1998 Annual Report - Kinross Gold

1998 Annual Report - Kinross Gold

1998 Annual Report - Kinross Gold

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

KINROSSGOLD CORPORATION<strong>1998</strong> ANNUAL REPORT

CONTENTSCORPORATE PROFILE1 Highlights4 Message to ShareholdersOperations12 Operations Review16 Fort Knox19 Hoyle Pond24 Kubaka27 Refugio28 Macassa29 Denton-Rawhide30 Blanket31 Residual Properties34 Exploration and Development37 Community Commitment38 EnvironmentFinancial Information42 Management’s Discussion and Analysis51 Auditor’s <strong>Report</strong>52 Consolidated Financial Statements56 Notes to the Consolidated FinancialStatements76 Supplemental Information77 Corporate DataON JUNE 1, <strong>1998</strong> KINROSS GOLD CORPORATIONMERGED WITH AMAX GOLD INC. MAKING THE “NEW”KINROSS THE FIFTH LARGEST NORTH AMERICANGOLD PRODUCER. THIS MERGER HAS RESULTED ININCREASING THE COMPANY’S RESERVES ANDPRODUCTION DRAMATICALLY, WHILE LOWERING CASHCOSTS. SINCE THE COMPANY’S FORMATION IN 1993,KINROSS HAS QUICKLY BECOME AN INTERNATIONALGOLD MINING COMPANY, WELL POSITIONED AS AMAJOR PLAYER ON THE GLOBAL SCENE.Cover:The image of the golden retriever has appeared on every cover of the <strong>Kinross</strong> annual report since 1994 with the exception of 1997.Last year we felt that using such a light image would not be appropriate in such a dark period in the gold industry.This year’s cover is designed to indicate that maybe... just maybe... there is light at the end of the tunnel.Note:All dollar amounts contained in this report are expressed in U.S. dollars unless otherwise specified.Cautionary Statement:This document includes certain “forward-looking statements” within the meaning of section 21E of the United States Securities Exchange Actof 1934, as amended. All statements, other than statements of historical fact, included herein, including without limitation, statements regardingpotential mineralization and reserves, exploration results and future plans and objectives of <strong>Kinross</strong> <strong>Gold</strong> Corporation (“<strong>Kinross</strong>”), are forwardlookingstatements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, andactual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual resultsto differ materially from <strong>Kinross</strong>’ expectations are disclosed under the heading “Risk Factors” and elsewhere in <strong>Kinross</strong>’ documents filed fromtime to time with the Toronto Stock Exchange, the United States Securities and Exchange Commission and other regulatory authorities.

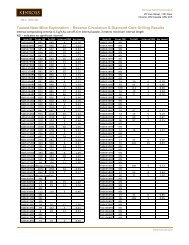

H I G H L I G H T SORE RESERVES AND RESOURCES<strong>Kinross</strong> <strong>Gold</strong> Corporation’s Share at December 31, <strong>1998</strong> (1)Grade Contained ContainedOperating and <strong>Kinross</strong> ORE <strong>Gold</strong> Silver <strong>Gold</strong> Silver <strong>Gold</strong> SilverDeveloping Mines Share (%) (tonnes) (g/t) (g/t) (kg) (kg) (ozs) (ozs)PROVEN AND PROBABLE RESERVESBased on $325/oz. <strong>Gold</strong> (Including stockpiles - Inplace, Mineable and Diluted)Canadian Operations:Hoyle Pond 100.0% 1,413,000 10.72 - 15,148 - 487,000 -Macassa 100.0% 877,000 12.38 - 10,855 - 349,000 -U.S. Operations:Fort Knox 100.0% 142,092,000 0.82 - 116,484 - 3,745,000 -Denton-Rawhide 49.0% 19,991,000 0.70 11.37 14,028 227,370 451,000 7,310,000Outside U.S. and Canada:Kubaka - Russia 53.0% 1,667,000 16.08 21.76 26,812 36,267 862,000 1,166,000Refugio - Chile 50.0% 38,286,000 0.90 - 34,339 - 1,104,000 -Blanket - Zimbabwe 100.0% 2,870,000 2.36 - 6,781 - 218,000 -Development Projects:Hoyle 2000 - Canada 100.0% 145,000 7.30 - 1,058 - 34,000 -Aginskoe - Russia 25.0% 230,000 29.62 13.12 6,812 3,017 219,000 97,000Total Proven +Probable Reserves 207,571,000 1.12 1.28 232,317 266,654 7,469,000 8,573,000POSSIBLE RESERVESCanadian Operations:Hoyle Pond 100.0% 1,741,000 7.74 - 13,468 - 433,000 -Macassa 100.0% 65,000 24.88 - 1,617 - 52,000 -U.S. Operations:Fort Knox 100.0% 11,487,000 0.75 - 8,616 - 277,000 -Denton-Rawhide 49.0% - 0.00 - - - - -Outside U.S. and Canada:Kubaka - Russia 53.0% - 0.00 - - - - -Refugio - Chile 50.0% 3,029,000 0.98 - 2,955 - 95,000Blanket - Zimbabwe 100.0% - 0.00 - - - - -Development Projects:Hoyle 2000 - Canada 100.0% - - - - - - -Aginskoe - Russia 25.0% 172,000 19.71 11.58 3,390 1,991 109,000 64,000Total Possible Reserves 16,494,000 1.82 0.12 30,046 1,991 966,000 64,000RESOURCES (Measured, Indicated and Inferred Resources Excluding Proven, Probable and Possible Reserves)Canadian Properties:Hoyle Pond 100.0% 2,736,000 7.18 - 19,658 - 632,000 -Macassa 100.0% 3,588,000 9.92 - 35,583 - 1,144,000 -Q.R. 100.0% 802,000 5.12 - 4,106 - 132,000 -U.S. Properties:Fort Knox 100.0% 49,405,000 0.77 - 37,822 - 1,216,000Denton-Rawhide 49.0% 2,362,000 0.88 10.61 2,084 25,070 67,000 806,000Candelaria 100.0% 9,777,000 0.15 144.44 1,493 1,412,215 48,000 45,403,000DeLamar 100.0% 9,266,000 1.25 32.05 11,571 296,950 372,000 9,547,000Haile 100.0% 7,925,000 3.06 - 24,261 - 780,000 -Outside U.S. and Canada:Kubaka - Russia 53.0% 1,895,000 6.66 157.83 12,628 299,096 406,000 9,616,000Refugio - Chile 50.0% 118,152,000 0.82 - 96,547 - 3,104,000 -Blanket - Zimbabwe 100.0% 2,612,000 5.70 - 14,899 - 479,000 -Angostura - Colombia 20.6% 30,125,000 1.17 4.73 35,179 142,425 1,131,000 4,579,000Development Projects:Hoyle 2000 - Canada 100.0% 11,552,000 4.45 - 51,415 - 1,653,000 -<strong>Gold</strong>banks - U.S. 100.0% 166,191,000 0.48 1.40 80,093 232,285 2,575,000 7,468,000Pentland Firth - Canada 46.4% 41,058,000 1.03 - 42,208 - 1,357,000 -Mirage - El Salvador 50.7% 2,112,000 6.73 49.20 14,215 103,918 457,000 3,341,000Mt. Henry - Australia 100.0% 10,832,000 1.25 - 13,499 - 434,000 -Selene - Australia 100.0% 14,138,000 1.18 - 16,641 - 535,000 -Total Resources 484,528,000 1.06 5.18 513,902 2,511,959 16,522,000 80,760,000(1) Reserves and Resources reflect <strong>Kinross</strong>' ownership but do not reflect the merger with La Teko Resources Ltd.which became effective February 26, 1999.1

H I G H L I G H T S<strong>Gold</strong> Equivalent Production(000’s of ounces)1,2001,1001,000900800700600500400300200384225245CASH MARGIN PER OUNCEOF PRODUCTION388 388254342258525344268499309874214400300200100Total Cash Costs & Realized <strong>Gold</strong> Prices(U.S.$ / ounces)50403020100CASH FLOW PROVIDEDFROM OPERATIONS(millions $)5040302010010001994 1995 1996 1997 <strong>1998</strong>01996 1997 <strong>1998</strong><strong>Gold</strong> Equivalent ProductionRealized <strong>Gold</strong> PricesTotal Cash Costs<strong>1998</strong> GOLD AND SILVER PRODUCTION<strong>Kinross</strong> <strong>Gold</strong> Corporation’s Share at December 31, <strong>1998</strong>Company’s Share <strong>Gold</strong> Production Silver Productionof Production (%) (kg) (oz.) (kg) (oz.)Primary Operations:Hoyle Pond 100% 4,944 158,953 - -Macassa 100% 2,427 78,034 - -Fort Knox* 100% 6,314 203,010 - -Kubaka* 50% 4,801 154,350 - -Denton-Rawhide 49% 1,898 61,015 13,219 425,000Refugio* 50% 1,320 42,446 - -Blanket 100% 1,097 35,266 - -22,801 733,074 13,219 425,000Residual Properties 2,819 90,647 70,667 2,272,000Total 25,620 823,721 83,886 2,697,000* For the seven month period of <strong>Kinross</strong>’ ownershipSTOCK PRICE(Canadian dollars as quoted on the Toronto Stock Exchange)CDN.$141210864214$CDN.12108642J J A S O N D J F MA M J J A S O N D J F M AM J J A S O N D J F M AM J J A S O N D J F M AM J J A S O N D J F M AM J J A S O N D1993 1994 199519961997<strong>1998</strong>2

H I G H L I G H T SPROPERTY LOCATION MAPRyan Lode & True NorthFort KnoxKubaka (53%)Pentland (46%)DeLamarHayden HillDenton-Rawhide (49%)<strong>Gold</strong>banksHoyle PondMacassaAginskoe (25%)CandelariaEl Dorado, Mirage (51%)Greystar (21%)BlanketGuanaco (90%)Refugio (50%)Mt. Henry & SelenePrimary OperationsResidual PropertiesAdvanced Exploration/Development Projects3

M E S S A G E T OS H A R E H O L D E R SFor <strong>Kinross</strong> shareholders, the most significant event of <strong>1998</strong> was clearly the company’ssuccessful merger with U.S. based Amax <strong>Gold</strong> Inc. Announced in February and completed inJune, the merger propelled <strong>Kinross</strong> into the million ounce per year level, adding 700,000ounces of gold production annually. Our company is now the fifth largest gold producer inNorth America and possibly the fastest growing company in the industry.Critics may scoff that bigger is not always better. But, in today’s gold market, I think they’re just plain wrong. I believethat, when gold prices are low and profit margins reduced, most investors cut back their exposure to gold stocks. As aresult, they generally single out for investment only large companies whose stock is easy to get in and out of. Stock inthose companies will inevitably tend to trade at prices that, on a comparative basis, are far higher than for their smallercompetitors. Those higher prices are good for shareholders. They also increase a company’s flexibility for acquisitionand financing opportunities. So, they are clearly desirable. Producers wanting to achieve this elevated level of pricingneed either a major new discovery or bigger size, financial strength and momentum to move up the scale. And that wasour thinking behind the merger with Amax.The strategy was right. The merger gave us size and that attracted the attention of the U.S. investment and brokeragecommunities. It gave us financial strength by reducing our overall cash–operating costs to $200 per ounce of goldequivalent, supporting the increasing view that we’re far more than just survivors. And it gave us momentum. Thatmomentum continues with the acquisition of Alaskan-focussed La Teko Resources Ltd. and increased ownership of theKubaka mine in Russia. We are the new kid on the block.The merger also helped eliminate concern about a perceived weakness in the company. The old <strong>Kinross</strong> had grownrapidly in five years. <strong>Annual</strong>ized gold equivalent production of 25,000 ounces per year in June, 1993, climbeddramatically to more than 500,000 ounces in 1996. However, we really only had one world class asset in the company– Hoyle Pond. Now, Hoyle Pond has never disappointed and it is expected to produce for decades to come. But the natureof its orebody makes reserve determination difficult and costly. It begs comparison with the Dome mine also located inTimmins, Ontario. Dome has run the majority of its 88-year life so far with just four years of reserves. Hoyle Pond, too,has a low level of reserve ounces, but a good level of resource ounces. Many Canadian analysts and institutions have ahigh comfort level with this type of orebody, because it’s proven itself. But the asset is not yet as well accepted in otherparts of the world, particularly the U.S., where this type of deposit is not as well known. As a result, having Hoyle Pondas our only world class asset caused some concern.4

M E S S A G E T O S H A R E H O L D E R SThat concern has been eliminated by the merger with Amax <strong>Gold</strong>. <strong>Kinross</strong> now boasts three world class assets – the FortKnox mine in Alaska, the Kubaka mine in Russia and the Hoyle Pond mine in Timmins. Proof is in the pudding. Themerger has resulted in a 128% increase in reserve ounces of gold.Before I outline where our sights are set for <strong>Kinross</strong>’ future, I want to note that the merger was also successful on anotherfront – personnel. I am pleased to tell you that with few problems, the merger was completed without acrimony and thenew <strong>Kinross</strong> is operating as one entity.And so to the future. We will work to maximize the value of all the company’s assets, but in particular the three keyoperations at Fort Knox, Kubaka and Hoyle Pond. Currently these three mines produce at about a 750,000 ounce peryear rate to <strong>Kinross</strong>’ interest, or about 70% of our total annual production.However, given the low total cash costs at these operations of about $180 perounce, they contribute over 80% of cash flow.Our first focus is F O R T K N O X . That operation is the most efficientand has the quickest and lowest cost production growth potential. Thisopportunity results from the acquisition of La Teko Resources with its twomajor deposits within easy trucking distance of our mill.Currently we have begun the process of permitting the Ryan Lode deposit,Proof is in the pudding.The merger has resultedin a 128% increase inreserve ounces of gold.which has about 800,000 ounces of gold resources. We hope to produce about 75,000 ounces per year from this property,starting late next year. Given that this will displace some lower grade production in the mill from the existing pit, thenet increase will probably be closer to 50,000 ounces per year.Development of the True North deposit with about 1.3 million ounces of gold resources, will require reaching agreementwith our joint venture partner to proceed with permitting. Our objective is to process the True North deposit in the FortKnox mill at a rate of about 175,000 ounces per year starting in 2001. Taking into account the displacement of lowergrade ore from the mill, this scenario would increase the gold production of the Fort Knox mill by over 100,000 ouncesper year.The net result should be that the Fort Knox plant will produce about 500,000 ounces per year, at total cash costs of about$180 – $185 per ounce in 2001. Capital cost for this level of production is estimated at less than $35 million.As well, longer term, we are advancing the Gil deposit (433,000 ounces of gold resources and growing) and expect othergood prospect areas to generate further reserves to allow this level of production to continue for many years to come.So far as I’m concerned, Fort Knox is looked after, its future assured.5

M E S S A G E T O S H A R E H O L D E R SOn to K U B A K A. The Kubaka mine in the Russian Far East is a high grade, open-pit operation. While the technicalcapability of the mine has never been a concern to investors, the political climate has been. When Russia’s financialcrisis shocked world markets in the late summer, the effects on <strong>Kinross</strong> were twofold.First, the government – through its state agency Gokhran – no longer had the money to purchase Kubaka’s output. Asa result, the company requested under its contract to export the gold. Quite a request! To the best of our knowledge, nocommercial organization had ever before exported gold from Russia, unless all the money made was returned to thecountry. As a result, we were trying to break new ground, a very time-consuming and stressful endeavour. It took almosttwo months to get a real answer, during which time the mine inventory rose to over 150,000 ounces of gold. While thefirst few of <strong>Kinross</strong>’ historic shipments were quite complicated, now that the company and exporting agencies haveagreed on a process, it has become routine. To date, we have exported over 275,000 ounces of gold.The second way in which <strong>Kinross</strong> was affected by the Russian financial crisis was investor concern about the company’sRussian holdings. Concern about Russia’s future generally, combined with inaccurate reporting of the Russiangovernment’s intentions regarding the domestic gold industry, caused fears about the future of Kubaka and <strong>Kinross</strong>’ rolein this mine. Although our successful export of gold has allayed those fears, IThe Kubaka mine inthe Russian Far East isa high grade, open-pitoperation.want to reassure our shareholders that the level of co-operation that we havehad from both the federal and state levels of government has been excellent.The federal government and the central bank have been responsive to ourneeds. And, at the state level, the government is attempting to have Magadandeclared an economic zone which would result in lowering import duties onus. The establishment of a gold refinery in the province, combined with ourability to export bullion, has the potential to increase our flexibility inmanaging production revenues.At the mine itself, <strong>Kinross</strong> has put in place numerous initiatives to reduce costs and improve productivity. These includechanging from helicopter to fixed-wing aircraft, changing crew rotations, reconfiguring procurement methods andimplementing a productivity bonus strategy. While our Russian workers, like any workers, were initially skeptical andreluctant to accept our proposed changes, a trust has gradually grown between <strong>Kinross</strong> management and the workforce.In fact, more than just embracing the initiative, workers have now become proactive in the changes and improvements.In 1999, we expect to see the impact of these changes in higher productivity and reduced costs per tonne.As an aside, through the financial turmoil in the late summer and early fall of <strong>1998</strong>, when the Russian banks in Magadanwere not permitted to allow depositors access to their accounts, <strong>Kinross</strong> found the Rubles necessary to pay our workforcein cash. While it was not easy, I am very proud of the efforts to secure the funds and to maintain the trust our workforcehas in the company. More recently, the company has been actively involved in arranging food and fuel shipments forcertain remote villages that are woefully short of both. The company will monitor the effect of the current crisis on itsconstituents and act appropriately.6

M E S S A G E T O S H A R E H O L D E R SWhen the company merged with Amax <strong>Gold</strong>, <strong>Kinross</strong> not only became operator of the Kubaka mine, but also became a50% shareholder in Omolon Mining, the organization that holds the Kubaka license directly. Late in <strong>1998</strong>, at the requestof Geometal Plus, an Omolon shareholder, we made a payment on that company’s equity loan relating to its originalinvestment in Kubaka. While this loan is fully secured by the cash flows from the mine, we also received a 3% equitybonus for supplying the financial support to Geometal Plus. As a result, at the end of <strong>1998</strong>, we reported a 53% ownershipof Omolon Mining and thus the Kubaka mine. Subsequent to the end of the year, the company has agreed to purchasea further 1.7% in the mine from the bankruptcy trustee of another of Omolon’s shareholders.<strong>Kinross</strong> is delighted to increase its ownership in Kubaka to 54.7%. It is both an excellent use of capital and a clearindication of our commitment to Kubaka, the largest gold mine in Russia, and to the Russian Far East in general.On to H O Y L E P O N D. It is a reflection of the size, diversity and strength of <strong>Kinross</strong> today that Hoyle Pond isnot discussed until now. The third largest mine that the company owns, Hoyle Pond remains an extremely importantasset of which we are justly proud. In <strong>1998</strong>, the mine completed its move to shaft hoisting from ramp haulage, atransition that began with the sinking of a shaft in November 1995. Since <strong>Kinross</strong> took over the Hoyle Pond mine in1993, we have continually increased production from 60,000 ounces per yearto almost 175,000 ounces in 1997. However, in <strong>1998</strong>, Hoyle Pondmanagement and staff took a breather to complete the transition to shafthoisting and to look at future options. As a result, our production in <strong>1998</strong>declined for the first time since 1993 to 158,953 ounces. Total cash costsremained competitive at about $171 per ounce compared to $186 in 1997.Two years ago, we described a new initiative at Hoyle, called Hoyle 2000. Thisgroup of professional engineers and geologists were to evaluate all ore sourceson the Hoyle property (and on others that <strong>Kinross</strong> might not even own) andHoyle Pond remains anextremely importantasset of which we arejustly proud.to develop a strategy and a timetable to maximize Hoyle’s production by the year 2000. Since we announced this targetdate, gold prices began their bear market and this initiative became less pressing to accomplish. However, the group hasbeen working diligently and effectively to outline the company’s options and, at this point, Hoyle is prepared to movequickly to increase production once the group’s results are in. A detailed description of the Hoyle 2000 initiative ispresented on page 22 of this report.Meanwhile the mine is expected to produce 165,000 ounces of gold in 1999, although at a lower cash cost, budgeted atless than $160 per ounce.Following the 1997 rockburst at the Macassa mine, a detailed review was conducted to establish the future of the mine.We believed that we could at least operate into the spring of 1999 but the reserve potential beyond that was questionable.During the review, however, research identified a number of promising targets that were subsequently followed upin <strong>1998</strong>.7

M E S S A G E T O S H A R E H O L D E R SOur success, as you will read on page 28, has been quite remarkable and we believe bodes well for continued productionfrom this mine for many years to come. This success underlines a well worn tenet. The best place to look for gold is insight of your headframe. The success at Macassa is a credit to the explorationists who identified the opportunity and thestaff and miners who have efficiently exploited it. This is also the strategy we are currently following at our three keyoperations and will always remain a powerful, underlying strategy to our exploration effort.The only one of our primary operations that caused the management any headaches in <strong>1998</strong> was the Refugio mine inChile. This 50% joint venture mine has consistently under performed since its construction and we were frankly reluctantto give it our full support once we owned it. However, along with our partner, we have committed considerable time andeffort into identifying the problems and over time they are being solved.As we’ve told you in previous annual reports, the company’s goal was toreach one million ounces of gold equivalent production per year. Critics saidour goal was aggressive and unrealistic. Once again, they were wrong.The true motivation in this effort has been the recognition that the orebody and the mechanics of the leaching processare sound and that the problems are simply the plant. I use simply because, without an orebody, there is no mine but,with an orebody, solutions are possible. We look forward in 1999 to seeing the results of the ongoing hard work, andfeel confident that this mine will show improvement throughout this year.As we’ve told you in previous annual reports, the company’s goal was to reach one million ounces of gold equivalentproduction per year. Critics said our goal was aggressive and unrealistic. Once again, they were wrong.I’m pleased to tell you that, even in that short time and in this market, we have achieved our goal and that, in fact, in1999, <strong>Kinross</strong> is budgeted to produce approximately 1.1 million ounces of gold equivalent. We had set our sights on themillion ounce a year target because, at that level of production, <strong>Kinross</strong> would have achieved senior status and, as such,could look forward to an increased cash flow multiple and more diversified ownership. However, now that we’ve hit themark, the bar has been raised. Senior status now appears to be 2 million ounces per year of production. While, on onelevel, it’s disappointing to have conquered a mountain only to find other, higher ones, hidden behind it, on another level,it is rejuvenating to think of the opportunities therein. As your CEO, I endorse these opportunities, and, as a company,we look forward to meeting the challenges they represent.To do so, in the near term, we will focus on improving production at our three key operations. We look forward to FortKnox achieving the half million ounce per year mark, a 130,000 ounce increase from the 1999 budget. At Kubaka wecould add about 100,000 ounces over the original 200,000 ounces budgeted for 1999 if we can continue to increaseour ownership.8

M E S S A G E T O S H A R E H O L D E R SAnd while no decision has yet been made, production increases at Hoyle Pond are likely. Assuming Hoyle can increaseoutput to 235,000 ounces, those three mines would boost our production level to about 1.4 million ounces, with verylittle technical risk. To complement this growth, we are also developing the Norseman project in Western Australia (seepage 35), that could well be taken to feasibility in 1999 and production in 2000. Taken together, the above achievabletargets would eventually provide <strong>Kinross</strong> with 1.5 million ounces of production annually. That represents significantgrowth, achieved with capital we currently have, a laudable achievement which should result in substantial shareappreciation.But you know where I’m heading now... remarkable as those figures are, they will not elevate our company to seniorstatus. As a result, the 500,000 ounce per year shortfall will be the focus of our acquisition strategy going forward. Butall in good time. The market has not yet credited us for the internal growth that we can foresee. As a result, we do nothave a stock that properly reflects <strong>Kinross</strong> in relation to its peer group. Until that’s corrected, acquisition of enoughproduction to get us senior status is unlikely and not currently being pursued. We do, however, remain vigilant and readyto make acquisitions when they are available and accretive.In 1996, <strong>Kinross</strong> started its exploration program, hiring a Vice-President Exploration. The move reflected the company’sgrowth and the need to start spending money to find new reserves.Since that modest beginning, the size of the exploration program has kept pace with company growth. And this year,we expect to have our first major success attributed to the exploration group with the Norseman project in WesternAustralia. While cash flow obviously remains tight in this low gold price environment, we have allocated $11 millionfor exploration and business development in 1999. The bulk of this budget will be spent on reserve and resourceenhancement around the Kubaka mine ($3 million on a 100% basis), the Gil deposit at Fort Knox ($1.4 million) andadditional drilling and a feasibility study at Norseman ($2.7 million). While funds for more speculative explorationefforts will thus be quite modest, we will stay focused and opportunistic in this area as well.One of the most important programs that mining companies undertake today is securing the environment at their minesites both during and after production. Some environmental groups erroneously believe that mining companies enjoypolluting their surroundings. Nothing could be further from the truth. Our families live on the same planet, have thesame aspirations for our children and we share the same moral obligation to act carefully and responsibly, no matterwhere we operate. I want our shareholders to know that we take that responsibility seriously.We have a highly developed environmental protection program, monitored at numerous levels of the corporationincluding an environmental committee of the board. Our system of checks and balances more than fully meets thecompany’s mandated obligations and helps create a corporate culture of caring and continued improvement. More ofsenior management’s time will be devoted to environmental issues, including continued improvement in best practices,proactive education in communities impacted by our operations and deflection and correction of bias and poorlyinformed criticism of our industry. <strong>Kinross</strong> is a leader in environmental management and is committed to remain in theforefront in the years to come.9

M E S S A G E T O S H A R E H O L D E R SLast year, we reported $59.8 million from forward gold sales that were closed out in January and July <strong>1998</strong>. While thiswas an acceptable return that reflected our belief that the gold market had bottomed, it left the company without anyhedging program. To address this problem, we hired a Treasurer, with a background in metal trading with a major goldmining company. The company has developed a hedging strategy, approved by the board late in <strong>1998</strong>. This strategyanticipates that <strong>Kinross</strong> will build up a book of forward gold sales appropriate for a company of its size. While this willtake time, we have begun the process and currently the company has sold forward 150,000 ounces of gold, using spotdeferred contracts at approximately $300 per ounce. Hopefully throughout 1999 this book will gradually increase asopportunity allows.While I have outlined our company goals for 1999 and beyond, I believe it would be useful to re-iterate them so you,the shareholder, will have no doubt about what we are trying to achieve. These goals are doable and reflect our directionand skill as a company. They are also the ones which I believe we can be judged on.ª Produce a record 1,075,000 gold equivalent ounces at a record low total cash cost of $200 per ounce ofgold equivalent.ª Complete the permitting of Ryan Lode and commence the permitting of True North.ª Decide on a production growth goal for Hoyle Pond and report to the shareholders, before the end of 1999, what thatgoal is and how we expect to achieve it.ª Complete the drilling of the Mt. Henry and Selene deposits that make up the Norseman Project and commence afeasibility study, targeting initial production for the year 2000.ª Complete the technical improvements at the Refugio mine necessary to put this operation on a strong footing.ª Increase investor awareness of what the new <strong>Kinross</strong> is about, why it is worthy of a better relative stock price andhave that reflect in the stock’s relative performance.Looking forward into 1999, my goal as CEO is to ensure that our targets as set out in this message and in the body ofthe report are achieved. My other priority is to ensure that investors interested in gold securities will be made aware of<strong>Kinross</strong>. I need to broadcast what it has achieved and what it can reasonably be expected to achieve going forward. Ineed to insist that investors looking only at the top four senior North American producers emerge from their tunnelvision to review the price and outlook for <strong>Kinross</strong>. I need to make them recognize and acknowledge that we are alegitimate alternative to those four producers. If we do our job and they respond, then we can eventually achieve thelevel of production and financial capability that would elevate <strong>Kinross</strong> to senior producer status.And then just watch what the new kid on the block can do.Robert M. BuchanChairman and Chief Executive OfficerMarch 17, 199910

Left: Robert (Bob) M. BuchanChairman and Chief Executive OfficerRight: Arthur (Art) H. DittoPresident and Chief Operating Officer

O P E R A T I O N SHIGHLIGHTS<strong>Kinross</strong> enjoyed a watershed year in <strong>1998</strong>. The Amax <strong>Gold</strong>merger elevated the company to a million ounces ofannual gold production, with new operating bases in theRussian Far East, Alaska, and Chile. The transaction hasadded to our managerial and technical strength, and willhelp further reduce our gold production costs.This year, the company increased production by 75%,producing a gold equivalent output of 874,447 ounces. TheMacassa, Kubaka, and Denton-Rawhide operationsexceeded production goals for the year. Hoyle Pond, FortKnox, and Blanket were close but slightly below targetdue to lower grade ore. The Refugio joint-venture in Chile,and the DeLamar mine in Idaho both experiencedsignificant production shortfalls. Refugio's throughput wassignificantly under budget, and DeLamar experienced bothlower grade ore and reduced mill throughput. Expectingcontinuing weak gold prices, operations at DeLamar weresuspended in early 1999 and facilities were placed on careand maintenance.Average production grade for the year at Hoyle Pond was13.17 grams of gold per tonne, compared to 13.60 theprior year. Less production from the high-grade Hoyleveins, and more production from the lower grade 1060area long-hole stopes were the main factors. As well, 7Vein ore grade was less this year than last.Extensive development in the 1060 region continues toprepare more mining areas and to improve ore and wastehandling capability. By year end about 28,000 tonnes permonth, representing 64% of all ore and waste from theHoyle Pond operation, were being hoisted instead of truckhauled, improving mine efficiency.The Hoyle 2000 initiative incorporated all district geologicand drill-hole data into a common database which greatlyimproved our understanding of property geology.This work guided an extensive and successful drillingprogram in the Owl Creek East area west of the Hoylemine. These results justified driving a ramp from Hoylewestward to this area. This access will be used forunderground diamond drilling and for later mining andmine servicing in the Owl Creek East region. A badlyneeded administrative and mine-dry facility, which willimprove employee effectiveness, was completed at theHoyle shaft by year end.Despite a slow beginning, Macassa exceeded its productionand cost goals this year. The operation increased itsunderground output above the 5000 Level, successfullycompleted the Lakeshore crown pillar mining program,and achieved desired results from the tailings treatmentoperation. By year end, we had identified new reserveopportunities to the west of No. 3 shaft, to the east of areasbeing mined above the 5000 level, and above the 3800Level. The future of the operation, bleak after the 1997rock burst, now looks promising, provided productivitycontinues to improve.Kubaka's first full year of operation was excellent. Themine produced 506,868 ounces of gold equivalent. As well,cost saving and productivity improvements begun at midyear have steadily reduced costs. Similarly, excessiveunsold gold inventory, a problem from the outset ofoperations, was reduced to normal quantities. <strong>Gold</strong> salesnow satisfactorily match production. Winter supply routeswere established on schedule, and material to restock theoperation's 1999 needs moved routinely to site.12

O P E R A T I O N SFort Knox experienced a year of record mill throughput,achieved in part, by adding a pebble crushing circuit inthe fourth quarter. Commercial gold production was up by14% compared to 1997 due to greater mill throughput.Reserve development drilling during the year replaced goldmined, although reserves reported at year end wereslightly reduced because estimates this year were based ona gold price of $325 per ounce instead of $375 per ounceused in 1997. The maintenance of the mine's mobileequipment, a job previously contracted out, is now doneby Fort Knox employees. This change creates more costreduction opportunities.At Refugio, production was 10% better than 1997, but totalcash costs of $313 per ounce for the full year, althoughimproved, remain unsatisfactory. Mechanical failures anda legacy of design and construction weakness continue toplague the operation. By the third quarter, most operatingbottlenecks and system problems were restricted to thetertiary crushing circuit. We made persistent efforts toresolve outstanding financial claims against the projectcontractor who had taken the project on a fixed-price,"turn key" basis. After accepting a mediated settlement inOctober, the joint-venture partners were optimistic that thecontractor would advance funds to make necessaryretrofits. However, this has not happened, and other legalremedies are underway. We believe the operation can, withmodest capital from each of the joint venture partners, befixed to achieve stable output at costs below $240 perounce. Reserves at year end were approximately 26% lessthan the prior year because of mining and the use of alower gold price for calculation of reserves.Performance at Denton-Rawhide exceeded expectations. Forthe first time, the operation crushed 5.4 million tonnes ofore. <strong>Gold</strong> production increased and unit costs were belowtarget. At the Blanket mine, the gold production shortfallwas offset by lower cash costs reflecting the weakZimbabwean dollar.Several non-operating properties contributed goldproduction as they wind down to permanent closure.Most challenges associated with the operating side of theAmax <strong>Gold</strong> merger were addressed by year end. A new andcomprehensive administrative management system wasinitiated to improve the company's procurement,accounting, materials management, maintenance, humanresource, and information reporting functions.COSTS OF PRODUCTIONWe reduced consolidated total cash costs for the year by20%, from $268 to $214 per ounce of gold equivalent. Theimprovement is primarily due to lower production costs atFort Knox and Kubaka, although other operationscontributed also. Closing the high cost operations atDeLamar and Candelaria will help reduce total cash coststo our $200 per ounce target for 1999.RESERVES AND RESOURCESThe Amax merger dramatically increased proven andprobable gold reserves which are now 174% highercompared to 1997. Proven and probable gold and silverreserves are 7,469,000 and 8,573,000 ounces respectively.Possible reserves amount to 966,000 and 64,000 ouncesrespectively and gold and silver resources are 16,522,000and 80,760,000 ounces respectively. Mining depletedapproximately 1,400,000 gold equivalent ounces.CAPITAL EXPENDITURESCapital expenditures related to operations during <strong>1998</strong>totaled $33.8 million. The majority, $16.9 million wasspent at Hoyle Pond and Hoyle 2000 for major minedevelopment, mine equipment, and construction of a newadministration complex. At Fort Knox, approximately$10.2 million was spent raising the mill tailings structureand constructing a pebble crushing circuit in the mill.13

O P E R A T I O N SThroughout the rest of our operations, capital programswere modest, totaling about $6.7 million. Most capitalthis year helped sustain operations, improve productivityand lower costs. Our capital budget for 1999 is $52.6million – $43.7 million to properly sustain operations andprepare Hoyle Pond for future growth, and $8.9 million indiscretionary funds, not yet approved for expenditure.ENVIRONMENTAL AFFAIRS<strong>Kinross</strong> spent about $5.6 million on reclamation andenvironmental improvements this year. The scale andquality of that reclamation work is impressive andongoing under careful engineering and qualitysupervision. Around our sites, about 486 hectares of landhave been reclaimed, a big accomplishment. Ourreclamation obligations increased dramatically this yearwith the addition of three major operations, and five plantsite closings. The company has updated its reclamationplans and cost estimates for those plans total about $75million. Obtaining regulatory permits for reclamation andclosure is a daunting job and requires the continuous anddiligent work of highly qualified professionals. <strong>Kinross</strong> iscommitted to the process and to meeting its reclamationresponsibilities.We also conducted a thorough audit program at alllocations, including an engineering risk assessment ofseveral operations and facilities. This initiative assessespermit compliance, emergency response plans, structuralrisks, and policy compliance. As well, this year, we put inplace a land application program to dissipate accumulatedwater at DeLamar. Our commitment continues.OUR PEOPLE<strong>Kinross</strong> has become a global enterprise operating on fivecontinents. Our workforce climbed 78% this year toapproximately 2,800. They speak several languages anddialects and contribute a variety of skills.They are a dedicated group of which we are proud.The huge growth our company experienced this yearinvolved significant change for many. Such changes were,at times, disruptive and stressful. However, personnel fromseveral organizations and joint ventures are now workingtogether effectively.Reflective of our growth, Scott Caldwell, Chris Hill andAllan Schoening joined <strong>Kinross</strong> as Senior Vice President,Surface Operations, Vice President, Treasurer and VicePresident, Human Resources and Community Relations,respectively. In addition, Don MacKinnon, Rick Dye andBob Gosik were promoted to the positions of VicePresidents of Underground Operations, Technical Servicesand Project Development and Environmental Affairs,respectively.We worked hard to promote safety awareness throughoutthe company and that work paid off. We lowered our losttimeaccident rate from 1.63 to 1.25 for every 200,000employee hours worked. Unacceptably, a fatal accidentoccurred at Hoyle Pond in November.OUTLOOKOur business plan anticipates little change in the 1999gold price. Consequently, emphasis is not on increasingoutput but on containing and reducing costs. Our capitalprogram is flexible and under continual review such thatit can be contracted or curtailed if necessary. We expect toproduce just under 1.1 million gold equivalent ounces attotal cash costs of $200 per ounce in 1999, whichrepresents a 23% increase in output and a 7% decrease incost compared to <strong>1998</strong>.Arthur H. DittoPresident and Chief Operating Officer14

O P E R A T I O N S15 <strong>Gold</strong> pour at Fort Knox.

O P E R A T I O N SF O R T K N O XU . S . A .<strong>1998</strong> OVERVIEWProduction:365,452 ounces of gold(320,758 ounces of gold in 1997)(203,010 ounces of gold for theseven month period of <strong>Kinross</strong>’ownership)Total ore milled:12,466,179 tonnesAverage grade:0.99 grams of gold per tonneTotal cash costs:$189 per ounce($170 per ounce in 1997)($199 per ounce for the sevenmonth period of <strong>Kinross</strong>’ownership)Large mining equipment at Fort Knoxachieves economies of scale.REVIEW OF OPERATIONSFort Knox, an open pit mine, islocated 40 kilometers northeast ofFairbanks, Alaska.Although Fort Knox personnelincreased annual gold productionby 14% over 1997, that figure was4% below plan due to lower thanexpected mill feed grade. The slightshortfall in ounces produced wasnearly overcome by this year’s recordannual mill throughput of 12.5million tonnes, a 29% increaseover tonnes processed in 1997. Theimprovement in mill throughputwas accredited to efficient plantoperation and the installation of aSAG mill recycle crusher whichbegan operation in October, <strong>1998</strong>.The construction of the SAG millrecycle crusher was completed amonth ahead of schedule and withinexpected capital costs.In <strong>1998</strong>, Fort Knox mined 30.3million tonnes of material, abovethe target tonnage of 26.6 milliontonnes. Improved results reflectedmore and better use of the existingmining fleet.Capital spending for the year wason budget with $10.2 million ofexpenditures during the last sevenmonths of the year. The <strong>1998</strong> totalcash cost per ounce was $189 ($199for the period of <strong>Kinross</strong>’ ownership).Exploration efforts were concentratedon near-mine potential. The “in-pit”drilling program delineated anadditional 7.2 million tonnes of orecontained inside the current ultimateopen pit mine. We conductedextensive soil sampling andgeochemistry work on the Gil, anexciting, nearby exploration target.Fort Knox personnel completed theirsecond year of operations withouta lost-time accident. Mine employeeshave now worked in excess ofone million hours since the last losttimeaccident which occurred inAugust, 1996.As part of Fort Knox’s ongoingenvironmental commitment,approximately 71 hectares ofdisturbed land were reclaimed.16

802 35022 6 011 8 1 0-013001400160017 018 020001700200016 304 01015001100120011001200110013001200110012001300O P E R A T I O N SFORT KNOX SITE PLAN1010 0911 9 9 02 0 802 17 02 2 6 02 3 501 9 9 01 81 01 6 301 7 0STOCKPILES222 602 0 8 019901 4 5 03601316 02701 36 0501415 4 01 6 301 72 03522 0 8 0Fort Knox1 9 0 0Road4 01 51 7 2 01 90 01 01817201 63 01 5 4 01 1 8 01 27 00190BORROWMATERIAL14001300120011001000N1 9 901 6 3 0015 45 01 4100018 1 019 0 0217 01 990217 02 0 8019 0 0226 02 1 7 02 0 8 01 9 0 00116 37 2 01 5 4 0OPEN PITMILLCOMPLEX1 9 0 0Tailing Haul Road1 8 1 01 5 4 0STARTERPOND1 5 4 01 3 6 0TAILINGDAM127 01 3 6 01 9 0 01 1 8 010 901 6 3 01 5Electric Transmission Line1 5 4 01 1 8014 50Service Road and Pipeline1 2 70DEVELOPEDWETLANDS12 70120013001400130012001100WaterReservoirALTERNATEBORROWMATERIALLOST HORSEBORROW/TOPSOILSTOCKPILE AREABORROWMATERIAL1200140011001100WATER DAMEXCAVATIONACCESSLAT 65 0 24.66NLON 147 12 44.47W14 5 01 990160015002 17 0190 01 6 3 01 7 2 020801 7 2 015009 9 020 8 02 2 6 02 0 8 01 9 9 0181 0021 71 8 101 6 30140014002 2 6 0TOPSOIL STOCKPILESAND/OR ROCK DUMPS1 7 201 6 3 08 020190 01 9 9 0GILMORE DOME1 811 5 4 01 45 01 3 6 01 2 7PROJECT BOUNDARY1 5 4 0170019 0015001800210019001800190001 km.17

O P E R A T I O N SOUTLOOKWith the successful installation ofthe SAG mill recycle crusher, 1999mill throughput is expected to be13.5 million tonnes. <strong>Gold</strong> recoveriesare forecast to exceed 90%.As a result, the Fort Knox Mine isexpected to produce approximately370,000 ounces of gold in 1999,despite a slight decline in mill feedgrade compared to <strong>1998</strong>. Fort Knoxpersonnel will continue to focuson improving mill throughput andgold recovery.The open-pit mine is scheduled tomove 30.5 million tonnes of materialin 1999. We also expect a continuedimprovement in major equipmentmechanical availability.The 1999 total cash cost per ounceis expected to be approximately$192 compared to $189 for the fullyear of <strong>1998</strong>.The slight increase in total cash costper ounce reflects lower forecastmill feed grades and a slight increasein labour costs offset by higherthroughput. We will pursue potentialcost savings in lower bulkconsumable prices and improvedproductivity.We will also continue our near-minesite exploration with further in-pitore delineation drilling and work atthe Gil exploration site. In addition,exploration of the Ryan Lode andTrue North deposits is expectedto lead to definitive developmentplans for these higher gradesatellite deposits.A limited, capital-spending programof approximately $6 million isplanned for 1999. Majorexpenditures include the near-pitexploration programs, mine de-waterdrilling and mine mobile equipment.TECHNICAL BACKGROUNDThe Fort Knox mine is the mostrecent development in a miningdistrict that has produced inexcess of 8 million ounces of gold.The low cost mine began commercialproduction on March 1, 1997.Construction of the mine andprocess facility cost approximately$373 million.The gold deposit is hosted by theFort Knox pluton, a multi-phasegranitic body that intrudesPrecambrian to mid-upper Paleozoicschist of the Yukon-Tanana terrane.The surface exposure is elongatedmeasuring approximately 1.1kilometers east-west and 0.6kilometers north-south. The goldoccurs in and along the margins ofpegmatite veins, quartz veins andveinlets, quartz-filled shears, andfractures within granite. Themineralization is low in sulfides.Fort Knox’s commitment to on-goingmine site reclamation will continue,with over 40 hectares of landscheduled for reclamation in 1999.Open pit mining at Fort Knoxis accomplished by utilizing 150ton trucks and 24 cubic yardhydraulic shovels.18

O P E R A T I O N SH O Y L E P O N DC A N A D A<strong>1998</strong> OVERVIEWProduction:158,953 ounces of gold(174,317 ounces in 1997)Total ore milled:424,376 tonnesAverage grade:13.17 grams of gold per tonneTotal cash costs:$171 per ounce($186 in 1997)REVIEW OF OPERATIONSThe Hoyle Pond underground mineis located 18 kilometers northeast ofdowntown Timmins, Ontario.In <strong>1998</strong>, the Hoyle Pond operationproduced 158,953 ounces of gold attotal cash costs of $171 per ounceversus a budgeted $176 per ounce.The mill processed about 10% lesstonnage in <strong>1998</strong> compared to 1997.This reduced throughput and slightlylower grade were partially offset byimproved metallurgical recoveriesresulting from further optimizationof the carbon-in-pulp (CIP) circuitinstalled in 1997.Capital expenditures for minedevelopment, exploration, equipmentand mine infrastructure totalled$16.9 million. Mine developmenttotaled 14,915 meters, including7,416 meters of ore and 7,499 metersof waste. Waste developmentconsisted of an ore and waste passsystem, ventilation raises, 7B Veinaccess/exploration drifting andextension of the 1060 ramp to the340 meter level. The paste fillsystem was also extended to the440 meter level.Ore development on the 440 levelincluded level drifting, subleveldrifting, Alimak stope access raising,and open raising. Stope developmentand exploration drifting alsocontinued on the Hoyle Pond veins.Rail haulage was commissioned onthe 440 level with ore and wastenow skipped to surface.Exploration expenditures totaled$2.2 million and involved 39,393meters of surface and undergrounddiamond drilling. Explorationfocused on delineating existingpossible reserves in the 1060BZones, 16 Vein, 9 Vein, and 7B Vein.Possible reserves within the 1060Zone were upgraded to Probablebetween the 300 and 440 meterlevels as well as 60 meter abovethe 720 meter level.19

O P E R A T I O N SHOYLEPOND AREA – SITE PLAN AND SOUTH PARALLEL LONGITUDINAL SECTIONMarlhillJoanisZonePENTLANDKINROSSNEZ IIINEZBell CreekPentlandWetmorePentlandSchumacherPentlandWetmore EastBlack Hawk(Vogel)Thunderwood JVOwl CreekPit99350E99550E750Owl Creek EastMineralized Belt99950EBlack HawkPENTLANDLegend<strong>Gold</strong> MineralizationMafic VolcanicUltramaficVolcanicSedimentsFelsic IntrusiveBell Creek MineProduction (1986-1994)146,797 ozs.Joanis(~800m North)Resource18,915 ozs.Owl Creek PitProduction (1981-1989)225,000 ozs.120m200m300m440m120m200m300m440mPhase 3Phase 2750 block720m800m<strong>Kinross</strong>Reserves (Bell Creek North A)33,547 ozs. PentlandResources (Bell Creek North A)Resource70,773 ozs.30,300 ozs.Resources (Bell Creek West) Pentland - Schumacher III8,600 ozs.(<strong>Kinross</strong> 46.4%)Resources (Bell Creek N.E. Zones)226,318 ozs.BlackhawkBlackhawk / VogelResource459,678 ozs.(Blackhawk 50%<strong>Kinross</strong> 32.5%,Thunderwood 17.5%)Thunderwood<strong>Kinross</strong> J.V.Resource149,545 ozs.(<strong>Kinross</strong> 65% interest)720m800mOwl CreekResource(above 200m Level)408,000 ozs.(below 200m Level)402,327 ozs.Owl Creek EastResources421,058 ozs.20

40M RampRemuckO P E R A T I O N SHoylePond2000Zone7 VeinSedimentZoneKINROSSMill Creek350950Zone1060ZoneKidd CreekMet Site101KINROSSHoyle Twp. Matheson Twp.Whitney Twp. Cody Twp.0 1kmHoyle PondRamp PortalHoyle Pond Ore BodiesKidd Creek Met Site350 BlockPhase 1120m200m300m440m950 Zone720m800mProjectionHoyle Pond MineReserves (includes Hoyle,1060 and 7 Vein)920,172 ozs.Resources (includes Hoyle,1060 and 950 Zone)632,028 ozs.ResourcesReserves21

O P E R A T I O N SLimited widely spaced drilling belowthe 720 level indicated the continuityof all zones below the level with allzones remaining open at depth.Three sub parallel veins werediscovered north of the 1060 Zone440 level access drift. These narrowstructures called the 1060 N Zonesare high grade with visible gold (vg).The zones are open in all directionsand will be drilled in 1999. The weststrike extension of the 1060 Zoneswere tested above the 720 levelwhere a 1060 type structure wasintersected 170 meters west of the B1west plunge line at the 575 meterlevel. Further drilling is plannedfrom the 440 level.Approximately 190,000 tonnes at11.51 grams per tonne (70,000)ounces of new reserves were outlinedin the Lower Porphyry Zone fromthe 280 level to the 80 meter level.Current drilling immediately abovethe 440 level shows that the zonecontinues down plunge to at leastthat elevation.The 950 Zone access drift on the440 level was begun and will beused as a platform for diamonddrilling and exploration drifting.Geologic data compilation of theHoyle Pond main mine throughout<strong>1998</strong> has defined a number ofexploration drill and developmenttargets that are the focus of thepresent exploration effort. At leastfour potential mining blocks havebeen targeted for short termdevelopment. Exploration drillingnorth of the 407E access drift hasdefined a Hoyle Pond type structure(150 Zone) from the 340 level tothe 440 level. The zone appears tocorrelate with the previously drilledhigh grade 2000 Zone intersection of294.5 grams per tonne over 0.8meters just above the 720 level.Recent results include 22.3 grams pertonne over 3.0 meters (vg). Currentdrilling is targeting the zone close tomine workings on the 440 and onthe 400 meter levels.Hoyle 2000The Hoyle 2000 Projects group,with extensive experience inevaluating mineral deposits andprocessing, was mandated twoyears ago to add value to theTimmins operation by identifyingand evaluating explorationand production opportunities.As well, the group helps improveinfrastructure in the form of roads,buildings and processing.In <strong>1998</strong>, as well as providingtechnical assistance to both theHoyle Pond and Macassa mines,the group also completed resourceevaluations on the <strong>Kinross</strong>-ownedHoyle township lands and onarea properties containing shorttermproduction potential presentlycontrolled by others.A total of 190 drill holes for 26,597meters and 300 meters of rampingwere completed on targets in HoyleTownship in <strong>1998</strong>.22

O P E R A T I O N SThe group also constructedgeological models of all significantlymineralized zones on the Hoyleproperty, including Owl Creek East,Owl Creek, Thunderwood, and BellCreek deposits. This effort resultedin an increase of approximately500,000 ounces in the resourcecategory. Technical support inthe form of improved geologicalmodeling and mine planningwas also provided to the KirklandLake operations.The group’s major effort in <strong>1998</strong> wasa successful exploration programinvolving 16,841 meters for 164holes of surface diamond drillingfocused on the Owl Creek Easthorizon. This work was targeted attwo blocks, each 200 meters longand to a depth of 120 meters. Thedrilling revealed that the originalinterpretation of three mineralizedhorizons was incorrect and that, infact, up to seven horizons werepresent. The additional tonnes inthese lenses increased the containedounces in the targeted blocks inthe order of 50%. Grades remainat 8.0 grams per tonne. A ramp wasalso initiated extending from the20 meter level from the Hoyle Pondramp west towards the 350 block onthe Owl Creek East horizon.In addition, 9,756 meters of diamonddrilling in 26 holes was alsocompleted on other targets on theproperties.OUTLOOKThe Hoyle Pond operation isexpected to produce about 165,000ounces of gold in 1999 at totalcash costs of approximately $160per ounce. The mill is scheduledto process about 10% moretonnage than <strong>1998</strong> at a gradeabout 5% lower.Plans for 1999 include the continuedconstruction of the Owl Creek Eastramp through to the end of Phase 2.This project will include 1,000meters of ramping and drill cutouts,extraction of a 4,000 tonnebulk sample, 52,000 meters ofunderground drilling and 26,000meters of surface drilling. Expectedcompletion date is the end of thethird quarter in 1999.Exploration diamond drilling is alsoscheduled to be completed fromsurface targeted at the “Fold Nose”area to search for mineralized veinsystems at depths similar to thoseat the Hoyle Pond mine.In addition, the Hoyle 2000 groupwill continue to evaluate the pitpotential of the Owl Creek East andOwl Creek deposits, forecastingcompletion of an economic studyby mid 1999.New office and mine dry adjoiningthe Hoyle Pond headframe.23

O P E R A T I O N SK U B A K AR U S S I A<strong>1998</strong> OVERVIEW(50% ownership interest –increased to 53% effectiveDecember 16, <strong>1998</strong>)Production:253,434 ounces of goldequivalent (131,852 ounces ofgold equivalent in 1997)(154,350 ounces of goldequivalent for the seven monthperiod of <strong>Kinross</strong>’ ownership)Total ore milled:646,508 tonnesAverage grade:24.55 grams per tonneTotal cash costs:$154 per ounce of gold equivalent($175 per ounce of gold equivalentin 1997)($149 per ounce of goldequivalent for the seven monthperiod of <strong>Kinross</strong>’ ownership)REVIEW OF OPERATIONSThe Kubaka Mine is located in theRussian Far East, within the MagadanOblast, 950 kilometers northeast ofthe city of Magadan. Access to thesite is via air and winter road.The export and sale of approximately218,000 ounces of gold wascompleted in <strong>1998</strong>. This processcontinues to go smoothly.The Kubaka Mine produced506,868 ounces of gold equivalentin <strong>1998</strong>, approximately 8% betterthan plan. Although the annual millthrough put was 1.6% below plan,this tonnage shortfall was more thancompensated for by higher-thanexpectedfeed grades, and betterthan-expectedrecoveries.Aerial view of the Kubaka operation.The mill processed 646,508 tonnesof ore with an average gold recoveryof 98.2% compared to plannedrecoveries of 97%. Productivityenhancements showed good resultsat the mine as personnel moved 10.7million tonnes of material, exceedingplan by about 2%.Cash spending for the year was wellbelow plan. The <strong>1998</strong> total cash costsper ounce of gold equivalent were$154, approximately $18 per ouncelower than plan.Several initiatives, in almost allareas of the operation, significantlyreduced operating costs andimproved productivity. The moresignificant initiatives includedreducing the size of the workforce,improving overseas procurementmethods, and using fixed wingaircraft instead of helicopters totransport personnel.The major exploration programsundertaken during the yeardelivered mixed results. Althoughmineralization was further definedat several outlying targets, noadded ore reserves, capable ofproviding additional Kubaka millfeed, were identified.24

O P E R A T I O N SKUBAKA MINE SITE PLANBoundary of Kubaka operationsKubaka MineReagentStorageExplosiveMagazineBoundary of Kubaka operationsTailingsFacilityWaterRetentionDamFuelFarmMillTruck Shop,Administration,WarehouseLiving & Dining3x0.4 åKubaka River0 250 500m25

O P E R A T I O N SAlthough capital spending at Kubakais modest the major capital programfor the year was the start ofconstruction of a water treatmentplant. Construction will be completedby May, 1999.OUTLOOKThe Kubaka Mine should produceapproximately 400,000 ounces ofgold equivalent in 1999. The millis scheduled to process a minimumof 657,000 tonnes of ore and themine will move 8.6 million tonnesof material in that time.Total cash spending for 1999 isforecast to be far lower than <strong>1998</strong>levels. Despite this fact, total cashcosts per ounce of equivalent goldare expected to increase to the$170-180 per ounce range due tothe processing of lower grade ore.The Kubaka operations group willcontinue to focus on initiatives toimprove productivity and loweroperating costs. Site personnel areconfident they can make significantadvances in these areas.A limited capital program ofapproximately $1 million isscheduled to take place in 1999.The 1999 exploration effort willconcentrate on delineating nearmine-siteore to provide additionalfeed for the Kubaka mill. Severaltargets have been identified, andfield exploration activities willbegin this spring.TECHNICAL BACKGROUNDThe high grade Kubaka mine iswithin a historic, gold-producingarea and is now the largest operatinggold mine in Russia. The open pit,low-cost mine achieved commercialproduction in June, 1997. The mineand process facility cost about $242million to build.The gold deposit is located in anarea of highly weathered Paleozoicvolcanic rocks resting on aPrecambrian crystalline basement.The Kubaka deposit is an epithermalquartz-adularia vein systemhosted in volcanic rocks and theirsedimentary derivatives.The main Kubaka vein is steeplydipping and outcrops at surface.The vein consists of massive tofinely banded quartz. <strong>Gold</strong> occursas disseminated grains of electrum.The gold to silver ratio is one to one.Open pit mining is accomplishedon 6-meter benches by utilizing 50tonne trucks and front-end loaders.The mill is designed to processbetween 650,000 and 700,000tonnes of ore per year. Power isgenerated on site by a series ofdiesel-powered generators.Sign post at Kubaka during construction– “You can get there from here!”26

O P E R A T I O N SR E F U G I OC H I L E<strong>1998</strong> OVERVIEW(50% Basis)Production:80,660 ounces of gold equivalent(73,698 ounces of gold equivalentin 1997)(42,446 ounces of goldequivalent for the seven monthperiod of <strong>Kinross</strong>’ ownership)Total ore mined:8,239,339 tonnes crushedAverage grade:0.93 grams of gold per tonneTotal cash costs:$313 per ounce($341 per ounce in 1997)($336 per ounce for theseven month period of<strong>Kinross</strong>’ ownership)Open pit mining at Refugio.REVIEW OF OPERATIONS<strong>Gold</strong> production, although short ofbudget, increased 9% over 1997levels as operational changescontinue to show improvements.Overall gold equivalent productionfor <strong>1998</strong> was 161,320 ounces(42,446 ounces to <strong>Kinross</strong>’ account)compared to 147,396 ounces in1997. Production in other areas alsoimproved. Crusher throughputincreased by 22% and total crushedore to the leach pad increased by15%. While total cash costs perounce of gold declined from 1997to <strong>1998</strong>, marked improvementswere seen in the last quarter.Major capital expenditures duringthe year included completing processimprovements, fixing constructiondeficiencies and better winterizingfacilities. These site-wideimprovements have increasedproduction through the crusher andrecovery facility and significantlyreduced weather-related delays.The one major operational shortfallthis year resulted from mechanicalfailures in the main conveyorsystem, significantly reducingproduction for three months.These deficiencies have beenidentified and corrected.Safety results in <strong>1998</strong> improved overeight-fold compared to previousyears through investments inimproved facilities, training andsafety programs.OUTLOOKLate in <strong>1998</strong>, a fully revised resourceestimate and mine plan wascompleted. This new plan will greatlyenhance operational flexibility andallow us to better adjust to changingoperating conditions.Mined ore production will increase18% over <strong>1998</strong> levels but wasteproduction will decrease by over56%. Budgeted ore production is10.5 million tonnes while waste isbudgeted at 4.7 million tonnes.Ore grade is budgeted at 0.94 gramsper tonne. Budgeted gold equivalentproduction is 220,000 ounces(<strong>Kinross</strong>’ 50% share is 110,000ounces) at total cash cost of $240per equivalent ounce.Operational improvements in 1999centre around two major changes.First, we will replace the tertiarycrushers. To that end, onsite testingof an alternative tertiary crushersystem has begun. The goal is toreplace the current crushers withlarger machines capable ofproducing a smaller crushed productwhich will improve recovery.Target completion date is mid-year.Secondly, we will change fromcontract to self-mining. Byassuming mining operations,Refugio will realize lower miningcosts and a greater flexibility toadapt to changing conditions.27

O P E R A T I O N SM A C A S S AC A N A D A<strong>1998</strong> OVERVIEWProduction:78,034 ounces of gold(56,709 ounces of gold in 1997)Total ore milled:(tonnes)Underground: 107,195Lakeshore Crown Pillar: 48,019Lakeshore Tailings: 200,126Average Grade:(grams of gold per tonne)Underground: 15.05Lakeshore Crown Pillar: 12.17Lakeshore Tailings: 2.57Total cash costs:$257 per ounce ($370 in 1997)Aerial view of the No. 3 headframe at Macassa.REVIEW OF OPERATIONSThe Macassa Mine is located inKirkland Lake, Ontario.In <strong>1998</strong>, total gold production atMacassa reached 78,034 ounces,about 3,000 ounces above budget, attotal cash costs of $257 per ounce.In addition, 121,841 tonnes ofcustom mill feed was processed. Thethree main sources of mill feed forthis production included the MacassaNo. 3 Shaft, the Lakeshore Tailingsand the Lakeshore Crown Pillar.As well, this year’s accidentfrequency at the Kirkland Lakeoperation was at a historic low. Thatachievement was recognized whenthe operation won two prestigioussafety awards - the Angus CampbellAward for lowest lost-time frequencyin the Porcupine Safety Group andthe <strong>Kinross</strong> <strong>Gold</strong> Corporation Awardfor safest underground mine.At the Macassa No. 3 Shaft, miningcontinued above the 5025 level.A permanent rockbreaker wasinstalled at the 5025 level and a newdrift at the 3800 foot elevation wasdeveloped. This new development isencountering significant ore gradevalues along the '04 Break, while anaggressive diamond drill programhas delineated an additional 74,000ounces of gold above the 5025 level.At Lakeshore, an additional 11,600ounces of gold above budgetwas achieved from the crown pillar,while dry mining of tailingscontinued successfully.OUTLOOKIn 1999, $1.9 million has beenbudgeted to expand the mineinfrastructure from the 5025 leveldown to the 5300 level and fromthe 4250 level up to the 3800 level.The 5725 loading pocket will be reestablishedto handle ore and wastefrom below the 5025 level and theegress and muck pass raises will beextended up to the 3800 level.As well, proposed explorationexpenditures of over $1.8 millionwill aim to establish new reservesaround the No. 3 Shaft, particularlyabove the 4250 level towardsurface. Also in 1999, the drymining of tailings at Lakeshorewill re-commence in late spring.The production target for theKirkland Lake operation in 1999 is80,000 ounces of gold at total cashcosts of about $240 per ounce.This is an increase over <strong>1998</strong> ounceproduction and a decrease of 7%in total cash costs.28

O P E R A T I O N SD E N T O N - R A W H I D EU . S . A .<strong>1998</strong> OVERVIEW(49% basis)Production:69,015 ounces of gold equivalent(66,402 ounces of gold equivalentin 1997)Total ore mined:5,432,000 tonnes crushed;4,025,000 tonnes run of mineAverage crushed grade:0.86 grams of gold per tonne10.6 grams of silver per tonneTotal cash costs:$235 per ounce of gold equivalent($247 per ounce of gold equivalentin 1997)REVIEW OF OPERATIONSThe Denton-Rawhide mine is locatedin Nevada, about 50 miles southeastof Fallon.Overall gold production in <strong>1998</strong> was5% better than plan, the result of anincreased amount of ore processedand a faster than expected gold leachcycle. More ore was processedbecause of the installation of a newprimary crusher feeder.This equipment improves crusherproductivity by allowing more ore tobe crushed and stacked on the leachpad. Another contributing factor wasthat a greater than predicted amountof low-grade ore was encounteredduring the year and placed on therun of mine leach pads.OUTLOOKDenton-Rawhide is planning toproduce approximately 60,000ounces of gold equivalent in 1999.to <strong>Kinross</strong>’ interest and total cashcosts are expected to be about$260 per gold equivalent ounce.The mine is planning to spend$1.9 million (49%) on capitalimprovements during the year,primarily on mobile mine equipment.Mine management has developedprograms to improve mobileequipment availability and furtherlower operating costs. In addition,the Denton-Rawhide group hassuccessfully lowered the cost ofmajor consumables used in the mineand process areas.Open pit mining at Denton-Rawhide.Total ore processed at Denton-Rawhide was 5.43 million tonnes,a 3% increase over 1997 tonnescrushed and stacked on the leachpads. Total ore and waste mined in<strong>1998</strong> was 18.1 million tonnes.Exploration will focus on claimblock targets with the potential tosupply supplemental ore for theexisting process facility.The total cash costs per ounceaveraged $235 for the year, 9%below plan.Exploration activities in <strong>1998</strong> wereconcentrated on the Regent Hill,Northwest Regent, North Jet andArrow areas. The continuousimprovement program was utilizedextensively in <strong>1998</strong>, resulting inproductivity improvements andlower costs.29

O P E R A T I O N SB L A N K E TZ I M B A B W E<strong>1998</strong> OVERVIEWProduction:35,266 ounces of gold(35,237 ounces in 1997)Total ore milled: (tonnes)Underground: 202,350Tailings: 1,096,360Average grade:(grams of gold per tonne)Underground: 4.24Tailings: 0.81Total cash costs:$193 per ounce($262 per ounce in 1997)REVIEW OF OPERATIONSThe Blanket Mine is an undergroundgold mine located in southwesternZimbabwe within a two hour driveof the city of Bulawayo.<strong>Gold</strong> production of 35,266 ounces,although below budget, showed aslight improvement over 1997 levels.Lower tonnage and lower recoveriesfrom underground ore contributed tothe shortfall. As well, about 17,000tonnes of budgeted higher gradeore was mined but not hauled tothe mill. It was stockpiled to allowother capital development in themine. The higher grade ore will beprocessed in 1999.The tailings plant performance wasreduced to 11,071 ounces (13,291ounces in 1997) because of acutemetallurgical problems. Recoveriesfell from 45% in 1997 to about 38%.Most of the problem resulted fromuncertainties about the supply ofoxygen, necessary to the recoveryprocess and currently imported fromSouth Africa. To this end, we havefinalized plans to procure our ownoxygen generating plant.About $1 million was spentdeveloping the mine and plant.Most of this capital investmentimproved underground haulage andshafts. As well, money was spenton exploration diamond drillingnear the operating mine site.Encouraging results wereencountered in the developmentof the Smiler mine (six kilometersnorth of the Blanket mine).A shaft was sunk 60 meters andlevel development was begun.Successfully developed, this projectcould increase Blanket undergroundproduction by some 20%.Productivity and safety at the mineimproved, primarily due to thecontinued use of longhole miningand the introduction ofthe shrinkage method during thesecond quarter.A successful third quarter audit ofenvironmental practices produceda blueprint to make the entireoperation environmentallycompliant. A major improvementwas the construction of an extensionto the tailings plant which greatlyincreases the ability to manageand contain spills.OUTLOOKKey developments will includecontinued haulage developmenton the 510 meter and 750 meterlevels and shaft sinking, haulagedevelopment and diamond drillingof the Smiler project. Diamonddrilling of the Eroica ore zone tofirm up resources below the 510meter level will also continue.A feasibility study of a newshaft project will be completedand environmental improvementswill continue.The oxygen plant will becommissioned in the first quarter tooptimize recoveries. The savingsrealized from having our ownoxygen supply will be redirectedtowards plant improvements.Production targets are 40,000ounces of gold at total cash costsof less than $200 per ounce. Totalcapital expenditures are forecast atapproximately $2 million.30

O P E R A T I O N SR E S I D U A L P R O P E R T I E SCANDELARIAU.S.A.REVIEW OF OPERATIONSThe Candelaria Mine is located insouth central Nevada, approximately80 kilometers southeast ofHawthorne, Nevada.Although metal recovery from leachpad No. 2 kept up with projectionsand was on budget for the first halfof the year, it fell well belowprojections as the year progressed.Several attempts were made toimprove the grade, including blastingthe pad to improve solution flow.However by year-end, because thegrade could no longer offset costs,the decision was made to stop metalrecovery early in 1999 and reclaimthe entire site.Property closure issues remained themajor priority during the year. Freshwater rinsing of leach pad No. 1continued and much of the crushersystem and site buildings weredismantled and removed.Recontouring and revegetation ofthe site also continued during theyear. The final site closure planwas approved and approval of thereclamation plan was receivedsubsequent to year-end.OUTLOOKThe goal for 1999 is to complete allmajor reclamation activities atCandelaria so that by the year 2000only site monitoring will be required.A possible exception includes somefinish rinsing and minor piperemoval from leach pad No. 2.Reclamation activities during 1999will include final rinsing andrevegetation of leach pad No. 1,rinsing of leach pad No. 2 and finalremoval of the crusher, truck shopand other sold buildings.DELAMARU.S.A.REVIEW OF OPERATIONSThe DeLamar Mine is locatedapproximately 160 kilometers fromBoise, Idaho, in the southeasternpart of the state, near the Oregon-Nevada-Idaho border.The DeLamar Mine produced62,056 ounces of gold equivalent in<strong>1998</strong>. Lower than expected millfeed grade and ore tonnage from theFlorida Mountain area hamperedmetal production in <strong>1998</strong>.Due to an extended period ofdepressed metal prices, <strong>Kinross</strong>management decided to suspendproduction at DeLamar in late<strong>1998</strong>. Limited production continuedto the end of the fourth quarterof <strong>1998</strong>.The facility will be ready to re-openwhen economic conditions and metalprices improve. <strong>Kinross</strong> has madeevery effort to identify opportunitiesfor those employees affected by thesuspension of operations.The Land Application Treatmentsystem (LAT) was successfully built,commissioned and operating in <strong>1998</strong>.The LAT, approved by state andfederal regulatory agencies, isan environmentally sound andeconomically efficient method ofeliminating surplus water throughevaporation. It allows us to lowerwater levels contained in the processwater storage area.31

O P E R A T I O N SOUTLOOKThe DeLamar Mine was placed in acare and maintenance state by themiddle of the first quarter of 1999.So that operations can resume in anefficient and cost effective manner,the facility will remain in a stand-bymode. The resumption of operationsat DeLamar is contingent uponan improvement in gold andsilver prices.DeLamar site personnel willcontinue to uphold <strong>Kinross</strong>’ strongcommitment to the environment.Activities will consist of ongoingsurface reclamation, watermanagement, water and airquality monitoring.GUANACOCHILEREVIEW OF OPERATIONSThe Guanaco Mine is approximately230 kilometers southeast ofAntofagasta, Chile.Although mining at Guanaco wascompleted in 1997, crushing andstacking continued into January,<strong>1998</strong> and recovery of metal from theleach pads continued throughout theyear. Production has exceededbudget (15,019 equivalent ouncesversus a budget of about 12,000equivalent ounces to <strong>Kinross</strong>’account). Recovery results of 57%almost hit the projected target of57.5%. Recovery was slowed in midyearas piping was removed and theheaps recontoured to their final slope.OUTLOOKGuanaco’s production target for theyear is about 16,000 ounces of goldequivalent at total cash costs of justover $200 per ounce. Total recoveryfrom the heaps is now projected atover 59%. Study is also underway onadditional mining and explorationopportunities on the substantial landposition at Guanaco.All reclamation that can be donewithout interrupting production isnow completed.However, as a result of reslopingthe heaps and the improvedsolution distribution, metal recoveryimproved to the point that theproject is currently runningboth circuits.32

O P E R A T I O N SHAYDEN HILLU.S.A.REVIEW OF OPERATIONSThe Hayden Hill Mine is located190 kilometers northeast ofReno, Nevada.Mining at Hayden Hill wascompleted late in 1997. Recovery ofmetal from the leach pads continuedthroughout <strong>1998</strong>. <strong>Gold</strong> recovery fromthe pads reached 65.5% versus abudget of 62.9% by year’s end.Total gold equivalent ouncesrecovered for the year to <strong>Kinross</strong>’account was 18,922 ounces exceededbudget by over 10,000 ounces.In addition to production, propertyclosure issues were the major priorityduring the year. The crushing plantand other minor buildings were soldand removed from the site. Majorwork was completed on reslopingand revegetation of waste dumpsand the closure of the Providencepit was completed. An updatedand comprehensive reclamation planwas completed and submittedfor approval.OUTLOOKRecovery of gold from the leachpad will continue through the year2000. Production for 1999 isprojected at approximately 17,000equivalent gold ounces at totalcash costs of approximately $235per ounce.Reclamation of all areas not relatedto processing will continuethroughout the year. Resloping ofthe heap leach pad to its finalconfiguration will be completedduring the year.QRCANADAREVIEW OF OPERATIONSThe QR Mine is located in BritishColumbia approximately 70kilometers southeast of Quesnel.Due to declining gold prices, thedecision was made to ceaseoperations at QR. Open pitoperations at QR were completed thelast quarter of 1997. Undergroundproduction ended in February <strong>1998</strong>.Milling of stockpiled ore wascompleted in April. For the year,a total of 14,071 ounces of goldequivalent were recovered frommilling and mill cleanup at a totalcash cost of $253 per ounce of goldequivalent. As part of a detailedclosure plan, the mill and anyequipment remaining on site wasserviced and prepared for saleor storage. All other equipment wasremoved from site and sold or sentto other <strong>Kinross</strong> operations. Initialsite stabilization work was completedduring the year. Reclamation plansare being updated and the majorityof the closure reclamation workis scheduled for completion in 1999.33