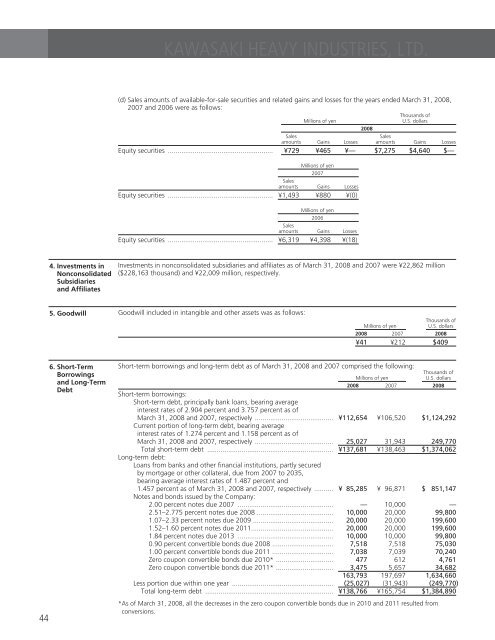

KAWASAKI HEAVY INDUSTRIES, LTD.(d) Sales amounts of available-for-sale securities and related gains and losses for the years ended March 31, <strong>2008</strong>,2007 and 2006 were as follows:Thousands ofMillions of yenU.S. dollars<strong>2008</strong>SalesSalesamounts Gains Losses amounts Gains LossesEquity securities ....................................................... ¥729 ¥465 ¥— $7,275 $4,640 $—Millions of yen2007Salesamounts Gains LossesEquity securities ....................................................... ¥1,493 ¥880 ¥(0)Millions of yen2006Salesamounts Gains LossesEquity securities ....................................................... ¥6,319 ¥4,398 ¥(18)4. Investments inNonconsolidatedSubsidiariesand AffiliatesInvestments in nonconsolidated subsidiaries and affiliates as of March 31, <strong>2008</strong> and 2007 were ¥22,862 million($228,163 thousand) and ¥22,009 million, respectively.5. GoodwillGoodwill included in intangible and other assets was as follows:Thousands ofMillions of yenU.S. dollars<strong>2008</strong> 2007 <strong>2008</strong>¥41 ¥212 $409446. Short-TermBorrowingsand Long-TermDebtShort-term borrowings and long-term debt as of March 31, <strong>2008</strong> and 2007 comprised the following:Thousands ofMillions of yenU.S. dollars<strong>2008</strong> 2007 <strong>2008</strong>Short-term borrowings:Short-term debt, principally bank loans, bearing averageinterest rates of 2.904 percent and 3.757 percent as ofMarch 31, <strong>2008</strong> and 2007, respectively ......................................... ¥112,654 ¥106,520 $1,124,292Current portion of long-term debt, bearing averageinterest rates of 1.274 percent and 1.158 percent as ofMarch 31, <strong>2008</strong> and 2007, respectively ......................................... 25,027 31,943 249,770Total short-term debt .................................................................. ¥137,681 ¥138,463 $1,374,062Long-term debt:Loans from banks and other financial institutions, partly securedby mortgage or other collateral, due from 2007 to 2035,bearing average interest rates of 1.487 percent and1.457 percent as of March 31, <strong>2008</strong> and 2007, respectively .......... ¥ 85,285 ¥ 96,871 $ 851,147Notes and bonds issued by the Company:2.00 percent notes due 2007 .................................................. — 10,000 —2.51–2.775 percent notes due <strong>2008</strong> ........................................ 10,000 20,000 99,8001.07–2.33 percent notes due 2009 .......................................... 20,000 20,000 199,6001.52–1.60 percent notes due 2011........................................... 20,000 20,000 199,6001.84 percent notes due 2013 .................................................. 10,000 10,000 99,8000.90 percent convertible bonds due <strong>2008</strong> ................................ 7,518 7,518 75,0301.00 percent convertible bonds due 2011 ................................ 7,038 7,039 70,240Zero coupon convertible bonds due 2010* .............................. 477 612 4,761Zero coupon convertible bonds due 2011* .............................. 3,475 5,657 34,682................................................................................................................ 163,793 197,697 1,634,660Less portion due within one year ..................................................... (25,027) (31,943) (249,770)Total long-term debt ................................................................... ¥138,766 ¥165,754 $1,384,890*As of March 31, <strong>2008</strong>, all the decreases in the zero coupon convertible bonds due in 2010 and 2011 resulted fromconversions.

ANNUAL REPORT <strong>2008</strong>As of March 31, <strong>2008</strong>, convertible bonds due from <strong>2008</strong> through 2011 were convertible into shares of commonstock at the option of the holder at prices of ¥598 ($5.97), ¥182 ($1.82) and ¥232 ($2.32) per share. The conversionprices are subject to adjustments under specified conditions.As of March 31, <strong>2008</strong> and 2007, the following assets were pledged as collateral for short-term borrowings andlong-term debt:Thousands ofMillions of yenU.S. dollars<strong>2008</strong> 2007 <strong>2008</strong>Land ............................................................................................................ ¥ 940 ¥1,255 $ 9,381Buildings ..................................................................................................... 5,522 2,321 55,110Other investments ....................................................................................... 315 318 3,143Total ........................................................................................... ¥6,777 ¥3,894 $67,634As of March 31, <strong>2008</strong> and 2007, debt secured by the above pledged assets was as follows:Thousands ofMillions of yenU.S. dollars<strong>2008</strong> 2007 <strong>2008</strong>Trade payables ............................................................................................ ¥ 79 ¥ 66 $ 788Short-term and long-term debt ................................................................... 2,698 4,374 26,926Total ........................................................................................... ¥2,777 ¥4,440 $27,714The aggregate annual maturities of long-term debt as of March 31, <strong>2008</strong> were as follows:Thousands ofYear ending March 31, Millions of yen U.S. dollars2009 ........................................................................................................................... ¥ 25,027 $ 249,7702010 ........................................................................................................................... 31,782 317,1852011 ........................................................................................................................... 5,324 53,1342012 ........................................................................................................................... 56,749 566,3572013 and thereafter .................................................................................................... 44,911 448,214Total ................................................................................................................ ¥163,793 $1,634,6607. Employees’Retirementand SeveranceBenefitsThe liability for employees’ retirement and severance benefits included in the liability section of the consolidatedbalance sheets as of March 31, <strong>2008</strong> and 2007 consisted of the following:Thousands ofMillions of yenU.S. dollars<strong>2008</strong> 2007 <strong>2008</strong>Projected benefit obligation .................................................................... ¥182,766 ¥ 186,953 $1,824,012Unrecognized prior service costs ............................................................. 14,162 16,347 141,337Unrecognized actuarial differences ......................................................... 4,682 26,398 46,726Less fair value of plan assets ................................................................... (96,979) (116,999) (967,854)Less unrecognized net transition obligation ............................................. (25,029) (37,545) (249,790)Prepaid pension cost ............................................................................... 2,326 2,330 23,214Liability for retirement and severance benefits ..................................... ¥ 81,928 ¥ 77,484 $ 817,645Retirement and severance benefit expenses in the consolidated statements of income for the years ended March31, <strong>2008</strong>, 2007 and 2006 comprised the following:Thousands ofMillions of yenU.S. dollars<strong>2008</strong> 2007 2006 <strong>2008</strong>Service costs—benefits earned during the year ...................... ¥ 8,556 ¥ 8,722 ¥ 8,548 $ 85,389Interest cost on projected benefit obligation .......................... 4,625 4,676 4,512 46,157Expected return on plan assets .............................................. (945) (974) (860) (9,431)Amortization of prior service costs ......................................... (2,285) (2,214) (2,248) (22,804)Amortization of actuarial differences ..................................... (1,983) (782) 1,664 (19,790)Amortization of net transition obligation ............................... 12,514 12,516 12,989 124,890Contribution to the defined contribution pension plans ......... 483 420 367 4,820Retirement and severance benefit expenses ....................... ¥20,965 ¥22,364 ¥24,972 $209,23145

- Page 1 and 2: Annual Report 2008Year ended March

- Page 3: Consolidated Financial HighlightsKa

- Page 6 and 7: KAWASAKI HEAVY INDUSTRIES, LTD.Thus

- Page 8 and 9: An Interview with Tadaharu Ohashi,

- Page 10 and 11: KAWASAKI HEAVY INDUSTRIES, LTD.Q:Wh

- Page 12 and 13: AbcdeKawasaki Heavy Industries, Ltd

- Page 14 and 15: Review of OperationsKAWASAKI HEAVY

- Page 16 and 17: Review of OperationsKAWASAKI HEAVY

- Page 18 and 19: Review of OperationsKAWASAKI HEAVY

- Page 20 and 21: Review of OperationsKAWASAKI HEAVY

- Page 22 and 23: Review of OperationsKAWASAKI HEAVY

- Page 24 and 25: Review of OperationsKAWASAKI HEAVY

- Page 26 and 27: Review of OperationsKAWASAKI HEAVY

- Page 28 and 29: Six-Year Abcde SummaryKawasaki Heav

- Page 30 and 31: KAWASAKI HEAVY INDUSTRIES, LTD.annu

- Page 32 and 33: KAWASAKI HEAVY INDUSTRIES, LTD.Euro

- Page 34 and 35: KAWASAKI HEAVY INDUSTRIES, LTD.Plan

- Page 36 and 37: Consolidated Balance SheetsKawasaki

- Page 38 and 39: Consolidated Statements of IncomeKa

- Page 40 and 41: Consolidated Statements of Cash Flo

- Page 42 and 43: Notes to the Consolidated Financial

- Page 44 and 45: KAWASAKI HEAVY INDUSTRIES, LTD.(r)

- Page 48 and 49: KAWASAKI HEAVY INDUSTRIES, LTD.Basi

- Page 50 and 51: KAWASAKI HEAVY INDUSTRIES, LTD.(c)

- Page 52 and 53: KAWASAKI HEAVY INDUSTRIES, LTD.(a)

- Page 54 and 55: KAWASAKI HEAVY INDUSTRIES, LTD.The

- Page 56: KAWASAKI HEAVY INDUSTRIES, LTD.(d)

- Page 59 and 60: ANNUAL REPORT 2008EXECUTIVE OFFICER

- Page 61 and 62: ANNUAL REPORT 2008Paid-in CapitalEq

- Page 63 and 64: NetworkANNUAL REPORT 2008Kobe Head

- Page 65 and 66: Corporate DataANNUAL REPORT 2008Kaw