answer sheet for the second homework assignment

answer sheet for the second homework assignment

answer sheet for the second homework assignment

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

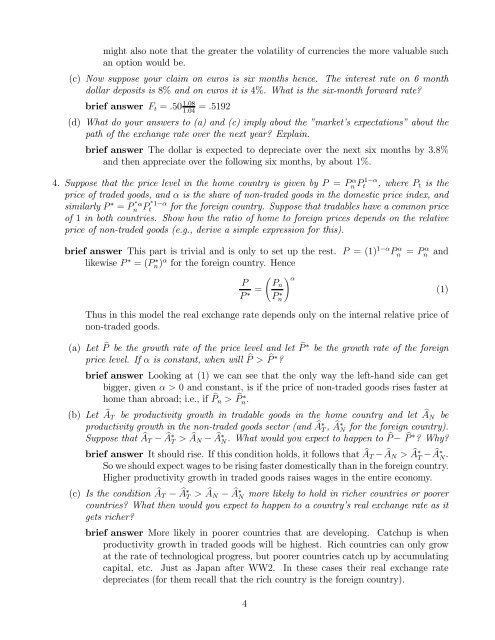

might also note that <strong>the</strong> greater <strong>the</strong> volatility of currencies <strong>the</strong> more valuable suchan option would be.(c) Now suppose your claim on euros is six months hence. The interest rate on 6 monthdollar deposits is 8% and on euros it is 4%. What is <strong>the</strong> six-month <strong>for</strong>ward rate?brief <strong>answer</strong> F t = .50 1.08 = .51921.04(d) What do your <strong>answer</strong>s to (a) and (c) imply about <strong>the</strong> ”market’s expectations” about <strong>the</strong>path of <strong>the</strong> exchange rate over <strong>the</strong> next year? Explain.brief <strong>answer</strong> The dollar is expected to depreciate over <strong>the</strong> next six months by 3.8%and <strong>the</strong>n appreciate over <strong>the</strong> following six months, by about 1%.4. Suppose that <strong>the</strong> price level in <strong>the</strong> home country is given by P = Pn α Pt1−α ,whereP t is <strong>the</strong>price of traded goods, and α is <strong>the</strong> share of non-traded goods in <strong>the</strong> domestic price index, andsimilarly P ∗ = P ∗ αn<strong>for</strong> <strong>the</strong> <strong>for</strong>eign country. Suppose that tradables have a common priceof 1 in both countries. Show how <strong>the</strong> ratio of home to <strong>for</strong>eign prices depends on <strong>the</strong> relativeprice of non-traded goods (e.g., derive a simple expression <strong>for</strong> this).P ∗ 1−αtbrief <strong>answer</strong> This part is trivial and is only to set up <strong>the</strong> rest. P =(1) 1−α Pn α = Pn α andlikewise P ∗ =(Pn) ∗ α <strong>for</strong> <strong>the</strong> <strong>for</strong>eign country. Henceà ! αPP = Pn(1)∗ Pn∗Thus in this model <strong>the</strong> real exchange rate depends only on <strong>the</strong> internal relative price ofnon-traded goods.(a) Let P b be <strong>the</strong> growth rate of <strong>the</strong> price level and let P b∗ be<strong>the</strong>growthrateof<strong>the</strong><strong>for</strong>eignprice level. If α is constant, when will P> b P b∗ ?brief <strong>answer</strong> Looking at (1) we can see that <strong>the</strong> only way <strong>the</strong> left-hand side can getbigger, given α>0 and constant, is if <strong>the</strong> price of non-traded goods rises faster athome than abroad; i.e., if P b n > P b n.∗(b) Let A b T be productivity growth in tradable goods in <strong>the</strong> home country and let A b N beproductivity growth in <strong>the</strong> non-traded goods sector (and A b∗ T , A b∗ N <strong>for</strong> <strong>the</strong> <strong>for</strong>eign country).Suppose that A b T − A b∗ T > A b N − A b∗ N. What would you expect to happen to P b − P b∗ ?Why?brief <strong>answer</strong> It should rise. If this condition holds, it follows that A b T −A b N > A b∗ T −A b∗ N.So we should expect wages to be rising faster domestically than in <strong>the</strong> <strong>for</strong>eign country.Higher productivity growth in traded goods raises wages in <strong>the</strong> entire economy.(c) Is <strong>the</strong> condition A b T − A b∗ T > A b N − A b∗ N more likely to hold in richer countries or poorercountries? What <strong>the</strong>n would you expect to happen to a country’s real exchange rate as itgets richer?brief <strong>answer</strong> More likely in poorer countries that are developing. Catchup is whenproductivity growth in traded goods will be highest. Rich countries can only growat <strong>the</strong> rate of technological progress, but poorer countries catch up by accumulatingcapital, etc. Just as Japan after WW2. In <strong>the</strong>se cases <strong>the</strong>ir real exchange ratedepreciates (<strong>for</strong> <strong>the</strong>m recall that <strong>the</strong> rich country is <strong>the</strong> <strong>for</strong>eign country).4