VALUATION DISCOUNTS AND PREMIUMS

VALUATION DISCOUNTS AND PREMIUMS

VALUATION DISCOUNTS AND PREMIUMS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

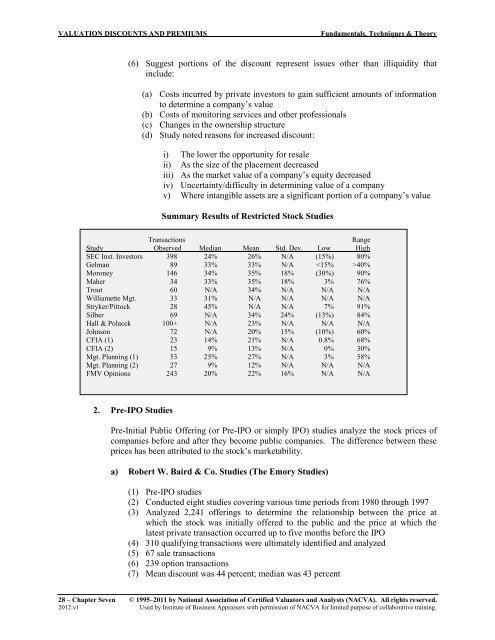

<strong>VALUATION</strong> <strong>DISCOUNTS</strong> <strong>AND</strong> <strong>PREMIUMS</strong>Fundamentals, Techniques & Theory(6) Suggest portions of the discount represent issues other than illiquidity thatinclude:(a) Costs incurred by private investors to gain sufficient amounts of informationto determine a company’s value(b) Costs of monitoring services and other professionals(c) Changes in the ownership structure(d) Study noted reasons for increased discount:i) The lower the opportunity for resaleii) As the size of the placement decreasediii) As the market value of a company’s equity decreasediv) Uncertainty/difficulty in determining value of a companyv) Where intangible assets are a significant portion of a company’s valueSummary Results of Restricted Stock StudiesTransactionsRangeStudy Observed Median Mean Std. Dev. Low HighSEC Inst. Investors 398 24% 26% N/A (15%) 80%Gelman 89 33% 33% N/A 40%Moroney 146 34% 35% 18% (30%) 90%Maher 34 33% 35% 18% 3% 76%Trout 60 N/A 34% N/A N/A N/AWilliamette Mgt. 33 31% N/A N/A N/A N/AStryker/Pittock 28 45% N/A N/A 7% 91%Silber 69 N/A 34% 24% (13%) 84%Hall & Polacek 100+ N/A 23% N/A N/A N/AJohnson 72 N/A 20% 15% (10%) 60%CFIA (1) 23 14% 21% N/A 0.8% 68%CFIA (2) 15 9% 13% N/A 0% 30%Mgt. Planning (1) 53 25% 27% N/A 3% 58%Mgt. Planning (2) 27 9% 12% N/A N/A N/AFMV Opinions 243 20% 22% 16% N/A N/A2. Pre-IPO StudiesPre-Initial Public Offering (or Pre-IPO or simply IPO) studies analyze the stock prices ofcompanies before and after they become public companies. The difference between theseprices has been attributed to the stock’s marketability.a) Robert W. Baird & Co. Studies (The Emory Studies)(1) Pre-IPO studies(2) Conducted eight studies covering various time periods from 1980 through 1997(3) Analyzed 2,241 offerings to determine the relationship between the price atwhich the stock was initially offered to the public and the price at which thelatest private transaction occurred up to five months before the IPO(4) 310 qualifying transactions were ultimately identified and analyzed(5) 67 sale transactions(6) 239 option transactions(7) Mean discount was 44 percent; median was 43 percent28 – Chapter Seven © 1995–2011 by National Association of Certified Valuators and Analysts (NACVA). All rights reserved.2012.v1 Used by Institute of Business Appraisers with permission of NACVA for limited purpose of collaborative training.