Maturity Transformation and Interest Rate Risk in Large European ...

Maturity Transformation and Interest Rate Risk in Large European ...

Maturity Transformation and Interest Rate Risk in Large European ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

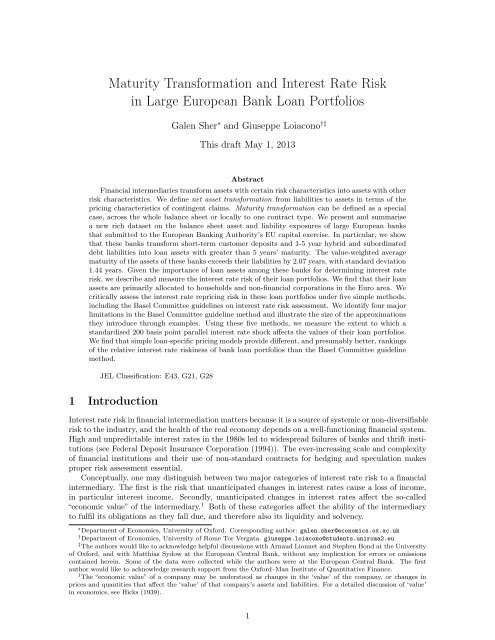

<strong>Maturity</strong> <strong>Transformation</strong> <strong>and</strong> <strong>Interest</strong> <strong>Rate</strong> <strong>Risk</strong><strong>in</strong> <strong>Large</strong> <strong>European</strong> Bank Loan PortfoliosGalen Sher ∗ <strong>and</strong> Giuseppe Loiacono †‡This draft May 1, 2013AbstractF<strong>in</strong>ancial <strong>in</strong>termediaries transform assets with certa<strong>in</strong> risk characteristics <strong>in</strong>to assets with otherrisk characteristics. We def<strong>in</strong>e net asset transformation from liabilities to assets <strong>in</strong> terms of thepric<strong>in</strong>g characteristics of cont<strong>in</strong>gent claims. <strong>Maturity</strong> transformation can be def<strong>in</strong>ed as a specialcase, across the whole balance sheet or locally to one contract type. We present <strong>and</strong> summarisea new rich dataset on the balance sheet asset <strong>and</strong> liability exposures of large <strong>European</strong> banksthat submitted to the <strong>European</strong> Bank<strong>in</strong>g Authority’s EU capital exercise. In particular, we showthat these banks transform short-term customer deposits <strong>and</strong> 1-5 year hybrid <strong>and</strong> subord<strong>in</strong>ateddebt liabilities <strong>in</strong>to loan assets with greater than 5 years’ maturity. The value-weighted averagematurity of the assets of these banks exceeds their liabilities by 2.07 years, with st<strong>and</strong>ard deviation1.44 years. Given the importance of loan assets among these banks for determ<strong>in</strong><strong>in</strong>g <strong>in</strong>terest raterisk, we describe <strong>and</strong> measure the <strong>in</strong>terest rate risk of their loan portfolios. We f<strong>in</strong>d that their loanassets are primarily allocated to households <strong>and</strong> non-f<strong>in</strong>ancial corporations <strong>in</strong> the Euro area. Wecritically assess the <strong>in</strong>terest rate repric<strong>in</strong>g risk <strong>in</strong> these loan portfolios under five simple methods,<strong>in</strong>clud<strong>in</strong>g the Basel Committee guidel<strong>in</strong>es on <strong>in</strong>terest rate risk assessment. We identify four majorlimitations <strong>in</strong> the Basel Committee guidel<strong>in</strong>e method <strong>and</strong> illustrate the size of the approximationsthey <strong>in</strong>troduce through examples. Us<strong>in</strong>g these five methods, we measure the extent to which ast<strong>and</strong>ardised 200 basis po<strong>in</strong>t parallel <strong>in</strong>terest rate shock affects the values of their loan portfolios.We f<strong>in</strong>d that simple loan-specific pric<strong>in</strong>g models provide different, <strong>and</strong> presumably better, rank<strong>in</strong>gsof the relative <strong>in</strong>terest rate risk<strong>in</strong>ess of bank loan portfolios than the Basel Committee guidel<strong>in</strong>emethod.JEL Classification: E43, G21, G281 Introduction<strong>Interest</strong> rate risk <strong>in</strong> f<strong>in</strong>ancial <strong>in</strong>termediation matters because it is a source of systemic or non-diversifiablerisk to the <strong>in</strong>dustry, <strong>and</strong> the health of the real economy depends on a well-function<strong>in</strong>g f<strong>in</strong>ancial system.High <strong>and</strong> unpredictable <strong>in</strong>terest rates <strong>in</strong> the 1980s led to widespread failures of banks <strong>and</strong> thrift <strong>in</strong>stitutions(see Federal Deposit Insurance Corporation (1994)). The ever-<strong>in</strong>creas<strong>in</strong>g scale <strong>and</strong> complexityof f<strong>in</strong>ancial <strong>in</strong>stitutions <strong>and</strong> their use of non-st<strong>and</strong>ard contracts for hedg<strong>in</strong>g <strong>and</strong> speculation makesproper risk assessment essential.Conceptually, one may dist<strong>in</strong>guish between two major categories of <strong>in</strong>terest rate risk to a f<strong>in</strong>ancial<strong>in</strong>termediary. The first is the risk that unanticipated changes <strong>in</strong> <strong>in</strong>terest rates cause a loss of <strong>in</strong>come,<strong>in</strong> particular <strong>in</strong>terest <strong>in</strong>come. Secondly, unanticipated changes <strong>in</strong> <strong>in</strong>terest rates affect the so-called“economic value” of the <strong>in</strong>termediary. 1 Both of these categories affect the ability of the <strong>in</strong>termediaryto fulfil its obligations as they fall due, <strong>and</strong> therefore also its liquidity <strong>and</strong> solvency.∗ Department of Economics, University of Oxford. Correspond<strong>in</strong>g author: galen.sher@economics.ox.ac.uk† Department of Economics, University of Rome Tor Vergata. giuseppe.loiacono@students.uniroma2.eu‡ The authors would like to acknowledge helpful discussions with Arnaud Lionnet <strong>and</strong> Stephen Bond at the Universityof Oxford, <strong>and</strong> with Matthias Sydow at the <strong>European</strong> Central Bank, without any implication for errors or omissionsconta<strong>in</strong>ed here<strong>in</strong>. Some of the data were collected while the authors were at the <strong>European</strong> Central Bank. The firstauthor would like to acknowledge research support from the Oxford–Man Institute of Quantitative F<strong>in</strong>ance.1 The “economic value” of a company may be understood as changes <strong>in</strong> the ‘value’ of the company, or changes <strong>in</strong>prices <strong>and</strong> quantities that affect the ‘value’ of that company’s assets <strong>and</strong> liabilities. For a detailed discussion of ‘value’<strong>in</strong> economics, see Hicks (1939).1

There are at least three ways that an analyst (say, a regulator) may monitor or assess the <strong>in</strong>terestrate risk of a f<strong>in</strong>ancial <strong>in</strong>termediary. Publicly listed banks <strong>and</strong> <strong>in</strong>surers disclose measures of thesensitivity of their balance sheets to shifts <strong>in</strong> the term structure of <strong>in</strong>terest rates, so <strong>in</strong> the first<strong>in</strong>stance an analyst may refer to these disclosures. These self-reported measures have the advantagethat they may take <strong>in</strong>to account the complex structure of the contracts held by an <strong>in</strong>termediary thatmay not be visible <strong>in</strong> its f<strong>in</strong>ancial statements, but such measures also rely on the will<strong>in</strong>gness <strong>and</strong>ability of the <strong>in</strong>termediary to make an accurate assessment. Furthermore, only one to two measuresare typically disclosed, which cannot be hoped to provide a complete picture of the <strong>in</strong>termediary’sexposure to <strong>in</strong>terest rate changes.As an alternative, the analyst could use regression analysis to measure the sensitivity of the stockreturn of publicly-listed <strong>in</strong>termediaries aga<strong>in</strong>st changes <strong>in</strong> specific <strong>in</strong>terest rates or aga<strong>in</strong>st measuresreflect<strong>in</strong>g the shape of the yield curve. The pr<strong>in</strong>ciple paper <strong>in</strong> this category is Flannery <strong>and</strong> James(1984a), where the authors f<strong>in</strong>d that US banks’ stock returns are sensitive to <strong>in</strong>terest rate changes,<strong>and</strong> that the degree of sensitivity is correlated with the degree of maturity transformation measuredfrom the nom<strong>in</strong>al contracts on their balance sheets. Flannery <strong>and</strong> James (1984b) <strong>in</strong>fer the effectivedegree of maturity transformation based on these stock sensitivity measures. Saunders <strong>and</strong> Yourougou(1990) f<strong>in</strong>d that bank stock returns are more sensitive to <strong>in</strong>terest rate changes than the stock returnsof other companies; they also f<strong>in</strong>d some evidence to suggest that universal banks would be more robustto <strong>in</strong>terest rate changes due to better diversification. Czaja, Scholz, <strong>and</strong> Wilkens (2009) measurethe sensitivity of stock returns of German banks <strong>and</strong> <strong>in</strong>surers to level, slope <strong>and</strong> curvature changes<strong>in</strong> local yield curves, <strong>and</strong> f<strong>in</strong>d that bank <strong>and</strong> <strong>in</strong>surer stock returns offer a premium for those banks<strong>and</strong> <strong>in</strong>surers with greater sensitivities to the level <strong>and</strong> curvature factors. English, van den Heuvel,<strong>and</strong> Zakrajsek (2012) use high-frequency stock <strong>and</strong> <strong>in</strong>terest rate data around Federal Open MarketCommittee announcements to measure the effect of <strong>in</strong>terest rate level <strong>and</strong> slope changes <strong>in</strong> bank stockreturns; study<strong>in</strong>g short time <strong>in</strong>tervals helps to avoid the pollutive effects of unrelated news on stockprices.The analyst could also measure the <strong>in</strong>terest rate sensitivity of each item on the balance sheet, byask<strong>in</strong>g the question “How would the unit prices of the major asset <strong>and</strong> liability categories change if<strong>in</strong>terest rates were different on the valuation date?” This is the approach taken <strong>in</strong> our paper, <strong>and</strong>can be thought of as a ‘prospective’ assessment of <strong>in</strong>terest rate risk, as opposed to the ‘retrospective’assessments follow<strong>in</strong>g Flannery <strong>and</strong> James (1984a). The concepts of duration <strong>and</strong> convexity as measuresof price sensitivity to <strong>in</strong>terest rate changes were <strong>in</strong>troduced by Macaulay (1938), Hicks (1939),Samuelson (1945) <strong>and</strong> Red<strong>in</strong>gton (1952). Houpt <strong>and</strong> Embersit (1991) propose a duration-based methodfor assess<strong>in</strong>g the <strong>in</strong>terest rate sensitivity of banks’ economic value based on their publicly disclosedbalance sheets. This model has s<strong>in</strong>ce become known as the Federal Reserve’s Economic Value Model(EVM). Wright <strong>and</strong> Houpt (1996) evaluate the performance of this simple model for ‘thrift <strong>in</strong>stitutions’aga<strong>in</strong>st a model that uses more detailed private supervisory data, <strong>and</strong> aga<strong>in</strong>st the Office for ThiftSupervision’s <strong>in</strong>ternal model. Despite the limitations of publicly-available data, the authors f<strong>in</strong>d thatthe simple model provides useful <strong>in</strong>formation for measur<strong>in</strong>g the sensitivity of banks’ economic valueto <strong>in</strong>terest rate changes; they also f<strong>in</strong>d that the biggest limitation of such models are the arbitraryassumptions that have to be made about the behaviour of depositors.Jarrow <strong>and</strong> van Deventer (1998) offer a no-arbitrage model for determ<strong>in</strong><strong>in</strong>g the economic valueof deposit contract liabilities, <strong>and</strong> this pric<strong>in</strong>g function could also be used <strong>in</strong> pr<strong>in</strong>ciple to measure itssensitivity to <strong>in</strong>terest rate changes. O’Brien (2000) also offers such a no-arbitrage model, <strong>and</strong> furtherestimates its parameters on US bank data, provid<strong>in</strong>g detailed sensitivity estimates of the economicvalue of bank liabilities to changes <strong>in</strong> the short term <strong>in</strong>terest rate. Sierra <strong>and</strong> Yeager (2004) evaluatethe predictions of the EVM aga<strong>in</strong>st the actual performance of US community banks, which do nottypically engage <strong>in</strong> complex derivative transactions, <strong>and</strong> f<strong>in</strong>d that those banks that the EVM identifiesas most sensitive to ris<strong>in</strong>g rates show the greatest deterioration <strong>in</strong> performance <strong>in</strong> the 1998-2000 periodof ris<strong>in</strong>g rates <strong>in</strong> the US. Sierra (2009) f<strong>in</strong>ds that the ‘prospective’ sensitivities of US bank economicvalue to <strong>in</strong>terest rates calculated from the EVM are consistent with the ‘retrospective’ <strong>in</strong>terest ratesensitivities of stock prices discussed above. Entrop, Memmel, Wilkens, <strong>and</strong> Zeisler (2011) try toproduce a ref<strong>in</strong>ed EVM model calibrated to German bank<strong>in</strong>g data by us<strong>in</strong>g repeated observations ofbalance sheets over time. By evaluat<strong>in</strong>g their model us<strong>in</strong>g private supervisor data, they are able toargue that their model outperforms the EVM, which relies on data at only one po<strong>in</strong>t <strong>in</strong> time. Themost important paper for estimat<strong>in</strong>g the sensitivity of US bank balance sheet derivative exposures is2

‘duration’ number <strong>in</strong> the penultimate column of Table 1. Multiply<strong>in</strong>g this duration number by the sizeof the st<strong>and</strong>ardised shock, which is 2%, gives the risk-weight measure that is shown <strong>in</strong> percent <strong>in</strong> thef<strong>in</strong>al column of this Table. The risk weight is an estimate of the <strong>in</strong>terest rate revaluation sensitivity ofthe hypothetical security under a st<strong>and</strong>ardised <strong>in</strong>terest rate shock.We can immediately observe several shortcom<strong>in</strong>gs of this guidel<strong>in</strong>e method for <strong>in</strong>terest rate revaluationsensitivity. These shortcom<strong>in</strong>gs can be summarised as follows:1. The method does not depend on the specific type of security. We might expect different securitieswith the same rema<strong>in</strong><strong>in</strong>g time to maturity to have different sensitivities to <strong>in</strong>terest rate changes.In particular, we have no <strong>in</strong>dication of how good this guidel<strong>in</strong>e method is for loan contracts.2. The method does not depend on the current yield curve. Not only is the st<strong>and</strong>ardised shock of2% <strong>in</strong>variant to historical yields, but the sensitivity calculation itself is unrelated to the prevail<strong>in</strong>g<strong>in</strong>terest rate environment. For example, <strong>in</strong> a high <strong>in</strong>terest rate environment, we might expectlarger absolute changes <strong>in</strong> <strong>in</strong>terest rates to be likely, <strong>and</strong> we might expect the price of a securityto be more sensitive to a given absolute change <strong>in</strong> <strong>in</strong>terest rates <strong>in</strong> a low <strong>in</strong>terest rate environmentthan <strong>in</strong> a high <strong>in</strong>terest rate environment.3. The method encourages the use of a parallel upward shift <strong>in</strong> <strong>in</strong>terest rates of 2%, without explicitlyrequir<strong>in</strong>g that the supervisor <strong>in</strong>vestigate other scenarios. As a scenario, there is little reason toexpect that a parallel upward shift <strong>in</strong> <strong>in</strong>terest rates of 2% is commensurate with a desired level ofrisk<strong>in</strong>ess, or even that it is plausible, given the well-known correlation between levels <strong>and</strong> slopesof yield curves. As a risk measurement device, a s<strong>in</strong>gle scenario <strong>in</strong>centivises banks to reducetheir exposure to just this one scenario, while potentially rema<strong>in</strong><strong>in</strong>g severely exposed to otherscenarios, which <strong>in</strong>clude parallel shifts not equal to 2% <strong>and</strong> slope changes.4. The method provides only an ad hoc way to aggregate the sensitivity of many exposures <strong>in</strong>to aportfolio sensitivity, despite the fact that the method is recommended for measur<strong>in</strong>g the <strong>in</strong>terestrate revaluation risk of the whole balance sheet.Indeed given these four criticisms, it is difficult to see how the method improves on so-called gapanalysis, where the weighted average maturity all the assets <strong>and</strong> liabilities on the balance sheet is usedas a proxy for <strong>in</strong>terest rate risk.1.2 Structure of this paperOur objectives of this paper are twofold. First, we offer a def<strong>in</strong>ition of maturity transformation <strong>in</strong>terms of the pric<strong>in</strong>g characteristics of assets <strong>and</strong> liabilities. This theory of ‘transformation’, <strong>in</strong>clud<strong>in</strong>gmaturity transformation, is presented <strong>in</strong> Section 3.1. To measure the degree of maturity transformationof large <strong>European</strong> banks, we employ a dataset collected by the authors at the <strong>European</strong> Central Bankthat covers the asset <strong>and</strong> liability exposures <strong>in</strong> greater detail than currently available from majordata providers. All the asset <strong>and</strong> liability exposure data were collected from the consolidated annualf<strong>in</strong>ancial statements <strong>and</strong> Pillar III disclosures of these banks. We present <strong>and</strong> summarise the data <strong>in</strong>Section 2 <strong>and</strong> we measure the degree of transformation <strong>in</strong> Section 4.1.Hav<strong>in</strong>g determ<strong>in</strong>ed that the degree of on-balance-sheet <strong>in</strong>terest rate revaluation risk 6 is most substantially<strong>in</strong>fluenced by the loan asset portfolios of these banks, our second objective <strong>in</strong> this paper isto measure the <strong>in</strong>terest rate revaluation sensitivity of these loan assets. To do so, we employ severalmethods, <strong>in</strong>clud<strong>in</strong>g conventional gap analysis, 7 the Basel Committee guidel<strong>in</strong>e method <strong>in</strong>troduced <strong>in</strong>Section 1.1, <strong>and</strong> the simple present value formulae for amortis<strong>in</strong>g loan contracts of Section 3.2 comb<strong>in</strong>edwith stylised characterisations of the yield curve <strong>in</strong> Section 3.3. We present our results <strong>in</strong> Section4, <strong>in</strong>clud<strong>in</strong>g one rank<strong>in</strong>g of banks by the (2%-) <strong>in</strong>terest rate risk of their loan portfolios for each of thesensitivity methods, <strong>in</strong> Section 4.4. Section 5 concludes.6 As opposed to off-balance-sheet <strong>in</strong>terest rate revaluation risk, which is discussed for example <strong>in</strong> Gorton <strong>and</strong> Rosen(1995).7 Gap analysis is a method for measur<strong>in</strong>g the <strong>in</strong>terest rate risk of a bank by comput<strong>in</strong>g the weighted average maturityof all assets <strong>and</strong> liabilities on the balance sheet. By comput<strong>in</strong>g the weighted average maturity of loan assets only, weobta<strong>in</strong> an analog of gap analysis applied to the <strong>in</strong>terest rate risk assessment of just the loan assets of banks.4

Table 2: List of banks <strong>in</strong> the sample.EBA code Description EBA code DescriptionAT001 Erste Bank GB089 HSBCAT002 Raiffeisen Bank GB090 BarclaysAT003 Oesterreichische Volksbank GB091 LloydsBE004 Dexia GR030 EFG EurobankBE005 KBC GR031 National Bank of GreeceCY006 Marf<strong>in</strong> Popular GR032 Alpha BankCY007 Bank of Cyprus GR033 Piraeus Bank GroupDE017 Deutsche Bank HU036 OTP Bank NYRT.DE018 Commerzbank IE037 Allied Irish BanksDE019 LBBW IE038 Bank of Irel<strong>and</strong>DE020 DZ Bank IE039 Irish LifeDE021 Bayern LB IT040 Intesa SanpaoloDE022 Nord LB IT041 UnicreditDE023 Hypo RE IT042 Banca Monte Dei Paschi Di SienaDE024 West LB IT043 Banco PopolareDE025 HSH Nordbank IT044 UBI BancaDE026 Helaba LU045 Banque Et Caisse DEpargne De LEtatDE027 L<strong>and</strong>esbank Berl<strong>in</strong> MT046 Bank of ValettaDE028 DekaBank NL047 INGDK008 Danske Group NL048 RabobankDK009 Jyske Bank NL049 ABN AmroDK010 Sydbank NL050 SNS BankDK011 Nykredit NO051 DnB NORES059 Sant<strong>and</strong>er PL052 PKO Bank PolskiES060 BBVA PT053 Caixa Geral de DepositosES061 Bankia PT054 Banco ComercialES062 La Caixa PT055 Espirito SantoES064 Banco Popular PT056 Banco BPIFI012 OPO-Pohjola SE084 NordeaFR013 BNP SE085 SEBFR014 Credit Agricole SE086 Svenska H<strong>and</strong>elsbankenFR015 BPCE SE087 SwedbankFR016 Societe Generale SI057 NLB GroupGB088 RBS SI058 NKBM2 DataThe sample of banks we study here is the sample of banks analysed <strong>in</strong> the <strong>European</strong> Bank<strong>in</strong>g Authority’s2011 EU-wide capital exercise. They form the largest <strong>European</strong> bank hold<strong>in</strong>g companies <strong>and</strong>are listed <strong>in</strong> Table 2. Balance sheet data for these banks is publicly available from data providers likeReuters, Bloomberg <strong>and</strong> SNL, but not at the full level of detail that these <strong>in</strong>stitutions report <strong>in</strong> theirannual f<strong>in</strong>ancial statements. We use data collected by the authors at the <strong>European</strong> Central Bank onbalance sheet assets <strong>and</strong> liabilities as at 31 December 2011.In particular, our data segregates loan assets <strong>in</strong>to countries, sectors <strong>and</strong> rema<strong>in</strong><strong>in</strong>g time to maturity,which allows us to compute detailed estimates of the <strong>in</strong>terest rate sensitivity of these loans portfolios.While we use the country <strong>and</strong> sector classifications to measure “net asset transformation” <strong>in</strong> Section4.1, 8 we use only the maturity data to measure the <strong>in</strong>terest rate sensitivity of these loan assets.The jo<strong>in</strong>t distribution of loan asset values by geography, sector <strong>and</strong> maturity is not known (only themarg<strong>in</strong>al distributions are known) <strong>and</strong> the risk assessment by maturity already provides a rich analysis.We describe the cross-section of loan exposures by sector <strong>and</strong> country merely as a qualitative devicefor assess<strong>in</strong>g concentration risk. In this section we summarise these loan exposures data by maturiy,geographical location <strong>and</strong> sector. In Section 2.4 we also summarise the yield curve data used <strong>in</strong> this8 We def<strong>in</strong>e net asset transformation as a more general notion than maturity transformation <strong>in</strong> Section 3.1.5

paper.2.1 Account<strong>in</strong>g valuation methods <strong>in</strong> <strong>European</strong> countriesThe loan exposure data on which this paper is based has been gathered by the authors from thef<strong>in</strong>ancial statements of large <strong>European</strong> banks. In this section we provide an overview of the account<strong>in</strong>gmethods used to value these assets <strong>and</strong> liabilities. In do<strong>in</strong>g so, we ga<strong>in</strong> a better underst<strong>and</strong><strong>in</strong>g ofthe exposures underly<strong>in</strong>g the summaries <strong>in</strong> Section 2, <strong>and</strong> we can compare the account<strong>in</strong>g valuationmethods to the stylised economic valuation models of Section 3.2.1.1 Introduction to account<strong>in</strong>g rules for valu<strong>in</strong>g assets <strong>and</strong> liabilitiesIn the life of a corporate entity, every event has to be recorded <strong>in</strong> the f<strong>in</strong>ancial statements accord<strong>in</strong>g tocommon st<strong>and</strong>ards. Account<strong>in</strong>g st<strong>and</strong>ards can have a significant impact on the f<strong>in</strong>ancial system, <strong>in</strong> particularvia their potential <strong>in</strong>fluence on the behaviour of economic agents. Published f<strong>in</strong>ancial statementsprovide f<strong>in</strong>ancial <strong>and</strong> economic signals on which decisions can be made, <strong>and</strong> on which management canbe assessed. Therefore, comparability of f<strong>in</strong>ancial statements across countries is desirable. Pursu<strong>in</strong>gthis aim, the IFRS Foundation – an <strong>in</strong>dependent, not-for-profit private sector organisation work<strong>in</strong>g<strong>in</strong> the public <strong>in</strong>terest – developed a s<strong>in</strong>gle set underst<strong>and</strong>able, enforceable <strong>and</strong> globally accepted <strong>in</strong>ternationalf<strong>in</strong>ancial report<strong>in</strong>g st<strong>and</strong>ards (IFRSs) through its st<strong>and</strong>ard-sett<strong>in</strong>g body, the InternationalAccount<strong>in</strong>g St<strong>and</strong>ards Board.In Europe, the IFRS st<strong>and</strong>ards have not fully substituted for the national account<strong>in</strong>g st<strong>and</strong>ards(Generally Accepted Account<strong>in</strong>g Pr<strong>in</strong>ciples). EU Regulation 1606/2002 requires <strong>European</strong> companiesat the consolidated level to comply with IFRS st<strong>and</strong>ards, but does not make prescriptions for nonlisted<strong>European</strong> companies. Therefore subsidiary companies, like banks that are part of larger hold<strong>in</strong>gcompanies, are still subject to national GAAP <strong>and</strong> can move voluntarily to IFRS. 9 The banks that areused for the analysis <strong>in</strong> this paper complied with IFRS st<strong>and</strong>ards. They were chosen based on theirparticipation <strong>in</strong> the <strong>European</strong> Bank<strong>in</strong>g Authority’s 2011 EU capital exercise, <strong>and</strong> are therefore thelargest <strong>and</strong> most systemically important banks <strong>in</strong> Europe. For the sake of our analysis, this sectionfocuses on IAS 39 <strong>and</strong> IFRS 9, which are the specific IFRS st<strong>and</strong>ards that regulate the recognition<strong>and</strong> measurement of f<strong>in</strong>ancial assets <strong>and</strong> liabilities.2.1.2 Explanations of fair value <strong>and</strong> amortised costF<strong>in</strong>ancial assets <strong>and</strong> liabilities can be recorded on the balance sheet at either fair value or amortisedcost. Fair value is the amount for which an asset could be exchanged, or a liability settled, betweenknowledgeable, will<strong>in</strong>g parties <strong>in</strong> an arm’s length transaction [IAS 39.9]. IAS 39 provides a hierarchyto be used <strong>in</strong> determ<strong>in</strong><strong>in</strong>g the fair value for a f<strong>in</strong>ancial <strong>in</strong>strument: [IAS 39 Appendix A, paragraphsAG69-82]• Level 1: Quoted market prices <strong>in</strong> an active market 10 are the best evidence of fair value <strong>and</strong>should be used, where they exist, to value the f<strong>in</strong>ancial <strong>in</strong>strument.• Level 2: If a market for a f<strong>in</strong>ancial <strong>in</strong>strument is not active, an entity establishes fair value byus<strong>in</strong>g a model-based valuation technique that makes maximum use of market <strong>in</strong>puts, <strong>and</strong> withreference to recent arm’s length market transactions, the current fair value of similar <strong>in</strong>struments,discounted cash flow analysis, <strong>and</strong> option pric<strong>in</strong>g models. An acceptable valuation technique<strong>in</strong>corporates all factors that market participants would consider <strong>in</strong> sett<strong>in</strong>g a price <strong>and</strong> is consistentwith accepted economic methodologies for pric<strong>in</strong>g f<strong>in</strong>ancial <strong>in</strong>struments. A f<strong>in</strong>ancial <strong>in</strong>strumentfalls under Level 2 valuation if the model <strong>in</strong>puts are substantially based on market observables.For example, <strong>in</strong> pric<strong>in</strong>g debt <strong>in</strong>struments with default risk, the credit spread <strong>in</strong>puts should bebased on prevail<strong>in</strong>g credit spreads that are observable at the time of valuation.• Level 3: If the model <strong>in</strong>puts are not observable <strong>in</strong> the market, they should be estimated tothe extent possible from historical data. Cont<strong>in</strong>u<strong>in</strong>g the above example of debt <strong>in</strong>strument9 The “consolidated level” refers to the group hold<strong>in</strong>g company, which may own whole or majority stakes <strong>in</strong> subsidiarycompanies. Account<strong>in</strong>g statements are often produced for both the group hold<strong>in</strong>g company <strong>and</strong> the subsidiary companies.10 An active market <strong>in</strong> the account<strong>in</strong>g st<strong>and</strong>ards means a market <strong>in</strong> which transactions for the asset or liability takeplace with sufficient frequency <strong>and</strong> volume to provide <strong>in</strong>formative ongo<strong>in</strong>g prices.6

valuation, prepayment rates may be unobservable <strong>in</strong> the market, but should be calibrated tohistorical prepayment rates where possible. 11Accord<strong>in</strong>g to IAS 39.46-47, f<strong>in</strong>ancial assets <strong>and</strong> liabilities (<strong>in</strong>clud<strong>in</strong>g derivatives) should be measuredat fair value, with the follow<strong>in</strong>g exceptions:• Loans <strong>and</strong> receivables, held-to-maturity <strong>in</strong>vestments, <strong>and</strong> non-derivative f<strong>in</strong>ancial liabilities shouldbe measured at amortised cost us<strong>in</strong>g the effective <strong>in</strong>terest method.• Investments <strong>in</strong> equity <strong>in</strong>struments should be measured at fair value, but if the range of reasonablefair value measurements is large, then such <strong>in</strong>struments, <strong>and</strong> derivatives <strong>in</strong>dexed to such equity<strong>in</strong>struments, can be measured at cost less impairment.• F<strong>in</strong>ancial assets <strong>and</strong> liabilities that are designated as a hedged item or hedg<strong>in</strong>g <strong>in</strong>strument aresubject to measurement under the hedge account<strong>in</strong>g requirements of the IAS 39.• F<strong>in</strong>ancial liabilities that arise when a transfer of a f<strong>in</strong>ancial asset does not qualify for derecognition,12 or that are accounted for us<strong>in</strong>g the cont<strong>in</strong>u<strong>in</strong>g-<strong>in</strong>volvement method, are subject toparticular measurement requirements.Amortised cost is calculated us<strong>in</strong>g the effective <strong>in</strong>terest method. The effective <strong>in</strong>terest rate is the ratethat exactly discounts estimated future cash payments or receipts through the expected life of thef<strong>in</strong>ancial <strong>in</strong>strument to the net carry<strong>in</strong>g amount 13 of the f<strong>in</strong>ancial asset or liability. F<strong>in</strong>ancial assetsthat are not carried at fair value though profit <strong>and</strong> loss are subject to an impairment test. If theexpected life cannot be determ<strong>in</strong>ed reliably, then the contractual life is used.A f<strong>in</strong>ancial asset or liability valued at amortised cost is subject to an impairment test when there isobjective evidence to do so, as a result of one or more events that occurred after the <strong>in</strong>itial recognition 14of the asset. An entity is required to assess at each balance sheet date whether there is any objectiveevidence of impairment. If any such evidence exists, the entity is required to do a detailed impairmentcalculation to determ<strong>in</strong>e whether an impairment loss should be recognised [IAS 39.58]. The amountof the loss is measured as the difference between the asset’s carry<strong>in</strong>g amount <strong>and</strong> the present value ofestimated cash flows discounted at the f<strong>in</strong>ancial asset’s orig<strong>in</strong>al effective <strong>in</strong>terest rate [IAS 39.63].2.1.3 Account<strong>in</strong>g <strong>and</strong> valuation of f<strong>in</strong>ancial assetsIAS 39 requires f<strong>in</strong>ancial assets to be classified <strong>in</strong> different categories, used to determ<strong>in</strong>e how a particularf<strong>in</strong>ancial asset is recognized <strong>and</strong> measured <strong>in</strong> the f<strong>in</strong>ancial statements.F<strong>in</strong>ancial assets at fair value through profit or loss This category of assets can be divided <strong>in</strong>totwo subcategories:• The designated category <strong>in</strong>cludes any f<strong>in</strong>ancial asset that is designated on <strong>in</strong>itial recognition asone to be measured at fair value with fair value changes <strong>in</strong> profit or loss.• The held for trad<strong>in</strong>g category <strong>in</strong>cludes f<strong>in</strong>ancial assets that are held for trad<strong>in</strong>g purposes. Allderivatives (except those designated hedg<strong>in</strong>g <strong>in</strong>struments) <strong>and</strong> f<strong>in</strong>ancial assets acquired or heldfor the purpose of sell<strong>in</strong>g <strong>in</strong> the short term, or for which there is a recent pattern of short-termprofit tak<strong>in</strong>g, fall <strong>in</strong>to this category [IAS 39.9].Available-for-sale f<strong>in</strong>ancial assets (AFS) These are any non-derivative f<strong>in</strong>ancial assets designatedon <strong>in</strong>itial recognition as available for sale or any other <strong>in</strong>struments that are not classified as(a) loans <strong>and</strong> receivables, (b) held-to-maturity <strong>in</strong>vestments or (c) f<strong>in</strong>ancial assets at fair value11 Prepayment rates are rates at which loan debtors repay their loan contracts early. In most loan contracts, debtorsreta<strong>in</strong> the option to repay their loans early. Early repayment can be a risk to the creditor, because it raises the possibilityof poor re<strong>in</strong>vestment rates at the time of prepayment.12 Derecognition is a term used <strong>in</strong> the account<strong>in</strong>g st<strong>and</strong>ards to mean the deletion of an asset or liability from thef<strong>in</strong>ancial statements.13 The net carry<strong>in</strong>g amount <strong>in</strong> the account<strong>in</strong>g st<strong>and</strong>ards means the orig<strong>in</strong>al cost, less the accumulated amount of anydepreciation or amortization <strong>and</strong> less any impairments.14 The term <strong>in</strong>itial recognition is used <strong>in</strong> the account<strong>in</strong>g st<strong>and</strong>ards to mean the first time that an asset or liability isrecorded <strong>in</strong> the f<strong>in</strong>ancial statements.7

through profit or loss [IAS 39.9]. AFS assets are measured at fair value <strong>in</strong> the balance sheet. Fairvalue changes on AFS assets are recorded directly <strong>in</strong> equity, through the statement of changes<strong>in</strong> equity, except for <strong>in</strong>terest on AFS assets (which is recorded <strong>in</strong> <strong>in</strong>come on an effective yieldbasis), impairment losses <strong>and</strong> (for <strong>in</strong>terest-bear<strong>in</strong>g AFS debt <strong>in</strong>struments) foreign exchange ga<strong>in</strong>sor losses. The cumulative ga<strong>in</strong> or loss that has been recognised <strong>in</strong> equity is recognised <strong>in</strong> profitor loss when an available-for-sale f<strong>in</strong>ancial asset is derecognised [IAS 39.55(b)].Loans <strong>and</strong> receivables These are non-derivative f<strong>in</strong>ancial assets with fixed or determ<strong>in</strong>able paymentsthat are not quoted <strong>in</strong> an active market, other than those held at fair value throughprofit or loss or as available-for-sale. Loans <strong>and</strong> receivables for which the holder may not recoversubstantially all of its <strong>in</strong>itial <strong>in</strong>vestment, other than because of credit deterioration, should beclassified as available-for-sale [IAS 39.9]. Loans <strong>and</strong> receivables are measured at amortised cost[IAS 39.46(a)].Held-to-maturity <strong>in</strong>vestments These are non-derivative f<strong>in</strong>ancial assets with fixed or determ<strong>in</strong>ablepayments that an entity <strong>in</strong>tends <strong>and</strong> is able to hold to maturity <strong>and</strong> that do not meet the def<strong>in</strong>itionof loans <strong>and</strong> receivables <strong>and</strong> are not designated on <strong>in</strong>itial recognition as assets at fair value throughprofit or loss or as available for sale. Held-to-maturity <strong>in</strong>vestments are measured at amortisedcost. If an entity sells a held-to-maturity <strong>in</strong>vestment other than <strong>in</strong> <strong>in</strong>significant amounts or as aconsequence of a non-recurr<strong>in</strong>g, isolated event beyond its control that could not be reasonablyanticipated, all of its other held-to-maturity <strong>in</strong>vestments must be reclassified as available-for-salefor the current <strong>and</strong> next two f<strong>in</strong>ancial report<strong>in</strong>g years [IAS 39.9]. Held-to-maturity <strong>in</strong>vestmentsare measured at amortised cost [IAS 39.46(b)].2.1.4 Account<strong>in</strong>g valuation methods for f<strong>in</strong>ancial liabilitiesIAS 39 recognises two classes of f<strong>in</strong>ancial liabilities: [IAS 39.47]F<strong>in</strong>ancial liabilities at fair value through profit or loss This category has two subcategories:• Designated: a f<strong>in</strong>ancial liability that is designated by the entity as a liability at fair valuethrough profit or loss upon <strong>in</strong>itial recognition.• Held for trad<strong>in</strong>g: a f<strong>in</strong>ancial liability classified as held for trad<strong>in</strong>g, such as an obligation forsecurities borrowed <strong>in</strong> a short sale, which have to be returned <strong>in</strong> the future.F<strong>in</strong>ancial liabilities measured at amortised cost us<strong>in</strong>g the effective <strong>in</strong>terest method This category<strong>in</strong>cludes, for example, hybrid <strong>and</strong> subord<strong>in</strong>ated debt securities.2.2 <strong>Maturity</strong> data for all assets <strong>and</strong> liabilitiesAsset <strong>and</strong> liability maturities, where available, are classified <strong>in</strong> the f<strong>in</strong>ancial statements <strong>in</strong>to four‘buckets’: on dem<strong>and</strong>, up to three month, three to twelve month, one to five years <strong>and</strong> more than fiveyears. Although not all banks provide all the <strong>in</strong>formation required for our data collection exercise, therate of coverage on our asset <strong>and</strong> liability maturity data <strong>in</strong> 2011 is of the order 80%. 15 The coveragerate of our maturity data <strong>in</strong> 2011 for loan contracts only is 82%, which compares favourably with 70%for the st<strong>and</strong>ard data provider SNL F<strong>in</strong>ancial <strong>in</strong> the same year. Our maturity data also agree closelywith the SNL F<strong>in</strong>ancial maturity data, where they overlap. In particular, for the banks with totalloans <strong>in</strong> 2011 appear<strong>in</strong>g <strong>in</strong> both datasets, the ratio of our exposure to the exposure <strong>in</strong> SNL F<strong>in</strong>ancialis on average 97%, with st<strong>and</strong>ard deviation 13%, across the sample of banks. 16 We provide summary<strong>in</strong>formation about the maturity profiles of assets <strong>and</strong> liabilities <strong>in</strong> Figures 1 <strong>and</strong> 2.The weighted average maturity gap for banks, depicted <strong>in</strong> Figure 1, is calculated by subtract<strong>in</strong>g theweighted average maturity of liabilities from assets. The weights used are the total asset <strong>and</strong> liabilityvalues <strong>in</strong> each maturity bucket, normalised to sum to one. From Figure 1 it can be seen that exceptfor two banks (Piraeus Bank Group GR033 <strong>and</strong> Svenska H<strong>and</strong>elsbanken SE086) the weighted average15 By coverage of the data set, we mean the ratio of the number of non-miss<strong>in</strong>g observations across all banks, to thetotal number of observations that would characterise a complete data set.16 When we compare our total loan exposures to the total “exposure at default” used by the <strong>European</strong> Bank<strong>in</strong>gAuthority <strong>in</strong> its capital exercise, we obta<strong>in</strong> a mean of 93% <strong>and</strong> a st<strong>and</strong>ard deviation of 37% across all banks.8

AT002AT003BE004BE005CY006CY007DE018DE019DE020DE021DE023DE024DE025DE027DE028DE029DK008DK009DK010DK011ES059ES060ES061ES062ES064FI012FR013FR014FR016GB088GB089GB090GB091GR032GR033HU036IE037IE038IE039IT040IT041IT042IT043IT044MT046NL047NL048NL049NL050NO051PL052PT053PT055PT056SE084SE085SE086SE087SI057SI058Years6543210-1Weighted average maturity gap between assets <strong>and</strong> liabilities for large <strong>European</strong> banks <strong>in</strong> 2011Figure 1: Average maturity gap for large <strong>European</strong> banks <strong>in</strong> 2011, based on the cashflow tim<strong>in</strong>gassumptions used throughout this paper. The red l<strong>in</strong>e shows the sample mean (2.07 years) <strong>and</strong> thegreen l<strong>in</strong>es show plus/m<strong>in</strong>us one st<strong>and</strong>ard deviation (1.44 years).9

AT002AT003BE004BE005CY006CY007DE018DE019DE020DE021DE023DE024DE025DE027DE028DE029DK008DK009DK010DK011ES059ES060ES061ES062ES064FI012FR013FR014FR016GB088GB090GB091GR032GR033HU036IE037IE038IE039IT040IT041IT042IT043IT044MT046NL047NL048NL049NL050NO051PL052PT053PT054PT055PT056SE084SE085SE086SE087SI057SI058Eur billions6004002000-200-400-600Asset <strong>and</strong> liability exposures by maturity for large <strong>European</strong> banks <strong>in</strong> 2011dem<strong>and</strong> up to 3 month 3 to 12 month 1 to 5 years more than 5 yearsFigure 2: Asset <strong>and</strong> liability exposures accord<strong>in</strong>g to the annual f<strong>in</strong>ancial statements for large <strong>European</strong>banks as at December 2011. The maturity transformation activitiy from short term liabilities to longterm assets is immediately evident.10

Loan assets by bank <strong>and</strong> country of orig<strong>in</strong> <strong>in</strong> 2011Loans <strong>in</strong> EUR (billions)7505002500countryATBECYDEDKESFIFRGrHUIrITLUMTNLNOPLPTSESIUKAT001AT002AT003BE004BE005CY006CY007DE017DE018DE019DE020DE021DE022DE023DE024DE025DE026DE027DE028DK008DK009DK010DK011ES059ES060ES061ES062ES064FI012FR013FR014FR015FR016GB088GB089GB090GB091GR030GR031GR032GR033HU036IE037IE038IE039IT040IT041IT042IT043IT044LU045MT046NL047NL048NL049NL050NO051PL052PT053PT054PT055PT056SE084SE085SE086SE087SI057SI058BankFigure 3: Euro loan exposures by orig<strong>in</strong>at<strong>in</strong>g bank <strong>and</strong> country as at December 2011.maturity gap (the difference between the average maturity of assets <strong>and</strong> liabilities) is positive. Thesample mean is 2.07 years <strong>and</strong> the sample st<strong>and</strong>ard deviation is 1.44 years, as <strong>in</strong>dicated on the figure bythe horizontal red <strong>and</strong> green l<strong>in</strong>es. The representative bank <strong>in</strong> our sample is therefore ‘short’ the levelof <strong>in</strong>terest rates, mean<strong>in</strong>g that parallel upward shifts <strong>in</strong> yield curves would deteriorate the solvencyposition, while downward parallel shifts <strong>in</strong> yield curves would improve the solvency position. 17 We cansee that there is substantial variation between banks, even with<strong>in</strong> countries, <strong>and</strong> the largest weightedaverage maturity gaps appear <strong>in</strong> CY, FI, IE, MY <strong>and</strong> NL. <strong>Interest</strong>-rate sensitivity of balance sheets issimilarly heterogenous across banks <strong>in</strong> our sample.We present a summary of the bank balance sheet data <strong>in</strong> Table 3. From this table, we can see thatthe median bank tends to fund itself at short durations from customers <strong>and</strong> the <strong>in</strong>terbank market,<strong>and</strong> allocates these funds to longer-dated loans, especially to corporate <strong>and</strong> household borrowers. Themedian bank <strong>in</strong> our sample is therefore subject to the usual risk of parallel upward shifts <strong>in</strong> the yieldcurve, <strong>and</strong> to the liquidity risk associated with roll<strong>in</strong>g over short-term <strong>in</strong>terbank borrow<strong>in</strong>gs. The samestylised facts can be observed <strong>in</strong> Figure 2, where we see that banks tend to borrow <strong>in</strong> the “up to 3month” <strong>and</strong> “dem<strong>and</strong>” categories, <strong>and</strong> they tend to lend <strong>in</strong> the “1 to 5 years” <strong>and</strong> “more than 5 years”categories. In addition to parallel shifts, banks are therefore highly exposed to <strong>in</strong>creases <strong>in</strong> slope ofthe yield curve (with the average level of the curve fixed), because such <strong>in</strong>creases would tend to reducethe value of (long-dated) assets while simultaneously <strong>in</strong>creas<strong>in</strong>g the value of (short-dated) liabilities.Level, slope <strong>and</strong> curvature effects are all special cases of the variability we are able to simulate <strong>in</strong>this paper, although for consistency with the Basel Committee guidel<strong>in</strong>e method, we focus on parallelshifts <strong>in</strong> yield curves.2.3 Geography <strong>and</strong> sector data for loan assetsIn this section, we provide some summary <strong>in</strong>formation of the geographical <strong>and</strong> sectoral distributions ofthe loan asset exposures <strong>in</strong> the annual f<strong>in</strong>ancial statements of large <strong>European</strong> banks for the years 2007-2011. This <strong>in</strong>formation is directly related to the location (X) dimension of net asset transformationthat we def<strong>in</strong>e <strong>in</strong> Section 3.1 below, <strong>and</strong> which we illustrate <strong>in</strong> Section 4.1.When consider<strong>in</strong>g the geographic distribution of loan exposures, we must dist<strong>in</strong>guish betweenorig<strong>in</strong>ation <strong>and</strong> target countries. The orig<strong>in</strong>ation country is the country of domicile of the bank that17 The sensitivity of security prices to <strong>in</strong>terest rates is expla<strong>in</strong>ed for the case of loan contracts <strong>in</strong> Section 3.2.11

Table 3: Summary of the bank assets <strong>and</strong> liabilities by maturity across all banks <strong>in</strong> the sample (<strong>in</strong>millions of Euros).category subcategory maturity M<strong>in</strong>. Lower Q. Med. Upper Q. Max.liabilities <strong>in</strong>terbank up to 3 month 0 1707 8722 20282 280667liabilities <strong>in</strong>terbank 3 to 12 month 0 410 1816 5699 121359liabilities <strong>in</strong>terbank 1 to 5 years 0 540 3092 12996 49148liabilities <strong>in</strong>terbank more than 5 years 0 43 664 2860 26217liabilities customer deposits up to 3 month 0 3417 14506 55321 537284liabilities customer deposits 3 to 12 month 0 1822 5716 27616 1453598liabilities customer deposits 1 to 5 years 0 714 5556 17059 87785liabilities customer deposits more than 5 years 0 66 2086 10836 63077assets <strong>in</strong>terbank up to 3 month 0 898 4162 17467 223345assets <strong>in</strong>terbank 3 to 12 month 17 237 947 4110 204875assets <strong>in</strong>terbank 1 to 5 years 0 66 547 4546 70322assets <strong>in</strong>terbank more than 5 years 0 4 152 1729 30791assets loans corporate up to 3 month 0 991 3678 13122 55140assets loans corporate 3 to 12 month 117 1557 5192 12533 199475assets loans corporate 1 to 5 years 258 4633 15007 32487 258139assets loans corporate more than 5 years 0 5521 21343 48141 158765assets loans f<strong>in</strong>ancial <strong>in</strong>stitution up to 3 month 0 230 971 5158 34228assets loans f<strong>in</strong>ancial <strong>in</strong>stitution 3 to 12 month 22 321 1733 5023 116453assets loans f<strong>in</strong>ancial <strong>in</strong>stitution 1 to 5 years 48 625 5194 12392 150700assets loans f<strong>in</strong>ancial <strong>in</strong>stitution more than 5 years 0 947 4008 16887 62434assets loans household up to 3 month 0 342 2440 10243 85538assets loans household 3 to 12 month 0 1140 3825 11527 170050assets loans household 1 to 5 years 0 1688 10103 25336 220060assets loans household more than 5 years 0 1638 11330 46005 259236assets loans public sector up to 3 month 0 11 161 1466 19644assets loans public sector 3 to 12 month 0 29 199 1808 6653assets loans public sector 1 to 5 years 0 45 478 3893 18177assets loans public sector more than 5 years 0 5 660 3392 27372assets available for sale debt up to 3 month 0 93 1569 4191 29448assets available for sale debt 3 to 12 month 0 656 1374 4972 205487assets available for sale debt 1 to 5 years 0 1195 5848 25972 297715assets available for sale debt more than 5 years 0 631 2387 14373 79772assets available for sale equity up to 3 month 0 9 55 297 2800assets available for sale equity 3 to 12 month 0 14 64 353 3987assets available for sale equity 1 to 5 years 0 34 293 936 7950assets available for sale equity more than 5 years 0 25 177 842 7968assets held for trad<strong>in</strong>g debt up to 3 month 0 0 11 1003 10185assets held for trad<strong>in</strong>g debt 3 to 12 month 0 4 500 1397 25050assets held for trad<strong>in</strong>g debt 1 to 5 years 0 19 993 4004 25251assets held for trad<strong>in</strong>g debt more than 5 years 0 2 153 4838 37425assets held for trad<strong>in</strong>g equity up to 3 month 0 0 2 71 1826assets held for trad<strong>in</strong>g equity 3 to 12 month 0 1 13 153 1582assets held for trad<strong>in</strong>g equity 1 to 5 years 0 2 50 358 3780assets held for trad<strong>in</strong>g equity more than 5 years 0 0 13 152 739612

EUR billions0 2,000 4,000 6,000 8,000Loan asset values by target countryEUR billions0 1,000 2,000 3,000 4,000 5,000Loan asset values by sectorBa Basic <strong>and</strong>constructionBI Banks <strong>and</strong><strong>in</strong>termediationCa Capital goodsCC Consumer cyclicalEn EnergyGV GovernmentMO MortgageMT Media <strong>and</strong>telecommunicationsNC Consumernon−cyclicalOF Other f<strong>in</strong>ancialOT OtherRC Other consumerretailRE Commercial realestateTr TransportEuroareaOther<strong>European</strong>countriesNorthAmericaLat<strong>in</strong>AmericaAsiaRestofthewordBa BI Ca CC En GV MO MT NC OF OT RC RE Tr(a) Country(b) SectorFigure 4: Total allocation of loan assets by (a) country <strong>and</strong> (b) sector of loan counterparty, across allbanks <strong>in</strong> the sample <strong>in</strong> 2011.orig<strong>in</strong>ated the loan contract, <strong>and</strong> the target country is the country of domicile of the loan counterparty,which may be an <strong>in</strong>dividual or an <strong>in</strong>stitution. We summarise the loan exposures of large <strong>European</strong>banks as at December 2011 by orig<strong>in</strong>ation country <strong>in</strong> Figure 3. The heights of the bars show total loansof each bank, measured <strong>in</strong> Euros, <strong>and</strong> the colours on the plot group the banks <strong>and</strong> loans by countryof domicile. Banks <strong>in</strong> the sample are domiciled <strong>in</strong> 21 countries. We can see that the banks with thelargest loan exposures are <strong>in</strong> Spa<strong>in</strong>, France <strong>and</strong> the UK, while those <strong>in</strong> Italy <strong>and</strong> the Netherl<strong>and</strong>s arealso large. If we take a “dem<strong>and</strong>-side” view of economic growth under credit constra<strong>in</strong>ts, then theselargest banks are the most important for growth <strong>in</strong> Europe. The figure also shows that the countrywith the most banks <strong>in</strong> the sample is Germany.We also exam<strong>in</strong>e the geographic distribution of loans by country of loan counterparty <strong>in</strong> Figures4a <strong>and</strong> 5. Figure 4a shows that large <strong>European</strong> banks primarily allocate loan capital to counterparties<strong>in</strong> the Euro area <strong>and</strong> secondarily to counterparties <strong>in</strong> other <strong>European</strong> countries <strong>in</strong> 2011. In Figure 5,we see that the high-level sectoral portfolio location <strong>in</strong> 2011 is similar with<strong>in</strong> the loans extended tothese two regions. With<strong>in</strong> these two major regions, most loans are extended to households, followedclosely by non-f<strong>in</strong>ancial corporations. Loans to the public sector are the smallest allocation, whichmay be mislead<strong>in</strong>g because these banks could lend substantially to national <strong>and</strong> local governments bypurchas<strong>in</strong>g debt <strong>in</strong>struments. On a more detailed sector breakdown, Figure 4b shows that these large<strong>European</strong> banks allocate most of their loan capital to household mortgages <strong>and</strong> diversify among theother economic subsectors.2.4 Yield curve dataWe use Euro area swap curves, monthly from January 1999 to March 2013 to characterise the level<strong>and</strong> movements <strong>in</strong> yield curves. The tickers <strong>and</strong> maturities, taken from Bloomberg, are presented <strong>in</strong>Table 4. We present summary statistics for the yield curve data used <strong>in</strong> this paper <strong>in</strong> Table 5.13

Eur billionsLoan asset exposures by dest<strong>in</strong>ation region <strong>and</strong> sector for large <strong>European</strong> banks <strong>in</strong> 20113.5003.0002.5002.0001.5001.0005000Euro area Other european countries North America Lat<strong>in</strong> America Asia Rest of the worldCorporate F<strong>in</strong>ancial Institution Household Public SectorFigure 5: Total loan asset exposures <strong>in</strong> our sample of large <strong>European</strong> banks <strong>in</strong> 2011, summarised bytarget country <strong>and</strong> sector.Table 4: Yield curve tickers <strong>and</strong> maturities <strong>in</strong> years accord<strong>in</strong>g to Bloomberg. These maturities areused <strong>in</strong> Section 3.3 to model the level <strong>and</strong> changes of the yield curve.series term series term series termEONIA Index 0.00 EUSWK Curncy 0.92 EUSA11 Curncy 11.00EUR001W Index 0.02 EUSA1 Curncy 1.00 EUSA12 Curncy 12.00EUR001M Index 0.08 EUSA1F Curncy 1.50 EUSA15 Curncy 15.00EUR002M Index 0.17 EUSA2 Curncy 2.00 EUSA20 Curncy 20.00EUR003M Index 0.25 EUSA3 Curncy 3.00 EUSA25 Curncy 25.00EUR004M Index 0.33 EUSA4 Curncy 4.00 EUSA30 Curncy 30.00EUR005M Index 0.42 EUSA5 Curncy 5.00 EUSA35 Curncy 35.00EUR006M Index 0.50 EUSA6 Curncy 6.00 EUSA40 Curncy 40.00EUSWG Curncy 0.58 EUSA7 Curncy 7.00 EUSA45 Curncy 45.00EUSWH Curncy 0.67 EUSA8 Curncy 8.00 EUSA50 Curncy 50.00EUSWI Curncy 0.75 EUSA9 Curncy 9.00EUSWJ Curncy 0.83 EUSA10 Curncy 10.0014

Table 5: Summary statistics for the yield curve data, <strong>in</strong> percentage po<strong>in</strong>ts.series mean sd m<strong>in</strong> max series mean sd m<strong>in</strong> maxEONIA Index 2.47 1.44 0.08 5.16 EUSA3 Curncy 3.23 1.26 0.47 5.59EUR001M Index 2.52 1.43 0.11 5.05 EUSA30 Curncy 4.45 1.05 1.86 6.22EUR001W Index 2.45 1.44 0.08 4.89 EUSA35 Curncy 3.81 0.80 1.86 5.05EUR002M Index 2.59 1.43 0.15 5.13 EUSA4 Curncy 3.40 1.21 0.60 5.65EUR003M Index 2.67 1.40 0.19 5.28 EUSA40 Curncy 4.12 0.92 1.87 5.99EUR004M Index 2.70 1.38 0.23 5.32 EUSA45 Curncy 3.84 0.82 1.88 5.14EUR005M Index 2.74 1.36 0.28 5.36 EUSA5 Curncy 3.56 1.16 0.77 5.71EUR006M Index 2.77 1.34 0.32 5.38 EUSA50 Curncy 4.07 0.90 1.89 5.74EUSA1 Curncy 2.87 1.36 0.33 5.38 EUSA6 Curncy 3.70 1.13 0.95 5.76EUSA10 Curncy 4.09 1.04 1.56 5.95 EUSA7 Curncy 3.82 1.10 1.12 5.82EUSA11 Curncy 4.07 1.01 1.68 5.98 EUSA8 Curncy 3.92 1.08 1.29 5.86EUSA12 Curncy 4.22 1.01 1.79 6.06 EUSA9 Curncy 4.01 1.06 1.43 5.89EUSA15 Curncy 4.35 1.00 1.91 6.16 EUSWG Curncy 2.72 1.53 0.32 5.35EUSA1F Curncy 2.92 1.34 0.35 5.43 EUSWH Curncy 2.73 1.52 0.32 5.30EUSA2 Curncy 3.04 1.31 0.38 5.52 EUSWI Curncy 2.74 1.49 0.32 5.31EUSA20 Curncy 4.46 1.01 1.92 6.22 EUSWJ Curncy 2.74 1.52 0.32 5.33EUSA25 Curncy 4.43 1.03 1.90 6.22 EUSWK Curncy 2.75 1.52 0.32 5.343 Method3.1 A theory of maturity transformation <strong>and</strong> its relation to <strong>in</strong>terest rateriskConsider a f<strong>in</strong>ancial <strong>in</strong>stitution that enters <strong>in</strong>to contractual arrangements with other parties. Thesecontractual agreements b<strong>in</strong>d the <strong>in</strong>stitution <strong>in</strong>to mak<strong>in</strong>g <strong>and</strong> receiv<strong>in</strong>g payments many years <strong>in</strong>tothe future. Let us imag<strong>in</strong>e that there are f<strong>in</strong>itely many characteristics of these future cashflowsthat are relevant for determ<strong>in</strong><strong>in</strong>g the price today of transferr<strong>in</strong>g these rights <strong>and</strong> obligations toother <strong>in</strong>stitutions. We could call this set of characteristics Ω, <strong>and</strong> we could write Ω = X × T forsome f<strong>in</strong>ite sets X <strong>and</strong> T with T ⊂ R + to record the fact that among these characteristics will bethe contractual maturity or repric<strong>in</strong>g date of each cashflow (T ). The f<strong>in</strong>ancial <strong>in</strong>stitution is thereforedef<strong>in</strong>ed by its asset <strong>and</strong> liability cashflow streams { }{ }A x,t ∈ R : (x, t) ∈ X × T ⊂ R N × R + <strong>and</strong>Lx,t ∈ R : (x, t) ∈ X × T ⊂ R N × R + respectively, where x ∈ X ⊂ R N is an <strong>in</strong>dex<strong>in</strong>g set 18 <strong>and</strong>t ∈ T ⊂ R + is time <strong>in</strong>to the future. 19 We can def<strong>in</strong>e the net asset stream or equity stream us<strong>in</strong>g afunctional application of the account<strong>in</strong>g identity E {E x,t A x,t − L x,t : (x, t) ∈ X × T }. The equitystream can be thought of as the future profit or future net cashflow <strong>in</strong> the firm emerg<strong>in</strong>g over time <strong>in</strong>every tradable claim x ∈ X.We can say that an <strong>in</strong>stitution engages <strong>in</strong> net asset transformation if ∃(x, t), (x ′ , t ′ ) ∈ X × T suchthat E x,t ≠ E x ′ ,t′, or <strong>in</strong> words, if there are differences <strong>in</strong> its borrow<strong>in</strong>g <strong>and</strong> lend<strong>in</strong>g across characteristics<strong>in</strong> X × T . We give a graphical representation of transformation <strong>in</strong> Figure 6 , where an <strong>in</strong>termediaryis a net borrower of some tradable claims <strong>and</strong> a net lender of others. <strong>Maturity</strong> transformation is thena special case of net asset transformation <strong>and</strong> could be def<strong>in</strong>ed local to some x ∈ X or globally <strong>in</strong> allx ∈ X . An <strong>in</strong>termediary engages <strong>in</strong> local maturity transformation at x ∈ X if ∃t, t ′ ∈ T such thatE x,t ≠ E x,t ′, which says that the <strong>in</strong>termediary transforms assets of type x ∈ X from various maturities<strong>in</strong>to other maturities, while an <strong>in</strong>termediary engages <strong>in</strong> global maturity transformation if ∃t, t ′ ∈ Tsuch that ∑ x E x,t ≠ ∑ x E x,t ′. We can further talk of positive or negative maturity transformation,18 The <strong>in</strong>dex x ∈ X could be thought of as measurable time-<strong>in</strong>variant classifications of assets <strong>and</strong> liabilities relevant tothe price of a contract. Formally, X = Ω\T . Examples are sector, geographic, <strong>and</strong> rat<strong>in</strong>gs-based classifications of assets<strong>and</strong> liabilities. In the context of assess<strong>in</strong>g the revaluation effect of changes <strong>in</strong> asset prices or <strong>in</strong>terest rates, we assumethat we have a complete market so that we can treat every element x ∈ X as a tradable claim with a measurable price.We will require that X be f<strong>in</strong>ite, or <strong>in</strong> other words |X| < ∞. The <strong>in</strong>dex<strong>in</strong>g set X is relevant for group<strong>in</strong>g assets <strong>and</strong>liabilities that are traded together, have similar prices (which may or may not be related to others through substitutioneffects) <strong>and</strong> whose risk characteristics are therefore similar.19 We will require |T | < ∞, which does not <strong>in</strong> pr<strong>in</strong>ciple preclude the <strong>in</strong>stitution from hold<strong>in</strong>g non-matur<strong>in</strong>g assets likestocks.15

tA tt5++t t tt4−+L tt3+t t tt2−−−+t1−−+E tnegative none positivet t tx1 x2 x3 x4x5xFigure 6: A graphical representation of (net) Figure 7: Examples of positive <strong>and</strong> negativeasset transformation by a f<strong>in</strong>ancial <strong>in</strong>termediary.The <strong>in</strong>termediary is a net borrower at mediary. The top, middle <strong>and</strong> bottom rowsmaturity transformation for a f<strong>in</strong>ancial <strong>in</strong>ter-some contractual maturities (t1 1 , t 2 , t 4 ) <strong>and</strong> <strong>in</strong> give the values of assets, liabilities <strong>and</strong> net assetsby maturity.some markets (x 1 , x 2 , x 4 ) while be<strong>in</strong>g a netlender at other maturities <strong>and</strong> <strong>in</strong> other markets.where positive maturity transformation refers to assets that are ‘on average’ longer <strong>in</strong> maturity thanliabilities. We don’t def<strong>in</strong>e these notions explicitly, but provide some examples of positive <strong>and</strong> negativematurity transformation <strong>in</strong> Figure 7. From balance sheet data, we typically f<strong>in</strong>d that banks engage<strong>in</strong> positive maturity transformation, while <strong>in</strong>surers engage <strong>in</strong> negative maturity transformation. Asa complement to maturity transformation, if we use the term sector to refer to the more abstract Xdimension of future contracts, we can similarly def<strong>in</strong>e local <strong>and</strong> global (<strong>in</strong> t ∈ T ) sector transformation.In an economy where all claims <strong>in</strong>dexed by (x, t) ∈ X × T ⊂ R N × R + are traded <strong>in</strong> perfectlycompetitive markets populated by agents with weakly monotonic preferences, we have a unique pric<strong>in</strong>gkernel for tradable claims <strong>and</strong> hence a discount factor B : R N × R + → R + satisfy<strong>in</strong>g ∂B∂t≤ 0 for allt ∈ R + . In this case, the value of assets at time zero, which is the price that another <strong>in</strong>stitution wouldhave to pay to obta<strong>in</strong> these future cash <strong>in</strong>flows, is given by∑B(x, t)A x,t ,x,t1with the values of liabilities <strong>and</strong> equity at time zero similarly def<strong>in</strong>ed. The solvency position of thef<strong>in</strong>ancial <strong>in</strong>stitution is given by ∑ x,t B(x, t)E x,t, <strong>and</strong> the f<strong>in</strong>ancial <strong>in</strong>stitution is said to be solvent attime zero on a market-consistent basis if <strong>and</strong> only if∑B(x, t)E x,t > 0.x,tNote that the def<strong>in</strong>ition of A t is sufficiently general that it could depend on the pric<strong>in</strong>g function B,which would arise, for example, if the firm purchased a float<strong>in</strong>g-rate note, payments on which dependedon realised <strong>in</strong>terest rates. The value of equity is then the value of assets less the value of liabilities. Inthe case where we can express the pric<strong>in</strong>g function as B(x, t) = exp [ t−´ 0 r(x, s)ds] for some <strong>in</strong>tegrablefunction r : R N × R + → R <strong>and</strong> for all x, we can <strong>in</strong>terpret r { }r(x, t) : (x, t) ∈ R N × R + as the setof yield curves implied by the discount function B.For the balance sheet items that are valued on a market-consistent basis, the f<strong>in</strong>ancial <strong>in</strong>stitutionreports their value at the valuation date, E x,t B x,t . If the per-unit pric<strong>in</strong>g function B were to move16

to some B ′ , <strong>and</strong> if the quantity function E x,t were to rema<strong>in</strong> constant, then the market-consistentvaluation of the balance sheet item would become E x,t B ′ x,t, imply<strong>in</strong>g a percentage change ofE x,t B ′ x,t − E x,t B x,tE x,t B x,t= B′ x,tB x,t− 1 ≈ log B′ x,tB x,t. (1)By assum<strong>in</strong>g a distribution for B ′ , either through assum<strong>in</strong>g a distribution for the set of yield curvesr when this exists, or through assum<strong>in</strong>g a distribution for the pric<strong>in</strong>g function B ′ directly, we havea distribution for this percentage change <strong>in</strong> (1) above. The <strong>in</strong>terest rate risk or asset price risk thenarises from the revaluation effect of unanticipated changes <strong>in</strong> <strong>in</strong>terest rates or per-unit asset prices,<strong>and</strong> the <strong>in</strong>termediary’s exposure to such risk depends on the allocation of the <strong>in</strong>termediary’s net assetsacross all (x, t) claims.3.2 <strong>Interest</strong> rate risk of loan securities <strong>and</strong> portfoliosAs we see <strong>in</strong> Section 4.1, the most important component of the bank balance sheet for assess<strong>in</strong>g <strong>in</strong>terestrate revaluation risk, 20 ignor<strong>in</strong>g off-balance sheet <strong>in</strong>struments, are the loan assets, because of their longmaturity. In assess<strong>in</strong>g <strong>in</strong>terest rate revaluation risk of banks, we therefore focus on the <strong>in</strong>terest raterisk of these loan assets. Assess<strong>in</strong>g the <strong>in</strong>terest rate revaluation risk of the whole balance sheet <strong>in</strong> thespirit of the EVM for <strong>European</strong> banks would be a useful exercise, but it is beyond the scope of thispaper.In our study of these loan assets, we assume that all loan assets are fixed-rate amortis<strong>in</strong>g loans.Variable-rate loan contracts exist <strong>and</strong> are less price sensitive to <strong>in</strong>terest rate changes. However, s<strong>in</strong>ceour loan exposures by maturity are categorised by time to “next repric<strong>in</strong>g date”, rather than by timeto contractual maturity, variable-rate contracts behave like fixed-rate contracts matur<strong>in</strong>g on thir nextrepric<strong>in</strong>g date. However, to the extent that these loan exposures by maturity <strong>in</strong> fact <strong>in</strong>clude heterogenouscontract types, 21 the pric<strong>in</strong>g <strong>and</strong> risk methods associated with fixed-rate amortis<strong>in</strong>g loans maynot be appropriate.In Section 1.1 above we discuss the Basel Committee guidel<strong>in</strong>es for assess<strong>in</strong>g <strong>in</strong>terest rate revaluationrisk. In this section, we offer simple alternative methods for assess<strong>in</strong>g <strong>in</strong>terest rate revaluation riskbased on methods for pric<strong>in</strong>g such amortis<strong>in</strong>g loan contracts. The pric<strong>in</strong>g functions we propose here arewell known present value functions. 22 The simplest such pric<strong>in</strong>g function is the formula for the presentvalue of a fixed-term annuity of 1 per year for τ years, at constant annual cont<strong>in</strong>uously-compounded<strong>in</strong>terest δ:p(δ, τ) 1 − e−δτ.δThis formula corresponds to a present value under a flat yield curve, with level δ at every maturity.We can generalise this formula to the case where yield curves are not flat. If we let {f(m)} be theforward curve, 23 the present value of the same fixed-term annuity isp({f(m)}, τ) ˆ τ0exp(−ˆ u0f(m)dm)du.Us<strong>in</strong>g p(δ, τ) <strong>and</strong> p({f(m)}, τ), we have pric<strong>in</strong>g functions for <strong>in</strong>dividual loan contracts. However, if wewould like to compare banks, we need to be able to price portfolios of loan contracts too, so that wecan compute <strong>in</strong>terest rate sensitivities. The price of a portfolio def<strong>in</strong>ed by a (possibly countable) setof shares {φ i }, where perhaps ∑ i φ i = 1, is 2420 The revaluation or repric<strong>in</strong>g risk that we use <strong>in</strong>terchangeably throughout this paper simply means the percentagechange <strong>in</strong> value of a contract or portfolio of contracts given a change <strong>in</strong> <strong>in</strong>terest rates or yield curves.21 Heterogeneity <strong>in</strong> loan contracts <strong>in</strong> the form of collateral or embedded options, for example for default <strong>and</strong> prepaymentrespectively, would be key sources of pric<strong>in</strong>g heterogeneity <strong>and</strong> hence heterogeneity <strong>in</strong> <strong>in</strong>terest rate risk. Prepaymentrisk is def<strong>in</strong>ed <strong>in</strong> Footnote 11.22 More sophisticated pric<strong>in</strong>g functions like those us<strong>in</strong>g risk-neutral valuation would be an <strong>in</strong>terest<strong>in</strong>g extension to thispaper.23 For explanations of the terms forward curve <strong>and</strong> zero curve, see Section 3.3 <strong>and</strong> Svensson (1994).24 In the case where f(m) = δ ∀m, we havep({φ i }, δ, {τ i }) = ∑ iφ i p(δ, τ i ).17

p({φ i }, {f(m)}, {τ i }) ∑ iφ i p({f(m)}, τ i ).For the purposes of calculat<strong>in</strong>g sensitivity to <strong>in</strong>terest rate revaluation, we do not require that {φ i } benormalised to sum to one. In particular, we could use Euro-denom<strong>in</strong>ated exposures <strong>in</strong> place of {φ i },because the normalisation constant cancels out <strong>in</strong> the sensitivity measures below.We seek to measure the percentage change <strong>in</strong> value of a loan, or portfolio of loans, given a change<strong>in</strong> <strong>in</strong>terest rates or yield curves. We could consider us<strong>in</strong>g an analytic derivative 25 to compute thissensitivity, which also motivates the Basel Committee guidel<strong>in</strong>e discussed <strong>in</strong> 1.1 above. However, sucha derivative would only be valid, <strong>and</strong> an accurate approximation, for <strong>in</strong>f<strong>in</strong>itesimally small changes <strong>in</strong>yield curves. If, as per the Basel Committee guidel<strong>in</strong>es, we were to seek the effect of a 200 basis po<strong>in</strong>t<strong>in</strong>terest rate shock, which is fairly large, then we would not expect the derivative to provide a goodapproximation. A more exact approach would be to compute the present value under two <strong>in</strong>terest ratescenarios – one before, <strong>and</strong> one after the shock. This exact approach would capture the non-l<strong>in</strong>earities<strong>in</strong> exposure. For example, <strong>in</strong>creases <strong>and</strong> decreases <strong>in</strong> <strong>in</strong>terest rates of equal magnitude would not beexpected to produce equal decreases <strong>and</strong> <strong>in</strong>creases <strong>in</strong> present values, respectively. If we assume a flatforward curve, the change <strong>in</strong> present value takes the formlog p(δ 1 , τ) − log p(δ 0 , τ),where δ 0 is the constant annual cont<strong>in</strong>uously compounded <strong>in</strong>terest rate before the shock, <strong>and</strong> δ 1 is thesame rate after the shock. This expression can be <strong>in</strong>terpreted as a percentage change <strong>in</strong> the presentvalue of a loan contract <strong>and</strong> is directly analogous to (1) above. If we assume an arbitrary shape to theforward curve, the change <strong>in</strong> present value takes the formlog p({f(m)} 1 , τ) − log p({f(m)} 0 , τ),<strong>and</strong> if we consider a portfolio of loan contracts, the change <strong>in</strong> present value takes the formlog p({φ i }, {f(m)} 1 , {τ i }) − log p({φ i }, {f(m)} 0 , {τ i }),where the weights {φ i } are assumed <strong>in</strong>variant to the <strong>in</strong>terest rate change, <strong>and</strong> where the normalisationconstant for {φ i } cancels.3.3 Characteris<strong>in</strong>g <strong>in</strong>terest rate movementsWe can characterise the shape of the yield curve at any po<strong>in</strong>t <strong>in</strong> time by the forward curve or thezero curve. The zero rate at any given maturity is the yield to maturity one could obta<strong>in</strong> on a zerocouponbond of that maturity, <strong>and</strong> the zero curve is the collection of such zero rates at all maturities.The zero-coupon bond underly<strong>in</strong>g a zero rate may be hypothetical, for example a Treasury securityor corporate obligation that does not exist <strong>in</strong> the market at that particular maturity. Zero curvesare <strong>in</strong>ferred from the yields to maturity on a set of coupon-pay<strong>in</strong>g bonds, the prices of which can beobserved <strong>in</strong> the market, through a process known as bootstrapp<strong>in</strong>g. 26The forward curve at any maturity is def<strong>in</strong>ed as the <strong>in</strong>crease <strong>in</strong> yield to maturity one could obta<strong>in</strong>today by marg<strong>in</strong>ally extend<strong>in</strong>g one’s hold<strong>in</strong>g period from that maturity. If the zero curve is def<strong>in</strong>ed by{z(m)}, then the forward curve is def<strong>in</strong>ed by {f(m)|f(m) lim h→0 + ((m + h)z(m + h) − mz(m)) /h =d (mz(m)) /dm ∀m}, <strong>and</strong> similarly, the zero curve can be obta<strong>in</strong>ed from the forward curve po<strong>in</strong>twiseby z(m) = ´ m0 f(u)du/m.In this paper, our yield curves are given by the Euro area <strong>in</strong>terbank <strong>and</strong> swap rates discussed<strong>in</strong> Section 2.4. At every month-end, we therefore have 34 po<strong>in</strong>ts that characterise the shape of the25 Note that we would need a directional derivative <strong>in</strong> the case of a general forward curve. In this paper, we onlyconsider directional derivatives <strong>in</strong> the direction of a constant function, or <strong>in</strong> other words, we only consider parallel shifts<strong>in</strong> the yield curve for consistency with the Basel Committee guidel<strong>in</strong>e method for <strong>in</strong>terest rate sensitivity assessment. InSection 4.3 we show that parallel shifts are not plausible from historical data on Euro yield curves.26 The process of bootstrapp<strong>in</strong>g <strong>in</strong>volves transformation <strong>and</strong> <strong>in</strong>terpolation. For a discussion, see Svensson (1994).18