You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

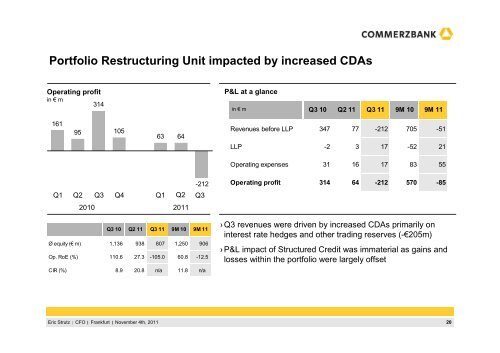

Portfolio Restructuring Unit impacted by increased CDAs<br />

Operating profit<br />

in € m<br />

161<br />

Q1<br />

95<br />

Q2<br />

314<br />

<strong>Q3</strong><br />

105<br />

Q4<br />

Eric Strutz CFO <br />

Frankfurt <br />

November 4th, <strong>2011</strong><br />

63 64<br />

Q1<br />

2010 <strong>2011</strong><br />

-212<br />

Q2 <strong>Q3</strong><br />

<strong>Q3</strong> 10 Q2 11 <strong>Q3</strong> 11 9M 10 9M 11<br />

Ø equity (€ m) 1,136 938 807 1,250 906<br />

Op. RoE (%) 110.6 27.3 -105.0 60.8 -12.5<br />

CIR (%) 8.9 20.8 n/a 11.8 n/a<br />

P&L at a glance<br />

in € m <strong>Q3</strong> 10 Q2 11 <strong>Q3</strong> 11 9M 10 9M 11<br />

Revenues before LLP 347 77 -212 705 -51<br />

LLP -2 3 17 -52 21<br />

Operating expenses 31 16 17 83 55<br />

Operating profit 314 64 -212 570 -85<br />

› <strong>Q3</strong> revenues were driven by increased CDAs primarily on<br />

interest rate hedges and other trading reserves (-€205m)<br />

› P&L impact of Structured Credit was immaterial as gains and<br />

losses within the portfolio were largely offset<br />

20