Credit Opinion: SpareBank 1 Gruppen AS - Investor Relations - IR ...

Credit Opinion: SpareBank 1 Gruppen AS - Investor Relations - IR ...

Credit Opinion: SpareBank 1 Gruppen AS - Investor Relations - IR ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

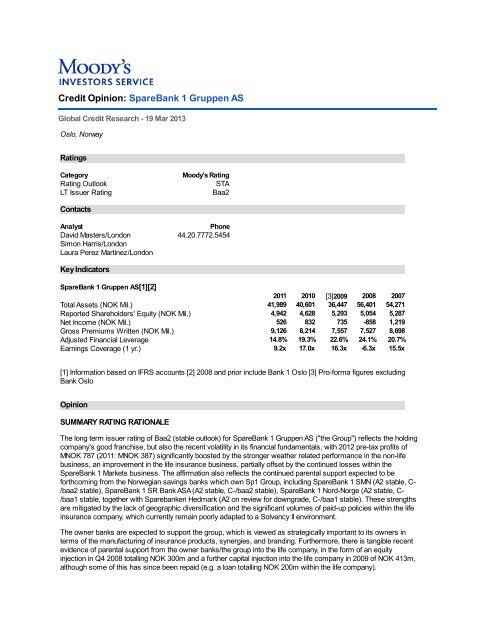

<strong>Credit</strong> <strong>Opinion</strong>: <strong>SpareBank</strong> 1 <strong>Gruppen</strong> <strong>AS</strong>Global <strong>Credit</strong> Research - 19 Mar 2013Oslo, NorwayRatingsCategoryRating OutlookLT Issuer RatingMoody's RatingSTABaa2ContactsAnalystPhoneDavid Masters/London 44.20.7772.5454Simon Harris/LondonLaura Perez Martinez/LondonKey Indicators<strong>SpareBank</strong> 1 <strong>Gruppen</strong> <strong>AS</strong>[1][2]2011 2010 [3]2009 2008 2007Total Assets (NOK Mil.) 41,989 40,601 36,447 56,401 54,271Reported Shareholders' Equity (NOK Mil.) 4,942 4,628 5,293 5,054 5,287Net Income (NOK Mil.) 526 832 735 -858 1,219Gross Premiums Written (NOK Mil.) 9,126 8,214 7,557 7,527 8,698Adjusted Financial Leverage 14.8% 19.3% 22.6% 24.1% 20.7%Earnings Coverage (1 yr.) 9.2x 17.0x 16.3x -6.3x 15.5x[1] Information based on IFRS accounts [2] 2008 and prior include Bank 1 Oslo [3] Pro-forma figures excludingBank Oslo<strong>Opinion</strong>SUMMARY RATING RATIONALEThe long term issuer rating of Baa2 (stable outlook) for <strong>SpareBank</strong> 1 <strong>Gruppen</strong> <strong>AS</strong> ("the Group") reflects the holdingcompany's good franchise, but also the recent volatility in its financial fundamentals, with 2012 pre-tax profits ofMNOK 787 (2011: MNOK 387) significantly boosted by the stronger weather related performance in the non-lifebusiness, an improvement in the life insurance business, partially offset by the continued losses within the<strong>SpareBank</strong> 1 Markets business. The affirmation also reflects the continued parental support expected to beforthcoming from the Norwegian savings banks which own Sp1 Group, including <strong>SpareBank</strong> 1 SMN (A2 stable, C-/baa2 stable), <strong>SpareBank</strong> 1 SR Bank <strong>AS</strong>A (A2 stable, C-/baa2 stable), <strong>SpareBank</strong> 1 Nord-Norge (A2 stable, C-/baa1 stable, together with Sparebanken Hedmark (A2 on review for downgrade, C-/baa1 stable). These strengthsare mitigated by the lack of geographic diversification and the significant volumes of paid-up policies within the lifeinsurance company, which currently remain poorly adapted to a Solvency II environment.The owner banks are expected to support the group, which is viewed as strategically important to its owners interms of the manufacturing of insurance products, synergies, and branding. Furthermore, there is tangible recentevidence of parental support from the owner banks/the group into the life company, in the form of an equityinjection in Q4 2008 totalling NOK 300m and a further capital injection into the life company in 2009 of NOK 413m,although some of this has since been repaid (e.g. a loan totalling NOK 200m within the life company).

<strong>SpareBank</strong> 1 <strong>Gruppen</strong> is a holding company whose main owners are 15 Norwegian savings banks, together withthe Norwegian Confederation of Trade Unions (LO). The group was established in 1996 in response to strongercompetition in the Norwegian financial market. Until end-December 2009, the group has consisted of five whollyowned product companies in life insurance, non-life insurance, asset management, banking, factoring and debtcollection. Since 1st January 2010, Bank 1 Oslo has been separated from <strong>SpareBank</strong> 1 <strong>Gruppen</strong> and is nowdirectly owned by the <strong>SpareBank</strong> 1-banks and the Norwegian Confederation of Trade Unions. <strong>SpareBank</strong> 1<strong>Gruppen</strong> is also an owner in the brokerage firm <strong>SpareBank</strong> 1 Markets (97.55%).The market share of the alliance (<strong>SpareBank</strong> 1 <strong>Gruppen</strong> and member banks) has gradually improved thanks to awider and deeper product offering, increased marketing and good cross-selling, as well as new banks joining thealliance. On a reported basis, <strong>SpareBank</strong> 1 Alliance is the second-largest financial institution in Norway and has amarket share of around 20% in retail lending, c.16% in corporate lending, around 10% in equity funds,approximately 10% in non-life insurance and around 3% in life insurance.<strong>Credit</strong> Profile of Significant Subsidiaries<strong>SpareBank</strong> 1 SkadeforsikringMoody's considers the property & casualty (P&C) business to be a significant market player in the Norwegianmarket, where it has a number 4 position with a market share at YE 2012 of 10.1%. After a period of improvingprofitability in recent years, albeit driven largely by investment income in 2009 and the relatively good product risk,being focused primarily on personal motor and property risks, 2010 witnessed an increase in the overall combinedratio to 97.7%, driven in part by the severe 2010 winter, and 2011 witnessed a further deterioration to 103.5%. The2011 deterioration was driven, inter alia, by a combination of elevated flood related claims in Q2 2011, together withstorm and other large claims. More recently, the 2012 performance improved to 98.2%, reflecting, inter alia, morebenign weather conditions and lower levels of large claims than 2011 and higher revenues. This resulted in a pretaxprofit of MNOK 619 (2011: MNOK 185).Moody's also notes that there remains some degree of reserving volatility within the portfolio, particularly on thelonger tailed commercial lines business and the P&C business remains heavily dependent on a single distributionchannel, namely the owner banks.<strong>SpareBank</strong> 1 LivsforsikringFollowing significant losses in 2008 and capital injections into the life business during both 2008 and 2009, Moody'snotes the recent improvements in both profitability and capitalisation within the life business, particularly withregard to the improvement in the administration result in 2012 to MNOK -56 (2011: MNOK -66, 2010: MNOK -187)and an overall pre-tax profit of MNOK 479 (2011: MNOK 414). Whilst policyholder buffer capital remains higher(2012: 13.6% of technical provisions) and remains significantly above the 5.8% reported at YE 2008, Moody'sconsiders the life business to remain significantly exposed to investment market volatility. As with the P&Cbusiness, the life business remains heavily exposed to the Norwegian economy, lacking the geographicdiversification of larger continental life insurers.More specifically, as at YE 2012, SP1 Liv's paid up policies (poorly adapted to a Solvency II requirement) were c.NOK 4bn and the life company is expected to have some reserve strengthening need arising out of the newlongevity tables published by the FSA on the 8th March, albeit manageable in the context of the <strong>SpareBank</strong>1 Groupand its owner banks.<strong>Credit</strong> Strengths- Strong brand, which is among the most recognised financial brands in Norway- Diversified operations, including the owner banks- Relatively low risk profile of non-life insurance business- Expected high support from the owner banks reflecting its important role in the wider <strong>SpareBank</strong> 1 Alliance<strong>Credit</strong> Challenges- Improving profitability and growing business in the mature market- High competition in both the insurance and banking markets

- Volatility of investment results, particularly with the life insurance business, which necessitated capital injectionsduring the crisis- Dependence on the distribution channels of the alliance- Lower coherence in the alliance as there is no joint and several liability guarantee- Potential departure of any member bank, although this at the moment is not considered likelyWhat to Watch for:- Any deterioration in the credit profile of the owners would likely be reflected in the issuer rating of the Group.- Seasonality of profitability in the P&C business given the frequent adverse winter weather in the Nordics.- Challenge of Solvency 2 implementation, particularly for the life business which has provided products withguaranteed returns.- Treatment of Paid up Policies within the life portfolio currently remains a concern for Norwegian life insurersRating OutlookThe long-term issuer rating (Baa2 stable) was affirmed with a stable outlook at Baa2 on 18 March 2013. At thesame time, the short-term issuer rating (P-2) was affirmed. This rating action follows the publication of the newlongevity tables by the Norwegian FSA on 08th March 2013(see relevant press release for further details).What Could Change the Rating - UpNot considered likely in the short term due to the ratings being on stable outlook. However, in the longer term,positive rating action could arise in the event of:- An upgrade in one of more of the owners' ratings- If the commitment from the owner banks were to be perceived as higher, and/or- If a sustained improvement in the financial performance of the group were to occur.What Could Change the Rating - Down- A downgrade in one of more of the owners' ratings- The commitment from the owner banks were to be perceived as lower, and/or- A deterioration in the financial performance of the group.Recent ResultsAt YE 2012, the group reported a post-tax profit of NOK 443mn (YE 2011: NOK 526mn), and a return on equity of8.7% (2011: 11.1%).Capital Structure and LiquidityThe majority of the group's borrowings are made by <strong>SpareBank</strong> 1 <strong>Gruppen</strong> <strong>AS</strong>. The group's refinancing risk islimited as the outstanding term of the debt is relatively long with a mixture of perpetual instruments and post 2015maturities, although we note that there is some refinancing need in 2013. The liquidation ranking is varied withmaterial amounts of senior, subordinate and junior subordinate in issue.Financial leverage was moderate at 15% at year-end 2011. In addition, Moody's assigns equity credit to thesupplementary and security provisions, with, in particular the supplementary reserves recovering in 2010 thanks tothe relative improvement in financial markets, at least as at YE 2010, although the securities adjustment reservedeclined materially in 2011. Furthermore, policyholder reserves continue to be lower than pre-crisis levels.Earnings cover is estimated to be good at 9x in 2011 (2007-11 5 year average of 10x), in line with the healthyprofitability of the company and the relatively modest levels of financial leverage. Nevertheless, Moody's notes thesubstantial volatility of the group's operating performance could pressurise earnings cover in future quarters, as

substantial volatility of the group's operating performance could pressurise earnings cover in future quarters, asdemonstrated in 2008, which resulted in a negative interest coverage figure.Holding company cash flows have been pressurised in recent years, driven in part by meaningful dividends to theowner banks, although there have also been capital injections (as mentioned above) from the owner banks tosupport the life business during times of stress and we note in the last 2 years (2010/11) that the net dividend waszero due to a share issuance at the subsidiary level offsetting actual dividend payments.Overall, we view <strong>SpareBank</strong>1 <strong>Gruppen</strong>'s access to capital markets as being satisfactory but not comparable withlarger European peers, although we note that from May 2012, the larger owner banks are financing <strong>SpareBank</strong>1<strong>Gruppen</strong> <strong>AS</strong> directly.© 2013 Moody's <strong>Investor</strong>s Service, Inc. and/or its licensors and affiliates (collectively, "MOODY'S"). All rights reserved.CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. ("MIS") AND ITS AFFILIATES AREMOODY'S CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDITCOMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND CREDIT RATINGS AND RESEARCHPUBLICATIONS PUBLISHED BY MOODY'S ("MOODY'S PUBLICATIONS") MAY INCLUDE MOODY'S CURRENTOPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT ORDEBT-LIKE SECURITIES. MOODY'S DEFINES CREDIT RISK <strong>AS</strong> THE RISK THAT AN ENTITY MAY NOT MEETITS CONTRACTUAL, FINANCIAL OBLIGATIONS <strong>AS</strong> THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSSIN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOTLIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS ANDMOODY'S OPINIONS INCLUDED IN MOODY'S PUBLICATIONS ARE NOT STATEMENTS OF CURRENT ORHISTORICAL FACT. CREDIT RATINGS AND MOODY'S PUBLICATIONS DO NOT CONSTITUTE OR PROVIDEINVESTMENT OR FINANCIAL ADVICE, AND CREDIT RATINGS AND MOODY'S PUBLICATIONS ARE NOT ANDDO NOT PROVIDE RECOMMENDATIONS TO PURCH<strong>AS</strong>E, SELL, OR HOLD PARTICULAR SECURITIES.NEITHER CREDIT RATINGS NOR MOODY'S PUBLICATIONS COMMENT ON THE SUITABILITY OF ANINVESTMENT FOR ANY PARTICULAR INVESTOR. MOODY'S ISSUES ITS CREDIT RATINGS AND PUBLISHESMOODY'S PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILLMAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FORPURCH<strong>AS</strong>E, HOLDING, OR SALE.ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHTLAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED,FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FORSUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANYMEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY'S PRIOR WRITTEN CONSENT. All informationcontained herein is obtained by MOODY'S from sources believed by it to be accurate and reliable. Because of thepossibility of human or mechanical error as well as other factors, however, all information contained herein is provided"<strong>AS</strong> IS" without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses inassigning a credit rating is of sufficient quality and from sources Moody's considers to be reliable, including, whenappropriate, independent third-party sources. However, MOODY'S is not an auditor and cannot in every instanceindependently verify or validate information received in the rating process. Under no circumstances shall MOODY'S haveany liability to any person or entity for (a) any loss or damage in whole or in part caused by, resulting from, or relating to,any error (negligent or otherwise) or other circumstance or contingency within or outside the control of MOODY'S or anyof its directors, officers, employees or agents in connection with the procurement, collection, compilation, analysis,interpretation, communication, publication or delivery of any such information, or (b) any direct, indirect, special,

interpretation, communication, publication or delivery of any such information, or (b) any direct, indirect, special,consequential, compensatory or incidental damages whatsoever (including without limitation, lost profits), even ifMOODY'S is advised in advance of the possibility of such damages, resulting from the use of or inability to use, any suchinformation. The ratings, financial reporting analysis, projections, and other observations, if any, constituting part of theinformation contained herein are, and must be construed solely as, statements of opinion and not statements of fact orrecommendations to purchase, sell or hold any securities. Each user of the information contained herein must make itsown study and evaluation of each security it may consider purchasing, holding or selling. NO WARRANTY, EXPRESSOR IMPLIED, <strong>AS</strong> TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANYPARTICULAR PURPOSE OF ANY SUCH RATING OR OTHER OPINION OR INFORMATION IS GIVEN OR MADE BYMOODY'S IN ANY FORM OR MANNER WHATSOEVER.MIS, a wholly-owned credit rating agency subsidiary of Moody's Corporation ("MCO"), hereby discloses that most issuersof debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferredstock rated by MIS have, prior to assignment of any rating, agreed to pay to MIS for appraisal and rating servicesrendered by it fees ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain policies andprocedures to address the independence of MIS's ratings and rating processes. Information regarding certain affiliationsthat may exist between directors of MCO and rated entities, and between entities who hold ratings from MIS and havealso publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually atwww.moodys.com under the heading "Shareholder <strong>Relations</strong> — Corporate Governance — Director and ShareholderAffiliation Policy."For Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services Licenseof MOODY'S affiliate, Moody's <strong>Investor</strong>s Service Pty Limited ABN 61 003 399 657AFSL 336969 and/or Moody's AnalyticsAustralia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended to be provided only to"wholesale clients" within the meaning of section 761G of the Corporations Act 2001. By continuing to access thisdocument from within Australia, you represent to MOODY'S that you are, or are accessing the document as arepresentative of, a "wholesale client" and that neither you nor the entity you represent will directly or indirectlydisseminate this document or its contents to "retail clients" within the meaning of section 761G of the Corporations Act2001. MOODY'S credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the equitysecurities of the issuer or any form of security that is available to retail clients. It would be dangerous for retail clients tomake any investment decision based on MOODY'S credit rating. If in doubt you should contact your financial or otherprofessional adviser.