answer sheet for the second homework assignment

answer sheet for the second homework assignment

answer sheet for the second homework assignment

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

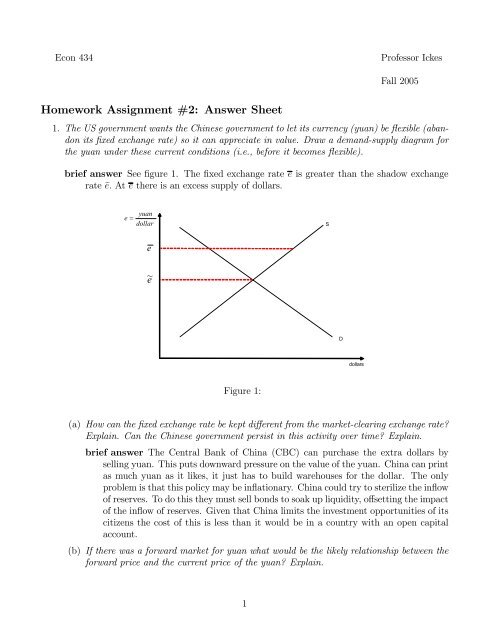

Econ 434Professor IckesFall 2005Homework Assignment #2: Answer Sheet1. The US government wants <strong>the</strong> Chinese government to let its currency (yuan) be flexible (abandonits fixed exchange rate) so it can appreciate in value. Draw a demand-supply diagram <strong>for</strong><strong>the</strong> yuan under <strong>the</strong>se current conditions (i.e., be<strong>for</strong>e it becomes flexible).brief <strong>answer</strong> See figure 1. The fixed exchange rate e is greater than <strong>the</strong> shadow exchangerate e. At e <strong>the</strong>re is an excess supply of dollars.e =yuandollarSee~DdollarsFigure 1:(a) How can <strong>the</strong> fixed exchange rate be kept different from <strong>the</strong> market-clearing exchange rate?Explain. Can <strong>the</strong> Chinese government persist in this activity over time? Explain.brief <strong>answer</strong> The Central Bank of China (CBC) can purchase <strong>the</strong> extra dollars byselling yuan. This puts downward pressure on <strong>the</strong> value of <strong>the</strong> yuan. China can printas much yuan as it likes, it just has to build warehouses <strong>for</strong> <strong>the</strong> dollar. The onlyproblem is that this policy may be inflationary. China could try to sterilize <strong>the</strong> inflowof reserves. To do this <strong>the</strong>y must sell bonds to soak up liquidity, offsetting <strong>the</strong> impactof <strong>the</strong> inflow of reserves. Given that China limits <strong>the</strong> investment opportunities of itscitizens <strong>the</strong> cost of this is less than it would be in a country with an open capitalaccount.(b) If <strong>the</strong>re was a <strong>for</strong>ward market <strong>for</strong> yuan what would be <strong>the</strong> likely relationship between <strong>the</strong><strong>for</strong>ward price and <strong>the</strong> current price of <strong>the</strong> yuan? Explain.1

ief <strong>answer</strong> The <strong>for</strong>ward price of <strong>the</strong> yuan should be higher than <strong>the</strong> current price ifinvestors expect <strong>the</strong> yuan to appreciate. How much depends on <strong>the</strong> probability that<strong>the</strong> CBC will let <strong>the</strong> yuan appreciate during <strong>the</strong> period.(c) What if <strong>the</strong> yuan were overvalued instead of undervalued? What problems would <strong>the</strong>Central Bank of China face if it tried to maintain <strong>the</strong> pegged rate?brief <strong>answer</strong> In this case e

TQ 0PC ~ P 0Figure 2:NXPNT3. Suppose that you are a US exporter expecting to receive a payment of 100 euros in 12 months.The one-year interest rate on euro deposits is 5% per annum, and <strong>the</strong> one-year interest rateon dollar deposits is 8%. The present spot exchange rate is $0.50 per euro.(a) What is <strong>the</strong> one-year <strong>for</strong>ward exchange rate?1+ibrief <strong>answer</strong> Covered interest parity implies that F t = e t ,sowehaveF1+i ∗ t = .50 1.08 = 1.05.5142. The dollar is expected to depreciate, that is why domestic interest rates exceedeuro rates.(b) Assuming that you ultimately need dollars, describe at least two ways you can coveryourself from <strong>the</strong> exchange rate risk.brief <strong>answer</strong> You could purchase <strong>the</strong> dollars <strong>for</strong> delivery in one year with a <strong>for</strong>wardcontract. This would involve a contract with a commercial bank. At <strong>the</strong> end of <strong>the</strong>year you deliver euros and get dollars at <strong>the</strong> price of <strong>the</strong> contract today. Alternatively,you could purchase a one year ahead futures contract. This is also a commitmentto buy <strong>for</strong>eign exchange at a given price, but it is traded on a centralized market infixed sizes. At <strong>the</strong> end of <strong>the</strong> year you are committed to trade euros <strong>for</strong> dollars at<strong>the</strong> price you contracted <strong>for</strong> today. Notice that if <strong>the</strong> dollar ended up depreciatingby more than <strong>the</strong> 2.8% that was anticipated, <strong>the</strong> actual spot price next year will beeven higher than .5142. So had you not hedged you would be able to convert <strong>the</strong>euros back into even more dollars. But you still hedged <strong>the</strong> risk. 1 But <strong>the</strong>re is a thirdway to hedge <strong>the</strong> risk: purchasing a currency option. This gives you <strong>the</strong> right to selleuros <strong>for</strong> dollars at a fixed rate, but it is not an obligation. If <strong>the</strong> euro appreciatedmore than expected you could walk away from <strong>the</strong> option. If <strong>the</strong> dollar appreciated,on <strong>the</strong> o<strong>the</strong>r hand, <strong>the</strong> option would protect you from <strong>the</strong> currency risk. Notice thatyou have to pay something <strong>for</strong> this insurance. That is <strong>the</strong> price of <strong>the</strong> option. You1 If you drive to school and don’t have an accident it does not mean you wasted your money on car insurance.3

might also note that <strong>the</strong> greater <strong>the</strong> volatility of currencies <strong>the</strong> more valuable suchan option would be.(c) Now suppose your claim on euros is six months hence. The interest rate on 6 monthdollar deposits is 8% and on euros it is 4%. What is <strong>the</strong> six-month <strong>for</strong>ward rate?brief <strong>answer</strong> F t = .50 1.08 = .51921.04(d) What do your <strong>answer</strong>s to (a) and (c) imply about <strong>the</strong> ”market’s expectations” about <strong>the</strong>path of <strong>the</strong> exchange rate over <strong>the</strong> next year? Explain.brief <strong>answer</strong> The dollar is expected to depreciate over <strong>the</strong> next six months by 3.8%and <strong>the</strong>n appreciate over <strong>the</strong> following six months, by about 1%.4. Suppose that <strong>the</strong> price level in <strong>the</strong> home country is given by P = Pn α Pt1−α ,whereP t is <strong>the</strong>price of traded goods, and α is <strong>the</strong> share of non-traded goods in <strong>the</strong> domestic price index, andsimilarly P ∗ = P ∗ αn<strong>for</strong> <strong>the</strong> <strong>for</strong>eign country. Suppose that tradables have a common priceof 1 in both countries. Show how <strong>the</strong> ratio of home to <strong>for</strong>eign prices depends on <strong>the</strong> relativeprice of non-traded goods (e.g., derive a simple expression <strong>for</strong> this).P ∗ 1−αtbrief <strong>answer</strong> This part is trivial and is only to set up <strong>the</strong> rest. P =(1) 1−α Pn α = Pn α andlikewise P ∗ =(Pn) ∗ α <strong>for</strong> <strong>the</strong> <strong>for</strong>eign country. Henceà ! αPP = Pn(1)∗ Pn∗Thus in this model <strong>the</strong> real exchange rate depends only on <strong>the</strong> internal relative price ofnon-traded goods.(a) Let P b be <strong>the</strong> growth rate of <strong>the</strong> price level and let P b∗ be<strong>the</strong>growthrateof<strong>the</strong><strong>for</strong>eignprice level. If α is constant, when will P> b P b∗ ?brief <strong>answer</strong> Looking at (1) we can see that <strong>the</strong> only way <strong>the</strong> left-hand side can getbigger, given α>0 and constant, is if <strong>the</strong> price of non-traded goods rises faster athome than abroad; i.e., if P b n > P b n.∗(b) Let A b T be productivity growth in tradable goods in <strong>the</strong> home country and let A b N beproductivity growth in <strong>the</strong> non-traded goods sector (and A b∗ T , A b∗ N <strong>for</strong> <strong>the</strong> <strong>for</strong>eign country).Suppose that A b T − A b∗ T > A b N − A b∗ N. What would you expect to happen to P b − P b∗ ?Why?brief <strong>answer</strong> It should rise. If this condition holds, it follows that A b T −A b N > A b∗ T −A b∗ N.So we should expect wages to be rising faster domestically than in <strong>the</strong> <strong>for</strong>eign country.Higher productivity growth in traded goods raises wages in <strong>the</strong> entire economy.(c) Is <strong>the</strong> condition A b T − A b∗ T > A b N − A b∗ N more likely to hold in richer countries or poorercountries? What <strong>the</strong>n would you expect to happen to a country’s real exchange rate as itgets richer?brief <strong>answer</strong> More likely in poorer countries that are developing. Catchup is whenproductivity growth in traded goods will be highest. Rich countries can only growat <strong>the</strong> rate of technological progress, but poorer countries catch up by accumulatingcapital, etc. Just as Japan after WW2. In <strong>the</strong>se cases <strong>the</strong>ir real exchange ratedepreciates (<strong>for</strong> <strong>the</strong>m recall that <strong>the</strong> rich country is <strong>the</strong> <strong>for</strong>eign country).4