels, and the lower fuel consumptionwhen using traditional drivelines, provide fortwice the benefit – less impact on the environmentand lower costs for customers. <strong>The</strong> <strong>Volvo</strong><strong>Group</strong> is a driving force in the areas of environmentaladaptation and energy efficiency. <strong>The</strong>undertaking involves a gradual transition fromfossil fuels, such as oil and natural gas, to fuelsfrom renewable sources and to hybrids.<strong>The</strong> <strong>Group</strong> continuously strengthens thedevelopment of aftermarket products and serviceswith the aim of meeting customer needsthrough the entire product life cycle.Future directionWithin the strategic area of Product Renewal thefuture direction is:• Meet future emission standards with competitiveproducts – capitalize on converging technologies.• Start production in India of medium-duty engineplatform developed by the <strong>Group</strong>.• Develop new products adapted for growth markets.• Further enhance the <strong>Group</strong>’s market-leading positionwithin diesel engines and automatic gearboxes.• Commercialize the <strong>Group</strong>’s shared technology fordiesel-electric hybrids.• Focus on fully utilizing common architecture andshared technology.<strong>Volvo</strong> BusesIn the summer of <strong>2010</strong> serial productionstarted of <strong>Volvo</strong>’s hybrid buses, bothsingle deckers and double deckers.Hybrid buses reduce fuel consumptionand emissions of CO 2by as much as35%. <strong>The</strong> company has redeived ordersfor some 200 hybrid buses in Europeand has carried out positive tests atoperators in Brazil and Mexico.<strong>Volvo</strong> Construction Equipment<strong>Volvo</strong> CE is highlighting its commitmentto improving fuel efficiency with a rangeof solutions that encompasses engines,hydraulic systems, operator behavior andhybrid technology. <strong>The</strong> company is rampingup its investments in new technologyto maintain its leadership in fuelefficiency and thereby environmentalprotection.<strong>Volvo</strong> PentaWith new and specially designed controlsfrom <strong>Volvo</strong> Penta, boat drivers canquickly choose between a number offeatures, for example cruise control,powertrim assistant and tow mode. <strong>The</strong>electronics development makes it possiblefor <strong>Volvo</strong> Penta to offer its customerssoft products of this kind. Alsoamong these is the appreciated joystick,which makes maneuvering a boat easierand safer.<strong>Volvo</strong> Aero<strong>The</strong> main challenge for the airline industryis to reduce the engines’ fuel consumptionand thus also the emissions. <strong>Volvo</strong>Aero’s lightweight technologies aretherefore in increasing demand from thelarge, international engine manufacturers,while the technologies also get newapplications in the aerospace industry15

A global GROUP <strong>2010</strong>Strength factors<strong>Volvo</strong>profitabilityBasedStrategically important for futureMackBy selling products with different brands, theStrong brands<strong>Volvo</strong> <strong>Group</strong> can penetrate many different customerand market segments in mature marketsas well as growth markets.<strong>The</strong> <strong>Volvo</strong> brand, which has been built up overdecades, is one of the world’s best known andrespected names within trucks, buses, constructionequipment, marine engines, industrialengines and in the aviation industry.Mack is one of the most well-known truckbrands in North America, while Renault Trucksholds a special position in Southern Europe. <strong>The</strong>UD brand is one of the biggest in the Japanesetruck market.Prevost sells coaches and Nova Bus city busesLingongin North America.<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> also sells construction equipmentunder the SDLG brand mainly in China, andthrough joint-venture companies, trucks andbuses under the Eicher brand mainly in India andbuses under the Sunwin and Silver brands inChina.Sunwinmachines. All in all, the <strong>Volvo</strong> <strong>Group</strong> in <strong>2010</strong> wasSilverintended to provide for improved competitiveness.PrevostNova BusRenaultUD TrucksEicher1998Successful inroads into new marketsShare of Industrial Operations’ net sales16Western Europe 52%North America 31%Eastern Europe 3%South America 6%Asia 5%Other markets 3%on its strategies and by utilizing its strength factors, the <strong>Volvo</strong><strong>Group</strong>’s ambition is to further increase its competitiveness and improveits profitability.A customer offering at the forefront<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> offers customers complete, efficienttransport solutions. Products with reliability,durability, good driveability, favorable fuelefficiency and high environmental performanceare combined with services such as financing,insurance, various service contracts, accessoriesand spare parts that support the core products.<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s increasingly broad offeringof these services and aftermarket products isStrong dealersThrough the years, the <strong>Volvo</strong> <strong>Group</strong> has investedconsiderable resources in building a very strongdealer network with overall well-developed salesand service channels. <strong>The</strong> network consists ofwholly-owned as well as independent dealers.Thanks to large populations of <strong>Group</strong> products inmost markets, the dealers have a stable base ofrevenues from the important aftermarket withservice and repair.Strong market positions<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> has leading positions globally ineach of its business areas. <strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> isEurope’s largest and one of the world’s largest<strong>2010</strong>Western Europe 34%North America 18%Eastern Europe 5%South America 11%Asia 25%Other markets 7%17% 48%manufacturers of heavy-duty trucks and one ofthe largest manufacturers of buses in Europe andNorth America. Within construction equipment,the <strong>Volvo</strong> <strong>Group</strong> is the world’s largest manufacturerof articulated haulers as well as one of theworld’s largest manufacturers of wheel loaders,excavators equipment and road developmentone of the world’s largest producers of heavydutydiesel engines.Strengthened presence in Asia andSouth AmericaIn recent years, the <strong>Volvo</strong> <strong>Group</strong> has strengthenedits position in important growth markets inAsia and South America through a combinationof organic growth and acquisitions. Among theacquired companies are UD Trucks in Japan, Lingong(70% ownership) in China and VE CommercialVehicles (50% ownership) with its Eicherbrand in India. During <strong>2010</strong>, 19% of the IndustrialOperations’ net sales were generated in the BRICcountries (Brazil, Russia, India and China). Altogether,the markets outside Western Europe andNorth America accounted for 48% of net sales inthe Industrial Operations during <strong>2010</strong>.Organic growth• Strong brand and distribution in Eastern Europe• Product portfolio expansion and distribution inSouth America and Asia• Development of acquired businessesAcquisitions and JVs• Lingong, China• UD Trucks, Japan• VECV (Eicher), India

Financial goalsMeasured over a business cycle<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s financial goals were established by the Boardin September 2006. <strong>The</strong> Board focuses on three goals comprisinggrowth, operating margin and capital structure for the <strong>Group</strong>’sIndustrial Operations.Financial goals for Industrial OperationsGrowth<strong>The</strong> growth target is that net sales should increaseby a minimum of 10% annually. During 2000–<strong>2010</strong>, the average growth rate was 7.4% annually.Operating margin<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s profitability target is that operatingmargin for the Industrial operations is toexceed an average of 7% annually over a businesscycle. <strong>The</strong> average annual operating margin for the<strong>Volvo</strong> <strong>Group</strong>’s Industrial Operations was 3.9%from 2000 to <strong>2010</strong>.Capital structure<strong>The</strong> capital structure target is set to a net debtincluding provisions for post-employment benefitsfor the Industrial operations of a maximum of40% of shareholders’ equity under normal conditions.As of December 31, <strong>2010</strong>, the <strong>Volvo</strong><strong>Group</strong>’s Industrial operations had a net financialdebt position corresponding to 37.4% of shareholders’equity.Net sales growth, % Operating margin, % Net financial debt as percentage ofshareholders’ equity, %100(30)Target: above 10%100(10)Target: above 7%806040200(20)(40)Target: below 40%Net cash Net debt067071008609(28)1021067.907 087.8 5.209(7.8)106.906(29.2)075.70839.70970.91037.4Financial goals for Customer Finance Operations<strong>The</strong> target for Customer Finance is a return on shareholders’ equity of 12–15% and an equity ratioabove 8.0%. At year end the equity ratio was 9.0%. <strong>The</strong> average annual return on shareholders’ equityfor 2006–<strong>2010</strong> amounted to 7.2%.Return on shareholders’ equity, %Target: 12–15%151050(5)(10)0613.207 0815.9 12.609(6.2)100.417

A Global <strong>Group</strong> <strong>2010</strong>World-cl ass servicesStrengthens customerrelationshipsMany customers want long-term cooperation around total solutionsto execute their work as efficiently as possible with maximumprofitability and reliability.When customers choose supplier of vehicles ormachinery, the offering of supplementary servicescombined with excellent products is a crucialfactor.Accordingly, the <strong>Volvo</strong> <strong>Group</strong> offers such servicesas financing and insurance, various forms ofservice agreements, accessories and spareparts. <strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s increasingly broad rangeof these services and aftermarket products, socalled soft products, is of ever-increasing importanceto the <strong>Group</strong>’s competitiveness.Growing aftermarket business<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s offering includes various typesof financing solutions, insurance, rental services,used vehicles, spare parts, preventive maintenance,service agreements, assistance servicesand IT services. <strong>The</strong> range and flexibility of theoffering means that the solutions can be customizedfor each customer.Since a large part of the accessories, spareparts and services in the aftermarket business isrequested as long as products are being used,they contribute to balancing the fluctuations inServices and aftermarket products (so called soft products)Aftermarket products Extended product offering Services offeringSparepartsSoftwareAccessoriesServiceProductsExtendedproductofferingUptimeservicesFleet/TransportServicesSupportServicesFinancialServicesNew partsUsed andremanufacturedpartsExtendedpartsVehiclesoftwareAccessoriesNon-<strong>Volvo</strong>accessoriesMerchandiseproductsServicelitteratureService /dealertoolsPartsServicesUsedvehiclesTrailersand superstructuresAttachmentsand optionsServiceplanningMaintance andrepairUpdates andupgradesTransportmanagementDriver timemanagementVehiclemanagementCompetencedevelopmentFleet and assetmanagementCall centreservicesDealerfinancingCustomerfinancingRentalSpecialvehiclesServicecontractsExtendedcoverageSecurity, safety& environmentDriver infoand supportConsultancyservicesInformationservicesInsuranceCard andpaymentsolutions18

Soft product share of Industrial Operations’ net sales <strong>2010</strong>Sales of hardproducts, 65%Sales of services andaftermarket products(soft products), 35%the business cycle for the <strong>Volvo</strong> <strong>Group</strong>. By strengtheningthe aftermarket offering, profitability and revenuesustainability can improve for the <strong>Group</strong>throughout the business cycle.<strong>The</strong> strategy to increase sales of services andaftermarket products is an important element inthe <strong>Volvo</strong> <strong>Group</strong>’s effort to achieve targets forprofitability and growth, both in mature marketsand in the <strong>Group</strong>’s new markets. During <strong>2010</strong>, theservices and aftermarket products business representedapproximately 35% of net sales in theIndustrial Operations, of which roughly half wasattributable to spare parts and workshop services.Develop and increase interface withcustomers<strong>The</strong> majority of <strong>Volvo</strong> <strong>Group</strong>’s customers arecompanies within the transportation or constructionindustries. <strong>The</strong> reliability and productivity ofthe products are important and in many casescrucial to the customers’ success and profitability.<strong>The</strong> goal is that <strong>Volvo</strong> <strong>Group</strong> companies shallbe regarded as number one in customer satisfaction,in terms of both products and services. <strong>The</strong><strong>Volvo</strong> <strong>Group</strong> shall also be number one when thedealers’ customers assess customer satisfaction.A competent and professional dealer and servicenetwork is of vital importance to the <strong>Volvo</strong> <strong>Group</strong>and contributes to strengthening the <strong>Group</strong>’svarious brands.A missed deliveryis a missed saleLast year, the bread producer, Pågen AB, placed an orderfor 61 <strong>Volvo</strong> FL trucks.“We are in the fresh produce business. Distribution isthe one part of our chain that must be completely faultless,”says Johan Blixt, Purchasing Manager at the Pågen<strong>Group</strong>.<strong>The</strong> first <strong>Volvo</strong> trucksFor 20 years, the drivers at Pågen AB have driven another brandof trucks, so the decision to change supplier and make an investmentof this size requires serious consideration.“Our procurement processes are very thorough. Suppliers arecompared in great detail. <strong>Volvo</strong> came out well and won this contract.But <strong>Volvo</strong> will still have to work hard for several years to come.”<strong>The</strong> service organization was decisivePrice was not the main reason the Pågen <strong>Group</strong> made its choice.“I would say the decisive factor was <strong>Volvo</strong>’s service organization.We have been very well received, they have listened to what we hadto say and we feel well looked after. <strong>The</strong>se things are important forme as Purchasing Manager when taking such large decisions andfor our employees that leave the vehicles at the workshop.”Pågen AB has chosen to invest in <strong>Volvo</strong>’s Gold Service Contractfor the new trucks.“When a driver hands in a truck for service, whatever work hasbeen ordered must be completed in the appointed time. If welose time, we miss deliveries and a missed delivery is a lost sale.It just has to work!”Fits Pågen’s environmental profile<strong>Volvo</strong> trucks’ environmental qualities are highly valued by Pågen.“We strive to minimize our environmental impact throughout ourchain and invest in premium environmental technology, and thetransports are no exception.Pågen ABPågen is Sweden’s largest bread producer. Netsales amounted to SEK 2.7 billion.Freshly baked bread is distributed acrossSweden from bakeries in Malmö and Gothenburg,seven days a week, all year long.Of the approximately 1,400 employees, 430work as sales staff and drive bread trucks aroundtheir own district of stores. In total, Pågen’s salesstaff visit 5,000 stores every day.<strong>The</strong> order: 61 trucks of the <strong>Volvo</strong> FL model.19

A global group <strong>2010</strong>Moving the worldRed hybridbus of the future forthe streets of LondonUp to 35% lower fuel consumption<strong>The</strong> <strong>Volvo</strong> B5L Hybrid Double Decker is equipped with a diesel engine with smaller cylinder volume than usual,since it is combined with an electric motor. It is the electric motor that is running the bus when it accelerates toa speed of 15–20 km/h. When the bus is underway, the parallel hybrid system combines diesel and electricpower to maintain speed. At higher speeds, the bus uses diesel power alone. Regenerative braking energycharges the battery via the generator. Several of the <strong>Volvo</strong> hybrid auxiliary systems are powered by independentelectric motors. <strong>The</strong>se measures all contribute to high fuel savings on routes with frequent braking andacceleration, like city bus traffic. <strong>The</strong> parallel hybrid technology reduces fuel consumption and CO 2emissionsby up to 35% compared to conventional diesel buses. In the hybrid configuration, the emissions ofnitrogen oxide and particulates are reduced by up to 50%.20

When mega city London makes a commitment to reduce emissions,tradition and new technology are combined: A classic red double-deckerbus using <strong>Volvo</strong>’s latest hybrid technology carries London’s citizens just asit always has – but with up to 35% less fuel consumption.Of all passengers using public transportation in the world, 80% go by bus.Buses are easy to use in almost all types of traffic and are in many parts of theworld the only public transportation. In London, buses are one out of manymeans of transportation, and play an important role as the city aims toreduce traffic.North London’s Green Lanes is a chaotic experience during rush hour. Atthe bus stop outside the popular pub <strong>The</strong> Fox, commuters get on and off anever-ending stream of red doubledeckers. Noise pollution from cars anddiesel buses fills the street with an aggressive roar.All this makes the contrast with <strong>Volvo</strong>’s new hybrid double-deckers all themore evident. When it arrives at the bus stop, the diesel engine shuts downcompletely. You are left with a comforting silence that remains even as thehybrid bus leaves the stop, only using its electric motor to accelerate.“It’s fantastic how quiet it is when the diesel engine is turned off and it onlyruns on electricity,” says Daniel Clarke, one of the commuters standing in lineat the bus stop. “I can’t even imagine what the difference would be if all buseswere hybrids.”Arriva’s Wood Green bus garage in North London is a pioneer of hybridbuses for London. In the summer of 2009, six brand new <strong>Volvo</strong> B5L HybridDouble Decker buses arrived at the garage that has had previous experienceof hybrid technology.“We received the first hybrid buses in 2007 and now have a total of 11hybrid double-deckers at Wood Green. Our experience of hybrid technologyhas been positive and all our staff, from mechanics to drivers, are pleased tobe involved,”says Ian Tarran, engineering director at Arriva London.Transport for London, the body responsible for London’s transport system,has made the hybrid buses a key part of their strategy for public transportwith less environmental impact. To really put the <strong>Volvo</strong> Hybrid DoubleDecker to the test, bus route 141, was selected. <strong>The</strong> route starts at PalmersGreen and ends at London Bridge, with a total length of nine kilometers anda tour frequency of 6–12 minutes.“<strong>The</strong> field tests have shown that the fuel consumption of the <strong>Volvo</strong> HybridDouble Decker is within our goals. On route 141, the buses have the toughestcycle possible and still their fuel consumption has been reduced by over 30%compared to the regular diesel buses on route 141,” says Niklas Deras at<strong>Volvo</strong> Buses.21

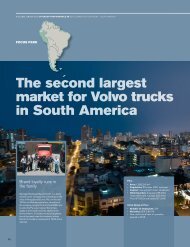

EN A global group koncern <strong>2010</strong> <strong>2010</strong>Market overviewLong-term increase in demand forthe <strong>Group</strong>’s products and servicesDuring 2009, the <strong>Group</strong>’s mature markets showed a sharp decline in demand and during <strong>2010</strong> agradual recovery from historically low levels. Demand in the <strong>Group</strong>’s growth markets were affectedto a much lesser extent by the financial crisis. After a brief downturn at the beginning of 2009,these markets returned to growth, and they showed a continued good growth in <strong>2010</strong>.Long-term growthIn the long-term, demand for freight capacity, andthus many of the <strong>Group</strong>’s products, is closelylinked to the GDP trend. <strong>The</strong> extent of investmentin infrastructure, which drives demand for buildingand construction equipment, is also, closelylinked to the GDP trend. In the short-term,demand is affected by a number of factors includingfuel prices, the implementation of new emissionregulations, interest rates, etc.From a historical perspective, despite therecovery in the truck and construction equipmentmarkets in <strong>2010</strong>, demand was below the longtermtrend in Europe, North America and Japan.<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> sees no development that wouldimply that the connection between GDP trendsand the sales of vehicles and machines wouldhave changed and, accordingly, the view is that intime, demand will recover and return to levels correspondingwith the long-term trend.North AmericaIn North America, sales of heavy-duty trucks rose 20%to 142,096 vehicles (117,983), primarily driven by risingdemand for trucks for long distance haulage andregional distribution. <strong>The</strong> market for construction trucksremained weak. <strong>The</strong> market for construction equipmentrose 20% after a three-year decline. However, the marketstill remained at a low level.Despite the uncertain macroeconomic trend, the needto replace old trucks and upgrade the truck fleets is substantial,which is expected to drive an improvement indemand. <strong>The</strong> total market for heavy-duty trucks in NorthAmerica is expected to amount to approximately220,000 trucks in 2011. <strong>The</strong> market for constructionequipment is expected to grow by 20–30% in 2011.Heavy-duty truck market, North AmericaVehicles, thousands40032024016080019901995 2000 2005 <strong>2010</strong>South AmericaIn South America, the key Brazilian marketremained strong, primarily due to a healthy economywith strong growth in GDP, but also due tosupport measures including advantageousfinancing. <strong>The</strong> Brazilian market for heavy-dutytrucks rose 64% to 109,760 vehicles (66,950). InSouth America as a whole, the market rose 61%to 138,763 heavy trucks (86,398). In Brazil, themarket for construction equipment rose 68%.<strong>The</strong> pace of growth in the South Americantruck market is expected to plane out during2011 after an extremely strong <strong>2010</strong>, but despitethis, demand is expected to remain at a healthylevel. <strong>The</strong> Brazilian market for construction equipmentis expected to grow by 5–15% in 2011.Heavy-duty truck market, BrazilVehicles, thousands120906030019901995 2000 2005 <strong>2010</strong>22

Economic growth in the U.S., EU and Brazil<strong>Annual</strong> GDP-growth, %Source: ConsensusEconomicsEconomic growth in Asia<strong>Annual</strong> GDP-growth, %Source: ConsensusEconomicsAccording to Consensus Economics, global GDP grewby 4.0% during <strong>2010</strong> compared with a decline of 1.8%in 2009. GDP in the EU grew by 1.8% (–4.1%), in theUS by 2.9% (–2.6%) and in Japan by 4.3% (–6.3%).Growth in countries such as Brazil, India and China wasvery strong. For 2011, global GDP is expected to growby 3.4% with continued high growth rates in, amongothers, Brazil, India and China.06 07 08 09 104.0 6.1 5.2 (0.6) 7.5 Brazil3.4 3.1 0.6 (4.1) 1.8 Europe2.7 1.9 0.0 (2.6) 2.9 USA0611.60713.0089.0099.11010.1 China9.7 9.0 6.7 7.4 8.7 India6.5 7.2 3.8 1.9 6.9 Asia/Pacific*2.0 2.3 (1.2) (6.3) 4.3 Japan* China, Hong Kong, South Korea, Taiwan, Indonesia,Malaysia, Singapore, Thailand, Phillippines, Vietnam,Australia, New Zealand, India, Japan, Sri LankaEuropeIn Europe 29, (the 27 EU member states and Norway andSwitzerland) registrations of heavy-duty trucks rose 8% to179,185 vehicles in <strong>2010</strong>, compared with 165,269 vehiclesin 2009, driven by a recovery in Central and NorthernEurope, while Southern Europe remained weak. <strong>The</strong> marketfor construction equipment rose by 15% in <strong>2010</strong>.It is difficult to gauge the effects European austeritypackages will have on the economy in 2011, but <strong>Volvo</strong> currentlyestimates the truck market will amount to approximately220,000 heavy-duty trucks. <strong>The</strong> market for constructionequipment is expected to grow by 5–15% in 2011.Heavy-duty truck market, EuropeVehicles, thousands40032024016080Asia<strong>The</strong> <strong>Group</strong>’s most substantial truck market in Asia is Japan,where demand weakened in the second half of the yearafter government scrapping premiums ceased and newtougher emission regulations were introduced. However, thetotal market amounted to 24,453 heavy-duty trucks, whichwas an increase of 29% compared with 18,889 trucks in2009. In other Asian markets, demand rose compared withthe preceding year. <strong>The</strong> Indian market for heavy-duty trucksrose by 69% to 211,543 vehicles (125,173). <strong>The</strong> market forconstruction equipment in Asia rose by a total of 60%, primarilydriven by continued strong growth in China and India.After a weak second half in <strong>2010</strong>, demand for heavydutytrucks is expected to recover gradually in Japan in2011. <strong>The</strong> Japanese market for heavy-duty trucks isexpected to grow by 10%. <strong>The</strong> market for constructionequipment in both China and India is expected to grow by5–15% in 2011.Construction equipment market, ChinaMachines, thousands400019901995 2000 2005 <strong>2010</strong>32024016080019901995 2000 2005 <strong>2010</strong>Other marketsFor trucks, Other markets comprises Africa andAustralia. <strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s deliveries of trucksto Other markets rose 10% to 14,888 with apositive trend shown especially in North Africaand Australia. <strong>The</strong> market for constructionequipment grew by 42%.23

Board of directors’ report <strong>2010</strong>Significant e ventsRecovery, growth and productlaunches<strong>2010</strong> was characterized by a recovery in the <strong>Group</strong>’s mature markets anda continued strong development in most of the growth markets. <strong>The</strong> <strong>Volvo</strong><strong>Group</strong>’s intensive product renewal continued in all business areas.<strong>The</strong> first quarter<strong>Annual</strong> General Meeting<strong>The</strong> <strong>Annual</strong> General Meeting of AB <strong>Volvo</strong> held onApril 14, <strong>2010</strong> approved the proposal from theBoard of Directors and the President not to pay adividend to the shareholders and that all of thefunds at the disposal of the <strong>Annual</strong> GeneralMeeting would be carried forward to the followingyear.Peter Bijur, Jean-Baptiste Duzan, Leif Johansson,Anders Nyrén, Louis Schweitzer, RaviVenkatesan, Lars Westerberg and Ying Yeh werereelected as members of the Board of AB <strong>Volvo</strong>,and Hanne de Mora was newly elected. LouisSchweitzer was elected Chairman of the Board.Thierry Moulonguet, representing RenaultS.A.S., Carl-Olof By, representing AB Industrivärden,Håkan Sandberg, representing SvenskaHandelsbanken, SHB Pension Fund, SHBEmployee Fund, SHB Pensionskassa andOktogonen, Lars Förberg, representing VioletPartners LP and the Chairman of the Board, wereelected members of the Election Committee.<strong>The</strong> registered public accounting firm PricewaterhouseCoopersAB was elected as the company’sauditor for a period of four years.New trucks launchedOn April 20, <strong>2010</strong>, UD Trucks presented a newrange of Quon heavy-duty trucks. <strong>The</strong> latestQuon lineup has been developed to meet highlevels of demand for both fuel economy and drivingperformance. It features newly developedengines and automated manual transmissionsbased on <strong>Group</strong> architecture. UD Trucks has alsoadded a new model equipped with a new mediumdutyengine to its Condor truck lineup.On April 19, <strong>Volvo</strong> Trucks launched its new<strong>Volvo</strong> FMX construction truck at the Bauma internationalmachinery trade fair in Munich, Germany.With the new truck, <strong>Volvo</strong> Trucks aims to increaseits presence in the construction segment. Salesof the new <strong>Volvo</strong> FMX will begin in Europe inSeptember, <strong>2010</strong>.Detailed information about the events is availableat www.volvogroup.com<strong>The</strong> second quarterInvestment in Indian facility for productionof excavatorsAs part of <strong>Volvo</strong> Construction Equipment’s (<strong>Volvo</strong>CE) objective of supporting customers in thegrowing BRIC (Brazil, Russia, India and China)markets, <strong>Volvo</strong> CE has announced a strategicinvestment in its existing facility in Bangalore,India. <strong>The</strong> investment, which totals around SEK144 M, will allow <strong>Volvo</strong> CE to produce mediumsizedexcavators at the plant. <strong>The</strong>se machines willprimarily be models for use in the Indian market.Production of the first machines is expected tostart by the end of 2011.Production of new medium-duty enginein India<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong>’s Indian joint venture company,VE Commercial Vehicles (VECV) is to invest atotal of SEK 480 M in the production of the<strong>Group</strong>’s new global medium-duty engine in India.<strong>The</strong> investment gives the <strong>Volvo</strong> <strong>Group</strong> a completefacility in India for machining and assembling thenew medium-duty engine, which will be introducedin the <strong>Group</strong>’s trucks and buses worldwidein the next few years. Through this investment, itwill be possible for the <strong>Volvo</strong> <strong>Group</strong> to locatemost of its production of medium-duty engines toVECV’s plant in Pithampur, India.Sale of <strong>Volvo</strong> Aero’s US service businessIn July it was announced that <strong>Volvo</strong> Aero hadsigned an agreement to sell its US subsidiary<strong>Volvo</strong> Aero Services. <strong>The</strong> sale had a negative24

impact of SEK 538 M on <strong>Volvo</strong> Aero’s operatingincome in <strong>2010</strong>. <strong>The</strong> sale of <strong>Volvo</strong> Aero Servicesis due to <strong>Volvo</strong> Aero’s strategy of focusing on itscore operations of developing and manufacturingcomponents for aircraft engines, combined withthe goal of reducing the company’s tied-up capital.<strong>The</strong> third quarterUD Trucks and Nissan Motor end collaborationon contract manufacturing of light-dutytrucks<strong>The</strong> collaboration between <strong>Volvo</strong> <strong>Group</strong>’s Japanesesubsidiary UD Trucks and Nissan Motor onthe contract manufacturing of light-duty truckswill expire and the production will end in January2011. <strong>The</strong> decision enables UD Trucks to focusmore on medium and heavy-duty trucks. UDTrucks will continue to have its own manufacturingoperation for light-duty trucks for the exportmarket. During 2009, UD Trucks produced 6,150light-duty trucks within the collaboration frameworkand up to August <strong>2010</strong>, 4,800 vehicles hadbeen produced and sold to Nissan Motor. <strong>The</strong>end of contract manufacturing for Nissan Motorwill not result in any restructuring costs or haveany significant impact on the <strong>Volvo</strong> <strong>Group</strong>’s earningsor financial position.<strong>The</strong> fourth quarter<strong>Volvo</strong> <strong>Group</strong> President and CEO LeifJohansson to resign in the summer of 2011After almost 14 years as President and CEO of<strong>Volvo</strong>, Leif Johansson in December informed theBoard of AB <strong>Volvo</strong> of his intention to resign inconjunction with his 60th birthday in the summerof 2011. At the same time Leif Johansson willalso leave the Board of AB <strong>Volvo</strong>.<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> enters partnership withWWF to reduce CO 2-emissions<strong>The</strong> <strong>Volvo</strong> <strong>Group</strong> will be the world’s first vehiclemanufacturer to join the World Wide Fund forNature’s (WWF) Climate Savers Program. As aWWF partner, the <strong>Volvo</strong> <strong>Group</strong>’s truck companiesundertake to reduce the CO 2-emissions fromvehicles manufactured between 2009 and 2014by 13 million tons. Independent technical expertswill oversee the results.Events after balance-sheet date<strong>Volvo</strong> part of investigation by EuropeanCommissionIn January 2011, <strong>Volvo</strong> <strong>Group</strong> and a number ofother companies in the truck industry havebecome part of an investigation by the EuropeanCommission regarding a possible violation of EUantitrust rules.Proposal for voluntary conversion ofseries A sharesIn a letter to AB <strong>Volvo</strong>’s Board of Directors aheadof the <strong>Annual</strong> General Meeting (AGM) on April 6this year, AB <strong>Volvo</strong>’s two largest shareholders –Renault S.A. and Industrivärden – have proposedan addendum to AB <strong>Volvo</strong>’s articles of associationthat would permit voluntary conversion ofseries A to series B shares.Corporate Governance <strong>Report</strong> <strong>Volvo</strong> has issueda corporate governance report which is separatefrom the annual report. <strong>The</strong> corporate governancereport is included in this document, after theannual report as such, on the pages 138–147.25