2007 Annual Report - Town of Wilton

2007 Annual Report - Town of Wilton

2007 Annual Report - Town of Wilton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

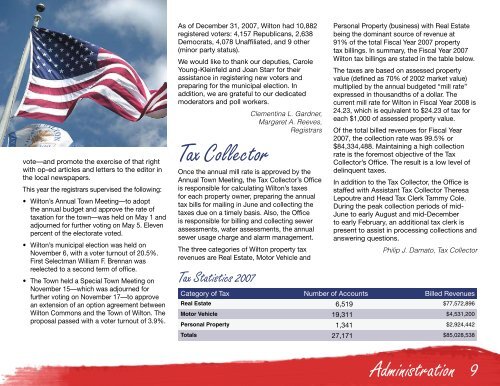

vote—and promote the exercise <strong>of</strong> that rightwith op-ed articles and letters to the editor inthe local newspapers.This year the registrars supervised the following:• <strong>Wilton</strong>’s <strong>Annual</strong> <strong>Town</strong> Meeting—to adoptthe annual budget and approve the rate <strong>of</strong>taxation for the town—was held on May 1 andadjourned for further voting on May 5. Elevenpercent <strong>of</strong> the electorate voted.• <strong>Wilton</strong>’s municipal election was held onNovember 6, with a voter turnout <strong>of</strong> 20.5%.First Selectman William F. Brennan wasreelected to a second term <strong>of</strong> <strong>of</strong>fice.• The <strong>Town</strong> held a Special <strong>Town</strong> Meeting onNovember 15—which was adjourned forfurther voting on November 17—to approvean extension <strong>of</strong> an option agreement between<strong>Wilton</strong> Commons and the <strong>Town</strong> <strong>of</strong> <strong>Wilton</strong>. Theproposal passed with a voter turnout <strong>of</strong> 3.9%.As <strong>of</strong> December 31, <strong>2007</strong>, <strong>Wilton</strong> had 10,882registered voters: 4,157 Republicans, 2,638Democrats, 4,078 Unaffiliated, and 9 other(minor party status).We would like to thank our deputies, CaroleYoung-Kleinfeld and Joan Starr for theirassistance in registering new voters andpreparing for the municipal election. Inaddition, we are grateful to our dedicatedmoderators and poll workers.Clementina L. Gardner,Margaret A. Reeves,RegistrarsTax CollectorOnce the annual mill rate is approved by the<strong>Annual</strong> <strong>Town</strong> Meeting, the Tax Collector’s Officeis responsible for calculating <strong>Wilton</strong>’s taxesfor each property owner, preparing the annualtax bills for mailing in June and collecting thetaxes due on a timely basis. Also, the Officeis responsible for billing and collecting sewerassessments, water assessments, the annualsewer usage charge and alarm management.The three categories <strong>of</strong> <strong>Wilton</strong> property taxrevenues are Real Estate, Motor Vehicle andTax Statistics <strong>2007</strong>Personal Property (business) with Real Estatebeing the dominant source <strong>of</strong> revenue at91% <strong>of</strong> the total Fiscal Year <strong>2007</strong> propertytax billings. In summary, the Fiscal Year <strong>2007</strong><strong>Wilton</strong> tax billings are stated in the table below.The taxes are based on assessed propertyvalue (defined as 70% <strong>of</strong> 2002 market value)multiplied by the annual budgeted “mill rate”expressed in thousandths <strong>of</strong> a dollar. Thecurrent mill rate for <strong>Wilton</strong> in Fiscal Year 2008 is24.23, which is equivalent to $24.23 <strong>of</strong> tax foreach $1,000 <strong>of</strong> assessed property value.Of the total billed revenues for Fiscal Year<strong>2007</strong>, the collection rate was 99.5% or$84,334,488. Maintaining a high collectionrate is the foremost objective <strong>of</strong> the TaxCollector’s Office. The result is a low level <strong>of</strong>delinquent taxes.In addition to the Tax Collector, the Office isstaffed with Assistant Tax Collector TheresaLepoutre and Head Tax Clerk Tammy Cole.During the peak collection periods <strong>of</strong> mid-June to early August and mid-Decemberto early February, an additional tax clerk ispresent to assist in processing collections andanswering questions.Philip J. Damato, Tax CollectorCategory <strong>of</strong> Tax Number <strong>of</strong> Accounts Billed RevenuesReal Estate 6,519 $77,572,896Motor Vehicle 19,311 $4,531,200Personal Property 1,341 $2,924,442Totals 27,171 $85,028,538Administration9