Medicare Part B Newsline March 2012 - Cahaba GBA

Medicare Part B Newsline March 2012 - Cahaba GBA

Medicare Part B Newsline March 2012 - Cahaba GBA

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

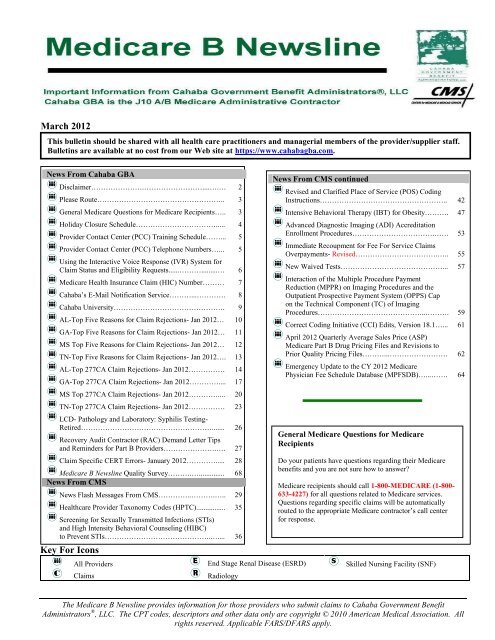

<strong>March</strong> <strong>2012</strong>This bulletin should be shared with all health care practitioners and managerial members of the provider/supplier staff.Bulletins are available at no cost from our Web site at https://www.cahabagba.com.News From <strong>Cahaba</strong> <strong>GBA</strong>Disclaimer………………….……………………....….… 2Please Route…………………………………………….. 3General <strong>Medicare</strong> Questions for <strong>Medicare</strong> Recipients….. 3Holiday Closure Schedule……………………………..... 4Provider Contact Center (PCC) Training Schedule……... 5Provider Contact Center (PCC) Telephone Numbers…... 5Using the Interactive Voice Response (IVR) System forClaim Status and Eligibility Requests......……….........… 6<strong>Medicare</strong> Health Insurance Claim (HIC) Number……… 7<strong>Cahaba</strong>’s E-Mail Notification Service………...………… 8<strong>Cahaba</strong> University………………………………………. 9AL-Top Five Reasons for Claim Rejections- Jan <strong>2012</strong>… 10GA-Top Five Reasons for Claim Rejections- Jan <strong>2012</strong>… 11MS Top Five Reasons for Claim Rejections- Jan <strong>2012</strong>… 12TN-Top Five Reasons for Claim Rejections- Jan <strong>2012</strong>…. 13AL-Top 277CA Claim Rejections- Jan <strong>2012</strong>…………… 14GA-Top 277CA Claim Rejections- Jan <strong>2012</strong>………….... 17MS Top 277CA Claim Rejections- Jan <strong>2012</strong>………….... 20TN-Top 277CA Claim Rejections- Jan <strong>2012</strong>…………… 23LCD- Pathology and Laboratory: Syphilis Testing-Retired………………………………………………....... 26Recovery Audit Contractor (RAC) Demand Letter Tipsand Reminders for <strong>Part</strong> B Providers………………….…. 27Claim Specific CERT Errors- January <strong>2012</strong>…………..... 28<strong>Medicare</strong> B <strong>Newsline</strong> Quality Survey……….….............. 68News From CMSNews Flash Messages From CMS…………..……….….. 29Healthcare Provider Taxonomy Codes (HPTC)................ 35Screening for Sexually Transmitted Infections (STIs)and High Intensity Behavioral Counseling (HIBC)to Prevent STIs……………………………………..….... 36Key For IconsAll ProvidersClaimsEnd Stage Renal Disease (ESRD)RadiologyNews From CMS continuedRevised and Clarified Place of Service (POS) CodingInstructions…………………………………………….. 42Intensive Behavioral Therapy (IBT) for Obesity………. 47Advanced Diagnostic Imaging (ADI) AccreditationEnrollment Procedures…………………………….…… 53Immediate Recoupment for Fee For Service ClaimsOverpayments- Revised…………………………….….. 55New Waived Tests……………………………………... 57Interaction of the Multiple Procedure PaymentReduction (MPPR) on Imaging Procedures and theOutpatient Prospective Payment System (OPPS) Capon the Technical Component (TC) of ImagingProcedures……………………………………...………. 59Correct Coding Initiative (CCI) Edits, Version 18.1…... 61April <strong>2012</strong> Quarterly Average Sales Price (ASP)<strong>Medicare</strong> <strong>Part</strong> B Drug Pricing Files and Revisions toPrior Quality Pricing Files………...…………………… 62Emergency Update to the CY <strong>2012</strong> <strong>Medicare</strong>Physician Fee Schedule Database (MPFSDB)…...……. 64General <strong>Medicare</strong> Questions for <strong>Medicare</strong>RecipientsDo your patients have questions regarding their <strong>Medicare</strong>benefits and you are not sure how to answer?<strong>Medicare</strong> recipients should call 1-800-MEDICARE (1-800-633-4227) for all questions related to <strong>Medicare</strong> services.Questions regarding specific claims will be automaticallyrouted to the appropriate <strong>Medicare</strong> contractor’s call centerfor response.Skilled Nursing Facility (SNF)The <strong>Medicare</strong> B <strong>Newsline</strong> provides information for those providers who submit claims to <strong>Cahaba</strong> Government BenefitAdministrators ® , LLC. The CPT codes, descriptors and other data only are copyright © 2010 American Medical Association. Allrights reserved. Applicable FARS/DFARS apply.

DisclaimerThis educational material was prepared as a tool to assist <strong>Medicare</strong> providers and other interested parties and is not intended togrant rights or impose obligations. Although every reasonable effort has been made to assure the accuracy of the informationwithin this module, the ultimate responsibility for the correct submission of claims lies with the provider of services. <strong>Cahaba</strong><strong>GBA</strong>, LLC employees, agents, and staff make no representation, warranty, or guarantee that this compilation of <strong>Medicare</strong>information is error-free and will bear no responsibility or liability for the results or consequences of the use of these materials.This publication is a general summary that explains certain aspects of the <strong>Medicare</strong> Program, but is not a legal document. Theofficial <strong>Medicare</strong> Program provisions are contained in the relevant laws, regulations, and rulings.We encourage users to review the specific statues, regulations and other interpretive materials for a full and accurate statementof their contents. Although this material is not copyrighted, CMS prohibits reproduction for profit making purposes.American Medical Association Notice and DisclaimerCPT codes, descriptors and other data only are Copyright 2011 American Medical Association. All rights reserved.ICD-9 NoticeThe ICD-9-CM codes and descriptors used in this material are copyright 2011 under uniform copyright convention. All rightsreserved.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 2

Holiday Closure Schedule-<strong>2012</strong><strong>Cahaba</strong> <strong>GBA</strong>’s <strong>Medicare</strong> offices in Birmingham, AL; Douglasville, GA, Savannah, GA; and Chattanooga,TN are closed on the following days listed below in <strong>2012</strong>. In addition, all <strong>Medicare</strong> Provider ContactCenters (PCC) close on federal holidays for continuing education training; therefore, customer servicerepresentatives will not be available on those days to receive your calls.Holiday / DateNew Year’s Day ObservedJanuary 2, <strong>2012</strong>MondayMartin Luther King BirthdayJanuary 16, <strong>2012</strong>MondayPresident’s DayFebruary 20, <strong>2012</strong>MondayGood FridayApril 6, <strong>2012</strong>FridayMemorial DayMay 28, <strong>2012</strong>MondayIndependence DayJuly 4, <strong>2012</strong>WednesdayLabor DaySeptember 3, <strong>2012</strong>MondayColumbus DayOctober 8, <strong>2012</strong>MondayVeterans Day ObservedNovember 12, <strong>2012</strong>MondayThanksgivingNovember 22-23, <strong>2012</strong>Thursday/FridayChristmasDecember 24-25, <strong>2012</strong>Monday/TuesdayNew Year’s DayJanuary 1, 2013TuesdayClosure ScheduleAll Offices ClosedAll Offices ClosedPCC Closed for TrainingAll Offices ClosedAll Offices ClosedAll Offices ClosedAll Offices ClosedPCC Closed for TrainingPCC Closed for TrainingAll Offices ClosedAll Offices ClosedAll Offices Closed<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 4

Provider Contact Center– Training Schedule<strong>Medicare</strong> is a continuously changing program, and it is important that we provide correct and accurateanswers to your questions. To better serve the provider community, the Centers for <strong>Medicare</strong> & MedicaidServices (CMS) allows the Provider Contact Centers the opportunity to offer training to our CustomerService Representatives (CSRs). Listed below are the dates and times the Provider Contact Center will beclosed for training.PCC Training DatesFriday, April 13, <strong>2012</strong>Friday, April 20, <strong>2012</strong>Friday, April 27, <strong>2012</strong>Time9:30 a.m.- 11:30 a.m. CST/10:30 a.m.- 12:30 p.m. EST9:30 a.m.- 11:30 a.m. CST/10:30 a.m.- 12:30 p.m. EST9:30 a.m.- 11:30 a.m. CST/10:30 a.m.- 12:30 p.m. ESTProvider Contact Center Telephone NumbersAlabama B, Georgia B, and Tennessee B: 877 567-7271Mississippi B: 866 419-9454Our Interactive Voice Response (IVR) system is designed to assist providers in obtaining answers tonumerous issues through self-service options. Options on our IVR include information regarding patienteligibility, checks, claims, deductible and other general information. Please note that our Customer ServiceRepresentatives (CSRs) are available to answer questions that cannot be answered by the IVR. CSRs arephysically located in Birmingham, Alabama and Savannah, Georgia. When your call is received, it is routedto the next available representative. CSRs are available Monday through Friday 8:00 a.m. until 4:00 p.m. inyour time zone.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 5

Using the Interactive Voice Response (IVR) System for Claim Status andEligibility Requests<strong>Cahaba</strong> Government Benefit Administrators®, LLC is experiencing a high volume of providers who areopting out of the Interactive Voice Response (IVR) system to speak to a Customer Service Representative(CSR) for information that can be accessed through the IVR.The Centers for <strong>Medicare</strong> and Medicaid Services (CMS) Internet Only Manual (IOM) Chapter 6 Section50.1 states:“Providers shall be required to use IVRs to access claim status and beneficiary eligibilityinformation. CSRs shall refer providers back to the IVR if they have questions about claims statusor eligibility that can be handled by the IVR. CSRs may provide claims status and/or eligibilityinformation if it is clear that the provider cannot access the information through the IVR because theIVR is not functioning.”If you are requesting whether <strong>Cahaba</strong> has received a claim or if a claim has finalized, this isconsidered a claim status request.In addition, according to IOM Chapter 6 Section 80.3.4, “If a CSR or written inquiry correspondent receivesan inquiry about information that can be found on a Remittance Advice (RA), the CSR/correspondentshould take the opportunity to educate the inquirer on how to read the RA, in an effort to encourage the useof self-service. The CSR/correspondent should advise the inquirer that the RA is needed in order to answerany questions for which answers are available on the RA. Providers should also be advised that any billingstaff or representatives that make inquiries on his/her behalf will need a copy of the RA.”<strong>Cahaba</strong> CSRs have visibility as to the path the provider takes in the IVR and/or whether they opt out tospeak with a representative up front. The CSR will instruct the provider to call back and utilize the IVR ifthey did not attempt to use this self service option as required by CMS.Provider Contact Center (PCC)<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 6

<strong>Medicare</strong> Health Insurance Claim (HIC) NumberA <strong>Medicare</strong> card is issued to every person who is entitled to <strong>Medicare</strong> benefits and may be identified by its red, whiteand blue coloring. This card identifies the <strong>Medicare</strong> beneficiary and includes the following information:Name (exactly as it appears on the Social Security records);<strong>Medicare</strong> Health Insurance Claim (HIC) number;Beginning date of <strong>Medicare</strong> entitlement for hospital and/or medical insurance;Sex and Beneficiary's signature.Three of the top five reasons for claim rejection in any given month are for:The last name submitted for the beneficiary does not match the last name we have on record for the HICnumber on the claim. The beneficiary's last name must include apostrophes, spaces, hyphens, etc., if theyappear in the beneficiary's last name on his or her <strong>Medicare</strong> card.The first name submitted for the beneficiary does not match the first name we have on record for the HICnumber on the claim. The beneficiary's first name must appear as it does on the beneficiary's <strong>Medicare</strong>card. This includes spaces, hyphens, apostrophes, etc.The HIC number not matching the name we have on record. The <strong>Medicare</strong> Claim Number must appear onthe claim exactly as it does on the beneficiary’s card, without the dashes and with no spaces.It is extremely important that you submit the patient’s complete name and HIC number to <strong>Medicare</strong> or any otherhealth care provider you use (i.e. clinical laboratories, radiology imaging groups, or outpatient therapy providers,etc.). This will ensure that those providers have the correct patient information to file their claims as well.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 7

<strong>Cahaba</strong>’s E-mail Notification Service Subscription Process<strong>Cahaba</strong> <strong>GBA</strong> recently implemented changes that simplify the process in which providers subscribe to our e-mail notification service (Listserv). New members simply provide their name, city, state, zip code, e-mailaddress, and an optional password. In addition, they can select from two different lists to subscribe to:• J10 <strong>Part</strong> A News• J10 <strong>Part</strong> B News*Once you are a member, you can edit your profile to:• unsubscribe from all lists• subscribe to additional lists• update your e-mail address• change your name or address information• change what <strong>Cahaba</strong> lists you are subscribed to.Already a Member?If you enrolled to <strong>Cahaba</strong>’s Listserv prior to November 1, 2009, you will continue to receive messages.However, depending on the selections you made on the subscription form when you originally enrolled, youmay receive messages from more than one <strong>Cahaba</strong> list. To change the list you are subscribed to, access the“Edit Your E-mail Notification Service Member Profile” Web page to review and edit your profile.In order to ensure that you receive your subscription emails and announcements from <strong>Cahaba</strong> <strong>GBA</strong>, pleaseadd us to your contact lists, adjust your spam settings, or follow the instructions from your email provideron how to prevent our emails from being marked “Spam” or “Junk Mail”.*Mississippi <strong>Medicare</strong> <strong>Part</strong> B providers will choose J10 <strong>Part</strong> B News for their selection to receive <strong>Medicare</strong><strong>Part</strong> B information.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 8

<strong>Cahaba</strong> University<strong>Cahaba</strong> <strong>GBA</strong> proudly introduces “<strong>Cahaba</strong> University,” an online self-service training tool for our providercommunity and their staff.<strong>Cahaba</strong> University is an educational program designed to provide a broad variety of <strong>Medicare</strong> relatedtraining to meet the needs of <strong>Medicare</strong> health care providers and suppliers. It is powered by Centra, alearning management system that will allow registered users to manage their own learning. <strong>Cahaba</strong>University allows for a blended e-learning environment. Blended means that users are allowed to register forWebinars, teleconferences, as well as assign self-paced learning tracks. It also provides centralizedmanagement and access to content created by the Provider Outreach and Education department for theprovider community.Our staff of well-trained professionals wants every provider to be pleased with their learning experience.We know you’re just as concerned about your claims being processed for your facility as you are about thequality of care administered to your <strong>Medicare</strong> patients. That is why we always try to provide additionaleducation and outreach activities to help improve this process.<strong>Cahaba</strong> University is located athttp://www.cahabagba.com/part_b/education_and_outreach/<strong>Cahaba</strong>University.pdf. All providers areencouraged to create a user profile. Click the “Create a new account” link, and then select either a <strong>Part</strong> A or<strong>Part</strong> B account. You must create a username and password to login. Make sure all the appropriate fields arecompleted. Once the account is created, log in using your new user name and password. Remember, yourusername and password is case-sensitive!<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 9

Alabama <strong>Medicare</strong> <strong>Part</strong> BTop Five Reasons for EDI Claim Rejections for January <strong>2012</strong>Audit trails show which of your claims were accepted by the <strong>Cahaba</strong> <strong>GBA</strong> <strong>Part</strong> A processing system, alongwith claims that were rejected and the reason for the rejection. Referring to this report will allow you tocorrect and resubmit claims quickly, resulting in a dramatically reduced turnaround time. You will alsobecome aware of any major problems with your claims so they can be corrected before they create aninterruption in your cash flow. Audit trail reports are available the next business day for files that arereceived before 3:30 p.m. Central Time. If you are not receiving your audit trails contact your softwarevendor, billing service, or clearing house.See Audit Trail Explanations for a more complete list of edits, along with descriptions of loops that mightbe referenced in an edit.In order to increase the number of claims that successfully pass through audit trails and into processing<strong>Cahaba</strong> <strong>GBA</strong> <strong>Part</strong> A EDI Services is providing you with the top five reasons for claim rejections. For themonth of January <strong>2012</strong>, these are:Claim DescriptionRejection213 INVALID PAYER ID OR QUAL IN 2010BBA payer ID or qualifier was submitted in the 2010BB loop(Payer Name) that is not valid for <strong>Medicare</strong> <strong>Part</strong> B.434 PROC CODE REQUIRES REFERRING NPIProcedure code billed was for a diagnostic procedure such as anx-ray or lab work which requires the NPI of the orderingphysician, or a consultation, which requires the NPI of thereferring physician, and this was not submitted on the claim.421 DIAG CODE (XXXXX) INVALID FOR DATE SVCThe date of service was outside of the effective date range ofthe diagnosis code used. The invalid diagnosis code will appearinside the parenthesis.888 INSTREAM REJECTIONThere was a problem involving HIPAA required loops,segments, or values. The specific loop will be identified, forexample, 'ELEMENT N401 (D.E. 19) AT COL. 4 ISMISSING, THOUGH MARKED "MUST BE USED"(LOOP:2010BA POS:3140)'. The number after 'POS' indicatesthe position in the file where the error occurred377 PAID & ADJUSTMENT AMOUNTS DO NOT EQUALCLAIM CHARGThe claim was submitted as <strong>Medicare</strong> Secondary Payer but theprimary paid amount plus the primary adjustment amounts donot equal the total claim charge.Number ofClaims701689595447439<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 10

Georgia <strong>Medicare</strong> <strong>Part</strong> BTop Five Reasons for EDI Claim Rejections for January <strong>2012</strong>Audit trails show which of your claims were accepted by the <strong>Cahaba</strong> <strong>GBA</strong> <strong>Part</strong> A processing system, alongwith claims that were rejected and the reason for the rejection. Referring to this report will allow you tocorrect and resubmit claims quickly, resulting in a dramatically reduced turnaround time. You will alsobecome aware of any major problems with your claims so they can be corrected before they create aninterruption in your cash flow. Audit trail reports are available the next business day for files that arereceived before 3:30 p.m. Central Time. If you are not receiving your audit trails contact your softwarevendor, billing service, or clearing house.See Audit Trail Explanations for a more complete list of edits, along with descriptions of loops that mightbe referenced in an edit.In order to increase the number of claims that successfully pass through audit trails and into processing<strong>Cahaba</strong> <strong>GBA</strong> <strong>Part</strong> A EDI Services is providing you with the top five reasons for claim rejections. For themonth of January <strong>2012</strong>, these are:Claim DescriptionRejection434 PROC CODE REQUIRES REFERRING NPIProcedure code billed was for a diagnostic procedure such as anx-ray or lab work which requires the NPI of the orderingphysician, or a consultation, which requires the NPI of thereferring physician, and this was not submitted on the claim.888 INSTREAM REJECTIONThere was a problem involving HIPAA required loops,segments, or values. The specific loop will be identified, forexample, 'ELEMENT N401 (D.E. 19) AT COL. 4 IS MISSING,THOUGH MARKED "MUST BE USED" (LOOP:2010BAPOS:3140)'. The number after 'POS' indicates the position in thefile where the error occurred385 CLAIM CONTAINS A MEDICARE LEGACY ID IN LOOP: XXXXThe indicated loop contained a legacy provider number, such asa commercial insurance number or a UPIN.421 DIAG CODE (XXXXX) INVALID FOR DATE SVCThe date of service was outside of the effective date range of thediagnosis code used. The invalid diagnosis code will appearinside the parenthesis.207 INVALID HIC NUMBER SUFFIXThe suffix in the Health Insurance Claim (HIC) numbersubmitted for the beneficiary is invalid. For an explanation ofHIC numbers and suffixes please visithttps://www.cahabagba.com/part_b/education_and_outreach/general_billing_info/hic_suffixes.htm.Number ofClaims2,2371,5371,3021,2331,135<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 11

Mississippi <strong>Medicare</strong> <strong>Part</strong> BTop Five Reasons for EDI Claim Rejections for January <strong>2012</strong>Audit trails show which of your claims were accepted by the <strong>Cahaba</strong> <strong>GBA</strong> <strong>Part</strong> A processing system, alongwith claims that were rejected and the reason for the rejection. Referring to this report will allow you tocorrect and resubmit claims quickly, resulting in a dramatically reduced turnaround time. You will alsobecome aware of any major problems with your claims so they can be corrected before they create aninterruption in your cash flow. Audit trail reports are available the next business day for files that arereceived before 3:30 p.m. Central Time. If you are not receiving your audit trails contact your softwarevendor, billing service, or clearing house.See Audit Trail Explanations for a more complete list of edits, along with descriptions of loops that mightbe referenced in an edit.In order to increase the number of claims that successfully pass through audit trails and into processing<strong>Cahaba</strong> <strong>GBA</strong> <strong>Part</strong> A EDI Services is providing you with the top five reasons for claim rejections. For themonth of January <strong>2012</strong>, these are:Claim DescriptionRejection888 INSTREAM REJECTIONThere was a problem involving HIPAA required loops,segments, or values. The specific loop will be identified, forexample, 'ELEMENT N401 (D.E. 19) AT COL. 4 IS MISSING,THOUGH MARKED "MUST BE USED" (LOOP:2010BAPOS:3140)'. The number after 'POS' indicates the position in thefile where the error occurred. If you need help locating specificpositions in your 4010A1 file here is an article explaining oneway you can do this:http://www.cahabagba.com/part_b/edi/hipaa_identifying_your_errors.htm.307 DIAG CODE (XXXXX) INVALID OR INACTIVEThe diagnosis code indicated is invalid, or was inactive on thedate of service billed.434 PROC CODE REQUIRES REFERRING NPIProcedure code billed was for a diagnostic procedure such as anx-ray or lab work which requires the NPI of the orderingphysician, or a consultation, which requires the NPI of thereferring physician, and this was not submitted on the claim421 DIAG CODE (XXXXX) INVALID FOR DATE SVCThe date of service was outside of the effective date range of thediagnosis code used. The invalid diagnosis code will appearinside the parenthesis.302 INVALID BILLING (NO CHARGES BILLED)Claim must contain at least one item with an associated billedamount.Number ofClaims3,0571,564609539226<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 12

Tennessee <strong>Medicare</strong> <strong>Part</strong> BTop Five Reasons for EDI Claim Rejections for January <strong>2012</strong>Audit trails show which of your claims were accepted by the <strong>Cahaba</strong> <strong>GBA</strong> <strong>Part</strong> A processing system, alongwith claims that were rejected and the reason for the rejection. Referring to this report will allow you tocorrect and resubmit claims quickly, resulting in a dramatically reduced turnaround time. You will alsobecome aware of any major problems with your claims so they can be corrected before they create aninterruption in your cash flow. Audit trail reports are available the next business day for files that arereceived before 3:30 p.m. Central Time. If you are not receiving your audit trails contact your softwarevendor, billing service, or clearing house.See Audit Trail Explanations for a more complete list of edits, along with descriptions of loops that mightbe referenced in an edit.In order to increase the number of claims that successfully pass through audit trails and into processing<strong>Cahaba</strong> <strong>GBA</strong> <strong>Part</strong> A EDI Services is providing you with the top five reasons for claim rejections. For themonth of January <strong>2012</strong>, these are:Claim DescriptionRejection888 INSTREAM REJECTIONThere was a problem involving HIPAA required loops,segments, or values. The specific loop will be identified, forexample, 'ELEMENT N401 (D.E. 19) AT COL. 4 IS MISSING,THOUGH MARKED "MUST BE USED" (LOOP:2010BAPOS:3140)'. The number after 'POS' indicates the position in thefile where the error occurred434 PROC CODE REQUIRES REFERRING NPIProcedure code billed was for a diagnostic procedure such as anx-ray or lab work which requires the NPI of the orderingphysician, or a consultation, which requires the NPI of thereferring physician, and this was not submitted on the claim.421 DIAG CODE (XXXXX) INVALID FOR DATE SVCThe date of service was outside of the effective date range of thediagnosis code used. The invalid diagnosis code will appear inside theparenthesis.207 INVALID HIC NUMBER SUFFIXThe suffix in the beneficiary’s <strong>Medicare</strong> number was not valid. For anexplanation of HIC numbers and their suffixes please visithttps://www.cahabagba.com/part_b/education_and_outreach/general_billing_info/hic_suffixes.htm.202 RAILROADThe beneficiary’s HIC (<strong>Medicare</strong> number) began with an alphabeticprefix, indicating the beneficiary s a Railroad retiree.Number ofClaims1,3651,187729478324<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 13

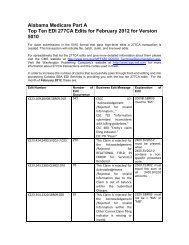

Alabama <strong>Medicare</strong> <strong>Part</strong> BTop Ten EDI 277CA Edits for January <strong>2012</strong> for Version 5010For claim submissions in the 5010 format that pass high-level edits a 277CA transaction is created. Thistransaction will indicate file, batch, claim, and line level edits.For spreadsheets that list the 277CA edits and give more detailed information about them please visit theCMS website at http://www.cms.gov/MFFS5010D0/20_TechnicalDocumentation.asp. Visit the WashingtonPublishing Company’s website at http://www.wpc-edi.com for more information about 277CA transactionsand the codes used in them.In order to increase the number of claims that successfully pass through front-end editing and intoprocessing <strong>Cahaba</strong> <strong>GBA</strong> EDI Services is providing you with the top ten 277CA edits. For the month ofJanuary <strong>2012</strong>, these are:ProductionEdit NumberNumber ofEditOccurrencesX222.087.2010AA.NM109.050 14,764Business EditMessageThis Claim isrejected forrelational fielddue to BillingProvider'ssubmitter notapproved forelectronicclaimsubmissions onbehalf of thisBillingProvider.X222.351.2400.SV101-7.020 8,637 This Claim isrejected forrelational fieldInformationwithin theDetaileddescription ofservice.X222.094.2010AA.REF02.050 7,451 This Claim isrejected forrelational fieldBillingProvider's NPI(NationalExplanation ofEdit2010AA.NM109billing providermust be"associated" to thesubmitter (from atrading partnermanagementperspective) in1000A.NM109.2400.SV101-7must be present.when 2400.SV101-2 is present on thetable of procedurecodes that require adescription.2010AA.REF mustbe associated withthe provideridentified in2010AA.NM109.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 14

Provider ID)and Tax ID.X222.295.2320.SBR03.006 6,993 This Claim isrejected forrelational fieldInformationsubmittedinconsistentwith billingguidelines forthe OtherInsured'sPolicy Number.X222.087.2010AA.NM109.030 6,489 This Claim isrejected forInvalidInformation inthe BillingProvider's NPI(NationalProvider ID).X222.273.2310C.N403.020 4,068 This Claim isrejected forInvalidInformation fora ServiceLocation'sPostal/Zip.X222.430.2420A.NM108.020 3,102 This Claim isrejected forMissingInformationwithin theRenderingProvider'sNationalProviderIdentifier (NPI)and IdentifierQualifier.X222.196.2300.REF.010 2,994 This Claim isrejected forInvalidInformationwithin thePayer AssignedCSCC A8:"Acknowledgement/ Rejected forrelational field inerror"CSC 163: "Entity'sPolicy Number"CSC 732"Informationsubmittedinconsistent withbilling guidelines."EIC: GB OtherInsured2010AA.NM109must be a valid NPIon the Crosswalkwhen evaluatedwith1000B.NM109.2310C.N403 mustbe a valid 9 digitZip Code.2420A.NM108must be present.2300.REF withREF01 = "F8"must not bepresent.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 15

Claim ControlNumberInformationsubmittedinconsistentwith billingguidelines.X222.351.2400.SV101-2.020 2,500 This Claim isrejected forrelational fieldInformationwithin theHCPCS.X999.DUPE 2,022 Rejected due toduplicateST/SEsubmission.When2400.SV101-1 ="HC",2400.SV101-2must be a validHCPCS Code onthe date in2400.DTP03 whenDTP01 = "472".Exact duplicate ofa previouslysubmittedtransaction set.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 16

Georgia <strong>Medicare</strong> <strong>Part</strong> BTop Ten EDI 277CA Edits for January <strong>2012</strong> for Version 5010For claim submissions in the 5010 format that pass high-level edits a 277CA transaction is created. Thistransaction will indicate file, batch, claim, and line level edits.For spreadsheets that list the 277CA edits and give more detailed information about them please visit theCMS website at http://www.cms.gov/MFFS5010D0/20_TechnicalDocumentation.asp. Visit the WashingtonPublishing Company’s website at http://www.wpc-edi.com for more information about 277CA transactionsand the codes used in them.In order to increase the number of claims that successfully pass through front-end editing and intoprocessing <strong>Cahaba</strong> <strong>GBA</strong> EDI Services is providing you with the top ten 277CA edits. For the month ofJanuary <strong>2012</strong>, these are:Production:Edit NumberX222.087.2010AA.NM109.050Number ofEditOccurrencesBusiness EditMessage22,737 This Claim isrejected forrelational fielddue to BillingProvider'ssubmitter notapproved forelectronicclaimsubmissionson behalf ofthis BillingProvider.X222.351.2400.SV101-7.020 19,008 This Claim isrejected forrelational fieldInformationwithin theDetaileddescription ofservice.X999.DUPE 11,462 Rejected dueto duplicateST/SEsubmission.X222.121.2010BA.NM109.0203,506 This Claim isrejected forExplanation ofEdit2010AA.NM109billing providermust be"associated" to thesubmitter (from atrading partnermanagementperspective) in1000A.NM109.2400.SV101-7must be present.when 2400.SV101-2 is present on thetable of procedurecodes that require adescription.Exact duplicate ofa previouslysubmittedtransaction set.2010BA.NM109must be 10 - 11<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 17

InvalidInformationfor aSubscriber'scontract/member number.X222.192.2300.REF02.060 3,105 This Claim isrejected forInvalidInformationwithin theAuthorization/certificationnumber.X222.273.2310C.N403.020 3,081 This Claim isrejected forInvalidInformationfor a ServiceLocation'sPostal/Zip.X222.351.2400.SV101-2.020 2,922 This Claim isrejected forrelational fieldInformationwithin theHCPCS.X222.295.2320.SBR03.006 2,590 This Claim isrejected forrelational fieldInformationsubmittedinconsistentwith billingguidelines forthe OtherInsured'sPolicyNumber.positions in theformat ofNNNNNNNNNAorNNNNNNNNNAAorNNNNNNNNNANwhere “A”represents an alphacharacter and “N”represents anumeric digit.2300.REF02 mustbe a validMammographyCertificationNumber.2310C.N403 mustbe a valid 9 digitZip Code.When2400.SV101-1 ="HC",2400.SV101-2must be a validHCPCS Code onthe date in2400.DTP03 whenDTP01 = "472".CSCC A8:"Acknowledgement / Rejected forrelational field inerror"CSC 163: "Entity'sPolicy Number"CSC 732"Informationsubmittedinconsistent withbilling guidelines."EIC: GB Other<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 18

X222.242.2300.HI01-2.020 2,322 This Claim isrejected forInvalidInformationwithin theNUBCConditionCode(s).X222.094.2010AA.REF02.0502,284 This Claim isrejected forrelational fieldBillingProvider's NPI(NationalProvider ID)and Tax ID.Insured2300.HI01-2 mustbe a validCondition code.2010AA.REF mustbe associated withthe provideridentified in2010AA.NM109.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 19

Mississippi <strong>Medicare</strong> <strong>Part</strong> BTop Ten EDI 277CA Edits for January <strong>2012</strong> for Version 5010For claim submissions in the 5010 format that pass high-level edits a 277CA transaction is created. Thistransaction will indicate file, batch, claim, and line level edits.For spreadsheets that list the 277CA edits and give more detailed information about them please visit theCMS website at http://www.cms.gov/MFFS5010D0/20_TechnicalDocumentation.asp. Visit the WashingtonPublishing Company’s website at http://www.wpc-edi.com for more information about 277CA transactionsand the codes used in them.In order to increase the number of claims that successfully pass through front-end editing and intoprocessing <strong>Cahaba</strong> <strong>GBA</strong> EDI Services is providing you with the top ten 277CA edits. For the month ofJanuary <strong>2012</strong>, these are:Production:Edit NumberX222.087.2010AA.NM109.050X222.351.2400.SV101-7.020Number ofEditOccurrencesDisposition/ErrorCode9,102 This Claim isrejected forrelational field dueto BillingProvider's submitternot approved forelectronic claimsubmissions onbehalf of thisBilling Provider.7,136 This Claim isrejected forrelational fieldInformation withinthe Detaileddescription ofservice.X222.273.2310C.N403.020 6,167 This Claim isrejected for InvalidInformation for aService Location'sPostal/Zip.X222.094.2010AA.REF02.0504,236 This Claim isrejected forrelational fieldExplanation ofEdit2010AA.NM109billing providermust be"associated" tothe submitter(from a tradingpartnermanagementperspective) in1000A.NM109.2400.SV101-7must be present.when2400.SV101-2 ispresent on thetable ofprocedure codesthat require adescription.2310C.N403must be a valid 9digit Zip Code.2010AA.REFmust beassociated with<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 20

Billing Provider'sNPI (NationalProvider ID) andTax ID.X222.295.2320.SBR03.006 3,621 This Claim isrejected forrelational fieldInformationsubmittedinconsistent withbilling guidelinesfor the OtherInsured's PolicyNumber.X999.DUPE 2,588 Rejected due toduplicate ST/SEsubmission.X222.351.2400.SV101-2.020X222.087.2010AA.NM109.0302,165 This Claim isrejected forrelational fieldInformation withinthe HCPCS.1,691 This Claim isrejected for InvalidInformation in theBilling Provider'sNPI (NationalProvider ID).X222.336.2330D.NM1.010 1,631 This Claim isrejected forrelational fieldInformationsubmittedinconsistent withbilling guidelinesfor the RenderingProvider's Nationalthe provideridentified in2010AA.NM109.CSCC A8:"Acknowledgement / Rejected forrelational field inerror"CSC 163:"Entity's PolicyNumber"CSC 732"Informationsubmittedinconsistent withbillingguidelines."EIC: GB OtherInsuredExact duplicateof a previouslysubmittedtransaction set.When2400.SV101-1 ="HC",2400.SV101-2must be a validHCPCS Code onthe date in2400.DTP03when DTP01 ="472".2010AA.NM109must be a validNPI on theCrosswalk whenevaluated with1000B.NM109.Segment mustnot be present.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 21

Provider Identifier(NPI).X222.403.2400.REF02.070 1,478 This Claim isrejected for InvalidInformation withintheAuthorization/certification number.2400.REF02must be a validMammographyCertificationNumber.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 22

Tennessee <strong>Medicare</strong> <strong>Part</strong> BTop Ten EDI 277CA Edits for January <strong>2012</strong> for Version 5010For claim submissions in the 5010 format that pass high-level edits a 277CA transaction is created. Thistransaction will indicate file, batch, claim, and line level edits.For spreadsheets that list the 277CA edits and give more detailed information about them please visit theCMS website at http://www.cms.gov/MFFS5010D0/20_TechnicalDocumentation.asp. Visit the WashingtonPublishing Company’s website at http://www.wpc-edi.com for more information about 277CA transactionsand the codes used in them.In order to increase the number of claims that successfully pass through front-end editing and intoprocessing <strong>Cahaba</strong> <strong>GBA</strong> EDI Services is providing you with the top ten 277CA edits. For the month ofJanuary <strong>2012</strong>, these are:Production:Edit NumberNumber ofEditOccurrencesBusiness EditMessageX223.352.2310F.REF.010 3,403 This Claim isrejected for theAcknowledgement /Rejected forInvalidInformationwithin theReferringProvider'sAdditional/Secondary Identifier.X223.109.2000B.SBR09.010 3,260 CSCC A7:"Acknowledgement /Rejected forInvalidInformation…"CSC 732"Informationsubmittedinconsistent withbillingguidelines."CSC 480"Entity's claimfiling indicator."EIC: PR "Payer"Explanation ofEdit2310F.REF mustnot be present.2000B.SBR09must be "MA".X223.424.2400.SV202- 2,172 This Claim is 2400.SV202-7<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 23

7.025 rejected for theAcknowledgement /Rejected forRELATIONALFIELD INERROR forService(s)Rendered.X223.090.2010AA.REF02.050X223.084.2010AA.NM109.0401,691 This Claim isrejected forAcknowledgement / Rejected forrelational field inerror within theBilling Provider'sNational ProviderIdentifier (NPI)and BillingProvider's tax id.1,399 This Claim isrejected forAcknowledgement / Rejected forrelational field inerror within theBilling Provider'sNational ProviderIdentifier (NPI)X223.354.2320.SBR09.020 936 This Claim isrejected for theAcknowledgement /Rejected forInvalidInformationwithin the OtherCarrier Claimfiling indicator ismissing orinvalid.X223.358.2320.CAS04.020 897 CSCC A7:"Acknowledgement /Rejected forInvalidInformation…"CSC 694:"Amount mustnot be equal tozero"must be present.when 2400.SV202-2 contains a nonspecificprocedurecode.2010AA.REF mustbe associated withthe provideridentified in2010AA.NM109.2010AA.NM109must be a valid NPIon the Crosswalkwhen evaluatedwith1000B.NM109.2320.SBR09 mustnot be = "MA" or"MB".2320.CAS04 mustnot = 0.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 24

X223.424.2400.SV202-2.020CSC 520:"AdjustmentQuantity"EIC: GB "OtherInsured".765 This Claim isrejected for theAcknowledgement /Rejected forInvalidInformationwithin theHCPCS.X223.424.2400.SV205.030 710 CSCC A7:"Acknowledgement /Rejected forInvalidInformation…"CSC 507:"HCPCS"X223.112.2010BA.NM109.020465 This Claim isrejected forAcknowledgement /Rejected forInvalidInformationwithin theSubscriber'scontract/membernumber.When2400.SV202-1 ="HC",2400.SV202-2must be a validHCPCS Code.When2400.SV202-1 ="HC",2400.SV202-2must be a validHCPCS Code.2010BA.NM109must be 7 - 12positions in theformat ofANNNNNN,AANNNNNN,ANNNNNNNNN,AANNNNNNNNN, AAANNNNNN,orAAANNNNNNNNN where “A”represents an alphacharacter and “N”represents anumeric digit.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 25

LCD – Pathology and Laboratory: Syphilis Testing- RetiredJ10 MAC B (Alabama, Georgia, Tennessee) (L30013)Carrier 00512 (Mississippi) (L31293)Effective November 7, 2011 the Local Coverage Determinations (LCDs) for Pathology and Laboratory:Syphilis Testing is retired. :<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 26

Recovery Audit Contractor (RAC) Demands Letters Tips and Remindersfor <strong>Part</strong> B ProvidersWith the implementation of Change Request (CR) 7436, responsibility for the issuance of Recovery AuditContractor (RAC) demand letters was shifted to the <strong>Medicare</strong> Administrative Contractors (MACs) effectiveJanuary 1, <strong>2012</strong>. Connolly Healthcare, the RAC for J10 and Mississippi <strong>Part</strong> B providers, will continue tosubmit claims adjustments to <strong>Cahaba</strong> Government Benefit Administrators ® , LLC (<strong>Cahaba</strong> <strong>GBA</strong>). <strong>Cahaba</strong><strong>GBA</strong> will process the adjustments based upon the review conducted by Connolly Healthcare and issue anautomated demand letter.The demand letters are generated based on an automated system setup by CMS which creates letter addressinformation for your practice or office that was obtained from your provider enrollment data. This addressis defined as the “Special Payment” address (e.g., remittance notices, special payments) in Section 4B onyour Provider/Supplier Enrollment application, CMS Form-855B. Providers may choose to update theiraddress information via the CMS Form-855B. Please note this change would impact other demand lettercorrespondence (non-RAC) that is also generated from the “Special Payment” address.Connolly Healthcare continues to be responsible for communicating to providers the rationale for claimadjustments initiated by their office. Connolly Healthcare will also continue sending letters to providerswith this information and is responsible for responding to providers regarding the rationale for the claimadjustments.Providers may visit the Connolly Healthcare RAC website at www.connollyhealthcare.com/RAC to reviewthe rationale for RAC transactions. To access the Provider Portal Login, enter the state abbreviation,<strong>Medicare</strong> provider number and the total charge amount listed for the appropriate ICN.Contact information for Connolly Healthcare is provided below:Connolly Healthcare RAC OfficeThe Navy Yard Corporate CenterOne Crescent Drive, Suite 300-APhiladelphia, PA 19112Toll-free phone number: (866) 360-2507Fax number: (203) 529-2995For additional information issued review the CMS MLN Matters article athttps://www.cms.gov/MLNMattersArticles/downloads/MM7436.pdf.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 27

Claim Specific CERT Errors- January <strong>2012</strong>J10 MAC B (Alabama, Georgia, Tennessee)Carrier 00512 (Mississippi)The Comprehensive Error Rate Testing (CERT) Program was implemented by the Centers for <strong>Medicare</strong> &Medicaid Services (CMS) to monitor the accuracy of claims processing by <strong>Medicare</strong> contractors, like<strong>Cahaba</strong>. Contractors are then notified by CERT of the errors and findings.We would like to remind you that should you receive an Additional Documentation Request (ADR) such asa request for records to support services that are involved in a CERT review, you should submit theappropriate documentation to support the services billed, including but not limited to progress note(s) tomatch the DOS billed, lab results, operative reports, diagnostic tests, physician orders, etc. <strong>Medicare</strong>requires a legible identifier for services provided/ordered. The method used shall be hand written or anelectronic signature (stamp signatures are not acceptable) to sign an order or other medical recorddocumentation for medical review purposes.Providers may appeal unfavorable decisions with additional supporting documentation. For detailedinformation regarding the Appeals Process, refer to the following link:www.cahabagba.com/part_b/claims/appeals_process.htm.Please contact the Provider Contact Center for individual questions concerning CERT errors:Alabama, Georgia and Tennessee Providers – 1-877-567-7271Mississippi Providers – 1-866-419-9454This summary provides examples of <strong>Cahaba</strong>'s errors identified by CERT. We encourage all providers toreview this listing to educate you on common errors. This information will be updated periodically. Theintent in providing this information is to prompt you to conduct an internal analysis of <strong>Medicare</strong> billing andreduce future denials by <strong>Medicare</strong>.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 28

News Flash Messages from CMS For All <strong>Part</strong> B ProvidersPresident Obama Signs the Middle Class Tax Relief and Job CreationAct of <strong>2012</strong>--New Law Includes Physician Update Fix through December <strong>2012</strong>--On Wednesday, February 22, <strong>2012</strong>, President Obama signed into law the Middle Class Tax Reliefand Job Creation Act of <strong>2012</strong> (Job Creation Act). This new law prevents a scheduled payment cutfor physicians and other practitioners who treat <strong>Medicare</strong> patients from taking effect on <strong>March</strong> 1,<strong>2012</strong>. The new law extends the current zero percent update for such services through December 31 ,<strong>2012</strong>. President Obama remains committed to a permanent solution to eliminating the SustainableGrowth Rate reductions, which result from the existing statutory methodology. The Administrationwill continue to work with Congress to achieve this goal, as well as implement the policies in theAffordable Care Act to move toward a patient-centered, quality oriented system.The new law extends several provisions of the Temporary Payroll Tax Cut Continuation Act of 2011(Continuation Act). Specifically, the following <strong>Medicare</strong> fee-for-service policies have been extended.We also have included <strong>Medicare</strong> billing and claims processing information associated with the newlegislation. Please note that these provisions do not reflect all of the <strong>Medicare</strong> provisions in th e newlaw, as some provisions are effective later in the year and more information about those provisionswill be forthcoming.Section 3003 - Physician Payment Update - The new law extends the current zero percent update forclaims with dates of service on or after <strong>March</strong> 1, <strong>2012</strong>, through December 31, <strong>2012</strong>. However, thenew law does not extend Sections 307 and 309 of the Continuation Act, the five percent physician feeschedule mental health add-on payment and the special 2011 payment rates for bone massmeasurement, respectively. The Centers for <strong>Medicare</strong> & Medicaid Services (CMS) is currentlyrevising the <strong>2012</strong> <strong>Medicare</strong> Physician Fee Schedule (MPFS) to reflect the expiration of both of theseprovisions. In order to allow sufficient time to develop, test, and implement the revised MPFS,<strong>Medicare</strong> claims administration contractors may hold mental health and bone density claims with<strong>March</strong> <strong>2012</strong> dates of service for up to 10 business days. We expect these claims to be released intoprocessing no later than <strong>March</strong> 15, <strong>2012</strong>. Other <strong>March</strong> <strong>2012</strong> claims will be unaffected by this claimhold. Claims with dates of service prior to <strong>March</strong> 1, <strong>2012</strong>, also are unaffected. Finally, <strong>Medicare</strong>contractors will be posting the new mental health and bone density rates on their websites no laterthan <strong>March</strong> 15, <strong>2012</strong>.Section 3004 - Extension of <strong>Medicare</strong> Physician Work Geographic Adjustment Floor - Theexisting 1.0 floor on the physician work geographic practice cost index is extended through December31, <strong>2012</strong>. As with the physician payment update, this extension will be reflected in the revised <strong>2012</strong>MPFS.Section 3001 - Extension of <strong>Medicare</strong> Modernization Act Section 508 Reclassifications -Section 3001 extends Section 508 reclassifications and certain special exception wage indexes fromDecember 1, 2011, through <strong>March</strong> 31, <strong>2012</strong>. For the period beginning on December 1, 2011, and ending on<strong>March</strong> 31, <strong>2012</strong>, section 3001 also requires (as did section 302 of the Continuation Act) removing Section508 and special exception wage data from the calculation of the reclassified wage index if doing so raisesthe reclassified wage index. All hospitals receiving section 508 reclassifications and inpatient specialexception reclassifications under the Continuation Act and the Job Creation Act shall be assigned a specialwage index effective for October 2011 through <strong>March</strong> <strong>2012</strong>. We will apply these provisions to both<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 29

inpatient and outpatient hospital payments. A special wage index will be applicable, from January 1, <strong>2012</strong>,through June 30, <strong>2012</strong>, for hospital outpatient payments, to special exception hospitals and reclassifiedhospitals affected by these extensions. Hospital inpatient and outpatient payments under both section 302 ofthe Continuation Act and section 3001 of the Job Creation Act will be made by June 30, <strong>2012</strong>.Section 3002 - Extension of Outpatient Hold Harmless Payments - Section 3002 extends outpatienthold harmless payments for rural hospitals and sole community hospitals with 100 or fewer beds throughDecember 31, <strong>2012</strong>. However, hold harmless payments for sole community hospitals with more than 100beds were not extended by this provision and are set to expire on February 29, <strong>2012</strong>.Section 3005 - Extension of Exceptions Process for <strong>Medicare</strong> Therapy Services - Section 3005extends the exceptions process for outpatient therapy caps from <strong>March</strong> 1, <strong>2012</strong>, until December 31, <strong>2012</strong>,with some modifications to current therapy policies. Providers of outpatient therapy services are required tosubmit the KX modifier on their therapy claims, when an exception to the cap is requested for medicallynecessary services furnished through December 31, <strong>2012</strong>. In addition, the new law includes changes relatedto therapy services furnished in a hospital outpatient department (OPD). These changes impact the annualtherapy cap in <strong>2012</strong> as well as the applicability of the therapy cap exception process. More informationabout the changes affecting hospital OPDs will be forthcoming in a future issuance. Additional informationabout the exception process for therapy services may be found in the <strong>Medicare</strong> Claims Processing Manual,Pub.100-04, Chapter 5, Section 10.3: http://www.cms.gov/manuals/downloads/clm104c05.pdf.The therapy caps are determined for a beneficiary on a calendar year basis, so all beneficiaries began a newcap for outpatient therapy services received on January 1, <strong>2012</strong>. For physical therapy and speech languagepathology services combined, the <strong>2012</strong> limit for a beneficiary on incurred expenses is $1,880. There is aseparate cap for occupational therapy services which is $1,880 for <strong>2012</strong>. Deductible and coinsuranceamounts applied to therapy services count toward the amount accrued before a cap is reached, and alsoapply for services above the cap where the KX modifier is used.Section 3005 also mandates that <strong>Medicare</strong> perform manual medical review of therapy services furnishedbeginning on October 1, <strong>2012</strong>, for which an exception was requested when the beneficiary has reached adollar aggregate threshold amount of $3,700 for therapy services, including OPD therapy services, for ayear. There are two separate $3,700 aggregate annual thresholds: (1) physical therapy and speech-languagepathology services, and (2) occupational therapy services.Finally, Section 3005 requires that all claims for therapy services furnished on or after October 1, <strong>2012</strong>,include the National Provider Identifier of the physician who reviews the therapy plan.CMS will issue additional information about all of these new requirements later in the year.Section 3006 - Extension of Moratorium On Qualified Pathologists and Independent LaboratoryBilling for the Technical Component of Physician Pathology Services Furnished to Hospital Patients -Section 3006 extends the moratorium through June 30, <strong>2012</strong>. Therefore, those qualified pathologistsand independent laboratories that are eligible may continue to submit claims to <strong>Medicare</strong> for thetechnical component of physician pathology services furnished to patients of a hospital, regardless of thebeneficiary's hospitalization status (inpatient or outpatient) on the date that the service was furnished. Thispolicy continues to be effective for claims with dates of service on or after <strong>March</strong> 1, <strong>2012</strong>, through June 30,<strong>2012</strong>.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 30

Section 3007 - Extension of Ambulance Add-On Payments - Section 3007 extends through December31, <strong>2012</strong>, the following three Continuation Act ambulance payment provisions: (1) the 3 percent increasein the ambulance fee schedule amounts for covered ground ambulance transports that originate in rural areasand the 2 percent increase for covered ground ambulance transports that originate in urban areas; (2) theprovision relating to air ambulance services that continues to treat as rural any area that was designated asrural on December 31, 2006, for purposes of payment under the ambulance fee schedule; and (3) theprovision relating to payment for ground ambulance services that increases the base rate for transportsoriginating in an area that is within the lowest 25 th percentile of all rural areas arrayed by population density(known as the “super rural” bonus). Suppliers of ambulance services affected by these provisions maycontinue billing as usual.Be on the alert for more information about the Job Creation Act and the provisions which take effectlater in the year.HIPAA Version 5010On January 1, <strong>2012</strong>, standards for electronic health care transactions changed from Version 4010/4010A1to Version 5010. These electronic health care transactions include, among others, claims processing,eligibility inquiries, and remittance advice. Unlike the current Version 4010/4010A1, Version 5010accommodates the International Classification of Diseases, 10th Revision, Clinical Modification/ProcedureCoding System (ICD-10-CM/PCS) codes, and must be in place first before the changeover to ICD-10. Thetransition to ICD-10 is dependent on a successful Version 5010 implementation. The Version 5010 changeoccurs well before the ICD-10 implementation date to allow adequate Version 5010 testing andimplementation time. Failure to prepare for these changes may result in rejection of claims or othertransactions and delays in claim reimbursement. Important Dates to Remember:January 1, <strong>2012</strong>- All electronic claims must use Version 5010Keep Up to Date on Version 5010 and ICD-10. Please visit the websites at http://www.cms.gov/icd10 andhttp://www.cms.gov/Versions5010andD0/, for the latest news and sign up for Version 5010 and ICD-10 e-mail updates!HIPAA Version 5010On November 17, 2011, the Centers for <strong>Medicare</strong> & Medicaid Services’ Office of E-Health Standards andServices (OESS) announced that it would not initiate enforcement with respect to any Health InsurancePortability and Accountability Act (HIPAA) covered entity that is not in compliance on January 1, <strong>2012</strong>,with the ASC X12 Version 5010 (Version 5010), National Council for Prescription Drug Programs(NCPDP) Telecom D.0 (NCPDP D.0) and NCPDP Medicaid Subrogation 3.0 (NCPDP 3.0) standards until<strong>March</strong> 31, <strong>2012</strong>. Notwithstanding OESS’ discretionary application of its enforcement authority, thecompliance date for use of these new standards remains January 1, <strong>2012</strong>. (Small health plans have untilJanuary 1, 2013, to comply with NCPDP 3.0.)<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 31

HHS Announces Intent to Delay ICD-10 Compliance DateAs part of President Obama’s commitment to reducing regulatory burden, Health and Human ServicesSecretary Kathleen G. Sebelius announced that HHS will initiate a process to postpone the date by whichcertain health care entities have to comply with International Classification of Diseases, 10th Editiondiagnosis and procedure codes (ICD-10).The final rule adopting ICD-10 as a standard was published in January 2009 and set a compliance date ofOctober 1, 2013 – a delay of two years from the compliance date initially specified in the 2008 proposedrule. HHS will announce a new compliance date moving forward.“ICD-10 codes are important to many positive improvements in our health care system,” said HHSSecretary Kathleen Sebelius. “We have heard from many in the provider community who have concernsabout the administrative burdens they face in the years ahead. We are committing to work with the providercommunity to reexamine the pace at which HHS and the nation implement these important improvements toour health care system.”ICD-10 codes provide more robust and specific data that will help improve patient care and enable theexchange of our health care data with that of the rest of the world that has long been using ICD-10. Entitiescovered under the Health Insurance Portability and Accountability Act of 1996 (HIPAA) will be required touse the ICD-10 diagnostic and procedure codes.Vaccinate Early to Protect Against the Flu /2011-<strong>2012</strong> Influenza VaccinePrices Are Now AvailableThe Centers for Disease Control (CDC) recommends a yearly flu vaccination as the most important step inprotecting against flu viruses. Remind your patients that annual vaccination is recommended for optimalprotection. Under <strong>Medicare</strong> <strong>Part</strong> B, <strong>Medicare</strong> pays for the flu vaccine and its administration for seniors andother <strong>Medicare</strong> beneficiaries with no co-pay or deductible. Take advantage of each office visit and startprotecting your patients as soon as your 2011-<strong>2012</strong> seasonal flu vaccine arrives. And don’t forget toimmunize yourself and your staff. Get the Flu Vaccination – Not the Flu.CMS has posted the 2011-<strong>2012</strong> seasonal influenza vaccine payment limits at:http://www.CMS.gov/Mcr<strong>Part</strong>BDrugAvgSalesPrice/10_VaccinesPricing.asp on the CMS website.Influenza vaccine is NOT a <strong>Part</strong> D-covered drug. For information about <strong>Medicare</strong>’s coverage of theinfluenza vaccine, its administration, and educational resources for healthcare professionals and their staff,visit http://www.CMS.gov/MLNProducts/35_PreventiveServices.asp on the CMS website.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 32

Enrolling In the <strong>Medicare</strong> Program Fact SheetsSeveral fact sheets that provide education to specific provider types on how to enroll in the <strong>Medicare</strong>Program and maintain their enrollment information using Internet-based Provider Enrollment, Chain, andOwnership System (PECOS) have been recently updated and are available in downloadable format from the<strong>Medicare</strong> Learning Network® (MLN). Please visithttp://www.CMS.gov/<strong>Medicare</strong>ProviderSupEnroll/downloads/<strong>Medicare</strong>_Provider-Supplier_Enrollment_National_Education_Products.pdf for a complete list of all MLN products related to<strong>Medicare</strong> provider-supplier enrollment.Primary Care Incentive Payment (PCIP) programPer Section 5501(a) of the Affordable Care Act, the Primary Care Incentive Payment (PCIP) programauthorizes an incentive payment of 10% of <strong>Medicare</strong>'s program payments to be paid to qualifying primarycare physicians and non-physician practitioners for services rendered from Sunday, January 1, 2011, toThursday, December 31, 2015. CMS has published 22 Frequently Asked Question (FAQ) items related tothe PCIP program. These new FAQs can be found here. Alternatively, these FAQ items can be found byvisiting http://questions.CMS.hhs.gov/ and searching for “PCIP” or “Primary Care Incentive Payment.”Electronic Funds Transfer (EFT)Existing regulations at 42 CFR 424.510(e)(1)(2) require that at the time of enrollment, enrollment changerequest or revalidation, providers and suppliers that expect to receive payment from <strong>Medicare</strong> for servicesprovided must also agree to receive <strong>Medicare</strong> payments through Electronic Funds Transfer (EFT). Section1104 of the Affordable Care Act further expands Section 1862 (a) of the Social Security Act by mandatingfederal payments to providers and suppliers only by electronic means. As part of <strong>Medicare</strong>’s revalidationefforts, all suppliers and providers who are not currently receiving EFT payments will be identified, andrequired to submit the CMS 588 EFT form with the Provider Enrollment Revalidation application. For moreinformation about provider enrollment revalidation, review the <strong>Medicare</strong> Learning Network’s SpecialEdition Article SE1126 titled, “Further Details on the Revalidation of Provider Enrollment Information” athttp://www.cms.gov/MLNMattersArticles/downloads/SE1126.pdf.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 33

Advanced Diagnostic Imaging (ADI)Remember: Beginning Sunday, January 1, <strong>2012</strong>, suppliers who furnish the Technical Component (TC) ofAdvanced Diagnostic Imaging (ADI) must be accredited to bill <strong>Medicare</strong> for certain services. MRI, CT,nuclear medicine imaging, and positron emission tomography. X-ray, ultrasound, fluoroscopy, and hospitaloutpatient procedures are excluded. For Dates of Service on or after Sunday, January 1, <strong>2012</strong>, <strong>Medicare</strong>Administrative Contractors (MACs) will deny claims for the Technical Component of ADI that aresubmitted under the Physician Fee Schedule by suppliers who have not yet been accredited. For moreinformation, please refer to the Advanced Diagnostic Imaging Accreditation web page and MLN Matters®Special Edition Article #SE1122.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 34

News from CMS For <strong>Part</strong> B ProvidersHealthcare Provider Taxonomy Codes (HPTC) Update April <strong>2012</strong>BackgroundThe Healthcare Provider Taxonomy Code (HPTC) set is maintained by the National Uniform ClaimCommittee (NUCC) for standardized classification of health care providers. The NUCC updates the code settwice a year with changes effective April 1 and October 1. The HPTC list is available for view or fordownload from the Washington Publishing Company (WPC) Web site at www.wpc-edi.com/codes.The changes to the code set include the addition of a new code and addition of definitions to existing codes.When reviewing the Health Care Provider Taxonomy code set online, revisions made since the last releasecan be identified by the color code; new items are green, modified items are orange, and inactive items arered.PolicyHealth Insurance Portability and Accountability Act (HIPAA) requires that covered entities comply with therequirements in the electronic transaction format implementation guides adopted as national standards. Theinstitutional and professional claim electronic standard implementation guides (X12 837-I and 837-P) eachrequire use of valid codes contained in the HPTC set when there is a need to report provider type orphysician, practitioner, or supplier specialty for a claim. Valid HPTCs are those codes approved by theNUCC for current use. Terminated codes are not approved for use after a specific date and newly approvedcodes are not approved for use prior to the effective date of the code set update in which each new code firstappears. Although the NUCC generally posts their updates on the WPC Web page 3 months prior to theeffective date, changes are not effective until April 1 or October 1 as indicated in each update. Specialtyand/or provider type codes issued by any entity other than the NUCC are not valid, and <strong>Medicare</strong> would beguilty of non-compliance with HIPAA if <strong>Medicare</strong> contractors accepted claims that contain invalid HPTCs.Change Request (CR) 7742<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 35

Screening for Sexually Transmitted Infections (STIs) and High IntensityBehavioral Counseling (HIBC) to Prevent STIsProvider Types AffectedThis MLN Matters® article is intended for all physicians, providers, and suppliers submitting claims to<strong>Medicare</strong> contractors (Fiscal Intermediaries (FIs), carriers, and A/B <strong>Medicare</strong> Administrative Contractors(MACs)) for <strong>Medicare</strong> beneficiaries.Provider Action NeededEffective for dates of service on or after November 8, 2011, the Centers for <strong>Medicare</strong> & Medicaid Services(CMS) will cover screening for Sexually Transmitted Infections (STIs) - specifically chlamydia, gonorrhea,syphilis, and hepatitis B - with the appropriate Food and Drug Administration (FDA) approved/clearedlaboratory tests when ordered by the primary care provider. The tests must be used consistent with FDAapproved labeling and in compliance with the Clinical Laboratory Improvement Act (CLIA) regulations andperformed by an eligible <strong>Medicare</strong> provider for these services.In addition, <strong>Medicare</strong> will cover High Intensity Behavioral Counseling (HIBC) to prevent STIs. Ensure thatyour billing staffs are aware of these changes.BackgroundPursuant to Section 1861(ddd) of the Social Security Act, CMS may add coverage of "additional preventiveservices" through the National Coverage Determination (NCD) process. The preventive services must be:1) Reasonable and necessary for the prevention or early detection of illness or disability;2) Recommended with a grade of A or B by the United States Preventive Services Task Force(USPSTF); and3) Appropriate for individuals entitled to benefits under <strong>Part</strong> A or enrolled under <strong>Part</strong> B.CMS reviewed the USPSTF recommendations and supporting evidence for screening for STIs and HIBC toprevent STIs and determined that the criteria listed above were met, enabling CMS to cover these preventiveservices. Therefore, effective November 8, 2011, CMS will cover screening for the indicated STIs andHIBC to prevent STIs. The covered screening lab tests must be ordered by the primary care provider. TheHIBC must be provided by primary care providers in primary care settings such as by the beneficiary’sfamily practice physician, internal medicine physician, or nurse practitioner (NP) in the doctor’s office.A new Healthcare Common Procedure Coding System (HCPCS) code, G0445 (high-intensity behavioralcounseling to prevent sexually transmitted infections, face-to-face, individual, includes: education, skillstraining, and guidance on how to change sexual behavior, performed semi-annually, 30 minutes), has beencreated for use when reporting HIBC to prevent STIs, effective November 8, 2011. This code is included inthe January <strong>2012</strong> <strong>Medicare</strong> Physician Fee Schedule Database (MPFSDB) and Integrated Outpatient CodeEditor (IOCE) updates.This code may be paid on the same date of service as an annual wellness visit (AWV), evaluation andmanagement (E&M) code, or during the global billing period for obstetrical care, but only one G0445 may<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 36

e paid on any one date of service. If billed on the same date of service with an E&M code, the E&M codeshould have a distinct diagnosis code other than the diagnosis code used to indicate high/increased risk forSTIs for the G0445 service. An E&M code should not be billed when the sole reason for the visit isHIBC to prevent STIs.The use of the correct diagnosis code(s) on the claims is imperative to identify these services aspreventive services and to show that the services were provided within the guidelines for coverage aspreventive services. The patient’s medical record must clearly support the diagnosis of high/increasedrisk for STIs and clearly reflect the components of the HIBC service provided – education, skillstraining, and guidance on how to change sexual behavior - as required for coverage.The appropriate screening diagnosis code (ICD-9-CM V74.5 (screening bacterial – sexually transmitted) orV73.89 (screening, disease or disorder, viral, specified type NEC)), when used with the screening lab testsidentified by Change Request (CR) 7610, will indicate that the test is a screening test covered by <strong>Medicare</strong>.Diagnosis code V69.8 (other problems related to life style) is used to indicate that the beneficiary is athigh/increased risk for STIs. Providers should also use V69.8 for sexually active adolescents when billingG0445 counseling services.Diagnosis codes V22.0 (supervision of normal first pregnancy), V22.1 (supervision of other normalpregnancy), or V23.9 (supervision of unspecified high-risk pregnancy) are also to be used when appropriate.For services provided on an annual basis, this is defined as a 12-month period.Further DetailsCMS will cover screening for Chlamydia (86631, 86632, 87110, 87270, 87320, 87490, 87491, 87810,87800 (used for combined Chlamydia and gonorrhea testing), gonorrhea (87590, 87591, 87850, 87800 (usedfor combined Chlamydia and gonorrhea testing), syphilis (86592, 86593, 86780), and hepatitis B (hepatitisB surface antigen) 87340, 87341)) with the appropriate FDA approved/cleared laboratory tests, usedconsistent with FDA-approved labeling and in compliance with the CLIA regulations, when ordered by theprimary care provider, and performed by an eligible <strong>Medicare</strong> provider for these services. As per therequirements, the presence of V74.5 or V73.89 and V69.8, denoting STI screening and high-risk behavior,respectively, and/or V22.0, V22.1, or V23.9, denoting pregnancy as appropriate, must also be present on theclaim for STI services along with one of the procedure codes above.Screening for chlamydia and gonorrhea:Pregnant women who are 24 years old or younger when the diagnosis of pregnancy is known andthen repeat screening during the third trimester if high-risk sexual behavior has occurred since theinitial screening test;Pregnant women who are at increased risk for STIs when the diagnosis of pregnancy is known andthen repeat screening during the third trimester if high-risk sexual behavior has occurred since theinitial screening test; andWomen at increased risk for STIs annually.<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 37

Screening for syphilis:Pregnant women when the diagnosis of pregnancy is known and then repeat screening during thethird trimester and at delivery if high-risk sexual behavior has occurred since the previous screeningtest; andMen and women at increased risk for STIs annually.Screening for hepatitis B:Pregnant women at the first prenatal visit when the diagnosis of pregnancy is known and then rescreeningat the time of delivery for those with new or continuing risk factors.Coverage for HIBCCMS will also cover up to two, individual, 20- to 30-minute, face-to-face counseling sessions annually for<strong>Medicare</strong> beneficiaries for HIBC to prevent STIs (G0445) for all sexually active adolescents and for adultsat increased risk for STIs (V69.8), if referred for this service by a primary care provider and provided by a<strong>Medicare</strong> eligible primary care provider in a primary care setting. HIBC is defined as a program intended topromote sexual risk reduction or risk avoidance which includes each of these broad topics, allowingflexibility for appropriate patient-focused elements:Education;Skills training; and,Guidance on how to change sexual behavior.The high/increased risk individual sexual behaviors, based on the USPSTF guidelines, include any of thefollowing:Multiple sex partners;Using barrier protection inconsistently;Having sex under the influence of alcohol or drugs;Having sex in exchange for money or drugs;Age (24 years of age or younger and sexually active for women for chlamydia and gonorrhea);Having an STI within the past year;IV drug use (hepatitis B only); and,In addition, for men – men having sex with men (MSM) and engaged in high-risk sexual behavior,but no regard to age.Community social factors such as high prevalence of STIs in the community populations should also beconsidered in determining high/increased risk for chlamydia, gonorrhea, syphilis, and in recommendingHIBC.High/increased risk sexual behavior for STIs is determined by the primary care provider by assessing thepatient’s sexual history which is part of any complete medical history, typically part of an AWV or prenatalvisit and considered in the development of a comprehensive prevention plan. The medical record should bea reflection of the service provided.For the purposes of this NCD, a primary care setting is defined as the provision of integrated, accessiblehealth care services by clinicians who are accountable for addressing a large majority of personal health care<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 38

needs, developing a sustained partnership with patients, and practicing in the context of family andcommunity. Emergency departments, inpatient hospital settings, ambulatory surgical centers (ASCs),independent diagnostic testing facilities, skilled nursing facilities (SNFs), inpatient rehabilitationfacilities, clinics providing a limited focus of health care services, and hospice are examples of settingsnot considered primary care settings under this definition.For the purposes of this NCD, a “primary care physician” and “primary care practitioner” will be definedconsistent with existing sections of the Social Security Act (Sections 1833(u)(6), 1833(x)(2)(A)(i)(I) and1833(x)(2)(A)(i)(II)), as follows:1833(u) (6) Physician Defined.—For purposes of this paragraph, the term “physician” means aphysician described in Section 1861(r)(1) and the term “primary care physician” means a physicianwho is identified in the available data as a general practitioner, family practice practitioner, generalinternist, or obstetrician or gynecologist.1833(x)(2)(A)(i) (I) is a physician (as described in Section 1861(r)(1)) who has a primary specialtydesignation of family medicine, internal medicine, geriatric medicine, or pediatric medicine; or (II)is a nurse practitioner, clinical nurse specialist, or physician assistant (as those terms are defined inSection 1861(aa)(5)).Billing RemindersInstitutional providers should note that coverage requires services be performed in a primary caresetting. Consequently, if STI services are billed on Types of Bill (TOB) other than 13X, 14X and 85X(when the revenue code on the 85X is not 096X, 097X, or 098X), OR, if G0445 is submitted on a TOBother than 13X, 71X, 77X, or 85X, payment for the services will be denied using the following:o Claim Adjustment Reason Code (CARC) 170 – “Payment is denied when performed/billed by thistype of provider. Note: Refer to the 835 Healthcare Policy Identification Segment (loop 2110Service Payment Information REF), if present.”o Remittance Advice Remark Code (RARC) N428 – “This service was denied because <strong>Medicare</strong> onlycovers this service in certain settings.”When applying frequency limitations to HIBC services, contractors will allow both a claim for theprofessional service and a claim for the facility fee. Institutional claims may be identified as facility feeclaims for screening services if they contain G0445, and TOB 13X or TOB 85X (when the revenue codeis not 096X, 097X, or 098X). All other claims should be identified as professional service claims forHIBC services (professional claims, and institutional claims with TOB 71X or 77X, or 85X when therevenue code is 096X, 097X, or 098X.Contractors will allow institutional claims, TOBs 71X and 77X, to submit additional revenue lines onclaims with G0445. Also, HCPCS G0445 will not pay separately with another encounter/visit on thesame day for TOBs 71X and 77X with the exception of: initial preventive physical claims, claimscontaining modifier 59, and 77X claims containing diabetes self-management training and medicalnutrition therapy services. If HCPCS G0445 is present on revenue lines along with an encounter/visitwith the same line-item date of service, contractors will assign group code CO and reason code 97 –“The benefit for this service is included in the payment/allowance for another service/procedure that hasalready been adjudicated. Note: Refer to the 835 Healthcare Policy Identification Segment (loop 2110Services Payment Information REF), if present.”<strong>Medicare</strong> B <strong>Newsline</strong> <strong>March</strong> <strong>2012</strong> 39