SUNSHINE S CORPORATION - Drake Software Support

SUNSHINE S CORPORATION - Drake Software Support

SUNSHINE S CORPORATION - Drake Software Support

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

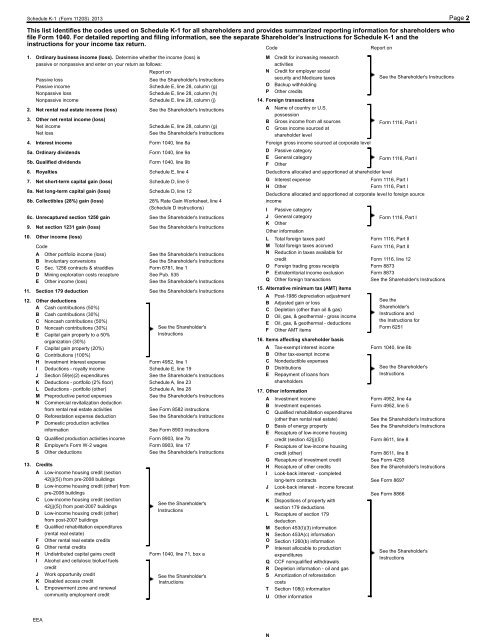

Schedule K-1 (Form 1120S) 2013This list identifies the codes used on Schedule K-1 for all shareholders and provides summarized reporting information for shareholders whofile Form 1040. For detailed reporting and filing information, see the separate Shareholder's Instructions for Schedule K-1 and theinstructions for your income tax return.CodeReport on1. Ordinary business income (loss). Determine whether the income (loss) isM Credit for increasing researchpassive or nonpassive and enter on your return as follows:activitiesReport onN Credit for employer socialSee the Shareholder's InstructionsPassive lossSee the Shareholder's Instructionssecurity and Medicare taxesPassive incomeSchedule E, line 28, column (g)O Backup withholdingNonpassive lossSchedule E, line 28, column (h)P Other creditsNonpassive incomeSchedule E, line 28, column (j)14. Foreign transactions2. Net rental real estate income (loss)See the Shareholder's InstructionsA Name of country or U.S.possession3. Other net rental income (loss) B Gross income from all sourcesForm 1116, Part INet income Schedule E, line 28, column (g) C Gross income sourced atNet lossSee the Shareholder's Instructionsshareholder level4. Interest incomeForm 1040, line 8aForeign gross income sourced at corporate level5a. Ordinary dividendsForm 1040, line 9aD Passive categoryE General categoryForm 1116, Part I5b. Qualified dividendsForm 1040, line 9bF Other6. RoyaltiesSchedule E, line 4Deductions allocated and apportioned at shareholder level7. Net short-term capital gain (loss)Schedule D, line 5G Interest expenseForm 1116, Part IH OtherForm 1116, Part I8a. Net long-term capital gain (loss)Schedule D, line 12Deductions allocated and apportioned at corporate level to foreign source8b. Collectibles (28%) gain (loss)28% Rate Gain Worksheet, line 4 income(Schedule D instructions)I Passive category8c. Unrecaptured section 1250 gainSee the Shareholder's InstructionsJ General categoryForm 1116, Part IK Other9. Net section 1231 gain (loss)See the Shareholder's InstructionsOther information10. Other income (loss) L Total foreign taxes paidForm 1116, Part IICodeM Total foreign taxes accruedForm 1116, Part IIA Other portfolio income (loss)See the Shareholder's InstructionsN Reduction in taxes available forB Involuntary conversionsSee the Shareholder's Instructionscredit Form 1116, line 12C Sec. 1256 contracts & straddles Form 6781, line 1O Foreign trading gross receipts Form 8873D Mining exploration costs recapture See Pub. 535P Extraterritorial income exclusion Form 8873E Other income (loss)See the Shareholder's InstructionsQ Other foreign transactionsSee the Shareholder's Instructions15. Alternative minimum tax (AMT) items11. Section 179 deductionSee the Shareholder's InstructionsA Post-1986 depreciation adjustment12. Other deductions See theB Adjusted gain or lossA Cash contributions (50%)Shareholder'sC Depletion (other than oil & gas)B Cash contributions (30%)Instructions andD Oil, gas, & geothermal - gross incomeC Noncash contributions (50%)the Instructions forE Oil, gas, & geothermal - deductionsD Noncash contributions (30%)See the Shareholder's Form 6251F Other AMT itemsE Capital gain property to a 50%Instructionsorganization (30%)16. Items affecting shareholder basisF Capital gain property (20%)A Tax-exempt interest incomeForm 1040, line 8bG Contributions (100%)B Other tax-exempt incomeH Investment interest expense Form 4952, line 1C Nondeductible expensesI Deductions - royalty income Schedule E, line 19D DistributionsSee the Shareholder'sJ Section 59(e)(2) expendituresSee the Shareholder's InstructionsE Repayment of loans fromInstructionsK Deductions - portfolio (2% floor) Schedule A, line 23shareholdersL Deductions - portfolio (other) Schedule A, line 2817. Other informationM Preproductive period expensesSee the Shareholder's InstructionsA Investment incomeForm 4952, line 4aN Commercial revitalization deductionB Investment expenses Form 4952, line 5from rental real estate activitiesSee Form 8582 instructionsC Qualified rehabilitation expendituresO Reforestation expense deductionSee the Shareholder's Instructions(other than rental real estate)See the Shareholder's InstructionsP Domestic production activitiesD Basis of energy propertySee the Shareholder's InstructionsinformationSee Form 8903 instructionsE Recapture of low-income housingQ Qualified production activities income Form 8903, line 7b credit (section 42(j)(5)) Form 8611, line 8R Employer's Form W-2 wages Form 8903, line 17 F Recapture of low-income housingS Other deductions See the Shareholder's Instructions credit (other) Form 8611, line 8G Recapture of investment credit See Form 425513. CreditsH Recapture of other creditsSee the Shareholder's InstructionsA Low-income housing credit (sectionI Look-back interest - completed42(j)(5)) from pre-2008 buildings long-term contracts See Form 8697B Low-income housing credit (other) fromJ Look-back interest - income forecastpre-2008 buildings method See Form 8866C Low-income housing credit (sectionK Dispositions of property withSee the Shareholder's42(j)(5)) from post-2007 buildingssection 179 deductionsInstructionsD Low-income housing credit (other) L Recapture of section 179from post-2007 buildingsdeductionE Qualified rehabilitation expendituresM Section 453(I)(3) information(rental real estate)N Section 453A(c) informationF Other rental real estate creditsO Section 1260(b) informationG Other rental creditsP Interest allocable to productionSee the Shareholder'sH Undistributed capital gains credit Form 1040, line 71, box a expendituresInstructionsI Alcohol and cellulosic biofuel fuelsQ CCF nonqualified withdrawalscreditR Depletion information - oil and gasJ Work opportunity creditSee the Shareholder'sS Amortization of reforestationK Disabled access credit Instructions costsL Empowerment zone and renewalT Section 108(i) informationcommunity employment creditU Other informationPage 2EEAN