Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

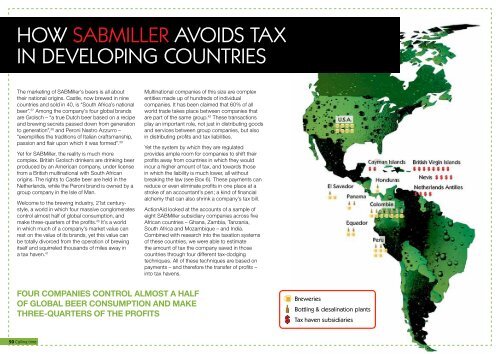

xxx how SABMiller AvoidS tAx<br />

in developinG CountrieS<br />

The marketing of SABMiller’s beers is all about<br />

their national origins. Castle, now brewed in nine<br />

countries and sold in 40, is “South Africa’s national<br />

beer”. 37 Among the company’s four global brands<br />

are Grolsch – “a true Dutch beer based on a recipe<br />

and brewing secrets passed down from generation<br />

to generation”, 38 and Peroni Nastro Azzurro –<br />

“exemplifies the traditions of Italian craftsmanship,<br />

passion and flair upon which it was formed”. 39<br />

Yet for SABMiller, the reality is much more<br />

complex. British Grolsch drinkers are drinking beer<br />

produced by an American company, under license<br />

from a British multinational with South African<br />

origins. The rights to Castle beer are held in the<br />

Netherlands, while the Peroni brand is owned by a<br />

group company in the Isle of Man.<br />

Welcome to the brewing industry, 21st centurystyle,<br />

a world in which four massive conglomerates<br />

control almost half of global consumption, and<br />

make three-quarters of the profits. 40 It’s a world<br />

in which much of a company’s market value can<br />

rest on the value of its brands, yet this value can<br />

be totally divorced from the operation of brewing<br />

itself and squirreled thousands of miles away in<br />

a tax haven. 41<br />

fouR CoMPAnIeS ConTRol AlMoST A hAlf<br />

of globAl beeR ConSuMPTIon AnD MAke<br />

ThRee-quARTeRS of The PRofITS<br />

20 <strong>Calling</strong> time<br />

Multinational companies of this size are complex<br />

entities made up of hundreds of individual<br />

companies. It has been claimed that 60% of all<br />

world trade takes place between companies that<br />

are part of the same group. 42 These transactions<br />

play an important role, not just in distributing goods<br />

and services between group companies, but also<br />

in distributing profits and tax liabilities.<br />

Yet the system by which they are regulated<br />

provides ample room for companies to shift their<br />

profits away from countries in which they would<br />

incur a higher amount of tax, and towards those<br />

in which the liability is much lower, all without<br />

breaking the law (see Box 6). These payments can<br />

reduce or even eliminate profits in one place at a<br />

stroke of an accountant’s pen; a kind of financial<br />

alchemy that can also shrink a company’s tax bill.<br />

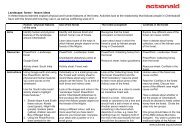

<strong>ActionAid</strong> looked at the accounts of a sample of<br />

eight SABMiller subsidiary companies across five<br />

African countries – Ghana, Zambia, Tanzania,<br />

South Africa and Mozambique – and India.<br />

Combined with research into the taxation systems<br />

of these countries, we were able to estimate<br />

the amount of tax the company saved in those<br />

countries through four different tax-dodging<br />

techniques. All of these techniques are based on<br />

payments – and therefore the transfer of profits –<br />

into tax havens.<br />

Breweries<br />

Bottling & desalination plants<br />

Tax haven subsidiaries