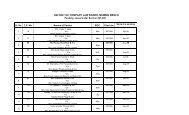

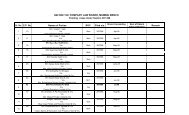

before the company law board - Company Law Board Mumbai Bench

before the company law board - Company Law Board Mumbai Bench

before the company law board - Company Law Board Mumbai Bench

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

53. It is fur<strong>the</strong>r submitted that <strong>the</strong> petitioners decided to inspect<strong>the</strong> records of <strong>the</strong> R1 with <strong>the</strong> ROC and inspected <strong>the</strong> records of <strong>the</strong>R1 on 10 th April, 2008 and shocked to know that fur<strong>the</strong>r 49,960equity shares have been allotted by R1 <strong>Company</strong> and <strong>the</strong> paid upshare capital has been increased to 50,000 equity shares. Thepetitioners have also come to know that R2 to 6 are using <strong>the</strong> propertyof R1 situated at Andheri (East), <strong>Mumbai</strong> for <strong>the</strong>ir own personal useand not for <strong>the</strong> purpose of <strong>the</strong> business of R1; and it is found that<strong>the</strong>re is no revenue generating for R1 which is clear and unambiguouscase of diversion and siphoning off <strong>the</strong> funds of R1 <strong>Company</strong>. Thepetitioners have also come to know that <strong>the</strong> R2 to 6 have given <strong>the</strong>property of R1 <strong>Company</strong> situated at Andheri (East), <strong>Mumbai</strong> on leaseto R7 without <strong>the</strong> knowledge and consent of <strong>the</strong> petitioners. Thepetitioners requested <strong>the</strong> R2 to 6 as well as <strong>the</strong> R7 to produce <strong>the</strong>copy of <strong>the</strong> Lease Agreement entered into between <strong>the</strong> R1 and R7.The petitioner No.1 has come to know from <strong>the</strong> correspondenceexchanged with <strong>the</strong> R7 that <strong>the</strong> said purported lease agreement wasapproved in <strong>the</strong> alleged <strong>Board</strong> Meeting held on 15 th December, 2005while <strong>the</strong> fact is that <strong>the</strong> petitioner No.1 never received any notice of<strong>the</strong> said alleged <strong>Board</strong> Meeting of <strong>the</strong> R1 <strong>Company</strong>. The respondentsare using <strong>the</strong> R1 <strong>Company</strong> as a vehicle for <strong>the</strong>ir personal enrichment.The petitioners have now also learnt that as a part of <strong>the</strong>ir design todeny and deprive <strong>the</strong> legitimate rights and expectations asCP 15/2008P Exports

6shareholders, as also of <strong>the</strong> fruits of <strong>the</strong>ir labour and vision, <strong>the</strong> R2 to6 have been siphoning away valuable assets and rights of <strong>the</strong> R1<strong>Company</strong>. The sole motive of R2 to 6 is to exclusively take over <strong>the</strong>R1 and its management to <strong>the</strong> exclusion of <strong>the</strong> petitioners, with <strong>the</strong>ultimate aim and objective of converting <strong>the</strong> <strong>Company</strong> into <strong>the</strong>irpersonal business for <strong>the</strong>ir personal benefits and enhancement. It isfur<strong>the</strong>r submitted that R2 to 6 are not interested in <strong>the</strong> welfare andwell being of <strong>the</strong> R1 but is actively engaged in illegalities andmisconduct and misappropriating assets to <strong>the</strong>ir personal accountsunder his control which is prejudicial to <strong>the</strong> R1 and <strong>the</strong> petitioners as<strong>the</strong> 50% shareholder of R1. Such actions are bound to result intowinding up of <strong>the</strong> R1. The Learned Counsel fur<strong>the</strong>r submitted that<strong>the</strong> respondents admitted <strong>the</strong> fact that <strong>the</strong> petitioners and <strong>the</strong>respondents are equal shareholders. After Sept., 2003 <strong>the</strong> petitionerswere excluded from <strong>the</strong> management and <strong>the</strong> respondents are only in<strong>the</strong> management. The R2 appointed R3 as director. He contendedthat <strong>the</strong>re must be clear denial in respect of pleadings if <strong>the</strong>re is noadmission ei<strong>the</strong>r denial or admission it amounts to admission of factand in support <strong>the</strong>reof he relied upon <strong>the</strong> following citations:CP 15/2008P Exports(1) AIR 1964 SC 538 In <strong>the</strong> matter of Badat & <strong>Company</strong>Vs East India Trading <strong>Company</strong> at Para 11 & 13. (2) AIR 2004SC 230 In <strong>the</strong> matter of Sushil Kumar Vs. Rakesh Kumar. Headnote ‘G’.

74. Respondents have filed detailed reply to <strong>the</strong> petition. ShriMadon, Learned Senior Counsel narrated <strong>the</strong> brief facts andsubmitted that <strong>the</strong> present Petition proceeds on <strong>the</strong> basis of totallyfalse and/or misleading allegations to <strong>the</strong> effect that <strong>the</strong> Petitionersare <strong>the</strong> shareholders and are entitled to act as directors and have aninterest in <strong>the</strong> property and asset owned by <strong>the</strong> Gyandev Sadh<strong>Company</strong>. The Petitioners have also suppressed from this Hon’ble<strong>Bench</strong> that in fact and on <strong>the</strong> contrary, by and under a familyarrangement arrived at inter alia between <strong>the</strong> Petitioners and <strong>the</strong>respondents, on 30 th August 2004 and 11 th September 2004, it hasbeen inter alia agreed between <strong>the</strong> parties that <strong>the</strong> shares held in <strong>the</strong>name of <strong>the</strong> Petitioners belong to Mr. Bazzardev Sadh and <strong>the</strong>petitioners shall resign as directors of <strong>the</strong> Respondent No. 1<strong>Company</strong>. The said family arrangement/settlement has beensubstantially implemented and pursuant to such implementation, interalia, <strong>the</strong> possession, of <strong>the</strong> property held in <strong>the</strong> name of <strong>the</strong> GyandevSadh <strong>Company</strong> has been handed over to <strong>the</strong> Respondents and <strong>the</strong>y arein exclusive use, occupation, possession and enjoyment. Therespondents are receiving and appropriating <strong>the</strong> income and profits aswell as making payment of <strong>the</strong> outgoings in respect of suchproperties. Since <strong>the</strong> Petitioners have failed and / or neglected and /ordelayed completing <strong>the</strong> remaining part of <strong>the</strong> implementation, <strong>the</strong>CP 15/2008P Exports

8respondents have filed a Suit in <strong>the</strong> Hon’ble High Court being SuitNo. 1937 of 2008. The Petitioner No. 1 and R2 are bro<strong>the</strong>rs and sonsof late Mr. Parmeshwar Narain Sadh. The Bazzardev Sadh Group and<strong>the</strong> Gyandev Sadh Group are parties to <strong>the</strong> familyarrangement/settlement and accordingly <strong>the</strong> division has taken placein <strong>the</strong> following manner, M/s. Ananya Fashions Pvt. Ltd., M/s. ArshFashions Pvt. Ltd., M/s. Parmeshwar Exports Pvt. Ltd. (hereinafterreferred to as “<strong>the</strong> Bazzardev Sadh Group Companies”) and one M/s.Club-3 Apparels Pvt. Ltd. (hereinafter referred to as “<strong>the</strong> GyandevSadh Group <strong>Company</strong>”) wherein <strong>the</strong> Bazzardev Sadh Group and <strong>the</strong>Gyandev Sadh Group held more or less 50% share each. Theproperties held in <strong>the</strong> name of <strong>the</strong> Bazzardev Sadh Group Companies,by and under <strong>the</strong> family arrangement/settlement have been allotted to<strong>the</strong> Bazzardev Sadh Group and <strong>the</strong> property held in <strong>the</strong> name of <strong>the</strong>Gyandev Sadh Group <strong>Company</strong>, has been allotted to <strong>the</strong> GyandevSadh Group. As per such family arrangement/settlement, <strong>the</strong> sharesheld by <strong>the</strong> Gyandev Sadh Group in <strong>the</strong> Bazzardev Sadh GroupCompanies belong to and have to be formally transferred in favour of<strong>the</strong> Bazzardev Sadh Group and similarly, <strong>the</strong> shares held by <strong>the</strong>Bazzardev Sadh Group in <strong>the</strong> Gyandev Sadh Group <strong>Company</strong> belongCP 15/2008P Exports

9to and have to be formally transferred in favour of <strong>the</strong> Gyandev SadhGroup.5. To resolve <strong>the</strong> disputes and differences between <strong>the</strong>petitioners and <strong>the</strong> respondents, <strong>the</strong> above family arrangement cameto be arrived at. It is an admitted fact that <strong>the</strong> Bazzardev Sadh Groupand <strong>the</strong> Gyandev Sadh Group held certain, inter alia, immovableproperties, ei<strong>the</strong>r in <strong>the</strong> individual names of <strong>the</strong> members of <strong>the</strong>family or in <strong>the</strong> name of partnership firms or limited companies.Certain disputes and differences arose between <strong>the</strong> parties, inter alia,in respect of such immovable properties. The parties referred suchdisputes and differences to <strong>the</strong> mediation of <strong>the</strong>ir family Advocate &Solicitors and <strong>the</strong>ir family Chartered Accountants for division and/orsegregation and/or separate allotment of such properties, among <strong>the</strong>said 2 bro<strong>the</strong>rs and <strong>the</strong>ir respective family members. Pursuant to suchmediation, family arrangement/settlement was arrived at between <strong>the</strong>Bazzardev Sadh Group and <strong>the</strong> Gyandev Sadh Group, whereby siximmovable properties were divided and/or segregated andconsequently allotted to <strong>the</strong> Bazzardev Sadh Group and <strong>the</strong> GyandevSadh Group. The heads or main features of such familyarrangement/settlement have been recorded in writing byMemorandum duly signed by <strong>the</strong> parties and such familyarrangement/settlement has been substantially implemented. Pursuantto such family arrangement/settlement and in implementation <strong>the</strong>reof,CP 15/2008P Exports

10inter alia <strong>the</strong> possession of <strong>the</strong> properties coming to <strong>the</strong> share of eachGroup has been handed over to each Group and each of <strong>the</strong> saidGroups are in exclusive use, occupation, possession and enjoyment of<strong>the</strong> properties coming to <strong>the</strong>ir respective share. The concerned Groupis also in complete control and management of such<strong>company</strong>/companies and is enjoying <strong>the</strong> income, profits and assets ofsuch <strong>company</strong>. Virtually <strong>the</strong> only part of <strong>the</strong> implementation thatremains pending of such family arrangement/settlement, being that<strong>the</strong> parties are required to execute certain formal documents toformally convey title in respect of such properties coming to <strong>the</strong> shareof respective Groups and/or to execute documents inter alia necessaryfor formal retirement by <strong>the</strong> concerned members of each group, aspartners of <strong>the</strong> concerned partnership firm and/or formally transfer<strong>the</strong> shareholding held by <strong>the</strong> concerned members of each group. Mostof <strong>the</strong> documents required to be signed by <strong>the</strong> Bazzardev Sadh Groupin respect of <strong>the</strong> properties coming to <strong>the</strong> share of <strong>the</strong> Bazzardev SadhGroup, have in fact been executed by <strong>the</strong>m. The Gyandev SadhGroup, however with mala fide intention and ulterior motive, havefailed and/or neglected and/or avoided to execute such documents andconsequently to complete <strong>the</strong> implementation of <strong>the</strong> familyarrangement/settlement arrived at between <strong>the</strong> parties and is nowappear to be interested in resiling and/or wriggle out of <strong>the</strong> familyarrangement/settlement already arrived at and not implementing <strong>the</strong>CP 15/2008P Exports

11remaining part of <strong>the</strong> same. The Bazzardev Sadh Group <strong>the</strong>refore wasconstrained to file <strong>the</strong> said suit <strong>before</strong> <strong>the</strong> Hon’ble High Court.Needless to state that <strong>the</strong> respondents i.e. <strong>the</strong> Bazzardev Sadh Grouphave always been ready and willing to fulfill <strong>the</strong>ir part of <strong>the</strong>obligations under <strong>the</strong> family arrangement/settlement and toimplement <strong>the</strong> same as agreed including by executing appropriatedocuments for formally conveying <strong>the</strong> title in respect of <strong>the</strong> propertiescoming to <strong>the</strong> share of <strong>the</strong> Petitioners i.e. <strong>the</strong> Gyandev Sadh Group.6. In or about November 2007, to <strong>the</strong> shock and surprise of<strong>the</strong> said respondents viz. <strong>the</strong> Bazzardev Group, <strong>the</strong> said respondentslearnt that <strong>the</strong> Gyandev Sadh Group, and in particular <strong>the</strong> concernedmembers of Gyandev Sadh Group indulged into several acts ofoppression and mismanagement in respect of <strong>the</strong> income andproperties of and belonging to ano<strong>the</strong>r Pvt. Ltd. <strong>Company</strong> of <strong>the</strong> SadhFamily Group viz. M/s. River Technoplast Pvt. Ltd., not forming apart of <strong>the</strong> said family arrangement/settlement already arrived at. In<strong>the</strong> circumstances, <strong>the</strong> Bazzardev Sadh was constrained to file apetition being CP No. 6 of 2008 under section 397 & 398 ofCompanies Act, <strong>before</strong> <strong>the</strong> <strong>Company</strong> <strong>Law</strong> <strong>Board</strong>, Principal <strong>Bench</strong> atNew Delhi. The Hon’ble <strong>Company</strong> <strong>Law</strong> <strong>Board</strong> has passed appropriateorder granting protection to <strong>the</strong> petitioner <strong>the</strong>rein.7. The Learned Senior Counsel made his submissions to <strong>the</strong>specific allegations made in <strong>the</strong> petition. He submitted that Mr.CP 15/2008P Exports

12Varundev Sadh i.e. R3 is not a Director of R1 <strong>Company</strong> although R4has been appointed as Director of <strong>the</strong> <strong>Company</strong> on or about 29 thSeptember 2007. Similarly, R6 is not a shareholder of R1. It isParmeshwar Fashions, a partnership firm who is <strong>the</strong> shareholder ofParmeshwar Exports Pvt. Ltd. It is also incorrect that R7 is <strong>the</strong>licensee of any premises owned by <strong>the</strong> R1 <strong>Company</strong>. The License infavour of R7 has been terminated long ago and from December 2007onwards Global Travel Solutions Pvt. Ltd. is <strong>the</strong> licensee in respect of<strong>the</strong> basement, ground and first floor and <strong>the</strong>reafter <strong>the</strong> premises on <strong>the</strong>second floor has also been given on license to <strong>the</strong> said licensee,pursuant to agreement dated 7 th November 2007 and 17 th December2007. It is reiterated that in view of <strong>the</strong> said familyarrangement/settlement no question arises of <strong>the</strong> shareholding patternof <strong>the</strong> R1 <strong>Company</strong> remaining <strong>the</strong> same and under <strong>the</strong> said familyarrangement/settlement <strong>the</strong> said <strong>company</strong> and <strong>the</strong> properties andassets held in <strong>the</strong> name of <strong>the</strong> said <strong>company</strong> solely and exclusivelybelong to <strong>the</strong> Bazzardev Sadh Group and <strong>the</strong> shares formerly held in<strong>the</strong> name of <strong>the</strong> members of <strong>the</strong> Gyandev Sadh Group are formerlyliable to be transferred in favour of Mr. Bazzardev Sadh. After <strong>the</strong>said family arrangement/settlement <strong>the</strong> petitioners are not concernedwith <strong>the</strong> said <strong>company</strong> or its management and/or its affairs.However, <strong>the</strong> staff of <strong>the</strong> <strong>company</strong> as in a routine manner sent allnecessary accounts to all <strong>the</strong> shareholders including <strong>the</strong> Petitioners asCP 15/2008P Exports

13<strong>the</strong>ir names continue to be shown as shareholders of <strong>the</strong> <strong>company</strong>,save and except in respect of <strong>the</strong> year 2007-2008, as <strong>the</strong> accounts for<strong>the</strong> same are not yet audited and finalized. The R6 is one of <strong>the</strong>shareholders of <strong>the</strong> R1 <strong>Company</strong>. It is false to state that <strong>the</strong>Respondents are using <strong>the</strong> property of <strong>the</strong> <strong>company</strong> for <strong>the</strong>ir personaluse and <strong>the</strong> same is being used for <strong>the</strong> purpose of <strong>the</strong> <strong>company</strong> as setout in <strong>the</strong> books of accounts of <strong>the</strong> <strong>company</strong>. In any event, it is noneof <strong>the</strong> business of <strong>the</strong> petitioners as under <strong>the</strong> said familyarrangement/settlement <strong>the</strong> said <strong>company</strong>, <strong>the</strong> management, control<strong>the</strong>reof as well as <strong>the</strong> properties, assets and income solely andexclusively belong to <strong>the</strong> Bazzardev Sadh Group and <strong>the</strong> GyandevSadh Group have no right, title or interest of any nature whatsoever inrespect of <strong>the</strong> same. When <strong>the</strong> property was given on licence to <strong>the</strong>Respondent No. 8, <strong>the</strong> same was appropriately recorded in <strong>the</strong>minutes of <strong>the</strong> meeting of <strong>the</strong> <strong>Board</strong> of Directors.8. The Learned Senior Counsel fur<strong>the</strong>r submitted thatpetitioner admitted at para 2.5 of <strong>the</strong> petition that <strong>the</strong> R1 is a familybusiness and quasi partnership between <strong>the</strong> Petitioner No.1 familyand Respondent No.2 family. The family settlement dated 30 thAugust, 2004 and 11 th Sept., 2004 are binding upon all <strong>the</strong> parties. Itis also pertinent to note that all <strong>the</strong> properties/assets reflected in <strong>the</strong>family settlement have been purchased out of a common pool offunds/assets jointly owned by <strong>the</strong> Sadh Family.CP 15/2008P ExportsOn this point he

14relied upon <strong>the</strong> decision of <strong>the</strong> Apex Court reported in (1) AIR 1976SC 807 In <strong>the</strong> matter of Kale & Ors Vs. Dy.Director ofConsolidation & Ors.CP 15/2008P ExportsIt is held “Family arrangements aregoverned by principles which are not applicable to dealings betweenstrangers. The Court, when deciding <strong>the</strong> rights of parties underfamily arrangements or claims to upset such arrangements, considerswhat in <strong>the</strong> broadest view of <strong>the</strong> matter is most for <strong>the</strong> interest offamilies and has regard to considerations which in dealing withtransactions between persons not members of <strong>the</strong> same family, wouldnot be taken into account. Matters which would be fatal to <strong>the</strong>validity of similar transactions between strangers are not objectionsto <strong>the</strong> binding effect of family arrangements.” (2) AIR 1971 SC 1337In <strong>the</strong> matter of Shambhu Prasad Singh Vs. Phool Kumari & Ors.Para 9. (3) AIR 1966 SC 1836 In <strong>the</strong> matter of Maturi Pullaiah &Anr. Vs. M.Narasimham & Ors. Para 17. (4) AIR 2000 SC 2488 In<strong>the</strong> matter of Harishankar Singhania & Ors. Vs. GaurHarisinghania & Ors. Para 43, 44. (5) (2004) 9 SCC 204 In <strong>the</strong>matter of M.S.Madhusoodhanan & Anr. Vs. Kerala KaumudiPvt.Ltd. & Ors. Para 137, 139.He fur<strong>the</strong>r contended that <strong>the</strong>petitioners sought declarations and no relief can be granted in view ofSec.34 of Specific Relief Act and relied upon <strong>the</strong> following decisions:1) Vol.XIII MADRAS SERIES Page 75 In <strong>the</strong> matter ofKombi Vs Aundi & Ors. 2) AIR 2004 Jharkhand 92 In <strong>the</strong> matter

15of Chhabi Dushadh & Anr. Vs. Bhuneshwar Pandey & Anr. Para16. The Learned Counsel fur<strong>the</strong>r submitted that <strong>the</strong> petitionerobtained ex-parte orders from this <strong>Bench</strong> which he is not entitled toand relied upon <strong>the</strong> decisions: (1) (1994) 1 SCC Page 1 In <strong>the</strong> matterof S.P. Chengalvaraya Naidu Vs. Jagannath & Ors. Para 5.(2) (2006) 7 SCC 416 In <strong>the</strong> matter of Hamza Haji Vs. State ofKerala and Anr. Para 24. (3) (2007) 4 SCC 221 In <strong>the</strong> matter ofA.V.Papayya Sastry & Ors. vs. Government of A.P. & Ors. Para21, 29.9. While rejoining to <strong>the</strong> submissions of <strong>the</strong> respondents, <strong>the</strong>Learned Counsel for <strong>the</strong> petitioner submitted that MOU cannot bepart of Corporate Governance and not binding on shareholders or<strong>Company</strong> and relied upon <strong>the</strong> following decisions. (1) AIR 1992 SC453 In <strong>the</strong> matter of V.B. Rangaraj Vs. V.B.Gopalakrishnan. Para7 and 9. (2) AIR 1955 SC 74 In <strong>the</strong> matter of Mrs.Bacha F. GuzdarVs. Commissioner of Income Tax. (3) 2000 Comp.Cases Vol 100page 19 (Bombay High Court) In <strong>the</strong> matter of Rolta India Limited& Anr. Vs. Venire Industries Limited & Ors. Page 32. (4) 2003Comp.Cases Vol.113 Page 298 CLB In <strong>the</strong> matter of RadheshyamTulsian & Ors Vs. Panchmukhy Investments Limited. It is toshow “The <strong>Company</strong> <strong>Law</strong> <strong>Board</strong> will not consider privateagreements between parties.CP 15/2008P ExportsMemorandum of Understandingbetween shareholding groups will not be considered.” (5) (2010) 7

16SCC Page 1 In <strong>the</strong> matter of Reliance Natural Resources LimitedVs. Reliance Industries Limited. Para 32910. The Learned Counsel for <strong>the</strong> petitioner relied upon <strong>the</strong>following citations during <strong>the</strong> course his arguments: (1) (2005) 7 SCC764 In <strong>the</strong> matter of Ajit Kumar Nag Vs. General Manager, IOC.Para 44. (2) (2007) 1 CLJ 437CLB In <strong>the</strong> matter of Smt.VijayKhanna & 8 O<strong>the</strong>rs Vs. V.K.Kafoor & Associates Pvt.Ltd.. Para5. (3) (2009) 8 SCC 257 In <strong>the</strong> matter of Sardar Associates & Ors.Vs. Punjab & Singh Bank & Ors. Para 27 (4) (2011) 1 SCC 466 In<strong>the</strong> matter of Motiram (Dead) through Lrs. Vs. Ashok Kumar &Anr.. (5) (2010) 1 SCC 83 In <strong>the</strong> matter of Grasim IndustriesLimited & Anr. Vs. Agarwal Steel. Para 6. (6) (2003) 2 SCC 355 In<strong>the</strong> matter of B.L.Sreedhar & Ors. Vs. K.M.Munireddy (Dead) &Ors. Para 13 & 5. (7) (2009) 12 SCC 378 In <strong>the</strong> matter of State ofOrissa & Ors. Vs. Haripriya Bisoi. Para 40.11. Heard <strong>the</strong> Learned Counsel appearing for <strong>the</strong> parties andperused <strong>the</strong> pleadings, documents and citations relied upon by <strong>the</strong>m.After analyzing <strong>the</strong> pleadings <strong>the</strong> following issues are felt forconsideration and <strong>the</strong> same are needed to be addressed.1) Whe<strong>the</strong>r <strong>the</strong> R1 <strong>Company</strong> is run on <strong>the</strong> basis ofprinciples of quasi partnership?CP 15/2008P Exports

172) Whe<strong>the</strong>r <strong>the</strong> respondents denied <strong>the</strong> inspection ofrecords and registers to <strong>the</strong> petitioners?3) Whe<strong>the</strong>r this <strong>Bench</strong> has any power to direct <strong>the</strong>parties to enforce <strong>the</strong> family arrangement/settlement?4) To what relief?Now I deal with <strong>the</strong> issue No.1.CP 15/2008P ExportsThe R1 <strong>Company</strong> was incorporated 27 th April, 1976 as aprivate <strong>company</strong> and <strong>the</strong> transfer of shares are restricted. It is anadmitted fact that <strong>the</strong> R1 <strong>Company</strong> consists of only family membersof <strong>the</strong> petitioner No.1 and Respondent No.2 and <strong>the</strong>re is no o<strong>the</strong>routside person. The petitioners contended that <strong>the</strong>y are holding 50%and <strong>the</strong> respondents also holding 50% of <strong>the</strong> paid up capital and <strong>the</strong>R1 <strong>Company</strong> is a family business and quasi partnership between <strong>the</strong>Petitioner No.1 family and Respondent No.2 family and also averredthat <strong>the</strong> same ratio of 50% each will be maintained in future as well.However, from <strong>the</strong> Articles it is seen that <strong>the</strong>re is no such clause orprovision with respect to <strong>the</strong> understanding that <strong>the</strong> 50% ratio will bemaintained in future between <strong>the</strong> petitioners and <strong>the</strong> respondents.The respondents in <strong>the</strong>ir reply have stated that in view of <strong>the</strong> familyarrangement no question arises of <strong>the</strong> shareholding pattern of R1<strong>Company</strong> remaining <strong>the</strong> same and contended that according to <strong>the</strong>family arrangement, properties and assets held in <strong>the</strong> name of <strong>the</strong> R1

18<strong>Company</strong> belong to <strong>the</strong> Respondent Group. The respondents in <strong>the</strong>irrejoinder to <strong>the</strong> reply filed by <strong>the</strong> defendants to <strong>the</strong> Notice of MotionNo.2487 of 2008 in Suit No.1937 of 2008 <strong>before</strong> <strong>the</strong> Hon’ble HighCourt of Bombay at para 5 wherein it was averred that “it is alsopertinent to note that all <strong>the</strong> properties/assets reflected in <strong>the</strong> familysettlement have been purchased out of a common pool of funds/assetsjointly owned by <strong>the</strong> Sadh family.” Thus <strong>the</strong> respondents clearlyadmitted that all <strong>the</strong> properties/assets have been purchased out of acommon pool of funds jointly owned by <strong>the</strong> Sadh family. Thepetitioners have filed search report dated 10 th April, 2008, it reflectsthat <strong>the</strong> petitioner No.1 and <strong>the</strong> respondent No.2 and o<strong>the</strong>r twopersons are directors of <strong>the</strong> <strong>Company</strong> and 1 stCP 15/2008P Exportspetitioner andRespondent No.2 still continuing as directors. According to <strong>the</strong>shareholding pattern of <strong>the</strong> <strong>Company</strong>, <strong>the</strong> petitioners’ group holds25,000 shares and <strong>the</strong> respondents’ group holds 25,000 shares.There is no denial to this report and it fur<strong>the</strong>r streng<strong>the</strong>ns <strong>the</strong> standthat <strong>the</strong> petitioners’ group and <strong>the</strong> respondents’ group hold 50% each.Moreover <strong>the</strong> respondents have nei<strong>the</strong>r specifically denied noradmitted with respect to <strong>the</strong> averment made by <strong>the</strong> petitioners that <strong>the</strong>R1 <strong>Company</strong> is a family business and a quasi partnership exceptstating that in view of family arrangement <strong>the</strong> question of 50% ratiodoes not arise. The Learned Counsel for <strong>the</strong> petitioners contended that<strong>the</strong>re must be clear denial in respect of pleadings, if <strong>the</strong>re is no

19admission ei<strong>the</strong>r denial or admission it amounts to admission of factsand relied upon <strong>the</strong> judgements cited supra. I agree with <strong>the</strong>submissions that <strong>the</strong> respondents have not denied nei<strong>the</strong>r admitted <strong>the</strong>fact of family business and quasi partnership. Therefore, I am of <strong>the</strong>view that <strong>the</strong> R1 <strong>Company</strong> is a family run <strong>company</strong> and <strong>the</strong> principlesof quasi partnership will apply since <strong>the</strong> petitioners and <strong>the</strong>respondents hold 50% each and <strong>the</strong>re is no change in <strong>the</strong> shareholdingpattern. Accordingly <strong>the</strong> issue is answered.Now I deal with <strong>the</strong> issue No.2:CP 15/2008P ExportsThe petitioners contended that <strong>the</strong> respondents have notprovided <strong>the</strong> inspection of <strong>the</strong> records and registers to <strong>the</strong>m. It is <strong>the</strong>ircase that <strong>the</strong>y had signed <strong>the</strong> Annual Accounts for <strong>the</strong> year ended31.3.2003 and after that <strong>the</strong> R2 has not signed any Annual Accountsfor <strong>the</strong> year ended 31 stMarch, 2004 to 2008. The respondentscontended that <strong>the</strong> petitioners are not concerned with <strong>the</strong> managementor its affairs after <strong>the</strong> family arrangement dated 30 th August, 2004 and11 th Sept., 2004. However, <strong>the</strong>y sent necessary accounts to all <strong>the</strong>shareholders including <strong>the</strong> petitioners as <strong>the</strong>ir names continue to beshown as shareholders of <strong>the</strong> <strong>Company</strong>. The respondents along with<strong>the</strong>ir reply produced documents wherefrom it is seen that <strong>the</strong>re iscorrespondence between <strong>the</strong> respondents’ solicitors and <strong>the</strong>petitioners. It is relevant to mention that <strong>the</strong> Respondent No.2 filedCP No.6 of 2008 <strong>before</strong> <strong>the</strong> CLB Principal <strong>Bench</strong>, New Delhi in <strong>the</strong>

20month of January, 2008 and <strong>the</strong> petitioners have filed CP Nos.15, 16and 17 of 2008 <strong>before</strong> this <strong>Bench</strong> in <strong>the</strong> month of May, 2008. Afterfiling of <strong>the</strong> petitions <strong>the</strong> petitioners’ solicitors and <strong>the</strong> respondents’solicitors have addressed letters to each o<strong>the</strong>r. The petitioners havesought inspection of <strong>the</strong> documents vide <strong>the</strong>ir letters dated 23rd June,2008 and 26 th June, 2008 addressed to <strong>the</strong> <strong>Company</strong>. The respondentsthrough <strong>the</strong>ir solicitors have replied vide para 10 wherein it is statedthat “in <strong>the</strong> circumstances aforesaid kindly let us know how youclaim to make or maintain any request for inspection of documentspertaining to <strong>the</strong> said <strong>Company</strong>? After receipt of your response weshall <strong>the</strong>reafter deal with your request on merits.” From <strong>the</strong>correspondence it is seen that <strong>the</strong>re is no clear intention of <strong>the</strong>respondents to provide inspection of <strong>the</strong> documents to <strong>the</strong> petitioner.It is an admitted fact that <strong>the</strong> petitioners are 50% shareholders of <strong>the</strong><strong>Company</strong> and <strong>the</strong>y are entitled to inspect <strong>the</strong> records and registers in<strong>the</strong> capacity as shareholders and directors. Therefore, it is herebydirected <strong>the</strong> <strong>Company</strong> to provide <strong>the</strong> inspection of registers andrecords to <strong>the</strong> petitioners in accordance with <strong>law</strong>. The petitioners arealso entitled to <strong>the</strong> notices for <strong>the</strong> <strong>Board</strong> and General Meetings as per<strong>the</strong> Articles of Association and <strong>the</strong> <strong>law</strong>. Accordingly <strong>the</strong> issue isanswered.Now I deal with <strong>the</strong> issue No.3CP 15/2008P Exports

21CP 15/2008P ExportsThe respondents in <strong>the</strong>ir counter dated 18 th July, 2008heavily relied upon that under a family arrangement arrived atbetween <strong>the</strong> 1 st petitioner and <strong>the</strong> 2 nd respondent on 30 th August, 2004and 11 th Sept., 2004, according to which <strong>the</strong> properties were dividedbetween <strong>the</strong>m. The respondents enclosed <strong>the</strong> said family arrangementalong with <strong>the</strong>ir reply. The family arrangement dated 30 th August,2004 wherefrom it shows that <strong>the</strong> petitioner No.1 and RespondentNo.2 and solicitor and Chartered Accountants present and shown <strong>the</strong>immovable properties divided and distributed between <strong>the</strong> petitionerNo.1 and Respondent No.2. The family arrangement dated 11 th Sept.,2004, is in continuation of <strong>the</strong> earlier arrangement dated 30 th August,2004. However, it is captioned as Sadh Family Business Separationand signed by <strong>the</strong> petitioner No.1 and Respondent No.2. Thepetitioners have not mentioned about <strong>the</strong> said family arrangement in<strong>the</strong> petition and no relief to that effect has been sought. Therespondents in <strong>the</strong>ir reply stressed that <strong>the</strong> family arrangement hasbeen substantially implemented and pursuant to such implementation<strong>the</strong> possession of <strong>the</strong> property held in <strong>the</strong> name of <strong>the</strong> 1 st petitionerhas been handed over to <strong>the</strong> respondents and <strong>the</strong> respondentsappropriating <strong>the</strong> income and profits. It is also stated that since <strong>the</strong>petitioners failed and neglected and delayed in completing <strong>the</strong>remaining part of <strong>the</strong> implementation, <strong>the</strong> respondents filed Suit beingNo.1937 of 2008 <strong>before</strong> <strong>the</strong> High Court of Bombay. It is fur<strong>the</strong>r

22stated that in view of <strong>the</strong> family arrangement <strong>the</strong> present petition isnot maintainable and <strong>the</strong> petitioners have no subsisting right, title orinterest of any nature in <strong>the</strong> shareholding and <strong>the</strong> management of <strong>the</strong>property which belongs to <strong>the</strong> respondents. The respondents havedetailed out <strong>the</strong> properties/companies which belong to <strong>the</strong> Sadhfamily in <strong>the</strong> reply. The petitioners have filed rejoinder on 23 rd Sept.,2008 and stated that <strong>the</strong> Suit was filed by <strong>the</strong> respondents herein as acounter blast to <strong>the</strong> petition. It is stated in <strong>the</strong> rejoinder that <strong>the</strong> R1<strong>Company</strong> is an artificial legal entity and has nothing to do with anyalleged family business separation between <strong>the</strong> shareholders. Thepetitioners also filed an additional affidavit dated 12 th April, 2010 byenclosing affidavit in reply filed by <strong>the</strong> defendants (petitioners herein)to notice of Motion No.2487 of 2008 dated 13 th January, 2010. In <strong>the</strong>said reply it is stated that <strong>the</strong> suit filed by <strong>the</strong> plaintiffs (respondentsherein) seeking specific performance against <strong>the</strong> independent entitiesand <strong>the</strong> same cannot be enforceable. The stand of <strong>the</strong> petitioners hasmuch bearing on <strong>the</strong> stand taken by <strong>the</strong> respondents with regard to <strong>the</strong>family arrangement <strong>before</strong> this <strong>Bench</strong> in <strong>the</strong>ir counter affidavit. Theletter dated 15 th Sept., 2006 addressed by <strong>the</strong> 2 nd respondent toKuwait Petroleum Corporation, <strong>Mumbai</strong> wherein it is stated that “weregret to inform you that we have not reached any family agreementwith Mr.Gyandev Sadh as yet. If he has informed you so he ismisleading you.” The petitioners have relying upon this letter andCP 15/2008P Exports

23contended that <strong>the</strong> respondents also have admitted <strong>the</strong> fact that <strong>the</strong>yhave not reached any agreement with <strong>the</strong> petitioner. Whatever maybe <strong>the</strong> reason, whe<strong>the</strong>r this <strong>Bench</strong> can go into <strong>the</strong> merits of <strong>the</strong> familyarrangement/settlement in a petition under Sec.397-398 of <strong>the</strong> Actwhen such family arrangement is sub-judice and subject matter of <strong>the</strong>Hon’ble High Court of Bombay. In this regard <strong>the</strong> relevant provisionis necessary to emphasis. Any member of <strong>the</strong> <strong>Company</strong> whocomplains that <strong>the</strong> affairs of <strong>the</strong> <strong>Company</strong> are being conducted in amanner prejudicial to public interest or in a manner oppressive to anymember or members, may apply to <strong>the</strong> CLB by invoking <strong>the</strong>provisions of Sec.397 of <strong>the</strong> Act and in case of mismanagement in <strong>the</strong>affairs of <strong>the</strong> <strong>Company</strong> <strong>the</strong> member can invoke <strong>the</strong> provisions ofSec.398 of <strong>the</strong> Act, provided <strong>the</strong>y qualify <strong>the</strong> required criteria asenumerated under Sec.399 of <strong>the</strong> Act. The proceedings <strong>before</strong> <strong>the</strong>CLB are summary in nature and <strong>the</strong> <strong>Bench</strong> upon adjudicating <strong>the</strong>matter after completion of its pleadings can pass orders as vestedunder Sec.402 to put an end to <strong>the</strong> affairs complained <strong>the</strong>reof to avoidwinding up of <strong>the</strong> <strong>Company</strong> in equitable manner. It is well settled<strong>law</strong> that if <strong>the</strong>re is conflict between <strong>law</strong> and equity <strong>the</strong> <strong>law</strong> as suchmust prevail as held by <strong>the</strong> Hon’ble Apex Court in <strong>the</strong> matter ofVijay Narayan Thatte & Ors Vs State of Maharashtra & Ors.reported in ( 2009) 9 SCC 92. The legislation vested <strong>the</strong> powers toCLB, to deal with <strong>the</strong> oppression and mismanagement in <strong>the</strong> affairs ofCP 15/2008P Exports

24<strong>the</strong> <strong>Company</strong> complained by any member or members. In <strong>the</strong> presentcase <strong>the</strong>re is no controversy/conflict in respect of <strong>law</strong> and equity. Theprovision of <strong>the</strong> Companies Act is very clear on this aspect. But eventhough <strong>the</strong> petitioners have not sought any relief seeking enforcementor implementation of family settlement in <strong>the</strong> petition, howevertaking into consideration <strong>the</strong> <strong>law</strong> of equity, <strong>the</strong> stand of <strong>the</strong>respondents that <strong>the</strong> petition is not maintainable on <strong>the</strong> basis of familyarrangement arrived between <strong>the</strong>m, is necessary to be addressed.Admittedly <strong>the</strong> respondents have filed suit <strong>before</strong> <strong>the</strong> Hon’ble HighCourt of Bombay for specific performance of familyarrangement/settlement. Even o<strong>the</strong>rwise this <strong>Bench</strong> sitting under <strong>the</strong>jurisdiction of 397-398 cannot decide <strong>the</strong> private agreements,contracts and settlements, more particularly when <strong>the</strong> <strong>Company</strong> is nota party to it. I am of <strong>the</strong> view that this <strong>Bench</strong> has ample power underSec.402 to pass an order in regulating <strong>the</strong> affairs of <strong>the</strong> <strong>Company</strong> inits best interest avoiding winding up provided that <strong>the</strong> facts to do <strong>the</strong>equity shall emerge from uncontroversial facts and bare truth. Asstated supra <strong>the</strong> family settlement is not <strong>the</strong> subject matter ofoppression and mismanagement and this <strong>Bench</strong> has no jurisdiction.The Learned Counsel for <strong>the</strong> respondents relied upon variouscitations contending that <strong>the</strong> parties have acted upon <strong>the</strong> familysettlement and <strong>the</strong> petitioners have received <strong>the</strong> monies and have notexpressed any grievance after <strong>the</strong> family agreement and it is bindingCP 15/2008P Exports

25on <strong>the</strong>m. On <strong>the</strong> o<strong>the</strong>r hand <strong>the</strong> Learned Counsel for <strong>the</strong> petitionerrelied upon various citations on <strong>the</strong> point that <strong>the</strong> MOU is not bindingon <strong>the</strong> shareholders. The Hon’ble Apex Court in <strong>the</strong> matter of V.B.Rangaraj (supra) <strong>the</strong> Apex Court held that <strong>the</strong> private agreementswhich are contrary to <strong>the</strong> Articles are not binding ei<strong>the</strong>r onshareholders or on <strong>the</strong> <strong>Company</strong>. The CLB in <strong>the</strong> matter of RadheShyam Tulsian & Ors (supra), is of <strong>the</strong> view that <strong>the</strong> <strong>Company</strong> <strong>Law</strong><strong>Board</strong> will not consider private agreements between parties. Therecent judgement of <strong>the</strong> Apex Court in <strong>the</strong> matter of RelianceNatural Resources Limited vs. RIL (supra) at para 329 held thatMOU is a private pact between <strong>the</strong> members of Ambani Familywhich is not binding on RIL. I follow <strong>the</strong> <strong>law</strong> laid down by <strong>the</strong> ApexCourt that <strong>the</strong> private agreements between <strong>the</strong> parties, however, willnot be considered by <strong>the</strong> CLB. The private agreements can nei<strong>the</strong>r besought to be enforced nor <strong>the</strong>ir breach give any cause of action to filea petition under Sec.397-398 of <strong>the</strong> Act. The said provisions are <strong>the</strong>exclusive domain of <strong>the</strong> members and shareholders of <strong>the</strong> <strong>Company</strong>against acts of oppression and mismanagement in <strong>the</strong> affairs of <strong>the</strong><strong>Company</strong>, but cannot seek any specific performance of privateagreements. Since I hold that <strong>the</strong> family arrangement/settlement isnot within <strong>the</strong> purview of this <strong>Bench</strong>, <strong>the</strong>refore <strong>the</strong> citations reliedupon by <strong>the</strong> respondents will not apply squarely to <strong>the</strong> core point.Accordingly, <strong>the</strong> issue is answered.CP 15/2008P Exports

26Now I deal with <strong>the</strong> issue No.4CP 15/2008P ExportsOne of <strong>the</strong> allegations in <strong>the</strong> petition is that <strong>the</strong>property of <strong>the</strong> R1 <strong>Company</strong> situated at Andheri (East), <strong>Mumbai</strong> isused by <strong>the</strong> Respondents 2 to 6 for <strong>the</strong>ir own personal use and not for<strong>the</strong> benefit of <strong>the</strong> R1 <strong>Company</strong>. It is also contended that <strong>the</strong> saidproperty is given on lease to <strong>the</strong> respondent No.7 without <strong>the</strong>knowledge and consent of <strong>the</strong> petitioners. The respondents havedenied <strong>the</strong> misusing of <strong>the</strong> property, however, admitted that it wasgiven on license to Respondent No.7 and <strong>the</strong> same was recorded in<strong>the</strong> minutes of <strong>the</strong> meeting of <strong>the</strong> <strong>Board</strong> of Directors. From <strong>the</strong>sequence of documents filed by <strong>the</strong> petitioners it is evident that <strong>the</strong>property which is referred by <strong>the</strong> petitioners was allotted to <strong>the</strong> R1<strong>Company</strong> and in that regard a letter was addressed by <strong>the</strong> ClothingExport Processing Zone on 21.6.1983. Thereafter <strong>the</strong> R1 <strong>Company</strong>became a member of <strong>the</strong> Society. The petitioner vide his letter dated26 th August, 2006 addressed to <strong>the</strong> Chairman, WICEL stating that <strong>the</strong>property is owned by <strong>the</strong> R1 <strong>Company</strong> and he is <strong>the</strong> Chairman of <strong>the</strong><strong>Company</strong> and also 50% shareholder of <strong>the</strong> same and endorsed that<strong>the</strong>y have a family dispute on all <strong>the</strong> properties including <strong>the</strong> R1.They also stated that <strong>the</strong> property has not been transferred inanybody’s favour and nobody remains <strong>the</strong> sole owner. The 1stpetitioner vide his letter dated 29 th August, 2006 addressed to R7asking <strong>the</strong>m to vacate <strong>the</strong> premises occupied by <strong>the</strong>m. In turn <strong>the</strong> R7

27vide <strong>the</strong>ir reply dated 13.9.2006 clarified that <strong>the</strong> R1 <strong>Company</strong> in<strong>the</strong>ir <strong>Board</strong> Meeting held on 15 thCP 15/2008P ExportsDecember, 2005 resolved andauthorized <strong>the</strong> R2 to enter into an agreement and to execute <strong>the</strong> saidagreement and in exercise of <strong>the</strong> said power <strong>the</strong> R2 had entered andexecuted <strong>the</strong> agreement of lease on behalf of R1 <strong>Company</strong> andhanded over <strong>the</strong> peaceful possession to <strong>the</strong>m. They vehementlydenied that <strong>the</strong> property was occupied illegally. From <strong>the</strong> reply of <strong>the</strong>respondents and <strong>the</strong> reply of <strong>the</strong> R7 to <strong>the</strong> letters addressed by <strong>the</strong>petitioner it is apparent that <strong>the</strong> R1 entered into agreement with R7 asan independent entity and not in individual capacity. Therefore,addressing <strong>the</strong> letters by <strong>the</strong> petitioner No.1 as shareholder is notcorrect. The R1 <strong>Company</strong> is only competent to take decision with R7in respect of lease according to <strong>the</strong> terms and conditions of <strong>the</strong> leaseagreement. Be that as it may, <strong>the</strong> respondents stated that leaseagreement has been terminated with R7. In view of <strong>the</strong> statement Iam of <strong>the</strong> view that it is a closed controversy with R7. The petitionersin <strong>the</strong>ir prayer prayed this <strong>Bench</strong> to declare all <strong>the</strong> <strong>Board</strong> Resolutionsand shareholders’ resolutions passed by <strong>the</strong> Respondents 2 to 6 fromSept., 2003 are illegal, null and void. It is seen that except <strong>the</strong> prayerno documents/copies of <strong>the</strong> Resolutions have been produced <strong>before</strong>this <strong>Bench</strong> showing that <strong>the</strong> Respondents have taken decisions whichprejudiced <strong>the</strong> petitioners. In absence of any evidence, <strong>the</strong> prayer of<strong>the</strong> petitioners seeking declaration is vague and <strong>the</strong> same is rejected.

28The petitioners also sought declaration that any agreements to sell,transfer, alienate <strong>the</strong> property of <strong>the</strong> R1 <strong>Company</strong> to be set aside isconcerned, except prayer in <strong>the</strong> petition <strong>the</strong>y have not given anydocumentary proof to show that <strong>the</strong> respondents are trying to sell oralienate <strong>the</strong> property. Therefore, I am of <strong>the</strong> view that <strong>the</strong> prayer isvague and baseless hence rejected. The Learned Counsel for <strong>the</strong>petitioners during <strong>the</strong> course of arguments orally submitted that <strong>the</strong>petitioners are willing to exit <strong>the</strong> <strong>Company</strong> on receipt of fair valuedetermined by <strong>the</strong> independent valuer whereas in <strong>the</strong> petition <strong>the</strong>petitioner prayed this <strong>Bench</strong> at para 8.3 that <strong>the</strong> 50:50 ratio by <strong>the</strong>petitioner No.1 family and <strong>the</strong> Respondent No.2 family should bemaintained in future in all respects. Since I hold that <strong>the</strong> R1<strong>Company</strong> is a family business and quasi partnership, <strong>the</strong> ratio of50:50 should be maintained as it was prior to familyarrangement/settlement if it is not implemented with free will,conscience of <strong>the</strong> parties. I am of <strong>the</strong> view that <strong>the</strong> interest of <strong>the</strong><strong>Company</strong> is paramount. Irrespective of above, if <strong>the</strong> parties i.e.petitioners and <strong>the</strong> respondents act in good faith to resolve <strong>the</strong>irdifferences and disputes permanently, it would not be an impedimentto any of <strong>the</strong> observations/views in this order to part ways byamicable means of settlement if necessary by appointing anCP 15/2008P Exports

29independent valuer to value <strong>the</strong> assets of <strong>the</strong> <strong>Company</strong>. Thisobservation is not obligatory. With <strong>the</strong> above <strong>the</strong> CP is disposed off.No orders as to cost. All applications stand disposed off. All interimorders stand vacated.(KANTHI NARAHARI)MEMBERDated this <strong>the</strong> 5 th day of October, 2011.CP 15/2008P Exports