APRIL 2012 issue n°128THE DISRUPTIVE SEMICONDUCTOR TECHNOLOGIES MAGAZINEINSIDE…SCHMID’s solar cell turnkey manufacturingsolutionsSCHMID, a well-established machine manufacturer, offers a complete turnkeysolar solution—from silicon to module. The company’s machines and processesare, notably, also suitable for use in many microelectronics applications.Copyrights © <strong>Yole</strong> Développement SA. All rights reserved - Recycled paperAs a privately held, family business based inGermany, SCHMID has a remarkably longhistory of nearly 150 years makingmachinery. The company, known for its printedcircuit board and fl at panel display technologies,became involved in the photovoltaics industry backin 2001 and is now providing solar cell turnkeymanufacturing solutions.SCHMID is differentiating itself in the photovoltaicsindustry by offering true turnkey solutions rangingfrom silicon to module manufacturing, and, mostnotably, by being the only company thatmanufactures nearly 100% of the equipment it usesin-house for silicon, wafer, cell, and modulemanufacturing.MachineryIn the photovoltaic area, SCHMID makes and offersa wide range of equipment.For silicon manufacturing, the company offers a fullturnkey facility or individual pieces of equipmentsuch as hydrochlorination, disproportionation, orCVD reactors, based on a monosilane- process.Their wafer manufacturing tool line includes:Diverters, metrology sorter systems, pick+placerobots, wafer cleaning, wafer pre-cleaning, andwafer singulation tools.For cell manufacturing, their tool line and productofferings include: Acid texturing, alkaline texturing,buffer and fl ex buffer, carrier loader and unloader,cell sorter, conveyor including inline measurement,inline diffusion furnace, electroplating, fi ring, inkjetDOD <strong>30</strong>0, laserblue, laser transfer printing, lasertreatment, LIP light-induced plating, load cell line,multilane loader and unloader, PECVD loader andunloader, phosphor doper, pick+place robots,POCL3 diffusion furnace, APCVD system, SE jet,selective emitter technology, single-side edgeisolation, and PSG etching.For modules, they offer: Module certifi cation, glassloader, glass washer, stringer, laminator, layupstation, trimming station, framing station, conveyor,and sun simulation. And for thin fi lms, their tool lineand products include: Developer, glass washer,KCN-etch, single-side etch, and TCO-etch.ProcessesThe manufacturing processes involved inphotovoltaics are, for the most part, quite differentthan those used in microelectronics, according toChristian Buchner, vice president of SCHMIDGroup’s Cell Unit. But there is some crossover andthere are areas in which the microelectronicsindustry could benefit from their tools andprocesses.Solar cell manufacturing begins with metallurgicalsilicon, which is essentially run through ahydrochlorination process, followed by a distillation,and then finally through a chemical vapordeposition monosilane process to generate silicon.“The advantage of this process is that we end upwith a very high purity silicon, which provideseffi ciency benefi ts at the end,” explains Buchner.“The conversion of sunlight to electricity dependson the material quality of the wafers. Ourtechnology also includes excellent cleaningprocesses of the wafers. When using ingotgeneratedsilicon, it gets sliced into wafers, andthen cleaned again before we send it off tomanufacturing.”The next step is cell manufacturing and theprocesses become more closely linked to those inthe microelectronics world. Using a dopingprocess, the p-n junction is added to the solarcells, which then generates the electricity. “Weuse thin film applications for passivation and ananti-reflection coating, then metallizationprocesses in which we seed silver-lined plates,which then act as the final electrode,” Buchnersays. “Metallization also uses partial screenprinting processes.”After creation of the final cell comes the“moduleing” step, in which SCHMID tabs andstrings the cells. This is followed by “laying up” thestrings to a matrix.Encapsulation and sun simulation are the finalSCHMID Mono Silane based Silicon Fab (Courtesy of SCHMID Group)SCHMID Solar cell manufacturing line(Courtesy of SCHMID Group)steps, and the result is functional modules.“As a machine manufacturer, we design theproducts and are also actively involved in solar celldesign. We’re working in-house in our R&D labs todevelop new solar cell concepts that increase thesolar cell power conversion effi ciency as well as toreduce the cost—both major issues. Rather thanjust building machines, we’re focused on improvingthe fi nal product,” points out Buchner.Applications in microelectronicsSCHMID’s technology and their machines can alsobe used outside the solar realm. The polysiliconmaterial generated for solar purposes is ideal formicroelectronics, Buchner notes.“The cell manufacturing steps in which we use wetchemistry processes, facility automation, ormetallization can also be used in themicroelectronics or PCB industries. Our thin fi lmdeposition systems are ideal for microelectronics.And doping is one of the key things that comes outof the semiconductor industry and, with ourmodifi cation, can be made cheaper,” says Buchner.GoalsSolar power is already quite competitive cost-wise,but remains greatly underestimated. In the future,from a cost perspective, Buchner believesphotovoltaics will make it diffi cult for conventionalpower-generating plants to compete.“We intend to push photovoltaics to its limits interms of effi ciency and lower costs. And by the endof this year, SCHMID will be coming out withstorage solutions, which is a big step in pushingphotovoltaics through and into the privatehouseholds and industry. If you’re able to storepower cheaply, it becomes a total solution. Ourgoal is for photovoltaics to power independenthouseholds in the future,” says Buchner.www.schmid-group.com4

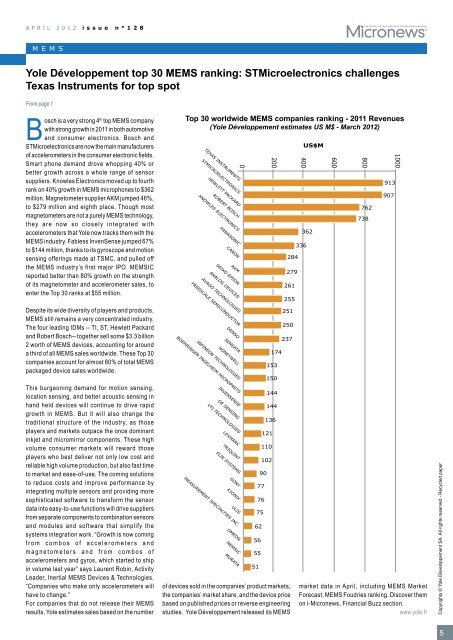

APRIL 2012 issue n°128THE DISRUPTIVE SEMICONDUCTOR TECHNOLOGIES MAGAZINE<strong>MEMS</strong><strong>Yole</strong> Développement <strong>top</strong> <strong>30</strong> <strong>MEMS</strong> <strong>ranking</strong>: <strong>STMicroelectronics</strong> challengesTexas Instruments for <strong>top</strong> spotFrom page 1Bosch is a very strong 4 th <strong>top</strong> <strong>MEMS</strong> companywith strong growth in 2011 in both automotiveand consumer electronics. Bosch and<strong>STMicroelectronics</strong> are now the main manufacturersof accelerometers in the consumer electronic fields.Smart phone demand drove whopping 40% orbetter growth across a whole range of sensorsuppliers. Knowles Electronics moved up to fourthrank on 40% growth in <strong>MEMS</strong> microphones to $362million. Magnetometer supplier AKM jumped 46%,to $279 million and eighth place. Though mostmagnetometers are not a purely <strong>MEMS</strong> technology,they are now so closely integrated withaccelerometers that <strong>Yole</strong> now tracks them with the<strong>MEMS</strong> industry. Fabless InvenSense jumped 67%to $144 million, thanks to its gyroscope and motionsensing offerings made at TSMC, and pulled offthe <strong>MEMS</strong> industry’s first major IPO. <strong>MEMS</strong>ICreported better than 80% growth on the strengthof its magnetometer and accelerometer sales, toenter the Top <strong>30</strong> ranks at $55 million.Top <strong>30</strong> worldwide <strong>MEMS</strong> companies <strong>ranking</strong> - 2011 Revenues(<strong>Yole</strong> Développement estimates US M$ - March 2012)Despite its wide diversity of players and products,<strong>MEMS</strong> still remains a very concentrated industry.The four leading IDMs -- TI, ST, Hewlett Packardand Robert Bosch-- together sell some $3.3 billion2 worth of <strong>MEMS</strong> devices, accounting for arounda third of all <strong>MEMS</strong> sales worldwide. These Top <strong>30</strong>companies account for almost 80% of total <strong>MEMS</strong>packaged device sales worldwide.This burgeoning demand for motion sensing,location sensing, and better acoustic sensing inhand held devices will continue to drive rapidgrowth in <strong>MEMS</strong>. But it will also change thetraditional structure of the industry, as thoseplayers and markets outpace the once dominantinkjet and micromirror components. These highvolume consumer markets will reward thoseplayers who best deliver not only low cost andreliable high volume production, but also fast timeto market and ease-of-use. The coming solutionsto reduce costs and improve performance byintegrating multiple sensors and providing moresophisticated software to transform the sensordata into easy-to-use functions will drive suppliersfrom separate components to combination sensorsand modules and software that simplify thesystems integration work. “Growth is now comingfrom combos of accelerometers andmagnetometers and from combos ofaccelerometers and gyros, which started to shipin volume last year” says Laurent Robin, ActivityLeader, Inertial <strong>MEMS</strong> Devices & Technologies.“Companies who make only accelerometers willhave to change.”For companies that do not release their <strong>MEMS</strong>results, <strong>Yole</strong> estimates sales based on the numberof devices sold in the companies’ product markets,the companies’ market share, and the device pricebased on published prices or reverse engineeringstudies. <strong>Yole</strong> Développement released its <strong>MEMS</strong>market data in April, including <strong>MEMS</strong> MarketForecast, <strong>MEMS</strong> Foudries <strong>ranking</strong>. Discover themon i-Micronews, Financial Buzz section.www.yole.frCopyrights © <strong>Yole</strong> Développement SA. All rights reserved - Recycled paper5