June 2013 - Cahaba GBA

June 2013 - Cahaba GBA

June 2013 - Cahaba GBA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

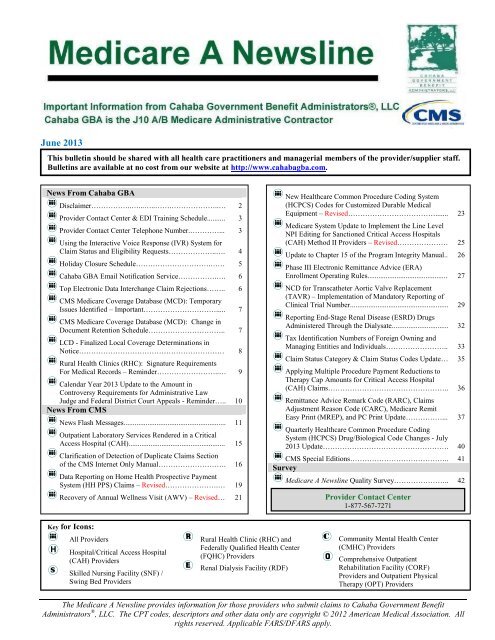

<strong>June</strong> <strong>2013</strong>This bulletin should be shared with all health care practitioners and managerial members of the provider/supplier staff.Bulletins are available at no cost from our website at http://www.cahabagba.com.News From <strong>Cahaba</strong> <strong>GBA</strong>Disclaimer……………..…...…..…….………………..… 2Provider Contact Center & EDI Training Schedule.......... 3Provider Contact Center Telephone Number.…………... 3Using the Interactive Voice Response (IVR) System forClaim Status and Eligibility Requests………………..…. 4Holiday Closure Schedule………………………….…… 5<strong>Cahaba</strong> <strong>GBA</strong> Email Notification Service…………….…. 6Top Electronic Data Interchange Claim Rejections…….. 6CMS Medicare Coverage Database (MCD): TemporaryIssues Identified – Important…………………………..... 7CMS Medicare Coverage Database (MCD): Change inDocument Retention Schedule………………………….. 7LCD - Finalized Local Coverage Determinations inNotice…………………………………………………… 8Rural Health Clinics (RHC): Signature RequirementsFor Medical Records – Reminder……………………..… 9Calendar Year <strong>2013</strong> Update to the Amount inControversy Requirements for Administrative LawJudge and Federal District Court Appeals - Reminder….. 10News From CMSNews Flash Messages........................................................ 11Outpatient Laboratory Services Rendered in a CriticalAccess Hospital (CAH)..................................................... 15Clarification of Detection of Duplicate Claims Sectionof the CMS Internet Only Manual………………………. 16Data Reporting on Home Health Prospective PaymentSystem (HH PPS) Claims – Revised………………….… 19Recovery of Annual Wellness Visit (AWV) – Revised… 21New Healthcare Common Procedure Coding System(HCPCS) Codes for Customized Durable MedicalEquipment – Revised………………………………....... 23Medicare System Update to Implement the Line LevelNPI Editing for Sanctioned Critical Access Hospitals(CAH) Method II Providers – Revised………………… 25Update to Chapter 15 of the Program Integrity Manual.. 26Phase III Electronic Remittance Advice (ERA)Enrollment Operating Rules............................................ 27NCD for Transcatheter Aortic Valve Replacement(TAVR) – Implementation of Mandatory Reporting ofClinical Trial Number...................................................... 29Reporting End-Stage Renal Disease (ESRD) DrugsAdministered Through the Dialysate............................... 32Tax Identification Numbers of Foreign Owning andManaging Entities and Individuals…………………….. 33Claim Status Category & Claim Status Codes Update… 35Applying Multiple Procedure Payment Reductions toTherapy Cap Amounts for Critical Access Hospital(CAH) Claims………………………………………….. 36Remittance Advice Remark Code (RARC), ClaimsAdjustment Reason Code (CARC), Medicare RemitEasy Print (MREP), and PC Print Update……………... 37Quarterly Healthcare Common Procedure CodingSystem (HCPCS) Drug/Biological Code Changes - July<strong>2013</strong> Update……………………………………………. 40CMS Special Editions………………………………….. 41SurveyMedicare A Newsline Quality Survey………………….. 42Provider Contact Center1-877-567-7271Key for Icons:All ProvidersHospital/Critical Access Hospital(CAH) ProvidersSkilled Nursing Facility (SNF) /Swing Bed ProvidersRural Health Clinic (RHC) andFederally Qualified Health Center(FQHC) ProvidersRenal Dialysis Facility (RDF)Community Mental Health Center(CMHC) ProvidersComprehensive OutpatientRehabilitation Facility (CORF)Providers and Outpatient PhysicalTherapy (OPT) ProvidersThe Medicare A Newsline provides information for those providers who submit claims to <strong>Cahaba</strong> Government BenefitAdministrators ® , LLC. The CPT codes, descriptors and other data only are copyright © 2012 American Medical Association. Allrights reserved. Applicable FARS/DFARS apply.

DisclaimerThis educational material was prepared as a tool to assist Medicare providers and other interested parties and is notintended to grant rights or impose obligations. Although every reasonable effort has been made to assure the accuracyof the information within this module, the ultimate responsibility for the correct submission of claims lies with theprovider of services. <strong>Cahaba</strong> Government Benefit Administrators ® , LLC employees, agents, and staff make norepresentation, warranty, or guarantee that this compilation of Medicare information is error-free and will bear noresponsibility or liability for the results or consequences of the use of these materials. This publication is a generalsummary that explains certain aspects of the Medicare Program, but is not a legal document. The official MedicareProgram provisions are contained in the relevant laws, regulations, and rulings.We encourage users to review the specific statues, regulations and other interpretive materials for a full and accuratestatement of their contents. Although this material is not copyrighted, CMS prohibits reproduction for profit makingpurposes.American Medical Association Notice and DisclaimerCPT codes, descriptors and other data only are Copyright 2012 American Medical Association. All rights reserved.ICD-9 NoticeThe ICD-9-CM codes and descriptors used in this material are Copyright 2012 under uniform copyright convention.All rights reserved.The Medicare A Newsline provides information for those providers who submit claims to <strong>Cahaba</strong> Government BenefitAdministrators ® , LLC. The CPT codes, descriptors and other data only are copyright © 2012 American Medical Association. Allrights reserved. Applicable FARS/DFARS apply.

News from <strong>Cahaba</strong> <strong>GBA</strong> for All Part A ProvidersProvider Contact Center (PCC) and Electronic Data Interchange (EDI)Training ScheduleMedicare is a continuously changing program, and it is important that we provide correct and accurateanswers to your questions. To better serve the provider community, the Centers for Medicare & MedicaidServices (CMS) allows the Provider Contact Centers and the EDI Help Desk the opportunity to offertraining to their representatives. Listed below are the closed training dates and times:PCC Training DatesFriday, <strong>June</strong> 07, <strong>2013</strong>Friday, <strong>June</strong> 14, <strong>2013</strong>Friday, <strong>June</strong> 21, <strong>2013</strong>Friday, <strong>June</strong> 28, <strong>2013</strong>Time9:30 a.m.- 11:30 a.m. CT / 10:30 a.m.- 12:30 p.m. ET9:30 a.m.- 11:30 a.m. CT / 10:30 a.m.- 12:30 p.m. ET9:30 a.m.- 11:30 a.m. CT / 10:30 a.m.- 12:30 p.m. ET9:30 a.m.- 11:30 a.m. CT / 10:30 a.m.- 12:30 p.m. ETProvider Contact Center Telephone Number1-877-567-7271Our Interactive Voice Response (IVR) system is designed to assist providers in obtaining answers tonumerous issues through self-service options. Options on our IVR include information regarding patienteligibility, checks, claims, deductible and other general information. Please note that our Customer ServiceRepresentatives (CSRs) are available to answer questions that cannot be answered by the IVR. CSRs arephysically located in Birmingham, Alabama and Douglasville, Georgia. When your call is received, it isrouted to the next available representative. CSRs are available Monday through Friday 8:00 a.m. until 4:00p.m. in your time zone.Medicare A Newsline April <strong>2013</strong> 3

Using the Interactive Voice Response (IVR) System for Claim Status andEligibility Requests<strong>Cahaba</strong> Government Benefit Administrators ® , LLC is experiencing a high volume of providers who areopting out of the Interactive Voice Response (IVR) system to speak to a Customer Service Representative(CSR) for information that can be accessed through the IVR.The Centers for Medicare and Medicaid Services (CMS) Internet Only Manual (IOM) Chapter 6 Section50.1 states:“Providers shall be required to use IVRs to access claim status and beneficiary eligibilityinformation. CSRs shall refer providers back to the IVR if they have questions about claims statusor eligibility that can be handled by the IVR. CSRs may provide claims status and/or eligibilityinformation if it is clear that the provider cannot access the information through the IVR because theIVR is not functioning.”If you are requesting whether <strong>Cahaba</strong> <strong>GBA</strong> has received a claim or if a claim has finalized, this isconsidered a claim status request.In addition, according to IOM Chapter 6 Section 80.3.4, “If a CSR or written inquiry correspondent receivesan inquiry about information that can be found on a Remittance Advice (RA), the CSR/correspondentshould take the opportunity to educate the inquirer on how to read the RA, in an effort to encourage the useof self-service. The CSR/correspondent should advise the inquirer that the RA is needed in order to answerany questions for which answers are available on the RA. Providers should also be advised that any billingstaff or representatives that make inquiries on his/her behalf will need a copy of the RA.”<strong>Cahaba</strong> <strong>GBA</strong> CSRs have visibility as to the path the provider takes in the IVR and/or whether they opt outto speak with a representative up front. The CSR will instruct the provider to call back and utilize the IVRif they did not attempt to use this self service option as required by CMS.Medicare A Newsline April <strong>2013</strong> 4

<strong>Cahaba</strong> <strong>GBA</strong>’s Email Notification Service Subscription Process<strong>Cahaba</strong> <strong>GBA</strong> recently implemented changes that simplify the process in which providers subscribe to ouremail notification service (Listserv). New members simply provide their name, city, state, zip code, emailaddress, and an optional password. In addition, they can select from two different lists to subscribe to:J10 Part A NewsJ10 Part B NewsOnce you are a member, you can edit your profile to:unsubscribe from all listssubscribe to additional listsupdate your email addresschange your name or address informationchange what <strong>Cahaba</strong> lists you are subscribed to.Already a Member?If you enrolled to <strong>Cahaba</strong>’s Listserv prior to November 1, 2009, you will continue to receive messages.However, depending on the selections you made on the subscription form when you originally enrolled, youmay receive messages from more than one <strong>Cahaba</strong> list. To change the list you are subscribed to, access the“Edit Your Email Notification Service Member Profile” Web page to review and edit your profile.In order to ensure that you receive your subscription emails and announcements from <strong>Cahaba</strong> <strong>GBA</strong>, pleaseadd us to your contact lists, adjust your spam settings, or follow the instructions from your email provideron how to prevent our emails from being marked “Spam” or “Junk Mail”.Top Electronic Data Interchange (EDI) Claim RejectionsThe Electronic Data Interchange (EDI) Department publishes information on the Top 10 EDI ClaimRejections for HIPAA 5010 on our website. The rejections are updated monthly and can be viewed athttp://www.cahabagba.com/part-a/claims/electronic-data-interchange-edi/top-edi-claim-rejections/.The information published has been extracted from the 277CA transactions created for the month indicated.The 277CA indicates files, batch, and claim level rejections. Information about the 277CA transactions canbe found on the Washington Publishing Company's website at http://www.wpc-edi.com/. For moreinformation about specific edits, visit the CMS website athttp://www.cms.gov/Medicare/Billing/MFFS5010D0/Technical-Documentation.html.Referring to these reports will allow you to correct and resubmit claims quickly, reducing delay of payment.Medicare A Newsline April <strong>2013</strong> 6

CMS Medicare Coverage Database (MCD): Temporary Issues Identified -ImportantThe following issues have been identified with the Centers for Medicare & Medicaid Services (CMS)Medicare Coverage Database (MCD).Currently, when MCD users choose to print a Local Coverage Determination (LCD) or Article by selectingthe ‘Print Record’ button and the ‘Print This Page’ button from within the document, the completedocument does not print. The printing issue is specific to those using Internet Explorer as their browsertype. As an alternative, you can use a different browser type (i.e. Firefox) or use the ‘Need a PDF’ functionand then print using Internet Explorer.The archived versions of LCDs and Articles accessed from the link to the ‘MCD Archive Site’ that islocated at the bottom of an active document are not displaying correctly. The correct archived documentscan be accessed from the link to the ‘MCD Archive Site’ located on the ‘Overview’ section of the MCD onthe CMS.gov website. A link to the MCD Archive is also provided on the ‘Local Coverage Determination(LCD) & Articles’ page of the Medical Review section on <strong>Cahaba</strong> <strong>GBA</strong>’s web site.The CMS MCD support team is working on a resolution to these issues; however, there is no estimated timefor a fix. Notification will be posted when the issue is resolved. <strong>Cahaba</strong> <strong>GBA</strong> does not manage the CMSMCD.CMS Medicare Coverage Database (MCD): Change in Document RetentionSchedulePlease be advised effective April 11, <strong>2013</strong> the time table for when Local Coverage Determinations (LCDs)and Local Coverage Articles on the CMS Medicare Coverage Database (MCD) move from the MCD to theMCD Archive website is changing.The new schedule shortens the amount of time that documents remain on the CMS MCD. The new lifecycle for Coverage Documents on the MCD is as follows:All superseded versions of active LCDs and Articles will remain on the MCD for one year.All retired LCDs and Articles will remain on the MCD for 90 days.Proposed/Draft LCDs that have been released to final will remain on the MCD for 90 days.After these timeframes, the documents can be accessed from the MCD Archive.Active and retired LCDs and Articles can also be accessed from the Local Coverage Determinations (LCDs)and Articles page of the Medical Review section of the <strong>Cahaba</strong> <strong>GBA</strong> website.Medicare A Newsline April <strong>2013</strong> 7

LCD - Finalized Local Coverage Determinations in NoticeNotice Period: <strong>June</strong> 15, <strong>2013</strong> through July 31, <strong>2013</strong>Effective Date: August 1, <strong>2013</strong>The Local Coverage Determinations (LCDs) listed below have been finalized. Following the Notice Periodabove, the LCDs will become effective.When the Notice Period begins, the finalized LCDs can be accessed from the Local CoverageDeterminations (LCDs) and Articles page of the ‘Medical Review’ section of the <strong>Cahaba</strong> <strong>GBA</strong> website(select ‘LCDs’ for your state, and choose ‘Future LCDs/Future contract number LCDs’).A ‘Comment and Response’ document is located at the end of each LCD under the Related Documentsfield.Medicine: Nerve Conduction Studies (NCS) and Electromyography (EMG) (L33068)This new LCD describes coverage conditions for NCS and EMG CPT codes 95905, 95907 - 95913,95933, 95937 and 51785, 92265, 95860, 95861, 95863 - 95870, 95872 - 95874, 95885 – 95887. TheLCD also describes the noncoverage of HCPCS code G0255Radiology: Proton Beam Therapy (L33070)This new LCD describes coverage conditions for CPT codes 77520, 77522, 77523, 77525 fortreatment of various neoplasms.Surgery: Nerve Blocks and Electrostimulation for Peripheral Neuropathy (L33072)This new LCD describes the noncoverage of CPT 64450, with or without the use ofelectrostimulation, for treatment of neuropathies or peripheral neuropathies caused by underlyingsystemic diseases.A printed version of the LCDs is available upon request by contacting the Provider Contact Center.Medicare A Newsline April <strong>2013</strong> 8

Rural Health Clinics (RHC): Signature Requirements for Medical Records- ReminderComprehensive Error Rate Testing (CERT) data analysis and medical record review has shown insufficientdocumentation pertaining to signature requirements. CERT review samples of Rural Health Clinics (RHC)medical records did not include required physician signatures.The following examples of documentation errors were identified during CERT reviews:The rendering provider’s signature was missing from clinic visit notesNo signature attestation was submittedNotes with typed initials onlyInitial submission includes unauthenticated progress note. CERT requested a signature attestation; aduplicate altered progress note with the addition of a hand written signature was submittedIn order to prevent signature errors, providers are reminded to follow CMS signature requirementsguidelines. Based on the Program Integrity Manual Publication 100-08, Chapter 3; Section 3.3.2.4 -Signature Requirements, acceptable signature methods are handwritten or electronic. If a signature ismissing or illegible, providers must submit a signature attestation or signature log, and include a legibleidentifier with typed initials. To amend, correct, or add delayed entries to the medical record, refer toChange Request 8105: Update for Amendments, Corrections and Delayed Entries in MedicalDocumentation, in the resource list below.Submitting accurate medical records to the CERT Documentation Contractor will help lower claim paiderror rates and facilitate a timelier record review. For additional CERT, signature requirements, and RHCguidelines, refer to the following references:Comprehensive Error Rate Testing (CERT) – The Centers for Medicare & Medicaid Services (CMS)implemented the CERT program to measure improper payments in the Medicare fee-for-service(FFS) program.Medicare Program Integrity Manual Chapter 3 - Verifying Potential Errors and Taking Corrective Actions –Section 3.3.2.4 - Signature RequirementsChange Request 6698: Signature Guidelines for Medical Review PurposesComprehensive Error Rate Testing (CERT): Submitting CERT DocumentationChange Request 8105 - Program Integrity Manual Pub. 100 - 8: Chapter 3, Section 3.3.2.5 Amendments,Corrections and Delayed Entries in Medical DocumentationMedicare Benefit Policy Manual Chapter 13 - Rural Health Clinic (RHC) and Federally Qualified HealthCenter (FQHC) ServicesMedicare A Newsline April <strong>2013</strong> 9

Calendar Year <strong>2013</strong> Update to the Amount in Controversy Requirementsfor Administrative Law Judge and Federal District Court Appeals -ReminderThe Medicare Prescription Drug, Improvement, and Modernization Act requires an annual reevaluation ofthe dollar amount in controversy required for an Administrative Law Judge (ALJ) hearing or FederalDistrict Court review. The amount in controversy increases by the percentage increase in the medical carecomponent of the consumer price index for all urban consumers (U.S. city average) for July 2003 to the Julypreceding the year involved. Any amount that is not a multiple of $10 will be rounded to the nearestmultiple of $10.The amount that must remain in controversy for ALJ hearing requests filed on or before December 31,2012, is $130. This amount increases to $140 for ALJ hearing requests filed on or after January 1, <strong>2013</strong>.The amount that must remain in controversy for Federal District Court review requests filed on or beforeDecember 31, 2012 is $1,350. This amount increases to $1,400 for appeals to Federal District Court filedon or after January 1, <strong>2013</strong>.Medicare A Newsline April <strong>2013</strong> 10

NEW Products from the Medicare Learning Network® (MLN)Providing the Annual Wellness Visit (AWV), Booklet, ICN 907786, Downloadable only.Recovery Auditors Findings Resulting from Medical Necessity Reviews of Renal and Urinary TractDisorders, Podcast, ICN 906985, Downloadable only.Safeguarding Your Medical Identity, Web-based Training (WBT) Course - Continuing educationcredits are available to learners who successfully complete this course. See course description formore information. To access the WBT, go to Web-Based Training, and click on ‘Web-BasedTraining Courses’ under ‘Related Links’ at the bottom of the web page.Discharge Planning, Booklet, ICN 908184, downloadable.An index of Recovery Audit and Comprehensive Error Rate Testing (CERT) findings fromcurrent and previous newsletters is now available. The index is customized and sorted by providertypes to help providers quickly identify those findings that impact them directly. Visit the MedicareQuarterly Provider Compliance Newsletter Archive Page to download the index and view an archiveof previous newsletters.Sole Community Hospital, Fact Sheet, ICN 006399, downloadableThe Medicare Fee-for-Service Recovery Audit Program Process, Educational Tool, ICN 908524,downloadable.Internet-based Provider Enrollment, Chain and Ownership System (PECOS) Contact Information,Fact Sheet, ICN 903766, Downloadable only.REVISED Products from the Medicare Learning Network® (MLN)Inpatient Rehabilitation Services: Complying with Documentation Requirements, Fact Sheet, ICN905643, Downloadable only.Contractor Entities At A Glance: Who May Contact You About Specific Centers for Medicare &Medicaid Services (CMS) Activities, Educational Tool, ICN 906983, Downloadable only.Medicare Claim Submission Guidelines, Fact Sheet, ICN 906764, Hard Copy only.Preventive Immunizations, Booklet, ICN 907787, Downloadable only.Medicare Claim Review Programs: MR, NCCI Edits, MUEs, CERT, and RAC, Booklet, ICN 006973,DownloadableHospital Reclassifications, Fact Sheet, ICN 907243, Downloadable only.Basic Medicare Information for Providers and Suppliers, Guide, ICN 005933, Downloadable only.Medicare Vision Services, Fact Sheet, ICN 907165, Downloadable only.Mass Immunizers and Roster Billing, Fact Sheet, ICN 907275, Downloadable.Long Term Care Hospital Prospective Payment System: Short-Stay Outliers, Fact Sheet, ICN 006394,Downloadable only.Long Term Care Hospital Prospective Payment System: High Cost Outliers, Fact Sheet, ICN 006396,Downloadable only.The DMEPOS Competitive Bidding Program: Grandfathering Requirements for Non-ContractSuppliers, Fact Sheet, ICN 900923, Downloadable only.End-Stage Renal Disease Prospective Payment System, Fact Sheet, ICN 905143, Downloadable only.DMEPOS Competitive Bidding Program Hospitals That Are Not Contract Suppliers, Fact Sheet, ICN905463, Downloadable only.Medicare A Newsline April <strong>2013</strong> 12

ICD-10 Implementation DateThe ICD-10-related implementation date is now October 1, 2014, as announced in final rule CMS-0040-Fissued on August 24, 2012. This final rule is available athttp://www.cms.gov/Medicare/Coding/ICD10/Statute_Regulations.html on the Centers for Medicare & MedicaidServices (CMS) website. The switch to the new code set will affect every aspect of how your organizationprovides care, but with adequate planning and preparation, you can ensure a smooth transition for yourpractice. Keep Up to Date on ICD-10. Please visit the ICD-10 website for the latest news and resources tohelp you prepare.<strong>2013</strong> ICD-10-PCS FilesThe <strong>2013</strong> ICD-10-PCS files have been posted on the <strong>2013</strong> ICD-10 PCS and GEMs web page. This includesthe <strong>2013</strong> Index and Tabular files, guidelines, code titles, addendum to reference manual, and slides. The<strong>2013</strong> ICD-10-PCS files contain information on the new procedure coding system, ICD-10-PCS, that is beingdeveloped as a replacement for ICD-9-CM, Volume 3. The <strong>2013</strong> General Equivalent Mappings (GEMs),Reimbursement Mappings, and Reference Manual will be posted at a later date.ICD-10 MS-DRG Version 30.0 Now AvailableThe ICD-10 Medicare Severity Diagnosis Related Grouper (MS-DRG), version 30.0 (FY <strong>2013</strong>) mainframeand PC software is now available. This software is being provided to offer the public a better opportunity toreview and comment on the ICD-10 MS-DRG conversion of the MS-DRGs. This software can be orderedthrough the National Technical Information Service (NTIS) website. A link to NTIS is also available in theRelated Links section of the ICD-10 MS-DRG Conversion Project website. The final version of the ICD-10MS-DRGs will be subject to formal rulemaking and will be implemented on October 1, 2014.Nursing Home Free ToolkitCMS Distributes Free Hand in Hand Toolkit to Every Nursing Home in the Nation - Nursing Homes, CMSRegional Offices, and State Survey Agencies will receive a free toolkit from CMS by January 31, <strong>2013</strong>.Hand in Hand is a high quality training series for nursing homes that emphasizes person-centered care forpersons with dementia, as well as the prevention of abuse. These toolkits are being mailed free to everynursing home in the country by IPC Systems, a CMS contractor. While annual training for nurse aides ondementia care and abuse prevention is required in current nursing home regulations, CMS does not requirenursing homes to use the Hand in Hand training specifically. Other tools and resources are also available.More information is available on the Hand in Hand website. If you have questions or comments regardingthese materials, please contact cms_training_support@icpsystems.com via email.Medicare A Newsline April <strong>2013</strong> 13

Text-Only Rural Health Fact Sheets – ReleasedTo assist rural providers who have limited internet access, the following rural health publications are nowavailable in text-only format:Telehealth Services Text-OnlySwing Bed Services Text-OnlyRural Health Clinic Text-OnlyMedicare Shared Savings Program, Accepting Notices of Intent to ApplyCMS is accepting Notices of Intent to Apply for the Medicare Shared Savings Program, Program Start DateJanuary 1, 2014 – NOI Due by May 31. If you are interested in applying for participation for the January 1,2014 program start date of the Medicare Shared Savings Program, please submit a Notice of Intent to Apply(NOI) by May 31, <strong>2013</strong>. For more information, visit the Shared Savings Program Application web page. Tolearn more about the application process, register to attend upcoming National Provider Calls on <strong>June</strong> 20and July 18.Medicare A Newsline April <strong>2013</strong> 14

News from CMS for Part A ProvidersOutpatient Laboratory Services Rendered in a Critical Access Hospital(CAH)MLN Matters® MM8025Provider Types AffectedThis MLN Matters® Article is intended providers submitting claims to Medicare contractors (FiscalIntermediaries (FIs) and A/B Medicare Administrative Contractors (MACs)) for services provided toMedicare beneficiaries.Provider Action NeededThis article is based on Change Request (CR) 8025 which informs Medicare contractors about theimplementation of the necessary system changes to apply beneficiary cost sharing for non clinicaldiagnosticlaboratory services rendered in an outpatient Critical Access Hospital (CAH) setting. Make surethat your billing staffs are aware of these changes. See the Background and Additional Information Sectionsof this article for further details regarding these changes.BackgroundCurrently, all outpatient laboratory services, other than clinical diagnostic laboratory services, do not havecoinsurance and/or deductible applied to them. Medicare beneficiaries are not liable for any coinsurance,deductible, copayment, or other cost sharing amounts for outpatient clinical diagnostic laboratory services.However, there are non-clinical diagnostic laboratory services for which coinsurance and deductible shouldbe applicable. CR8025 implements the necessary system changes to apply beneficiary cost sharing for nonclinical-diagnostic laboratory services rendered in an outpatient CAH setting.Per the regulation at CFR 413.70(b)(3)(iii), payment to a CAH, other than for clinical diagnostic laboratorytests, is subject to the Part B deductible and coinsurance amounts as determined under 410.152(k), 410.160,and 410.161. Medicare contractors will apply the correct coinsurance and deductible based on the HCPCSfile.Additional InformationThe official instruction, CR8025 issued to your FI or A/B MAC, regarding this change may be viewed athttp://www.cms.hhs.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R2581CP.pdf on theCMS website.Medicare A Newsline April <strong>2013</strong> 15

Clarification of Detection of Duplicate Claims Section of the CMS InternetOnly ManualMLN Matters® MM8121Provider Types AffectedThis MLN Matters® Article is intended for physicians, providers, and suppliers submitting claims toMedicare contractors (carriers, Fiscal Intermediaries (FIs), A/B Medicare Administrative Contractors (A/BMACs), Durable Medical Equipment Medicare Administrative Contractors (DME MACs), and/or RegionalHome Health Intermediaries (RHHIs)) for services provided to Medicare beneficiaries.Provider Action NeededThe purpose of this Change Request (CR) is for clarification only and does not constitute any change inMedicare policy. The Centers for Medicare & Medicaid Services (CMS) is alerting providers to the updateof the Medicare Internet-Only Manual (IOM), Chapter 1, Section 120: "Detection of Duplicate Claims."Change Request (CR) 8121, from which this article is taken, alerts providers that the claims processingsystems contain edits which identify duplicate claims and suspect duplicate claims. All exact duplicateclaims or claim lines are auto-denied or rejected (absent appropriate modifiers). Suspect duplicate claimsand claim lines are suspended and reviewed by the Medicare contractors to make a determination to pay ordeny the claim or claim line.Please be aware that Medicare contractors examine and compare to the prior bill any bill that is identified asa suspect duplicate. If the services (revenue or HCPCS codes) on a claim duplicate the services for the other,contractors will check the diagnosis. If the diagnosis codes are duplicates, contractors will request anexplanation before making payment. The official instruction for CR8121 spells out what your Medicarecontractor looks for when analyzing the history of paid and pending claims, duplicate claims and the criteriafor detecting suspect duplicate claims.BackgroundSome claims that appear to be duplicates are actually claims or claim lines that contain an item or service, ormultiple instances of an item or service, for which Medicare payment may be made. Correct coding rulesapplicable to all billers of health care claims encourage the appropriate use of condition codes or modifiersto identify claims that may appear to be duplicates, but are in fact, not.For example, there are some Healthcare Common Procedure Coding System (HCPCS) modifiers that areappropriate to be appended to some services and can indicate that a claim line is not a duplicate of aprevious line on the claim. Level I modifiers would typically be used by a biller to indicate that a potentialduplicate claim or claim line is not, in fact, a duplicate. Level II modifiers may also be used. The Level IImodifiers “RT” and “LT,” for example, indicate that a service was performed on the right and left side ofthe body, respectively.However, not every HCPCS code has an appropriate modifier to indicate that a claim line is not a duplicate.In that case, the claims and claim lines are reviewed by Medicare Contactors’ local software modules for adetermination, or they suspend for contractor review.Medicare A Newsline April <strong>2013</strong> 16

Key Points of CR8121Exact DuplicatesA. Submission of Institutional ClaimsClaims or claim lines that have been determined an exact duplicate are rejected and do not have appealrights. An exact duplicate for institutional claims is a claim or claim line that exactly matches anotherclaim or claim line with respect to the following elements:Health Insurance Claim (HIC) number;Type of Bill;Provider Identification Number;From Date of Service;Through Date of Service;Total Charges (on the line or on the bill); andHCPCS, CPT-4, or Procedure Code modifiers.Whenever any of the following claim situations occur, your Medicare contractor develops procedures toprevent duplicate payment of claims. This includes, but is not limited to:Outpatient payment is claimed where the date of service is totally within inpatient dates ofservice at the same or another provider.Outpatient bill is submitted for services on the day of an inpatient admission or the day beforethe day of admission to the same hospital.Outpatient bill overlaps an inpatient admission period.Outpatient bill for services matches another outpatient bill with a service date for the samerevenue code at the same provider or under a different provider number.B. Claims Submitted by Physicians, Practitioners, and other Suppliers (except DMEPOSSuppliers)Claims or claim lines that have been determined an exact duplicate are denied. Such denials may beappealed. An exact duplicate for physician and other supplier claims submitted to a MAC or carrier is aclaim or claim line that exactly matches another claim or claim line with respect to the followingelements:HIC Number;Provider Number;From Date of Service;Through Date of Service;Type of Service;Procedure Code;Place of Service; andBilled Amount.Medicare A Newsline April <strong>2013</strong> 17

C. Claims Submitted by DMEPOS SuppliersClaims or claim lines that have been determined an exact duplicate are denied. Such denials may not beappealed. An exact duplicate for DMEPOS Supplier claims submitted to a DME MAC is a claim orclaim line that exactly matches another claim or claim line with respect to the following elements:Suspect DuplicatesHIC Number;From Date of Service;Through Date of Service;Place of service;HCPCS;Type of Service;Billed Amount; andSupplier.Suspect duplicates are claims or claim lines that contain closely aligned elements and require that the claimbe reviewed.A. Criteria for Detecting Suspect Duplicates on Institutional ClaimsA “suspect duplicate” claim is a claim being processed which, when compared to Medicare's history orpending files, begins with these characteristics:Match on the beneficiary information;Match on provider identification; andSame date of service or overlapping dates of service.B. Suspect Duplicate Claims Submitted by Physicians and other Suppliers (including DMEPOSClaims)The criteria for identifying suspect duplicate claims submitted by physicians and other suppliers varyaccording to the type of billing entity, type of item or service being billed, and other relevant criteria.The denial of claim as a duplicate of another claim may be appealed when the denial is based on criteriaother than those specified above for exact duplication.Additional InformationYou can find the official instruction, CR8121, issued to your FI, carrier, A/B MAC, RHHI, or DME MACby visiting http://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R2678CP.pdf on the CMS website.Medicare A Newsline April <strong>2013</strong> 18

Data Reporting on Home Health Prospective Payment System (HH PPS)ClaimsMLN Matters® MM8136 – RevisedProvider Types AffectedThis MLN Matters® Article is intended for Home Health Agencies (HHAs) that bill Regional Home HealthIntermediaries (RHHIs) or Medicare Administrative Contractors (A/B MACs) for home health servicesprovided to Medicare beneficiaries.Provider Action NeededThis article is based on Change Request (CR) 8136 which adds new data reporting requirements for HomeHealth Prospective Payment System (HH PPS) claims. Home Health Agencies (HHAs) must report newcodes indicating the location of where services were provided. Make sure that your billing staffs are awareof these changes.BackgroundGenerally, Original Medicare makes payment under the HH PPS on the basis of a national standardized 60-day episode payment rate that is adjusted for the applicable case-mix and wage index. The nationalstandardized 60-day episode rate pays for the delivery of home health services, which includes the six homehealth disciplines (skilled nursing, home health aide, physical therapy, speech-language pathology,occupational therapy, and medical social services). Claims must report all home health services provided tothe beneficiary within the episode.Healthcare Common Procedure Coding System (HCPCS) codes Q5001 through Q5009 currently describewhere hospice services were provided (in the patient’s home, assisted living facility, etc). These codeshave been reported on hospice claims since 2007.Medicare is planning to capture data to show where home health services were provided by requiringHome Health Agencies (HHAs) to report the location on the claim.Effective for HH episodes beginning on or after July 1, <strong>2013</strong>, HHAs are to use the HCPCS codes Q5001,Q5002, and Q5009 on home health claims to report where home health services were provided. Thefollowing table lists the definitions of the Q codes Q5001, Q5002, and Q5009, which were revised effectiveApril 1, <strong>2013</strong>:HCPCS CodeQ5001Q5002Q5009DefinitionHospice or home health care provided in patient’s home/residenceHospice or home health care provided in assisted living facilityHospice or home health care provided in place not otherwisespecified (NO)The patient’s residence is wherever he or she makes his or her home. This may be his or her own dwelling,an apartment, a relative’s home, a home for the aged, or some other type of institution. Q code Q5002Medicare A Newsline April <strong>2013</strong> 19

should be used to indicate that home health services were provided at an assisted living facility (as definedby the State in which the beneficiary is located). Conversely, Q code Q5001 should be used to indicate thathome health services provided at a patient’s residence except in the cases where the services are provided atan assisted living facility. Finally, Q code Q5009 may be reported in the rare instance an HHA believes thedefinitions of Q5001 and Q5002 do not accurately describe the location where services are provided.The location where services were provided should be reported along with the first billable visit in a HH PPSepisode. In addition to reporting a service line according to current instructions, HHAs must report anadditional line item with the same revenue code and date of service, reporting one of the three Q codes(Q5001, Q5002, and Q5009), one unit, and a nominal charge (e.g., a penny).If the location where services were provided changes during the episode, the new location should bereported with an additional line corresponding to the first visit provided in the new location.Note: Revisions to the definitions of the Q codes above (Q5001, Q5002, and Q5009) will be published inthe HCPCS update on March 31, <strong>2013</strong>.Billing InformationNote the following billing requirements:HCPCS codes Q5001, Q5002, or Q5009 must be reported on HH PPS claims containing revenuecode 042X, 043X, 044X, 055X, 056X, or 057X or the claim will be returned to the provider.The line item date of service of the line reporting Q5001, Q5002, or Q5009 must match the earliestdated HH visit line (revenue codes 042X, 043X, 044X, 055X, 056X, or 057X) on the claim or theclaim will be returned to the provider.When more than one line on an HH PPS claim reports Q5001, Q5002, or Q5009, then the sameHCPCS code must not be reported on consecutive dates or the claim will be returned to the provider.Claim lines reporting Q5001, Q5002, or Q5009 are not included in the visit counts passed to the HHPricer, nor are they counted in medical policy parameters that count number of visits.Additional InformationThe official instruction, CR8136 issued to your A/B MACs and RHHIs regarding this change may beviewed at http://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R2680CP.pdfon the Centers for Medicare & Medicaid Services (CMS) website.Medicare A Newsline April <strong>2013</strong> 20

Recovery of Annual Wellness Visit (AWV) OverpaymentsMLN Matters® MM8153 - RevisedNote: This article was revised on April 11, <strong>2013</strong>, to reflect changes made to CR8153 on April 11. Therevision clarified the types of contractors taking recovery actions. Information has been added in the lastparagraph on page 2 of this article. The transmittal number, CR release date, and web address of the CR wasalso changed. All other information is unchanged.Provider Types AffectedThis MLN Matters® Article is intended for physicians and providers submitting claims to Medicarecontractors (Fiscal Intermediaries (FIs), carriers, and A/B MACs for certain services to Medicarebeneficiaries.What You Need to KnowThis article is based on Change Request (CR) 8153, which provides instructions to Medicare contractors forrecovering Annual Wellness Visit (AWV) overpayments that have been made.For claims with dates of service on and after January 1, 2011, that were processed by Medicareprocessed on and after April 4, 2011 through March 31, <strong>2013</strong>, Medicare systems allowed for anAWV visit (Healthcare Common Procedure Coding System (HCPCS) G0438 or G0439) on aninstitutional claim and a professional claim for the same patient on the same day. In some cases, thishas resulted in overpayments.CR8107 has updated those business requirements in order to prevent future overpayments.CR8153 instructs contractors on recovering those overpayments.Make sure that your billing staffs are aware of these changes.BackgroundCR7079 provided billing instructions for Annual Wellness Visit (AWV) services, which informed providersthat they may provide an initial AWV visit (HCPCS code G0438) to a beneficiary once in a lifetime. Inaddition, providers may provide a subsequent AWV (HCPCS code G0439) if the beneficiary has notreceived an Initial Preventive Physical Examination (IPPE) or an AWV within the past 12 months.For claims with dates of service on and after January 1, 2011, and processed on and after April 4, 2011through March 31, <strong>2013</strong>, the business requirements of CR7079 allowed an AWV visit (HCPCS G0438 andG0439) on an institutional claim and a professional claim for the same patient on the same day. In somecases, this resulted in double billing of the same service, since institutional and professional claims may besubmitted for the same service. In other instances, both a professional and an institutional claims have beenreceived for the same patient with different dates of service exceeding the allowed services under coverageguidelines. .As a response to double billing of AWV services, the Centers for Medicare & MedicaidServices (CMS) issued CR8107 to provide instructions for edits to be modified to only allow payment foreither the practitioner or the facility for furnishing the AWV. CR8107 will be implemented on April 1,<strong>2013</strong>. In the interim period from April 4, 2011, through March 31, <strong>2013</strong>, double billings have occurred andMedicare A Newsline April <strong>2013</strong> 21

may continue to occur. CR8153 provides instructions to contractors to initiate a recovery process for theseoverpayments of AWV services.Section 4103(c)(3)(A) of the Affordable Care Act specifically excludes the AWV from payment under theOutpatient Prospective Payment System (OPPS) and establishes payment for the AWV when performed in ahospital outpatient department under the Medicare Physician Fee Schedule (MPFS). CMS will accept claimsfor payment from facilities furnishing the AWV in a facility setting if no physician claim for professionalservices has been submitted to CMS for payment. That is, Medicare will pay either the practitioner or thefacility for furnishing the AWV providing Personalized Prevention Plan Services (PPPS) in a facilitysetting, and only a single payment under the MPFS will be allowed. Where an AWV payment for abeneficiary has been made, this is an overpayment that must be recovered.For providers who submit claims to Part B MACs or Medicare Carriers, contractors will useprocedures for recovering overpayments, as provided in the "Medicare Financial Management Manual",Chapter 3, Overpayments and Chapter 4, Debt Collection (http://www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/Downloads/fin106c03.pdf). For these overpayments that are recovered fromproviders, the beneficiaries will be notified that they are not responsible for reimbursing the providers forthe recovered amount.Additional InformationThe official instruction, CR8153, issued to your carrier and A/B MAC regarding this change, may beviewed at http://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R1209OTN.pdf on the CMS website.To review the initial MLN Matters® article, MM7079, that describes the AWV along with the particulars ofthe Personalized Prevention Plan Services (PPPS) go to http://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNMattersArticles/Downloads/MM7079.pdf on the CMSwebsite.To review the MLN Matters® article, MM8107, that describes the modified billing instructions for anAMW visit, go to http://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNMattersArticles/downloads/MM8107.pdf on the CMS website.Medicare A Newsline April <strong>2013</strong> 22

New Healthcare Common Procedure Coding System (HCPCS) Codes forCustomized Durable Medical EquipmentMLN Matters® MM8158 – RevisedNote: This article was revised on May 23, <strong>2013</strong>, to reflect the revised CR8158 issued on May 21. In thearticle, the CR release date, transmittal number, and the Web address for accessing the CR were revised. Allother information remains the same.Provider Types AffectedThis MLN Matters® Article is intended for Home Health Agencies (HHAs), other providers, and DurableMedical Equipment (DME) suppliers submitting claims to Medicare contractors (Regional Home HealthIntermediaries (RHHIs), Part A Medicare Administrative Contractors (A MACs), or Durable MedicalEquipment Medicare Administrative Contractors (DME MACs) for services to Medicare beneficiaries.Provider Action NeededEffective July 1, <strong>2013</strong>, the Centers for Medicare & Medicaid Services (CMS) is adding three newHealthcare Common Procedure Coding System (HCPCS) codes for payment of customized DME. ChangeRequest (CR) 8158, from which this article is taken, announces the addition of the following HCPCS codesto the HCPCS code set:K0008 (Custom Manual Wheelchair/Base);K0013 (Custom Motorized/Power Wheelchair Base); andK0900 (Custom Durable Medical Equipment, Other Than Wheelchairs).Make sure that you only use these codes for items that meet the definition of “customized item” that is usedspecifically for Medicare payment purposes only. Very few items meet the Medicare regulatory definitionof customized items. Effective July 1, <strong>2013</strong>, you should bill claims for custom manual wheelchairs, custompower wheelchairs, and all other custom DME that is not a wheelchair base using these respective codes.Claims for items billed using these codes will be manually processed and evaluated to ensure that the itemfurnished meets the Medicare definition of customized item.BackgroundCustomized DME ItemsPer 42 Code of Federal Regulations (CFR) Section 414.224(a), in order to be considered a customized DMEitem, a covered item (including a wheelchair) must be: 1) Uniquely constructed or substantially modified fora specific beneficiary according to a physician’s description and orders; and 2) So different from anotheritem used for the same purpose that the two items cannot be grouped together for pricing purposes.For example, a wheelchair that is custom fabricated, or substantially modified, so that it can meet the needsof wheelchair-confined, conjoined twins facing each other is unique and cannot be grouped with any otherwheelchair used for the same purpose. It is a one-of-a-kind item, fabricated to meet specific needs.Medicare A Newsline April <strong>2013</strong> 23

Medicare System Update to Implement the Line Level National ProviderIdentifier (NPI) Editing for Sanctioned Critical Access Hospitals (CAH)Method II ProvidersMLN Matters® MM8170 – RevisedEffective Date: October 1, <strong>2013</strong>Implementation Date: October 7, <strong>2013</strong>Note: This article was revised on May 20, <strong>2013</strong> to reflect the correct effective & implementation dates (see above).All other information remains the same.Provider Types AffectedThis MLN Matters® Article is intended for Critical Access Hospital (CAH) Method II Providers submittingclaims to Medicare contractors (Fiscal Intermediaries (FIs) and A/B Medicare Administrative Contractors(MACs)) for services to Medicare beneficiaries.Provider Action NeededThis article, based on Change Request (CR) 8170, instructs Medicare contractors on implementing a systemupdate to include the line level National Provider Identifier (NPI) field editing for Sanctioned CriticalAccess Hospital (CAH) providers reimbursed under the optional method. Please make sure that your billingstaffs are aware of updates.BackgroundWith the October 2012 implementation of CR7578, the Centers for Medicare & Medicaid Services (CMS)stored line level NPI information for CAHs. At the time of the implementation of CR7578, NPI editing wasnot applied at the line level. CR 8170 instructs the Fiscal intermediary Shared System (FISS) to apply thesame editing, conditions and sanctions for the line level NPI fields that are currently being applied at theclaim level. The policy for this provision remains the same.Additional InformationThe official instruction, CR 8170, issued to your FI and A/B MAC regarding this change, may be viewed athttp://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R1214OTN.pdf on theCMS website.Medicare A Newsline April <strong>2013</strong> 25

Update to Chapter 15 of the Program Integrity Manual (PIM)MLN Matters® MM8222Provider Types AffectedThis MLN Matters® Article is intended for physicians, providers and suppliers submitting claims toMedicare contractors (carriers, Fiscal Intermediaries (FIs), Regional Home Health Intermediaries (RHHIs),and A/B Medicare Administrative Contractors (MACs)) for services to Medicare beneficiaries.What You Need to KnowThis article is based on Change Request (CR) 8222, which makes several revisions to Chapter 15 of theCenters for Medicare & Medicaid Services (CMS) "Medicare Program Integrity Manual." The keyclarification is as follows:Sections 15.25.1.2 and 15.25.2.2 (Reconsideration Requests) are revised as follows: Consistent with42 CFR 498.24(a), the provider, the supplier, or the Medicare contractor may submit corrected, new,or previously omitted documentation or other facts in support of its reconsideration request of aprovider enrollment denial or revocation at any time prior to the Hearing Officer's (HO’s) decision.The HO must determine whether the denial or revocation is warranted based on all of the evidencepresented. This includes:o The initial determination itself,o The findings on which the initial determination was based,o The evidence considered in making the initial determination, ando Any other written evidence submitted under 42 CFR 498.24(a), taking into account factsrelating to the status of the provider or supplier subsequent to the initial determination.Additional InformationThe official instruction, CR8222 issued to your FI, RHHI, carrier, or A/B MAC regarding this change maybe viewed at http://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R461PI.pdf on the CMS website.Medicare A Newsline April <strong>2013</strong> 26

Phase III Electronic Remittance Advice (ERA) Enrollment Operating RulesMLN Matters® MM8223Provider Types AffectedThis MLN Matters® Article is intended for physicians, providers and suppliers enrolling for ElectronicRemittance Advice (ERA) with Medicare contractors (Fiscal Intermediaries (FIs), carriers, Regional HomeHealth Intermediaries (RHHI), A/B Medicare Administrative Contractors (MACs) and Durable MedicalEquipment (DME MACs)).What You Need to KnowThis article is based on Change Request (CR) 8223, which instructs Medicare contractors on the steps theymust take to come into compliance with Phase III ERA Enrollment Operating Rule requirements by October1, <strong>2013</strong>. Contractors must have paper-based ERA enrollment forms in compliance with Attachment 1 of CR8223 no later than July 1, 2014.Medicare contractors must update their Electronic Remittance Advice (ERA) Enrollment forms for newenrollments to comply with Attachment 1 of CR 8223. The contractors must comply with the followingrequirements:1. Identify a maximum set of standard data elements to be requested from providers for enrollment toreceive Electronic Remittance Advice (ERA).2. Apply “controlled vocabulary” – predefined and authorized terms- for use when referring to thesame data element.3. Use standard data elements to appear on paper enrollment form in a standard format and flow, usingconsistent data elements and vocabulary as on the electronic form.4. Use specific information or instruction to providers to assist in manual paper-based ERA enrollment.5. Offer electronic ERA enrollment.Make sure that your billing staffs are aware of these updates to the ERA Enrollment Operating Rules.BackgroundSection 1104 of the Affordable Care Act requires the Secretary of Health and Human Services to adopt andregularly update standards, implementation specifications, and operating rules for the electronic exchangeand use of health information for the purpose of financial and administrative transaction.What You Need to Know about the ERA Enrollment FormProviders who have a signed ERA Enrollment Form on file with a particular Medicare contractor orCommon Electronic Data Interchange (CEDI) are not required to submit a new signed ERA EnrollmentForm to the same Medicare contractor or CEDI each time they change their method of electronic billing orbegin to use another type of electronic data interchange (EDI) transaction, e.g., changing from directsubmission to submission through a clearinghouse or changing from one billing agent to another.Medicare A Newsline April <strong>2013</strong> 27

Additionally, providers are not required to notify their Medicare contractor or CEDI if their existingclearinghouse begins to use alternate software; the clearinghouse is responsible for notification in thatinstance.Medicare contractors and CEDIs must inform providers that providers are obligated to notify them inwriting in advance of a change that involves a change in the billing agent(s) or clearinghouse(s) used by theprovider, the effective date on which the provider will discontinue using a specific billing agent and/orclearinghouse, if the provider wants to begin to use additional types of EDI transactions, or of other changesthat might impact their use of ERA.When a Medicare contractor or CEDI receives a signed request from a provider or supplier to accept ERAtransactions from or send ERA transactions to a third party, the Medicare contractor or CEDI must verifythat an ERA Enrollment Form is already on file for that provider or supplier. The request cannot beprocessed until both are submitted and issued.The binding information in an ERA Enrollment Form does not expire if the person who signed that form fora provider is no longer employed by the provider, or that Medicare contractor or CEDI is no longerassociated with the Medicare program. Medicare responsibility for ERA oversight and administration issimply transferred in that case to that entity that the Centers for Medicare & Medicaid Services (CMS)chooses to replace that Medicare contractor or CEDI, and the provider as an entity retains responsibility forthose requirements mentioned in the form regardless of any change in personnel on staff.Contractors may require a wet signature to be submitted in conjunction with the electronic enrollment.(Note: A wet signature is an original signature on a document that is then scanned and sent by e-mail.)The document will become effective when signed by the provider. The responsibilities and obligationscontained in this document will remain in effect as long as Medicare claims are submitted to the Medicarecontractor, CEDI, or other contractor if designated by CMS. Either party may terminate the arrangement bygiving the other party thirty (30) days written notice of its intent to terminate. In the event that the notice ismailed, the written notice of termination shall be deemed to have been given upon the date of mailing, asestablished by the postmark or other appropriate evidence of transmittal.Additional InformationThe official instruction, CR 8223, issued to your FI, carrier and A/B MAC regarding this change may beviewed at http://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R1224OTN.pdf on the CMS website.Medicare A Newsline April <strong>2013</strong> 28

National Coverage Determination (NCD) for Transcatheter Aortic ValveReplacement (TAVR) – Implementation of Mandatory Reporting of ClinicalTrial NumberMLN Matters® MM8255Provider Types AffectedThis MLN Matters® Article is intended for physicians, other providers, and suppliers who submit claims toMedicare contractors (Fiscal Intermediaries (FIs), carriers, and A/B Medicare Administrative Contractors(A/B MACs)) for Transcatheter Aortic Valve Replacement (TAVR) services provided to Medicarebeneficiaries.Provider Action NeededChange Request (CR) 8255 is being issued to require that claims for TAVR carry an approved clinical trialnumber, effective for claims processed on or after July 1, <strong>2013</strong>. Given that TAVR is covered only underCoverage with Evidence Development (CED), the Centers for Medicare & Medicaid Services (CMS) hasensured that the approved clinical trials and approved registry have obtained valid numbers fromhttp://www.clinicaltrials.gov and that those numbers are maintained athttp://www.cms.gov/Medicare/Coverage/Coverage-with-Evidence-Development/Transcatheter-Aortic-Valve-Replacement-TAVR-.html on the CMS website. See the Background and Additional InformationSections of this article for further details regarding these changes. Please make sure that your billing staffsare aware of these changes.BackgroundOn May 1, 2012, CMS issued a National Coverage Determination (NCD) covering TAVR with CED. TheTAVR NCD is available at http://www.cms.gov/medicare-coverage-database/details/ncddetails.aspx?NCDId=355on the CMS website.TAVR (also known as TAVI or transcatheter aortic valve implantation) is a new technology for use intreating aortic stenosis. A bioprosthetic valve is inserted percutaneously using a catheter and implanted inthe orifice of the native aortic valve. The procedure is performed in a cardiac catheterization lab or a hybridoperating room/cardiac catheterization lab with advanced quality imaging and with the ability to safelyaccommodate complicated cases that may require conversion to an open surgical procedure. Theinterventional cardiologist and cardiac surgeon jointly participate in the intra-operative technical aspects ofTAVR.CR8255 requires that claims for TAVR carry an approved clinical trial number. Specific claims processinginstructions are as follows:For professional claims processed on or after July 1, <strong>2013</strong>, Medicare expects this numeric, 8-digitclinical trial (CT) registry number to be preceded by the alpha characters of "CT" in Field 19 ofpaper Form CMS-1500 claims or entered similarly in the electronic 837P in Loop 2300 REF01(REF01=P4).Medicare A Newsline April <strong>2013</strong> 29

Professional claim lines for 0256T, 0257T, 0258T, 0259T, 33361, 33362, 33363, 33364, 33365, and0318T must have the CT registry number, a Q0 modifier, and a secondary diagnosis code of V70.7(ICD-10=Z00.6). Such claims lines will be returned as unprocessable if the CT registry number, themodifier Q0, or the V70.7 (ICD-10=Z00.6) is not present.Claims for TAVR submitted without the CT registry number will be returned as unprocessable with thefollowing messages:Claims Adjustment Remarks Code (CARC) 16: “Claim/service lacks information which is neededfor adjudication. At least one Remark Code must be provided (may be comprised of either NCPDPReject Reason Code, or Remittance Advice Remark Code that is not an ALERT.)”;Remittance Advice Remarks Code (RARC) MA50: “Missing/incomplete/invalid InvestigationalDevice Exemption number for FDA-approved clinical trial services.”;RARC MA130: “Your claim contains incomplete and/or invalid information, and no appeal rightsare afforded because the claim is unprocessable. Please submit a new claim with thecomplete/correct information.”; andGroup Code-Contractual Obligation (CO).TAVR claims submitted without the Q0 modifier will be returned as unprocessable with the followingmessages:CARC 4: “The procedure code is inconsistent with the modifier used or a required modifier ismissing. Note: Refer to the 835 Healthcare Policy Identification Segment (loop 2110 ServicePayment Information REF), if present.”;RARC N29: “Missing documentation/orders/notes/summary/report/chart.”;RARC MA130: “Your claim contains incomplete and/or invalid information, and no appeal rightsare afforded because the claim is unprocessable. Please submit a new claim with thecomplete/correct information.”; andGroup Code-Contractual Obligation (CO).For claims processed on or after July 1, <strong>2013</strong>, the claim lines for 0256T, 0257T, 0258T, 0259T, 33361,33362, 33363, 33364, 33365 & 0318T will be returned as unprocessable when billed without secondarydiagnosis code V70.7 (ICD-10=Z00.6) with the following messages:CARC 16: “Claim/service lacks information which is needed for adjudication. At least one RemarkCode must be provided (may be comprised of either NCPDP Reject Reason Code, or RemittanceAdvice Remark Code that is not an ALERT.)”;RARC M76: “Missing incomplete/invalid diagnosis or condition.”;Medicare A Newsline April <strong>2013</strong> 30

RARC MA130: “Your claim contains incomplete and/or invalid information, and no appeal rightsare afforded because the claim is unprocessable. Please submit a new claim with thecomplete/correct information.”; andGroup Code-Contractual Obligation (CO).Medicare also requires the CT registry number on hospital claims for TAVR for inpatient hospitaldischarges on or after July 1, <strong>2013</strong>. Claims for TAVR for inpatient discharges on or after July 1, <strong>2013</strong> thatdo not have the registry number will be rejected. Medicare is ensuring the presence of the procedure codesand associated diagnosis and condition codes per CR7897/TR2552, issued September 24, 2012.Additional InformationThe official instruction, CR 8255 issued to your Medicare contractor regarding this change may be viewedat http://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R2689CP.pdf on theCMS website. Add links to CR7897 and CR8168/TR2628, issued January 7, <strong>2013</strong>, for additional claimsprocessing information.Note: CR8255 does not eliminate the previous instructions contained in CRs 7897 and 8168 that were notformally replaced/revised.Medicare A Newsline April <strong>2013</strong> 31

Reporting End-Stage Renal Disease (ESRD) Drugs Administered Throughthe DialysateMLN Matters® MM8256Provider Types AffectedThis MLN Matters® Article is intended for providers and suppliers who submit claims to Medicarecontractors (Fiscal Intermediaries (FIs) and/or A/B Medicare Administrative Contractors (A/B MACs)) forEnd-Stage Renal Disease (ESRD) services provided to Medicare beneficiaries.Provider Action NeededThis article is based on Change Request (CR) 8256 which instructs ESRD facilities to append the newmodifier, JE (Administered via Dialysate), to all ESRD claims where drugs and biologicals are furnished toESRD beneficiaries via the dialysate solution on claims with dates of service on or after July 1, <strong>2013</strong>. Makesure that your billing staffs are aware of this change.BackgroundChange Request (CR) 8256 instructs ESRD facilities to append the new JE modifier to all ESRD claim lineitems reporting drugs and biologicals that are furnished to ESRD beneficiaries via the dialysate solution fordates of service on or after July 1, <strong>2013</strong>. Dialysate can be compounded with injectable drugs and biologicalsas a way to administer the drug or biological.All drugs and biologicals that are furnished to ESRD beneficiaries for the treatment of ESRD are paid underthe ESRD Prospective Payment System (PPS) base rate regardless of the method of administration.ESRD facilities will continue to have the ability to append the AY modifier (Item or service furnished to anESRD patient that is not for the treatment of ESRD) when the drug or biological is furnished for reasonsother than the treatment of ESRD with the exception of those drugs that are considered to always beESRD-related. The list of drugs and biologicals that are included in the ESRD PPS consolidated billingrequirements can be reviewed at http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/ESRDpayment/Consolidated_Billing.html on the Centers for Medicare & Medicaid Services(CMS) website.CMS believes that the JE modifier will prevent inappropriate application of the AY modifier, because CMSbelieves that there is confusion whether a drug or biological is considered ESRD-related when it is added tothe dialysate.Additional InformationThe official instruction, CR8256 issued to your FI or A/B MAC regarding this change may be viewed athttp://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R2688CP.pdf on the CMSwebsite.Medicare A Newsline April <strong>2013</strong> 32

Tax Identification Numbers of Foreign Owning and Managing Entities andIndividualsMLN Matters® MM8258Provider Types AffectedThis MLN Matters® Article is intended for physicians, other providers, and suppliers submitting claims toMedicare contractors (Fiscal Intermediaries (FIs), carriers, Regional Home Health Intermediaries (RHHIs)and A/B Medicare Administrative Contractors (A/B MACs)) for services to Medicare beneficiaries.Provider Action NeededThis article is based on Change Request (CR) 8258, which furnishes guidance regarding the reporting of taxidentification numbers (TINs) in Sections 5 and 6 of the Form CMS-855. Make sure that your staffs areaware of these changes. See the Background and Additional Information Sections of this article for furtherdetails regarding these changes.BackgroundIn chapter 15 of the "Medicare Program Integrity Manual," section 15.5.6.1 has been added to adviseMedicare contractors of new instructions regarding the reporting of TINs of owning and managingorganizations and individuals.The content of the new section is as follows:Consistent with Sections 1124 and 1124A of the Social Security Act, the TINs (employer identificationnumbers or social security numbers) of all entities and individuals listed in Sections 5 and 6, respectively, ofthe Form CMS-855 must be disclosed. If a Medicare contractor receives an initial, reactivation, revalidation,or change of ownership Form CMS-855 application from a provider and the provider fails to disclose theTIN of a particular organization or individual listed in Section 5 or 6, the contractor shall follow normaldevelopment procedures for requesting the TIN. In doing so, if the contractor learns or determines that theTIN was not furnished because the entity or person in question is foreign, the contractor shall take thefollowing steps:a. The contractor shall ask the provider (via any means) whether the person or entity is able to obtain a TINor, in the case of individuals, an Individual Taxpayer Identification Number (ITIN).1) If the provider fails to respond to the contractor’s inquiry within 30 days, the contractor shall followthe instructions in (c) below.2) If the provider states that the person or entity is able to obtain a TIN or ITIN, the contractor shallsend an e-mail, fax, or letter to the provider stating that (i) the person or entity must obtain aTIN/ITIN, and (ii) the provider must furnish the TIN/ITIN on the Form CMS-855 with a newlysignedcertification statement within 90 days of the contractor’s request.Medicare A Newsline April <strong>2013</strong> 33

3) If the provider states that the person or entity is unable to obtain a TIN or ITIN, the contractor shallsend an e-mail, fax, or letter to the provider stating that (i) the provider must submit writtendocumentation to the contractor explaining why the person or entity cannot legally obtain a TIN orITIN, and (ii) the explanation – which can be in any written format and may be submittedelectronically or via fax – must be submitted within 30 days of the contractor’s request.b. If the provider timely submits the explanation in (a)(3) above, the contractor shall forward theexplanation to the appropriate contact at the Centers for Medicare & Medicaid Services (CMS). CMS willnotify the contractor as to how the application should be handled.c. If the provider fails to timely respond to the contractor’s inquiry in (a) or fails to timely furnish theTIN/ITIN in (a)(2), the contractor shall – unless another CMS instruction directs otherwise - reject theapplication in accordance with the procedures identified in chapter 15.In addition:For purposes of section 15.5.6.1 only, the term “change of ownership” - as used in the firstparagraph of this section - refers to (1) CHOW, acquisition/merger, and consolidation applicationssubmitted by the new owner, (2) change in majority ownership applications submitted by a homehealth agency (HHA), and (3) change of information applications in which a new entity or individual(e.g., owner, managing employee, corporate director) is being added in Section 5 or 6.Additional InformationThe official instruction, CR8258 issued to your FI, carrier, RHHI, and A/B MAC regarding this change maybe viewed at http://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R459PI.pdf on the CMS website.Medicare A Newsline April <strong>2013</strong> 34

Claim Status Category and Claim Status Codes UpdateMLN Matters® MM8265Provider Types AffectedThis MLN Matters® Article is intended for all physicians, other providers, and suppliers submitting claimsto Medicare contractors (carriers, Fiscal Intermediaries (FI), Regional Home Health Intermediaries(RHHIs), Medicare Administrative Contractors (A/B MACs), and Durable Medical Equipment MedicareAdministrative Contractors (DME MACs)) for services to Medicare beneficiaries.What You Need to KnowChange Request (CR) 8265, from which this article is taken, requires Medicare contractors to use onlynational Code Maintenance Committee-approved Claim Status Category Codes and Claim Status Codeswhen sending Medicare healthcare status responses (277 transactions) to report the status of your submittedclaim(s). Proprietary codes may not be used in the X12 276/277 to report claim status.All code changes approved during the January <strong>2013</strong> Committee meeting will be posted on or about March 1,<strong>2013</strong>, at http://www.wpc-edi.com/reference/codelists/healthcare/claim-status-category-codes andhttp://www.wpc-edi.com/reference/codelists/healthcare/claim-status-codes and are to be reflected in the X12277 transactions issued on and after the date of implementation of CR8265 (July 1, <strong>2013</strong>).BackgroundThe Health Insurance Portability and Accountability Act (HIPAA) requires all health care benefit payers touse only national Code Maintenance Committee-approved Claim Status Category Codes and Claim StatusCodes to explain the status of submitted claims. These codes, which have been adopted as the nationalstandard to explain the status of submitted claim(s), are the only such codes permitted for use in the X12276/277 Health Care Claim Status Request and Response format.The national Code Maintenance Committee meets three times each year (February, <strong>June</strong>, and October) inconjunction with the Accredited Standards Committee (ASC) X12 trimester meeting, and makes decisionsabout additions, modifications, and retirement of existing codes. The Committee has decided to allow theindustry 6 months for implementation of the newly added or changed codes. Therefore, on and after the dateof implementation of CR8265 (July 1, <strong>2013</strong>), your Medicare contractor must: 1) Complete the entry of allapplicable code text changes and new codes; 2) Terminate the use of deactivated codes; 3) Use these newcodes for editing all X12 276 transactions and reflect them in the X12 277 transactions that they issue.Additional InformationThe official instruction, CR8265 issued to your carrier, FI, RHHI, A/B MAC, or DME MAC regarding thischange may be viewed at http://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R2681CP.pdf on the CMS website.Medicare A Newsline April <strong>2013</strong> 35

Applying Multiple Procedure Payment Reductions to Therapy CapAmounts for Critical Access Hospital (CAH) ClaimsMLN Matters® MM8278Provider Types AffectedThis MLN Matters® Article is intended for providers and suppliers who submit claims to Medicarecontractors (Fiscal Intermediaries (FIs) and/or A/B Medicare Administrative Contractors (A/B MACs)) forservices provided to Medicare beneficiaries.Provider Action NeededThis article is based on Change Request (CR) 8278 which revises the amount applied toward a beneficiary'stherapy cap amounts when therapy services are provided in a Critical Access Hospital (CAH). Therequirements of CR8278 ensure that the multiple procedure payment reduction is applied to these amounts.Make sure billing staff are aware of this change.BackgroundThe American Taxpayer Relief Act of 2012 (ATRA; Section 603; seehttp://www.gpo.gov/fdsys/pkg/BILLS-112hr8enr/pdf/BILLS-112hr8enr.pdf) contained a number ofOriginal Medicare provisions affecting the outpatient therapy caps and manual medical review threshold.These provisions became effective on January 1, <strong>2013</strong>. One of the provisions required that outpatienttherapy services provided in CAH settings should be included in the beneficiary's therapy cap and thresholdtotal, using the amount that would be payable if the services were paid under the Medicare Physician FeeSchedule. This change was implemented via CR 7881.You can review the MLN Matters® articlecorresponding to CR7881 athttp://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNMattersArticles/Downloads/MM7881.pdf on the CMS website.Payments for outpatient hospital therapy services include a multiple procedure payment reduction whenmore than one unit or procedure is provided to the same patient on the same day by the same provider.Inadvertently, Medicare's initial implementation of this provision updated the therapy cap and thresholdtotal by the full fee schedule amount, without applying the multiple procedure payment reduction. Therequirements of CR8278 correct how CAH claims update the therapy cap and threshold total.If the results of CR8278 are that previously denied therapy claims become payable, you may request thatyour FI or A/B MAC adjust such claims.Additional InformationThe official instruction, CR8278, issued to your FIs and A/B MACs regarding this change may be viewed athttp://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R1216OTN.pdf on theCMS website.A copy of the “Therapy Cap Fact Sheet” can be found at http://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medical-Review/Downloads/Therapy-Cap-Fact-Sheet_1-17.pdf on the CMSwebsite.Medicare A Newsline April <strong>2013</strong> 36

Remittance Advice Remark Code (RARC), Claims Adjustment ReasonCode (CARC), Medicare Remit Easy Print (MREP), and PC Print UpdateMLN Matters® MM8281Provider Types AffectedThis MLN Matters® Article is intended for physicians, providers, and suppliers submitting claims toMedicare contractors (Fiscal Intermediaries (FIs), Regional Home Health Intermediaries (RHHIs), carriers,Durable Medical Equipment Medicare Administrative Contractors (DME MACs) and A/B MACs) forservices to Medicare beneficiaries.What You Need to KnowThis article is based on Change Request (CR) 8281, which instructs Medicare contractors to makeprogramming changes to incorporate updates to the Claim Adjustment Reason Code (CARC) andRemittance Advice Remark Code (RARC) lists. It also instructs the Fiscal Intermediary Standard System(FISS) and the VIPs Medicare System (VMS) maintainers to update Medicare Remit Easy Print (MREP)and PC Print. Please make sure that your billing staffs are aware of these changes.BackgroundThe Health Insurance Portability and Accountability Act (HIPAA) of 1996, instructs health plans to be ableto conduct standard electronic transactions adopted under HIPAA using valid standard codes. Medicarepolicy states that CARC and appropriate RARC that provide either supplemental explanation for a monetaryadjustment or policy information that generally applies to the monetary adjustment are required in theremittance advice and coordination of benefits transactions.The CARC and RARC changes that affect Medicare are usually requested by the Centers for Medicare &Medicaid Services (CMS) staff in conjunction with a policy change. If a modification has been initiated byan entity other than CMS for a code currently used by Medicare, Medicare contractors must either use themodified code or another code if the modification makes the modified code inappropriate to explain thespecific reason for adjustment.CR8281 lists only the changes that have been approved since the last code update CR (CR8154, Transmittal2618, issued on December 21, 2012, available at http://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNMattersArticles/Downloads/MM8154.pdf), and does not provide a completelist of codes for these two code sets.Note: In case of any discrepancy in the code text as posted on Washington Publishing Company (WPC)website and as reported in any CR, the WPC version should be implemented.Changes in CARC List Since CR8154These are the changes in the CARC database since the last code update CR8154. The full CARC list mustbe downloaded from the WPC website, available at http://wpc-edi.com/Reference on the Internet.Medicare A Newsline April <strong>2013</strong> 37