Application Basics Guide - PPL Electric Utilities

Application Basics Guide - PPL Electric Utilities

Application Basics Guide - PPL Electric Utilities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

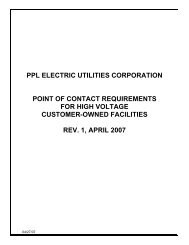

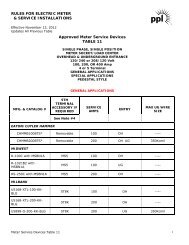

3. <strong>PPL</strong> Bill – Commercial Customer (Sample)- <strong>PPL</strong> Account # - 10-digit- “Service To” is the correct <strong>PPL</strong> Customer Name and Address (Address must match the"Installation Address: on the application)- Rate Class – located on second page of bill4. W-9 (Sample)A signed copy of this document is required for all rebate applications5. PA Lighting Form (MUST BE SUBMITTED IN EXCEL FORMAT)Complete all grey fields in top portion, left side of form; in the body, complete oneline per identical fixture types (pre- and post), making sure all fields in grey (some aredrop-downs) are completed with the correct code (SEE “FIXTURE CODE CHEATSHEETS”).6. Invoice (Paid)Make sure the fixture, lamp and ballast (if required) quantity and manufacturer areclearly called out on the paid invoice.7. Specification Sheet(s)Specification (or “cut-sheets”) are required for all retrofit fixtures, lamps and ballasts.

Lighting <strong>Application</strong> Cover Page<strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong> E-Power RebatesRetrofit Lighting Project <strong>Application</strong>Eligibility for E-power Rebates. Eligible projects are completed between June 1,2013, and May 31,2014.. Only <strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong> customers may apply for this rebate.. lnstall equipment at a site with an active meter using <strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong> services.. Complete installation by May 31,2014, for rebates listed in this application., Equipment must meet program requirements (specifications)-. Submit a final application within 180 days of installation.npower<strong>PPL</strong> ELEcrRrc urr.-rrlEs\*4fVersion: June 2O13

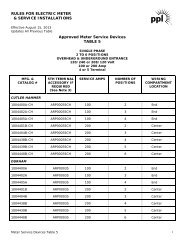

Lighting <strong>Application</strong> ChecklistLighting <strong>Application</strong> Checklist<strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong> offers rebates for qualifying purchases for energy-saving projects installed betweenJune 1, 2013, and May 31, 2014. Some restrictions apply. The rebate may not exceed the total project costs(not including internal labor).All rebates listed in this application are available through May 31, 2014, and applications must be postmarked byJune 30, 2014. Rebates that are paid per kWh saved are paid based on first-year savings. Rebate applicationssubmitted after the deadline may be incented at a different rate.How to Participate1. Read the <strong>Application</strong> Checklist to determine what you will need to submit, which includes:a. A completed, signed rebate application including all inventory worksheets and documentation, asappropriate for the equipment installed.b. Pre-qualification is strongly encouraged to reserve funds for all projects not yet completed and arerequired for custom rebate projects. Pre-qualification must be received before materials are purchasedto guarantee funding for custom rebate projects.c. An itemized receipt or invoice with the manufacturer, model number, and purchase price of eachqualifying product (for final application only).d. Submit a W-9 for the <strong>PPL</strong> customer and the person or company who will receive the rebate.2. Make a copy of all submissions for your records and e-mail, mail, or fax submission to the E-power programteam.3. If you prefer the rebate be sent to someone other than yourself, complete the Third-Party Payment ReleaseAuthorization section found in the Final <strong>Application</strong> Agreement form. Your rebate will be sent when allcompleted project documentation is received and verified.FINAL A<strong>PPL</strong>ICATIONS LACKING PROPER DOCUMENTATION WILL NOT QUALIFY.PRE-QUALIFICATIONRequired Attachments for All ProjectsSigned <strong>Application</strong>Copy of <strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong> Bill for InstallationAddressPA Lighting Form for Retrofit ProjectsNew Construction Lighting Savings CalculationToolManufacturer’s Specification SheetsFINAL A<strong>PPL</strong>ICATIONRequired Attachments for All ProjectsComplete Signed <strong>Application</strong>Copy of <strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong> Bill for InstallationAddress W-9 Download (Signed) Letter from IRS Verifying Tax-Exemption if Non-ProfitPA Lighting Form for Retrofit ProjectsNew Construction Lighting Savings CalculationToolManufacturer’s Specification SheetsCopies of Itemized InvoicesPage 2

Customer InformationCustomer Information FormPlease read the Terms and Conditions and Final <strong>Application</strong> Agreement before signing and submitting thisapplication. Complete all information and provide required documentation to avoid processing delays.Customer InformationBusiness Name _____________________________________________________________________________________Project Name (If Applicable)___________________________________________________________________________<strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong> Account Number _________________________ Taxpayer ID (SSN/FEIN) _________________Installation Address _________________________________________________________________________________City____________________________________________________________________ State_______ Zip____________Please indicate the dollar amount of other (non-<strong>PPL</strong>) rebates you may receive for this purchase.This information does not change the amount of your E-power rebate. ____________________Customer ContactFirst Name ___________________________________ Last Name___________________________________________Title ___________________________________________ Phone #__________________________ Ext.________ ___Mailing Address _____________________________________________________________________________________City____________________________________________________________________ State_______ Zip____________Email _______________________________________________________________ Fax #_________________________How did you initially hear about E-Power rebates? _______________________________________________Project Information<strong>Application</strong> Type Building Type Business Type_______________________________ ____________________ ___________ ________________________________Space Cooling Type Space Heating Type Total Square Footage_______________________________ _______________________________ ________________________________Building Age Tax Status Estimated Project Cost_______________________________ _______________________________ ________________________________Estimated Material Ordered Date Estimated Start Date of Install Estimated Install & Operational Date_______________________________ _______________________________ ________________________________Page 3

Trade Ally/Contractor InformationTrade Ally/Contractor Information FormTrade Ally/Contractor InformationName of Contracting Company ______________________________________________________________________Contact Name _____________________________________________________________________________________Title of Contact ___________________________________________ Phone #____________________ Ext.__________Email 1 __________________________________________________________________ Fax #_______________________Mailing Address ____________________________________________________________________________________City ____________________________________________________________________ State_______ Zip____________Digital Signature InstructionsCustomer SignatureI understand <strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong> reserves the right to audit my rebate application and, if requested, Iwill allow <strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong>’ representatives reasonable access to verify the installation of qualifyingproduct(s) and potentially the removal of older products. I understand <strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong> may providemy name and address to <strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong> representatives to verify this information and I approvesending the rebate to the address on my W-9.Customer Signature ____________________________________________ Date ___________________¹Email used to send status updates regarding this application and additionalinformation about other <strong>PPL</strong> programs.Page 4

Final <strong>Application</strong> AgreementFinal <strong>Application</strong> AgreementI have read and understand the program requirements, measure specifications, and E-power rebatesTerms and Conditions and Final <strong>Application</strong> Agreement set forth in this application (collectively, the“Requirements”) and agree to abide by the Requirements. Furthermore, I concur that I must meet alleligibility criteria in order to be paid under this program.For final applications, sign and submit only after all equipment is installed and operational. A customersignature is required for payment. Signed applications received by fax or email will be treated the same asoriginal applications received by mail.Total Project Cost Total Rebate Requested¹ Actual Installation Date_______________________________ _______________________________ ________________________________Digital Signature InstructionsCustomer Signature _________________________________________________________Print Name _____________________________________________ Date ______________________________<strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong> Account # ______________________________¹Rebate amount will pay the lesser of 1) The calculated rebate as approved or2) 100% of the project cost or 50% of the project cost for LED and induction measures.In-house labor is not considered part of the project cost; only out-of-pocket expenses are eligible.Page 10

Third-Party Payment Release AuthorizationThird-Party Payment FormThird-Party Payment Release Authorization (optional)Complete this section ONLY if rebate payment should be paid to an entity other than the <strong>PPL</strong> customer listedon the Customer Information page. Third-party payment requires a W-9 of the payee. The rebate will be sentto the name and address as it appears on the W-9.Company _______________________________________________ Attention _________ _____________Mailing Address _________________________________________________________________________City ____________________________________________________ State_______ Zip________________Email __________________________________________ Phone #__________________________ Ext.________ ___Tax Status ________________________________ Taxpayer ID# (SSN/FEIN of Payee) ________________I authorize this rebate payment to the third party named above and understand that I will not be receivingthe rebate payment check from <strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong>. I also understand that my release of payment to thethird party does not exempt me from the rebate requirements outlined in the application.Digital Signature InstructionsCustomer Signature ____________________________________________________________Print Name ____________________________________________________ Date ______________________Submit <strong>Application</strong>SUBMIT VIA EMAILPRINT A<strong>PPL</strong>ICATIONWhen submitting your application, please email it to EpowerSolutions@dnvkema.com, and be sure to attachany applicable documents including TRM worksheets.Page 11

Lighting WorksheetLighting Worksheet (Sample)Fluorescent Lighting RetrofitsT12 to High Performance/Reduced Wattage T8 FixturesRetrofit existing fixtures with new high performance (HP)/reduced wattage (RW) T8 lamps and ballasts.Installed lamps and ballasts must qualify for the Consortium for Energy Efficiency (CEE) HP/RW T8specification. Find a list of qualified lamps and ballasts at cee1.org. Rebate is $6 per lamp, not to exceedcost.32-Watt T8 Lamps to High Performance/Reduced Wattage T8 or T5 LampsRetrofit existing T8 or T5 fixtures with new high performance (HP)/reduced wattage (RW) T8 lamps. Installedlamps must be lower wattage and must qualify for the Consortium for Energy Efficiency (CEE) HP/RW T8specification. Find a list of qualified lamps at cee1.org. Rebate is $1 per lamp, not to exceed cost.High Bay T5HO and T8 FixturesNew T5HO and T8 fluorescent fixtures must have a wattage ≥ 100 watts. Must replace ≥ 150 watts. New andretrofit fixtures are eligible. Rebate is $16 per lamp for T5HO and $12 per lamp for T8, not to exceed cost.T5 and T8 FixturesReplace or retrofit existing fixture with the same number of new T8 or T5 lamps and ballasts. Rebate is $4per lamp, not to exceed cost.Pre-Fixture Post-Fixture Measure Type Qty.Rebate/LampTotalRebatePage 5

Creating a New Digital SignatureWhen you first click to sign, the program will check your computer to see if you already have adigital signature and offer to use that one. If you choose to create a new signature:1. Select “A new digital ID I want to create now”2. Select the first option to save your digital signature to your desktop.

3. Enter your personal information.4. Enter a file location

5. The signature is created. Clicking the “sign” button will sign the application and save thesigned version on the computer. The next time the signature is needed, the program willfind it on the computer and ask if you want to sign the application using the signature.Then you bypass most of these steps and just enter the password and sign.

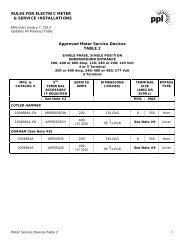

<strong>PPL</strong> Bill - Commercial Customer (Sample)pti"i*:pft Etdrrlc u$llu€a/il Questions? Please call-/AVisit us online at\J,,1 our Business Accounts (-l pplelectric.comhelp line by Sep 6.1-888-22G991t1businessaccounts@ pplweb.com12345-54321Sep 6,2012Page 1s27,384.61Your <strong>Electric</strong> Usage Profile Billino Summary (Billing details on back)Service to:* Joe Customer123 Any Street<strong>PPL</strong> Territory, PAYour next meter reading is on or about Sep t9,2Ot2.This section helps you understand your year-to-yearelectric use by moirth. Meter readings are actual unlessotherwise noted.E3o {fo4ttit312mO1000080m6{nolttno2mo0900750f zo'tt lzotzJFMAMJJAMonthsI zorr lzotz*This address MUST match"Installation Address" onapplication600; EaEo6 450300150ot\---7Citince as of Aug 2r.,20lt2Charges:Total <strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong> ChargesTotal First Energy Solutions ChargesTotal ChargesAccount Balance$0.0oDueBySep 6,2012 127,Your Messaqe Centero Peak Demand,687.24 kW.e With paperless billing, you can receive and pay_your<strong>PPL</strong> Eiectric <strong>Utilities</strong> bills online. The process is free,quick, convenient and secure. To learn more or sign up,visit pplelectric.com.r Before digging around your home or property, youshould always call the state's One Call notificationsystem to locate any underground utility lines. You cando this by simply dialing 811, which will connect You tothe One Call system. Be safe and call 811 before youdie.r Save postage and late charges - sign up forAutomatedBill Payment.Pavment MethodsL{Online at:pplelectric.comBy Mail:2 North 9th StreetCPC-GENN1Allentown, PA 18101-1175s4,335.97s23,048.64527,384.6L527,3W.616$1 By phone: I-8O&iJ/l2-5775v or call BillMatrix (service fee applies)at 1{Xl-672-2413 to pay using Visa,MasterCard, Discover or debit card.Correspondence should be sentto:Business Accounts827 Hausman RoadAllentown, PA 18104-9392Other important information on the back of this bill )""jri"1+.ppl .it<strong>PPL</strong> El€dnc UUlltlG.Retum this part in the enveloPeprovided with a check payableto <strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong>.12345-54321Sep 6,2012 $27,384.61Joe Customer123 Any Street<strong>PPL</strong> Territory, PAAmount Endosed:NTruTNNT<strong>PPL</strong> ELECTRIC UTILITIESP.O.BOX25222LEHIGH VALLEY, PA 18002.5222

Your Supplier Contact lnformationFor questions regarding the generation and transmissionportions of this bill, please contact your supplier at:1g1 First Energy Solutions r,q., Phone:^ Customer Seruices \, 1-800-977-0500CUSTOMER CARE 413395 GHENT ROADAKRON, OH 44333Manage YourAccountVisit pplelectric.com for self-service optionsincluding:-View your bill, payment, and usage history.-Make a payment, set up a payment agreement.-Start/stop service.-Enroll in paperless billing automatic bill pay,budget billing.-Report an outage, check outage status, and more.View your rate schedule at pplelectric.com/rates orcall 1-8fi1-342-5775to request a copy.General lnformationGeneration prices and charges are set by the electricgeneration supplier you have chosen. The PublicUtility Commission regulates distribution rates andservices. The Federal Energy Regulatory Commissionregulates transmission prices and services.<strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong> uses about 54.90 of this bill to paystate taxes and about 5241.34 is used to pay the PAGross Receipts Tax.Understanding Your BillAct 129 Compliance Rider - Charge to recover costs associatedwith Energv Efficiencv and Conse-rvation orograms forcustomers''as approv6d by the Public Utility Commission.Customer Charce - Monthlv basic distribution charse to covercosts for billing,-.meter reT{ing, equipment, maintehance andaovanceo metenng wnen tn use.Distribution Charse - Charee for the use of local wires.transformers, subltations a.-nd other equiDment used tb deliverelectricity. to end-use consumers from thb high voltagetransmrssron lrneskWh{Kllowatt-hour} - The basic unit of electric enersv forwhich most cqs-tomeirs.are c.hqrged, The. amount of el6ctricityused bv ten 100-watt liehts leftbn for t hour. Consumers areusuallycharged for eleclricity in cents per kilowatt-hour.Smart Meter Rider - Charee to recover costs associated withthe Smart Meter Plan for Eustomers as approved by the PUC.Billing Details - (Bin Acct. i) Page2Previous Balance527,7A6.52Payment Received Aug 9, 2012 - Thank You! _ -527,706.52Bolonce as of Aug 27,2072Charges for - First Energy SolutionsFES 9251STE for Jul 20 - Aus 20<strong>Electric</strong> Chs: 288000 KWH @ SO.OzSSOSTATE SALES TAXGROSS RECETPTS TAX 51,317.69Total First Energy Solutions Charges2\,744.OOL,304.64kWh Use By MeterReading Dates Meter Meter Meter Reading KilowattPrevious/Present Number Constant Previous/Present HoursJul 20 Aug 20 600 12523 13003 288000Total 288000S0.0C523,048.64CharC"s for - PPt Etect"'. UtifitiesGeneral Service Rate: GS3 for Jul 2O - Aug 20Distribution Charge:Customer Charge 30.00687.0 kW at 54.51000000 per kW 3,098.37Smart Meter Rider 74.40Act 129 Compliance Rider 961.92PA Tax Adj Surcharge at -0.3450@00% -74.76PA Sales Tax 245.44Iotal <strong>PPL</strong> <strong>Electric</strong> <strong>Utilities</strong> Charges 54,335.97lmount Due By Sep 6 2012 527,184.61Account BalanceSZz,Zgq.OtState Tax Adiustment Surcharge - Charee or credit on electricf?.tes_to reflelt changes in variSus..stateiaxes included in yourbill. The surcharge riay vary by bill component.Tvoe(sl of Meter Readines:'Aciu'al - Reading by dislribution company.*Federal t.D.$27,384.61

Form W-9(Rev. December 2011)Department of the TreasuryInternal Revenue ServiceName (as shown on your income tax return)Request for TaxpayerIdentification Number and CertificationGive Form to therequester. Do notsend to the IRS.Print or typeSee Specific Instructions on page 2.Business name/disregarded entity name, if different from aboveCheck appropriate box for federal tax classification:Individual/sole proprietor C Corporation S Corporation Partnership Trust/estateExempt payeeLimited liability company. Enter the tax classification (C=C corporation, S=S corporation, P=partnership) ▶Other (see instructions) ▶Address (number, street, and apt. or suite no.)Requester’s name and address (optional)City, state, and ZIP codeList account number(s) here (optional)Part I Taxpayer Identification Number (TIN)Enter your TIN in the appropriate box. The TIN provided must match the name given on the “Name” lineto avoid backup withholding. For individuals, this is your social security number (SSN). However, for aresident alien, sole proprietor, or disregarded entity, see the Part I instructions on page 3. For otherentities, it is your employer identification number (EIN). If you do not have a number, see How to get aTIN on page 3.Note. If the account is in more than one name, see the chart on page 4 for guidelines on whosenumber to enter.Social security number– –Employer identification numberPart II CertificationUnder penalties of perjury, I certify that:1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal RevenueService (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I amno longer subject to backup withholding, and3. I am a U.S. citizen or other U.S. person (defined below).Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholdingbecause you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgageinterest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), andgenerally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN. See theinstructions on page 4.SignHereSignature ofU.S. person ▶General InstructionsSection references are to the Internal Revenue Code unless otherwisenoted.Purpose of FormA person who is required to file an information return with the IRS mustobtain your correct taxpayer identification number (TIN) to report, forexample, income paid to you, real estate transactions, mortgage interestyou paid, acquisition or abandonment of secured property, cancellationof debt, or contributions you made to an IRA.Use Form W-9 only if you are a U.S. person (including a residentalien), to provide your correct TIN to the person requesting it (therequester) and, when applicable, to:1. Certify that the TIN you are giving is correct (or you are waiting for anumber to be issued),2. Certify that you are not subject to backup withholding, or3. Claim exemption from backup withholding if you are a U.S. exemptpayee. If applicable, you are also certifying that as a U.S. person, yourallocable share of any partnership income from a U.S. trade or businessis not subject to the withholding tax on foreign partners’ share ofeffectively connected income.Date ▶Note. If a requester gives you a form other than Form W-9 to requestyour TIN, you must use the requester’s form if it is substantially similarto this Form W-9.Definition of a U.S. person. For federal tax purposes, you areconsidered a U.S. person if you are:• An individual who is a U.S. citizen or U.S. resident alien,• A partnership, corporation, company, or association created ororganized in the United States or under the laws of the United States,• An estate (other than a foreign estate), or• A domestic trust (as defined in Regulations section 301.7701-7).Special rules for partnerships. Partnerships that conduct a trade orbusiness in the United States are generally required to pay a withholdingtax on any foreign partners’ share of income from such business.Further, in certain cases where a Form W-9 has not been received, apartnership is required to presume that a partner is a foreign person,and pay the withholding tax. Therefore, if you are a U.S. person that is apartner in a partnership conducting a trade or business in the UnitedStates, provide Form W-9 to the partnership to establish your U.S.status and avoid withholding on your share of partnership income.Cat. No. 10231X Form W-9 (Rev. 12-2011)–

Pennsylvania Act 129 Lighting Audit and Design ToolLIGHTING FORMPY5 PA Lighting FormApplicant Name:Facility Name:Facility Address:<strong>Application</strong> Submittal Date:Installation Date:Facility Type:Default Hours of Use (HOU):Default Coincidence Factor (CF):<strong>PPL</strong> Project #: (<strong>PPL</strong>-13-XXXXX)<strong>PPL</strong> Account #: (12345-67890)Input FieldComputed FieldLine Item Building Address Floor Area Description Usage Group Hours ofUse (HOU)SpaceCooling TypePreFixtureNo.PRE-INSTALLATION (BASELINE)Pre Fixture Pre Watts / Pre kW /Code Fixture SpacePre ControlPostFixtureNo.POST-INSTALLATION (RETROFIT)Ex. 200 First Avenue 1 Office N/A 2,567 COOL 3 F44ILL 112 0.34 S LS 3 F42ILL 59 0.18 O OS 0.16 61% 34% 12% 24% 0.13 5791234567891011121314151617181920212223242526272829303132333435363738394041424344454647484950TotalsPost FixtureCodePost Watts /FixturePost kW /SpacePostControlChange inConnectedLoadCoincidenceFactorInteractiveFactor(demand)InteractiveFactor(energy)ControlsFactorPeakDemandSavingsAnnualkWhSavedVersion 13 Page 1 of 1 10/1/2013

Invoice (Sample)wffJune 1, 2013 100-001Joe Customer123 Any Street<strong>PPL</strong> Territory, PAagreement Net 301OB4-W.CS.TL3-TBGE-432-MV_HF32n8t841ktHLlnstallationDisposalFreightRetroKit 8ft 4 lamp tandem TB WreflectorGE 4 lamp T8 MultiVolt (lSH) BallastEiKO 32w TB Lamp B00 Series CRI4100k High Lumenlnstallation - LightingAl Recycle DisposalShipping - Delivery chargeSaies Tax24249623.2722.75a -7.71,680.0094.0028.696.00%558.487546.007358.0871,680.0094.0028.6987.75Thank you for your business.Payments/Credits$-1..i53.00Balance Dues0.00

Specification Sheet (Sample)