before the company law board - Company Law Board Mumbai Bench

before the company law board - Company Law Board Mumbai Bench

before the company law board - Company Law Board Mumbai Bench

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

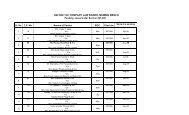

BEFORE THE COMPANY LAW BOARD,<br />

MUMABI BENCH, AT MUMBAI<br />

PRESENT: SHRI KANTHI NARAHARI, MEMBER (JUDICIAL)<br />

COMPANY PETITION NO. 17 of 2008<br />

IN THE MATTER OF THE COMPANIES ACT, 1956,<br />

Sections 397, 398, 402 & 403<br />

AND<br />

IN THE MATTER OF M/S. ARSH FASHIONS PRIVATE<br />

LIMITED & OTHERS<br />

BETWEEN:<br />

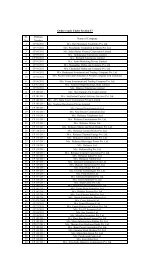

1. Smt. Nirulata Sadh,<br />

2. Shri Yashdev Gyandev Sadh<br />

3. Shri Rishidev Sadh<br />

all residing at 64 Tahini Heights,<br />

Napean Sea Road,<br />

<strong>Mumbai</strong> – 400 006.<br />

…Petitioners<br />

CP 17/2008<br />

Arsh<br />

AND<br />

1. M/s. Arsh Fashions Pvt. Ltd.,<br />

having its registered office at<br />

Plot No.52, MIDC,<br />

Andheri East,<br />

<strong>Mumbai</strong> – 400 093.<br />

2. Smt.Neelam Devi Sadh,<br />

3. Shri Uttam Dev Sadh<br />

4. Shri Anand Dev Sadh,<br />

5. Shri Varun Dev Sahd

2<br />

6. Shri Bazzar Dev Sadh,<br />

7. Ms.Jessica Uttam Dev Sadh<br />

8. Ms.Shilpi Anand Dev Sadh<br />

all residing at 101 Satyam<br />

Apartments, Rungta Lane,<br />

Napean Sea Road,<br />

<strong>Mumbai</strong>- 400 006<br />

9. Ms. Priyanka Rishidev Sadh<br />

10. Shri Gyan Dev Sadh,<br />

both 9 and 10 residing at 64, Tahini Heights,<br />

Nepeansea Road, <strong>Mumbai</strong> – 400 006.<br />

….Respondents<br />

PRESENT FOR PARTIES:<br />

Mr. Sanjay Maria, Advocate<br />

Mr.D.D.Madon, Senior Counsel,<br />

Mr.J.P.Sen, Advocate<br />

Mr.Ali Abbas Delhiwala, Advocate<br />

Ms.Janki Thakkar, Advocate<br />

Mr.Shaun Fanthome, Advocate<br />

… For Petitioners<br />

…For Respondents<br />

O R D E R<br />

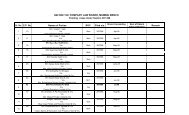

The present petition is filed by invoking various<br />

provisions of <strong>the</strong> Companies Act, 1956 (‘<strong>the</strong> Act’) alleging certain<br />

acts of oppression and mismanagement in <strong>the</strong> affairs of <strong>the</strong><br />

<strong>Company</strong> and sought declarations that: i) & ii) All <strong>the</strong> <strong>Board</strong> and<br />

Shareholders Resolutions passed by <strong>the</strong> respondents 2 to 8 from<br />

March, 2000 onwards are illegal, null and void. iii) Appointment<br />

CP 17/2008<br />

Arsh

3<br />

of Respondent Nos. 3, 6 and 7 as purported directors of R1 is<br />

illegal, null and void. iv) R1 <strong>Company</strong> is a quasi partnership<br />

between Petitioner No.1 family and <strong>the</strong> Respondent No.2 family<br />

with 50:50 and <strong>the</strong> same should be maintained. v) The equity<br />

share capital of <strong>the</strong> R1 <strong>Company</strong> will not be fur<strong>the</strong>r increased<br />

without express consent of <strong>the</strong> petitioners. vi) Any agreement to<br />

sell, transfer, alienate in respect of fixed assets situated at Vapi<br />

Industrial Estate, Vapi, Valsad without consent of <strong>the</strong> petitioners is<br />

set aside. vii)<br />

CP 17/2008<br />

Arsh<br />

Non sending of notices for <strong>the</strong> <strong>Board</strong> meetings,<br />

general meetings and non sending of Annual Accounts and reports<br />

of <strong>the</strong> R1 to <strong>the</strong> petitioners are illegal.<br />

2. Shri Sanjay Maria, Learned Counsel for <strong>the</strong><br />

petitioners narrated <strong>the</strong> brief facts. He submitted that R1 <strong>Company</strong><br />

was incorporated as a private limited <strong>company</strong> on 13 th<br />

March,<br />

2000 and was registered with <strong>the</strong> Registrar of Companies,<br />

Maharashtra by taking over <strong>the</strong> business of <strong>the</strong> partnership firm –<br />

PNN International along with its assets and liabilities. The partners<br />

of <strong>the</strong> said partnership firm were <strong>the</strong> Petitioner No.1, 2 and 3 and<br />

R2, 3, 4 and 5. Petitioner No.1, 2 and 3 hold 250 Equity Shares of<br />

Rs.100/- each, out of total of 500 equity shares of Rs.100/- each<br />

representing 50% of <strong>the</strong> issued, subscribed and paid up share<br />

capital of R1 <strong>Company</strong> as on 16 th June, 2000. Respondent No.2, 3,<br />

4 and 5 hold 250 equity shares of Rs.100/- each out of total of 500

4<br />

equity shares of Rs.100/- each representing 50% of <strong>the</strong> issued,<br />

subscribed and paid up share capital of R1 as on 16 th June, 2000. It<br />

is fur<strong>the</strong>r submitted that R1 is a quasi partnership between <strong>the</strong><br />

petitioner No.1 family and <strong>the</strong> R2 family on 50:50 basis and <strong>the</strong><br />

same ratio will always be maintained in future as well.<br />

CP 17/2008<br />

Arsh<br />

Petitioner<br />

No.1 and <strong>the</strong> R2 had signed <strong>the</strong> Annual Accounts for <strong>the</strong> year<br />

ended 31 st March, 2004 and after that <strong>the</strong> R2 has not sent any<br />

annual accounts for <strong>the</strong> year ended 31.3.2005, 2006, 2007 and<br />

2008 respectively. Petitioner No.1 requested R2 to 5 to clarify how<br />

<strong>the</strong> Authorized Share Capital of <strong>the</strong> R1 has been increased from<br />

Rs.50,000 to Rs.1,00,000/- without her knowledge and <strong>the</strong><br />

Petitioner No.1 and 2 have serious objection to <strong>the</strong> same but <strong>the</strong> R2<br />

to 5 nei<strong>the</strong>r gave any details nor gave any clarification for <strong>the</strong><br />

same. Petitioner No.2 had given unsecured loan of Rs.4,57,481/-<br />

to <strong>the</strong> R1 which is still outstanding and <strong>the</strong> same has not been<br />

returned by <strong>the</strong> R2 to 5 till date. Petitioners requested <strong>the</strong> R2 to 5<br />

to provide <strong>the</strong> progress report of business of <strong>the</strong> R1 and <strong>the</strong> use of<br />

<strong>the</strong> property at Vapi, Gujarat owned by R1, but <strong>the</strong> R2 to 5 always<br />

postponed <strong>the</strong> matter on one pretext or <strong>the</strong> o<strong>the</strong>r and never<br />

provided <strong>the</strong> report of <strong>the</strong> same. Petitioners requested <strong>the</strong> R2 to 5<br />

to provide <strong>the</strong> copy of <strong>the</strong> financial statements including Annual<br />

Accounts of R1 from <strong>the</strong> year 2001 to 2008 but <strong>the</strong> R2 to 5 never<br />

provided any statement while understanding well that <strong>the</strong>

5<br />

petitioners are 50% partner in <strong>the</strong> quasi partnership. Petitioners<br />

also requested <strong>the</strong> R2 to 5 to provide <strong>the</strong> notice of <strong>Board</strong> Meetings<br />

and General Meetings and minutes of <strong>the</strong> same but <strong>the</strong> R2 to 5<br />

never provided any statement while understanding well that <strong>the</strong><br />

petitioners are 50% partner in <strong>the</strong> quasi partnership.<br />

2. It is fur<strong>the</strong>r submitted that <strong>the</strong> petitioners decided to<br />

inspect <strong>the</strong> record of <strong>the</strong> R1 with <strong>the</strong> ROC and inspected <strong>the</strong><br />

records of <strong>the</strong> R1 on 14 th January, 2008 on MCA website and were<br />

shocked to know that <strong>the</strong> R2 has appointed her two sons, namely<br />

Shri Uttam Dev Sadh (R3) and Shri Varun Dev Sadh (R5) and her<br />

husband Shri Bazzar Dev Sadh (R6) as directors of R1 un<strong>law</strong>fully<br />

and un-authorizedly w.e.f. 12 th December, 2004 without<br />

knowledge and consent of Petitioners. R2 to 5 by this un<strong>law</strong>ful<br />

and unauthorized act, had increased <strong>the</strong>ir strength on <strong>the</strong> <strong>Board</strong> of<br />

Directors from one member on 1 st April, 2000 to four members in<br />

<strong>the</strong> year 2004 and on <strong>the</strong> o<strong>the</strong>r hand <strong>the</strong> strength of <strong>the</strong> petitioners<br />

on <strong>the</strong> <strong>Board</strong> of Directors remained <strong>the</strong> same from one member in<br />

<strong>the</strong> year 2000 to one member in <strong>the</strong> year 2004. As a result <strong>the</strong> R2<br />

to 5 have breached <strong>the</strong> understanding of <strong>the</strong> quasi partnership<br />

agreed between <strong>the</strong> petitioner No.1 family and <strong>the</strong> R2 family. The<br />

petitioners have also come to know that R2 to 5 have made fur<strong>the</strong>r<br />

allotment of 500 equity shares of Rs.100/- each without knowledge<br />

and consent of <strong>the</strong> petitioners. The list of shareholders as stated in<br />

CP 17/2008<br />

Arsh

6<br />

<strong>the</strong> Search Report is totally different than it was in <strong>the</strong> year 2000.<br />

The name of <strong>the</strong> petitioner No.1 has been removed from <strong>the</strong><br />

shareholders and in her place <strong>the</strong> name of her husband, <strong>the</strong> R10 has<br />

been substituted. Similarly, <strong>the</strong> name of R2 has been removed and<br />

<strong>the</strong> name of her husband, <strong>the</strong> R6 has been substituted while in fact<br />

<strong>the</strong> petitioners and <strong>the</strong> R10 had nei<strong>the</strong>r applied for <strong>the</strong> same nor<br />

made payment for <strong>the</strong> same. Petitioners have also come to know<br />

that R2 to 8 are using <strong>the</strong> property of R1 situated at Vapi, Gujart<br />

for <strong>the</strong>ir own personal use and not for <strong>the</strong> purpose of <strong>the</strong> business<br />

of R1 and R2 to 5 are not generating any revenue for <strong>the</strong> R1 which<br />

is unambiguous case of diversion and siphoning off <strong>the</strong> funds of<br />

R1 <strong>Company</strong>. R2 to 8 are invading and/or threatening to invade <strong>the</strong><br />

petitioners’ rights in <strong>the</strong> R1. There exists no standard for<br />

ascertaining <strong>the</strong> damage caused or likely to be caused by such<br />

invasion. Compensation in money alone would not afford adequate<br />

relief. It is necessary to compel <strong>the</strong> R2 to 8 to act in a manner in<br />

consonance with <strong>the</strong> understanding relating to <strong>the</strong> management and<br />

control of <strong>the</strong> <strong>Company</strong>. There is no alternative remedy available<br />

to <strong>the</strong> petitioners to redress <strong>the</strong>ir grievances as shareholders of <strong>the</strong><br />

R1. All efforts of <strong>the</strong> petitioners to reach a fair and reasonable and<br />

acceptable via media to run <strong>the</strong> R1 in fair manner have met with no<br />

positive response from R2 to 8 and have been turned down by R2<br />

to 8 repeatedly, whose intentions are malafide and unreliable. R2<br />

CP 17/2008<br />

Arsh

7<br />

to 8 are not interested in <strong>the</strong> welfare and well being of <strong>the</strong> R1 but<br />

are actively engaged in illegalities and misconduct and<br />

misappropriating assets to <strong>the</strong>ir personal accounts under <strong>the</strong>ir<br />

control, which is prejudicial to <strong>the</strong> R1 and <strong>the</strong> petitioners as <strong>the</strong><br />

50% shareholders. The Learned Counsel relied upon various<br />

decisions during <strong>the</strong> course of arguments on various points and<br />

requested <strong>the</strong> <strong>Bench</strong> to pass appropriate orders as prayed for.<br />

Since I discussed elaborately in CP 15 of 2008 filed by Mr.Gyan<br />

Dev Sadh and his group against Mr. Bazzar Dev Sadh and his<br />

group except <strong>the</strong> points addressed hereunder, <strong>the</strong>refore, I do not<br />

consider it to repeat <strong>the</strong> same.<br />

3. Respondents 1 to 8 have filed detailed reply to <strong>the</strong><br />

petition and denied <strong>the</strong> allegations, averments made in <strong>the</strong> petition.<br />

Shri Madon, Learned Senior Counsel narrated <strong>the</strong> brief facts. He<br />

submitted that <strong>the</strong> petitioners have suppressed from this <strong>Bench</strong> that<br />

in fact and on <strong>the</strong> contrary, by and under a family arrangement<br />

dated 30 th August, 2004 and 11 th Sept., 2004 arrived at inter alia<br />

between <strong>the</strong> petitioners and <strong>the</strong> respondents, according to that <strong>the</strong><br />

shares held in <strong>the</strong> name of <strong>the</strong> petitioners belong to Mr.Bazzar Dev<br />

Sadh and <strong>the</strong> concerned petitioners shall resign as directors of R1<br />

<strong>Company</strong>. The petitioners have no right, title or interest of any<br />

nature whatsoever in <strong>the</strong> shares held by <strong>the</strong>m in <strong>the</strong> Gyandev Sadh<br />

<strong>Company</strong> or in <strong>the</strong> properties held in <strong>the</strong> name of <strong>the</strong> Gyandev<br />

CP 17/2008<br />

Arsh

8<br />

Sadh <strong>Company</strong> and that <strong>the</strong> petitioners are no longer concerned<br />

with <strong>the</strong> management and affairs of R1 or <strong>the</strong> income <strong>the</strong>reof. The<br />

heads or main features of such family arrangement/settlement have<br />

been recorded in writing by Memorandum dated 30 th August, 2004<br />

and 11 th<br />

CP 17/2008<br />

Arsh<br />

Sept., 2004, <strong>the</strong> last having being duly signed by<br />

Mr.Gyandev Sadh representing <strong>the</strong> petitioners.<br />

4. Now coming to <strong>the</strong> averments/allegations in respect of<br />

R1 <strong>Company</strong>, he submitted that M/s.Arsh Fashions Pvt.Ltd. was<br />

formerly a partnership firm called M/s. PNN International (PNN)<br />

which was subsequently converted into a Private Limited<br />

<strong>Company</strong> under part IX of <strong>the</strong> Companies Act with <strong>the</strong> name M/s.<br />

PNN Apparels Pvt. Ltd. and after <strong>the</strong> family<br />

arrangement/settlement arrived at between <strong>the</strong> parties, as set out in<br />

detail <strong>the</strong>rein, and in implementation <strong>the</strong>reof, <strong>the</strong> name of such<br />

<strong>Company</strong> was changed by <strong>the</strong> Bazzardev Sadh Group, as desired<br />

by <strong>the</strong>m to M/s.Arsh Fashions Private Limited. One of <strong>the</strong><br />

properties allotted to <strong>the</strong> Bazzardev Sadh Group under <strong>the</strong> family<br />

arrangement/settlement is <strong>the</strong> only property held by <strong>the</strong> said<br />

<strong>Company</strong>. The issued, subscribed and paid up share capital of <strong>the</strong><br />

said <strong>Company</strong> is 1000 shares of Rs.100/- each. The Bazzardev<br />

Sadh Group held 500 shares and Gyandev Sadh group held 500<br />

shares. As per <strong>the</strong> family arrangement/settlement <strong>the</strong> shares held<br />

by <strong>the</strong> Gyandev Sadh Group in <strong>the</strong> said <strong>company</strong> shall belong to

9<br />

<strong>the</strong> Bazzardev Sadh being <strong>the</strong> head of <strong>the</strong> Bazzardev Sadh group<br />

and <strong>the</strong> Gyandev Sadh Group shall formally transfer <strong>the</strong>ir<br />

shareholding in favour of <strong>the</strong> Bazzardev Sadh or his nominee/s<br />

and that <strong>the</strong> concerned directors shall cease to be <strong>the</strong> directors of<br />

<strong>the</strong> <strong>Company</strong> and <strong>the</strong>y shall formally retire and/or resign as<br />

directors of <strong>the</strong> <strong>Company</strong>.<br />

CP 17/2008<br />

Arsh<br />

The Bazzardev Sadh Group shall be<br />

free and entitle to appoint any member of <strong>the</strong>ir group as director/s<br />

of <strong>the</strong> said <strong>company</strong> and <strong>the</strong>y shall be in complete management<br />

and control of <strong>the</strong> assets and affairs of <strong>the</strong> <strong>Company</strong> and shall be<br />

responsible for <strong>the</strong> liability and shall be entitled to <strong>the</strong> income and<br />

profits of <strong>the</strong> <strong>Company</strong> to <strong>the</strong> total execution of <strong>the</strong> Gyandev Sadh<br />

Group.<br />

6. It is submitted that this <strong>Bench</strong> has no jurisdiction to<br />

entertain <strong>the</strong> petition in view of <strong>the</strong> family arrangement which is<br />

also subject matter of <strong>the</strong> suit filed by <strong>the</strong>se respondents <strong>before</strong> <strong>the</strong><br />

Hon’ble High Court of Bombay.<br />

In view of <strong>the</strong> family<br />

arrangement <strong>the</strong> petitioners are nothing to do with <strong>the</strong> R1<br />

<strong>Company</strong> or its shareholders or in <strong>the</strong> management and its affairs<br />

or property assets income <strong>the</strong>reof.<br />

The appointment of<br />

Respondents 3, 5 & 6 was done after due compliance of <strong>the</strong><br />

provisions of <strong>the</strong> Companies Act. It is to say that <strong>the</strong> petitioners<br />

never bo<strong>the</strong>red with <strong>the</strong> management and its affairs after <strong>the</strong> said<br />

family arrangement, since <strong>the</strong>y have already transferred and

10<br />

released <strong>the</strong>ir right in respect of <strong>the</strong> shares held in <strong>the</strong>ir names,<br />

although <strong>the</strong> formal transfer and execution of <strong>the</strong> necessary<br />

documents in that behalf is yet to be carried out by <strong>the</strong> petitioners.<br />

The increase of share capital was made in compliance of <strong>the</strong><br />

relevant provisions of <strong>the</strong> Act and with <strong>the</strong> knowledge and consent<br />

of <strong>the</strong> petitioners and <strong>the</strong> respondents as <strong>the</strong> same was done prior<br />

to <strong>the</strong> family arrangement. Moreover, <strong>the</strong> balance sheet showing<br />

<strong>the</strong> share capital as Rs.1 lac has been duly signed by Mr.Gyan Dev<br />

Sadh of <strong>the</strong> petitioners’ group and Mr.Bazzar Dev Sadh of <strong>the</strong><br />

respondents’.<br />

CP 17/2008<br />

Arsh<br />

In view of <strong>the</strong> reasons stated above <strong>the</strong> petitioners<br />

have not made out any case and <strong>the</strong> petition is liable to be<br />

dismissed. The Learned Senior Counsel relied upon various<br />

decisions in support of his case. The relevant decisions have been<br />

discussed in CP 15 of 2008 filed by Mr.Gyan Dev Sadh and his<br />

group/family against Mr. Bazzar Dev Sadh and his group/family,<br />

<strong>the</strong>refore, I do not consider it to repeat <strong>the</strong> same.<br />

7. Heard <strong>the</strong> Learned Counsel appearing for <strong>the</strong> parties,<br />

perused <strong>the</strong> pleadings, documents filed in <strong>the</strong>ir support. After<br />

analyzing <strong>the</strong> pleadings, <strong>the</strong> following issues are felt for<br />

consideration and <strong>the</strong> same are need to be addressed.<br />

1) Whe<strong>the</strong>r <strong>the</strong> R1 <strong>Company</strong> is run on <strong>the</strong> basis of<br />

principles of quasi partnership<br />

2) Whe<strong>the</strong>r this <strong>Bench</strong> has any power to direct <strong>the</strong>

11<br />

parties to enforce <strong>the</strong> family arrangement/ settlement<br />

CP 17/2008<br />

Arsh<br />

3) Whe<strong>the</strong>r <strong>the</strong> respondents denied <strong>the</strong> inspection of<br />

records and registers to <strong>the</strong> petitioners<br />

4) To what relief<br />

The Issues 1 & 2 have been decided in detail in CP 15 of 2008<br />

filed by Mr.Gyan Dev Sadh against M/s.Parmeshwar Exports<br />

Private Limited and O<strong>the</strong>rs, as issues 1 & 3 <strong>the</strong>rein, <strong>the</strong>refore, no<br />

need to repeat in this petition.<br />

Now I deal with <strong>the</strong> issue No. 3:<br />

The petitioners contended that <strong>the</strong> respondents have not<br />

provided <strong>the</strong> inspection of <strong>the</strong> records and registers to <strong>the</strong>m. It is<br />

<strong>the</strong>ir case that though <strong>the</strong>y have signed <strong>the</strong> Annual Accounts for<br />

<strong>the</strong> year ended 31.3.2004 and after that <strong>the</strong> Respondent No.2 has<br />

not sent any Annual Accounts for <strong>the</strong> year ended 31 st March, 2005<br />

to 31 st March, 2008 respectively. Except <strong>the</strong> averments made in<br />

<strong>the</strong> petition, <strong>the</strong>re is no o<strong>the</strong>r documentary proof to show that <strong>the</strong><br />

petitioners requested <strong>the</strong> respondents to provide inspection of <strong>the</strong><br />

records and documents of <strong>the</strong> <strong>Company</strong>. It is on <strong>the</strong> record that<br />

Mr.Gyan Dev Sadh and his group being petitioners in CP 15 of<br />

2008 have sought inspection of <strong>the</strong> documents of that <strong>Company</strong><br />

and <strong>the</strong> respondents have enclosed a copy of that letter dated 23 rd<br />

June, 2008 addressed by <strong>the</strong> petitioners <strong>the</strong>rein. Though <strong>the</strong><br />

petitioners are 50% shareholders in this <strong>Company</strong> also, however,

12<br />

R1 being a separate entity must have requested to <strong>the</strong> <strong>Company</strong><br />

seeking inspection of records and documents independently. Even<br />

o<strong>the</strong>rwise <strong>the</strong> petitioners being 50% shareholders and directors are<br />

entitled to inspect <strong>the</strong> records and registers of <strong>the</strong> <strong>Company</strong> with<br />

prior intimation and can obtain <strong>the</strong> copies <strong>the</strong>reof as per <strong>law</strong>.<br />

Accordingly, <strong>the</strong> issue is answered.<br />

Now I deal with <strong>the</strong> issue No.4<br />

CP 17/2008<br />

Arsh<br />

The o<strong>the</strong>r contentions of <strong>the</strong> petitioners are that <strong>the</strong><br />

respondents increased <strong>the</strong> Share capital from Rs.50,000/- to Rs.1<br />

lakh without <strong>the</strong> knowledge of <strong>the</strong> petitioners. The respondents<br />

have contended that <strong>the</strong> increase in <strong>the</strong> share capital was made<br />

after due compliance of <strong>the</strong> provisions of <strong>the</strong> Companies Act. As<br />

per <strong>the</strong> provisions of <strong>the</strong> Act, a Private Limited <strong>Company</strong> now<br />

must have minimum paid up share capital of Rs.1 lakh.<br />

Accordingly, <strong>the</strong> <strong>Company</strong> increased <strong>the</strong> share capital prior to<br />

family arrangement. To establish <strong>the</strong> same, <strong>the</strong> petitioners have<br />

enclosed balance sheet as on 31 st<br />

March, 2004 wherein <strong>the</strong><br />

Authorised Share Capital of <strong>the</strong> <strong>Company</strong> is shown as Rs.1 lakh<br />

for <strong>the</strong> current year and also previous year and also one of <strong>the</strong><br />

petitioner and one of <strong>the</strong> respondents have signed <strong>the</strong> balance<br />

sheet. There is no dispute with regard to this balance sheet and <strong>the</strong><br />

petitioners have admitted that <strong>the</strong>y signed <strong>the</strong> balance sheet apart<br />

from <strong>the</strong> auditor of <strong>the</strong> <strong>Company</strong> at para 6.5 of <strong>the</strong> petition. The

13<br />

search report dated 28 th<br />

CP 17/2008<br />

Arsh<br />

January, 2008 filed by <strong>the</strong> petitioners,<br />

wherefrom it is also evident that <strong>the</strong> share capital and <strong>the</strong> paid up<br />

capital is shown as Rs.1 lakh. Thus, it is clear that <strong>the</strong> petitioners<br />

are aware of <strong>the</strong> increase of <strong>the</strong> Authorised Capital and it was<br />

required to raise <strong>the</strong> capital from Rs.50,000/- to Rs.1 lakh, since it<br />

was mandatory in accordance with <strong>law</strong>. Therefore, <strong>the</strong>re is no<br />

merit in <strong>the</strong> allegation. It is only an attempt to denigrate <strong>the</strong> image<br />

of <strong>the</strong> respondents. The o<strong>the</strong>r contention of <strong>the</strong> petitioners is that<br />

<strong>the</strong> petitioner No.2 had given unsecured loan of Rs.4,57,481/- to<br />

<strong>the</strong> <strong>Company</strong> and <strong>the</strong> respondents have not returned <strong>the</strong> same till<br />

date. The respondents contended that no amount is payable by <strong>the</strong><br />

respondents as agreed under <strong>the</strong> family agreement. Since I hold<br />

that <strong>the</strong> Private Agreements between <strong>the</strong> parties will not be<br />

considered by <strong>the</strong> CLB, at issue No.3 in CP 15 of 2008, <strong>the</strong>refore,<br />

<strong>the</strong> <strong>Company</strong> is bound to repay <strong>the</strong> unsecured loan to <strong>the</strong> 2 nd<br />

petitioner as per <strong>the</strong>ir understanding. The o<strong>the</strong>r contention of <strong>the</strong><br />

petitioners is that <strong>the</strong> respondents are using <strong>the</strong> property of <strong>the</strong><br />

<strong>Company</strong> for <strong>the</strong>ir personal benefit. The respondents denied <strong>the</strong><br />

said allegation and stated that <strong>the</strong> property is being used for <strong>the</strong><br />

purpose of <strong>the</strong> <strong>Company</strong> as reflected in <strong>the</strong> books of accounts of<br />

<strong>the</strong> <strong>Company</strong>. Except <strong>the</strong> averment <strong>the</strong> petitioners have not shown<br />

any documentary proof that <strong>the</strong> property was used by <strong>the</strong><br />

respondents for <strong>the</strong>ir personal benefit.<br />

In absence of <strong>the</strong> same, I

14<br />

do not find any merit in <strong>the</strong> allegations against <strong>the</strong> respondents and<br />

also I do not find any diversion of funds by <strong>the</strong> respondents as<br />

contended. The petitioners contended that <strong>the</strong> name of <strong>the</strong><br />

petitioner No.1 has been removed and in her place <strong>the</strong> name of her<br />

husband i.e. R10 has been substituted. Similarly <strong>the</strong> name of<br />

respondent No.2 has been removed and name of her husband i.e.<br />

R6 has been substituted. In fact, <strong>the</strong> petitioner and <strong>the</strong> respondent<br />

No.10 had nei<strong>the</strong>r applied for <strong>the</strong> same nor made payment for <strong>the</strong><br />

same. On <strong>the</strong> o<strong>the</strong>r hand <strong>the</strong> respondents contended that in view of<br />

<strong>the</strong> family settlement <strong>the</strong>y have already transferred/released <strong>the</strong>ir<br />

rights in respect of <strong>the</strong> shares held by <strong>the</strong> petitioners, though <strong>the</strong><br />

formal transfer and execution of necessary documents in that<br />

behalf is yet to be carried out by <strong>the</strong> petitioners. Though <strong>the</strong><br />

petitioners have not filed any shareholding pattern prior to <strong>the</strong><br />

family arrangement/settlement to prove <strong>the</strong>ir shareholding in <strong>the</strong><br />

<strong>Company</strong>, however, on perusal of search report filed by <strong>the</strong><br />

petitioners dated 28 th January, 2008, <strong>the</strong> names of <strong>the</strong> petitioner<br />

No.1 & 3 and respondents 2,3,4,5 & 6 have been shown in <strong>the</strong><br />

directors column. However, <strong>the</strong> 1 st petitioner’s name and <strong>the</strong> 2 nd<br />

Respondent’s name do not appear in <strong>the</strong> column meant for<br />

shareholders’ details. It is now not known whe<strong>the</strong>r <strong>the</strong> petitioner<br />

No.1 and respondent No.2 hold any shares in <strong>the</strong> <strong>Company</strong> and to<br />

that effect <strong>the</strong>y have not produced any documentary evidence to<br />

CP 17/2008<br />

Arsh

15<br />

establish <strong>the</strong> same. Whilst <strong>the</strong> respondents have not denied <strong>the</strong><br />

shareholding pattern. Whatever may be <strong>the</strong> reason, since I already<br />

hold that <strong>the</strong> private agreements between <strong>the</strong> parties will not be<br />

considered by <strong>the</strong> CLB at issue No.3 in CP 15 of 2008, <strong>the</strong><br />

shareholding pattern prior to <strong>the</strong> family settlement should be<br />

maintained or else if <strong>the</strong> petitioners’ group and <strong>the</strong> respondents’<br />

group feel that irrespective of changes in names of shareholders, if<br />

<strong>the</strong> ratio is maintained 50:50, <strong>the</strong>y can continue <strong>the</strong> same. So far<br />

as <strong>the</strong> main reliefs of <strong>the</strong> petition are concerned, <strong>the</strong> petitioners<br />

sought declaration of all <strong>the</strong> <strong>Board</strong> and Shareholders resolutions<br />

passed by <strong>the</strong> respondents after March, 2000 to be declared as<br />

illegal. The petitioners have not enclosed any resolutions ei<strong>the</strong>r<br />

<strong>Board</strong> or Shareholders, wherefrom it could be said that <strong>the</strong>y<br />

prejudiced with <strong>the</strong> said decisions. Whence-so-ever <strong>the</strong> petitioners<br />

have not made out any case in respect of those allegations and <strong>the</strong>y<br />

are not entitled to any relief as claimed. So far as appointment of<br />

respondents 3,5 & 6 is concerned, from <strong>the</strong> search report dated 28 th<br />

January, 2008 filed by <strong>the</strong> petitioners, among o<strong>the</strong>r details, <strong>the</strong><br />

directors’ details are also given wherefrom it is apparent that <strong>the</strong><br />

petitioner No.1 and Respondent No.2 & 4 were appointed as<br />

directors w.e.f. 14.3.2000 and Petitioner No.3 was appointed as<br />

director on 1.4.2000 and Respondents 3,5 & 6 were appointed as<br />

directors on 12 th<br />

CP 17/2008<br />

Arsh<br />

December, 2004, presumably after <strong>the</strong> family

16<br />

arrangement/settlement. There is no documentary proof to show<br />

that <strong>the</strong> petitioners have ever objected to <strong>the</strong> appointment of<br />

Respondents 3,5 & 6 until filing of this petition i.e. May, 2008<br />

almost all more than three & half years for <strong>the</strong> reasons best known<br />

to <strong>the</strong>m. Whatever may be <strong>the</strong> position, since I already hold that<br />

<strong>the</strong> family arrangements will not be considered by <strong>the</strong> CLB,<br />

<strong>the</strong>refore <strong>the</strong> position prior to <strong>the</strong> family arrangement i.e. 30 th<br />

August, 2004 and 11 th Sept., 2004 to be maintained in respect of<br />

<strong>Board</strong> of Directors and Shareholding pattern. As I already hold<br />

that <strong>the</strong> R1 <strong>Company</strong> is a family business and quasi partnership,<br />

<strong>the</strong> ratio of 50:50 should be maintained as it was prior to family<br />

arrangements /settlement if it is not implemented with free will and<br />

conscience of <strong>the</strong> parties. It is also worthwhile to mention that <strong>the</strong><br />

50% ratio also to be maintained in respect of <strong>Board</strong> of Directors to<br />

avoid disparity in <strong>the</strong> <strong>Board</strong> wherever <strong>the</strong> petitioners’ and<br />

respondents’ group maintain 50% each in <strong>the</strong>ir companies. The<br />

petitioners are entitled to <strong>the</strong> notices to <strong>the</strong> <strong>Board</strong> and General<br />

Meetings in <strong>the</strong> capacity as shareholders and directors, in<br />

accordance with <strong>law</strong>. The Learned Senior Counsel for <strong>the</strong><br />

petitioners during <strong>the</strong> course of arguments orally submitted that <strong>the</strong><br />

petitioners are willing to exit <strong>the</strong> <strong>Company</strong> on receipt of fair value<br />

determined by <strong>the</strong> independent valuer, whereas <strong>the</strong> petitioners at<br />

para 8.4 in <strong>the</strong> petition prayed that <strong>the</strong> ratio of 50:50 between <strong>the</strong><br />

CP 17/2008<br />

Arsh

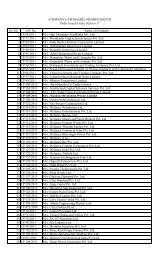

17<br />

petitioner No.1 family and Respondent No.2 family should be<br />

maintained in future in all respects. I am of <strong>the</strong> view that <strong>the</strong><br />

interest of <strong>the</strong> <strong>Company</strong> is paramount. Irrespective of above, if <strong>the</strong><br />

parties act in good faith to resolve <strong>the</strong>ir differences and disputes<br />

permanently, it would not be an impediment to any of <strong>the</strong><br />

observations/views in this order to part ways by amicable means of<br />

settlement if necessary by appointing an independent valuer to<br />

value <strong>the</strong> assets of <strong>the</strong> <strong>Company</strong>. With <strong>the</strong> above, <strong>the</strong> CP is<br />

disposed off. No orders as to cost. All applications stand disposed<br />

off and all interim orders stand vacated.<br />

(KANTHI NARAHARI)<br />

MEMBER<br />

Dated this <strong>the</strong> 14 th day of October, 2011<br />

CP 17/2008<br />

Arsh