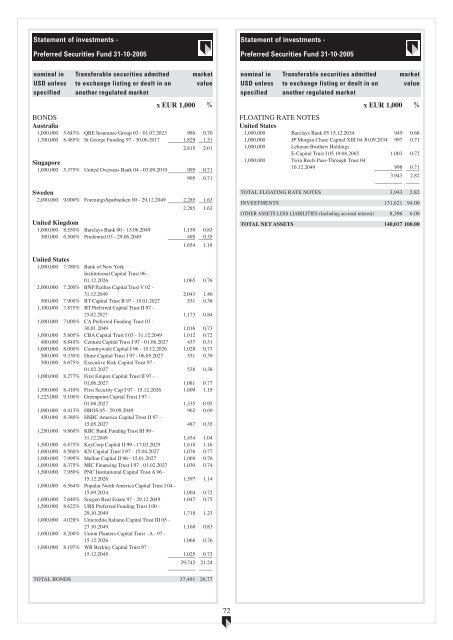

Statement of investments -Preferred Securities Fund 31-10-2005Statement of investments -Preferred Securities Fund 31-10-2005nominal inUSD unlessspecifiedTransferable securities admittedto exchange listing or dealt in onanother regulated marketmarketvaluex EUR 1,000 %BONDSAustralia1,000,000 5.647% QBE Insurance Group 03 - 01.07.2023 986 0.701,700,000 8.485% St George Funding 97 - 30.06.2017 5555 1,829 55 1.312,815 2.01Singapore1,000,000 5.375% United Overseas Bank 04 - 03.09.20195555 995 55 0.71995 0.71Sweden2,000,000 9.000% ForeningsSparbanken 00 - 29.12.2049 5555 2,285 55 1.632,285 1.63United Kingdom1,000,000 8.550% Barclays Bank 00 - 15.06.2049 1,159 0.83500,000 6.500% Prudential 03 - 29.06.2049 495 0.355555 551,654 1.18nominal inUSD unlessspecifiedTransferable securities admittedto exchange listing or dealt in onanother regulated marketmarketvaluex EUR 1,000 %FLOATING RATE NOTESUnited States1,000,000 Barclays Bank 05 15.12.2034 945 0.681,000,000 JP Morgan Chase Capital XIII 04 30.09.2034 997 0.711,000,000 Lehman Brothers HoldingsE-Capital Trust I 05 19.08.2065 1,003 0.721,000,000 Twin Reefs Pass-Through Trust 0410.12.2049 5555 998 55 0.713,943 2.825555 55TOTAL FLOATING RATE NOTES 3,943 2.82INVESTMENTS 131,621 94.00OTHER ASSETS LESS LIABILITIES (Including accrued interest) 8,396 6.00TOTAL NET ASSETS 140,017 100.00United States1,000,000 7.780% Bank of New YorkInstitutional Capital Trust 96 -01.12.2026 1,065 0.762,000,000 7.200% BNP Paribas Capital Trust V 02 -31.12.2049 2,043 1.46500,000 7.900% BT Capital Trust B 97 - 15.01.2027 531 0.381,100,000 7.875% BT Preferred Capital Trust II 97 -25.02.2027 1,173 0.841,000,000 7.000% CA Preferred Funding Trust 03 -30.01.2049 1,016 0.731,000,000 5.805% CBA Capital Trust I 03 - 31.12.2049 1,012 0.72400,000 8.845% Centura Capital Trust I 97 - 01.06.2027 437 0.311,000,000 8.000% Countrywide Capital I 96 - 15.12.2026 1,028 0.73500,000 9.330% Dime Capital Trust I 97 - 06.05.2027 551 0.39500,000 8.675% Executive Risk Capital Trust 97 -01.02.2027 538 0.381,000,000 8.277% First Empire Capital Trust II 97 -01.06.2027 1,081 0.771,500,000 8.410% First Security Cap I 97 - 15.12.2026 1,609 1.151,225,000 9.100% Greenpoint Capital Trust I 97 -01.06.2027 1,335 0.951,000,000 6.413% HBOS 05 - 29.09.2049 962 0.69450,000 8.380% HSBC America Capital Trust II 97 -15.05.2027 487 0.351,250,000 9.860% KBC Bank Funding Trust III 99 -31.12.2049 1,454 1.041,500,000 6.875% KeyCorp Capital II 99 - 17.03.2029 1,618 1.161,000,000 8.560% KN Capital Trust I 97 - 15.04.2027 1,076 0.771,000,000 7.995% Mellon Capital II 96 - 15.01.2027 1,069 0.761,000,000 8.375% MIC Financing Trust I 97 - 01.02.2027 1,030 0.741,500,000 7.950% PNC Institutional Capital Trust A 96 -15.12.2026 1,597 1.141,000,000 6.564% Popular North America Capital Trust I 04 -15.09.2034 1,004 0.721,000,000 7.640% Socgen Real Estate 97 - 29.12.2049 1,047 0.751,500,000 8.622% UBS Preferred Funding Trust I 00 -29.10.2049 1,718 1.231,000,000 4.028% Unicredito Italiano Capital Trust III 05 -27.10.2049 1,168 0.831,000,000 8.200% Union Planters Capital Trust - A - 97 -15.12.2026 1,068 0.761,000,000 8.197% WR Berkley Capital Trust 97 -15.12.2045 5555 1,025 55 0.7329,742 21.245555 55TOTAL BONDS 37,491 26.7772

Statement of investments -Stable Euro Bond Fund 31-10-2005Statement of investments -Stable Euro Bond Fund 31-10-2005nominal inEUR unlessspecifiedTransferable securities admittedto exchange listing or dealt in onanother regulated marketmarketvaluex 1,000 x EUR 1,000 %BONDSFinancial institutionsNLG 1,026 6.750% <strong>ABN</strong> Amro Bank 86 - 01.08.2006 471 0.09NLG 8,010 6.000% <strong>ABN</strong> Amro Bank 97 - 28.11.2007 3,858 0.744,000 3.750% AyT Cedulas TerritorialesCajas I 03 - 24.10.2008 4,100 0.792,496 5.375% Baden Wurt L-Finance 98 -25.04.2008 2,647 0.518,000 4.250% Banco Bilbao VizcayaArgentaria 02 - 26.09.2007 8,227 1.58NLG 12,400 6.375% Bank Nederlandse Gemeenten 96 -04.01.2006 5,664 1.0820,000 6.125% Batavia Credit Card 97 - 15.12.2006 9,419 1.804,064 4.875% Bayerische Landesbank 01 -19.01.2006 4,085 0.782,000 3.375% ERAP 03 - 25.04.2008 2,029 0.394,600 5.250% European Credit Card Offerings 98 -18.06.2008 2,485 0.48NLG 16,000 5.875% European Mortgage Securities 97 -17.09.2047 7,650 1.475,000 3.750% HBOS Treasury Services 03 -26.07.2010 5,145 0.992,000 3.500% HBOS Treasury Services 04 -12.02.2009 2,035 0.39DEM 2,800 6.000% Helaba International Finance 96 -21.02.2006 1,447 0.283,000 5.625% HSH N Finance Guernsey 00 -16.11.2005 3,003 0.581,000 6.500% KFW - Kreditanstalt fuerWiederaufbau 95 - 28.11.2008 1,003 0.192,500 3.250% Kommunalkredit Austria 04 -05.03.2009 2,527 0.485,700 4.750% Landesbank Baden-Wurttemberg02 - 17.08.2007 5,904 1.13FRF 20,000 5.625% MBNA Amer Euro 97 - 19.09.2007 3,202 0.61DEM 8,000 5.125% MBNA Amer Euro Struc OFF 98 -19.04.2008 4,299 0.82NLG 6,000 6.625% Nederlandse Waterschapsbank 96 -04.01.2007 2,846 0.542,000 4.500% Rabobank Nederland 02 -22.01.2007 5555 2,045 55 0.3984,091 16.11Government5,000 5.000% Austria 98 - 15.01.2008 5,246 1.013,000 3.250% Denmark 03 - 14.11.2008 3,042 0.58PTE 500,000 8.500% European Investment Bank 96 -19.06.2006 2,586 0.5055,000 3.500% France 03 - 12.01.2008 55,898 10.7140,000 5.250% Germany 00 - 04.07.2010 43,945 8.424,500 2.500% Germany 05 - 23.03.2007 4,496 0.8625,700 5.375% Germany 99 - 04.01.2010 28,146 5.39NLG 14,000 6.625% Inter-AmericanDevelopment Bank 96 - 01.08.2006 6,546 1.25DEM 1,700 6.125% Inter-AmericanDevelopment Bank 96 - 16.10.2006 898 0.176,000 5.750% Italy 97 - 10.07.2007 6,295 1.2140,000 2.750% Netherlands 03 - 15.01.2009 39,959 7.663,900 2.500% Netherlands 05 - 15.01.2008 5555 3,882 55 0.74200,939 38.50nominal inEUR unlessspecifiedTransferable securities admittedto exchange listing or dealt in onanother regulated marketmarketvaluex 1,000 x EUR 1,000 %FLOATING RATE NOTESFinancial institutions5,000 <strong>ABN</strong> Amro Bank 99 - 28.09.2009 5,013 0.965,000 <strong>ABN</strong> Amro Bouwfonds NederlandseGemeenten 02 - 06.02.2007 5,007 0.965,000 Amstel Securitisation ofContingent Obligations 2003-1 03 -15.10.2013 5,014 0.962,080 ARMS II 04 - 10.01.2035 2,083 0.405,775 AyT Genova Hipotecario 03 -15.07.2035 5,808 1.115,000 Bank Austria Creditanstalt 01 -20.11.2006 5,004 0.9610,000 Bank of America 04 - 28.06.2011 10,058 1.9310,000 Bank of America 05 - 18.05.2010 10,000 1.917,876 Bankinter Fondo DeTitulizacion Hipotecaria 03 -26.08.2038 7,918 1.52611 Berica MBS 02 - 25.02.2032 612 0.1210,000 Caisse Nationale des Caissesd’Epargne et de Prevoyance 05 -04.02.2009 9,998 1.915,000 Chalet Finance No.1 03 - 24.07.2013 5,009 0.967,500 Chalet Finance No.2 03 - 26.11.2013 7,513 1.445,000 Citigroup Global Markets Holdings03 - 08.08.2008 5,010 0.962,000 Credico 04 - 20.11.2025 2,000 0.3810,000 Danske Bank 05 - 16.03.2010 9,992 1.9111,570 Danske Bank 05 - 09.09.2013 11,565 2.225,000 F-E Green 04 - 30.10.2018 5,011 0.9612,500 HBOS Treasury Services 05 -14.06.2012 12,517 2.404,428 Interstar Millennium Trust 04 -07.05.2036 4,440 0.854,410 Italease Finance 03 - 14.12.2012 4,422 0.855,000 Landesbank Hessen-ThueringenGirozentrale 03 - 15.08.2008 5,002 0.965,000 LRP LandesbankRheinland-Pfalz04 - 30.09.2015 5,028 0.969,726 Lusitano Mortgages - A - 03 -16.11.2036 9,771 1.8715,350 Paragon Mortgages 05 - 15.05.2041 15,349 2.948,700 Permanent Financing 05 -10.09.2032 8,698 1.674,000 Popular Finance Europe 03 -10.11.2008 3,998 0.772,561 Saecure 03 - 31.08.2034 2,570 0.4915,000 Ulster Bank Finance 05 -27.06.2008 14,999 2.877,000 UniCredito Italiano 03 -23.10.2008 5555 7,002 55 1.34206,411 39.545555 55TOTAL FLOATING RATE NOTES 206,411 39.54INVESTMENTS 522,122 100.03NET LIABILITIES (Including accrued interest) (156) (0.03)TOTAL NET ASSETS 521,966 100.00Miscellaneous15,000 3.375% GlaxoSmithKline Capital 03 -15.04.2008 15,185 2.9115,000 5.125% Tokyo Electric Power 02 -27.03.2007 5555 15,496 55 2.9730,681 5.885555 55TOTAL BONDS 315,711 60.4973