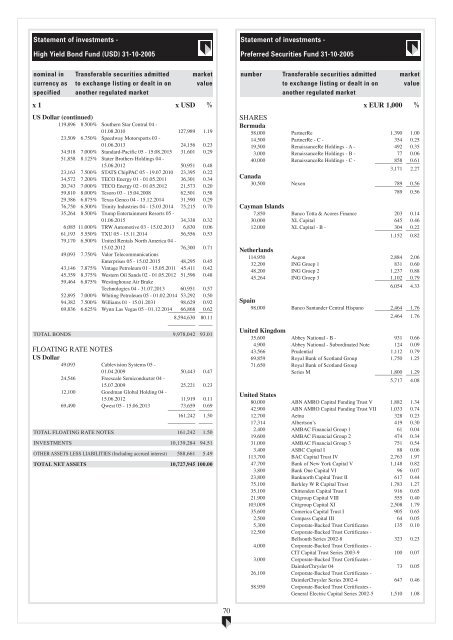

Statement of investments -High Yield Bond Fund (USD) 31-10-2005Statement of investments -Preferred Securities Fund 31-10-2005nominal incurrency asspecifiedTransferable securities admittedto exchange listing or dealt in onanother regulated marketmarketvaluex 1 x USD %US Dollar (continued)119,896 8.500% Southern Star Central 04 -01.08.2010 127,989 1.1923,509 6.750% Speedway Motorsports 03 -01.06.2013 24,156 0.2334,918 7.000% Standard-Pacific 05 - 15.08.2015 31,601 0.2951,858 8.125% Stater Brothers Holdings 04 -15.06.2012 50,951 0.4823,163 7.500% STATS ChipPAC 05 - 19.07.2010 23,395 0.2234,572 7.200% TECO Energy 01 - 01.05.2011 36,301 0.3420,743 7.000% TECO Energy 02 - 01.05.2012 21,573 0.2059,810 8.000% Tesoro 03 - 15.04.2008 62,501 0.5829,386 6.875% Texas Genco 04 - 15.12.2014 31,590 0.2976,750 6.500% Trinity Industries 04 - 15.03.2014 75,215 0.7035,264 8.500% Trump Entertainment Resorts 05 -01.06.2015 34,338 0.326,085 11.000% TRW Automotive 03 - 15.02.2013 6,830 0.0661,193 5.550% TXU 05 - 15.11.2014 56,556 0.5379,170 6.500% United Rentals North America 04 -15.02.2012 76,300 0.7149,093 7.750% Valor TelecommunicationsEnterprises 05 - 15.02.2015 48,295 0.4543,146 7.875% Vintage Petroleum 01 - 15.05.2011 45,411 0.4245,359 8.375% Western Oil Sands 02 - 01.05.2012 51,596 0.4859,464 6.875% Westinghouse Air BrakeTechnologies 04 - 31.07.2013 60,951 0.5752,895 7.000% Whiting Petroleum 05 - 01.02.2014 53,292 0.5094,382 7.500% Williams 01 - 15.01.2031 98,629 0.9269,836 6.625% Wynn Las Vegas 05 - 01.12.2014 5555 66,868 55 0.628,594,630 80.115555 55TOTAL BONDS 9,978,042 93.01FLOATING RATE NOTESUS Dollar49,093 Cablevision Systems 05 -01.04.2009 50,443 0.4724,546 Freescale Semiconductor 04 -15.07.2009 25,221 0.2312,100 Goodman Global Holding 04 -15.06.2012 11,919 0.1169,490 Qwest 05 - 15.06.2013 73,659 0.695555 55161,242 1.505555 55TOTAL FLOATING RATE NOTES 161,242 1.50INVESTMENTS 10,139,284 94.51OTHER ASSETS LESS LIABILITIES (Including accrued interest) 588,661 5.49TOTAL NET ASSETS 10,727,945 100.00numberTransferable securities admittedto exchange listing or dealt in onanother regulated marketmarketvaluex EUR 1,000 %SHARESBermuda58,000 PartnerRe 1,390 1.0014,500 PartnerRe - C - 354 0.2519,500 RenaissanceRe Holdings - A - 492 0.353,000 RenaissanceRe Holdings - B - 77 0.0640,000 RenaissanceRe Holdings - C - 5555 858 55 0.613,171 2.27Canada30,500 Nexen 5555 789 55 0.56789 0.56Cayman Islands7,850 Banco Totta & Acores Finance 203 0.1430,000 XL Capital 645 0.4612,000 XL Capital - B - 5555 304 55 0.221,152 0.82Netherlands114,950 Aegon 2,884 2.0632,200 ING Groep 1 831 0.6048,200 ING Groep 2 1,237 0.8845,264 ING Groep 3 5555 1,102 55 0.796,054 4.33Spain98,000 Banco Santander Central Hispano 5555 2,464 55 1.762,464 1.76United Kingdom35,600 Abbey National - B - 931 0.664,900 Abbey National - Subordinated Note 124 0.0943,566 Prudential 1,112 0.7969,859 Royal Bank of Scotland Group 1,750 1.2571,650 Royal Bank of Scotland GroupSeries M 5555 1,800 55 1.295,717 4.08United States80,000 <strong>ABN</strong> <strong>AMRO</strong> Capital Funding Trust V 1,882 1.3442,900 <strong>ABN</strong> <strong>AMRO</strong> Capital Funding Trust VII 1,033 0.7412,700 Aetna 328 0.2317,314 Albertson’s 419 0.302,400 AMBAC Financial Group 1 61 0.0419,600 AMBAC Financial Group 2 474 0.3431,000 AMBAC Financial Group 3 751 0.543,400 ASBC Capital I 88 0.06113,700 BAC Capital Trust IV 2,763 1.9747,700 Bank of New York Capital V 1,148 0.823,800 Bank One Capital VI 96 0.0723,800 Banknorth Capital Trust II 617 0.4475,100 Berkley W R Capital Trust 1,783 1.2735,100 Chittenden Capital Trust I 916 0.6521,900 Citigroup Capital VIII 555 0.40103,009 Citigroup Capital XI 2,508 1.7935,600 Comerica Capital Trust I 905 0.652,500 Compass Capital III 64 0.055,300 Corporate-Backed Trust Certificates 135 0.1012,500 Corporate-Backed Trust Certificates -Bellsouth Series 2002-8 323 0.234,000 Corporate-Backed Trust Certificates -CIT Capital Trust Series 2003-9 100 0.073,000 Corporate-Backed Trust Certificates -DaimlerChrysler 04 73 0.0526,100 Corporate-Backed Trust Certificates -DaimlerChrysler Series 2002-4 647 0.4658,950 Corporate-Backed Trust Certificates -General Electric Capital Series 2002-5 1,510 1.0870

Statement of investments -Preferred Securities Fund 31-10-2005Statement of investments -Preferred Securities Fund 31-10-2005numberTransferable securities admittedto exchange listing or dealt in onanother regulated marketmarketvaluex EUR 1,000 %United States (continued)3,300 Corporate-Backed Trust Certificates -Series 2001-7 85 0.0630,400 Corporate-Backed Trust Certificates -Series 2002-1 320 0.2311,200 Corporate-Backed Trust Certificates -Verizon Global FundingSeries 2002-16 298 0.217,500 Corts Trust for Bellsouth Capital 191 0.1428,300 Corts Trust for Bristol Meyers Squibb 725 0.525,600 Corts Trust for DaimlerChrysler 137 0.103,100 Corts Trust forFirst Union Institutional Capital I 1 86 0.064,200 Corts Trust forFirst Union Institutional Capital I 2 108 0.084,300 CORTS Trust for General Electric Capital 105 0.084,100 Corts Trust for Goldman Sachs Capital I - A - 97 0.0711,500 Corts Trust for Safeco Capital Trust I 334 0.245,000 Corts Trust for Safeco Capital Trust II 130 0.095,800 Corts Trust for Verizon Global Funding 152 0.119,500 Corts Trust for WR Berkley 249 0.1836,900 Corts Trust II forBellsouth Telecommunications 950 0.684,700 Corts Trust II for Goldman Sachs Capital I 110 0.083,000 Corts-First Union Cap II 76 0.053,200 Corts-IBM 84 0.062,000 Corts-IBM 1 52 0.046,500 Corts-IBM 2 168 0.125,600 Corts-IBM 3 148 0.1122,800 Corts-Trust for Sherwin-Williams 587 0.422,800 Countrywide Financial 69 0.0510,800 Delphi Financial Group 282 0.207,800 Dominion CNG Capital Trust I 199 0.1410,300 Energy East Capital Trust I 262 0.1941,000 Everest Re Capital Trust II 912 0.652,200 Financial Security Assurance Holdings 56 0.0490,112 Financial Security Assurance Holdings 2 2,246 1.601,000 Fleet Capital Trust VII 25 0.025,000 General Electric Capital 124 0.095,200 Georgia Power 129 0.0943,963 Georgia Power - Series O 1,076 0.7780,000 Georgia Power - Series X 1,984 1.422,000 Georgia Power Capital Trust VII 48 0.03108,200 Hartford Capital III 2,756 1.978,600 Hartford Life Capital II 220 0.1611,400 Household Capital Trust VII 294 0.218,700 HSBC Finance 214 0.1518,300 JP Morgan Chase Capital X 471 0.3456,625 JP Morgan Chase Capital XIV 1,379 0.9818,875 JPMChase Capital IX 469 0.3360,600 Lehman Brothers Holdings Capital Trust III 1,488 1.0647,400 Lehman Brothers Holdings Capital Trust IV 1,153 0.8267,100 Lehman Brothers Holdings Capital Trust V 1,573 1.1211,400 Lincoln National Capital V 295 0.2119,000 Lincoln National Capital VI 486 0.3540,000 Merrill Lynch Preferred Capital Trust III 1,021 0.7348,578 Merrill Lynch Preferred Capital Trust IV 1,257 0.9027,000 Merrill Lynch Preferred Capital Trust V 702 0.508,900 Metlife 216 0.1529,500 Morgan Stanley Capital Trust II 745 0.5346,036 Morgan Stanley Capital Trust III 1,126 0.8074,565 Morgan Stanley Capital Trust V 1,706 1.223,000 National Commerce Capital Trust II 79 0.065,300 National Rural Utilities Cooperative Finance 1 134 0.104,200 National Rural Utilities Cooperative Finance 2 106 0.089,400 National Rural Utilities Cooperative Finance 3 239 0.1734,500 National Rural Utilities Cooperative Finance 4 838 0.6058,200 National Rural Utilities Cooperative Finance 5 1,398 1.001,800 Partner Re Capital Trust I 46 0.0310,300 PLC Capital Trust III 265 0.192,300 PLC Capital Trust V 57 0.04numberTransferable securities admittedto exchange listing or dealt in onanother regulated marketmarketvaluex EUR 1,000 %United States (continued)11,200 PMI Group 277 0.2016,800 PNC Capital Trust D 405 0.291,100 Preferred Plus TR-CCR1 29 0.029,100 Preferred Plus TR-CCR1 -Bellsouth Telecommunication 236 0.173,800 Preferred Plus TR-CCR1 - Goldman Sachs 90 0.069,100 Preferredplus Trust Series MSD-1 231 0.172,400 Public Credit & Repackaged Securities Trust 61 0.0427,300 Public Service Co of Oklahoma 684 0.495,000 SATURNS - AT&T Wireless 135 0.107,800 SATURNS - Bellsouth Capital Series 2001-3 200 0.1446,900 SATURNS - Goldman Sachs Series 2004-06 1,087 0.7810,000 SATURNS - Goldman Sachs Series 2004-2 231 0.165,200 SATURNS - IBM Series 2001-1 135 0.108,500 SATURNS - Safeco 223 0.161,100 SATURNS - Safeco Series 2001-7 29 0.027,700 SATURNS - Verizon GlobalFunding Series 2004-1 189 0.1325,655 SBC Communications 652 0.4745,600 SLM 1,097 0.7834,900 St Paul Capital Trust I 883 0.6324,200 Telephone & Data Systems Series A 616 0.4498,545 Tennessee Valley Authority 2,461 1.764,000 Torchmark Capital Trust II 102 0.0717,000 Trust Certificates 2001-2 439 0.311,300 US Cellular 1 35 0.0318,700 US Cellular 2 489 0.3511,300 USB Capital IV 286 0.20122,600 USB Capital V 2,812 2.014,000 Verizon South 100 0.0758,900 Viacom 1,485 1.0625,000 Virginia Power Capital Trust II 637 0.461,900 VNB Capital Trust I 49 0.0380,000 Wells Fargo Capital IX 1,862 1.333,000 Wells Fargo Capital V 555577 55 0.0570,840 50.595555 55TOTAL SHARES 90,187 64.4171