Pricing Currency Options Under Stochastic Volatility

Pricing Currency Options Under Stochastic Volatility

Pricing Currency Options Under Stochastic Volatility

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

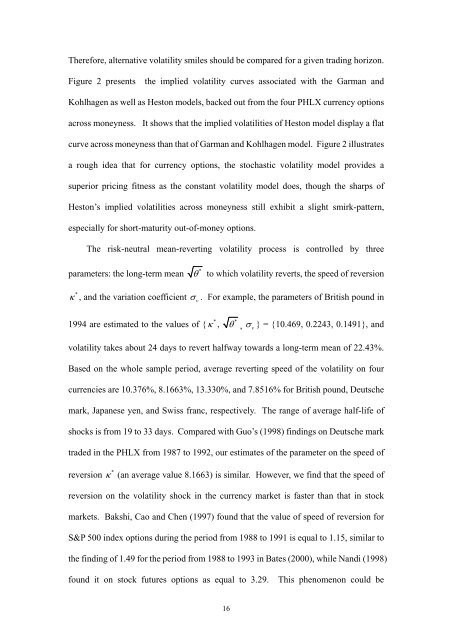

Therefore, alternative volatility smiles should be compared for a given trading horizon.Figure 2 presents the implied volatility curves associated with the Garman andKohlhagen as well as Heston models, backed out from the four PHLX currency optionsacross moneyness. It shows that the implied volatilities of Heston model display a flatcurve across moneyness than that of Garman and Kohlhagen model. Figure 2 illustratesa rough idea that for currency options, the stochastic volatility model provides asuperior pricing fitness as the constant volatility model does, though the sharps ofHeston’s implied volatilities across moneyness still exhibit a slight smirk-pattern,especially for short-maturity out-of-money options.The risk-neutral mean-reverting volatility process is controlled by threeparameters: the long-term mean*θ to which volatility reverts, the speed of reversion*κ , and the variation coefficient σv. For example, the parameters of British pound in1994 are estimated to the values of { κ * ,*θ , σv} = {10.469, 0.2243, 0.1491}, andvolatility takes about 24 days to revert halfway towards a long-term mean of 22.43%.Based on the whole sample period, average reverting speed of the volatility on fourcurrencies are 10.376%, 8.1663%, 13.330%, and 7.8516% for British pound, Deutschemark, Japanese yen, and Swiss franc, respectively. The range of average half-life ofshocks is from 19 to 33 days. Compared with Guo’s (1998) findings on Deutsche marktraded in the PHLX from 1987 to 1992, our estimates of the parameter on the speed of*reversion κ (an average value 8.1663) is similar. However, we find that the speed ofreversion on the volatility shock in the currency market is faster than that in stockmarkets. Bakshi, Cao and Chen (1997) found that the value of speed of reversion forS&P 500 index options during the period from 1988 to 1991 is equal to 1.15, similar tothe finding of 1.49 for the period from 1988 to 1993 in Bates (2000), while Nandi (1998)found it on stock futures options as equal to 3.29. This phenomenon could be16