Resume - INSEAD - PhD Programme

Resume - INSEAD - PhD Programme

Resume - INSEAD - PhD Programme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

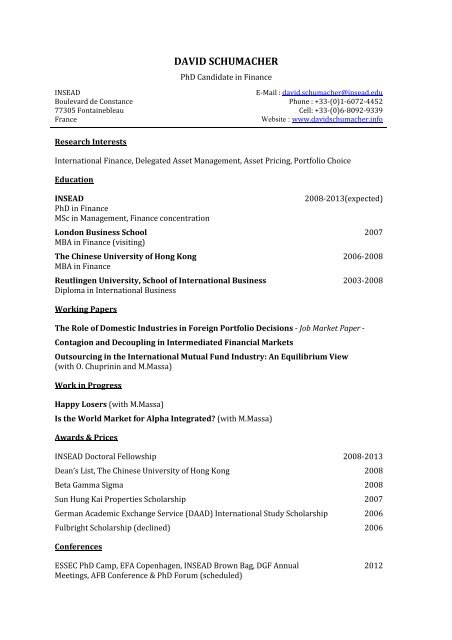

DAVID SCHUMACHER<strong>PhD</strong> Candidate in Finance<strong>INSEAD</strong>Boulevard de Constance77305 FontainebleauFranceE-Mail : david.schumacher@insead.eduPhone : +33-(0)1-6072-4452Cell: +33-(0)6-8092-9339Website : www.davidschumacher.infoResearch InterestsInternational Finance, Delegated Asset Management, Asset Pricing, Portfolio ChoiceEducation<strong>INSEAD</strong><strong>PhD</strong> in FinanceMSc in Management, Finance concentrationLondon Business SchoolMBA in Finance (visiting)The Chinese University of Hong KongMBA in FinanceReutlingen University, School of International BusinessDiploma in International Business2008-2013(expected)20072006-20082003-2008Working PapersThe Role of Domestic Industries in Foreign Portfolio Decisions - Job Market Paper -Contagion and Decoupling in Intermediated Financial MarketsOutsourcing in the International Mutual Fund Industry: An Equilibrium View(with O. Chuprinin and M.Massa)Work in ProgressHappy Losers (with M.Massa)Is the World Market for Alpha Integrated? (with M.Massa)Awards & Prices<strong>INSEAD</strong> Doctoral Fellowship 2008-2013Dean’s List, The Chinese University of Hong Kong 2008Beta Gamma Sigma 2008Sun Hung Kai Properties Scholarship 2007German Academic Exchange Service (DAAD) International Study Scholarship 2006Fulbright Scholarship (declined) 2006ConferencesESSEC <strong>PhD</strong> Camp, EFA Copenhagen, <strong>INSEAD</strong> Brown Bag, DGF AnnualMeetings, AFB Conference & <strong>PhD</strong> Forum (scheduled)2012

<strong>INSEAD</strong> Brown Bag, IFABS Annual Meeting, NBER Summer Institute (studenttravel grant), Paris International Finance Meeting2011Teaching ExperienceTutorial “Corporate Financial Policy” for Prof. Pascal MaenhoutTutorial “Corporate Financial Policy” for Prof. Astrid SchornickAverage Teaching Evaluation: 4.2/52011 (Fall)2011 (Spring)Professional ExperienceAllianz Global Investors, Germany, Systematic Products / Fund of Funds 2008Mercer Oliver Wyman, South Africa, Financial Services Consulting 2006Dresdner Kleinwort Wasserstein, Germany, M&A 2006Allianz Australia Services, Australia, Personal Injury Division 2004-2005OtherAd-hoc referee: Financial Analysts JournalLanguages: German (Native), English (Fluent), French (Intermediate), Spanish (Beginner)IT: Stata, SAS, Mathematica, Dynare, MS Office, Lyx, Thomson-Reuters Datastream, Worldscope,FactSet/LionShares, Morningstar Global, DataExplorersSummer Schools: CEMFI Summer School in Dynamic Panel Data EconometricsNationality: GermanReferencesBernard Dumas<strong>INSEAD</strong> Chaired Professor in FinanceE-Mail: bernard.dumas@insead.eduPhone: +33-(0)1-6072-4373<strong>INSEAD</strong>Boulevard de Constance77305 Fontainebleau, FrancePierre HillionThe de Picciotto Chaired Professor of AlternativeInvestmentsE-Mail: pierre.hillion@insead.eduPhone: +65-6799-5331<strong>INSEAD</strong>1 Ayer Rajah Avenue138676 SingaporeHong ZhangAssistant Professor of FinanceE-Mail: hong.zhang@insead.eduPhone: +65-6799-5340<strong>INSEAD</strong>1 Ayer Rajah Avenue138676 SingaporeZhiguo HeAssociate Professor of Finance and Robert KingSteel Faculty FellowE-Mail: zhiguo.he@chicagobooth.eduPhone: +1-773-834-3769The University of Chicago Booth School of Business5807 South Woodlawn AvenueChicago IL 60637, U.S.A.Massimo MassaThe Rothschild Chaired Professor of BankingE-Mail: massimo.massa@insead.eduPhone: +33-(0)1-6072-4481<strong>INSEAD</strong>Boulevard de Constance77305 Fontainebleau, France

Working Paper AbstractsThe Role of Domestic Industries in Foreign Portfolio Decisions - Job Market Paper -Abstract: I analyze foreign portfolio decisions and performance of international mutual funds.In their foreign portfolios, funds overweight and concentrate in industries that are large in theirhome country. On the country level, they underweight countries with a different industrystructure relative to home. This Foreign Industry Bias is concentrated in funds with a classicalHome Bias. For those funds, Foreign Industry Bias is associated with superior performance andforeign stock picking is a significant contributor to that performance. Their foreign trades comovewith current home country and global industry returns and subsequently predict foreignstock returns. Both portfolio characteristics and performance are persistent at the one yearhorizon. Taken as a whole, the evidence supports the view that some funds successfully usedomestically-rooted industry information when investing abroad and suggests that domesticindustry structures proxy for the relative informational advantage enjoyed by different foreigninvestors.Contagion and Decoupling in Intermediated Financial MarketsAbstract: I analyze the interplay between fundamental and intermediation risk in a multi-assetdynamic general equilibrium model with heterogeneous agents. Agents differ in their level ofdirect access to investment opportunities. Intermediation relationships are formed to overcomelimited market access. Intermediation risk is captured via frictions in the relationships betweenagents that introduce fragility into asset prices. Asset prices are fragile when they have aconcentrated investor base making them dependent on the fortunes of a few investors. Incontrast, a non-concentrated investor base makes asset prices resilient with respect tointermediation risk. But not all assets with a concentrated investor base are fragile. I identifyfundamental characteristics that induce resilience in assets with a common concentratedinvestor base. These characteristics lead to portfolio rebalancing within the common investorbase that makes some assets resilient and renders others fragile in the presence ofintermediation risk. Likewise, in a multi-asset framework, assets that are resilient due to abroad investor base are not completely immune to the fragility experienced by other assets. In adynamic context, fragile assets tend to experience contagion whereas resilient assets tend todecouple whenever the intermediation frictions are severe. I argue that an understanding of thedynamic behavior of asset prices requires an understanding of fundamental and intermediationrisk as well as the interaction between the two.Outsourcing in the International Mutual Fund Industry: An Equilibrium View(with O. Chuprinin and M.Massa)Abstract: We study international subcontracting in the asset management industry. Wedocument that in companies that manage both funds on behalf of other companies (outsourcedfunds) and own funds (inhouse funds), the inhouse funds outperform outsourced by 1.14%annually or by 50%-75% of their expense ratio. We explain this difference in performance asoutsourced funds subsidizing inhouse funds. We justify it as an implicit form of incentive-basedcompensation accepted by the contractor management company that incentivizes thesubcontractor to deliver higher performance on the managed funds. As contract theory posits,we find that subsidization makes the subcontractor deliver higher performance; subsidization islower the more difficult it is for the principal to observe the agent - i.e., the fund family and themanagement company are located in different countries -; subsidization is negatively related tothe degree of exclusivity in the family-subcontractor relationship; subsidization is positivelyrelated to the bargaining power of the management company - i.e., its ability to independentlymarket and distribute its funds to investors. All these results are consistent with an equilibriumview in which subsidization is a part of the incentive compensation of the agent.