Turkey â Türk Tuborg Bira ve Malt Sanayii A.S. - Carlsberg Group

Turkey â Türk Tuborg Bira ve Malt Sanayii A.S. - Carlsberg Group

Turkey â Türk Tuborg Bira ve Malt Sanayii A.S. - Carlsberg Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

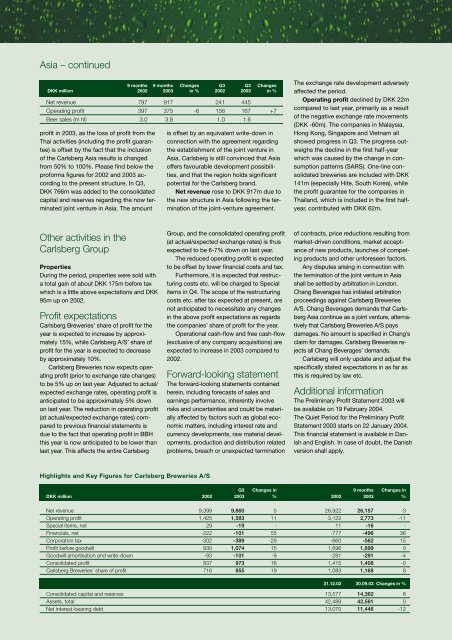

Asia – continued9 months 9 months Changes Q3 Q3 ChangesDKK million 2002 2003 in % 2002 2003 in %Net re<strong>ve</strong>nue 797 917 241 445Operating profit 397 375 -6 156 167 +7Beer sales (m hl) 3.0 3.8 1.0 1.6profit in 2003, as the loss of profit from theThai activities (including the profit guarantee)is offset by the fact that the inclusionof the <strong>Carlsberg</strong> Asia results is changedfrom 50% to 100%. Please find below theproforma figures for 2002 and 2003 accordingto the present structure. In Q3,DKK 766m was added to the consolidatedcapital and reser<strong>ve</strong>s regarding the now terminatedjoint <strong>ve</strong>nture in Asia. The amountis offset by an equivalent write-down inconnection with the agreement regardingthe establishment of the joint <strong>ve</strong>nture inAsia. <strong>Carlsberg</strong> is still convinced that Asiaoffers favourable de<strong>ve</strong>lopment possibilities,and that the region holds significantpotential for the <strong>Carlsberg</strong> brand.Net re<strong>ve</strong>nue rose to DKK 917m due tothe new structure in Asia following the terminationof the joint-<strong>ve</strong>nture agreement.The exchange rate de<strong>ve</strong>lopment ad<strong>ve</strong>rselyaffected the period.Operating profit declined by DKK 22mcompared to last year, primarily as a resultof the negati<strong>ve</strong> exchange rate mo<strong>ve</strong>ments(DKK -60m). The companies in Malaysia,Hong Kong, Singapore and Vietnam allshowed progress in Q3. The progress outweighsthe decline in the first half-yearwhich was caused by the change in consumptionpatterns (SARS). One-line consolidatedbreweries are included with DKK141m (especially Hite, South Korea), whilethe profit guarantee for the companies inThailand, which is included in the first halfyear,contributed with DKK 62m.Other activities in the<strong>Carlsberg</strong> <strong>Group</strong>PropertiesDuring the period, properties were sold witha total gain of about DKK 175m before taxwhich is a little abo<strong>ve</strong> expectations and DKK95m up on 2002.Profit expectations<strong>Carlsberg</strong> Breweries’ share of profit for theyear is expected to increase by approximately15%, while <strong>Carlsberg</strong> A/S’ share ofprofit for the year is expected to decreaseby approximately 10%.<strong>Carlsberg</strong> Breweries now expects operatingprofit (prior to exchange rate changes)to be 5% up on last year. Adjusted to actual/expected exchange rates, operating profit isanticipated to be approximately 5% downon last year. The reduction in operating profit(at actual/expected exchange rates) comparedto previous financial statements isdue to the fact that operating profit in BBHthis year is now anticipated to be lower thanlast year. This affects the entire <strong>Carlsberg</strong><strong>Group</strong>, and the consolidated operating profit(at actual/expected exchange rates) is thusexpected to be 6-7% down on last year.The reduced operating profit is expectedto be offset by lower financial costs and tax.Furthermore, it is expected that restructuringcosts etc. will be charged to Specialitems in Q4. The scope of the restructuringcosts etc. after tax expected at present, arenot anticipated to necessitate any changesin the abo<strong>ve</strong> profit expectations as regardsthe companies’ share of profit for the year.Operational cash-flow and free cash-flow(exclusi<strong>ve</strong> of any company acquisitions) areexpected to increase in 2003 compared to2002.Forward-looking statementThe forward-looking statements containedherein, including forecasts of sales andearnings performance, inherently invol<strong>ve</strong>risks and uncertainties and could be materiallyaffected by factors such as global economicmatters, including interest rate andcurrency de<strong>ve</strong>lopments, raw material de<strong>ve</strong>lopments,production and distribution relatedproblems, breach or unexpected terminationof contracts, price reductions resulting frommarket-dri<strong>ve</strong>n conditions, market acceptanceof new products, launches of competingproducts and other unforeseen factors.Any disputes arising in connection withthe termination of the joint <strong>ve</strong>nture in Asiashall be settled by arbitration in London.Chang Be<strong>ve</strong>rages has initiated arbitrationproceedings against <strong>Carlsberg</strong> BreweriesA/S. Chang Be<strong>ve</strong>rages demands that <strong>Carlsberg</strong>Asia continue as a joint <strong>ve</strong>nture, alternati<strong>ve</strong>lythat <strong>Carlsberg</strong> Breweries A/S paysdamages. No amount is specified in Chang’sclaim for damages. <strong>Carlsberg</strong> Breweries rejectsall Chang Be<strong>ve</strong>rages’ demands.<strong>Carlsberg</strong> will only update and adjust thespecifically stated expectations in as far asthis is required by law etc.Additional informationThe Preliminary Profit Statement 2003 willbe available on 19 February 2004.The Quiet Period for the Preliminary ProfitStatement 2003 starts on 22 January 2004.This financial statement is available in Danishand English. In case of doubt, the Danish<strong>ve</strong>rsion shall apply.Highlights and Key Figures for <strong>Carlsberg</strong> Breweries A/SQ3 Changes in 9 months Changes inDKK million 2002 2003 % 2002 2003 %Net re<strong>ve</strong>nue 9,399 9,860 5 26,922 26,157 -3Operating profit 1,425 1,583 11 3,122 2,773 -11Special items, net 29 -19 - 11 -16 -Financials, net -222 -101 55 -777 -496 36Corporation tax -302 -389 -29 -660 -562 15Profit before goodwill 930 1,074 15 1,696 1,699 0Goodwill amortisation and write-down -93 -101 -9 -281 -291 -4Consolidated profit 837 973 16 1,415 1,408 -0<strong>Carlsberg</strong> Breweries’ share of profit 716 855 19 1,083 1,168 831.12.02 30.09.03 Changes in %Consolidated capital and reser<strong>ve</strong>s 13,577 14,362 6Assets, total 42,489 42,561 0Net interest-bearing debt 13,070 11,446 -12

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49766377/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)

![[Name and Address] - Carlsberg Group](https://img.yumpu.com/49015962/1/184x260/name-and-address-carlsberg-group.jpg?quality=85)