Notes to the consolidated financial statements - Swisscom

Notes to the consolidated financial statements - Swisscom

Notes to the consolidated financial statements - Swisscom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

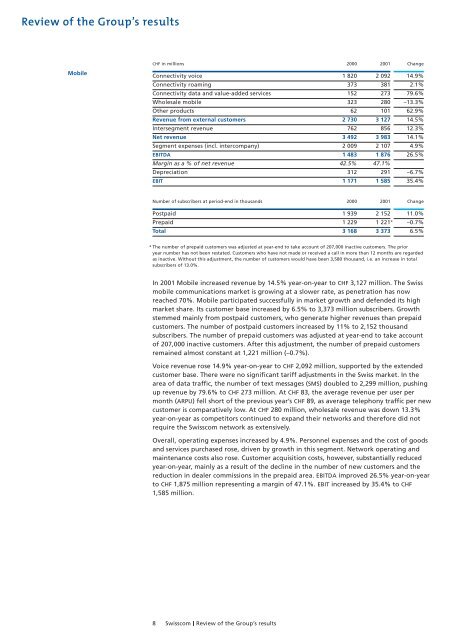

Review of <strong>the</strong> Group’s results<br />

Mobile<br />

CHF in millions 2000 2001<br />

Connectivity voice<br />

Connectivity roaming<br />

Connectivity data and value-added services<br />

Wholesale mobile<br />

O<strong>the</strong>r products<br />

Revenue from external cus<strong>to</strong>mers<br />

Intersegment revenue<br />

Net revenue<br />

Segment expenses (incl. intercompany)<br />

EBITDA<br />

Margin as a % of net revenue<br />

Depreciation<br />

EBIT<br />

Postpaid<br />

Prepaid<br />

Total<br />

In 2001 Mobile increased revenue by 14.5% year-on-year <strong>to</strong> CHF 3,127 million. The Swiss<br />

mobile communications market is growing at a slower rate, as penetration has now<br />

reached 70%. Mobile participated successfully in market growth and defended its high<br />

market share. Its cus<strong>to</strong>mer base increased by 6.5% <strong>to</strong> 3,373 million subscribers. Growth<br />

stemmed mainly from postpaid cus<strong>to</strong>mers, who generate higher revenues than prepaid<br />

cus<strong>to</strong>mers. The number of postpaid cus<strong>to</strong>mers increased by 11% <strong>to</strong> 2,152 thousand<br />

subscribers. The number of prepaid cus<strong>to</strong>mers was adjusted at year-end <strong>to</strong> take account<br />

of 207,000 inactive cus<strong>to</strong>mers. After this adjustment, <strong>the</strong> number of prepaid cus<strong>to</strong>mers<br />

remained almost constant at 1,221 million (–0.7%).<br />

Voice revenue rose 14.9% year-on-year <strong>to</strong> CHF 2,092 million, supported by <strong>the</strong> extended<br />

cus<strong>to</strong>mer base. There were no significant tariff adjustments in <strong>the</strong> Swiss market. In <strong>the</strong><br />

area of data traffic, <strong>the</strong> number of text messages (SMS) doubled <strong>to</strong> 2,299 million, pushing<br />

up revenue by 79.6% <strong>to</strong> CHF 273 million. At CHF 83, <strong>the</strong> average revenue per user per<br />

month (ARPU) fell short of <strong>the</strong> previous year’s CHF 89, as average telephony traffic per new<br />

cus<strong>to</strong>mer is comparatively low. At CHF 280 million, wholesale revenue was down 13.3%<br />

year-on-year as competi<strong>to</strong>rs continued <strong>to</strong> expand <strong>the</strong>ir networks and <strong>the</strong>refore did not<br />

require <strong>the</strong> <strong>Swisscom</strong> network as extensively.<br />

Overall, operating expenses increased by 4.9%. Personnel expenses and <strong>the</strong> cost of goods<br />

and services purchased rose, driven by growth in this segment. Network operating and<br />

maintenance costs also rose. Cus<strong>to</strong>mer acquisition costs, however, substantially reduced<br />

year-on-year, mainly as a result of <strong>the</strong> decline in <strong>the</strong> number of new cus<strong>to</strong>mers and <strong>the</strong><br />

reduction in dealer commissions in <strong>the</strong> prepaid area. EBITDA improved 26.5% year-on-year<br />

<strong>to</strong> CHF 1,875 million representing a margin of 47.1%. EBIT increased by 35.4% <strong>to</strong> CHF<br />

1,585 million.<br />

8 <strong>Swisscom</strong> Review of <strong>the</strong> Group’s results<br />

1 820<br />

373<br />

152<br />

323<br />

62<br />

2 730<br />

762<br />

3 492<br />

2 009<br />

1 483<br />

42.5%<br />

312<br />

1 171<br />

2 092<br />

381<br />

273<br />

280<br />

101<br />

3 127<br />

856<br />

3 983<br />

2 107<br />

1 876<br />

47.1%<br />

291<br />

1 585<br />

Number of subscribers at period-end in thousands 2000 2001<br />

1 939<br />

1 229<br />

3 168<br />

2 152<br />

1 221*<br />

3 373<br />

Change<br />

14.9%<br />

2.1%<br />

79.6%<br />

–13.3%<br />

62.9%<br />

14.5%<br />

12.3%<br />

14.1%<br />

4.9%<br />

26.5%<br />

–6.7%<br />

35.4%<br />

Change<br />

11.0%<br />

–0.7%<br />

6.5%<br />

* The number of prepaid cus<strong>to</strong>mers was adjusted at year-end <strong>to</strong> take account of 207,000 inactive cus<strong>to</strong>mers. The prior<br />

year number has not been restated. Cus<strong>to</strong>mers who have not made or received a call in more than 12 months are regarded<br />

as inactive. Without this adjustment, <strong>the</strong> number of cus<strong>to</strong>mers would have been 3,580 thousand, i.e. an increase in <strong>to</strong>tal<br />

subscribers of 13.0%.