Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

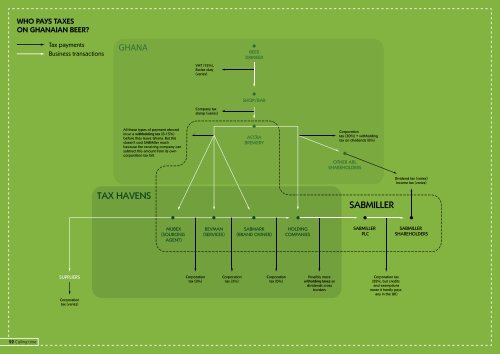

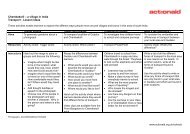

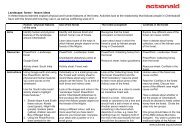

Who pays taxes<br />

on Ghanaian Beer?<br />

22 <strong>Calling</strong> time<br />

Tax payments<br />

Business transactions<br />

SUPPLIERS<br />

Corporation<br />

tax (varies)<br />

GHANA<br />

All these types of payment abroad<br />

incur a withholding tax (8-15%)<br />

before they leave Ghana. But this<br />

doesn’t cost SABMiller much<br />

because the receiving company can<br />

subtract this amount from its own<br />

corporation tax bill.<br />

TAX HAVENS<br />

MUBEX<br />

(SOURCING<br />

AGENT)<br />

VAT (15%),<br />

Excise duty<br />

(varies)<br />

Company tax<br />

stamp (varies)<br />

Corporation<br />

tax (8%)<br />

BEVMAN<br />

(SERVICES)<br />

Corporation<br />

tax (3%)<br />

BEER<br />

DRINKER<br />

SHOP/BAR<br />

ACCRA<br />

BREWERY<br />

SABMARK<br />

(BRAND OWNER)<br />

Corporation<br />

tax (0%)<br />

HOLDING<br />

COMPANIES<br />

Possibly more<br />

witholding taxes as<br />

dividends cross<br />

borders<br />

Corporation<br />

tax (30%) + withholding<br />

tax on dividends (8%)<br />

OTHER ABL<br />

SHAREHOLDERS<br />

SABMILLER<br />

SABMILLER<br />

PLC<br />

Corporation tax<br />

(28%, but credits<br />

and exemptions<br />

mean it hardly pays<br />

any in the UK)<br />

Dividend tax (varies)<br />

Income tax (varies)<br />

SABMILLER<br />

SHAREHOLDERS