ABN AMRO Funds

ABN AMRO Funds

ABN AMRO Funds

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

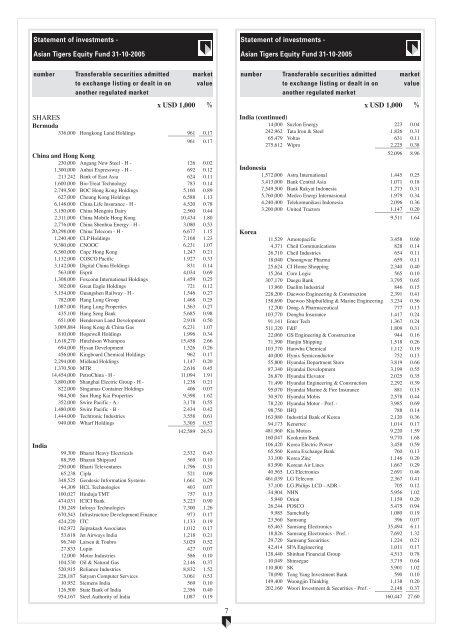

Statement of investments -Asian Tigers Equity Fund 31-10-2005Statement of investments -Asian Tigers Equity Fund 31-10-2005numberSHARESBermuda336,000 Hongkong Land Holdings 5555 961 55 0.17961 0.17China and Hong Kong230,000 Angang New Steel - H - 126 0.021,300,000 Anhui Expressway - H - 692 0.12213,242 Bank of East Asia 624 0.111,600,000 Bio-Treat Technology 783 0.142,749,500 BOC Hong Kong Holdings 5,160 0.89627,000 Cheung Kong Holdings 6,588 1.136,148,000 China Life Insurance - H - 4,520 0.783,150,000 China Mengniu Dairy 2,560 0.442,311,000 China Mobile Hong Kong 10,434 1.802,776,000 China Shenhua Energy - H - 3,080 0.5320,298,000 China Telecom - H - 6,677 1.151,240,400 CLP Holdings 7,168 1.239,380,000 CNOOC 6,231 1.076,360,000 Cnpc Hong Kong 1,247 0.211,132,000 COSCO Pacific 1,927 0.333,142,000 Digital China Holdings 831 0.14563,000 Esprit 4,034 0.691,308,000 Foxconn International Holdings 1,459 0.25302,000 Great Eagle Holdings 721 0.125,154,000 Guangshen Railway - H - 1,546 0.27782,000 Hang Lung Group 1,468 0.251,087,000 Hang Lung Properties 1,563 0.27435,100 Hang Seng Bank 5,685 0.98651,000 Henderson Land Development 2,918 0.503,009,884 Hong Kong & China Gas 6,231 1.07810,000 Hopewell Holdings 1,996 0.341,618,270 Hutchison Whampoa 15,458 2.66694,000 Hysan Development 1,526 0.26456,000 Kingboard Chemical Holdings 962 0.172,294,000 Midland Holdings 1,147 0.201,370,500 MTR 2,616 0.4514,454,000 PetroChina - H - 11,094 1.913,800,000 Shanghai Electric Group - H - 1,238 0.21822,000 Singamas Container Holdings 406 0.07984,500 Sun Hung Kai Properties 9,398 1.62352,000 Swire Pacific - A - 3,178 0.551,480,000 Swire Pacific - B - 2,434 0.421,444,000 Techtronic Industries 3,558 0.61949,000 Wharf Holdings 5555 3,305 55 0.57142,589 24.53IndiaTransferable securities admittedto exchange listing or dealt in onanother regulated marketmarketvaluex USD 1,000 %99,300 Bharat Heavy Electricals 2,532 0.4388,395 Bharati Shipyard 569 0.10250,000 Bharti Televentures 1,796 0.3165,238 Cipla 521 0.09348,525 Geodesic Information Systems 1,661 0.2944,309 HCL Technologies 403 0.07100,027 Hinduja TMT 757 0.13474,031 ICICI Bank 5,223 0.90130,249 Infosys Technologies 7,300 1.26670,543 Infrastructure Development Finance 973 0.17424,220 ITC 1,133 0.19162,972 Jaiprakash Associates 1,012 0.1753,618 Jet Airways India 1,218 0.2196,740 Larsen & Toubro 3,029 0.5227,833 Lupin 427 0.0712,000 Motor Industries 586 0.10104,530 Oil & Natural Gas 2,146 0.37520,915 Reliance Industries 8,832 1.52228,187 Satyam Computer Services 3,061 0.5310,952 Siemens India 569 0.10126,500 State Bank of India 2,356 0.40954,167 Steel Authority of India 1,087 0.19numberIndia (continued)14,000 Suzlon Energy 223 0.04242,962 Tata Iron & Steel 1,826 0.3165,479 Voltas 631 0.11275,612 Wipro 5555 2,225 55 0.3852,096 8.96Indonesia1,572,000 Astra International 1,445 0.253,413,000 Bank Central Asia 1,071 0.187,549,500 Bank Rakyat Indonesia 1,773 0.315,760,000 Medco Energi Internasional 1,979 0.344,240,400 Telekomunikasi Indonesia 2,096 0.363,200,000 United Tractors 5555 1,147 55 0.209,511 1.64KoreaTransferable securities admittedto exchange listing or dealt in onanother regulated marketmarketvaluex USD 1,000 %11,529 Amorepacific 3,458 0.604,371 Cheil Communications 828 0.1426,710 Cheil Industries 654 0.1118,040 Choongwae Pharma 659 0.1125,624 CJ Home Shopping 2,340 0.4015,264 Core Logic 565 0.10307,170 Daegu Bank 3,795 0.6513,960 Daelim Industrial 846 0.15228,200 Daewoo Engineering & Construction 2,391 0.41158,690 Daewoo Shipbuilding & Marine Engineering 3,234 0.5612,700 Dong-A Pharmaceutical 777 0.13103,770 Dongbu Insurance 1,417 0.2491,141 Enter Tech 1,367 0.24511,320 F&F 1,809 0.3122,060 GS Engineering & Construction 944 0.1671,590 Hanjin Shipping 1,518 0.26103,770 Hanwha Chemical 1,112 0.1940,000 Hynix Semiconductor 752 0.1355,800 Hyundai Department Store 3,819 0.6687,340 Hyundai Development 3,199 0.5526,870 Hyundai Elevator 2,025 0.3571,490 Hyundai Engineering & Construction 2,292 0.3995,070 Hyundai Marine & Fire Insurance 881 0.1530,970 Hyundai Mobis 2,578 0.4478,220 Hyundai Motor - Pref. - 3,985 0.6998,750 IHQ 788 0.14163,980 Industrial Bank of Korea 2,120 0.3694,173 Kenertec 1,014 0.17481,960 Kia Motors 9,220 1.59160,047 Kookmin Bank 9,770 1.68106,420 Korea Electric Power 3,458 0.5965,560 Korea Exchange Bank 760 0.1333,100 Korea Zinc 1,146 0.2083,990 Korean Air Lines 1,667 0.2940,565 LG Electronics 2,691 0.46461,039 LG Telecom 2,367 0.4137,100 LG.Philips LCD - ADR - 705 0.1234,904 NHN 5,956 1.025,940 Orion 1,159 0.2026,244 POSCO 5,475 0.949,985 Samchully 1,080 0.1923,560 Samsung 396 0.0765,463 Samsung Electronics 35,494 6.1118,826 Samsung Electronics - Pref. - 7,692 1.3229,720 Samsung Securities 1,224 0.2142,414 SFA Engineering 1,011 0.17128,440 Shinhan Financial Group 4,513 0.7810,049 Shinsegae 3,719 0.64110,800 SK 5,901 1.0278,090 Tong Yang Investment Bank 590 0.10149,400 Woongjin Thinkbig 1,138 0.20202,160 Woori Investment & Securities - Pref. - 5555 2,148 55 0.37160,447 27.607