VALUATION DISCOUNTS AND PREMIUMS

VALUATION DISCOUNTS AND PREMIUMS

VALUATION DISCOUNTS AND PREMIUMS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

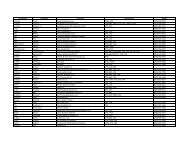

Fundamentals, Techniques & Theory<strong>VALUATION</strong> <strong>DISCOUNTS</strong> <strong>AND</strong> <strong>PREMIUMS</strong>An example of just how influential the modifications are on the listed premiums can be found inthe following chart (excerpted from Mercer’s 1996 paper):Mergerstat Review Implied MinorityHistorical Control Premiums Interest DiscountsAverages Median Averages MedianAs reported from 1995* 44.7% 29.2% 31.0% 23.0%Exclude < 0% and > 150% 35.3% 28.9% 26.0% 22.0%Exclude > 150%; Include < 0% 28.3% 24.9% 22.0% 20.0%Exclude > 100%; Include < 0% 24.2% 24.0% 19.0% 19.0%* Mergerstat Review excluded two premiums exceeding 100 percent in the reported averages.Also, the reported figures exclude 37 transactions with calculated premiums of less than orequal to zero,Simply including the negative premiums for the fourth quarter 2000 transactions reflect adecrease in the average premium from 44.7 to 31.0 percent. Therefore, it is critical that thebusiness valuator consider the implications of the data modifications in general and theexclusion of negative control premiums in particular.In the January 1999 issue of Shannon Pratt’s “Business Valuation Update,” Dr. Pratt observedthat for the quarter ended September 30, 1998, 20 of 58 reported domestic transactions reportedin the HLHZ Control Premium Study sold at discounts from their prior public trading prices.For the fourth quarter, 2000, the numbers are not quite as sharp with 30 of 147 domestictransactions reporting a discount. This equates to 20 percent of all transactions reported sellingat a discount instead of a premium.Obviously a valuator must be careful, but how does one best develop the appropriate controlpremium? The HLHZ Control Premium Study, which is published quarterly, offers numerousdata points with which specific control premium conclusions can be developed.Each situation should be considered based on its specific facts and circumstances. After anintimate knowledge of the company under valuation is developed, consider the appropriatenessof each of the reported transactions considered for comparison purposes. The valuator mustthen adjust the data to exclude unwarranted/ non-comparable transactions due to the inclusionof acquisition premiums, synergistic premiums and/or consolidation premiums.III. MINORITY <strong>DISCOUNTS</strong> FOR FAMILY TRANSFERSFor years, the Internal Revenue Service had tried to eliminate minority interest discounts fortransfers of stock in family-owned corporations. Without judicial intervention, such discounts wouldnow be completely disallowed. Despite the directive from the courts to allow discounts in suchcases, until 1993 the IRS attempted to disallow them. In Rev. Rul. 93-12, the IRS formallyrecognized that gifts of closely held stock among family members should be valued separately.However, in subsequent TAMs, the IRS has tried to limit this opportunity by imposing a swing votepremium, collapsing transfers made in contemplation of death and exploiting the discounts in maritaldeduction scenarios.© 1995–2012 by National Association of Certified Valuators and Analysts (NACVA). All rights reserved. Chapter Seven – 15Used by Institute of Business Appraisers with permission of NACVA for limited purpose of collaborative training. 2012.v1