SUNSHINE S CORPORATION - Drake Software Support

SUNSHINE S CORPORATION - Drake Software Support

SUNSHINE S CORPORATION - Drake Software Support

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

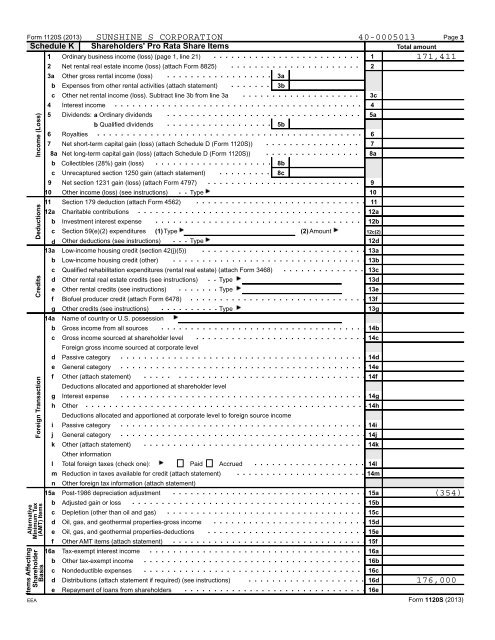

<strong>SUNSHINE</strong> S <strong>CORPORATION</strong> 40-0005013Schedule K Shareholders' Pro Rata Share Items Total amount1 Ordinary business income (loss) (page 1, line 21) . . . . . . . . . . . . . . . . . . . . . . . . . 1 171,411Form 1120S (2013) Page 3AlternativeIncome (Loss)DeductionsCreditsForeign Transaction(AMT) ItemsMinimum TaxItems AffectingShareholderBasisEEA. . . . . . . . . . . . . . . . . . . . . .2 Net rental real estate income (loss) (attach Form 8825)23a Other gross rental income (loss) . . . . . . . . . . . . . . . . . . 3ab Expenses from other rental activities (attach statement) . . . . . . . 3bc Other net rental income (loss). Subtract line 3b from line 3a . . . . . . . . . . . . . . . . . . . . 3c4 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45 Dividends: a Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5ab Qualified dividends . . . . . . . . . . . . . . . . . . 5b6 Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67 Net short-term capital gain (loss) (attach Schedule D (Form 1120S)) . . . . . . . . . . . . . . . . 78a Net long-term capital gain (loss) (attach Schedule D (Form 1120S)) . . . . . . . . . . . . . . . . 8ab Collectibles (28%) gain (loss) . . . . . . . . . . . . . . . . . . . . 8bc Unrecaptured section 1250 gain (attach statement) . . . . . . . . . 8c9 Net section 1231 gain (loss) (attach Form 4797) . . . . . . . . . . . . . . . . . . . . . . . . . . 910 Other income (loss) (see instructions) . . Type1011 Section 179 deduction (attach Form 4562) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1112a Charitable contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12ab Investment interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12bc Section 59(e)(2) expenditures (1) Type (2) Amount12c(2)d Other deductions (see instructions) . . . Type12d13a Low-income housing credit (section 42(j)(5)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13ab Low-income housing credit (other) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13bc Qualified rehabilitation expenditures (rental real estate) (attach Form 3468) . . . . . . . . . . . . . . 13cd Other rental real estate credits (see instructions) . . Type13de Other rental credits (see instructions) . . . . . . . Type13ef Biofuel producer credit (attach Form 6478) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13fg Other credits (see instructions) . . . . . . . . . . Type13g14a Name of country or U.S. possessionb Gross income from all sources . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14bc Gross income sourced at shareholder level . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14cForeign gross income sourced at corporate leveld Passive category . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14de General category . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14ef Other (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14fDeductions allocated and apportioned at shareholder levelg Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14gh Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14hDeductions allocated and apportioned at corporate level to foreign source incomei Passive category . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14ij General category . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14jk Other (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14kOther informationl Total foreign taxes (check one): Paid Accrued . . . . . . . . . . . . . . . . . . . 14lm Reduction in taxes available for credit (attach statement) . . . . . . . . . . . . . . . . . . . . . . 14mn Other foreign tax information (attach statement)15a Post-1986 depreciation adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15ab Adjusted gain or loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15bc Depletion (other than oil and gas) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15cd Oil, gas, and geothermal properties-gross income . . . . . . . . . . . . . . . . . . . . . . . . . . 15de Oil, gas, and geothermal properties-deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . 15ef Other AMT items (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15f16a Tax-exempt interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16ab Other tax-exempt income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16bc Nondeductible expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16cd Distributions (attach statement if required) (see instructions) . . . . . . . . . . . . . . . . . . . . 16de Repayment of loans from shareholders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16e(354)176,000Form 1120S (2013)