Notes to the consolidated financial statements - Swisscom

Notes to the consolidated financial statements - Swisscom

Notes to the consolidated financial statements - Swisscom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

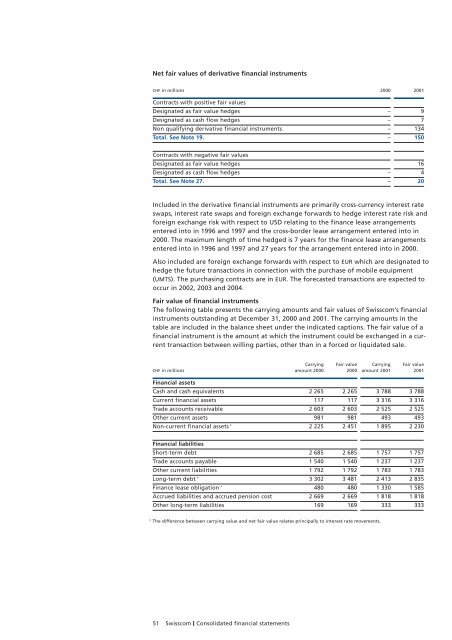

Net fair values of derivative <strong>financial</strong> instruments<br />

CHF in millions<br />

Contracts with positive fair values<br />

Designated as fair value hedges<br />

Designated as cash flow hedges<br />

Non qualifying derivative <strong>financial</strong> instruments<br />

Total. See Note 19.<br />

Contracts with negative fair values<br />

Designated as fair value hedges<br />

Designated as cash flow hedges<br />

Total. See Note 27.<br />

Included in <strong>the</strong> derivative <strong>financial</strong> instruments are primarily cross-currency interest rate<br />

swaps, interest rate swaps and foreign exchange forwards <strong>to</strong> hedge interest rate risk and<br />

foreign exchange risk with respect <strong>to</strong> USD relating <strong>to</strong> <strong>the</strong> finance lease arrangements<br />

entered in<strong>to</strong> in 1996 and 1997 and <strong>the</strong> cross-border lease arrangement entered in<strong>to</strong> in<br />

2000. The maximum length of time hedged is 7 years for <strong>the</strong> finance lease arrangements<br />

entered in<strong>to</strong> in 1996 and 1997 and 27 years for <strong>the</strong> arrangement entered in<strong>to</strong> in 2000.<br />

Also included are foreign exchange forwards with respect <strong>to</strong> EUR which are designated <strong>to</strong><br />

hedge <strong>the</strong> future transactions in connection with <strong>the</strong> purchase of mobile equipment<br />

(UMTS). The purchasing contracts are in EUR. The forecasted transactions are expected <strong>to</strong><br />

occur in 2002, 2003 and 2004.<br />

Fair value of <strong>financial</strong> instruments<br />

The following table presents <strong>the</strong> carrying amounts and fair values of <strong>Swisscom</strong>’s <strong>financial</strong><br />

instruments outstanding at December 31, 2000 and 2001. The carrying amounts in <strong>the</strong><br />

table are included in <strong>the</strong> balance sheet under <strong>the</strong> indicated captions. The fair value of a<br />

<strong>financial</strong> instrument is <strong>the</strong> amount at which <strong>the</strong> instrument could be exchanged in a current<br />

transaction between willing parties, o<strong>the</strong>r than in a forced or liquidated sale.<br />

CHF in millions<br />

Financial assets<br />

Cash and cash equivalents<br />

Current <strong>financial</strong> assets<br />

Trade accounts receivable<br />

O<strong>the</strong>r current assets<br />

Non-current <strong>financial</strong> assets *<br />

Financial liabilities<br />

Short-term debt<br />

Trade accounts payable<br />

O<strong>the</strong>r current liabilities<br />

Long-term debt *<br />

Finance lease obligation *<br />

Accrued liabilities and accrued pension cost<br />

O<strong>the</strong>r long-term liabilities<br />

Carrying<br />

amount 2000<br />

2 265<br />

117<br />

2 603<br />

981<br />

2 225<br />

2 685<br />

1 540<br />

1 792<br />

3 302<br />

480<br />

2 669<br />

169<br />

Fair value<br />

2000<br />

2 265<br />

117<br />

2 603<br />

981<br />

2 451<br />

2 685<br />

1 540<br />

1 792<br />

3 481<br />

480<br />

2 669<br />

169<br />

Carrying<br />

amount 2001<br />

* The difference between carrying value and net fair value relates principally <strong>to</strong> interest rate movements.<br />

51 <strong>Swisscom</strong> Consolidated <strong>financial</strong> <strong>statements</strong><br />

2000<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

3 788<br />

3 316<br />

2 525<br />

493<br />

1 895<br />

1 757<br />

1 237<br />

1 783<br />

2 413<br />

1 330<br />

1 818<br />

333<br />

2001<br />

9<br />

7<br />

134<br />

150<br />

16<br />

4<br />

20<br />

Fair value<br />

2001<br />

3 788<br />

3 316<br />

2 525<br />

493<br />

2 230<br />

1 757<br />

1 237<br />

1 783<br />

2 835<br />

1 585<br />

1 818<br />

333