Homework Assignment #1: Answer Key

Homework Assignment #1: Answer Key

Homework Assignment #1: Answer Key

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Econ 497A<br />

Energy Economics and Energy Security<br />

Professor Ickes<br />

Fall 2011<br />

<strong>Homework</strong> <strong>Assignment</strong> <strong>#1</strong>: <strong>Answer</strong> <strong>Key</strong><br />

1. Suppose that the aggregate production function for the economy, = ( ) was Leontief<br />

— that is the elasticity of substitution between and was zero. What does this imply<br />

Brief <strong>Answer</strong> Zero elasticity of substitution means that there are no possibilities of substituting<br />

inputs. Isoquants are L-shaped. We could write =min ³ <br />

´ <br />

where and are<br />

technologically determined constants. Notice that is thus equal to the unit requirements<br />

of capital per unit of output, for example. Suppose doubles but remains constant.<br />

Then output will not increase.<br />

(a) Now suppose that one of the factors, say , became increasingly scarce. What would<br />

happen to the share of national income that would go to labor over time Explain.<br />

brief answer If labor becomes increasingly scare the wage will increase relative to the<br />

priceofcapital. Sinceincomecannotincreaseif is fixed must increase. So<br />

<br />

labor’s share of income is rising.<br />

(b) Suppose that the elasticity of substitution was extremely high (close to infinity). What<br />

would this imply about the returns going to labor if it became exceedingly scarce Explain.<br />

brief answer If the elasticity of substitution () is extremely high then it is easy to<br />

substitute capital for labor. The production function with = ∞ leads to an isoquant<br />

that is linear. So the production function could be written as = + . Wecan<br />

substitute for without any changes in their marginal products. So the prices of<br />

the factors will not change. If is increasing due to labor scarcity, but it is easy to<br />

<br />

substitute capital for labor, the wage will not rise relative to the price of capital, so<br />

will fall.<br />

<br />

<br />

(c) Now suppose that as labor became more scarce its share of national income was unchanged.<br />

What would the elasticity of substitution be in this case<br />

brief answer If the share of national income is unchanged when labor becomes more<br />

scarce it must mean that the wage must rise in exact proportion to the fall in labor.<br />

Obviously this means that 0 ∞, from our answers to parts a and b. More<br />

specifically, it means that =1 The elasticity of substitution is the elasticity of the<br />

ratio of two inputs to a production function with respect to the ratio of their marginal<br />

products. If the ratio of the marginal products changes exactly in proportion to the<br />

ratio of the inputs then =1<br />

1

2. (This question appears more difficult than it really is. Just read carefully, and follow along.<br />

There are no mysteries here, but some interesting ideas.) Consider an economy with a production<br />

function, = ( ) 1−− ,where is resources used in production, all other<br />

variables are as usual, and are positive and + 1. Labor supply grows at the constant<br />

rate, , and grows at the constant rate . We consume resources over time, so the growth<br />

rate of ( ∆ )=−, where is a positive constant. From the production function it follows<br />

<br />

that the growth rate of income is given by:<br />

= + +(1− − )[ + ] (1)<br />

where isthegrowthrateofincomeattime, etc. We are interested in a balanced growth<br />

path where all the variables are growing at a constant rate and and grow at the same<br />

rate. Using (1) solve for the balanced growth rate of income, <br />

in terms of the parameters<br />

of the model. Show that <br />

is increasing in , for example.<br />

brief answer By definition on a balanced growth path and aregrowingatthesamerate.<br />

So = so using this in (1) we have:<br />

<br />

= <br />

+ +(1− − )[ + ]<br />

= <br />

− +(1− − )[ + ] (2)<br />

where the second line follows from the definitions of the growth rates in the problem.<br />

Solving (2) for <br />

yields:<br />

<br />

<br />

− <br />

= (1− − )[ + ] − <br />

(1 − − )[ + ] − <br />

=<br />

1 − <br />

addition after class, Sept 22 I really should not have asked you do show that <br />

is increasing<br />

in First, you would need calculus which is not required for the course, and<br />

second if you did differentiate (3) with respect to you would find it is negative not<br />

positive. What I meant to ask is show that <br />

is increasing in or and decreasing in<br />

That would have been a better and easier question. I will grade accordingly.<br />

(a) What happens to <br />

<br />

if increases. Why How does <br />

vary with <br />

brief answer If increases resources are declining at a faster rate. From (3) it is<br />

apparent that <br />

falls. We can also see that if rises, so growth is more sensitive<br />

to resources, then <br />

also falls.<br />

(b) The growth rate of output per worker is just − , so using your expression for <br />

<br />

what is the expression for the growth rate of output per worker on the balanced growth<br />

path, <br />

<br />

Is this necessarily positive Explain.<br />

brief answer Start with (3), and note that − = − , so<br />

<br />

− ≡ − +(1− − )[ + ]<br />

<br />

= − <br />

1 − <br />

− +(1− − )[ + ]<br />

= − 1 − <br />

1 − <br />

1 − <br />

2<br />

(3)

=<br />

− +(1− − )[ + ] − (1 − )<br />

1 − <br />

=<br />

− +(1− − ) − <br />

1 − <br />

=<br />

(1 − − ) − ( + )<br />

1 − <br />

(4)<br />

from (4) it is apparent that the numerator can be positive or negative. If → 0<br />

then <br />

<br />

is necessarily positive. If 0 then <br />

<br />

could be negative if resources<br />

growth is sufficiently negative, for example. That is if is large enough. Intuitively,<br />

if growth is sensitive to resources large and if resources are getting more scarce, it<br />

can offset the benefits of technical progress, .<br />

(c) Suppose there were resources were not fixed; instead suppose that they grow at the same<br />

rate as population, so ∆<br />

<br />

= . What would your expression for the balanced growth<br />

path of output per worker (call it e <br />

)looklikenow<br />

brief answer Now resources are growing, so replace − with in (4), so we have<br />

e (1 − − ) − ( − )<br />

<br />

=<br />

1 − <br />

(1 − − )<br />

= (5)<br />

1 − <br />

Resource growth is exactly offsetting the impact of labor growth in the expression.<br />

Now the growth rate of per-capita income on the balanced growth path is necessarily<br />

positive, because resources are always being augmented, and this offsets the negative<br />

impact of population growth on per-capita income growth.<br />

(d) Define the ”growth drag” from finite resources as the differencebetweengrowthinthe<br />

hypothetical case of part (c) and the actual case of part (b). That is = e <br />

− .<br />

What is equal to Why is this likely to be a pretty small number<br />

brief answer Using (4) and (5) we have<br />

=<br />

=<br />

(1 − − )<br />

−<br />

1 − <br />

( + )<br />

1 − <br />

(1 − − ) − ( + )<br />

1 − <br />

Parameters and are growth rates, numbers like 03 or something, is capital’s<br />

share something like .4 or something, and is by definition less than one. So the<br />

numerator is on the order of (2)(02 + 03) = 01 so is equal to something like<br />

1<br />

(01) ≈ 00167. Per-capita income growth tends to be much larger — at least an<br />

1−4<br />

order of magnitude; for example, in the US per-capita income growth has averaged<br />

about 2% since 1959. The key point is that the drag from resources is likely to be<br />

small, as long as is not very large.<br />

(e) Expression (1) seems to indicate that if income is growing today, it will continue to grow<br />

even as → 0. Why is this the case in this model What does the production function<br />

imply about the elasticity of substitution<br />

(6)<br />

3

ief answer It must mean that the elasticity of substitution is at least unity. We can<br />

substitute other inputs for declining resources without output falling. In fact, the<br />

production function we have chosen has =1. We have assumed that resources are<br />

notabindingconstraintongrowth. Butif1 then the share going to resource<br />

owners would rise as resources became more scarce — in other words, would increase<br />

as declined. So would not be a constant in (6), and thus your answer to part d<br />

understates the effect of declining resources in the case where substitution is difficult.<br />

We know from problem 1 that if production was Leontief then the share of national<br />

income that would go to resource owners would increase dramatically as → 0<br />

As your analysis in problem 1 shows, if =0then the share of income that goes<br />

tothescarceresourcegoesto100%,so −→ 1, and the drag approaches + ,<br />

which would overwhelm all sources of growth (it would still be true if 0 1).<br />

This is clearly a result that is consistent with the apocalyptic intuition about resource<br />

scarcity. When I wrote the production function as = ( ) 1−− I, in fact,<br />

assumed that =1(with such a production function, called Cobb-Douglas, the factor<br />

shares are independent of the capital labor ratio), as the shares and are constant.<br />

But, in fact, we know that the share of income going to resource owners has actually<br />

been falling in the US during the 20th century (real oil prices, for example, have<br />

been roughly constant and energy consumption per unit of GDP has been falling).<br />

So rather than 1 it seems almost certain that 1, and that the small drag<br />

computed in part d is closer to the truth.<br />

3. Consider the basic Hotelling model of exhaustible resources. Assume a competitive economy<br />

with many producers, a fixed cost of extraction, , and a choke price, . The rate of interest<br />

is given at rate . What happens to the extraction path of the resource (the plot of output,<br />

,againsttime)if:<br />

(a) the rate of interest falls.<br />

brief answer In class we analyzed a rise in , so this case is exactly opposite. If <br />

falls, it is all of a sudden better to keep a dollar’s worth of oil in the ground than a<br />

dollar in the bank. So oil production falls. This causes 0 to rise and 0 to fall. The<br />

Hotelling Rule requires that net rent grows at the rate of interest which is now lower.<br />

So clearly the time to exhaustion must rise. If price starts lower than before, and if<br />

it grows slower than before, it must take longer to reach Economically, the present<br />

value of future production has increased, so we should shift extraction towards the<br />

future (see figure 1).<br />

(b) the demand for the resource increases suddenly.<br />

brief answer If the choke price remains unchanged this means that the demand curve<br />

becomes flatter — greater demand at any price below In the case of the inverse<br />

demand curve used in class, = − , this means that falls. If the price path<br />

did not change we would extract more very period and total production would exceed<br />

. So 0 must rise to dampen down the quantity demanded. Since prices still grow<br />

at the rate it follows that 0 must also rise. If not, then we would reach before<br />

exhaustion. You can also see this from the expression we derived in class for output:<br />

= [1 − (1 + )− ],soif falls is higher. But this means that we must reach<br />

4

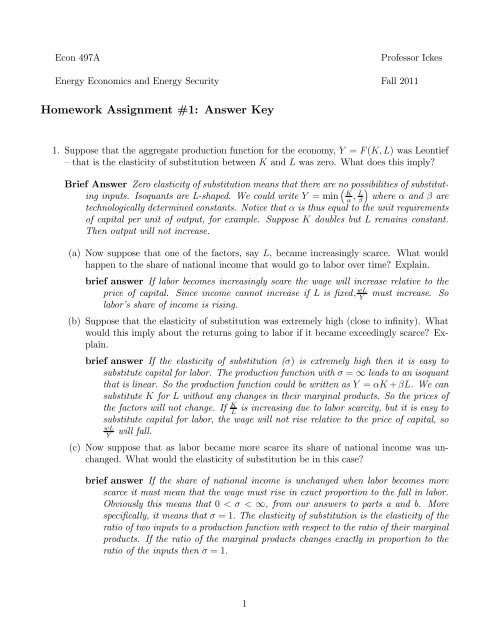

q t<br />

q 0<br />

initial optimal<br />

extraction path<br />

q <br />

0<br />

new optimal<br />

extraction path<br />

T<br />

T '<br />

t<br />

Figure 1: Shift in the Extraction Path<br />

exhaustion at a lower , so the new extraction path must have higher 0 and lower<br />

.<br />

(c) the choke price falls<br />

brief answer This means that is lower. If the price path were unchanged we would end<br />

up with extra oil which cannot be optimal. So 0 must fall and 0 must increase. The<br />

time to exhaustion must also fall, since reaches the new lower in less periods.<br />

So 0 rises and falls.<br />

(d) a tax on the sales (gross revenue) of the resource, per barrel is imposed on producers.<br />

brief answer This is a tax on revenues, not on rents. So the producer is now equating<br />

(1 − ) − = (1 − ) +1 − <br />

1+<br />

(7)<br />

thetaxisclearlynotneutral(asitwouldbeifthetaxwereonrents,thenwecould<br />

cancel out the (1 − ) terms). The impact of the tax is to lower the present value<br />

of current profits relative to future profits, as the left-hand side of (7) fall by more<br />

than the RHS. So the producer wants to produce less in the current period. So 0<br />

falls. Since production is moved to the future the time to exhaustion must rise, since<br />

prices still rise at the rate of interest.<br />

(e) a new discovery of oil takes place that doubles reserves.<br />

brief answer If reserves now equal 2, then production must rise. But if the choke<br />

price is unchanged and prices grow at the rate of interest, then 0 must rise and <br />

must increase as wellhso that the total amount of production Σ =0 −1 must rise. But<br />

we know that = i 2 1 − (1 + )<br />

−<br />

then the sum of production is given by:<br />

Σ =0 −1 = Σ =0<br />

−1 <br />

2 [1 − (1 + )− ]=<br />

so if doubles, and is given, the only thing that can rise is .<br />

5