before the company law board - Company Law Board Mumbai Bench

before the company law board - Company Law Board Mumbai Bench

before the company law board - Company Law Board Mumbai Bench

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

5and M/s.Vishwa Extrusions Pvt. Ltd. in which R2 was directly and/orindirectly interested and <strong>the</strong> said act is in total contravention of <strong>the</strong> provisionsof Sec.283 (1) (h) (i) of <strong>the</strong> Act. The R2 had no explanation to offer since itwas stated that he vacated his office due to <strong>the</strong> said contravention.Accordingly <strong>the</strong> <strong>Board</strong> directed <strong>the</strong> R6 being <strong>the</strong> MD to take appropriateaction that <strong>the</strong> R2 be directed to repay <strong>the</strong> amount of loans advanced to <strong>the</strong>above entities immediately. The <strong>Board</strong> fur<strong>the</strong>r authorized <strong>the</strong> R6 to operate<strong>the</strong> bank accounts. Form 32 in regard to cessation of office of director by R2was duly filed with ROC. b. <strong>Board</strong> Meeting held on 27.8.2003. It is to saythat as a counterblast to <strong>the</strong> decisions taken in <strong>the</strong> <strong>Board</strong> Meeting held on4.8.2003, a purported <strong>Board</strong> Meeting was held on 27 th August, 2003 attendedby R2 & R3 only. The quorum was absent. Decisions were taken andresolutions were passed in <strong>the</strong> said purported meeting to <strong>the</strong> effect that (i) R6& R7 ceased as Directors for non payment of calls in arrears underSec.283(1)(f) of <strong>the</strong> Act (ii) R4 and R5 were appointed as AdditionalDirectors (iii) R3 was appointed as Managing Director in place of R6.However, as per Inspection Report no notice convening <strong>the</strong> <strong>Board</strong> Meetingon 27 th August, 2003 was given to any o<strong>the</strong>r directors especially to ShriA.K.Sanghi, Shri N.V.S. Murthy, Mr.Harish A. Sahu (R6) and Mrs.(Dr.)Devila H. Sahu (R7) and <strong>the</strong>re was no requisite quorum. R2 havingvacated his office of directorship under <strong>the</strong> provisions of Sec. 283(1)(h)(i) of<strong>the</strong> Act had ceased to be a director who could not convene <strong>the</strong> meeting orparticipate in any proceedings of <strong>the</strong> <strong>Board</strong> or pass any resolutions. (ii) R2having vacated his office of directorship and <strong>the</strong> R3 being <strong>the</strong> only o<strong>the</strong>rCP 28/2010Union vs Gwalior

6person in that meeting, no meetings have taken place at all; no business couldbe legally transacted at that meeting for want of quorum. c. Whe<strong>the</strong>r R6 &R7 have ceased to be directors and have vacated <strong>the</strong>ir office?: In terms ofSec.283(1)(f) of <strong>the</strong> Act, a date should be fixed as <strong>the</strong> last date for makingpayment of <strong>the</strong> call. If <strong>the</strong> director does not make payment of call moneywithin six months from <strong>the</strong> last date fixed for payment, <strong>the</strong> director ceases tobe director and vacates his office of directorship. It is to say that as perArticle 18(1) & (2) of <strong>the</strong> AOA notice for calls in arrears shall be given by<strong>the</strong> <strong>Board</strong> of directors at least 30 days in advance. No proof was produced by<strong>the</strong> Respondents 2 & 3 with respect to <strong>the</strong> notice. Therefore, <strong>the</strong>re is nojustification to invoke <strong>the</strong> provisions of Sec.283(1)(f) of <strong>the</strong> Act. It appearsR2 & R3 herein, in collusion and with ulterior motive to get rid of <strong>the</strong> R6 &R7, carried out <strong>the</strong> proceedings and usurped taking control and managementof <strong>the</strong> <strong>company</strong> and its assets wrongfully and against <strong>law</strong> provisions. d.Loans advanced to entities in which R2 had direct and indirectinterest. During <strong>the</strong> period 1996 to 2002 <strong>the</strong> <strong>Company</strong> advanced loansto M/s. Central India Sulphonators, a Sole Proprietorship concern of R2.During <strong>the</strong> period 2003 <strong>the</strong> <strong>Company</strong> advanced loan to M/s.VishwaExtrusions Pvt.Ltd., a Private <strong>Company</strong> in which majority of shares areheld by R2 and his family. During <strong>the</strong> year 2002 <strong>the</strong> <strong>Company</strong>advanced loans to M/s.Flora Finnin Pvt.Ltd. in which R2 is a directorand to Mrs.Pragati Awasthi wife of R4 <strong>before</strong> he was appointed asAdditional Director on 27.8.2003. No <strong>Board</strong> resolution was passed inCP 28/2010Union vs Gwalior

7this regard under Sec.292(1)(e) of <strong>the</strong> Act. Rs.6,00,000/- was advancedas loan to M/s.Man Singh International Limited during <strong>the</strong> year ending31.3.2001 in violation of Sec.292(1)(e) of <strong>the</strong> Act. The aforesaid loansaggregating to Rs.64 lacs were diverted by <strong>the</strong> <strong>Company</strong> for <strong>the</strong> personalbenefit of R2 & R3 who are <strong>the</strong> only beneficiaries in <strong>the</strong> deal. R6 hasstated in his complaint that all <strong>the</strong>se payments have been made by R2without <strong>the</strong> knowledge and consent of R6 or approval of <strong>the</strong> <strong>Board</strong> ofDirectors. e. Misappropriation of funds of <strong>the</strong> <strong>Company</strong> upon sale ofproperty: A sum of Rs.10 lacs was advanced to M/s. Ansal HousingInfrastructure Ltd., Bhopal for purchase of immovable property by R1.No transfer of property has taken place and <strong>the</strong> said amount has beenwritten off as doubtful debt. f. Salaries drawn from two companiesby R2. R2 while acting as Whole Time Director in R1 also got himselfappointed as a Whole Time Director in M/s. Nisha Polymers IndustriesLtd. for a period five years and was drawing remuneration from both <strong>the</strong>public companies in contravention of <strong>the</strong> provisions of Section 269 of<strong>the</strong> Act. g. Fabrication of records regarding notice to be issued to<strong>the</strong> Members for <strong>the</strong> meeting: Shri Harish K. Sahu complained thatAnnual Accounts for <strong>the</strong> years 2002, 2003 signed by R2 and R3 asdirectors were not distributed to all <strong>the</strong> shareholders of R1 in which 80%of <strong>the</strong> shares are held by <strong>the</strong> public. h. Wongful claim ofdepreciation and accounts not correct and true. Depreciation has beenwrongly provided in <strong>the</strong> accounts on a car, cost of which has been debited toCP 28/2010Union vs Gwalior

8R6. Non appointment of <strong>Company</strong> Secretary. Since 30 th July, 2004 <strong>the</strong><strong>Company</strong> has not appointed any Whole Time <strong>Company</strong> Secretary and<strong>the</strong>reby violated <strong>the</strong> provisions of Sec.383A of <strong>the</strong> Act. The Learned Counselfur<strong>the</strong>r submitted that R1 is a listed <strong>Company</strong> in which Respondent Directorshold 16.88% shares along with <strong>the</strong>ir family members and <strong>the</strong> balance about80% shares of <strong>the</strong> <strong>Company</strong> is held by <strong>the</strong> Public. The mismanagement in <strong>the</strong><strong>Company</strong> has adversely affected <strong>the</strong> interest of public who have put in <strong>the</strong>irhard earned money in <strong>the</strong> capital of <strong>the</strong> <strong>Company</strong> based on projections of <strong>the</strong>works and finances given in <strong>the</strong> prospectus. The directors who have, in <strong>law</strong>,vacated <strong>the</strong>ir office of directorship have been holding <strong>the</strong> reigns of <strong>the</strong> affairsand <strong>the</strong> concept of good governance is missing. In fact, <strong>the</strong> presentmanagement appears to be indulging in siphoning of funds, misappropriating<strong>the</strong> assets and funds of <strong>the</strong> <strong>company</strong> to <strong>the</strong>ir own interest with impunity to <strong>the</strong><strong>law</strong> provisions highly detrimental to <strong>the</strong> interest of <strong>the</strong> public. TheRespondent No.2 & 3 appeared to be <strong>the</strong> beneficiaries of suchmismanagement. The net worth of <strong>the</strong> <strong>Company</strong> stands grossly eroded,considering <strong>the</strong> facts that <strong>the</strong> accumulated losses have exceeded Rs.8.7 croresduring <strong>the</strong> year ended 31.3.2005, Rs.9.44 crores during <strong>the</strong> year ended31.3.2006, Rs.9.93 crores during <strong>the</strong> year ended 31.3.2007 and Rs.9.86crores during <strong>the</strong> year ended 31.3.2008 which is more than <strong>the</strong> paid up capitaland free reserves of <strong>the</strong> respective years. He submitted that <strong>the</strong> R1 <strong>Company</strong>is referred to BIFR and <strong>the</strong> same is pending.4. Respondent No.1 to 5 filed <strong>the</strong>ir reply to <strong>the</strong> petition. Shri RajKumar Adukia, Learned PCS appearing on <strong>the</strong>ir behalf submitted that <strong>the</strong>CP 28/2010Union vs Gwalior

9present petition is not maintainable as it is barred by limitation in as much as<strong>the</strong> present petition has been filed after a lapse of about seven years and nocontinuing cause of action of maintaining <strong>the</strong> present petition has beendemonsratably established in <strong>the</strong> present petition. The petition is filed byUnion of India through Regional Director, Western Region, <strong>Mumbai</strong> byrelying heavily on false and self serving complaints filed by Shri Harish K.Sahu(R6) who was <strong>the</strong> ex-managing Director of <strong>the</strong> <strong>Company</strong> and who wasresponsible for <strong>the</strong> alleged defaults made by <strong>the</strong> <strong>Company</strong> u/s 295, 297 and299 of <strong>the</strong> Act and who had siphoned off an aggregate sum of Rs.97.64 lacsof <strong>the</strong> <strong>Company</strong>.5. It is submitted that Shri Harish K.Sahu (R6) on whose false andfrivolous complaint, <strong>the</strong> Registrar of Companies, Gwalior initiatedproceedings against <strong>the</strong> R1 and which has culminated in filing of <strong>the</strong> presentpetition, was not removed as Director and as Managing Director as alleged.R6 & R7 had vacated <strong>the</strong>ir office as directors under Sec.283(1)(f) of <strong>the</strong> Actand ceased to be director of <strong>the</strong> <strong>Company</strong> by operation of <strong>law</strong>. R6 was <strong>the</strong>Managing Director of <strong>the</strong> <strong>Company</strong> till 6.8.2003 and during his tenure asManaging Director he himself had entered into transactions with someentities and advanced loans by issuing cheque on behalf of <strong>the</strong> <strong>Company</strong>. R6being Managing Director and responsible for day to day conduct andmanagement of <strong>the</strong> affairs of <strong>the</strong> <strong>Company</strong> took all decisions himself; and R2& R3 being his younger bro<strong>the</strong>rs had obeyed R6 as <strong>the</strong>y had full faith in himas <strong>the</strong>ir elder bro<strong>the</strong>r. During <strong>the</strong> course of inspection under Sec.209A of <strong>the</strong>Act, <strong>the</strong> petitioner has raised several queries on various alleged violations andCP 28/2010Union vs Gwalior

10sought replies from R6 ( old <strong>Board</strong>) and from R2 & R3 (New <strong>Board</strong>). TheR6 gave false replies and agreed with <strong>the</strong> findings of <strong>the</strong> Inspecting Officer’sreport. It is denied that R2 has ceased to be a director and has vacated hisoffice on 4.8.2003 for contravention of <strong>the</strong> provisions of Sec.295 and 299 of<strong>the</strong> Act, as alleged. The petitioner has deliberately suppressed <strong>the</strong> true andcorrect facts about loan of over Rs.17.12 lacs to M/s. Central IndiaSulphonators and a loan of over Rs.11.05 lacs to M/s.Vishwa ExtrusionsPrivate Limited which were allegedly given by Sanil P. Sahu (R2) withoutinforming <strong>the</strong> <strong>Board</strong> of Directors of <strong>the</strong> <strong>Company</strong> and resulted into defaultu/s 295 and 299 of <strong>the</strong> Act. The true facts about <strong>the</strong> transactions with <strong>the</strong>above mentioned firm/<strong>Company</strong> are as under: LOAN TO CENTRALINDIA SULPHONATORS: It was R6 who was Managing Director of <strong>the</strong><strong>Company</strong> at <strong>the</strong> time when alleged loan was given to Central IndiaSulphonators and he himself had signed and issued <strong>the</strong> following chequesfrom <strong>the</strong> <strong>Company</strong>’s bank account No.31361 with State Bank of India,Kamla Nagar, Delhi.Cheque No. Dated Amount in lacs256594 8.9.1994 15.70261459 2.11.1994 6.00261463 12.11.1994 5.502641466 13.11.1994 7.50The above mentioned cheques were deposited by Central India Sulphonatorsinto <strong>the</strong>ir Bank Account No.31362 with State Bank of India, Kamla NagarBranch, Delhi which was also operated by R6. Though R2 was shown asCP 28/2010Union vs Gwalior

11sole proprietor of Central India Sulphonators, it was <strong>the</strong> R6 who was <strong>the</strong>main beneficiary as he was alone operating bank account No.31362. Thecheques were issued by R6 without <strong>the</strong> knowledge of R2. It is denied that R2had not disclosed his interest in <strong>the</strong> Central India Sulphonators as is evidentfrom <strong>the</strong> prospectus issued by <strong>the</strong> <strong>Company</strong> during its Second Public Issue in1994. The relevant disclosure at page No.11 of <strong>the</strong> prospectus is as under:“Central India Sulphonators is a proprietorship concern of Mr.Sanil P. Sahu,a promoter Director of <strong>the</strong> <strong>Company</strong>, for manufacturing Acid Slurry atMalanpur, which commenced production in November, 1991”. R2 has beendisclosing his interest in o<strong>the</strong>r companies/firms since beginning every yearand such disclosures have been made by o<strong>the</strong>r directors of <strong>the</strong> <strong>Company</strong> also.In fact it is Mr.Harish K. Sahu (R6) <strong>the</strong> Ex-Managing Director who did notdisclose his interest to <strong>the</strong> Central Government as its beneficial owner. Thealleged violation took place in 1994 and a long period had already expired.No amount is due from Central India Sulphonators in <strong>the</strong> books of <strong>the</strong><strong>Company</strong> which has also been verified by <strong>the</strong> petitioner from <strong>the</strong> books ofaccounts for <strong>the</strong> years 2002-03 to 2005-06 produced during <strong>the</strong> inspection.LOAN TO VISHWA EXTRUSION PRIVATE LIMITED:CP 28/2010Union vs GwaliorIt is deniedthat <strong>the</strong> <strong>Company</strong> had given any loan to Vishwa Extrusion Pvt.Ltd. as <strong>the</strong><strong>Company</strong> has entered into transaction of its finished products with <strong>the</strong><strong>company</strong>. Moreover, Vishwa Extrusion was not a Private Limited <strong>Company</strong>at <strong>the</strong> relevant time. It was a Public Limited <strong>Company</strong> and became PrivateLimited <strong>Company</strong> from 10.4.2003 and <strong>the</strong>refore <strong>the</strong> provisions of Sec.299 donot apply with respect to <strong>the</strong> captioned transactions. R2 has made full

12disclosures at all relevant times and it was <strong>the</strong> responsibility of <strong>the</strong> Ex-Managing Director, Mr.Harish K. Sahu to obtain <strong>the</strong> requisite approval of <strong>the</strong><strong>Board</strong>, shareholders and <strong>the</strong> Central Government for any non compliance.From <strong>the</strong> above it is apparent that R2 had not contravened <strong>the</strong>provisions of Sec.295 and 299 of <strong>the</strong> Act as he was not managing <strong>the</strong> day today affairs of <strong>the</strong> <strong>Company</strong> when <strong>the</strong> alleged defaults had occurred.6. It is fur<strong>the</strong>r denied that <strong>the</strong> meeting of <strong>the</strong> <strong>Board</strong> of Directors on27.8.2003 was held without proper notice and without <strong>the</strong>re being <strong>the</strong>requisite quorum. The notice for <strong>the</strong> said <strong>Board</strong> Meeting was dispatched on19.8.2003 and <strong>the</strong> Meeting was held on 27.8.2003 with proper quorum. In<strong>the</strong> said meeting R3 was appointed as Managing Director of <strong>the</strong> <strong>Company</strong>and all statutory compliances such as filing of Form 32, filing of Form 25Cwith ROC were duly complied with. The R4 and R5 were validly appointedas Additional Directors in <strong>the</strong> <strong>Board</strong> Meeting held on 27.8.2003 and <strong>the</strong>rewas no irregularity in <strong>the</strong>ir appointment as alleged. R6 was not allegedlyremoved as Managing Director by R2 & 3 with effect from 6.8.2003 as hevacated his office as director being disqualified to act as director u/s 283(1)(f)of <strong>the</strong> Act. Since R6 vacated his office by operation of <strong>law</strong> and becamedisqualified u/s 283(1)(f) of <strong>the</strong> Act, <strong>the</strong> question of his acting as Director oras Managing Director w.e.f. 6.8.2003 does not arise and hence <strong>the</strong> questionof preventing him to act in <strong>the</strong> said capacity also does not arise.7. It is fur<strong>the</strong>r submitted that <strong>the</strong> new <strong>Board</strong> of <strong>the</strong> R1 had givenExplanation on all <strong>the</strong> alleged issues such as: BOARD MEETING HELDON 4 th AUGUST, 2003CP 28/2010Union vs GwaliorIt is refuted that R2 had vacated his office of

13directorship due to alleged contravention of <strong>the</strong> provisions ofSec.283(1)(h)/(i). The meeting of <strong>Board</strong> of Directors held on 4 th August,2003 was not legally and validly convened <strong>Board</strong> Meeting and hence <strong>the</strong>proceedings of <strong>the</strong> said <strong>Board</strong> Meetings are illegal and non est. R6 hadcommitted grave acts of financial irregularities and has misappropriated andsiphoned a sum of Rs.97.84 lacs of <strong>the</strong> <strong>Company</strong> for his personal benefits andgains. R6 also ceased as Director and as Managing Director for non paymentof calls in terms of provisions of Sec.283(1)(f) of <strong>the</strong> Act. BOARDMEETING HELD ON 27.08.2003. It is refuted that no notice convening <strong>the</strong><strong>Board</strong> Meeting on 27.8.2003 was given to o<strong>the</strong>r Directors or <strong>the</strong>re was norequisite quorum in <strong>the</strong> said meeting as alleged. Two directors namely SanilP. Sahu (R2) and Anil P.Sahu (R3) were present in <strong>the</strong> meeting and <strong>the</strong>requirement of <strong>the</strong> quorum in terms of Section 287 i.e. 1/3 rd of <strong>the</strong> totalstrength or two Directors, whichever is higher was met as <strong>the</strong> <strong>Company</strong> hadonly four Directors on its <strong>Board</strong> namely Shri A.K.Sanghi, Sanil P.Sahu, AnilP.Sahu and Shri N V S Murthy. WHETHER THE RESPONDENTS NO.6& 7 HAVE CEASED TO BE DIREICTORS AND HAVE VACATEDTHEIR OFFICE: It is submitted that all legal requirements, includingfixation of date, notices, etc. for making calls and payment of calls in arrearswere fully complied with. It is emphatically refuted and denied that nodocumentary proof was produced by R2 & R3 in this regard. The respondents1 to 5 denied each and every allegation made in <strong>the</strong> petition and prayed this<strong>Bench</strong> to dismiss <strong>the</strong> petition.7. Respondents 6 to 9, filed affidavit in reply dated 1.6.2010.It isCP 28/2010Union vs Gwalior

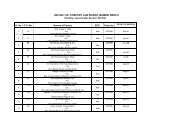

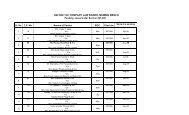

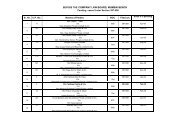

14submitted that <strong>the</strong> petition has been filed by Union of India upon completionof inspection of <strong>the</strong> affairs of <strong>the</strong> <strong>Company</strong> and working of <strong>the</strong> managementwhich was carried out by <strong>the</strong> office of <strong>the</strong> Regional Director, WR, <strong>Mumbai</strong>,on a complaint filed by (R6) and bears <strong>the</strong> result of <strong>the</strong> inquiry andinvestigation and also actions taken in different forum on <strong>the</strong> wrongscommitted by <strong>the</strong> concerned directors. The shares of <strong>the</strong> <strong>company</strong> were listedon <strong>the</strong> Stock Exchanges at <strong>Mumbai</strong>, Indore and Delhi in or about December,1985. The shares were regularly transacted upto 2002, <strong>the</strong> last transactionwhen <strong>the</strong> shares of <strong>the</strong> <strong>company</strong> were traded being in <strong>Mumbai</strong>. The lastquotation was at Rs.1.50/- per share. The management and control werevested in <strong>the</strong> <strong>Board</strong> of Directors of <strong>the</strong> <strong>company</strong> steered by R6 as itsManaging Director, appointed as such on 1.7.1984. The <strong>Board</strong> of Directorsconsisted of <strong>the</strong> following which for <strong>the</strong> purpose of this petition <strong>before</strong> thisforum are divided into two parts as follows:Group 1 DirectorsName of <strong>the</strong> DirectorAppointed on(i) Shri Harish K.Sahu (R6) 29.10.1982(ii) Mrs.(Dr.) Devila Sahu (R7)-do-(iii) Shri Jitendra Kapoor (R8) 22.9.2003(iv) Shri Dilip C.Parekh (R9)Group 2 DirectorsName of <strong>the</strong> Director-do-Appointed on(i) Shri Sanil P.Sahu(R2) 29.10.1982Whole Time Director w.e.f. 20.12.1990CP 28/2010Union vs Gwalior

15(ii) Shri Anil P.Sahu (R3) 29.10.1982(iii) Shri Sudhir Awasthi (R4) 27.8.2003(appointed in <strong>the</strong> meeting held illegallyby R2 & R3 calling it a <strong>Board</strong> Meeting)(iv) Shri Naresh Mangal (R5) 27.8.2003(appointed in <strong>the</strong> meeting held illegallyby R2 & R3 calling it a <strong>Board</strong> Meeting)8. It is submitted that duly convened <strong>Board</strong> meeting of Directors ofR1 was held on 4 th August, 2003. It was noted that R2 disbursed variousloans to three companies namely M/s.Flora Infotech Private Limited,M/s.Flora Fenin Private Limited and M/s.Vishwa Extrusion Private Limitedin which <strong>the</strong> said Mr. Sanil P. Sahu (R2) and his family held direct andindirect interest. The said loans were granted without knowledge of <strong>the</strong> <strong>Board</strong>of Directors and without disclosure of interest by R2 in those companies,much less with <strong>the</strong> prior approval of <strong>the</strong> Central Government, in crassviolation of <strong>the</strong> provisions of Sec.295 and 299 of <strong>the</strong> Act. The RegionalDirector has filed prosecution proceedings against R2 under Sec .283(1)(h) of<strong>the</strong> Act. The <strong>Board</strong> of Directors authorized R6 to take appropriate action andit was also directed that Mr.Sanil P.Sahu (R2) shall repay <strong>the</strong> loan amountalong with interest to <strong>the</strong> <strong>Company</strong>. As a counter blast to <strong>the</strong> above decisionof <strong>the</strong> <strong>Board</strong> in its meeting held on 4.8.2003, R2 and 3 held a so called <strong>Board</strong>Meeting on 27.8.2003 for which no notice was given to any o<strong>the</strong>r directors<strong>before</strong> holding <strong>the</strong> said meeting. None of <strong>the</strong> Respondent Nos. 6,7,8,9,10 and11 who were <strong>the</strong> only o<strong>the</strong>r directors were informed of <strong>the</strong> said meetingCP 28/2010Union vs Gwalior

16convened much less sending prior valid notice for <strong>the</strong> meeting alleged tohave been held on 27.8.2003. This so called meeting which did not have <strong>the</strong>required quorum present, passed resolutions (a) removing <strong>the</strong> R6 asManaging Director effective from 6 th August, 2003 as ceasing to be directorunder <strong>the</strong> provisions of Sec. 283(i)(f) of <strong>the</strong> Act for being in arrears inpayment of calls; (b) appointing R3 as Managing Director effective from 27 thAugust, 2003 and (c) appointing R4 and R5 as Additional directors effectivefrom that date. The Group 2 directors forcibly took over management andcontrol of R1 <strong>Company</strong>. R6 communicated to <strong>the</strong> ROC, Gwalior about <strong>the</strong>illegal happenings in <strong>the</strong> <strong>Company</strong> and <strong>the</strong> fact that R2 and R3 had usurped<strong>the</strong> <strong>company</strong>’s management by illegal means. As Managing Director of <strong>the</strong><strong>Company</strong>, R6 was aware that <strong>the</strong> <strong>Board</strong> of Directors had never called upon<strong>the</strong> shareholders including R6 to pay up <strong>the</strong> calls in arrears and <strong>the</strong>refore,<strong>the</strong>re could be no default by R6 in not paying up <strong>the</strong> calls in arrears. Theprovisions of Sec.283(i)(f) did not apply at all to <strong>the</strong> case of directors beingR6 and R7 in <strong>the</strong> petition.9. It is fur<strong>the</strong>r submitted that <strong>the</strong> wrong doings of R2 and R3 aredemonstrated through <strong>the</strong> inquiry and investigations carried out by <strong>the</strong> officeof <strong>the</strong> Regional Director and <strong>the</strong> action proposed are taken against suchwrongs of R2 and R3 which have been made part of <strong>the</strong> petition by <strong>the</strong>petitioners. From 2003 to 2009, Group 2 Directors with <strong>the</strong> reins ofmanagement in <strong>the</strong>ir hands have driven R1 to sickness and <strong>the</strong>reby filedreference under <strong>the</strong> provisions of Sec.15 of Sick Industrial Companies(Special Provisions) Act, 1986 <strong>before</strong> <strong>the</strong> BIFR. In <strong>the</strong> audited accounts ofCP 28/2010Union vs Gwalior

17<strong>the</strong> <strong>Company</strong> for <strong>the</strong> Financial Year 2004-2005, <strong>the</strong> management has debiteda total amount of Rs.337.05 lacs as doubtful recovery. This includes <strong>the</strong> badand doubtful debts as such classified and bad receivable of loans etc.. Thesaid sum of Rs.337.05 lacs debited to accounts among o<strong>the</strong>r things, includes(a) Rs.62 lacs due from M/s.Nisha Polymers Industries Limited in which <strong>the</strong>Directors of R1 have direct and indirect interest and <strong>the</strong> said <strong>company</strong> isactive and solvent; (b) Rs.10 lacs due from M/s. Ansal Housing Corporationfrom whom <strong>the</strong> R4 viz. Mr.Sudhir Awasthi acquired a house and disposed<strong>the</strong> same for profits in his name in which transaction <strong>the</strong> said sum of Rs.10lacs has been obviously adjusted; (c) Rs.5.56 lacs from M/s.Flora FinenPrivate Limited in which R2 and R3 are shareholders and directors and (d)Rs.4.25 lacs due from Mr.Anil Sharma, a director of M/s.Flora InfotechPrivate Limited and also M/s.Flora Finen Private Limited in which <strong>the</strong> R2and R3 have direct and indirect interest. The financial position of <strong>the</strong><strong>Company</strong> and its functioning under <strong>the</strong> management of <strong>the</strong> Group 2 directorshas deteriorated year after year and <strong>the</strong> <strong>Company</strong> has now filed a reference<strong>before</strong> BIFR under <strong>the</strong> provisions of Sick Industrial Companies (SpecialProvisions) Act for working out financial or industrial reconstruction of <strong>the</strong><strong>Company</strong> craving for concessions from various authorities including <strong>the</strong>Banks and Financial Institutions.9. Respondents 6 to 9 have filed fur<strong>the</strong>r affidavit in reply in additionto <strong>the</strong> reply dated 1.6.2010.CP 28/2010Union vs GwaliorAt <strong>the</strong> outset it is submitted that <strong>the</strong> initials ofMr.Anil P.Sahu i.e. R3 seem to be forged. The same is evident from <strong>the</strong> copyof salary certificate dated 27.5.2002 which shows that <strong>the</strong> initials of R3 are

18different from <strong>the</strong> ones affixed on <strong>the</strong> reply. Thus, <strong>the</strong> reply of R2 to R5 isliable to be rejected on this ground alone. In fact R2 to R5 are in <strong>the</strong> habit offorging and fabricating <strong>the</strong> records. R2 had gone to <strong>the</strong> extent of forging andusing fake stamps of postal authorities and filing <strong>the</strong> forged and fabricateddocuments with ROC, Gwalior to prove illegal service of audited balancesheet of <strong>the</strong> year 2002-03 to 13497 public shareholders. The prosecution for<strong>the</strong> alleged offences leveled against R6 to R9 is not maintainable in <strong>law</strong>. Inview of <strong>the</strong> provisions of <strong>law</strong> R6 to R9 were/are not officers responsible for<strong>the</strong> alleged offenses. It is denied that petition is filed by relying on false orserving complaints filed by R6. Complaints filed by R6 are true and correctand duly corroborated by documentary evidence. The Inspecting Officer hasbeen ra<strong>the</strong>r very lenient towards R2 to R5. R2 has not realized that he wasfull time director and director of a public limited <strong>company</strong> having a greatresponsibility to operate and work honestly as per <strong>law</strong>. R2 and R3 cannotclaim <strong>the</strong>ir ignorance of <strong>Company</strong> <strong>Law</strong> as both of <strong>the</strong>m are qualifiedChartered Accountants. It is denied that R6 had siphoned of Rs.97.64 lacs orany amount of <strong>the</strong> <strong>Company</strong> and R2 to R5 should be put to strict proof<strong>the</strong>reof.10. Heard <strong>the</strong> Learned Counsel, PCS appearing for <strong>the</strong> respectiveparties and perused pleadings, documents filed in <strong>the</strong>ir support. Afteranalyzing <strong>the</strong> pleadings, <strong>the</strong> following issues are felt for considerationand <strong>the</strong> same are need to be addressed.CP 28/2010Union vs Gwalior

191) Whe<strong>the</strong>r <strong>Board</strong> Meetings dated 4.8.2003 and 27.8.2003 arevalidly held?with <strong>law</strong>?2) The loans advanced by <strong>the</strong> <strong>Company</strong> whe<strong>the</strong>r in accordance3) Whe<strong>the</strong>r <strong>the</strong> respondents mismanaged <strong>the</strong> affairs of <strong>the</strong><strong>Company</strong> and <strong>the</strong>reby mis-utilized <strong>the</strong> funds of <strong>the</strong> <strong>Company</strong>?in office?4) Any contravention of <strong>Law</strong> committed by <strong>the</strong> directors while11. The Learned PCS appearing for <strong>the</strong> respondents 1 to 5 raised anobjection with regard to maintainability of <strong>the</strong> petition on <strong>the</strong> groundthat <strong>the</strong> R1 <strong>Company</strong> was referred to <strong>the</strong> BIFR and <strong>the</strong> same is pending<strong>before</strong> <strong>the</strong> BIFR, <strong>the</strong>refore, it is bar to adjudicate <strong>the</strong> matter by this<strong>Bench</strong> or any o<strong>the</strong>r forum in view of Sec.22 of SICA 1985. In view of<strong>the</strong> preliminary objection raised by <strong>the</strong> respondents, it is necessary todecide <strong>the</strong> same. It is an admitted fact that <strong>the</strong> R1 <strong>Company</strong> has beenreferred to <strong>the</strong> BIFR and <strong>the</strong> BIFR declared <strong>the</strong> R1 <strong>Company</strong> a sickindustrial <strong>Company</strong> in terms of Sec.3(1)(o) of Sick Industrial Companies(Special Provisions) Act, 1985 and directed not to dispose off, lease out,encumber or alienate in any way any of its fixed assets or current assetswithout specific prior approval of BIFR under Sec.22A of <strong>the</strong> Act.Whe<strong>the</strong>r this <strong>Bench</strong> has any bar in adjudicating <strong>the</strong> matter filed underSec.397-398 and o<strong>the</strong>r provisions of <strong>the</strong> Companies Act by <strong>the</strong> Union ofIndia. In this regard <strong>the</strong> relevant provision i.e. Sec.22 of SICA 1985CP 28/2010Union vs Gwalior

20expressly provides “suspension of legal proceedings, contracts etc.”From <strong>the</strong> reading of <strong>the</strong> above provision it is clear that “when an inquiryunder Sec.16 is pending or any scheme referred to under Sec.17 is underpreparation or consideration or a sanctioned scheme is underimplementation or where an appeal under Sec.25 relating to an industrial<strong>company</strong> is pending, <strong>the</strong>n, notwithstanding, anything contained in <strong>the</strong>Companies Act or any o<strong>the</strong>r <strong>law</strong> or <strong>the</strong> Memorandum and Articles ofAssociation of <strong>the</strong> industrial <strong>company</strong>, no proceedings for <strong>the</strong> windingup of <strong>the</strong> industrial <strong>company</strong> or for execution, distress or <strong>the</strong> like againstany of <strong>the</strong> properties of <strong>the</strong> Industrial <strong>Company</strong> or for <strong>the</strong> appointmentof a receiver in respect <strong>the</strong>reof, no suit for <strong>the</strong> recovery of money or for<strong>the</strong> enforcement of any security against <strong>the</strong> Industrial <strong>Company</strong> or ofany guarantee in respect of any loans or advance granted to <strong>the</strong> industrial<strong>company</strong>, shall lie or be proceeded with fur<strong>the</strong>r, except with <strong>the</strong> consentof <strong>the</strong> <strong>Board</strong> or as <strong>the</strong> case may be, <strong>the</strong> Appellate Authority. ” From <strong>the</strong>above it is clear that no proceedings for winding up or for execution,distress or appointment of receiver and no suit for recovery of moneycould be initiated against <strong>the</strong> Industrial <strong>Company</strong>. In <strong>the</strong> present case<strong>the</strong> petition is filed by <strong>the</strong> Union of India against <strong>the</strong> directors seekingdirections to declare <strong>the</strong> <strong>Board</strong> Meeting dated 27.8.2003 is invalid andsought direction to <strong>the</strong> respondents to repay <strong>the</strong> monies advanced toseveral entities. Therefore, <strong>the</strong> reliefs which are sought in <strong>the</strong> petitionare for <strong>the</strong> benefit of <strong>the</strong> Public <strong>Company</strong> and will not attract any of <strong>the</strong>CP 28/2010Union vs Gwalior

21clauses mentioned in Sec.22 of <strong>the</strong> SICA 1985. Therefore, I am of <strong>the</strong>view that this <strong>Bench</strong> can proceed with <strong>the</strong> matter.12. Now I deal with <strong>the</strong> issue No.1. :CP 28/2010Union vs GwaliorThe contention of <strong>the</strong> respondents 6 to 9 is that <strong>the</strong> <strong>Board</strong>Meeting dated 4 th August, 2003 was a properly convened meeting of <strong>the</strong><strong>Board</strong> of Directors and it was chaired by A.K.Sanghi, <strong>the</strong> <strong>the</strong>n NonExecutive Chairman of <strong>the</strong> <strong>Company</strong> and it was attended byRespondents 2,3,6 & 7.From <strong>the</strong> minutes it is apparent that amongo<strong>the</strong>r items it was discussed about <strong>the</strong> loans advanced to Flora InfotechPrivate Limited, Flora Finin Private Limited and Vishwa ExtrusionsLimited in which R2 was <strong>the</strong> executive director who was directly orindirectly interested and <strong>the</strong> said loans were in contravention of <strong>the</strong>provisions of Sec.292, 295 and 299 of <strong>the</strong> Companies Act and <strong>the</strong>reby itwas resolved that <strong>the</strong> respondent No.2 ceased to be <strong>the</strong> director and alsoExecutive director of <strong>the</strong> <strong>Company</strong> by operation of <strong>Law</strong> pursuant to <strong>the</strong>provision of Sec.283(1)(h)(i) of <strong>the</strong> Companies Act. It was also decidedthat <strong>the</strong> Respondent No.6 who was <strong>the</strong> Managing Director may takeappropriate action against <strong>the</strong> 2 nd Respondent and it was also decidedthat R2 shall repay <strong>the</strong> amounts of loan due to <strong>the</strong> <strong>Company</strong> forthwithalong with interest. From <strong>the</strong> minutes and its attendance sheet it isapparent that four directors along with <strong>the</strong> Chairman present in <strong>the</strong>meeting have signed <strong>the</strong> attendance sheet and it is not in dispute withregard to <strong>the</strong> said meeting. Having full quorum of <strong>the</strong> meeting I hold

22that <strong>the</strong> meeting is validly held meeting. With regard to <strong>the</strong> <strong>Board</strong>Meeting dated 27.8.2003 <strong>the</strong> Respondents 6 to 9 contended that <strong>the</strong> saidmeeting was a counter blast to <strong>the</strong> decisions taken in <strong>the</strong> <strong>Board</strong> Meetingdated 4 th August, 2003. On perusal of <strong>the</strong> minutes of <strong>the</strong> meeting, it isseen that R2 and 3 have attended <strong>the</strong> meeting and shown <strong>the</strong>ir positionas Whole Time Director and Director respectively. R4 and 5 have alsoattended <strong>the</strong> meeting as Special Invitee. The grievance of <strong>the</strong>Respondents 6 to 9 was that no notice for <strong>the</strong> said meeting given to <strong>the</strong>o<strong>the</strong>r directors and <strong>the</strong> Respondent No.2 ceased to be a director,<strong>the</strong>refore, <strong>the</strong> meeting was invalid for want of quorum on <strong>the</strong> ground that<strong>the</strong> Respondent No.3 only attended <strong>the</strong> meeting. There is no proof toestablish that <strong>the</strong> notice was given to <strong>the</strong> o<strong>the</strong>r directors. The decisionstaken in <strong>the</strong> <strong>Board</strong> Meeting dated 4 th August, 2003 were valid and legaland <strong>the</strong>re is no challenge to <strong>the</strong> said decision by <strong>the</strong> 2 nd respondent. Inpursuance of <strong>the</strong> said decision, <strong>the</strong> 2 nd Respondent ceased to be adirector and <strong>the</strong> Respondent No.3 being <strong>the</strong> only o<strong>the</strong>r director cannotconvene and hold <strong>the</strong> meeting and if it was held, is deemed to be illegaland invalid. I hold that <strong>the</strong> <strong>Board</strong> Meeting dated 27 th August, 2003 isinvalid meeting for want of quorum and all <strong>the</strong> decisions taken <strong>the</strong>reinare illegal and invalid and <strong>the</strong> same are set aside. Accordingly <strong>the</strong> issueis answered.CP 28/2010Union vs Gwalior

2313. Now I deal with Issue No.2, 3 and 4 collectively:The allegation of <strong>the</strong> petitioner is that <strong>the</strong> <strong>Company</strong> advancedloans to various entities without approval of <strong>the</strong> <strong>Board</strong> of Directors and<strong>the</strong> Central Government in accordance with <strong>law</strong>. It is fur<strong>the</strong>r allegedthat <strong>the</strong> 2 nd Respondent was directly and indirectly interested in thoseentities. The petitioner had given <strong>the</strong> details that various loans havebeen advanced to M/s. Central India Sulphonators a sole proprietorshipconcern of R2 and <strong>the</strong> same has been confirmed by M/s.S.K.Sharma &<strong>Company</strong>, Auditors. The 2 nd respondent in his reply stated that when <strong>the</strong>loan was given to Central India Sulphonators, <strong>the</strong> R6 was <strong>the</strong> ManagingDirector at that time and he himself had signed and issued <strong>the</strong> chequesand <strong>the</strong> said cheques were deposited by that <strong>Company</strong> in to <strong>the</strong>ir BankAccount. The Respondent No.6 simply denied <strong>the</strong> allegation and had notgiven any reasonable explanation. The Inspecting Officer in his reportconfirmed that <strong>the</strong> loans advanced to <strong>the</strong> Central India Sulphonators by<strong>the</strong> 2 nd Respondent while acting as whole time director of R1 and <strong>the</strong>said <strong>Company</strong> was a proprietorship of R2. It was also confirmed that<strong>the</strong> loan was given without informing <strong>the</strong> <strong>Board</strong> of Directors of R1 andwithout taking approval/permission of <strong>the</strong> Central Government asrequired under Sec.295 of <strong>the</strong> Act. It is to be noted that both group ofdirectors mainly <strong>the</strong> Respondent No.2 and 6 have not denied that <strong>the</strong>loans have been given to CIS. It is not in dispute that <strong>the</strong> R6 was <strong>the</strong>Managing Director at that point of time. Sec.295 of <strong>the</strong> Companies ActCP 28/2010Union vs Gwalior

24provides that without prior approval of <strong>the</strong> Central Government, directlyor indirectly, no loan can be made to any director of <strong>the</strong> lending<strong>Company</strong>/relative of any such director/ firm in which any such directoror relative is a partner. It has been established that <strong>the</strong> CIS was aproprietorship concern and at one point of time <strong>the</strong> said body was apartnership concern. The loan has been given to CIS in which <strong>the</strong>director of R1 <strong>Company</strong> is interested. In view of <strong>the</strong> clear provision,Sec.295 is squarely attracted against <strong>the</strong> directors, <strong>the</strong>reby rendered<strong>the</strong>mselves vacated from <strong>the</strong>ir directorship u/s 283 (1)(h) of <strong>the</strong> Act.Apart from ceasing to be directors, both <strong>the</strong> directors i.e. <strong>the</strong> R2 being asWhole Time Director and <strong>the</strong> R6 being as Managing Director areresponsible for <strong>the</strong> loans advanced to <strong>the</strong> CIS without <strong>the</strong> approval of <strong>the</strong><strong>Board</strong> and <strong>the</strong> Central Government <strong>the</strong>reby both <strong>the</strong> directors are equallyliable to refund <strong>the</strong> loan amount to <strong>the</strong> R1 with interest, if <strong>the</strong> same hasnot been repaid to <strong>the</strong> R1 <strong>Company</strong>.CP 28/2010Union vs GwaliorThe petitioner alleged that for <strong>the</strong> financial year ending i.e.31.3.2003 a loan of Rs.11,50,898.52 has been advanced to M/s.VishwaExtrusions Private Limited in which majority of shares are held by R2and his family. The 2 nd respondent denied <strong>the</strong> allegation and stated that<strong>the</strong> said <strong>Company</strong> was not a private limited <strong>company</strong> at <strong>the</strong> relevanttime, however, became a private limited <strong>company</strong> from 10.4.2003,<strong>the</strong>refore, Sec.299 does not apply with respect to <strong>the</strong> said transaction. Itis fur<strong>the</strong>r stated that R2 has made disclosure at all relevant times and it

25was <strong>the</strong> responsibility of <strong>the</strong> ex-managing director i.e. R6 to obtain <strong>the</strong>requisite approval of <strong>the</strong> <strong>Board</strong> and <strong>the</strong> Central Government for any noncompliance. The R2 also stated that <strong>the</strong> present management had fullyrecovered <strong>the</strong> entire amount due from Vishwa Extrusion PrivateLimited. The R6 simply stated that he was not aware of <strong>the</strong> amounttransferred to Vishwa Extrusion Private Limited by <strong>the</strong> R1 <strong>Company</strong>.However, he states that 99% of <strong>the</strong> shares in <strong>the</strong> said <strong>Company</strong> wereheld by R2, <strong>the</strong>refore, R2 to 5 with malafide intention transferred <strong>the</strong>amount to <strong>the</strong> Vishwa Extrusion Private Limited. The InspectingOfficer also confirmed that <strong>the</strong> loan was given to Vishwa ExtrusionPrivate Limited by R2 while he was acting as Whole Time Director ofR1. It was also confirmed that R2 holds majority shares in VishwaExtrusion Private Limited and confirmed that <strong>the</strong> loan was given withoutinforming <strong>the</strong> <strong>Board</strong> of Directors of R1 and without taking approval of<strong>the</strong> Central Government, <strong>the</strong>reby liable for contravention of Sec.299 of<strong>the</strong> Act. It is not in dispute that loan is given to Vishwa ExtrusionPrivate Limited by <strong>the</strong> 2 nd Respondent, <strong>the</strong>refore, he is liable to refund<strong>the</strong> said amount to <strong>the</strong> R1 <strong>Company</strong> along with interest.However, in <strong>the</strong> Counter it has been stated by him that <strong>the</strong> amount hasbeen fully recovered. There is no denial to <strong>the</strong> said averment by any of<strong>the</strong> o<strong>the</strong>r respondents. Whatever may be <strong>the</strong> position, <strong>the</strong> 2 nd respondentis liable to refund <strong>the</strong> loan amount to <strong>the</strong> R1 <strong>Company</strong> with interest if itis not recovered/repaid.CP 28/2010Union vs Gwalior

26CP 28/2010Union vs GwaliorThe petitioner fur<strong>the</strong>r alleged that for <strong>the</strong> year ending31.3.2002 a loan amounting to Rs.13,28, 818/- was advanced toM/s.Flora Infotech Private Limited in which R2 is a director and alsoalleged that for <strong>the</strong> year ending 31.3.2002 a loan amounting toRs.7,05,782/- has been advanced to M/s.Flora Finin Private Limited inwhich R2 is a director. The R2 filed his counter and denied that he wasdirectly or indirectly interested in <strong>the</strong> alleged loan made to <strong>the</strong> abovecompanies. He stated that Flora Infotech Private Limited was asubsidiary of R1 which was originally promoted by Anil Sharma. It isstated that <strong>the</strong> said fact was disclosed in <strong>the</strong> Annual Accounts of <strong>the</strong><strong>Company</strong> as required under Sec.212(2) of <strong>the</strong> Act.. On <strong>the</strong> o<strong>the</strong>r hand<strong>the</strong> Respondent No.6 denied that <strong>the</strong> Flora Infotech was a subsidiary ofR1. It is stated that <strong>the</strong>re is no fulfillment of being a subsidiary <strong>company</strong>by <strong>the</strong> said Flora Infotech. The Inspecting Officer in his enquiry soughtclarification with regard to Flora Infotech being a subsidiary of R1.However, <strong>the</strong>re is no conclusion by <strong>the</strong> Inspecting Officer with regard towhe<strong>the</strong>r Flora Infotech was a subsidiary of R1 or not. On considering <strong>the</strong>rival contentions, <strong>the</strong> conclusion is drawn that as per <strong>the</strong> admission of<strong>the</strong> 2 nd respondent, <strong>the</strong> Flora Infotech became subsidiary of R1 <strong>Company</strong>on 11.12.2002 and <strong>the</strong>refore <strong>the</strong> amount outstanding as unsecured loanas on 31.3.2002 squarely falls within <strong>the</strong> ambit of Sec.295 of <strong>the</strong> Act..The said <strong>company</strong> was incorporated in <strong>the</strong> months of May, 2000 andfrom its articles it is ascertained that R2 was <strong>the</strong> first director and one of

27<strong>the</strong> subscribers to <strong>the</strong> Memorandum of Association holding 100 sharesout of 200 shares. The 2 nd respondent who advanced <strong>the</strong> unsecured loanto M/s.Flora Infotech has contravened <strong>the</strong> provisions of <strong>law</strong> and alsoliable for refund of <strong>the</strong> said amount with interest to R1 <strong>Company</strong>, if it isalready not repaid.The allegation in respect of M/s.Flora Finin is concerned, <strong>the</strong> 2 ndRespondent denied that he was directly or indirectly interested in <strong>the</strong>said <strong>Company</strong>. It is stated that Flora Finin was an associate of R1 andhe was not holding any shares in his individual capacity and he was anominee director of <strong>the</strong> said <strong>Company</strong>. The 6 th respondent also admitted<strong>the</strong> fact that <strong>the</strong> Flora Finin was an associate <strong>company</strong>. The inspectingofficer also confirmed that Flora Finin was a subsidiary of R1 but hesought clarification on various points. However, <strong>the</strong> Inspecting Officercould not draw any conclusion. From <strong>the</strong> perusal of Return of Allotmentin Form 2 dated 12.12.2002 filed by Flora Finin Private Limited clearlyreveals that on 11.12.2002 500 equity shares of Rs.10/- each has beenallotted in favour of R2. Therefore from <strong>the</strong> above it is clear that <strong>the</strong> R2is holding shares in Flora Finin in his individual capacity only and<strong>the</strong>refore, <strong>the</strong> loan granted in favour of Flora Finin Private Limitedattracts Sec.295 and failure to obtain prior permission of CentralGovernment for granting such loans by R1 would render R2 to vacatehis office of directorship in R1 as per <strong>the</strong> provisions of Sec .283(1)(h) .CP 28/2010Union vs Gwalior

28Apart from <strong>the</strong> above <strong>the</strong> R2 is also liable for refund of loan amountwith interest to <strong>the</strong> R1 <strong>Company</strong>, if it is already no refunded.CP 28/2010Union vs GwaliorThe petitioner has fur<strong>the</strong>r alleged that an amount of Rs.9lacs was advanced to Mrs.Pragati Awasthi wife of R4 <strong>before</strong> he wasappointed as additional director on 27.8.2003 and no <strong>board</strong> resolutionwas passed in that regard.It was also alleged that Rs.6 lacs wasadvanced as loan to Man Singh International Limited during <strong>the</strong> yearending on 31.3.2001 in violation of Sec.292(1)(e) of <strong>the</strong> Act.Withrespect to <strong>the</strong> said allegations, <strong>the</strong> Respondent No.2 in his counter statedthat loan appears to have been given in <strong>the</strong> year 1999 whereas R4 wasappointed as Additional Director in <strong>the</strong> <strong>Board</strong> Meeting held on27.8.2003, it is stated that <strong>the</strong>re was no debit balance appearing when R4was appointed as additional director. It was fur<strong>the</strong>r contended that when<strong>the</strong> loan was advanced, <strong>the</strong> R6 was <strong>the</strong> Managing Director and he wasonly responsible for day to day management of <strong>the</strong> <strong>Company</strong> and <strong>the</strong>Respondent No.2 and 3 cannot be held responsible for <strong>the</strong> saidcontravention. With regard to loan advanced to Man Singh InternationalLimited is concerned, <strong>the</strong> R2 and 3 denied <strong>the</strong> said allegation and statedthat <strong>the</strong> R6 was <strong>the</strong> Managing Director at that point of time and he alonecan explain how <strong>the</strong> said advance was given to Man Singh InternationalLimited. The 6 th respondent has not denied <strong>the</strong> saidaverment/allegations, <strong>the</strong>refore, it is presumed that <strong>the</strong> loans have beenadvanced to <strong>the</strong> above i.e. Mrs. Pragati Awasthi and M/s.Man Singh

29International Limited by <strong>the</strong> <strong>Company</strong> during <strong>the</strong> period <strong>the</strong>Respondents were acting as directors of <strong>the</strong> R1 <strong>Company</strong>. Therefore,<strong>the</strong>y are liable to refund <strong>the</strong> amounts along with interest to <strong>the</strong> <strong>Company</strong>if it is not already repaid. The respondents being <strong>the</strong> directors of <strong>the</strong> R1<strong>Company</strong> are responsible for misappropriation of funds andmismanaging <strong>the</strong> affairs of <strong>the</strong> <strong>Company</strong>. They contravened <strong>the</strong>provisions of <strong>law</strong> and also failed to discharge <strong>the</strong> duties being directorsin <strong>the</strong>ir fiduciary capacity. Therefore, I hold that <strong>the</strong> directors areresponsible for <strong>the</strong> mismanagement and misappropriation of funds of <strong>the</strong>R1 <strong>Company</strong> and direct <strong>the</strong>m to make <strong>the</strong> good <strong>the</strong> default committed by<strong>the</strong>m. Though, I hold that <strong>the</strong> <strong>Board</strong> Meeting dated 27.8.2003 is illegal,however, from <strong>the</strong> above findings, it is unequivocal that <strong>the</strong> directorsmiserably failed <strong>the</strong>ir duties and caused loss to <strong>the</strong> <strong>Company</strong> and <strong>the</strong>general public. Therefore, in exercise of powers conferred under Sec.402of <strong>the</strong> Companies Act, to regulate <strong>the</strong> affairs of <strong>the</strong> <strong>Company</strong>, I dissolve<strong>the</strong> <strong>Board</strong> of R1 <strong>Company</strong> forthwith and hereby direct <strong>the</strong> Ministry ofCorporate Affairs to take appropriate and necessary action in appointingindependent <strong>Board</strong> of Directors for smooth functioning of <strong>the</strong> day to dayaffairs of <strong>the</strong> <strong>Company</strong>. Till such time and to protect <strong>the</strong> interest of <strong>the</strong>shareholders and public at large, it is hereby directed <strong>the</strong> Ministry ofCorporate Affairs to take custody of all <strong>the</strong> statutory registers, records,books of accounts and o<strong>the</strong>r documents of <strong>the</strong> R1 <strong>Company</strong> forth with.Accordingly <strong>the</strong> issue is answered. It is needless to say that actionCP 28/2010Union vs Gwalior

30should be taken against <strong>the</strong> defaulting directors who contravened <strong>the</strong>provisions of <strong>law</strong>.With <strong>the</strong> above <strong>the</strong> CP is disposed off. All interim ordersstand vacated. No orders as to cost.Dated this <strong>the</strong> 12 th day of November, 2011(KANTHI NARAHARI)MEMBERCP 28/2010Union vs Gwalior