Pricing Currency Options Under Stochastic Volatility

Pricing Currency Options Under Stochastic Volatility

Pricing Currency Options Under Stochastic Volatility

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

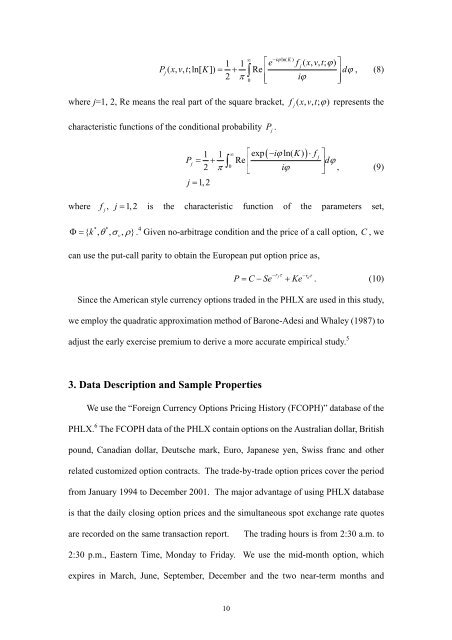

∞ −iϕln( K)1 1 ⎡e fj( x, v, t; ϕ)⎤Pj( x, v, t;ln[ K]) = + Redϕ2 π∫ ⎢ ⎥iϕ0 ⎢⎣⎥, (8)⎦where j=1, 2, Re means the real part of the square bracket, f ( xvtϕ , , ; ) represents thecharacteristic functions of the conditional probability Pj.( ϕ )1 1 ∞ ⎡exp −i ln( K)⋅ f ⎤Pj= + ⎢ ⎥2 π ⎣ iϕ⎦j = 1, 2jj∫ Redϕ0, (9)where fj, j = 1,2 is the characteristic function of the parameters set,Φ= . 4 Given no-arbitrage condition and the price of a call option, C , we* *{ k , θ , σv, ρ}can use the put-call parity to obtain the European put option price as,−rfτ−rdτ= − + . (10)P C Se KeSince the American style currency options traded in the PHLX are used in this study,we employ the quadratic approximation method of Barone-Adesi and Whaley (1987) toadjust the early exercise premium to derive a more accurate empirical study. 53. Data Description and Sample PropertiesWe use the “Foreign <strong>Currency</strong> <strong>Options</strong> <strong>Pricing</strong> History (FCOPH)” database of thePHLX. 6 The FCOPH data of the PHLX contain options on the Australian dollar, Britishpound, Canadian dollar, Deutsche mark, Euro, Japanese yen, Swiss franc and otherrelated customized option contracts. The trade-by-trade option prices cover the periodfrom January 1994 to December 2001. The major advantage of using PHLX databaseis that the daily closing option prices and the simultaneous spot exchange rate quotesare recorded on the same transaction report.The trading hours is from 2:30 a.m. to2:30 p.m., Eastern Time, Monday to Friday. We use the mid-month option, whichexpires in March, June, September, December and the two near-term months and10