VALUATION DISCOUNTS AND PREMIUMS

VALUATION DISCOUNTS AND PREMIUMS

VALUATION DISCOUNTS AND PREMIUMS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

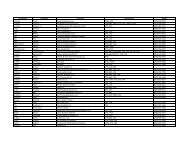

Fundamentals, Techniques & Theory<strong>VALUATION</strong> <strong>DISCOUNTS</strong> <strong>AND</strong> <strong>PREMIUMS</strong>Historical Premium CompilationA historical analysis of the control premiums and the corresponding minority discountscalculated in this study are as follows:Average Median ImpliedYear of Number of Premium Paid Premium Paid Minority InterestBuyout Transactions over Market (%) over Market (%) Discount (%)1980 169 49.9 44.6 30.81981 166 48.0 41.9 29.51982 176 47.4 43.5 30.31983 168 37.7 34.0 25.41984 199 37.9 34.4 25.61985 331 37.1 27.7 21.71986 333 38.2 29.9 23.01987 237 38.3 30.8 23.51988 410 41.9 30.9 23.61989 303 41.0 29.0 22.51990 175 42.0 32.0 24.21991 137 35.1 29.4 22.71992 142 41.0 34.7 25.81993 173 38.7 33.0 24.81994 260 41.9 35.0 25.91995 324 44.7 29.2 22.61996 381 36.6 27.3 21.51997 487 35.7 27.5 21.61998 512 40.7 30.1 23.11999 723 43.3 34.6 25.72000 574 49.2 41.1 29.12001 439 57.2 40.5 28.82002 326 59.7 34.4 25.6Source: Mergerstat ® Review 2003. (Los Angeles: Applied Financial Information L.P.)Computation of Implied Minority Discount from Mergerstat Review Data Formula:x = 1 – [1/ (1 + y)]x = implied minority discounty = median premium paidApplication:x = 1 – [1/ (1 + .344)]x = 1 - (1/1.344)x = 1 - .7440x = .256© 1995–2012 by National Association of Certified Valuators and Analysts (NACVA). All rights reserved. Chapter Seven – 13Used by Institute of Business Appraisers with permission of NACVA for limited purpose of collaborative training. 2012.v1