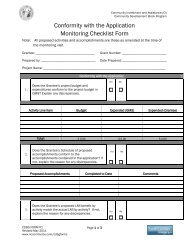

Safety and Security Equipment (SEC)OverviewReturn to top2008* 2009* 2010*Total Market Size 26,380 26,910 27,450Total Local Production 16,880 16,950 17,290Total Exports 5,010 5,110 5,490Total Imports 14,510 15,070 15,650Imports from the U.S. 4,060 4,070 4,070Exchange rate: USD 1.00 Euro 0.7 Euro 0.7 Euro 0.7*(Figures in USD millions; * indicates un<strong>of</strong>ficial estimates based on various industry sources including Atlasen Toute Sécurité). Year to year figures adjusted for varying exchange rate.The safety and sector represents 23 different security segments in France, which can beloosely grouped into the following areas: anti-terrorism, electronic security, monitoring,guarding, physical security, health and safety products, fire security and cash in transit.The total market was valued at approximately 18.9 billion Euros in 2008 (the latestpublished figures available) with a total growth valued at +4.7% over the previous year.Within the 23 French safety and security industry segments, the segments enjoying thehighest growth rate are anti-terrorist equipment (+16.7% in 2008), personal protectionservices (+13.2%), consulting and engineering (+14.9%), and IT security (+10.9%). Arecent French study shows that between 2003 and 2008, the video surveillance sectorhas known consistent growth, totaling 42% over the 5 years. Segments such as locks,retail theft protection, remote industrial and residential monitoring services, personalprotection equipment, anti-intrusion alarms and guard services remained flat or showeda decrease in 2008. <strong>In</strong> fact, only about 70% <strong>of</strong> companies operating in the securitysector in France in 2008 turned a pr<strong>of</strong>it. <strong>In</strong> many segments such as fire protection andguard services, there are simply too many players on the market; fierce competitioncoupled with low prices continues to drive a high number <strong>of</strong> firms out <strong>of</strong> business. Thesebusinesses continued to be hit hard in the poor economic climate <strong>of</strong> 2009, which isexpected to last through 2010, as companies deferred investments in new securityequipment whenever possible. <strong>In</strong>dustry experts expect the security sector to remainrelatively stable overall; some subsectors are very hard hit, while others such ashomeland security have been successful in growing their markets.For the first time, penetration <strong>of</strong> the security market by foreign companies decreased in2009, although overall the level remains high. Entire sub-sectors <strong>of</strong> French privatesecurity industry in France are dominated by foreign groups, as opposed to less than 20percent overall ten years ago. For example, in the cash-in-transit sector, non-Frenchgroups control 89 percent <strong>of</strong> market share in 2008. High ratios exist inequipment/services for pr<strong>of</strong>essional monitoring and many other market sub-sectors.Overall, foreign firms control more than 36 percent <strong>of</strong> the industry.2/18/2010 <strong>Country</strong> Commercial Guide for France 44INTERNATIONAL COPYRIGHT, U.S. & FOREIGN COMMERCIAL SERVICEAND U.S. DEPARTMENT OF STATE, © 2010. ALL RIGHTS RESERVED OUTSIDE OF THE UNITED STATES.

Best ProspectsReturn to topFortunately, there are a few bright spots; demand for homeland security equipment isexpected to be sustained, as is demand for personal monitoring (for elderly people, forexample), CCTV (especially for digital systems), and personal protection. The subsectorexpected to suffer the most is guard services and pr<strong>of</strong>essional monitoring, as prices arein a downward spiral. The sector expected to expand the most is video surveillance;both public and private entities in France should increase their spending in this particularsector.Closed Circuit TV (CCTV), especially for digital systems, represents an ongoing growtharea in the industrial security market in France. Municipalities continue to install IPCCTV systems; the Ministry <strong>of</strong> <strong>In</strong>terior recently announced that it will be pursuing a planto spend 21 million Euros in an effort to triple the number <strong>of</strong> video surveillance camerasin France. The plan increases the number <strong>of</strong> cameras from 20,000 to 60,000 in 75French cities by 2011. Of course, this expansion will have many more needs than justcameras, such as security s<strong>of</strong>tware, infrastructure to support the cameras, installationand maintenance, etc.Among the many technologies, the French are particularly interested in automatic facialrecognition systems, tracking video systems that analyze behavior and intelligentcameras. Biometrics and RFID technologies are generating a plethora <strong>of</strong> interesting newproducts, such as “all-in-one” cards for health insurance, transportation services oridentification.OpportunitiesReturn to topThe market in France is extremely fragmented and competitive, and it is very importantto work with a local partner or through a local sales <strong>of</strong>fice, which many U.S. firms chooseto establish. Some kind <strong>of</strong> local presence becomes essential when working withgovernment ministries or responding to public tenders.U.S. equipment and security technologies are well known for their innovation and quality.Imports should remain strong, although competition is extremely severe from bothFrench and third country sources.ResourcesReturn to topExpo Protection/Feu<strong>In</strong>ternational Safety & Security and Fire Fighting & RescueParis, France - November 2-4, 2010: http://www.expos-protection.com/expoprot/Alarmes Protection Sécurité (APS)Electronic and Physical Security ShowParis, France – September 2011: http://www.salon-aps.com<strong>In</strong>formation on the French Security MarketEn Toute Sécurité : http://www.security-info.comAmerican Embassy – U.S. Commercial Service Commercial Specialist:Cara.Boulesteix@mail.doc.gov2/18/2010 <strong>Country</strong> Commercial Guide for France 45INTERNATIONAL COPYRIGHT, U.S. & FOREIGN COMMERCIAL SERVICEAND U.S. DEPARTMENT OF STATE, © 2010. ALL RIGHTS RESERVED OUTSIDE OF THE UNITED STATES.

- Page 1 and 2: Doing Business in France:2010 Count

- Page 3 and 4: CRS Report for Congress. Order Code

- Page 5 and 6: Return to table of contentsChapter

- Page 7 and 8: Key Link: http://eurlex.europa.eu/L

- Page 9 and 10: Statutory representatives work acco

- Page 11 and 12: Key Link: http://ec.europa.eu/justi

- Page 13 and 14: premises (e.g., door-to-door sales)

- Page 15 and 16: Direct Marketing over the InternetT

- Page 17 and 18: Distribution and Sales ChannelsRetu

- Page 19 and 20: Department stores have lost some ma

- Page 21 and 22: Electronic CommerceReturn to topIn

- Page 24: Food SupplementsRegulation 1925/200

- Page 27 and 28: Legal Warranties and After-sales Se

- Page 29 and 30: Copyrightimports of IPR-infringing

- Page 31 and 32: Under the French intellectual prope

- Page 33 and 34: Designs and ModelsDesigns and model

- Page 35 and 36: At the same time the firm is provid

- Page 37 and 38: VAT on Electronic Service:http://ec

- Page 39 and 40: Le Nouvel Economiste: [http://www.n

- Page 41 and 42: Travel & Tourism (TRA)OverviewRetur

- Page 43: 2010 will continue to present chall

- Page 47 and 48: Computers and Software (CSF, CSV)Ov

- Page 49 and 50: OpportunitiesReturn to topThe curre

- Page 51 and 52: ServersEstimated at $562 million, t

- Page 53 and 54: ResourcesReturn to topInternational

- Page 55 and 56: then redistribute those minutes to

- Page 57 and 58: Wastewater Sludge TreatmentWastewat

- Page 59 and 60: Medical Equipment (MED)OverviewRetu

- Page 61 and 62: Automotive parts Equipment (APS)Ove

- Page 63 and 64: Plastics (PMR)OverviewReturn to top

- Page 65 and 66: Education Services (EDS)OverviewRet

- Page 67 and 68: Textile (TXT)OverviewReturn to top2

- Page 69 and 70: Major trade shows:• Lingerie trad

- Page 71 and 72: Trade events:Direct Marketing Show

- Page 73 and 74: Beverages, including Mineral Water,

- Page 75 and 76: Return to table of contentsChapter

- Page 77 and 78: Import DocumentationNon-agricultura

- Page 79 and 80: WEEE & RoHSEU rules on waste electr

- Page 81 and 82: Customs Regulations and Contact Inf

- Page 83 and 84: Website: http://www.douane.gouv.fr/

- Page 85 and 86: governmental organizations, such as

- Page 87 and 88: Products manufactured to standards

- Page 89 and 90: LEMVP/Laboratoire d'Essais des Mat

- Page 91 and 92: UTAC/Union Technique de l'Automobil

- Page 93 and 94: international markets. Register onl

- Page 95 and 96:

Trade AgreementsReturn to topEU web

- Page 97 and 98:

Web ResourcesReturn to topNational

- Page 99 and 100:

President Sarkozy in 2007. In an Am

- Page 101 and 102:

Most businesses must deal with sign

- Page 103 and 104:

decisions are made by the Ministry

- Page 105 and 106:

trader's card, please consult the I

- Page 107 and 108:

Western and Southern StatesIFANA Sa

- Page 109 and 110:

Protection of Property RightsReturn

- Page 111 and 112:

Exchange. Options are traded on the

- Page 113 and 114:

2/18/2010 Country Commercial Guide

- Page 115 and 116:

is generally deemed acceptable as l

- Page 117 and 118:

strongly endorses their eventual ac

- Page 119 and 120:

France actively pursues public corr

- Page 121 and 122:

Republic, Qatar, Romania, Saudi Ara

- Page 123 and 124:

Following the economic downturn, th

- Page 125 and 126:

of U.S. firms are established in Fr

- Page 127 and 128:

Stock by country of destination (Bo

- Page 129 and 130:

the terms requires the issuance of

- Page 131 and 132:

also offer hedging against interest

- Page 133 and 134:

The Bank of New York Mellon (repres

- Page 135 and 136:

subsequent public tenders related t

- Page 137 and 138:

around 14% was lent outside the EU.

- Page 139 and 140:

U.S. Banks in FranceAMERICAN EXPRES

- Page 141 and 142:

United States Visas.gov: http://www

- Page 143 and 144:

Professional equipment may be tempo

- Page 145 and 146:

United States Department of Agricul

- Page 147 and 148:

ANEC - European Association for the

- Page 149 and 150:

The Trans European Policy Studies A

- Page 151 and 152:

REGIONAL DIRECTOR FOR ANIMAL, PLANT

- Page 153 and 154:

Office of Capacity Building and Dev

- Page 155 and 156:

MINISTRY OF LABOR: http://www.trava

- Page 157 and 158:

Chemical Industry AssociationUNION

- Page 159 and 160:

Paints & Inks Industry AssociationF

- Page 161 and 162:

French BanksFEDERATION BANQUAIRE FR

- Page 163:

Return to table of contentsChapter